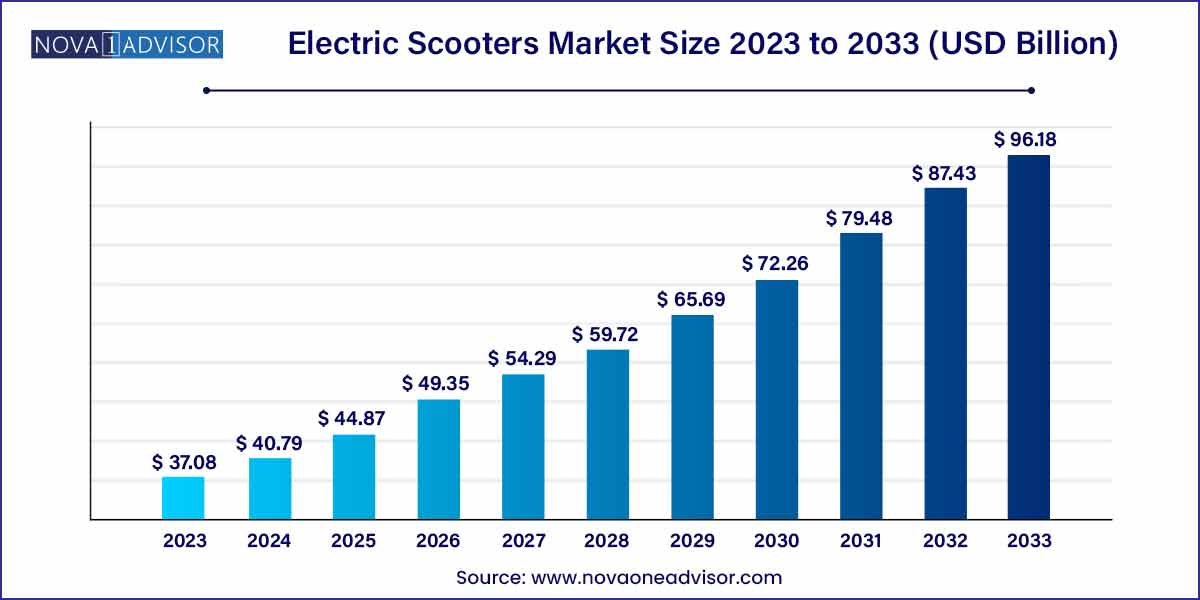

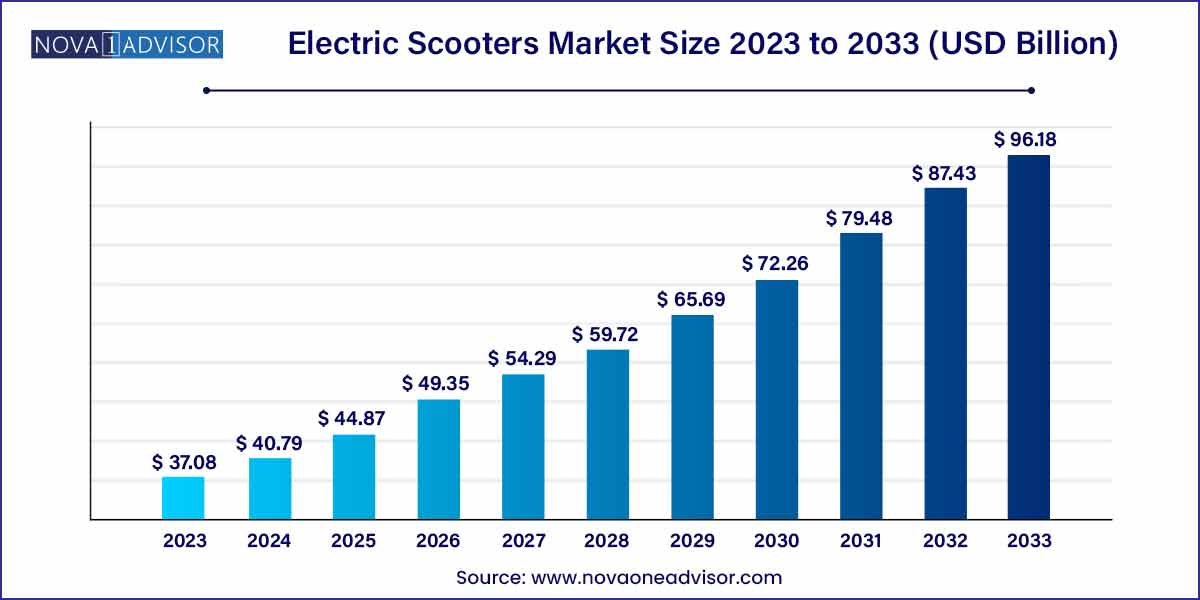

The global electric scooters market size was exhibited at USD 37.08 billion in 2023 and is projected to hit around USD 96.18 billion by 2033, growing at a CAGR of 10.0% during the forecast period of 2024 to 2033.

Key Takeaways:

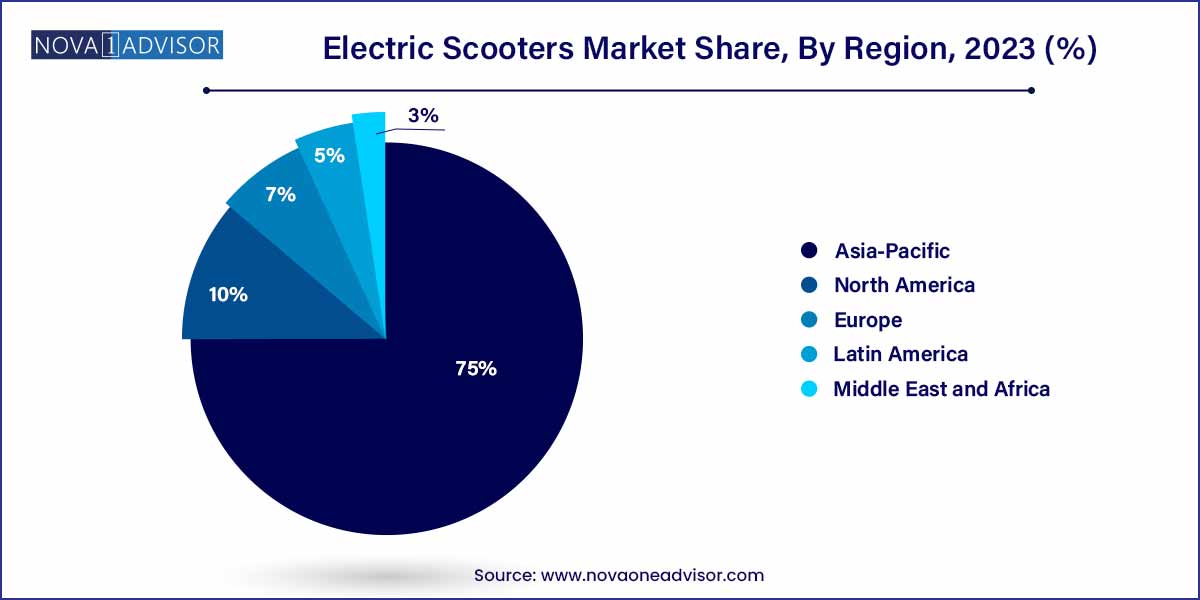

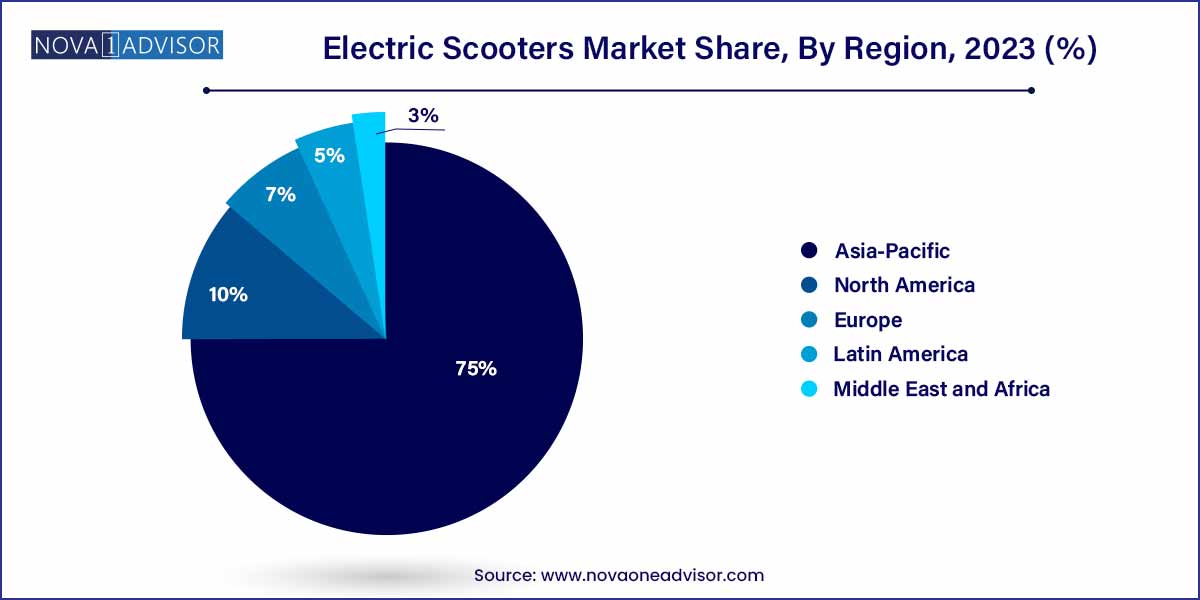

- Asia Pacific dominated the global industry in 2023 and accounted for the largest share, accounting for more than 75.0% of the overall revenue.

- The hub-drive motor type is expected to hold a dominant share of more than 70% in the electric scooters market during the forecast period.

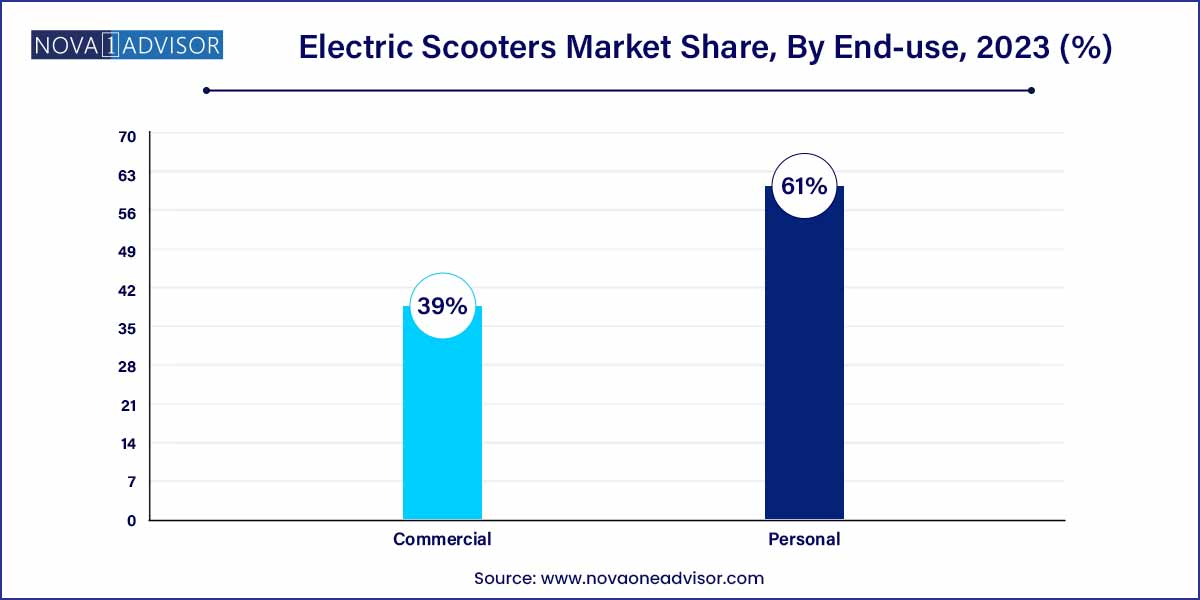

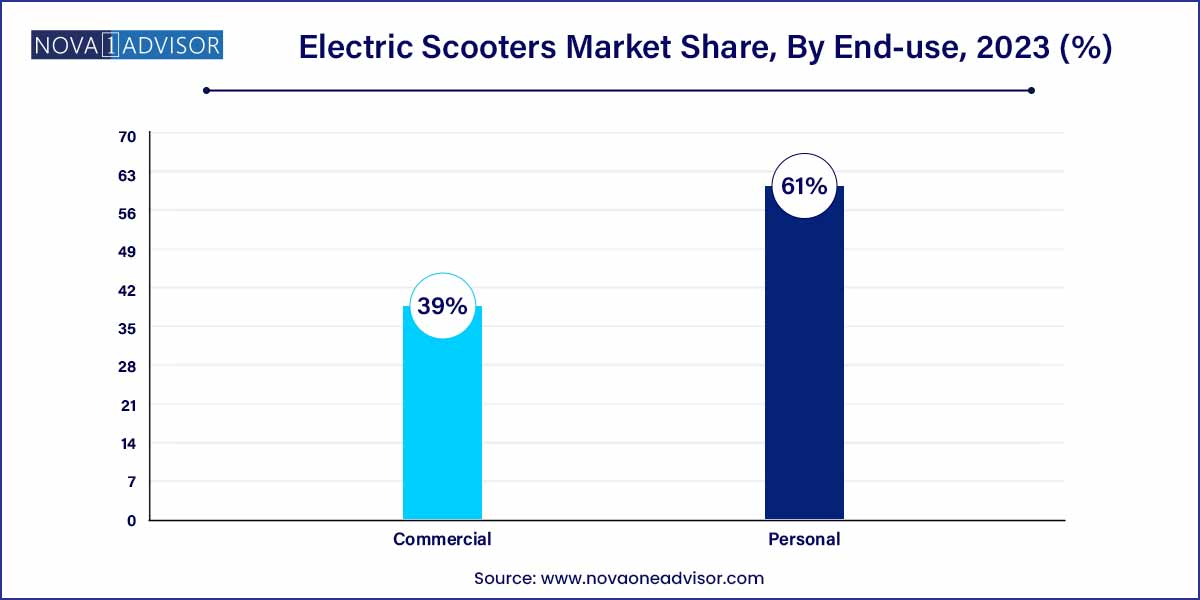

- The personal use segment holds a dominant share of more than 61% in the electric scooter market.

- The lead-acid battery segment will account for less than 20% of the electric scooter market in 2023.

Market Overview

The global electric scooters market has emerged as a pivotal player in the mobility revolution, offering a viable, eco-friendly alternative to traditional internal combustion engine (ICE) two-wheelers. Designed to serve urban and suburban environments, electric scooters have become increasingly mainstream due to advancements in battery technology, rising fuel prices, increasing urban congestion, and growing environmental consciousness among consumers.

Electric scooters (e-scooters) operate via rechargeable battery packs—most commonly lithium-ion or lead-acid—eliminating tailpipe emissions and significantly reducing operating costs. From personal commuters to last-mile delivery fleets and shared mobility operators, the versatility of e-scooters makes them an attractive choice in both developed and emerging economies. Urban mobility, in particular, is undergoing significant transformation with electric two-wheelers helping reduce traffic density and pollution.

Government support in the form of subsidies, tax exemptions, and infrastructure development (such as charging stations) further accelerates market adoption. Emerging markets like India, Vietnam, and Indonesia are experiencing rapid adoption, while advanced economies such as Germany, the U.S., and China continue to push product innovation. The result is a highly dynamic and competitive global electric scooter ecosystem poised for robust growth through 2030 and beyond.

Electric Scooters Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 37.08 Billion |

| Market Size by 2033 |

USD 96.18 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 10.0% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Drive Type, Battery Type, Product, Battery Fitting, End use, Region. |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Mahindra GenZe; BMW Motorrad International; Vmoto Limited; Terra Motors Corporation; Gogoro Inc.; Jiangsu Xinri Electric Vehicle Co. Ltd. |

Electric Scooters Market Dynamics

- Regulatory Landscape and Challenges:

The electric scooters market operates within a dynamic regulatory landscape, presenting both opportunities and challenges. While governments globally are increasingly supportive of sustainable mobility, regulations surrounding electric scooters vary, posing a challenge for market players. Issues such as speed limits, helmet requirements, and the allocation of dedicated lanes impact market penetration. Navigating these regulatory intricacies is crucial for industry players to ensure compliance and foster a conducive environment for sustained growth.

- Technological Innovations and Smart Features:

Technological advancements are driving innovation within the electric scooters market, with a surge in the integration of smart features. Companies are incorporating GPS tracking, mobile app connectivity, and digital locks to enhance user experience and address safety concerns. These technological upgrades not only improve the efficiency of electric scooters but also align with the contemporary demand for interconnected and user-friendly transportation solutions. As the market continues to evolve, the integration of cutting-edge technologies is expected to be a pivotal dynamic shaping the future growth trajectory of electric scooters.

Electric Scooters Market Restraint

- Safety Concerns and Regulatory Compliance:

One significant restraint affecting the electric scooters market revolves around safety concerns and the need for stringent regulatory compliance. Instances of accidents and injuries associated with electric scooters have raised apprehensions among users and regulatory authorities alike. Striking the right balance between fostering market growth and implementing safety regulations poses a challenge.

- Infrastructure Challenges and Range Limitations:

The electric scooters market faces a restraint linked to infrastructure challenges and the inherent limitations of battery range. The widespread adoption of electric scooters necessitates a robust charging infrastructure, which is currently underdeveloped in many regions. Additionally, the limited battery range of electric scooters poses constraints on their utility for longer journeys.

Electric Scooters Market Opportunity

- Growing Urbanization and Last-Mile Connectivity:

The electric scooters market is poised to capitalize on the burgeoning trend of global urbanization and the increasing need for efficient last-mile connectivity solutions. As cities expand and traffic congestion rises, electric scooters present an opportunity to provide quick, cost-effective, and eco-friendly transportation for short-distance commuting. The demand for seamless urban mobility positions electric scooters as a valuable solution, offering convenience to users and contributing to the reduction of traffic congestion and environmental impact.

- Advancements in Battery Technology and Range Extension:

Continuous advancements in battery technology present a significant opportunity for the electric scooters market. Improvements in battery efficiency, capacity, and charging speed are enhancing the range and overall performance of electric scooters. As battery technologies evolve, electric scooters can extend their range, making them more versatile and appealing to a broader audience. This opportunity not only addresses range limitations but also contributes to the overall sustainability and competitiveness of electric scooters in the broader transportation market.

Electric Scooters Market Challenges

- Regulatory Hurdles and Safety Concerns:

A primary challenge confronting the electric scooters market pertains to navigating regulatory hurdles and addressing safety concerns. Varied and evolving regulations, including speed limits, helmet requirements, and rider age restrictions, pose a complex landscape for market players. Moreover, incidents of accidents and injuries associated with electric scooters have raised safety apprehensions among both users and regulatory authorities. Striking a balance between encouraging market growth and implementing effective safety measures remains a critical challenge, necessitating collaboration between industry stakeholders and regulatory bodies.

- Charging Infrastructure and Range Limitations:

The electric scooters market faces a critical challenge related to charging infrastructure and the inherent limitations of battery range. The widespread adoption of electric scooters necessitates a robust and accessible charging network, which is currently underdeveloped in various regions. Additionally, the limited range of electric scooter batteries poses challenges for longer journeys, impacting their suitability for certain use cases. Overcoming these challenges requires substantial investment in charging infrastructure and ongoing advancements in battery technology to enhance the overall viability and appeal of electric scooters in the broader transportation landscape.

Segments Insights:

Drive Insights

Hub motors dominate the electric scooter market, owing to their compact design, low maintenance requirements, and direct torque delivery. Unlike chain or belt drives, hub motors are integrated within the wheel, resulting in fewer moving parts and reduced energy loss. Their simplicity enhances durability and efficiency, making them ideal for both consumer and fleet applications. Leading manufacturers such as NIU and Segway-Ninebot widely deploy hub motors in urban commuting models for their quiet operation and easy integration with regenerative braking systems.

Chain drive scooters are the fastest-growing sub-segment, especially in performance and commercial applications. While heavier and more complex than hub motors, chain drives offer better torque transmission and are more suitable for heavier loads or rough terrain. They are commonly found in maxi scooters and cargo models used in hilly areas or delivery services requiring enhanced load handling. Companies like Hero Electric and Super Soco are developing chain drive electric scooters targeted at delivery personnel and semi-urban geographies.

End Use Insights

The personal use segment dominates the electric scooters market, accounting for the majority of sales globally. Consumers purchase e-scooters for commuting, leisure, and utility purposes. Features like regenerative braking, cruise control, and anti-theft systems appeal to tech-savvy buyers looking for sustainable and economical mobility solutions. As more cities restrict ICE two-wheelers, personal electric scooters become the default option for daily transport. Emerging markets see strong growth from college students and working professionals, while advanced markets see uptake among urban commuters and green enthusiasts.

The commercial use segment is the fastest-growing, fueled by demand from last-mile delivery services, logistics firms, and scooter-sharing operators. Companies like Lime, Bird, and Bolt have expanded electric scooter fleets in North America and Europe. In Asia-Pacific, e-commerce companies are turning to e-scooters to address fuel cost inflation and environmental regulations. Many models now come with telemetry, remote immobilization, and centralized fleet tracking systems tailored for B2B applications. This segment is expected to grow exponentially as businesses embrace green logistics.

Battery Insights

Lithium-ion batteries dominate the battery type segment, thanks to their superior energy density, lightweight nature, and faster charging times compared to traditional lead-acid alternatives. Most premium and mid-range electric scooters today come equipped with Li-ion packs, offering ranges between 60–150 km per charge. Manufacturers such as Ola Electric and Ather Energy in India, and Segway in the U.S., use lithium batteries with enhanced thermal management and BMS (battery management systems) for improved safety and performance.

Lead-acid batteries are still growing modestly, particularly in price-sensitive markets. Though heavy and slower to charge, lead-acid battery scooters are cheaper and easier to manufacture, making them appealing for budget-conscious consumers in rural Asia and Africa. However, environmental concerns and declining performance in extreme weather are gradually shifting demand away from this segment. Manufacturers targeting low-income demographics continue to use these batteries while transitioning to Li-ion for premium models.

Regional Insights

Asia-Pacific dominates the electric scooters market, led by high urban population density, growing environmental concerns, and government support. China, India, Taiwan, and Vietnam collectively account for a large share of both production and consumption. China remains the largest electric two-wheeler market globally, with brands like Yadea, NIU, and Luyuan offering competitive models at scale. India is witnessing exponential growth backed by incentives under FAME-II, low-cost manufacturing, and rising fuel prices. Domestic players like Ola Electric and Ather Energy have disrupted traditional markets with software-driven scooters and charging ecosystems.

Europe is the fastest-growing region, supported by progressive environmental policies, rapid electrification goals, and booming shared mobility. Countries like Germany, France, the Netherlands, and the Nordics are seeing a sharp shift toward electric personal mobility. Governments offer rebates, tax exemptions, and subsidies for electric two-wheeler purchases. Cities like Paris and Berlin are restricting combustion vehicles and promoting e-scooters for urban use. European manufacturers such as Piaggio (Vespa Elettrica) and new entrants like Silence and Niu Europe are expanding their offerings to meet growing demand.

Recent Developments

-

January 2024 – Ola Electric launched its second-generation S1 Pro Gen-2, featuring a redesigned frame, upgraded battery, and AI-based riding modes, further cementing its position as India's top e-scooter brand.

-

February 2024 – Segway-Ninebot unveiled the E125S, an advanced electric scooter with a dual-swappable battery system, targeting European and Southeast Asian markets.

-

March 2024 – Gogoro announced a partnership with India's Zypp Electric to expand its battery-swapping network in Delhi and Mumbai, supporting commercial fleet electrification.

-

April 2025 – Yamaha introduced its concept Neo 2.0, a high-performance electric scooter aimed at Gen Z riders in urban areas, scheduled for launch across Asia-Pacific by late 2025.

Some of the prominent players in the electric scooters market include:

- AllCell Technologies LLC

- BMW Motorrad International

- BOXX Corp.

- Gogoro, Inc.

- Green Energy Motors Corp.

- Greenwit Technologies Inc.

- Honda Motor Co. Ltd.

- Jiangsu Xinri E-Vehicle Co., Ltd.

- KTM AG

- Mahindra GenZe.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global electric scooters market.

Drive

- Belt Drive

- Chain Drive

- Hub Motors

Battery

Product

- Standard

- Folding

- Self-Balancing

- Maxi

- Three wheeled

Battery Fitting

End Use

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)