The global e-bikes market size was exhibited at USD 19.08 billion in 2023 and is projected to hit around USD 75.20 billion by 2033, growing at a CAGR of 14.7% during the forecast period of 2024 to 2033.

.jpg)

Key Takeaways:

- Asia Pacific dominated the e-bikes market and accounted for the largest revenue share of 77.0% in 2023

- North America is expected to expand at the fastest CAGR of 24.2% during the forecast period.

- The pedal-assisted segment accounted for the largest share of over 85% of the market in 2023.

- The chain drive segment accounted for the largest market share of over 91% in 2023.

- The trekking segment accounted for over 49% of the market in 2023.

- The lithium-ion segment dominated, with over 54% of the market share in 2023.

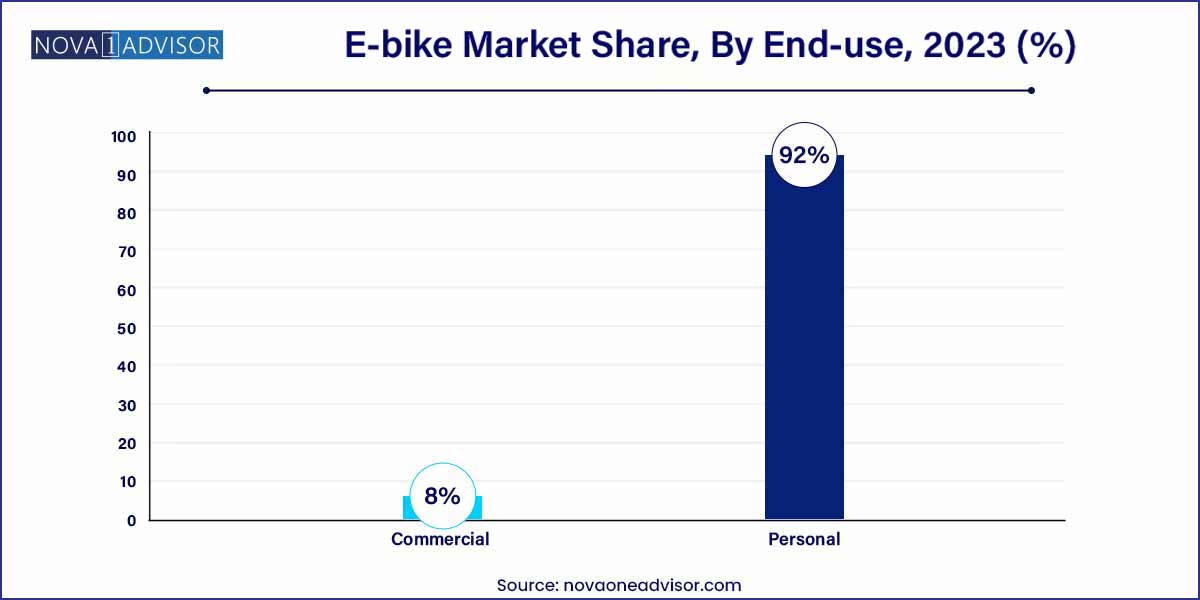

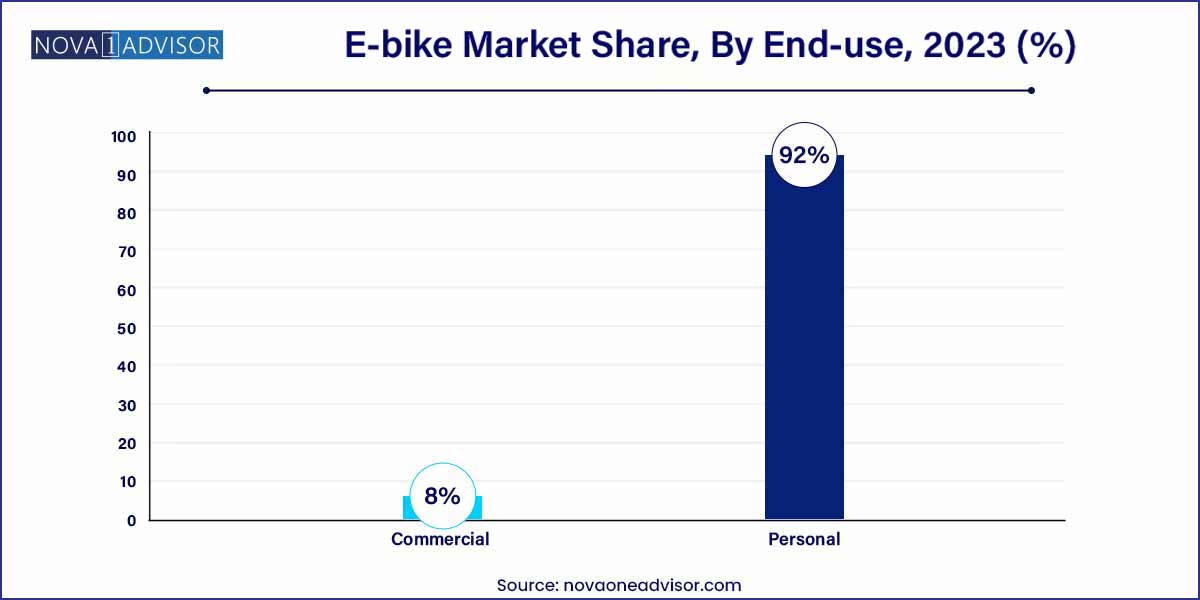

- The personal segment accounted for the largest share of around 92% of the e-bike market in 2023.

Market Overview

The global electric bicycle (e-bike) market has emerged as one of the fastest-growing segments in the broader electric mobility landscape. Combining traditional pedal-powered propulsion with electric assistance, e-bikes are revolutionizing personal and commercial transportation. Their appeal lies in offering an energy-efficient, cost-effective, and environmentally friendly solution to the challenges of urban congestion, long commutes, and carbon emissions.

E-bikes are widely adopted across age groups and demographics from young professionals seeking sustainable commuting alternatives to older populations leveraging pedal-assist for longer and less strenuous travel. Governments and municipalities across the world are promoting cycling infrastructure, incentivizing e-bike purchases, and imposing stricter vehicle emission norms all of which are contributing to market acceleration.

The market encompasses a range of products including city bikes, trekking e-bikes, cargo bikes, and specialty models. With rising demand in both personal and commercial sectors (such as delivery and logistics), the e-bike market is undergoing rapid innovation in drivetrain technologies, battery systems, and connectivity features. As a result, the market is set for a dynamic evolution across form, function, and geography.

E-bike Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 21.88 Billion |

| Market Size by 2033 |

USD 75.20 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 14.7% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Propulsion Type, Drive Type, Application, Battery, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Trek Bicycle Corporation; Aventon Bikes; Rad Power Bikes, Inc.; Lectric eBikes; Blix Electric Bikes; KHS Bicycles; Rambo Bikes; Juiced Bikes; Ride1UP; Cannondale. |

E-bike Market Dynamics

- Technological Innovation and Shifting Consumer Preferences

The E-bike market is dynamically influenced by ongoing technological innovations and a notable shift in consumer preferences. Continuous advancements in battery technology, particularly the development of lightweight and high-capacity lithium-ion batteries, have significantly enhanced the performance and range of E-bikes. This technological evolution not only improves the overall efficiency of E-bikes but also addresses concerns related to charging times and battery lifespan. Concurrently, consumers are increasingly drawn towards E-bikes due to their eco-friendly nature, health benefits, and the integration of smart features.

- Regulatory Support and Urbanization Trends

The E-bike market is subject to significant dynamics shaped by regulatory support and prevailing urbanization trends. Governments across the globe are recognizing the potential of E-bikes to address environmental concerns and traffic congestion. Subsequently, there is a growing trend of implementing supportive policies, including financial incentives, subsidies, and the development of dedicated infrastructure such as bike lanes and charging stations. These regulatory initiatives play a crucial role in fostering a conducive environment for E-bike adoption. Moreover, the ongoing trend of urbanization contributes to the market dynamics, with e-bikes emerging as a practical solution for urban commuting challenges.

E-bike Market Restraint

- High Initial Cost as a Restraint in the E-bike Market:

Despite the burgeoning popularity of E-bikes, a notable restraint in market expansion is the high initial cost associated with these electric-powered bicycles. The upfront investment required for purchasing an E-bike can be comparatively higher than that of traditional bicycles or even some fuel-efficient motorcycles. This financial barrier can act as a deterrent for a significant portion of potential buyers, particularly in price-sensitive markets. Industry stakeholders and manufacturers are actively addressing this challenge by exploring cost-effective manufacturing processes, economies of scale, and research into more affordable components.

- Infrastructure Development Challenges:

An inherent restraint in the widespread adoption of E-bikes revolves around the need for robust infrastructure development. For E-bikes to thrive, adequate support systems such as charging stations, secure parking facilities, and designated bike lanes are essential. The current lack of a comprehensive infrastructure poses challenges for E-bike users, hindering their overall convenience and range. Governments and urban planners are recognizing this restraint, leading to initiatives aimed at expanding infrastructure to accommodate the growing E-bike market.

E-bike Market Opportunity

- Growing Urbanization and Last-Mile Connectivity Opportunities in the E-Bike Market:

The accelerating trend of urbanization presents a significant opportunity for the e-bike market, particularly in addressing last-mile connectivity challenges within urban environments. As cities expand and traffic congestion rises, there is a heightened demand for sustainable and efficient transportation options for short-distance commuting. E-bikes, with their compact design and ability to navigate through congested areas, offer an ideal solution for the last-mile leg of journeys. Governments and city planners are recognizing this opportunity, leading to increased investment in infrastructure development, including bike lanes and charging stations, to facilitate the integration of e-bikes into urban transportation ecosystems.

- Environmental Sustainability Driving market growth:

The global emphasis on environmental sustainability and the reduction of carbon footprints creates a significant opportunity for the E-bike market. With consumers increasingly inclined towards eco-friendly transportation options, E-bikes emerge as a compelling choice due to their zero-emission nature. Governments, recognizing the environmental benefits of E-bikes, are implementing policies and incentives to encourage their adoption. This includes subsidies, tax credits, and awareness campaigns promoting the environmental advantages of E-bikes.

E-bike Market Challenges

- Limited battery technology advancements:

While battery technology has played a pivotal role in enhancing the performance of e-bikes, the market faces a challenge related to the limitations in current battery technologies. Despite strides in improving energy density and charging efficiency, challenges such as limited range and relatively long charging times persist. Innovations in battery technology are crucial for addressing these challenges and ensuring that e-bikes can meet the evolving expectations of consumers. Research and development efforts focused on creating more compact, lightweight, and high-capacity batteries are essential to overcoming these limitations.

- Safety Concerns and Regulatory Compliance:

As the e-bike market experiences rapid growth, safety concerns and regulatory compliance emerge as notable challenges. The varying classifications of E-bikes, such as pedal-assist and throttle-controlled models, raise questions about road safety and user behavior. Ensuring that e-bike users adhere to traffic regulations becomes crucial to mitigating potential accidents and conflicts with other road users. Regulatory bodies are tasked with establishing clear guidelines and standards for the operation of e-bikes, addressing issues such as speed limits and helmet requirements. Manufacturers must also prioritize safety features and user education to alleviate concerns and promote responsible e-bike usage.

Segments Insights:

Propulsion Type Insights

Pedal-assisted e-bikes dominate the propulsion segment, owing to their widespread legal acceptance, energy efficiency, and consumer appeal. These bikes offer an intuitive riding experience where electric assistance is provided based on pedaling input, making them ideal for commuting, exercise, and longer recreational rides. They are also more battery-efficient and enjoy wider regulatory support across global markets.

Throttle-assisted e-bikes are the fastest-growing propulsion type, particularly in North America and Asia-Pacific. These models offer motorcycle-like acceleration without pedaling and are especially appealing to delivery personnel, older users, or individuals with limited mobility. Although some regions impose restrictions on throttle-based e-bikes, consumer demand for convenience and minimal effort continues to drive their growth.

Drive Type Insights

Chain drive systems dominate the e-bike market, largely due to their compatibility with traditional bicycle designs, durability, and ease of replacement. Chain drives are cost-effective, readily available, and widely supported across aftermarket service centers. Most pedal-assisted e-bikes still rely on chain systems, making them a preferred choice among manufacturers.

Belt drive systems are gaining momentum as the fastest-growing drive type, driven by their low maintenance, noise-free operation, and enhanced longevity. They are especially favored in high-end urban and trekking e-bike models where durability and riding comfort are priorities. Belt drives also attract health-conscious riders and fleet managers aiming to reduce service costs.

Application Insights

City/Urban e-bikes dominate the market, as they cater to the largest user base: commuters, students, and recreational riders. Designed for comfort, efficiency, and maneuverability in dense traffic, urban e-bikes often come with integrated lighting, cargo racks, and smart features. Their role in city-wide mobility programs and integration with public transport networks has solidified their dominance.

Cargo e-bikes are the fastest-growing application, thanks to their uptake in commercial logistics, family transportation, and ride-sharing services. These e-bikes are engineered with reinforced frames, dual-battery systems, and high-load capacities. As the world shifts toward sustainable logistics, demand for heavy-duty, long-range cargo e-bikes is expected to skyrocket, especially in Europe and Asia.

Battery Insights

Lithium-ion batteries dominate the e-bike battery segment, accounting for a majority of new e-bike models. Their advantages—high energy density, lighter weight, faster charging, and longer cycle life—make them the battery of choice across both premium and mid-range segments. Technological advancements are further enhancing their safety, cost-efficiency, and recyclability.

Lead-acid batteries remain in limited use, primarily in entry-level or low-cost e-bike models across developing regions. Although they are cheaper upfront, their heavier weight, shorter lifespan, and environmental concerns have resulted in a gradual market phase-out. However, lead-acid variants still serve price-sensitive users and retrofitted bikes.

End-use Insights

Personal use leads the e-bike end-use segment, as consumers increasingly turn to electric bicycles for commuting, fitness, and leisure. Personal e-bikes are being purchased with an emphasis on customization, ergonomic design, and advanced features like app connectivity and GPS tracking. The rise in health consciousness and eco-awareness is further reinforcing this trend.

The commercial segment is expected to witness the highest CAGR over the forecast period. The growth can be attributed to the increase in the adoption of e-bikes in the logistics industry for transportation and initiatives undertaken by key players in the market for providing e-bikes gig delivery workers. For instance, in April 2023, U.S.-based online food delivery platform Grubhub Inc. partnered with online e-bikes rental platform Joco for providing free access to e-bikes to at least 500 gig delivery workers in New York.

Regional Insights

Europe dominates the global e-bike market, led by countries like Germany, the Netherlands, and France. The region benefits from mature cycling infrastructure, supportive legislation, and a strong environmental consciousness. Governments offer generous subsidies, tax rebates, and dedicated cycling lanes, making e-bikes a mainstream mobility solution. European manufacturers also lead in innovation, offering high-quality products tailored to urban and trekking applications.

Asia-Pacific is the fastest-growing region, with China being both the largest producer and consumer of e-bikes. Rising urbanization, traffic congestion, and governmental pollution control initiatives have fueled demand. Other emerging markets like India, Indonesia, and Vietnam are witnessing increased adoption driven by affordability and the rise of local manufacturers. The region’s robust supply chain and growing population make it a key driver for global market expansion.

Recent Developments

-

Yamaha Motor Co. (March 2025): Launched a new high-torque mid-drive motor for city and trekking e-bikes with enhanced battery optimization software.

-

Giant Bicycles (February 2025): Expanded its production facility in the Netherlands to meet increasing demand in the European market.

-

Rad Power Bikes (January 2025): Introduced a commercial e-cargo bike designed for last-mile delivery in U.S. urban markets.

-

Bosch eBike Systems (December 2024): Announced a partnership with Google Maps to provide real-time route suggestions and battery consumption estimates.

-

Trek Bicycle Corporation (November 2024): Rolled out a modular frame design compatible with both belt and chain drive systems for hybrid e-bike models.

Some of the prominent players in the e-bike market include:

- Trek Bicycle Corporation

- Aventon Bikes

- Rad Power Bikes, Inc.

- Lectric eBikes

- Blix Electric Bikes

- KHS Bicycles

- Rambo Bikes

- Juiced Bikes

- Ride1UP

- Cannondale

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global e-bike market.

Propulsion Type

- Pedal-assisted

- Throttle-assisted

Drive Type

Application

- City/Urban

- Trekking

- Cargo

- Others

Battery

- Lead-acid Battery

- Lithium-ion Battery

End-use

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

.jpg)