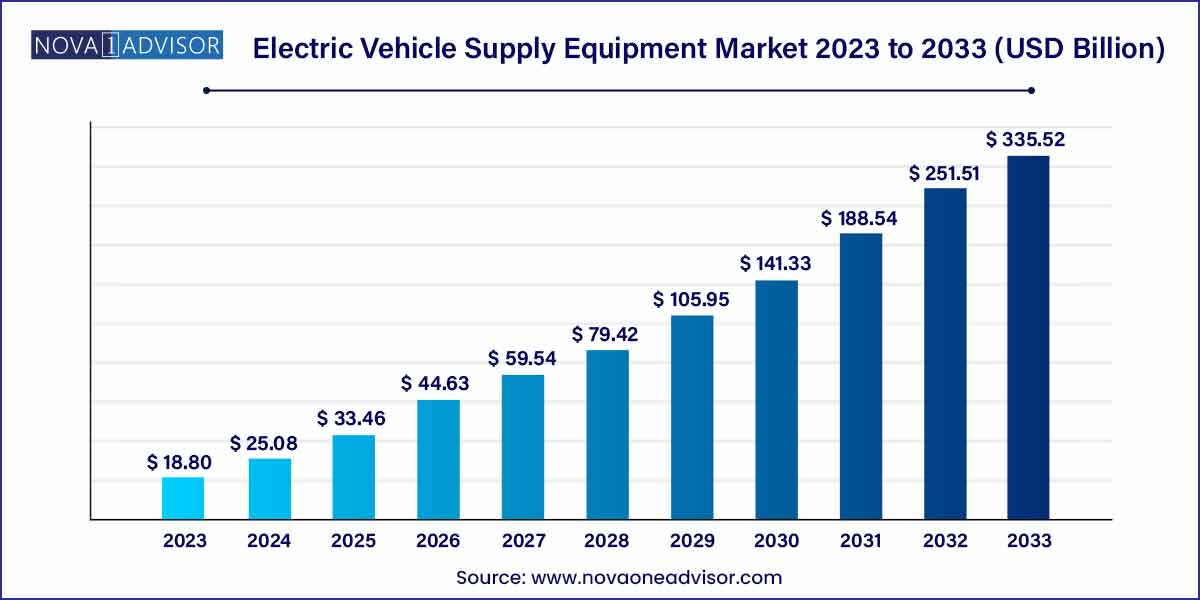

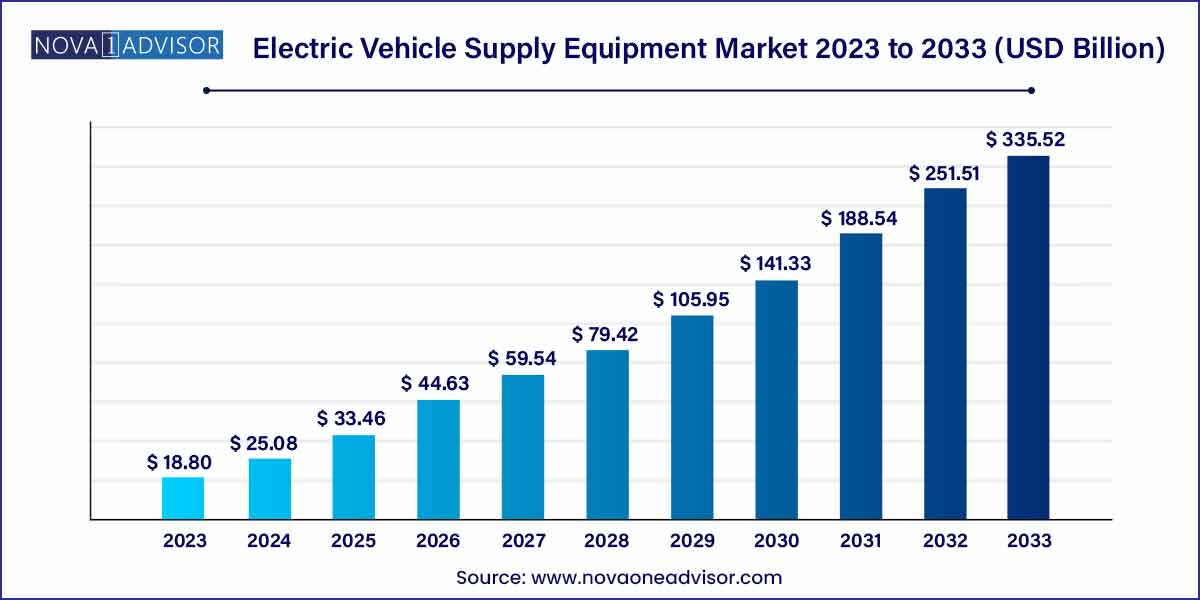

The global electric vehicle supply equipment market size was exhibited at USD 18.80 billion in 2023 and is projected to hit around USD 335.52 billion by 2033, growing at a CAGR of 33.4% during the forecast period of 2024 to 2033.

Key Takeaways:

- Based on the power type, the market has been segmented into AC power and DC power.

- Based on the product, the market has been segmented into a portable charger, an EV charging kiosk, an onboard charging station, and others.

- Based on the charging station type, the market has been segmented into normal charging, supercharging, and inductive charging.

- Based on the application, the market has been segmented into commercial and residential, with the commercial segment dominating the market in 2023.

- Asia Pacific accounted for the largest share in the market in 2023 and is expected to exhibit the fastest CAGR throughout the forecast period.

Electric Vehicle Supply Equipment Market: Overview

The Electric Vehicle Supply Equipment (EVSE) market is undergoing a transformative growth phase, fueled by the explosive rise in electric vehicle (EV) adoption and the parallel need for robust and scalable charging infrastructure. EVSE refers to the entire range of equipment that facilitates the transfer of electrical energy from the grid to the vehicle, including chargers, connectors, software platforms, and network services. As governments, automakers, and technology firms increasingly prioritize sustainable transportation, the role of EVSE has become pivotal in shaping the future of mobility.

The market's evolution is characterized by advancements in charging speed, integration of smart technologies, wireless solutions, and the establishment of standardized protocols to enhance user experience. From residential setups enabling overnight charging to ultra-fast commercial stations reducing charge times to minutes, the spectrum of EVSE solutions is broad and continually expanding. The ongoing initiatives to develop EV-friendly cities, combined with a surge in green investments, are expected to propel the market to unprecedented heights over the next decade.

Electric Vehicle Supply Equipment Market Growth

The growth of the Electric Vehicle Supply Equipment (EVSE) market is fueled by several key factors. Environmental consciousness, with a focus on reducing carbon emissions, is driving governments and automotive manufacturers to invest in EV infrastructure. Technological advancements, particularly in battery technology and charging solutions, are enhancing the feasibility and convenience of electric vehicles. Supportive policies and incentives, such as tax credits and subsidies, are further incentivizing EV adoption. The market segmentation, including various charging infrastructure types and end-user segments, contributes to its dynamic growth. Established players and emerging startups alike are driving innovation and competition in the market. With expanding infrastructure, integration with renewable energy sources, and the emergence of smart charging solutions, the EVSE market holds immense potential for future growth and transformation in the transportation sector.

Electric Vehicle Supply Equipment Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 18.80 Billion |

| Market Size by 2033 |

USD 335.52 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 33.4% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

power Type, Product, Charging Station Type, Application, And Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

AeroVironment Inc.; ABB Ltd.; ChargePoint, Inc.; ClipperCreek, Inc.; Chargemaster PLC; Eaton Corporation; Leviton Manufacturing Co., Inc.; SemaConnect, Inc.; Schneider Electric SE; Siemens AG; Tesla, Inc.; Webasto SE; Delta Electronics, Inc.; EVOTEC AG; Ecotap BV; COMECA Group; Heliox; DBT GROUP; Ekoenergetyka-Polska Sp. z o.o.; Phihong USA Corp.; SIGNET EV INC.; Efacec; CIRCONTROL S.A.; EVBox; Tritium Pty Ltd.; BTC Power. |

Electric Vehicle Supply Equipment Market Dynamics

The Electric Vehicle Supply Equipment (EVSE) market dynamics are characterized by two primary factors. Firstly, the diverse range of charging infrastructure types, including Level 1, Level 2, and DC fast chargers, caters to distinct consumer needs and preferences. This segmentation reflects the varying charging requirements of different EV users, spanning from residential settings to commercial and public infrastructure. Secondly, the market is influenced by regional landscapes, with developed regions such as North America and Europe leading in EV adoption and infrastructure development. However, emerging economies in the Asia-Pacific region present significant growth opportunities, driven by government initiatives and increasing consumer awareness.

Electric Vehicle Supply Equipment Market Restraint

Two notable restraints impacting the Electric Vehicle Supply Equipment (EVSE) market include infrastructure limitations and interoperability challenges. Firstly, the expansion of EV charging infrastructure faces hurdles such as high installation costs, regulatory complexities, and limited availability of charging stations, particularly in rural and underdeveloped areas. This infrastructure gap impedes widespread EV adoption and undermines consumer confidence in electric mobility. Secondly, interoperability issues arise due to the lack of standardized protocols and communication interfaces among EVSE manufacturers and vehicle OEMs. This fragmentation hampers seamless charging experiences and inhibits market growth by complicating the interoperability of charging networks and limiting consumer choice.

Electric Vehicle Supply Equipment Market Opportunity

Two significant opportunities in the Electric Vehicle Supply Equipment (EVSE) market include the integration of renewable energy sources and the development of smart charging solutions. Firstly, integrating renewable energy sources such as solar and wind power into EV charging infrastructure presents a compelling opportunity to enhance sustainability and reduce carbon emissions. By leveraging clean energy sources, EVSE operators can minimize reliance on fossil fuels and contribute to a greener transportation ecosystem. Secondly, the emergence of smart charging solutions, enabled by advancements in IoT and grid technologies, opens up avenues for dynamic load management, demand-response capabilities, and enhanced user experiences. Smart charging systems optimize energy use, reduce peak demand on the grid, and offer flexibility in charging schedules, thus enhancing efficiency and reliability.

Electric Vehicle Supply Equipment Market Challenges

Two significant challenges facing the Electric Vehicle Supply Equipment (EVSE) market are interoperability issues and infrastructure limitations. Firstly, interoperability challenges arise due to the lack of standardized protocols and communication interfaces among EVSE manufacturers and vehicle OEMs. This fragmentation complicates the interoperability of charging networks, hindering seamless charging experiences and limiting consumer choice. Secondly, infrastructure limitations, including high installation costs, regulatory complexities, and limited availability of charging stations, pose significant hurdles to the expansion of EV charging infrastructure. These challenges impede widespread EV adoption, particularly in rural and underdeveloped areas, and undermine consumer confidence in electric mobility. Addressing these challenges requires collaborative efforts among industry stakeholders and regulatory bodies to establish standards, streamline regulations, and invest in infrastructure development, thus fostering the growth of the EVSE market and advancing the transition towards sustainable transportation.

Segments Insights:

Power Type Insights

AC Power dominated the power type segment due to its prevalence in residential and commercial slow-to-moderate charging applications. AC chargers, particularly Level 2 units, are cost-effective, easier to install, and sufficiently meet the needs of daily commuters. Most home charging solutions are Level 1 or Level 2 AC chargers, allowing EV owners to conveniently charge their vehicles overnight. Tesla's Wall Connector and ChargePoint's Home Flex are examples of popular AC EVSE products that have gained widespread adoption.

Conversely, DC Power is the fastest-growing segment, driven by the necessity for rapid charging solutions in commercial and highway settings. DC fast chargers, operating at higher voltages and currents, can recharge an EV battery to 80% in under 30 minutes. Companies like Electrify America and Ionity are rapidly deploying DC charging networks to support long-distance travel. The increasing preference for quick turnaround times among fleet operators and commercial users is catalyzing the demand for high-capacity DC EVSE solutions.

Product Insights

Portable Chargers dominated the product segment, offering EV owners flexibility and peace of mind. These lightweight, easy-to-carry devices allow drivers to charge their vehicles from standard electrical outlets, making them an essential accessory for long-distance travelers and those without access to fixed charging stations. Brands like Lectron and BougeRV have popularized portable chargers as indispensable tools for EV owners.

Meanwhile, EV Charging Kiosks are the fastest-growing product segment, driven by commercial deployments at shopping malls, workplaces, parking garages, and public venues. These kiosks often feature payment integration, multiple charging points, and advanced user interfaces. Recent innovations, such as touchless payment systems and dynamic pricing models, are enhancing the appeal of EV charging kiosks, prompting wider adoption across metropolitan areas and urban centers.

Charging Station Type

Normal Charging dominated the charging station type segment, as Level 1 and Level 2 chargers fulfill the daily commuting needs of most EV users. These chargers are economical and sufficient for vehicles parked for extended periods, such as at homes or workplaces. Companies are focusing on improving normal charging technologies with smart features like load balancing and scheduled charging to optimize energy consumption.

However, Super Charging is the fastest-growing segment, catalyzed by the urgent demand for ultra-fast charging solutions. Tesla's Supercharger network, delivering up to 250kW of power, and new-generation 350kW chargers from networks like Ionity and EVgo exemplify this trend. Superchargers are becoming a strategic asset for highway corridors, fleet operators, and commercial hubs that require minimal downtime and maximum operational efficiency.

Application Insights

Commercial Application dominated the application segment, as businesses, governments, and fleet operators rapidly deploy EVSE to cater to rising EV adoption. Destination charging stations at hotels, restaurants, and shopping centers are becoming common to attract EV customers. Meanwhile, highway charging stations are critical to facilitating intercity EV travel. Companies like BP Pulse and Shell Recharge are heavily investing in expanding their commercial EVSE footprint.

Nonetheless, Residential Application is the fastest-growing application segment, fueled by the increasing preference for private charging solutions. As EV ownership rises, especially in suburban and rural areas, homeowners are installing Level 2 chargers to ensure convenient, reliable overnight charging. Real estate developers are also integrating EVSE into new housing projects, recognizing it as a key selling point for modern homebuyers.

Regional Insights

North America dominated the EVSE market, supported by strong federal and state-level policies, widespread EV adoption, and proactive private sector participation. The United States' "Build Back Better" framework, combined with California's aggressive push for zero-emission vehicles, has created a robust environment for EVSE expansion. Major networks like Electrify America, ChargePoint, and Blink Charging are expanding at a rapid pace, while utility companies are investing heavily in grid upgrades to accommodate increased EVSE load.

In contrast, Asia-Pacific is the fastest-growing region in the EVSE market. China leads globally in EV sales and public charging station installations, boasting over 1.5 million chargers as of 2025. The Chinese government's stringent emission norms, incentives for NEV adoption, and investments in "smart city" projects are propelling the demand for EVSE. Additionally, Japan and South Korea are investing in next-generation EVSE technologies, including wireless and V2G solutions, while India is scaling up its EV charging networks through public-private partnerships under the FAME-II scheme.

Some of the prominent players in the Electric vehicle supply equipment market include:

- AeroVironment Inc.;

- ABB Ltd.;

- ChargePoint, Inc.;

- ClipperCreek, Inc.;

- Chargemaster PLC;

- Eaton Corporation;

- Leviton Manufacturing Co., Inc.;

- SemaConnect, Inc.;

- Schneider Electric SE;

- Siemens AG; Tesla, Inc.;

- Webasto SE; Delta Electronics, Inc.;

- EVOTEC AG;

- Ecotap BV;

- COMECA Group;

- Heliox;

- DBT GROUP;

- Ekoenergetyka-Polska Sp. z o.o.;

- Phihong USA Corp.;

- SIGNET EV INC.;

- Efacec;

- CIRCONTROL S.A.;

- EVBox;

- Tritium Pty Ltd.;

- BTC Power

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global electric vehicle supply equipment market.

Power Type

Product

- Portable Charger

- EV Charging Kiosk

- Onboard Charging Station

- Others

Charging Station Type

- Normal Charging

- Super Charging

- Inductive Charging

Application

-

- Destination Charging Station

- Highway Charging Station

- Bus Charging Station

- Fleet Charging Station

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)