ELISpot And Fluorospot Assay Market Size and Growth

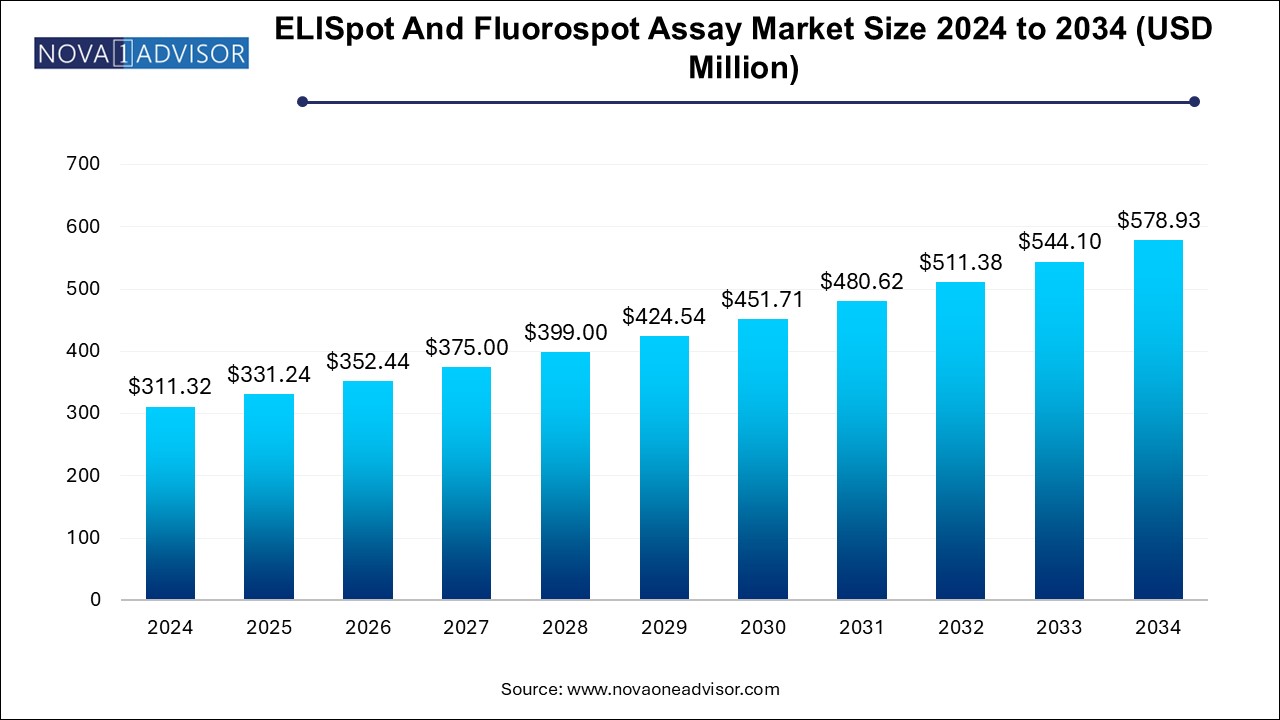

The ELISpot and fluorospot assay market size was exhibited at USD 311.32 million in 2024 and is projected to hit around USD 578.93 million by 2034, growing at a CAGR of 6.4% during the forecast period 2025 to 2034.

ELISpot and Fluorospot Assay Market Key Takeaways:

- Assay kits dominated the market and accounted for a share of 49.6% in 2024.

- The demand for analyzers is expected to grow lucratively over the forecast period.

- Diagnostic applications led the market with a revenue share of 66.1% in 2024.

- Research applications are expected to register significant growth over the forecast period

- Hospitals and clinical labs held the largest revenue share of 47.0% in 2024.

- Biopharmaceutical companies are projected to grow at the fastest CAGR of 6.6% over the forecast period.

- North America ELISpot and fluorospot assay market dominated the global market with a revenue share of 36.0% in 2024.

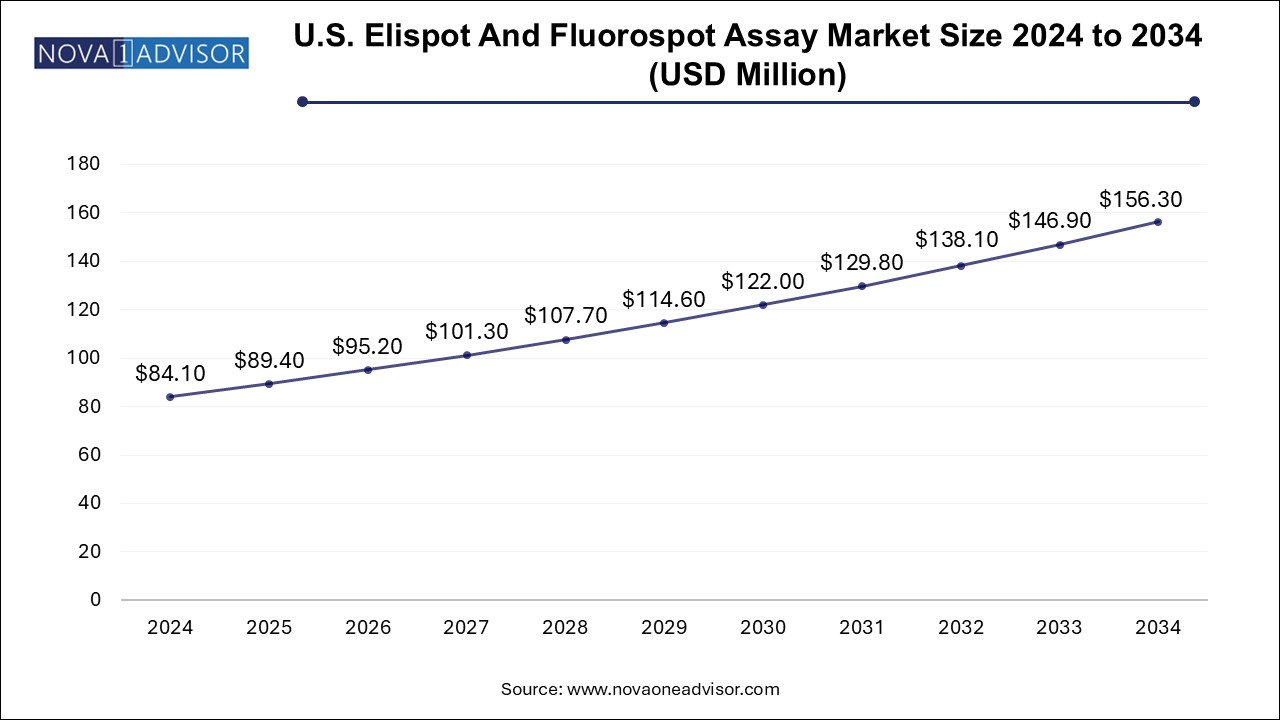

U.S. ELISpot and Fluorospot Assay Market Size and Growth 2025 to 2034

The U.S. ELISpot and fluorospot assay market size is evaluated at USD 84.1 million in 2024 and is projected to be worth around USD 156.3 million by 2034, growing at a CAGR of 5.79% from 2025 to 2034.

North America, particularly the United States, dominates the ELISpot and FluoroSpot assay market due to its robust biotechnology infrastructure, strong academic research output, and early adoption of immune-monitoring tools. The presence of major players such as Oxford Immunotec, Cellular Technology Limited (CTL), and Mabtech Inc. contributes to consistent innovation, kit availability, and training support.

U.S.-based biopharmaceutical companies rely heavily on ELISpot in clinical trial design, especially in immuno-oncology and infectious disease R&D. Furthermore, NIH-funded programs and university-industry partnerships have accelerated the incorporation of FluoroSpot in vaccine and autoimmunity studies. The availability of CLIA-certified labs and GMP-compliant ELISpot platforms ensures alignment with regulatory expectations.

Asia Pacific is emerging as the fastest-growing region, with countries like China, India, Japan, and South Korea investing heavily in immunology research, vaccine innovation, and infectious disease control. China’s “Healthy China 2030” strategy and India’s national vaccination roadmap are integrating advanced diagnostics and immune assessment platforms into public health efforts.

Moreover, expanding biopharma manufacturing hubs and the proliferation of CROs (contract research organizations) have increased demand for ELISpot and FluoroSpot assays in regional clinical trials. Academic institutions in Asia are also contributing to global immunological research, especially in tuberculosis, dengue, and hepatitis—endemic to this region. Local production of reagents and analyzer leasing models are expected to boost affordability and scalability.

Market Overview

The ELISpot and FluoroSpot assay market represents a rapidly evolving segment within the immunology and life sciences domain. These highly sensitive assays are used to monitor cell-mediated immune responses at the single-cell level. The Enzyme-Linked ImmunoSpot (ELISpot) and Fluorescence-Linked ImmunoSpot (FluoroSpot) assays have gained wide adoption in immunological research, vaccine development, infectious disease diagnostics, cancer immunotherapy, and autoimmune disorder investigations.

ELISpot assays enable the detection of cytokine-secreting cells, especially T and B lymphocytes, by capturing cytokines or antibodies secreted in response to specific antigens. FluoroSpot, a more advanced variant, allows simultaneous detection of multiple analytes using fluorescently labeled detection reagents—adding both dimensionality and efficiency to immune profiling.

In recent years, there has been an exponential increase in interest in these assays due to their role in clinical trials, particularly in immuno-oncology, vaccine response assessments, and infectious disease monitoring such as COVID-19 and tuberculosis. Their use has expanded across biopharmaceutical R&D, diagnostic laboratories, and academic institutions focused on translational research. Rising demand for precise immunological assays that can work with low sample volumes and deliver reproducible single-cell data is reinforcing the market’s upward trajectory.

As personalized medicine, immunotherapy, and cellular analysis tools advance globally, the ELISpot and FluoroSpot assay market is expected to witness significant growth through 2034.

Major Trends in the Market

-

Adoption of FluoroSpot for Multiplex Cytokine Detection in Cancer and Vaccine Research

-

Increasing Demand for T-cell Immune Monitoring in COVID-19, HIV, and TB Studies

-

Expansion of Immunotherapy Clinical Trials Using ELISpot to Measure Cellular Responses

-

Integration of Automated Analyzers for High-Throughput Screening in Pharma R&D

-

Development of Customized Assay Kits for Rare Cell Detection in Autoimmune Diseases

-

Advancements in Fluorescence-Based Technologies Enhancing Signal Resolution

-

Growing Use of ELISpot in CAR-T and TCR-T Cell Functionality Assessment

-

Collaborations Between CROs and Biotech Firms for Immune Monitoring Panels

-

Global Expansion of GMP-Compliant ELISpot Platforms for Regulatory Submissions

-

Miniaturization and Standardization of Ancillary Products to Support Lab Workflow

Report Scope of ELISpot and Fluorospot Assay Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 331.24 Million |

| Market Size by 2034 |

USD 578.93 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 6.4% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

BD; U-CyTech; Cellular Technology Limited; Mabtech; Abcam Limited; Autoimmun Diagnostika GmbH; Lophius Biosciences GmbH; Bio-Connect B.V.; Oxford Immunotec; Bio-Techne Corporation |

Market Driver: Rising Adoption in Immunotherapy and Vaccine Development

A key driver of the ELISpot and FluoroSpot assay market is the expanding role of these technologies in immunotherapy development and vaccine trials. The ability to precisely quantify antigen-specific T and B cell responses makes these assays indispensable in understanding immune kinetics during therapy. In cancer immunotherapy, for instance, ELISpot is used to evaluate cytotoxic T lymphocyte (CTL) activity, measure cytokine release (e.g., IFN-γ, IL-2), and monitor vaccine-induced cellular immunity.

During the COVID-19 pandemic, ELISpot assays gained prominence in assessing T-cell responses to SARS-CoV-2, complementing antibody-based assessments. Vaccine developers worldwide employed these assays in preclinical and clinical studies to assess immune memory and cross-reactivity. Similarly, therapeutic platforms targeting HIV, hepatitis, tuberculosis, and CMV depend on ELISpot for accurate immune profiling. This sustained demand from clinical research ensures continuous expansion of the market.

Market Restraint: High Cost and Technical Complexity in Standardization

Despite their utility, a notable restraint is the relatively high cost and complexity associated with ELISpot and FluoroSpot assay execution and data interpretation. These assays require specialized equipment, precise calibration, trained personnel, and robust data analysis platforms to ensure reliability and reproducibility.

Variability in spot counting, fluorescence bleed-through in FluoroSpot, and batch-to-batch inconsistency in reagent kits can hinder large-scale implementation—especially in diagnostic labs and smaller research institutes. Additionally, regulatory standardization for clinical diagnostics is still evolving, limiting their widespread clinical adoption outside of controlled research environments. While leading players are investing in automation and workflow simplification, the upfront investment continues to be a barrier for budget-constrained laboratories.

Market Opportunity: Expansion in Emerging Markets and Infectious Disease Surveillance

One of the most promising opportunities lies in the expansion of ELISpot and FluoroSpot assays in emerging markets, particularly for infectious disease surveillance and immunization program assessments. Diseases like tuberculosis (TB), leishmaniasis, dengue, and hepatitis remain endemic in parts of Asia, Africa, and Latin America. As governments and international health bodies intensify efforts toward elimination, immune-monitoring tools like ELISpot will be crucial in mapping community-level T-cell responses.

Additionally, FluoroSpot assays present a valuable alternative to costly flow cytometry platforms in resource-limited environments. Their ability to multiplex analytes from a single sample improves cost-efficiency and operational simplicity. As funding from global health initiatives such as GAVI and the Gates Foundation increases, the demand for affordable, standardized, and scalable cellular assays is expected to rise, unlocking market potential in developing regions.

ELISpot and Fluorospot Assay Market By Product Insights

Assay kits dominated the market and accounted for a share of 49.6% in 2024. attributed to their recurring use, ease of application, and expanding catalog of targets. ELISpot and FluoroSpot kits are widely used in immunology labs to detect cytokines like IFN-γ, TNF-α, IL-2, IL-6, and IL-17—key markers in T-cell activation, Th1/Th2 response profiling, and inflammation studies. These kits are often species-specific (human, mouse, primate) and are pre-optimized to reduce assay variability.

The demand for analyzers is expected to grow lucratively over the forecast period, Automation, image processing, and software analytics are becoming indispensable in high-throughput screening, particularly in pharma and biopharma labs. Advanced analyzers now incorporate features like real-time analysis, multi-channel fluorescence imaging, and integration with LIMS systems. These platforms reduce human error and enable scalable workflow across multiple plates, supporting industrial-scale immunogenicity studies and regulatory compliance.

ELISpot and Fluorospot Assay Market By Application Insights

Diagnostic applications led the market with a revenue share of 66.1% in 2024. especially in tuberculosis diagnostics. ELISpot-based platforms like the T-SPOT.TB assay are approved in multiple countries for TB detection and offer advantages over tuberculin skin tests (TST) and interferon-gamma release assays (IGRAs) in immunocompromised populations. FluoroSpot also holds potential for multiplexed diagnostics in HIV, CMV, and latent viral reactivation monitoring in transplant recipients.

Research applications are expected to register significant growth over the forecast period due to the assays’ entrenched use in academic immunology, vaccine research, and immunotherapeutic development. ELISpot has become a gold standard in T-cell ELISA, allowing researchers to study antigen-specific responses in vitro. Its utility spans cancer immunology, autoimmunity, transplantation biology, and neuroimmunology.

ELISpot and Fluorospot Assay Market By End-use Insights

Hospitals and clinical labs held the largest revenue share of 47.0% in 2024. fueled by increasing government funding for immunology research and global infectious disease surveillance. Universities, national labs, and translational research centers are using these assays to explore immune memory, aging immunity, and cross-reactivity of vaccines. The rise in collaborations with biotech firms and access to open-source assay platforms is helping bridge the affordability gap in research labs.

Biopharmaceutical companies are projected to grow at the fastest CAGR of 6.6% over the forecast period. driven by their use of ELISpot and FluoroSpot assays in drug development, vaccine trials, and immunogenicity assessments. These assays are embedded in preclinical studies, investigational new drug (IND) applications, and clinical trial endpoint analysis. CAR-T, TCR-T, peptide vaccines, and neoantigen therapies all rely on cytokine-secreting cell measurement, making ELISpot a critical part of the biologics development workflow.

Some of the prominent players in the ELISpot and fluorospot assay market include:

ELISpot and Fluorospot Assay Market Recent Developments

-

March 2025: Oxford Immunotec expanded its T-SPOT.TB platform with a new FluoroSpot-based co-infection panel for tuberculosis and CMV in transplant populations.

-

February 2025: Mabtech AB launched a triple-color FluoroSpot assay for simultaneous detection of IFN-γ, IL-2, and IL-17, targeting cancer vaccine monitoring studies.

-

January 2025: CTL (Cellular Technology Limited) announced integration of AI-powered image analysis into its ImmunoSpot® analyzer, improving spot quantification accuracy and reducing read times.

-

December 2024: ImmunoDX Inc. received NIH funding to develop FluoroSpot-based kits for emerging zoonotic infections with high mutation rates.

-

November 2024: Bio-Techne Corporation partnered with academic centers to expand the use of FluoroSpot in pediatric immunodeficiency diagnostics across North America and Europe.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the ELISpot and fluorospot assay market

By Product

- Assay Kits

- Analyzers

- Ancillary Products

By Application

- Research Applications

- Diagnostics Applications

By End-use

- Hospital and Clinical Labs

- Academic and Research Institutes

- Biopharmaceutical Company

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)