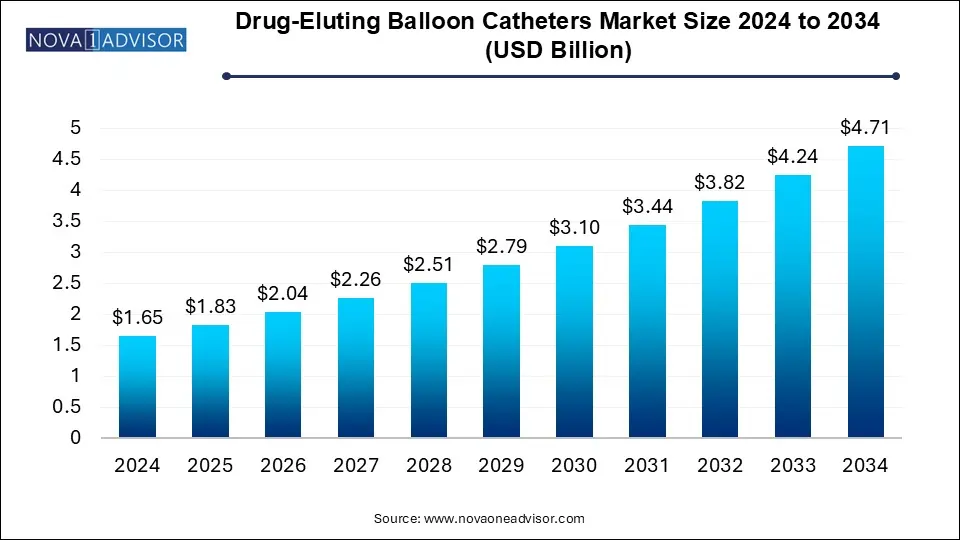

The drug-eluting balloon catheters market size was valued at USD 1.65 billion in 2024 and is expected to be worth around USD 4.71 billion by 2034, growing at a CAGR of 11.07 during the forecast period from 2025 to 2034. Technological advancement, rising healthcare expenditure, and R&D initiatives drive the drug-eluting balloon catheters market.

The drug-eluting balloon catheter market is expanding as emerging trends gravitate toward minimally invasive procedures, with developments in angioplasty as well. DEBs are specialized anti-proliferative coated angioplasty balloons, which can prevent restenosis in previously placed stents. Compared to traditional stents, DEBs will require short-term dual antiplatelet therapy and eliminate the possibility of stent thrombosis. They can deliver drugs to the target area and are more flexible than stents, so they are better suited to complex lesions. Commercially available DEBs include PACCOCATH, IN. PACT, DIOR, and SeQuent Please. Research and innovative prospects for DEBs hold promising scenarios in coronary, cardiac, and extracardiac interventions.

Market Trends

| Report Coverage | Details |

| Market Size in 2025 | USD 1.83 Billion |

| Market Size by 2034 | USD 4.71 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 11.07% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product, Raw Material, and End-Use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Medtronic, Aachen Resonance GmbH, B Braun Melsungen AG, BD Interventional, Biosensors International, Biotronik AG, Boston Scientific Corporation, Eurocor GmbH, iVascular S L U, Zhejiang Barty Medical Technology Co Ltd, Lepu Medical Technology (Beijing)Co Ltd, MedAlliance |

Risin cardiovascular prevalence driving the growth of the market

Cardiovascular diseases of all sorts, ranging from heart disease to stroke, are becoming a global concern, especially in areas like India. The contributory factors include but are not limited to, unhealthy diets, lack of exercise, excessive tobacco, high alcohol intake, metabolic disorders such as hypertension, high cholesterol, diabetes, obesity, kidney disorders, genetic predisposition, and prolonged stress. Rapid urbanization, early-life influences, and environmental factors like air pollution and obstructive sleep apnea place further risk of CVD. Prevention of these factors through life changes and healthy living is vital.

Evolving technology: A key opportunity for market growth

Alternative medications such as sirolimus and zotarolimus may potentially improve drug-eluting balloons (DEBs), showing up to promising preclinical results. Such drugs can inhibit smooth muscle cell proliferation and reduce neointimal growth, therefore showing superior angiographic outcomes compared to zotarolimus-eluting stents. More studies are needed, however, to see how useful these agents will be in clinical practice. DEB therapy is currently approved for in-stent restenosis of BMS and PAD; its efficacy in cases of DES restenosis is still under trial.

Technical challenges hamper the growth of the market

Drug-eluting balloons (DEBs) have a proven therapeutic efficacy but remain technically challenging. The foremost problem is the cytotoxicity of Paclitaxel, which hampers absorption efficiency in vascular walls and acts contra-productively in such conditions as atherosclerosis. Alternatives like rapamycin show promise, but their long-term efficacy is unknown. Particular stresses have to be placed on the use of excipients because hydrophilic substances may release their coats with time, which would decrease effectiveness. Balloon dilation pressure is another critical parameter where higher pressures will increase drug transfer but would also cause vascular injury. Studies are now focused on the optimization of inflation pressure and contact time of the balloon with the vessel wall.

By product insight, the peripheral vascular disease segment led the market. Peripheral vascular balloon catheter is used to deliver medications, prevent excessive vascular smooth muscle growth, and reduce restenosis. The rising incidence of atherosclerosis in the adult population has increased the demand for these catheters. The attractiveness of these procedures is accounted for by lower procedure costs, fewer post-operative complications, and a shorter duration of nursing care. Traditional stents are not able to treat long and diffuse diseases; this makes PVD-DEB catheters a better option.

By material insight, the polyurethane segment dominated the market. Flexible, strong, and resistant to abrasion, polyurethane makes up a very flexible material for DEB catheters. Such flexibility enables catheters to traverse difficult vascular paths, increasing patient comfort and reducing the risk of damage to the vascular tissues. Polyurethane DEBs are gaining popularity increasingly over similar applications in peripheral and coronary intervention since they are said to be the most enduring when it comes to abrasion damage.

By end-use insight, the hospital and clinics segment dominated the market. The growing trend of in-patient catheterization procedures with a preference for minimally invasive treatments renders hospitals and clinics the pivotal forces in the industry. Increasing incidences of vascular and urological disorders and conditions like arrhythmia are stimulating demand for advanced medical interventions. The very presence of qualified healthcare personnel provides further support to this market expansion. The enhancement of healthcare infrastructure in developing countries is poised to increase the current usage of drug-eluting balloon catheters, thus reinforcing the very pivotal role of hospitals and clinics in market growth.

North America has dominated the drug-eluting balloons catheters market with a 35.0% revenue share in 2024. in drug-eluting balloon catheters and, thus, the reimbursement policies in such countries and the surgical volume in the continent. The main driving factors behind the market growth include growth in incidence of life-threatening cardiovascular conditions due to lifestyle changes and an increasing geriatric population. The factors providing a momentum in the growth of market supplementary accounts for increasing rate of hospitalization and the presence of plugged major market players in the region. Growth catalyst includes the rising elderly population and advanced hospitalization rates. This presence of major players increases adoption and value of drug-eluting balloon catheters in the region.

The drug eluting balloon market in Asia Pacific will be growing at the highest rate due to increasing healthcare costs with rising incidences of cardiovascular diseases. An aging population, increase in disposable income, and health tourism in emerging economies are giving impetus to the demand for advanced treatment. These factors will certainly fuel the market mostly and thus will be the most significant propellant in the growth of the global drug-eluting balloon catheters market.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Drug-Eluting Balloon Catheters Market

By Product

By Raw Material

By End-Use

By Geography