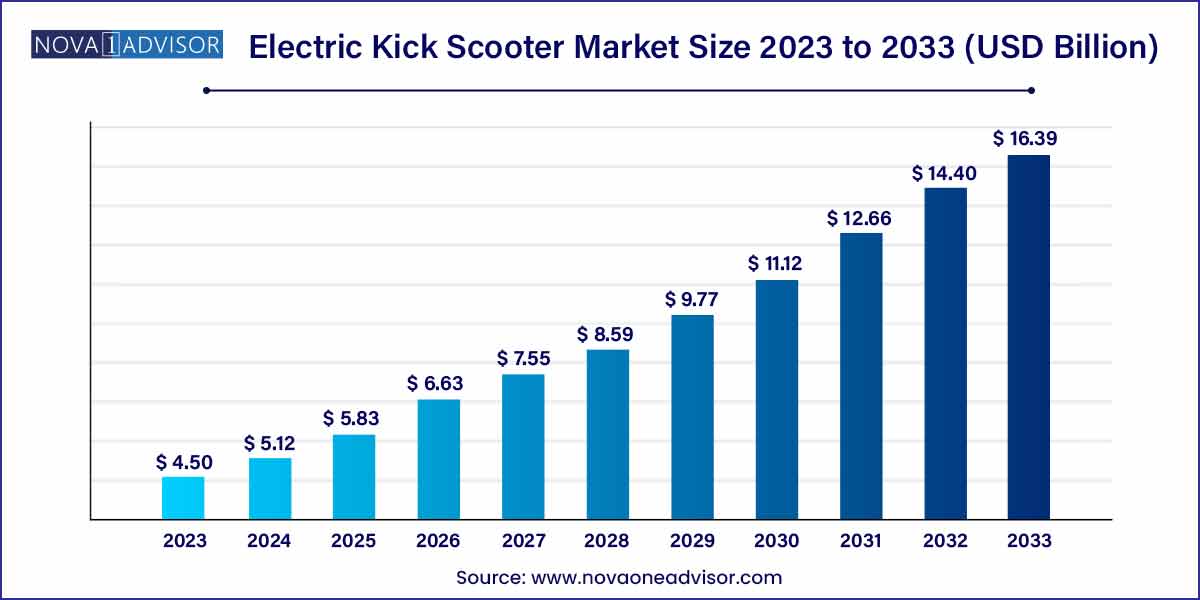

The global electric kick scooter market size was exhibited at USD 4.50 billion in 2023 and is projected to hit around USD 16.39 billion by 2033, growing at a CAGR of 13.8% during the forecast period of 2024 to 2033.

Key Takeaways:

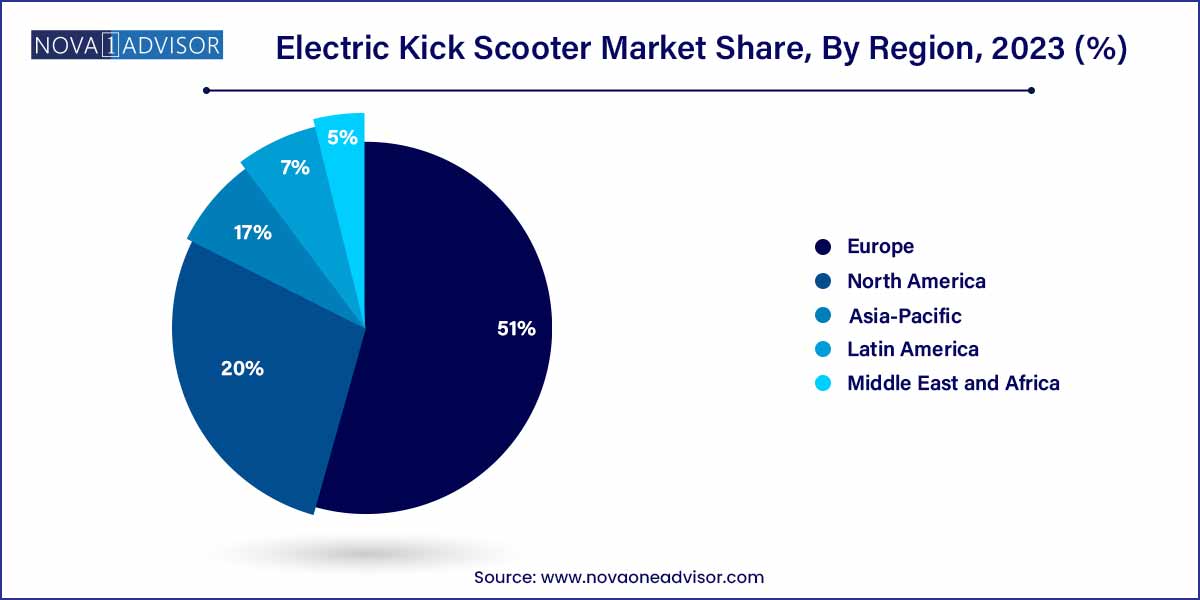

- Europe dominated the global market in 2023 and accounted for over 51.0% of global revenue.

- The demand for lithium-ion battery scooters accounted for over 85% of the overall revenue share in 2023.

- The hub drive segment dominated the market in 2023 and accounted for more than 90.0% of the global revenue.

Electric Kick Scooter Market: Overview

The global electric kick scooters market has undergone remarkable evolution, transitioning from a niche product for urban commuting to a mainstream mode of personal transportation. Electric kick scooters, often referred to as e-scooters, are two-wheeled battery-powered vehicles that offer an environmentally friendly, compact, and cost-effective mobility solution. Rising concerns about environmental sustainability, congested urban traffic, and the increasing demand for last-mile connectivity have fueled the adoption of e-scooters across cities worldwide.

Initially targeted at youth and young adults seeking recreational mobility, electric kick scooters have expanded their demographic appeal to include working professionals, students, and even the elderly. Their deployment in commercial sharing fleets in metropolitan areas like Paris, San Francisco, and Singapore has normalized their presence in daily urban transit ecosystems. Advances in battery technology, lightweight materials, and IoT integration have significantly enhanced the range, durability, and user experience of electric kick scooters, positioning them as a vital component of modern micro-mobility networks.

Electric Kick Scooter Market Growth

The growth of the electric kick scooter market is fueled by several key factors. Firstly, increasing urbanization and congestion in cities worldwide have propelled the demand for efficient and sustainable last-mile transportation solutions. Electric kick scooters offer a convenient and eco-friendly alternative, addressing the need for short-distance mobility within urban environments. Secondly, heightened environmental consciousness among consumers and governments has led to a greater emphasis on reducing carbon emissions and promoting clean transportation options. Electric scooters, being emission-free and energy-efficient, align with these sustainability objectives, driving their adoption. Additionally, advancements in technology, including improvements in battery efficiency, lightweight materials, and smart connectivity features, are enhancing the performance and appeal of electric scooters. These technological innovations are not only improving the user experience but also expanding the potential applications and market reach of electric kick scooters.

Electric Kick Scooter Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 4.50 Billion |

| Market Size by 2033 |

USD 16.39 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 13.8% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Battery, Drive, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Segway Inc.; Jiangsu Xinri E-Vehicle Co. Ltd.; YADEA Technology Group Co., Ltd.; NIU International; Bird Rides, Inc.; SWAGTRON; SEGWAY INC.; Xiaomi; iconBIT GmbH; Razor USA LLC. |

Electric Kick Scooter Market Dynamics

Urbanization and changing commuter preferences are driving the dynamics of the electric kick scooter market. As cities become increasingly congested, there is a growing need for efficient and sustainable last-mile transportation solutions. Electric kick scooters emerge as a viable option, offering commuters a convenient way to navigate urban landscapes while reducing their carbon footprint. Moreover, the rise of shared mobility services and the popularity of micro-mobility solutions have further accelerated the adoption of electric scooters, with rental services providing easy access to these vehicles for short-term use.

Regulatory frameworks and safety considerations play a significant role in shaping the dynamics of the electric kick scooter market. As the popularity of electric scooters grows, governments and regulatory bodies are grappling with how to manage their integration into urban environments effectively. Safety concerns regarding rider behavior, infrastructure compatibility, and interactions with other road users have prompted the development of regulations and guidelines aimed at ensuring the responsible deployment and usage of electric scooters.

Electric Kick Scooter Market Restraint

One significant restraint affecting the electric kick scooter market is the issue of safety and regulatory concerns. Despite their popularity as a convenient urban mobility solution, electric scooters face scrutiny due to safety hazards and regulatory challenges. Concerns regarding rider behavior, pedestrian safety, and compatibility with existing infrastructure have prompted regulatory bodies to impose restrictions and guidelines on electric scooter usage. Additionally, the lack of clear regulations in some regions creates uncertainty for both operators and consumers, hindering market growth.

Another significant restraint impacting the electric kick scooter market is the limited infrastructure to support their widespread adoption. While electric scooters offer a convenient and eco-friendly mode of transportation, the lack of dedicated infrastructure such as designated lanes and parking facilities poses challenges for users and operators alike. Inadequate infrastructure can lead to safety hazards, traffic congestion, and operational inefficiencies, discouraging potential users from embracing electric scooters as a viable transportation option.

Electric Kick Scooter Market Opportunity

The electric kick scooter market presents significant opportunities for growth and innovation, driven by the evolving landscape of urban mobility. With the global shift towards sustainable transportation solutions and the increasing emphasis on reducing carbon emissions, electric scooters emerge as a promising alternative for short-distance travel within urban environments. The market holds immense potential for expansion, particularly in emerging economies where rapid urbanization and infrastructure development create favorable conditions for the adoption of micro-mobility solutions.

Technological innovation presents a compelling opportunity for the electric kick scooter market to enhance its value proposition and appeal to a broader audience. Advancements in battery technology, lightweight materials, and connectivity features have the potential to revolutionize the electric scooter experience, making it more efficient, convenient, and user-friendly. Integration with smart city infrastructure, such as IoT sensors and mobile applications, can further enhance the functionality and accessibility of electric scooters, enabling seamless integration with existing transportation ecosystems.

Electric Kick Scooter Market Challenges

Safety concerns represent a significant challenge for the electric kick scooter market, affecting both consumer perception and regulatory acceptance. Despite their popularity as a convenient urban mobility solution, electric scooters have been associated with a rising number of accidents and injuries, primarily due to factors such as rider inexperience, reckless behavior, and inadequate infrastructure. Addressing these safety concerns requires a multi-faceted approach that encompasses rider education, infrastructure improvements, and regulatory measures. Operators must implement robust safety protocols, including mandatory helmet use, speed limits, and geofencing technologies to enforce compliance with designated riding areas.

Regulatory uncertainty poses a significant challenge to the electric kick scooter market, hindering market expansion and investment confidence. The rapid proliferation of electric scooters has outpaced regulatory frameworks in many regions, leading to ambiguity regarding their legality, safety standards, and operational requirements. This lack of regulatory clarity creates barriers to entry for new market participants, deters potential investors, and hampers the scalability of electric scooter operations. Furthermore, inconsistent regulations across different jurisdictions can impede the seamless operation of electric scooter fleets, limiting their effectiveness as a reliable transportation solution. To address this challenge, industry stakeholders must engage with policymakers to advocate for clear and standardized regulations that balance innovation with safety and sustainability.

Segments Insights:

Battery Insights

Lithium-ion (Li-Ion) batteries dominated the market due to their superior energy density and longevity.

Lithium-ion batteries have emerged as the preferred choice for powering electric kick scooters because they are lighter, charge faster, and last longer compared to traditional lead-acid batteries. Li-ion batteries support extended travel ranges and higher performance, making them ideal for both personal and commercial uses. Brands like Xiaomi, Segway-Ninebot, and Unagi prioritize Li-ion powered models to offer riders a dependable and efficient commuting experience. Moreover, declining costs of Li-ion battery production have made high-quality scooters more accessible to a broader audience, further cementing their dominance.

Meanwhile, the "Others" segment, including solid-state batteries, is the fastest growing due to ongoing innovations.

New battery technologies like solid-state batteries and graphene-enhanced batteries are poised to revolutionize the electric scooter industry. These alternatives promise higher energy storage, quicker charging, and enhanced safety profiles. Startups and research institutions are investing heavily in these technologies, with pilot models already hitting the market. As mass production scales and prices decrease, these next-generation batteries could dramatically reshape the competitive landscape, offering manufacturers an edge through longer range and faster-charging scooters.

Drive Insights

Hub drive systems dominated the electric kick scooter market in 2024.

Hub drives, where the motor is integrated directly into the wheel hub, have become the go-to drive system for electric kick scooters. They offer simplicity, lower maintenance, and quieter operation compared to belt and chain drives. Hub-driven e-scooters provide better energy efficiency and require fewer mechanical parts, making them both cost-effective and reliable for urban commuters. Most leading models across major brands employ hub motor technology, boosting the segment's stronghold.

At the same time, belt drive systems are the fastest growing drive type.

Belt drive systems are increasingly gaining popularity, particularly in premium and high-torque electric scooter models. Belt drives offer smoother acceleration, better power transfer, and virtually silent operation, making them ideal for urban areas sensitive to noise pollution. Companies like Boosted have pioneered high-performance belt drive systems, and their popularity is expanding as consumers seek more powerful, reliable scooters capable of handling hills and heavier loads.

End-use Insights

Personal end-use segment dominated the electric kick scooters market.

The bulk of electric kick scooter sales are for personal use, reflecting the product's roots in providing convenient and individualized transportation options. Personal ownership gives users greater flexibility in daily commuting and recreational activities. The rise of compact, foldable models has made personal e-scooters even more attractive for urban residents, especially those integrating scooters with public transport for a multimodal commute. Competitive pricing and the availability of financing options have further driven personal ownership.

Conversely, the commercial end-use segment is experiencing the fastest growth.

The commercial segment, driven by fleet operators and delivery companies, is expanding rapidly. Shared mobility programs, logistics services for food and small packages, and corporate commuting initiatives are all adopting electric kick scooters as viable options. Companies like Uber (with Lime) and Bolt are expanding their commercial fleets, signaling a robust growth trajectory. Moreover, eco-conscious delivery startups in cities like Amsterdam and New York are increasingly using electric scooters for quick, sustainable deliveries

Regional Insights

Europe dominated the electric kick scooters market, holding the largest revenue share.

Europe has emerged as the epicenter for electric kick scooter adoption, fueled by progressive environmental policies, heavy investments in cycling infrastructure, and a strong culture of urban mobility innovation. Countries like Germany, France, and Spain have embraced e-scooters both through public-private partnerships and personal ownership. European cities have been at the forefront of experimenting with scooter-sharing models and regulatory frameworks, creating a favorable environment for sustained growth. The European Green Deal, aiming for climate neutrality by 2050, further incentivizes the shift toward electric micro-mobility solutions.

Meanwhile, the Asia-Pacific region is witnessing the fastest growth.

The Asia-Pacific region is poised to outpace other markets in electric kick scooter adoption, propelled by rapid urbanization, rising disposable incomes, and increasing environmental consciousness. Countries such as China, India, and South Korea are aggressively promoting electric vehicles to combat urban pollution. Local players like Ninebot-Segway dominate the Chinese market, while new startups across Southeast Asia are offering low-cost, innovative solutions for last-mile connectivity. Infrastructure improvements, government incentives, and a tech-savvy young population are expected to fuel exponential growth in this region.

Some of the prominent players in the electric kick scooter market include:

- Segway Inc.

- Jiangsu Xinri E-Vehicle Co. Ltd.

- YADEA Technology Group Co., Ltd.

- NIU International

- Bird Rides, Inc.

- SWAGTRON

- SEGWAY INC.

- Xiaomi

- iconBIT GmbH

- Razor USA LLC

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global electric kick scooter market.

Battery

- Lead Acid

- Lithium Ion (Li-Ion)

- Others

Drive

- Belt Drive

- Chain Drive

- Hub Drive

End-use

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)