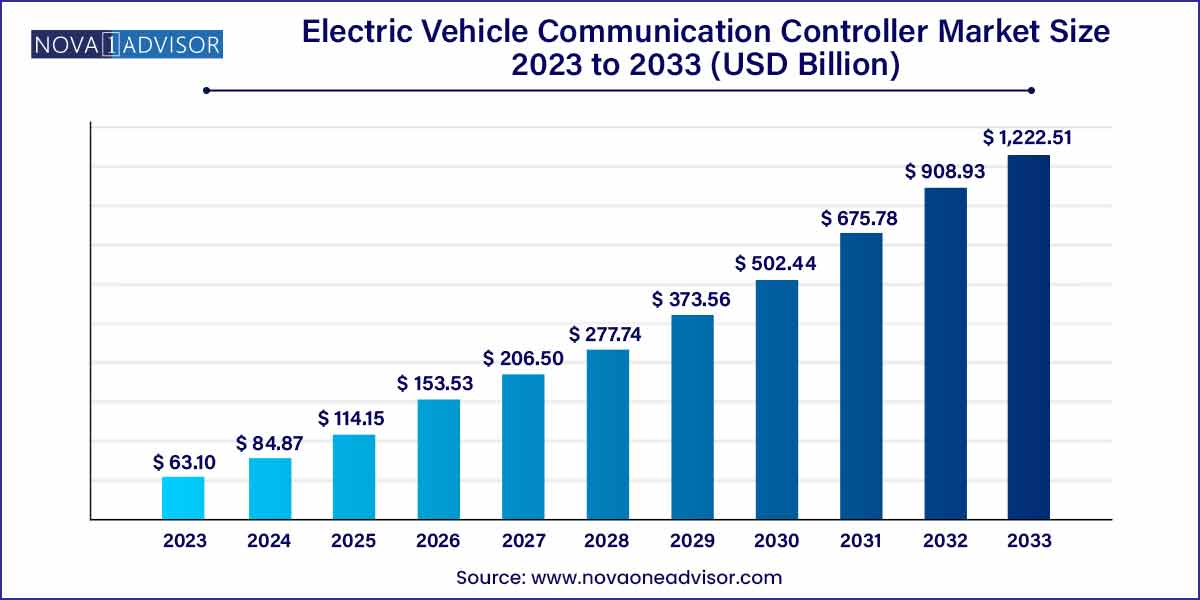

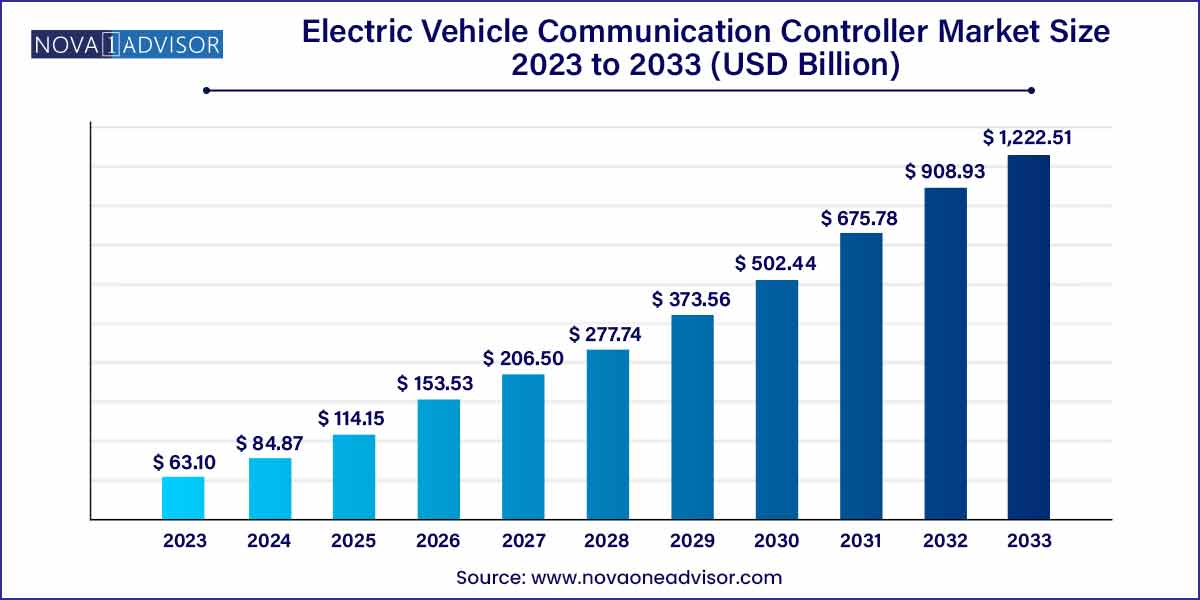

The global electric vehicle communication controller market size was exhibited at USD 63.10 billion in 2023 and is projected to hit around USD 1,222.51 billion by 2033, growing at a CAGR of 34.5% during the forecast period of 2024 to 2033.

Key Takeaways:

- Europe dominated the market in 2023.

- The vehicle-based communication controller segment dominated the market in 2023.

- The wired charging segment dominated the global electric vehicle communication controller market in 2023.

- The PHEV segment dominated the market in 2023.

- The passenger vehicle segment accounted for the largest share in the market in 2023.

Electric Vehicle Communication Controller Market: Overview

The Electric Vehicle Communication Controller (EVCC) market plays a critical role in the broader electric mobility ecosystem. As electric vehicles (EVs) increasingly become mainstream, seamless communication between the EV, the electric vehicle supply equipment (EVSE), and the grid becomes essential. This is where EV communication controllers both vehicle-based and supply equipment-based come into play. These controllers are embedded systems that manage the flow of information and data between the EV and the charging station, ensuring safety, interoperability, and efficiency.

EVCCs are responsible for handling several technical protocols such as ISO 15118, DIN 70121, and OCPP, which regulate the authentication, charging control, and secure communication between vehicles and chargers. The growing adoption of fast charging, wireless charging, and vehicle-to-grid (V2G) capabilities has elevated the significance of intelligent controllers. With governments worldwide focusing on expanding EV charging infrastructure, the market for EV communication controllers is on a strong growth trajectory.

Real-world implementations are increasingly showcasing the importance of EVCCs. For instance, smart charging initiatives across Europe—like those seen in the Netherlands and Germany—are integrating advanced communication controllers into public charging stations. Similarly, Tesla’s proprietary communication protocols and recent moves toward interoperability with CCS2 chargers underscore the growing need for sophisticated EVCC systems.

Electric Vehicle Communication Controller Market Growth

The Electric Vehicle Communication Controller (EVCC) market is experiencing robust growth driven by several key factors. Firstly, the increasing adoption of electric vehicles (EVs) worldwide is a significant growth driver. With growing environmental concerns and stringent emissions regulations, consumers and governments alike are incentivizing the transition to electric mobility, thereby boosting the demand for EVCCs. Secondly, technological advancements in EVCCs, including improved connectivity, cybersecurity features, and interoperability standards, are enhancing their functionality and appeal. These advancements not only optimize charging processes but also ensure seamless communication between EVs and charging infrastructure. Additionally, government initiatives and investments in charging infrastructure development are accelerating market growth by creating a conducive environment for EV adoption. As regulatory frameworks evolve to mandate standardized communication protocols and interoperability requirements, the EVCC market is poised for further expansion, offering promising opportunities for stakeholders across the e-mobility ecosystem.

Electric Vehicle Communication Controller Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 63.10 Billion |

| Market Size by 2033 |

USD 1,222.51 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 34.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

System,Charging Type,Electric Vehicle Type,Application,Regional |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

ABB, Ltd.; BYD Auto; Efacec; Ficosa; LG INNOTEK; Mitsubishi Electric; Robert Bosch LLC; Schneider Electric; Tesla, Inc.; and Vector. |

Electric Vehicle Communication Controller Market Dynamics

The Electric Vehicle Communication Controller (EVCC) market dynamics are influenced by various factors that shape its growth trajectory. One significant dynamic is the increasing adoption of electric vehicles (EVs) worldwide. With rising environmental awareness and stringent regulations aimed at reducing carbon emissions, the demand for EVs is on the rise. This surge in EV adoption directly impacts the demand for EVCCs, as they are essential components in facilitating communication between EVs and charging infrastructure. Additionally, technological advancements in EVCCs play a crucial role in driving market dynamics. Ongoing innovations, such as improved connectivity, cybersecurity features, and interoperability standards, enhance the functionality and reliability of EVCCs. These advancements not only optimize charging processes but also ensure seamless communication across diverse charging networks, thus fueling market growth and fostering the widespread adoption of electric mobility solutions.

Electric Vehicle Communication Controller Market Restraint

One of the significant restraints facing the Electric Vehicle Communication Controller (EVCC) market is the challenge of interoperability. The lack of standardized communication protocols and interoperability between EVs and charging infrastructure poses a significant hurdle to seamless EV charging experiences. Inconsistent standards and compatibility issues hinder the efficient communication and integration of EVCCs across different charging networks, thereby limiting their widespread adoption and usability. Additionally, cybersecurity risks present another restraint to the EVCC market. With the increasing connectivity of EVs and charging stations, the potential for cybersecurity threats and breaches escalates. Ensuring robust cybersecurity measures within EVCCs is imperative to safeguard against malicious attacks and protect sensitive data, but addressing these risks effectively remains a challenge for industry stakeholders. These restraints underscore the importance of developing standardized protocols and robust security measures to overcome interoperability and cybersecurity challenges in the EVCC market, thereby fostering its sustainable growth and advancement.

Electric Vehicle Communication Controller Market Opportunity

The Electric Vehicle Communication Controller (EVCC) market presents significant opportunities driven by the growing emphasis on infrastructure development. Government initiatives and investments in charging infrastructure expansion are creating a conducive environment for market growth. As nations worldwide prioritize the electrification of transportation, there is an increasing focus on building robust charging networks to support the growing fleet of electric vehicles. This presents an opportunity for EVCC manufacturers to capitalize on the rising demand for communication controllers that facilitate efficient charging processes and grid integration.

Another notable opportunity lies in the evolving regulatory landscape. With the emergence of regulatory frameworks mandating standardized communication protocols and interoperability requirements, there is a growing need for compliant EVCC solutions. Manufacturers that can develop EVCCs capable of meeting regulatory standards while offering enhanced features such as cybersecurity measures and advanced connectivity stand to gain a competitive edge in the market.

Electric Vehicle Communication Controller Market Challenges

Two significant challenges facing the Electric Vehicle Communication Controller (EVCC) market include interoperability concerns and cybersecurity risks.

Interoperability concerns arise from the lack of standardized communication protocols between electric vehicles (EVs) and charging infrastructure. Inconsistent standards and compatibility issues hinder seamless communication and integration across different charging networks. This lack of interoperability complicates the charging process for EV owners and presents challenges for EVCC manufacturers in developing solutions that can effectively interface with diverse charging systems.

Cybersecurity risks pose another significant challenge to the EVCC market. With the increasing connectivity of EVs and charging stations, there is a heightened risk of cybersecurity threats and breaches. Malicious actors may target EVCCs to access sensitive data or disrupt charging processes, posing risks to both vehicle owners and charging infrastructure operators. Ensuring robust cybersecurity measures within EVCCs is crucial to mitigate these risks and safeguard the integrity and security of electric vehicle charging systems.

Segments Insights:

System Insights

Vehicle-based communication controllers dominate the market, primarily because every EV must include a controller to facilitate communication with external charging infrastructure. These controllers manage crucial tasks such as charge initiation, current modulation, payment validation, and protocol translation. Leading automakers like Tesla, BMW, and Hyundai embed sophisticated EVCC modules that support both fast charging and bidirectional power flow.

However, Supply Equipment Communication Controllers (SECCs) are emerging as the fastest-growing segment. The push toward smart grid integration, demand-side management, and public infrastructure development is driving the need for SECCs in charging stations. These controllers ensure secure communication with EVs while handling grid coordination and software updates, particularly in fast-charging and V2G environments. The rise of SECCs is particularly evident in smart city projects in Europe and Asia.

Charging Type Insights

Wired charging remains the dominant charging type due to its maturity, cost-effectiveness, and widespread infrastructure presence. The majority of EVCCs today are optimized for wired communication protocols that manage charging profiles, safety interlocks, and billing mechanisms. OEMs and EVSE manufacturers continue to invest in improving DC fast charging infrastructure using wired standards like CCS and CHAdeMO.

Nevertheless, wireless charging is gaining momentum as the fastest-growing segment. Its potential to eliminate cable clutter, reduce wear and tear, and enable automatic alignment makes it highly attractive for consumer EVs and autonomous fleets. Communication controllers in wireless setups are tasked with additional responsibilities such as managing magnetic alignment, efficiency calibration, and real-time diagnostics. Companies like WiTricity and Electreon are pioneering pilot deployments where EVCCs act as core control units in contactless energy transfer.

Electric Vehicle Type Insights

Battery Electric Vehicles (BEVs) dominate the market for EVCCs as they require continuous and active communication throughout their charging cycles, especially in fast-charging environments. As BEVs operate solely on electricity, their reliance on communication controllers is critical for efficient energy management, battery optimization, and thermal balancing. High-volume BEV manufacturers like Tesla, BYD, and Rivian equip their vehicles with proprietary or standardized communication controllers to enhance performance and user experience.

Conversely, Plug-In Hybrid Electric Vehicles (PHEVs) are the fastest-growing sub-segment. As transitional vehicles in emerging markets and rural areas, PHEVs combine the benefits of both electric and conventional propulsion. EVCCs in PHEVs are evolving to manage hybrid system interactions, including charge mode switching, regenerative energy control, and smart grid connectivity. Their growth is particularly notable in regions like Eastern Europe and Southeast Asia where full BEV adoption is still in its early stages.

Application Insights

Passenger vehicles account for the majority of EVCC deployment, largely due to their sheer volume and diversity of use cases. Consumers demand intelligent features like Plug & Charge, real-time charging status via apps, and seamless roaming across public networks. EVCCs integrated into these vehicles ensure not just power delivery but also personalized charging experiences.

Commercial vehicles, including electric buses, delivery vans, and long-haul trucks, are witnessing the fastest EVCC adoption. These vehicles require sophisticated controller systems to manage bulk charging, route optimization, and real-time telematics. For instance, electric buses in China and Europe now use EVCCs that can coordinate with fleet management software and grid systems to reduce peak load impacts and ensure uptime.

Regional Insights

Asia-Pacific dominates the EV communication controller market, driven by the region’s leadership in EV production and infrastructure deployment. China, in particular, is a powerhouse with companies like BYD, SAIC, and Xpeng integrating advanced EVCC technologies into their models. The government’s proactive policies, such as mandatory charging protocol standardization and aggressive subsidies, further solidify the market.

Japan and South Korea also contribute significantly, with technology leaders like Panasonic, DENSO, and LG Innotek developing proprietary EVCC solutions. The region benefits from a dense network of public chargers, government-led standardization efforts (like CHAdeMO and China’s GB/T), and high penetration of BEVs in urban areas.

Europe is currently the fastest-growing region for EVCC deployment, fueled by policy mandates, environmental goals, and sophisticated automotive engineering. The EU’s AFIR regulation mandates standardized communication across all public charging infrastructure, placing EVCCs at the heart of compliance. Automakers like Volkswagen and BMW have adopted ISO 15118-based Plug & Charge capabilities across their latest EV models.

Moreover, smart grid integration and renewable energy coordination in countries like Germany, the Netherlands, and Norway are driving demand for bidirectional EVCCs that support V2G and dynamic pricing models. With pan-European roaming networks and carbon neutrality goals, the continent represents the most innovation-intensive geography for EVCC vendors.

Some of the prominent players in the Electric vehicle communication controller market include:

- ABB, Ltd

- BYD Auto

- Efacec

- Ficosa

- LG INNOTEK

- Mitsubishi Electric

- Robert Bosch LLC

- Schneider Electric

- Tesla, Inc

Recent Developments

-

March 2025: LG Innotek unveiled a next-gen EV communication controller supporting both wired and wireless protocols with enhanced cybersecurity modules.

-

February 2025: Siemens eMobility and SAP SE announced collaboration on cloud-based charging solutions integrated with EVCCs to manage real-time billing and fleet operations.

-

January 2025: WiTricity completed successful trials of wireless EV charging in partnership with OEMs, integrating ISO 15118-compliant EVCCs into test vehicles.

-

December 2024: Tesla rolled out a software update enabling Plug & Charge across its European fleet via retrofitted ISO 15118 modules.

-

November 2024: ABB launched a new line of fast chargers with embedded SECCs offering real-time diagnostics and over-the-air updates.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global electric vehicle communication controller market.

System

- Vehicle-based Communication Controller

- Supply Equipment Communication Controller (SECC)

Charging Type

- Wired Charging

- Wireless Charging

Electric Vehicle Type

- Battery Electric Vehicle (BEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

Application

- Passenger Vehicle

- Commercial Vehicle

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)