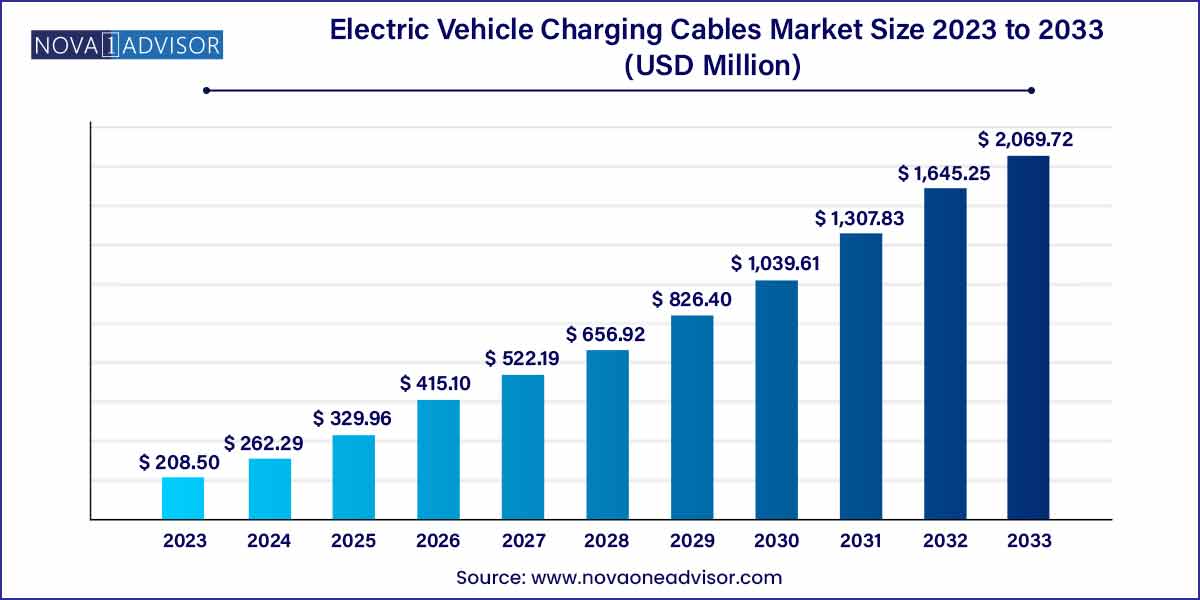

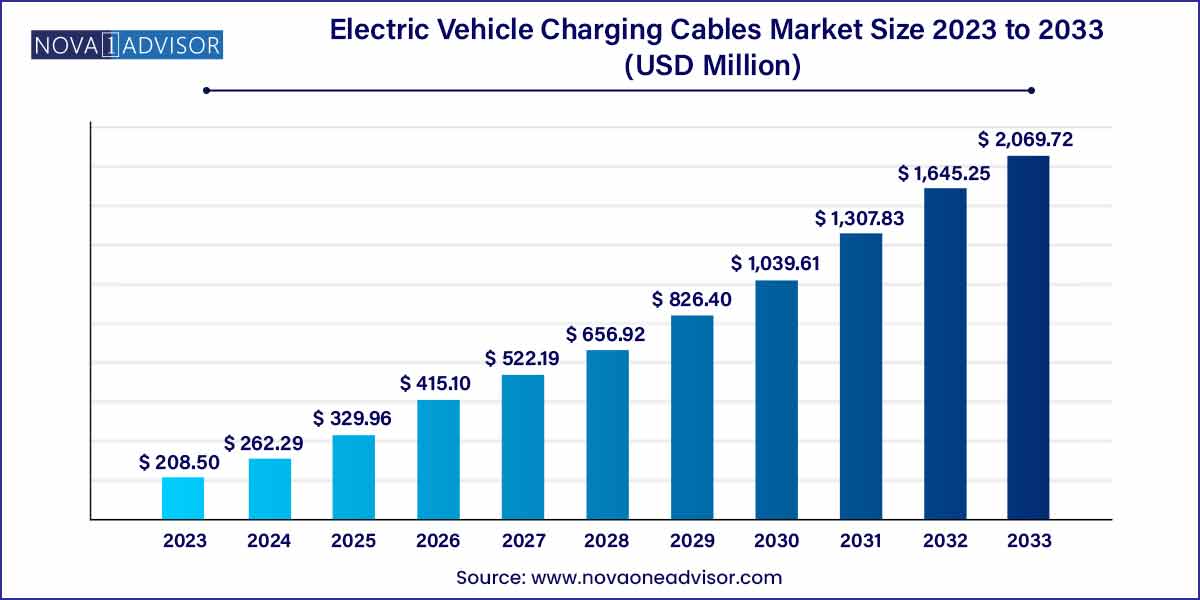

The global electric vehicle charging cables market size was exhibited at USD 208.50 million in 2023 and is projected to hit around USD 2,069.72 million by 2033, growing at a CAGR of 25.8% during the forecast period of 2024 to 2033.

Key Takeaways:

- Asia Pacific dominated the market in 2023 and held a 62.0% share of the overall revenue.

- The AC segment dominated the market in 2023 with a share of 73.3%.

- The below-5-meter cable length segment dominated the market in 2023 with over 53.0% share and is projected to maintain its lead over the forecast period.

- The private charging segment dominated the market in 2023 with over 75.0% of the overall revenue and is projected to maintain its lead over the forecast period.

Electric Vehicle Charging Cables Market: Overview

The Electric Vehicle (EV) Charging Cables Market has emerged as a crucial component of the rapidly growing electric mobility ecosystem. With governments globally pushing for reduced carbon emissions and enhanced adoption of electric vehicles, the demand for robust, efficient, and durable charging infrastructure is on a steep rise. EV charging cables serve as the essential link between the charging station and the electric vehicle, ensuring effective power transmission for battery replenishment.

Technological advancements, including the introduction of high-power DC fast charging cables and ultra-flexible, lightweight cables, have further stimulated market dynamics. The growing emphasis on the development of smart cities and electrification of public and private transportation fleets continues to provide fertile ground for the market's expansion. For instance, the roll-out of public EV charging networks in countries like the United States, Germany, and China has considerably propelled the demand for high-quality charging cables.

The increasing penetration of electric vehicles in both developed and emerging economies, driven by supportive government policies, fiscal incentives, and heightened environmental awareness, signifies a robust outlook for the EV charging cables market through the next decade.

Electric Vehicle Charging Cables Market Growth

The growth of the electric vehicle charging cables market is propelled by several key factors. Firstly, the increasing adoption of electric vehicles worldwide, driven by environmental concerns and government initiatives promoting sustainable transportation, is fueling demand for charging infrastructure, including charging cables. Additionally, rapid technological advancements in charging cable design and materials, such as high-power charging capabilities and smart charging features, are enhancing the efficiency and convenience of EV charging, further driving market growth. Moreover, investments in expanding EV charging infrastructure, both by public and private stakeholders, are facilitating the proliferation of electric vehicles and consequently boosting the demand for charging cables. Overall, these factors collectively contribute to the robust growth trajectory of the electric vehicle charging cables market, positioning it as a vital component of the burgeoning electric mobility ecosystem.

Electric Vehicle Charging Cables Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 208.50 Million |

| Market Size by 2033 |

USD 2,069.72 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 25.8% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Power Supply, Cable Length, Charging Level, Shape, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Leoni AG; Coroplast; Chengdu Khons Technology Co., Ltd.; Phoenix Contact; Aptiv; BESEN-Group; General Cable Technologies Corporation; Dyden Corporation; TE Connectivity |

Electric Vehicle Charging Cables Market Dynamics

- Technological Advancements and Innovation:

The electric vehicle charging cables market is experiencing significant growth due to continuous technological advancements and innovations. Manufacturers are investing in research and development to improve charging cable materials, design, and functionality. One notable trend is the development of high-power charging cables capable of delivering faster charging speeds, thereby reducing overall charging times for electric vehicles. Moreover, the integration of smart charging features, such as RFID authentication and remote monitoring capabilities, enhances user convenience and safety.

- Government Regulations and Incentives:

Government regulations and incentives play a crucial role in driving the adoption of electric vehicles and, consequently, the demand for charging cables. With growing concerns over air pollution and climate change, many governments worldwide are implementing stringent emissions standards and offering incentives to promote the adoption of electric vehicles. Incentives such as tax credits, rebates, and subsidies for purchasing electric vehicles and installing charging infrastructure incentivize consumers and businesses to transition towards electric mobility.

Electric Vehicle Charging Cables Market Restraint

- Compatibility Issues and Interoperability Challenges:

One of the primary restraints facing the electric vehicle charging cables market is the prevalence of compatibility issues and interoperability challenges. As electric vehicle manufacturers develop different charging standards and connector types, ensuring compatibility between charging cables and various EV models becomes increasingly complex. This fragmentation in charging standards poses a significant barrier to the widespread adoption of electric vehicles and creates inconvenience for EV owners who may encounter difficulties finding compatible charging stations or cables.

- Cost Constraints and Affordability:

Another key restraint impacting the electric vehicle charging cables market is the cost constraints associated with advanced charging technologies and materials. High-quality charging cables equipped with features such as fast-charging capabilities and smart functionalities tend to command higher prices, making them less accessible to price-sensitive consumers and businesses. Additionally, the cost of manufacturing durable and reliable charging cables using premium materials, such as high-grade insulation and corrosion-resistant connectors, contributes to the overall expense of EV charging infrastructure deployment.

Electric Vehicle Charging Cables Market Opportunity

- Expansion of Charging Infrastructure:

One of the most promising opportunities in the electric vehicle charging cables market lies in the expansion of charging infrastructure. With the increasing adoption of electric vehicles globally, there is a growing need to develop robust and extensive charging networks to support the growing EV fleet. This presents a significant opportunity for stakeholders in the charging cables market to invest in the deployment of charging stations, both public and private, across key locations such as urban centers, highways, commercial areas, and residential complexes.

- Integration of Wireless Charging Technology:

The integration of wireless charging technology presents a promising opportunity for the electric vehicle charging cables market. Wireless charging eliminates the need for physical cables, offering greater convenience and ease of use for electric vehicle owners. As wireless charging technology matures and becomes more widely adopted, there is a growing demand for wireless charging solutions in both residential and commercial settings. This presents an opportunity for charging cable manufacturers to diversify their product offerings and develop innovative wireless charging solutions compatible with electric vehicles.

Electric Vehicle Charging Cables Market Challenges

- Compatibility Issues and Interoperability Challenges:

A primary challenge in the electric vehicle charging cables market is the prevalence of compatibility issues and interoperability challenges. As electric vehicle manufacturers adopt different charging standards and connector types, ensuring compatibility between charging cables and various EV models becomes increasingly complex. This fragmentation in charging standards creates inconvenience for EV owners who may encounter difficulties finding compatible charging stations or cables, ultimately hindering the seamless adoption of electric vehicles. Moreover, the lack of standardized charging infrastructure poses challenges for charging network operators and service providers, requiring additional investments in developing universal charging solutions that can accommodate diverse EV models and address interoperability issues effectively.

- Cost Constraints and Affordability:

Another significant challenge impacting the electric vehicle charging cables market is the cost constraints associated with advanced charging technologies and materials. High-quality charging cables equipped with features such as fast-charging capabilities and smart functionalities tend to command higher prices, making them less accessible to price-sensitive consumers and businesses. Additionally, the cost of manufacturing durable and reliable charging cables using premium materials, such as high-grade insulation and corrosion-resistant connectors, contributes to the overall expense of EV charging infrastructure deployment.

Segments Insights:

Power Supply Insights

Alternate Charging (AC) dominated the power supply segment due to its wide adoption in residential and public slow-charging applications. AC charging cables are more cost-effective, compatible with existing electrical grids, and suitable for overnight or long-duration vehicle charging. Most private homes and commercial establishments prefer AC chargers for their simplicity and lower installation costs. Brands like Tesla and ChargePoint have focused significantly on improving the efficiency and durability of AC charging cables to cater to this ever-expanding market segment.

In contrast, Direct Charging (DC) is the fastest-growing power supply segment, driven by the escalating need for rapid and ultra-fast charging solutions in public spaces and highways. DC charging cables are essential for Level 3 chargers, which can recharge an EV battery up to 80% within 30 minutes. As the demand for inter-city travel solutions and fleet electrification (such as taxis and delivery trucks) rises, DC cable technology, characterized by high conductivity, thermal resilience, and enhanced safety standards, is witnessing robust growth.

Cable Length Insights

6 meters to 10 meters dominated the cable length segment, as this range strikes a balance between flexibility and practicality for most residential and commercial installations. Cables in this length range offer sufficient maneuverability to connect vehicles parked at different angles or distances from charging stations, without becoming too cumbersome or creating storage challenges. Public charging stations in urban settings especially prefer 6-10 meter cables for their operational ease.

Meanwhile, Above 10 meters is the fastest-growing segment in cable length, fueled by the need for more flexible and versatile solutions, particularly in large commercial charging hubs, fleet garages, and multi-vehicle installations. Longer cables are essential in scenarios where vehicles are parked at varying distances, and where accessibility constraints are prevalent. Companies are focusing on producing lightweight, highly durable long cables to mitigate handling difficulties traditionally associated with extended lengths.

Charging Level Insights

Level 2 charging dominated the charging level segment, offering a perfect middle ground between slow Level 1 and ultra-fast Level 3 charging. Level 2 chargers, operating at 240V, are ideal for both residential and commercial applications, allowing vehicles to charge overnight or during work hours efficiently. Their cost-effectiveness and compatibility with almost all EV models have made Level 2 charging cables the most common in urban landscapes.

On the other hand, Level 3 is the fastest-growing charging level segment, responding to the urgent market demand for ultra-fast public charging solutions. With Level 3 chargers capable of delivering hundreds of kilowatts of power, they significantly reduce charging time, which is crucial for commercial fleets and long-distance travelers. Innovations like liquid-cooled Level 3 charging cables are increasingly gaining attention, and companies like ABB and Tritium are aggressively investing in this space.

Shape Insights

Straight cables dominated the shape segment, favored for their ease of manufacturing, low cost, and widespread familiarity among users. Straight cables are straightforward to deploy, especially in settings where spatial constraints are minimal. Many public and private charging installations continue to rely on straight cables for their simplicity and lower price points.

However, Coiled cables are the fastest-growing segment, particularly in urban environments where minimizing cable clutter and preventing tripping hazards are critical. Coiled cables automatically retract when not in use, making them highly suitable for public settings like shopping malls, offices, and parking structures. EV cable producers are enhancing coiled cable designs to ensure longer lifespan, flexibility, and resistance to repeated stretching and coiling.

Application Insights

Private Charging dominated the application segment, fueled by the surging number of residential EV charging installations. Homeowners prefer the convenience and cost-effectiveness of private chargers, and with increasing EV sales, private installations are booming. Moreover, real estate developers are integrating EV charging facilities into new residential projects to attract eco-conscious buyers.

Nevertheless, Public Charging is the fastest-growing application segment, propelled by city governments and businesses establishing widespread public EV charging networks. The necessity to reduce range anxiety, combined with the electrification of commercial fleets, is dramatically increasing public charging installations in malls, highways, restaurants, and office complexes. As a result, demand for highly durable, safe, and fast-operating public charging cables is surging rapidly.

Regional Insights

Europe dominated the global EV charging cables market, accounting for the largest share in revenue and installations. Factors such as the European Union's strict emission regulations, generous EV purchase incentives, and strong public and private sector investment in EV infrastructure have positioned Europe as the leader. Countries like Norway, Germany, and the Netherlands are exemplary cases, with Norway already achieving over 70% EV share in new car sales by 2024. European standards like CCS (Combined Charging System) are becoming universal, prompting a high demand for compatible charging cables with advanced safety features.

Conversely, Asia-Pacific is the fastest-growing region in the EV charging cables market. China, Japan, South Korea, and emerging economies like India are experiencing rapid EV adoption driven by government policies, urban pollution concerns, and rising fuel costs. China's New Energy Vehicle (NEV) market is booming, with over 10 million EVs on the roads by early 2025. Simultaneously, infrastructure projects under initiatives like "Make in India" are catalyzing domestic EV charging infrastructure development. Consequently, the requirement for high-quality charging cables to support massive EV deployment is surging exponentially across Asia-Pacific.

Some of the prominent players in the Electric vehicle charging cables market include:

- Leoni AG

- Coroplast

- Chengdu Khons Technology Co., Ltd.

- Phoenix Contact

- Aptiv

- BESEN-Group

- General Cable Technologies Corporation

- Dyden Corporation

- TE Connectivity

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global electric vehicle charging cables market.

Power Supply

- Alternate Charging (AC)

- Direct Charging (DC)

Cable Length

- Below 5 meters

- 6 meters to 10 meters

- Above 10 meters

Charging Level

Shape

- Straight Cable

- Coiled Cable

Application

- Private Charging

- Public Charging

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)