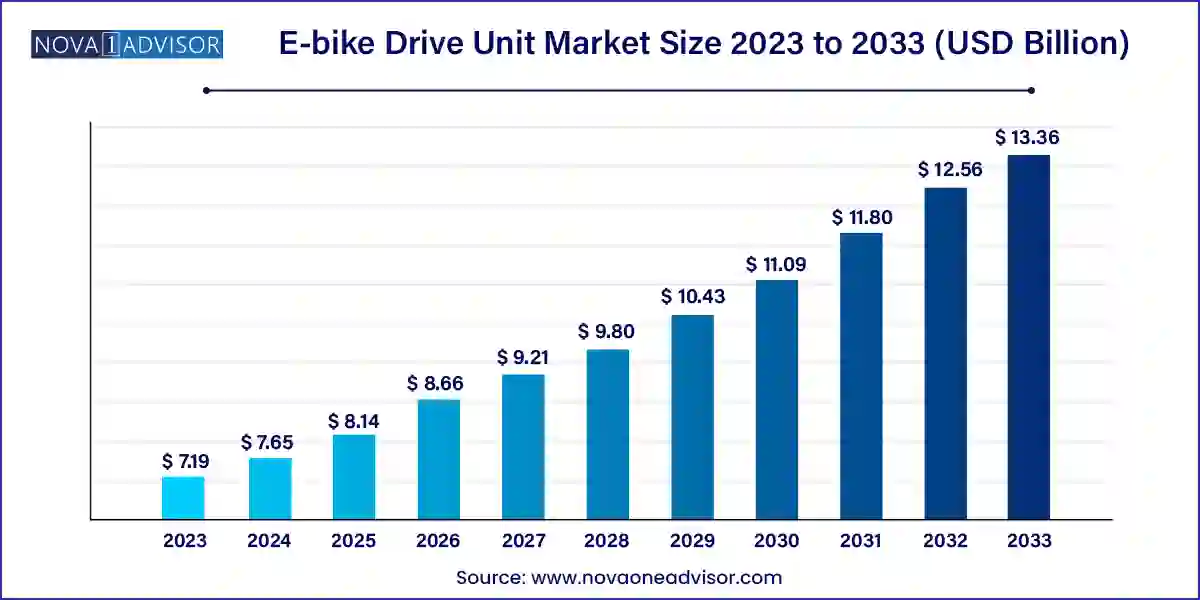

E-bike Drive Unit Market Size and Growth

The global e-bike drive unit market size was exhibited at USD 7.19 billion in 2023 and is projected to hit around USD 13.36 billion by 2033, growing at a CAGR of 6.39% during the forecast period 2024 to 2033.

Key Takeaways:

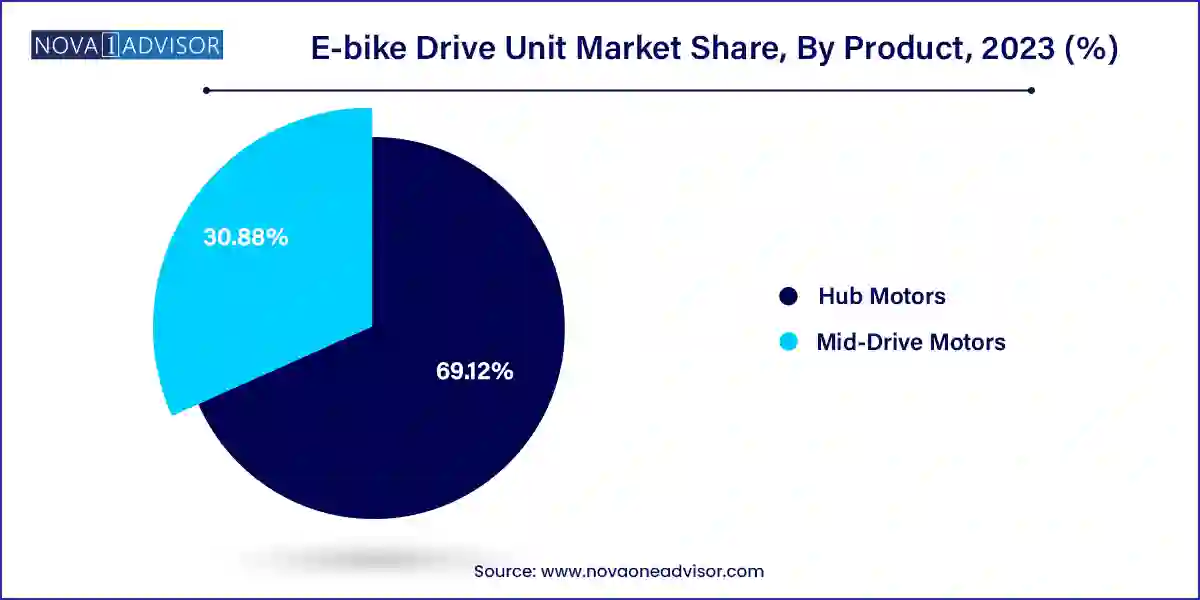

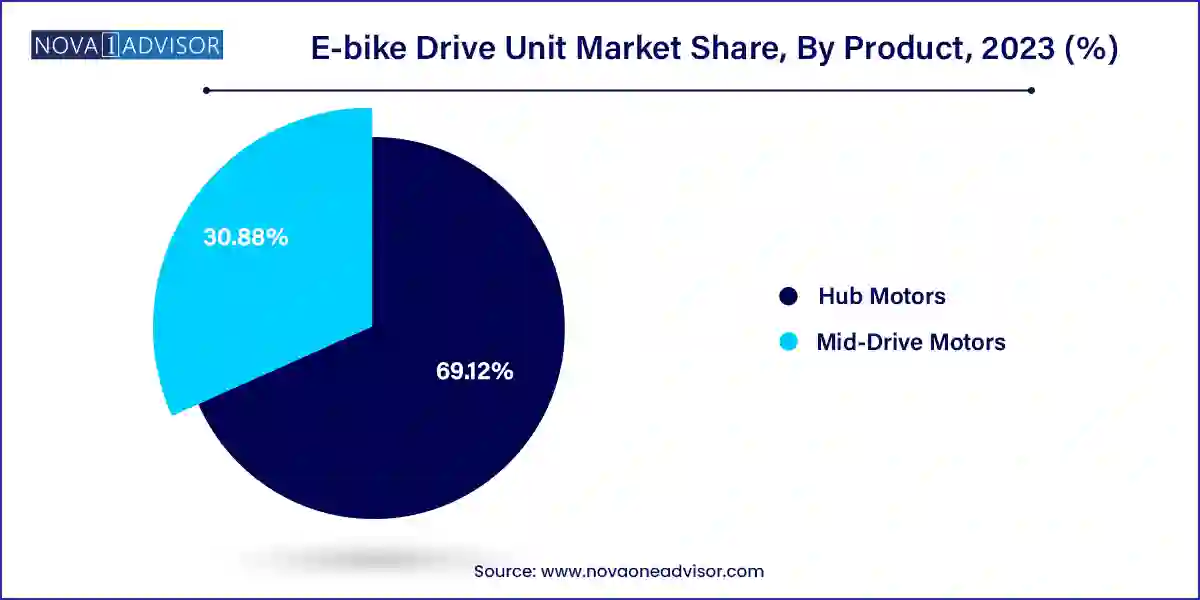

- There are two types of drive units utilized in the e-bike that include mid-drive motors and hub motors. Hub motors capture major revenue share of almost 70% in the year 2023.

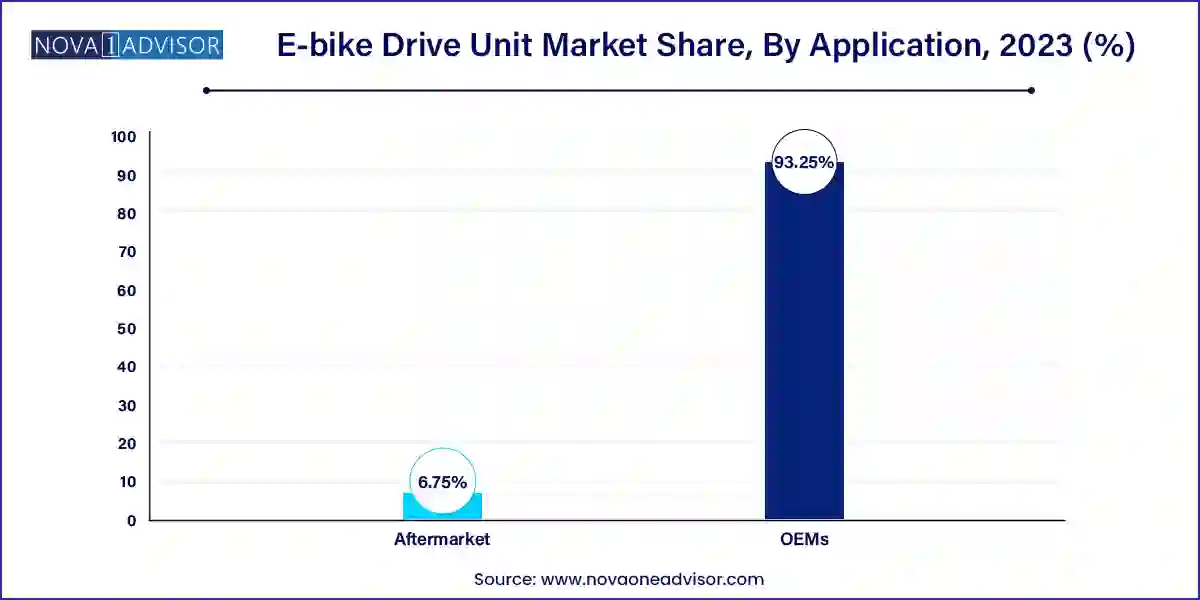

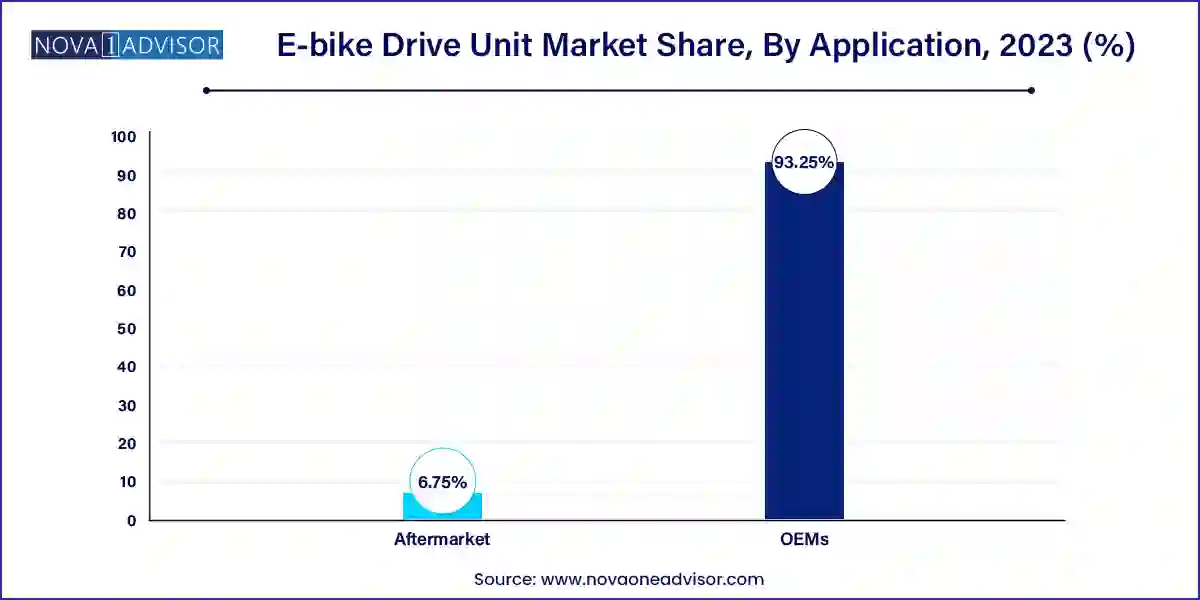

- In 2023, OEM dominated the market with around 93.0% share in terms of revenue of the total market and projected to grow at the highest CAGR during the forecast period

- Asia Pacific accounted for the largest portion of revenue and consumption share of more than 90% in 2023.

E-bike Drive Unit Market by Overview

The e-bike drive unit market encompasses a dynamic landscape characterized by technological advancements, evolving consumer preferences, and a surge in demand for greener modes of transportation. With urbanization on the rise and environmental concerns at the forefront, the global market for e-bike drive units has witnessed unprecedented growth in recent years.

E-bike Drive Unit Market Growth

The growth of the e-bike drive unit market is propelled by several key factors. Firstly, increasing environmental awareness and a growing emphasis on sustainability have led consumers to opt for eco-friendly transportation solutions, driving demand for efficient e-bike drive units. Additionally, supportive government initiatives and regulations promoting clean energy and reducing carbon emissions have provided a significant boost to the market. Technological innovation, including advancements in battery technology and motor efficiency, continues to enhance the performance and appeal of e-bike drive units, fostering market expansion. Moreover, urbanization and the associated challenges of traffic congestion and pollution have fueled the popularity of e-bikes equipped with efficient drive units as a convenient and eco-friendly mode of transportation. Lastly, shifting consumer preferences towards active lifestyles and alternative modes of commuting have further contributed to the growth of the e-bike drive unit market.

E-bike Drive Unit Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 7.65 Billion |

| Market Size by 2033 |

USD 13.36 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.39% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product Type, Application Type, Region Type |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Robert Bosch GmbH, Continental AG, Yamaha Motor Corporation, Panasonic, Shimano, MAHLE GmbH, Giant Bicycles, Bafang Electric (Suzhou) Co., Ltd, Brose Fahrzeugteile SE & Co. KG. |

E-bike Drive Unit Market Dynamics

- Technological Advancements:

The e-bike drive unit market is characterized by rapid technological innovation, driving improvements in efficiency, performance, and user experience. Advances in battery technology, motor design, and integration of smart features have enabled manufacturers to develop more powerful, compact, and reliable drive units. Moreover, the integration of connectivity features such as Bluetooth and GPS enhances the functionality and appeal of e-bikes, attracting tech-savvy consumers. Continuous R&D efforts and collaborations between manufacturers and technology providers are expected to further accelerate technological advancements in the e-bike drive unit market, opening up new possibilities for customization, efficiency, and sustainability.

Government regulations and policies play a significant role in shaping the e-bike drive unit market dynamics. With an increasing focus on reducing greenhouse gas emissions and promoting sustainable transportation, many regions have implemented supportive policies and incentives to encourage the adoption of e-bikes. These include subsidies, tax incentives, and infrastructure development to facilitate e-bike usage. Conversely, regulatory uncertainties or restrictions, such as speed limits or licensing requirements, can impede market growth and innovation. Therefore, monitoring and navigating the evolving regulatory landscape is crucial for stakeholders in the e-bike drive unit market to capitalize on emerging opportunities and mitigate risks.

E-bike Drive Unit Market Restraint

One of the primary restraints hindering the widespread adoption of e-bikes equipped with advanced drive units is their relatively high initial cost compared to traditional bicycles. While the long-term cost savings from reduced fuel expenses and maintenance may justify the investment for some consumers, the upfront price barrier can deter budget-conscious individuals from purchasing e-bikes. Additionally, the cost of replacing or upgrading e-bike drive units can further add to the overall ownership expenses, limiting market penetration, particularly in price-sensitive regions or demographic segments.

- Limited Infrastructure and Accessibility:

Despite the growing popularity of e-bikes, infrastructure limitations and accessibility challenges pose significant restraints to market growth. The lack of dedicated e-bike lanes, charging stations, and secure parking facilities in urban areas can discourage potential users from adopting e-bikes as a viable transportation option. Moreover, inadequate access to e-bike servicing and repair facilities may deter consumers concerned about maintenance and support. Addressing these infrastructure gaps and enhancing accessibility through urban planning initiatives and investment in e-bike-friendly infrastructure is essential to unlocking the full potential of the e-bike drive unit market and promoting sustainable mobility solutions.

E-bike Drive Unit Market Opportunity

- Growing Urbanization and Last-Mile Connectivity:

The rapid urbanization trend worldwide presents a significant opportunity for the e-bike drive unit market. As urban populations continue to expand, cities face challenges such as traffic congestion, air pollution, and limited space for parking. E-bikes equipped with efficient drive units offer a sustainable and convenient solution for urban commuters, providing flexibility and agility to navigate congested city streets while reducing environmental impact. Moreover, the rise of shared mobility services and micro-mobility solutions presents an opportunity for e-bike rental and sharing programs, further expanding the market reach and accessibility of e-bike drive units, particularly for short-distance commuting and last-mile connectivity.

- Shift Towards Electric Mobility and Green Transportation:

The global transition towards electric mobility and green transportation presents a significant opportunity for the e-bike drive unit market. With increasing concerns about climate change and air quality, governments and consumers alike are seeking alternatives to traditional fossil fuel-powered vehicles. E-bikes offer a sustainable and energy-efficient mode of transportation, with e-bike drive units playing a crucial role in enhancing performance and range. As consumers become more environmentally conscious and regulations incentivize the adoption of electric vehicles, the demand for e-bikes equipped with advanced drive units is expected to surge.

E-bike Drive Unit Market Challenges

- Battery Technology and Range Limitations:

One of the primary challenges facing the e-bike drive unit market is the limitation of battery technology and range. While advancements in battery technology have led to improvements in energy density and longevity, e-bike manufacturers still grapple with the challenge of balancing performance, weight, and cost. Additionally, the range of e-bikes heavily depends on factors such as terrain, rider weight, and weather conditions, leading to variability in user experience. Consumers often cite range anxiety as a concern, particularly for long-distance commuting or recreational rides. Addressing these challenges requires ongoing innovation in battery technology, as well as improvements in charging infrastructure and energy efficiency to extend the range and usability of e-bikes equipped with drive units.

- Safety and Regulatory Compliance:

Ensuring safety and regulatory compliance is another significant challenge for the e-bike drive unit market. As e-bikes become increasingly popular, concerns about rider safety, vehicle classification, and regulatory oversight have come to the forefront. Different regions have varying regulations governing the use of e-bikes, including speed limits, power output restrictions, and helmet requirements. Navigating these regulatory complexities and ensuring compliance with safety standards can pose challenges for manufacturers, distributors, and consumers alike. Moreover, the integration of advanced features such as electronic stability control and anti-lock braking systems adds complexity to the design and certification process. Addressing these challenges requires collaboration between industry stakeholders, policymakers, and regulatory bodies to establish clear standards and guidelines that promote safety while fostering innovation in the e-bike drive unit market.

Segments Insights:

Product Insights

Mid-drive motors dominated the product segment.

Mid-drive motors have gained dominance due to their superior performance characteristics. Positioned at the bike's crankset, these motors provide better weight distribution, higher torque, and more efficient use of power compared to hub motors. This design results in a more natural riding experience, better climbing ability, and enhanced battery life. E-bikes designed for mountain biking, touring, and high-performance commuting, such as models from Specialized and Haibike, predominantly use mid-drive systems from leading suppliers like Bosch, Brose, and Yamaha.

Meanwhile, hub motors are witnessing the fastest growth.

Hub motors, located either in the front or rear wheel, are simpler, more affordable, and easier to maintain, making them increasingly popular in entry-level and city commuter e-bikes. With advancements improving hub motor efficiency and integration, brands like Rad Power Bikes and Aventon are expanding their hub motor-based offerings. The affordability and versatility of hub motors, especially for urban commuting and casual riders, are driving their rapid adoption globally.

Application

OEMs dominated the application segment.

Original Equipment Manufacturers (OEMs) account for the largest share of e-bike drive unit installations. Leading bike manufacturers prefer to integrate proprietary or branded drive systems into their new models to ensure optimal performance, reliability, and branding consistency. Companies like Trek, Giant, and Scott Sports extensively collaborate with drive unit suppliers to develop customized, integrated solutions that cater to specific target audiences.

At the same time, the aftermarket segment is growing rapidly.

The aftermarket for e-bike drive units is expanding as existing e-bike owners seek to upgrade their motor systems or replace worn-out units. This trend is particularly strong among avid cyclists and enthusiasts who desire enhanced performance or wish to extend the lifecycle of their bikes. Specialized service providers and online platforms are capitalizing on this growing demand, offering retrofit kits and replacement drive units with advanced features such as torque sensors and smartphone connectivity.

Regional Insights

Europe dominated the e-bike drive unit market.

Europe, particularly countries like Germany, the Netherlands, and France, leads the global e-bike drive unit market. Strong environmental consciousness, well-developed cycling infrastructure, and generous government incentives have fueled high e-bike adoption rates in the region. European cities have embraced e-bikes as a core element of urban transportation, with mid-drive systems particularly favored for their superior performance on varied terrains. European drive unit manufacturers like Bosch and Brose enjoy a strong presence, benefiting from close collaboration with leading OEMs.

Meanwhile, Asia-Pacific is the fastest-growing regional market.

Asia-Pacific is witnessing explosive growth in the e-bike drive unit market, driven by large urban populations, rising disposable incomes, and increasing demand for affordable personal mobility solutions. China, the world's largest e-bike market, is at the forefront, with Japan, India, and Southeast Asian countries following closely. Innovations by regional players, combined with growing investments from international brands, are making Asia-Pacific a hotbed of e-bike and drive unit innovation. As more countries in the region promote sustainable transport policies, growth opportunities for drive unit manufacturers will continue to expand.

Some of the prominent players in the E-bike drive unit market include:

- Robert Bosch GmbH

- Continental AG

- Yamaha Motor Corporation

- Panasonic

- Shimano

- MAHLE GmbH

- Giant Bicycles

- Bafang Electric (Suzhou) Co., Ltd

- Brose Fahrzeugteile SE & Co. KG

- Other

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global E-bike drive unit market.

By Product

- Mid-Drive Motors

- Hub Motors

By Application

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)