Empty Capsules Market Size and Trends

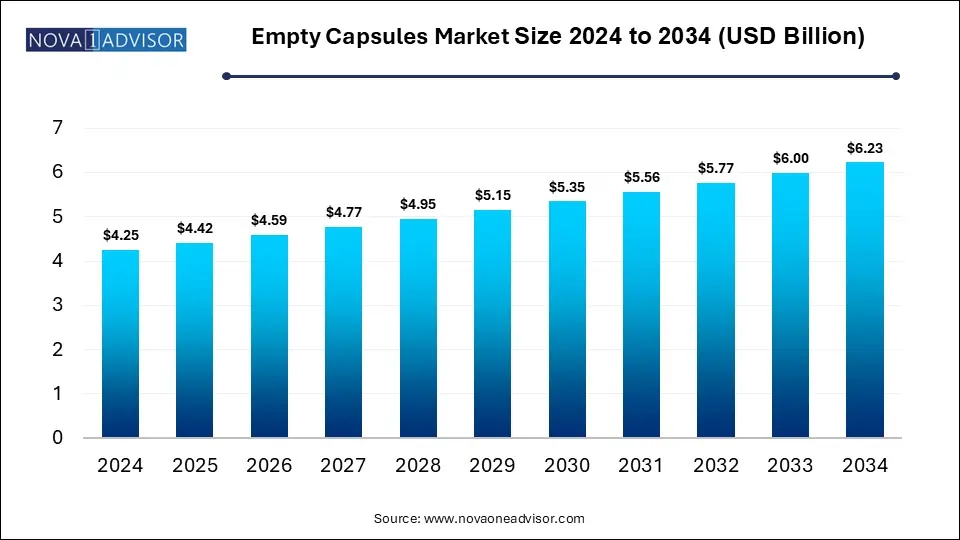

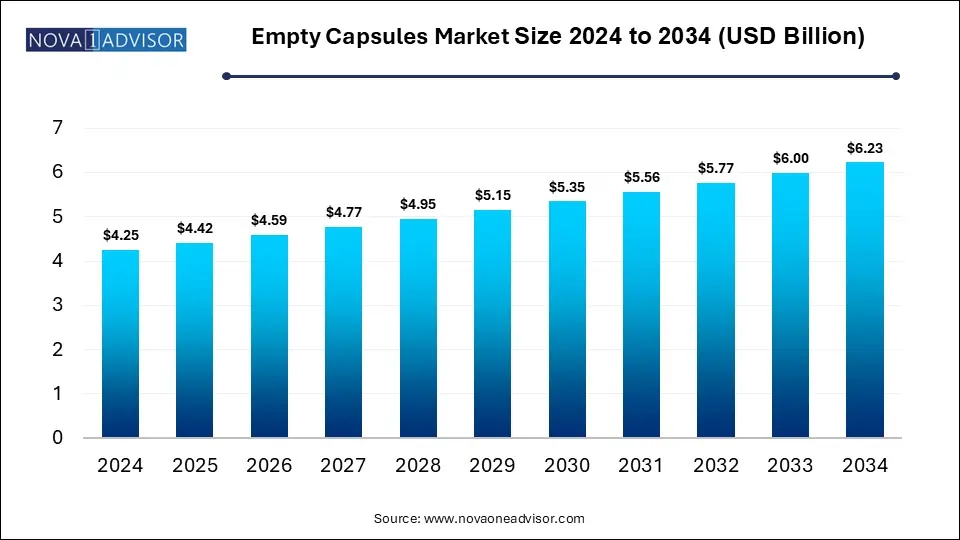

The global empty capsules market size is calculated at USD 4.25 billion in 2024, grow to USD 4.42 billion in 2025, and is projected to reach around USD 6.23 billion by 2034, growing at a CAGR of 3.9% from 2025 to 2034. The market is growing due to rising demand for personalized medicine and increased use of nutraceuticals. Additionally, advancements in capsule technology and preference for gelatin-free options are driving market expansion.

Empty Capsules Market Key Takeaways

- North America dominated the empty capsules market in 2024.

- Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By product, the gelatin segment dominated the market in 2024.

- By product, the non-gelatin segment is expected to grow at the fastest CAGR in the market during the studied years.

- By therapeutic application, the antibiotic and antibacterial drugs segment held the largest market share.

- By therapeutic application, the vitamins and dietary supplements segment is expected to grow at the fastest CAGR in the market during the studied years.

- By end use, the pharmaceutical segment led the market in 2024.

- By end use, the nutraceutical segment is expected to grow at the fastest CAGR in the market during the studied years.

How is Innovation Impacting the Empty Capsules Market?

An empty capsule is a small, shell-like container, typically made from gelatin-based materials, that is used to hold drugs, vitamins, or supplements in powder, liquid, or pellet form. These capsules are tasteless, easy to swallow, and are commonly used in pharmaceutical and nutraceutical applications for oral delivery. Innovation is significantly transforming the empty capsules market by introducing advanced materials like HPMC and pullulan for plant-based capsules, catering to vegetarian and vegan consumers. Technological advancements have enabled features like controlled-release, enhanced bioavailability, and compatibility with a wider range of drug formulations. Additionally, innovation in capsule design improves shelf life and allows for easier filling of liquids, powders, and pellets, thereby expanding their use across pharmaceutical, nutraceutical, and dietary supplement industries.

- For Instance, In October 2023, Roquette acquired pharmaceutical equipment and partnered with Qualicaps, a leading hard capsule manufacturer, to strengthen its global presence. This strategic move expanded their ability to deliver a wide range of oral dosage solutions, including capsules, binders, and fillers. The collaboration is expected to enhance technical capabilities and service quality, offering customers comprehensive pharmaceutical solutions built on decades of industry experience.

What are the Key Trends in the Empty Capsules Market in 2025?

- In January 2025, Hovione and Zerion Pharma entered into a joint venture to bring Dispersome technology to market, aiming to enhance the formulation of respiratory drugs and nutraceuticals. This collaboration focuses on improving drug solubility and effectiveness through advanced delivery solutions.

- In December 2024, Lonza announced its intention to sell its Capsules & Health Ingredients division, while also focusing on expanding its manufacturing capabilities in India and China to boost global operations.

How Can AI Affect the Empty Capsules Market?

AI is influencing the market by optimizing production processes, improving quality control, and enhancing supply chain management. It enables predictive maintenance of manufacturing equipment, reduces waste, and ensures consistent capsule quality. AI-driven data analysis also helps in forecasting market demand and personalizing capsule formulations for specific patient needs. This technological integration not only increases efficiency but also supports innovation in capsule design and functionality across pharmaceutical and nutraceutical applications.

Report Scope of Empty Capsules Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 4.42 Billion |

| Market Size by 2034 |

USD 6.23 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 3.9% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Therapeutic Application, End use, and Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Bright Pharma Caps Inc., Lonza Group, Qualicaps, HealthCaps India Ltd, Dun & Bradstreet, Inc. (Shanxi JC Biological Technology Co., Ltd), ACG, Medi-Caps Ltd, Suheung, capsCanada Corporation |

Market Dynamics

Driver

Rising Demand for Dietary Supplements

Growing interest in personal health and wellness has led to a surge in the use of dietary supplements, fueling demand for empty capsules. These capsules offer flexible dosing, better ingredient protection, and are preferred for their ease of consumption. As consumers seek natural and plant-based alternatives, manufacturers increasingly rely on empty capsules to deliver a wide range of supplements, making them a vital component in meeting evolving health and nutrition preferences.

- For Instance, In December 2023, Mumbai-based capsule manufacturer ACG introduced an innovative design for nutraceuticals using its Side-by-Side technology. This new approach allows a single capsule to hold two separate compartments, making it possible to combine different ingredient forms like liquid and powder within one capsule, enhancing formulation flexibility and product efficiency.

Restraint

Fluctuating Prices and Limited Availability of Raw Materials

Inconsistent supply and rising costs of key raw materials like gelatin and HPMC create major challenges for the empty capsule industry. These materials are crucial for maintaining product quality and production efficiency. When availability is limited or prices surge, it directly impacts manufacturing timelines, increases operational expenses, and reduces profit margins. Such unpredictability makes it difficult for producers to meet growing demand, especially in the pharmaceutical and nutraceutical sectors that rely on timely and consistent capsule delivery.

Opportunity

Technological Advancements in Capsule

Advancements in capsule technology are opening new avenues for the empty capsules market by allowing more complex formulation, such as combining multiple ingredients or enabling time-specific release. These innovations cater to evolving healthcare needs and consumer preferences for more effective and convenient treatments. Improved manufacturing techniques also boost production speed and precision, helping companies meet growing global demand while maintaining high quality and compliance with regulatory standards. This makes innovation a key driver of future market growth.

- For Instance, In February 2025, Roquette expanded its global presence by opening a new production facility in Germany focused on producing hydroxypropyl methylcellulose (HPMC) capsules. This initiative aims to meet the increasing demand for plant-based, vegetarian, and sustainable capsule solutions in the pharmaceutical and nutraceutical industries.

Segmental Insights

How will the Gelatin Segment Dominate the Empty Capsules Market in 2024?

The gelatin capsule segment led the market due to its proven efficiency in encapsulating various drug forms, including powders, granules, and liquids. Its natural original, smooth texture, and rapid dissolving ability enhance patient compliance and support effective drug delivery. Moreover, gelatin has been a trusted material in capsule production for decades, backed by a well-established supply chain and lower production costs, making it the preferred choice among pharmaceutical manufacturing globally.

- For Instance, In February 2023, Vivion, part of the Operio Group, introduced a new line of empty capsules made from gelatin, HPMC, and pullulan. This launch marked the brand’s expansion into diverse capsule offerings to meet growing demand for both traditional and plant-based solutions in the pharmaceutical and nutraceutical markets.

The non-gelatin segment is expected to grow at the fastest CAGR in the empty capsules market due to rising preferences for clean-label and animal-free products. Consumers are increasingly opting for capsules made from plant-derived materials like HPMS and pullulan, which align with vegan, halal, and kosher for sensitive ingredients and are ideal for moisture-prone formulations, making them a popular choice in both the pharmaceutical and nutraceutical industries.

Why Did the Antibiotic and Antibacterial Drugs Segment Dominate the Market in 2024?

The antibiotic and antibacterial drug segment accounted for the largest shares in the market due to the high global burden of infectious diseases and the consistent need for oral antibiotic therapies. Capsules are preferred for these drugs as they ensure accurate dosing, mask unpleasant tastes, and improve patient adherence. Their ability to accommodate a wide variety of antibiotic formulations makes them a reliable delivery method, driving widespread use across hospitals, clinics, and pharmacies.

The vitamins and dietary supplements segment is projected to grow at the fastest rate in the empty capsules market due to the rising focus on wellness, immunity, and active lifestyles. Consumers are increasingly incorporating supplements into their daily routines, driving demand for user-friendly dosage forms like capsules. These capsules support clean-label trends, allow for combination ingredients, and are ideal for plant-based formulations, making them attractive to health-conscious individuals across various age groups and global regions.

Why Did the Pharmaceutical Segment Dominate the Empty Capsules Market in 2024?

The pharmaceutical segment dominated the market in 2024 due to its heavy reliance on capsules for delivering both prescription and over-the-counter medications. Capsules provide accurate dosing, faster absorption, and better protection for sensitive drug compounds. Their versatility in formulating immediate or extended-release drugs makes them a preferred choice. Additionally, the rise in pharmaceutical R&D and increased production of generic drugs contributed to the market expansion.

The nutraceutical segment is projected to witness the highest CAGR in the empty capsules market due to the growing popularity of functional foods and supplements aimed at boosting immunity, energy, and overall health. Consumers are increasingly turning to natural and alternative health solutions, driving demand for capsule-based formulations. These capsules offer flexibility in combining multiple nutrients and appeal to those seeking vegetarian or allergen-free options, making them a preferred delivery in the rapidly expanding wellness sectors.

Regional Insights

How is North America Contributing to the Expansion of the Empty Capsules Market?

North America led the market in 2024 due to strong pharmaceutical manufacturing capabilities, rising demand for advanced drug delivery systems, and increasing use of dietary supplements. The region benefits from high healthcare spending, a growing elderly population, and widespread awareness of health and wellness. In addition, the presence of key market players and a supportive regulatory environment has further fueled innovation and large-scale production of empty capsules, securing the region’s dominant market position.

- For Instance, In March 2023, ACG’s Vantage Nutrition acquired ComboCap Inc. in the U.S. and BioCap in South Africa to strengthen its global presence and enhance its technological capabilities. These strategic acquisitions aim to support the company’s expansion into the North American market and broaden its reach worldwide by leveraging innovative capsule technologies.

How is the Asia Pacific Accelerating the Empty Capsules Market?

The Asia-Pacific region is set to grow at the fastest CAGR in the market due to expanding consumer demand for affordable healthcare and wellness products. A surge in lifestyle-related diseases, coupled with increased acceptance of dietary supplements, is driving capsule usage. Local pharmaceutical production is rising, supported by favorable government policies and foreign investments. Additionally, shifting preferences toward non-gelatin and plant-based capsules are fueling market expansion across emerging economies like China, India, and Southeast Asian nations.

Some of The Prominent Players in The Empty Capsules Market Include:

- Bright Pharma Caps Inc.

- Lonza Group

- Qualicaps

- HealthCaps India Ltd

- Dun & Bradstreet, Inc. (Shanxi JC Biological Technology Co., Ltd)

- ACG

- Medi-Caps Ltd

- Suheung

- capsCanada Corporation

Recent Development in the Empty Capsules Market

- In January 2025, Roquette finalized its USD 2.85 billion acquisition of IFF Pharma Solutions to strengthen its position in excipients and enhance its capabilities in oral dosage technologies. This strategic move aims to expand Roquette’s product offerings and expertise in drug formulation and delivery.

- In September 2024, Evonik introduced EUDRACAP® pre-locked capsules tailored for pharmaceutical use, suitable for filling with powders, pellets, or granules. These capsules are coated with EUDRAGIT®, enabling targeted pH release and providing up to four hours of protection against stomach acid. Designed to shield sensitive ingredients from heat, moisture, and gastric fluids, they enhance absorption and ensure delayed dissolution. EUDRACAP® is also compatible with standard filling equipment and meets high regulatory standards.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Empty Capsules Market.

By Product

-

- Pig Meat Gelatin

- Bovine Derived

- Bone Meal

- Other Gelatin Capsule Products

By Therapeutic Application

- Antibiotic and Antibacterial Drugs

- Vitamins and Dietary Supplements

- Antacid and Antiflatulent Preparations

- Antianemic Preparations (Hematenic Preparations)

- Anti-Inflammatory Drugs

- Cardiovascular Therapy Drugs

- Cough and Cold Preparations

- Other therapeutic applications

By End Use

- Pharmaceutical

- Nutraceutical

- Cosmeceutical

- Research Laboratories

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)