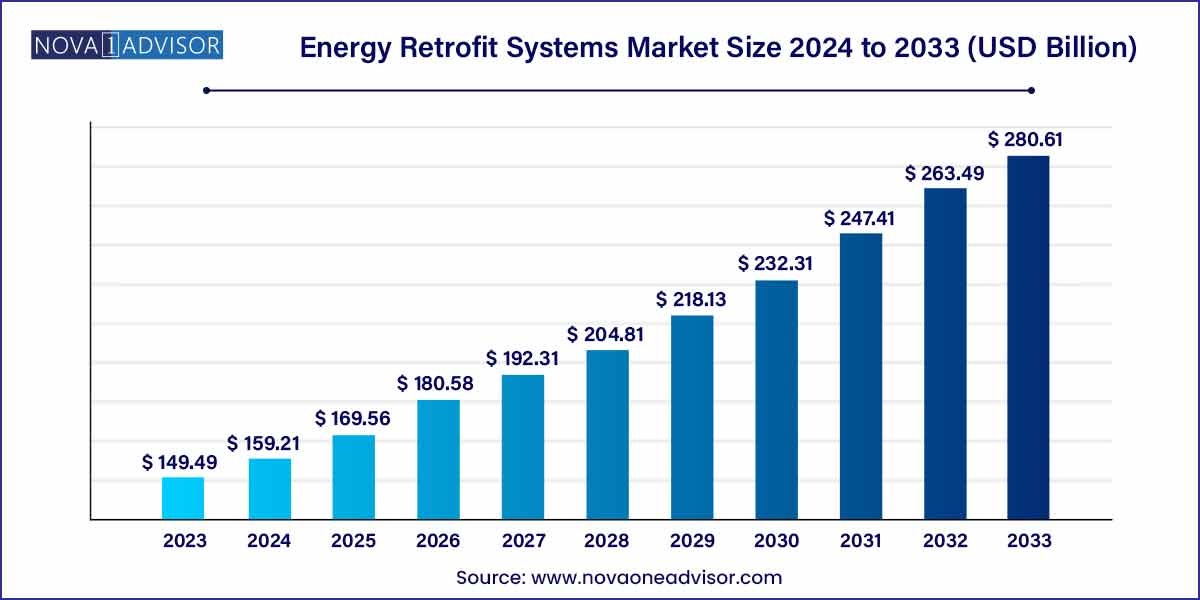

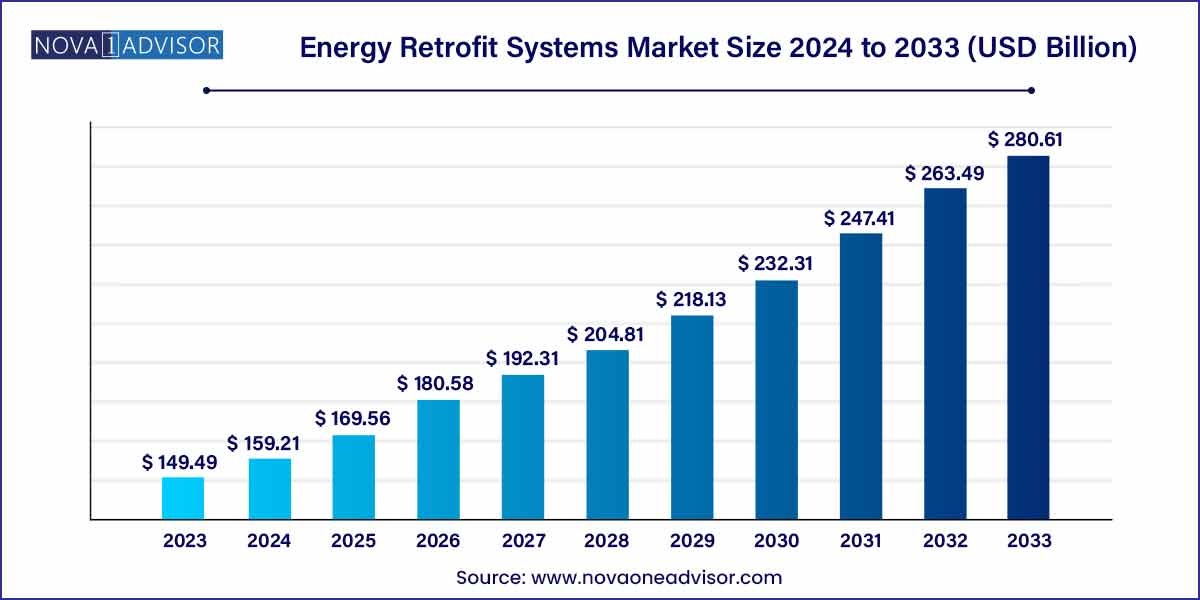

The global energy retrofit systems market size was exhibited at USD 149.49 billion in 2023 and is projected to hit around USD 280.61 billion by 2033, growing at a CAGR of 6.5% during the forecast period of 2024 to 2033.

Key Takeaways:

- Europe dominated the global market in 2023 and accounted for the largest volume share of over 48.0%.

- The envelope product segment led the market and accounted for 51.54% of the global volume share in 2023.

- The non-residential segment led the market and accounted for 72.0% of the global volume share in 2023.

Market Overview

The Energy Retrofit Systems market has witnessed significant momentum in recent years, primarily driven by increasing global awareness around energy efficiency, sustainability, and carbon footprint reduction. Retrofit systems refer to the modifications made to existing structures and systems to improve energy efficiency, thereby reducing operational costs and enhancing environmental performance. These systems are critical in helping both residential and commercial properties align with modern energy standards without necessitating full demolitions or reconstructions.

From insulating building envelopes to integrating LED lighting and upgrading HVAC systems, energy retrofitting presents an economically feasible path toward greener operations. Growing regulatory pressures, such as mandatory energy performance standards and emission reduction targets in the European Union, North America, and Asia-Pacific, have further fueled the demand for energy retrofits. Retrofits are not just about compliance—they also deliver tangible economic benefits, including higher property valuations and lower maintenance costs.

Moreover, aging infrastructure across developed economies has created an urgent need for retrofitting solutions. In the United States alone, more than 50% of commercial buildings are over 20 years old, many lacking contemporary energy-efficient designs. Programs like the U.S. Department of Energy’s Better Buildings Initiative have highlighted the critical importance of retrofits, further mainstreaming their adoption. Consequently, the global energy retrofit systems market is positioned for significant growth across diverse sectors and regions in the coming decade.

Major Trends in the Market

-

Rise in Smart Retrofits with IoT and AI Technologies: Incorporating sensors, automation, and predictive analytics into retrofit systems is enhancing building performance monitoring and energy management.

-

Government-Led Incentives and Mandates: Programs offering tax credits, rebates, and grants for energy-efficient upgrades are accelerating market penetration globally.

-

Shift Toward Net-Zero Energy Buildings (NZEBs): Growing focus on achieving net-zero operational emissions is promoting comprehensive retrofitting of existing structures.

-

Focus on Deep Energy Retrofits: Building owners are increasingly moving beyond minor upgrades to comprehensive interventions, targeting reductions of 50% or more in energy use.

-

Retrofit Financing Innovations: Models like Energy Service Performance Contracts (ESPCs) and Property Assessed Clean Energy (PACE) financing are making retrofits accessible to a broader range of property owners.

-

Integration of Renewable Energy Solutions: Retrofit projects are increasingly integrating solar panels, geothermal systems, and battery storage to complement energy conservation measures.

-

Rapid Commercial Sector Adoption: Retail centers, offices, and hospitals are emerging as major adopters due to significant operational cost-saving potentials.

Energy Retrofit Systems Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 149.49 Billion |

| Market Size by 2033 |

USD 280.61 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

DAIKIN INDUSTRIES, Ltd.; Ameresco; Eaton; AECOM; Johnson Controls; Orion Energy Systems, Inc.; Siemens; Trane; Signify Holding; Engie; General Electric; Schneider Electric. |

Key Market Driver: Growing Regulatory Push for Energy Efficiency

A primary driver for the energy retrofit systems market is the intensifying global regulatory landscape mandating improved energy efficiency in buildings. Governments worldwide are setting ambitious climate goals that hinge heavily on decarbonizing the building sector, which accounts for nearly 40% of global energy-related carbon emissions according to the International Energy Agency (IEA).

For example, the European Union’s Energy Performance of Buildings Directive (EPBD) sets strict standards requiring significant improvements in building energy performance across member states. Similarly, New York City’s Local Law 97 requires large buildings to cut emissions by 40% by 2030. These regulations are not merely recommendations—they often carry significant financial penalties for non-compliance. Thus, building owners, investors, and corporations are proactively investing in energy retrofit systems to future-proof their assets, remain compliant, and avoid fines, making regulation a powerful catalyst for market growth.

Key Market Restraint: High Initial Costs

Despite their long-term benefits, energy retrofit projects often come with high upfront capital requirements, creating a major restraint in the market. Comprehensive retrofits involving HVAC upgrades, building envelope improvements, and LED lighting conversions can entail significant investments, sometimes beyond the reach of small and medium-sized property owners without external financing support.

Furthermore, the payback periods for energy savings, although improving, can still extend up to 5–10 years, making decision-makers cautious, particularly in uncertain economic climates. The situation is compounded by logistical challenges such as the need to temporarily vacate buildings during certain deep retrofits. As a result, despite clear energy-saving and environmental advantages, high initial costs continue to inhibit more widespread adoption of retrofit technologies, especially in regions with limited financial incentives.

Key Market Opportunity: Digitalization of Retrofit Systems

The rising digitalization of the construction and real estate sectors offers a compelling opportunity for the energy retrofit systems market. Technologies such as Building Information Modeling (BIM), digital twins, AI-driven energy audits, and smart building platforms are transforming how retrofits are planned, implemented, and monitored.

By using real-time data from IoT sensors and predictive analytics, property owners can identify optimal retrofit interventions, simulate energy savings, and monitor actual performance improvements post-upgrade. For instance, companies like Schneider Electric are providing integrated digital energy management platforms that facilitate retrofit decision-making and enhance efficiency outcomes. Digitalization not only lowers project uncertainty but also offers compelling long-term value by enabling continuous optimization of building performance, thus expanding the market potential exponentially.

Segmental Analysis

By Product

The HVAC Retrofit segment dominated the market in 2024.

Heating, ventilation, and air conditioning (HVAC) systems are the largest energy consumers in buildings, accounting for over 40% of energy use in commercial properties. Retrofitting outdated HVAC systems with high-efficiency models—like variable refrigerant flow (VRF) systems, energy recovery ventilators, and advanced heat pumps—offers some of the highest returns on investment in terms of energy savings. Initiatives such as the UK's Minimum Energy Efficiency Standards (MEES) regulations, which set energy efficiency thresholds for rental properties, have further propelled HVAC retrofit demand. Moreover, corporate sustainability initiatives increasingly prioritize HVAC retrofits to meet internal carbon neutrality goals.

On the other hand, LED Retrofit Lighting is emerging as the fastest-growing segment.

The appeal of LED retrofitting lies in its relatively low cost, quick installation, and immediate impact on energy consumption. Commercial spaces such as warehouses, offices, and retail centers are aggressively replacing fluorescent and incandescent lighting systems with energy-efficient LED solutions. Furthermore, innovations like connected LED systems, which allow for dimming, occupancy sensing, and integration with smart building management systems, are enhancing their appeal. Government programs like the U.S. Department of Energy's Better Buildings Challenge have also accelerated adoption by showcasing real-world case studies demonstrating rapid payback periods of less than two years for LED retrofits.

By Application

The Non-Residential segment dominated the energy retrofit market in 2024.

Non-residential properties, including office buildings, hospitals, educational institutions, and shopping centers, are major energy consumers with extensive opportunities for efficiency improvements. Given their high operational costs, energy savings through retrofits deliver substantial financial incentives. The COVID-19 pandemic has further underscored the importance of indoor air quality and operational resilience, prompting non-residential building owners to invest in ventilation retrofits and smart energy management systems. Notably, corporate ESG (Environmental, Social, and Governance) reporting requirements have also spurred companies to upgrade facilities, further boosting demand in this segment.

Meanwhile, the Residential segment is anticipated to be the fastest growing.

Growing homeowner awareness, rising energy bills, and government-backed home energy efficiency schemes are fueling the residential retrofit boom. Programs like Germany's KfW funding schemes and the U.K.'s Green Homes Grant offer homeowners financial incentives to undertake retrofits ranging from attic insulation to solar thermal installations. Additionally, younger homebuyers are increasingly prioritizing energy efficiency as a criterion for home purchases. As smart home technologies continue to integrate seamlessly with retrofit measures, residential demand is expected to surge, particularly for energy-efficient appliances, smart thermostats, and integrated renewable solutions.

Regional Analysis

North America dominated the global Energy Retrofit Systems market in 2024.

North America’s leadership stems from its aging building stock, progressive energy efficiency regulations, and aggressive climate change mitigation efforts. U.S. states like California, New York, and Massachusetts have implemented stringent energy performance mandates for both residential and commercial buildings. Federal incentives, such as the 2022 Inflation Reduction Act, which allocated significant funds toward energy efficiency projects, have further boosted retrofit activity. The Canadian government’s Greener Homes Initiative similarly promotes retrofitting through rebates and low-interest loans. North America's strong financial ecosystems offering energy service performance contracts and green bonds—also make retrofitting projects financially viable at scale.

Asia-Pacific, however, is expected to be the fastest growing region in the market.

Rapid urbanization, burgeoning middle-class populations, and escalating energy consumption are propelling the demand for energy retrofits across Asia-Pacific. China, Japan, Australia, and India are aggressively implementing green building standards and energy codes. For instance, Japan’s Top Runner Program mandates that building equipment continuously improve its energy performance, promoting retrofits. In India, the Energy Efficiency Services Limited (EESL) agency drives large-scale retrofit initiatives such as the Unnat Jyoti by Affordable LEDs for All (UJALA) scheme. As governments focus on achieving net-zero goals, retrofit projects across the residential and commercial sectors in Asia-Pacific are poised for remarkable expansion.

Some of the prominent players in the energy retrofit systems market include:

- DAIKIN INDUSTRIES, Ltd.

- Ameresco

- Eaton

- AECOM

- Johnson Controls

- Orion Energy Systems, Inc.

- Siemens

- Trane

- Signify Holding

- Engie

- General Electric

- Schneider Electric

Recent Developments

-

Johnson Controls (February 2025): Announced a strategic partnership with Microsoft to develop AI-driven energy management solutions aimed at enhancing the performance of retrofitted commercial properties globally.

-

Honeywell International (March 2025): Launched its new Forge Energy Optimization system, an AI-powered cloud solution that targets energy savings of up to 30% in retrofitted commercial buildings.

-

Siemens Smart Infrastructure (January 2025): Rolled out a new retrofit solution package in Europe aimed at upgrading HVAC and lighting systems in aging municipal buildings to help cities meet climate neutrality goals.

-

Ameresco (December 2024): Secured a major $75 million energy performance contract to retrofit 120 government buildings across New York City, integrating LED lighting, HVAC, and solar PV solutions.

-

Signify (formerly Philips Lighting) (November 2024): Expanded its connected LED lighting portfolio, launching IoT-ready retrofit kits specifically designed for older commercial buildings.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global energy retrofit systems market.

Product

- Envelope

- LED Retrofit Lighting

- HVAC Retrofit

- Appliances

Application

- Residential

- Non-Residential

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)