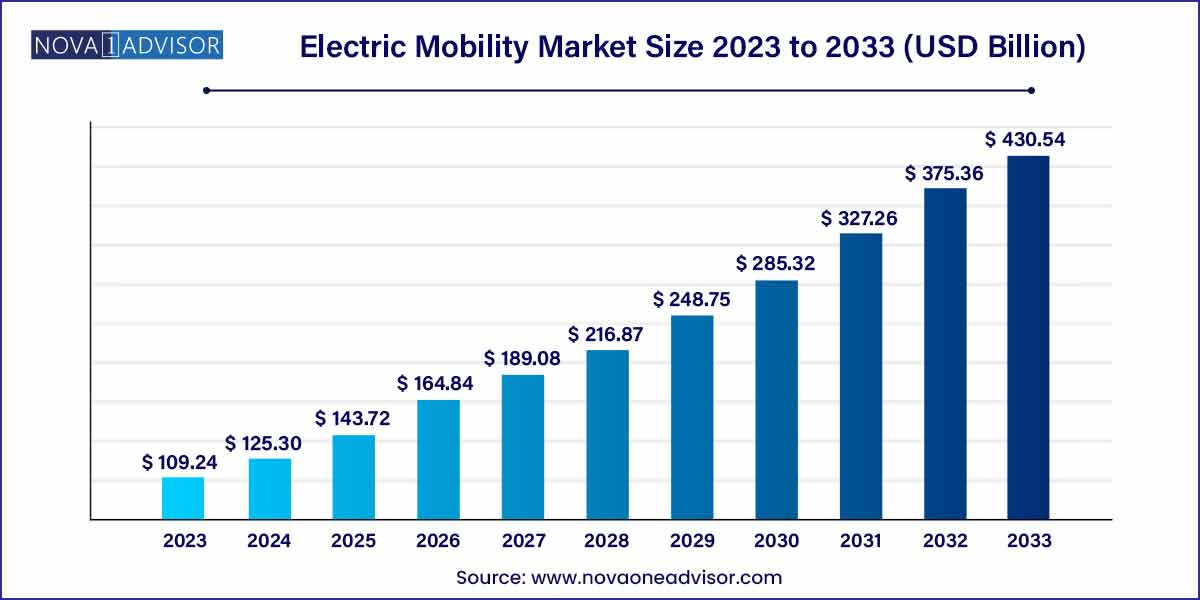

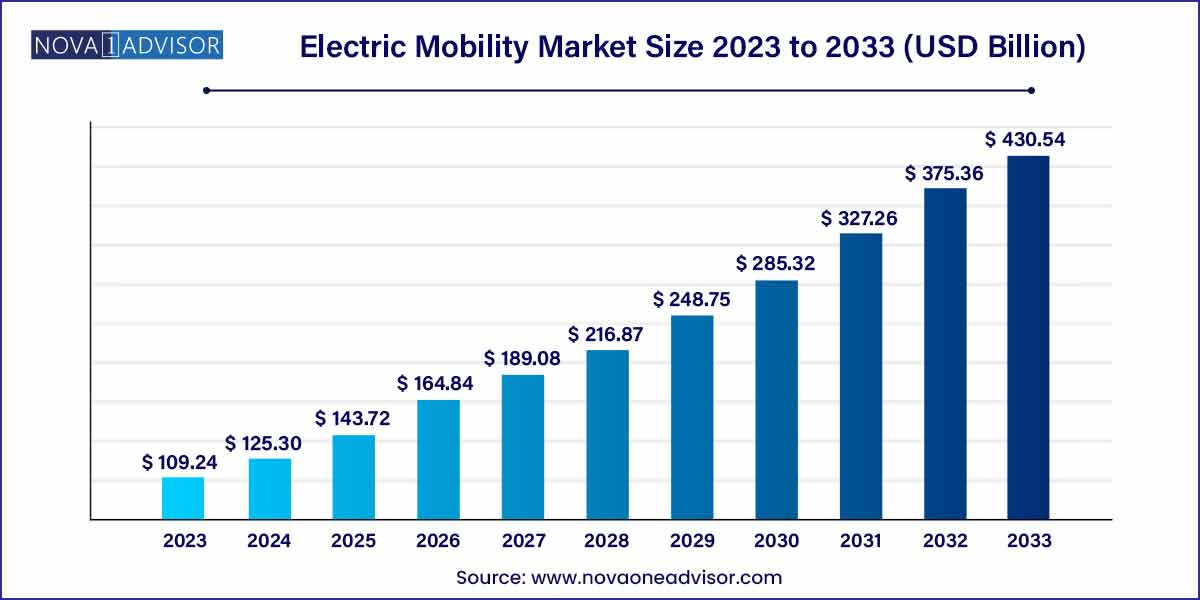

The global electric mobility market size was exhibited at USD 109.24 billion in 2023 and is projected to hit around USD 430.54 billion by 2033, growing at a CAGR of 14.7% during the forecast period of 2024 to 2033.

Key Takeaways:

- Asia Pacific held the largest share of over 69% of the global electric mobility market in the year 2023.

- The electric bikes segment held a dominant revenue share of more than 38% in 2023.

- The lithium-ion battery segment accounted for the largest revenue share of 82% in 2023.

- The personal segment accounted for the largest revenue share of 76% in 2023.

- The chain drive segment held the dominant revenue share of 47% in 2023.

Market Overview

The Electric Mobility (E-Mobility) Market is redefining the future of transportation, offering sustainable, efficient, and affordable alternatives to traditional internal combustion engine (ICE) vehicles. Covering a wide array of products such as electric bikes, electric scooters, electric motorized scooters, and electric motorcycles, the electric mobility sector addresses urgent global challenges including urban congestion, air pollution, and rising fuel costs.

Government initiatives, stringent environmental regulations, advancements in battery technology, and shifting consumer preferences are major factors accelerating the adoption of electric mobility worldwide. Urban populations increasingly prefer electric two-wheelers and personal electric transport options as they seek convenience, affordability, and a reduced environmental footprint.

The COVID-19 pandemic further underscored the need for independent, hygienic travel modes, propelling interest in personal electric vehicles. Post-pandemic recovery plans in several countries have included investments in EV infrastructure and green mobility, catalyzing market growth.

Technological innovations such as smart charging, Internet of Things (IoT)-enabled vehicles, battery swapping technologies, and lightweight materials are pushing the boundaries of electric mobility. As both startups and automotive giants race to capture a share of this expanding market, e-mobility is not just an option but is increasingly becoming a norm in global transportation ecosystems.

Electric Mobility Market Growth

The growth of the electric mobility market is underpinned by a confluence of factors driving its expansion. Technological advancements, particularly in battery technology, have significantly improved the performance and affordability of electric vehicles (EVs), making them increasingly competitive with traditional internal combustion engine vehicles. Moreover, government incentives, such as tax credits, subsidies, and regulatory mandates aimed at reducing carbon emissions, have incentivized both consumers and manufacturers to embrace electric mobility. Additionally, heightened environmental awareness and concerns over air quality have spurred a shift towards cleaner transportation options, further fueling the demand for EVs. Furthermore, the emergence of innovative business models, including ride-sharing and subscription-based services, has expanded access to electric mobility solutions, driving market growth. As infrastructure continues to improve and economies of scale are realized, the electric mobility market is poised for sustained expansion in the coming years.

Electric Mobility Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 109.24 Billion |

| Market Size by 2033 |

USD 430.54 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 14.7% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Drive, Battery, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

BMW Motorrad International; Gogoro, Inc.; Honda Motor Co. Ltd.; KTM AG; Mahindra Group; Ninebot Ltd.; Suzuki Motor Corporation; Terra Motors Corporation; Vmoto Limited ABN; Yamaha Motor Company Limited. |

Electric Mobility Market Dynamics

The electric mobility market has experienced remarkable expansion in recent years, driven by several key factors. Advances in battery technology have significantly enhanced the performance and affordability of electric vehicles (EVs), making them increasingly attractive to consumers. Additionally, growing concerns over climate change and air pollution have led governments worldwide to implement supportive policies, including subsidies, tax incentives, and emissions regulations, which have further stimulated market growth. Moreover, the increasing availability of charging infrastructure and improvements in range anxiety have alleviated consumer concerns about EV adoption, contributing to market expansion.

The electric mobility market is characterized by a diverse ecosystem of stakeholders, including established automotive manufacturers, startups, and technology companies, each vying for market share and innovation leadership. Traditional automotive giants have accelerated their investments in electric vehicle technology, launching a wide range of EV models to meet growing consumer demand and regulatory requirements. Simultaneously, startups and tech companies are disrupting the industry with innovative approaches to vehicle design, battery technology, and mobility services. Companies like Tesla, Nissan, and General Motors have emerged as key players, leveraging their expertise in electric vehicle manufacturing and brand recognition to gain competitive advantages. Moreover, collaborations and partnerships between automotive manufacturers, technology firms, and energy providers are becoming increasingly common, driving synergies and accelerating innovation within the electric mobility ecosystem.

Electric Mobility Market Restraint

- Infrastructure Development:

Despite significant progress in recent years, the development of charging infrastructure remains a significant challenge for the electric mobility market. Limited availability of charging stations, particularly in rural and remote areas, contributes to range anxiety and hampers widespread adoption of electric vehicles (EVs). Additionally, concerns regarding charging time and accessibility further impede consumer confidence in EVs. Moreover, the scalability of charging infrastructure to accommodate the growing number of electric vehicles on the road presents logistical and financial hurdles for stakeholders.

- Consumer Perceptions and Adoption Barriers:

Despite the advantages of electric mobility, including lower operating costs, reduced emissions, and enhanced performance, consumer perceptions and adoption barriers continue to hinder market growth. Range anxiety, or the fear of running out of battery charge before reaching a destination, remains a prevalent concern among potential EV buyers, particularly in regions with limited charging infrastructure. Moreover, misconceptions regarding EV affordability, maintenance costs, and charging convenience persist, leading some consumers to perceive electric vehicles as less practical or accessible than traditional gasoline-powered vehicles. Additionally, concerns over battery longevity, resale value, and uncertain technological advancements may further deter prospective buyers from embracing electric mobility.

Electric Mobility Market Opportunity

- Government Incentives and Supportive Policies:

The electric mobility market is poised to capitalize on a myriad of opportunities stemming from government incentives and supportive policies aimed at promoting sustainable transportation solutions. Many governments worldwide are implementing robust measures, including tax incentives, subsidies, and regulatory mandates, to accelerate the adoption of electric vehicles (EVs) and bolster the development of charging infrastructure. These incentives not only reduce the upfront costs of purchasing EVs but also incentivize investment in research and development, manufacturing capacity, and infrastructure deployment. Furthermore, initiatives to phase out internal combustion engine vehicles and incentivize EV adoption through preferential access to incentives, such as toll exemptions, parking privileges, and congestion charge waivers, are creating a conducive environment for market growth.

- Technological Advancements and Innovation:

The electric mobility market is ripe with opportunities driven by continuous technological advancements and innovation across the value chain. Breakthroughs in battery technology, including improvements in energy density, charging speed, and cost reduction, are enhancing the performance and affordability of electric vehicles (EVs), making them increasingly competitive with traditional internal combustion engine vehicles. Moreover, advancements in electric drivetrain technology, lightweight materials, and vehicle design are further enhancing the efficiency, range, and safety of EVs, driving consumer interest and adoption. Additionally, the convergence of electric mobility with emerging technologies such as autonomous driving, connectivity, and vehicle-to-grid integration is unlocking new possibilities for mobility services, smart grid management, and sustainable urban transportation solutions.

Electric Mobility Market Challenges

- Infrastructure Development:

One of the primary challenges facing the electric mobility market is the need for comprehensive infrastructure development to support widespread adoption of electric vehicles (EVs). This includes the deployment of charging stations across urban and rural areas, as well as upgrades to the electrical grid to accommodate increased electricity demand from EV charging. Insufficient charging infrastructure can lead to range anxiety among EV drivers and deter potential buyers from transitioning to electric vehicles. Moreover, ensuring the interoperability and reliability of charging networks poses additional challenges, particularly in regions with diverse regulatory frameworks and technical standards.

- Battery Technology and Cost:

Another significant challenge facing the electric mobility market is the ongoing development of battery technology and the associated costs. While advancements in battery chemistry and manufacturing processes have led to improvements in energy density, charging speed, and durability, the cost of batteries remains a significant barrier to broader EV adoption. High upfront costs of battery packs contribute to the overall price premium of electric vehicles compared to their gasoline-powered counterparts, limiting their affordability for many consumers. Additionally, concerns over the longevity and degradation of battery performance over time may deter potential buyers from investing in electric vehicles.

Segments Insights:

Product Insights

Electric Bikes (E-Bikes) dominated the product segment, capturing the largest market share due to their versatility, affordability, and widespread adoption for both commuting and recreational purposes. E-bikes offer a convenient solution for urban commuters, allowing faster travel than traditional bicycles while being cheaper and more sustainable than cars or motorcycles.

Their ability to cover mid-range distances efficiently, coupled with government subsidies on e-bike purchases in countries like Germany, France, and China, has further boosted their popularity. Companies like Giant Manufacturing, Specialized, and Rad Power Bikes are continuously launching high-performance models with integrated smart features.

Meanwhile, Electric Motorcycles are experiencing the fastest growth rate. Rising demand for performance-oriented, emission-free two-wheelers among urban youth and adventure seekers is propelling the segment. Brands like Zero Motorcycles, Harley-Davidson (with its LiveWire brand), and Energica are expanding portfolios with powerful, stylish electric motorcycles boasting fast acceleration and substantial range, appealing to new-age riders.

Battery Insights

Lithium-Ion (Li-Ion) batteries dominated the battery type segment, thanks to their superior energy density, lighter weight, longer lifecycle, and faster charging capabilities compared to lead-acid and nickel-metal hydride (NiMH) batteries. The rapid fall in Li-ion battery costs over the past decade has made electric mobility solutions increasingly accessible.

Major companies are focusing on Li-ion chemistry improvements, including the development of solid-state batteries that promise even greater performance and safety.

Meanwhile, Other battery types, including solid-state and lithium iron phosphate (LFP) batteries, are gaining traction for specific applications requiring enhanced safety, thermal stability, and lower cost — and are poised to become significant challengers over the coming years.

End-use Insights

Personal usage dominated the end-use segment, driven by rising consumer demand for convenient, eco-friendly transportation options for commuting, recreation, and short-distance travel. Consumers increasingly view electric bikes and scooters as viable alternatives to cars for daily commutes, particularly in congested urban areas.

Growing fitness consciousness, rising environmental awareness, and the expanding availability of stylish, high-performance models are further supporting personal adoption trends.

However, the Commercial segment is growing faster, driven by last-mile logistics, food delivery services, and fleet electrification initiatives by corporations aiming to reduce their carbon footprint. Commercial use of electric scooters, e-bikes, and motorcycles is becoming integral to urban business models seeking cost-effective and sustainable transport solutions.

Drive Insights

Hub drive systems dominated the market, primarily due to their cost-effectiveness, simplicity, and widespread use in electric bikes and scooters. Hub motors are integrated directly into the wheel, providing a compact and low-maintenance propulsion solution suitable for urban commuting.

Hub motors are particularly prevalent in the entry- and mid-level electric two-wheelers, offering sufficient torque for city riding without adding significant complexity to the drivetrain.

On the other hand, Belt Drive systems are expected to grow at the fastest pace. Belt drives offer smoother operation, lower maintenance, and longer lifespan compared to traditional chain drives. Premium e-bikes and motorcycles are increasingly adopting belt drive systems to enhance rider comfort, reduce noise, and improve overall reliability.

Regional Insights

Europe dominated the global electric mobility market, supported by progressive government policies, high consumer environmental awareness, and strong infrastructure development. Countries like Germany, the Netherlands, France, and the UK are at the forefront, offering attractive subsidies for electric vehicle purchases and investing in extensive cycling and EV charging networks.

The European Commission’s "Fit for 55" package and similar initiatives are pushing cities to reduce carbon emissions dramatically by 2030, encouraging a modal shift toward e-mobility. Moreover, cultural acceptance of two-wheelers for commuting, along with supportive financial schemes, has solidified Europe's leadership in the global market.

Asia-Pacific is witnessing the fastest growth, led by China, India, Japan, and Southeast Asian countries. China alone accounts for a significant share of global e-bike and electric scooter production and usage, driven by government mandates to curb pollution and strong domestic manufacturing capabilities.

India’s electric mobility revolution is gathering pace with initiatives like the FAME II scheme (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) offering financial incentives for EV adoption. Rising urbanization, supportive government policies, growing environmental concerns, and increasing affordability of electric mobility solutions are propelling regional market expansion.

Some of the prominent players in the electric mobility market include:

- BMW Motorrad International

- Gogoro, Inc.

- Honda Motor Co. Ltd.

- KTM AG

- Mahindra Group

- Ninebot Ltd.

- Suzuki Motor Corporation

- Terra Motors Corporation

- Vmoto Limited ABN

- Yamaha Motor Company Limited

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global electric mobility market.

Product

- Electric Bikes

- Electric Scooters

- Electric Motorized Scooters

- Electric Motorcycles

Drive

- Belt Drive

- Chain Drive

- Hub Drive

Battery

- Lead Acid Battery

- Li-Ion Battery

- Others

End-use

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)