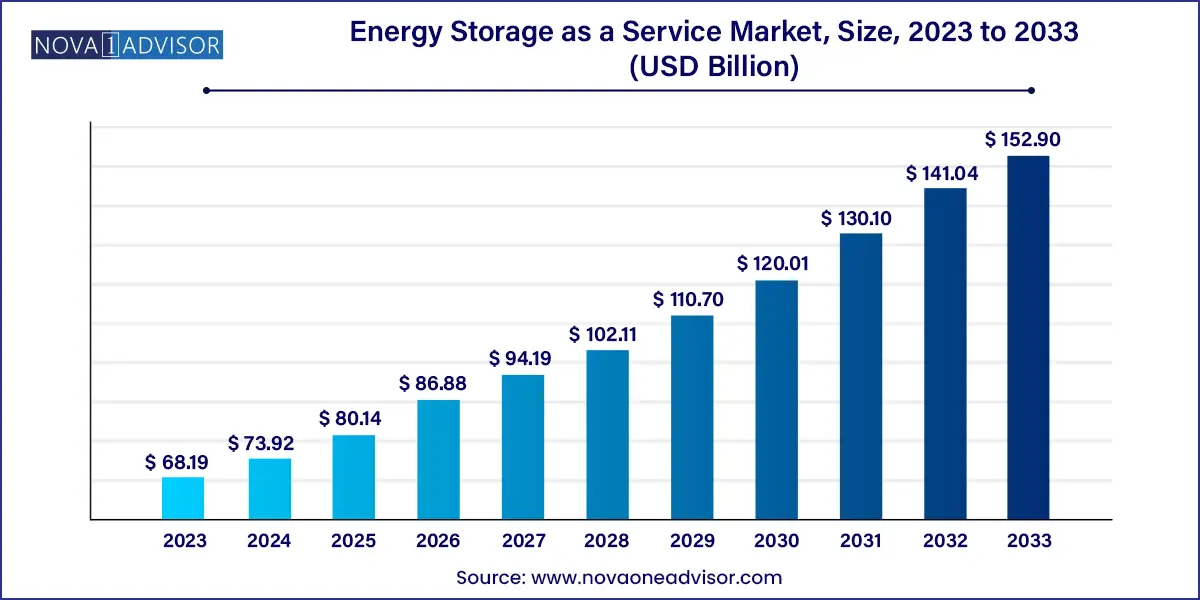

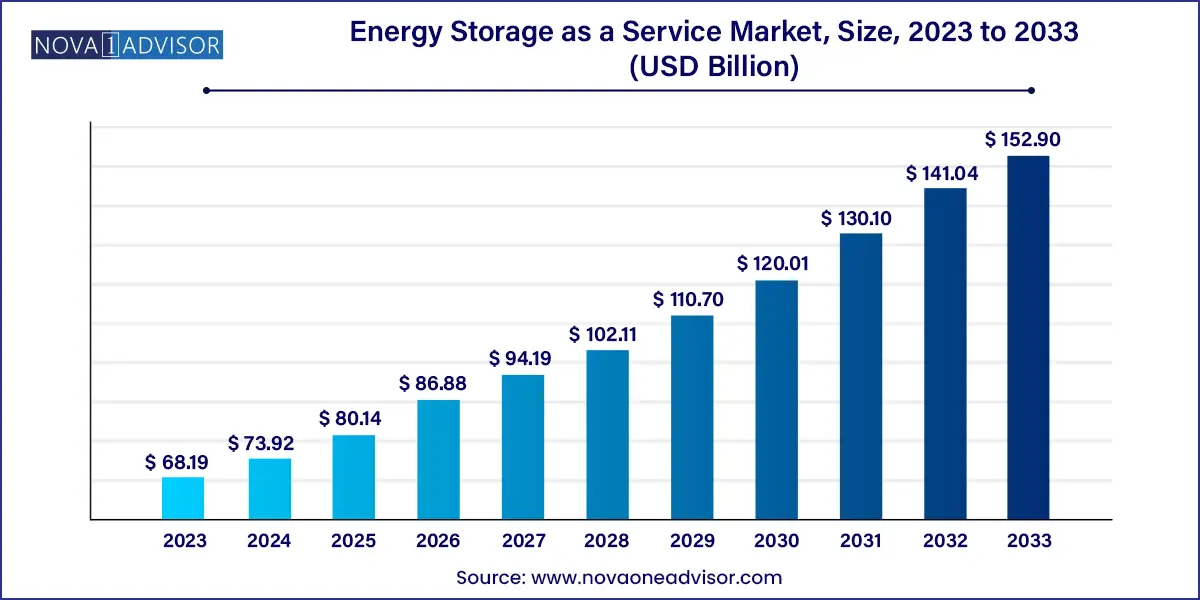

The global energy storage as a service market size was exhibited at USD 68.19 billion in 2023 and is projected to hit around USD 152.90 billion by 2033, growing at a CAGR of 8.41% during the forecast period of 2024 to 2033.

Key Takeaways:

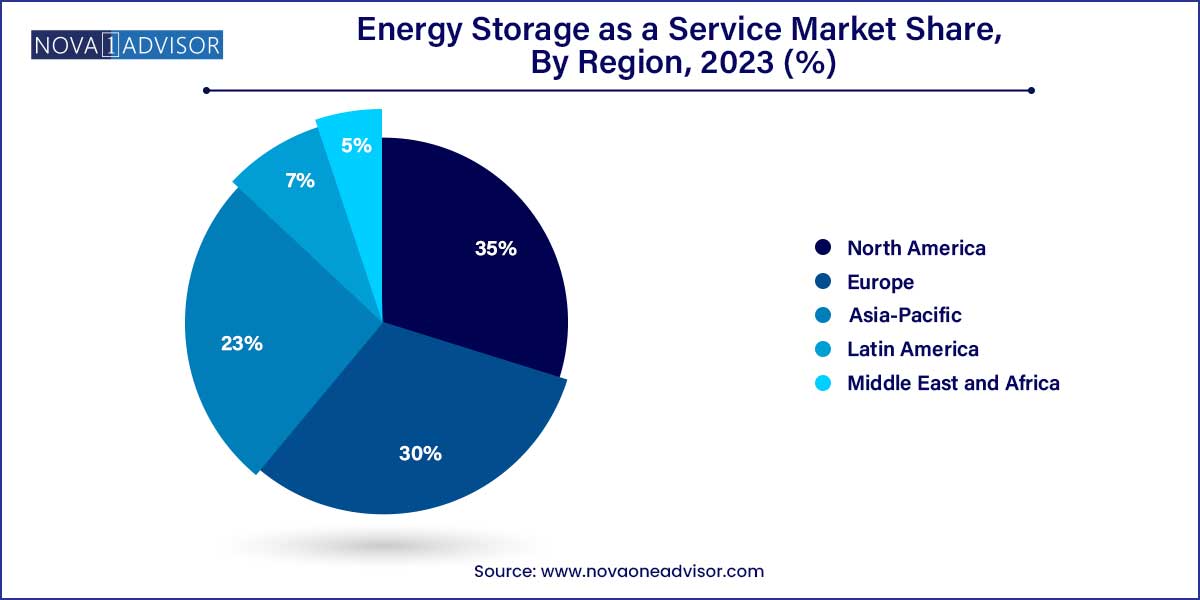

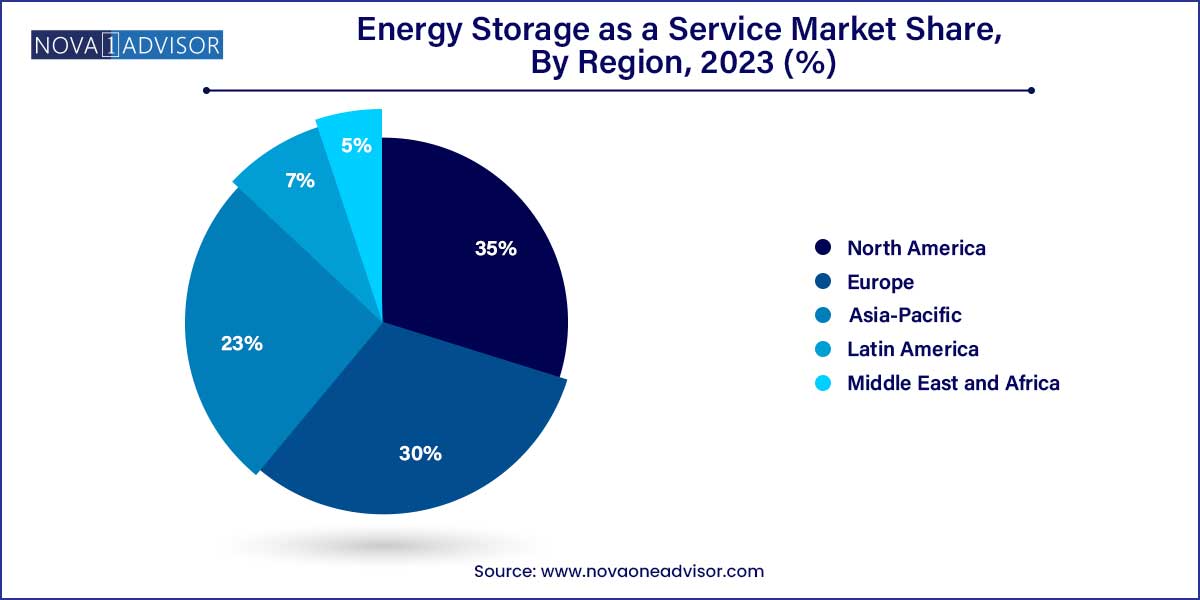

- North America dominated the market and accounted for over 35.0% share of the global revenue in 2023

- The customer energy management services segment led the market and accounted for over 30.0% share of the global revenue in 2023.

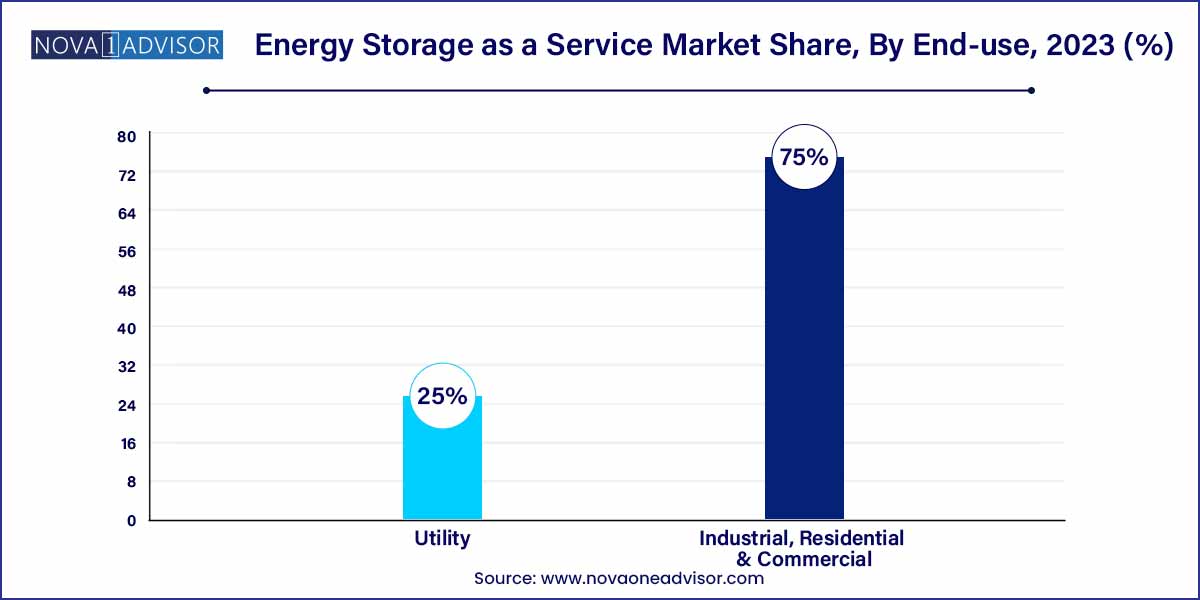

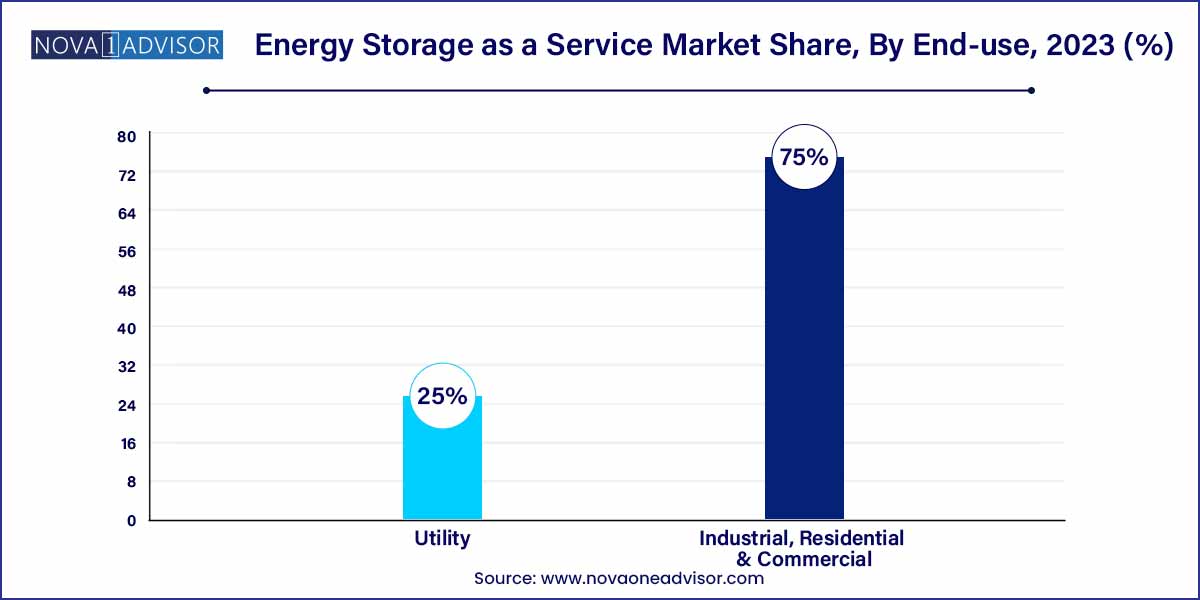

- The industrial, residential, and commercial segment led the market and accounted for over 75.0% share of the global revenue in 2023.

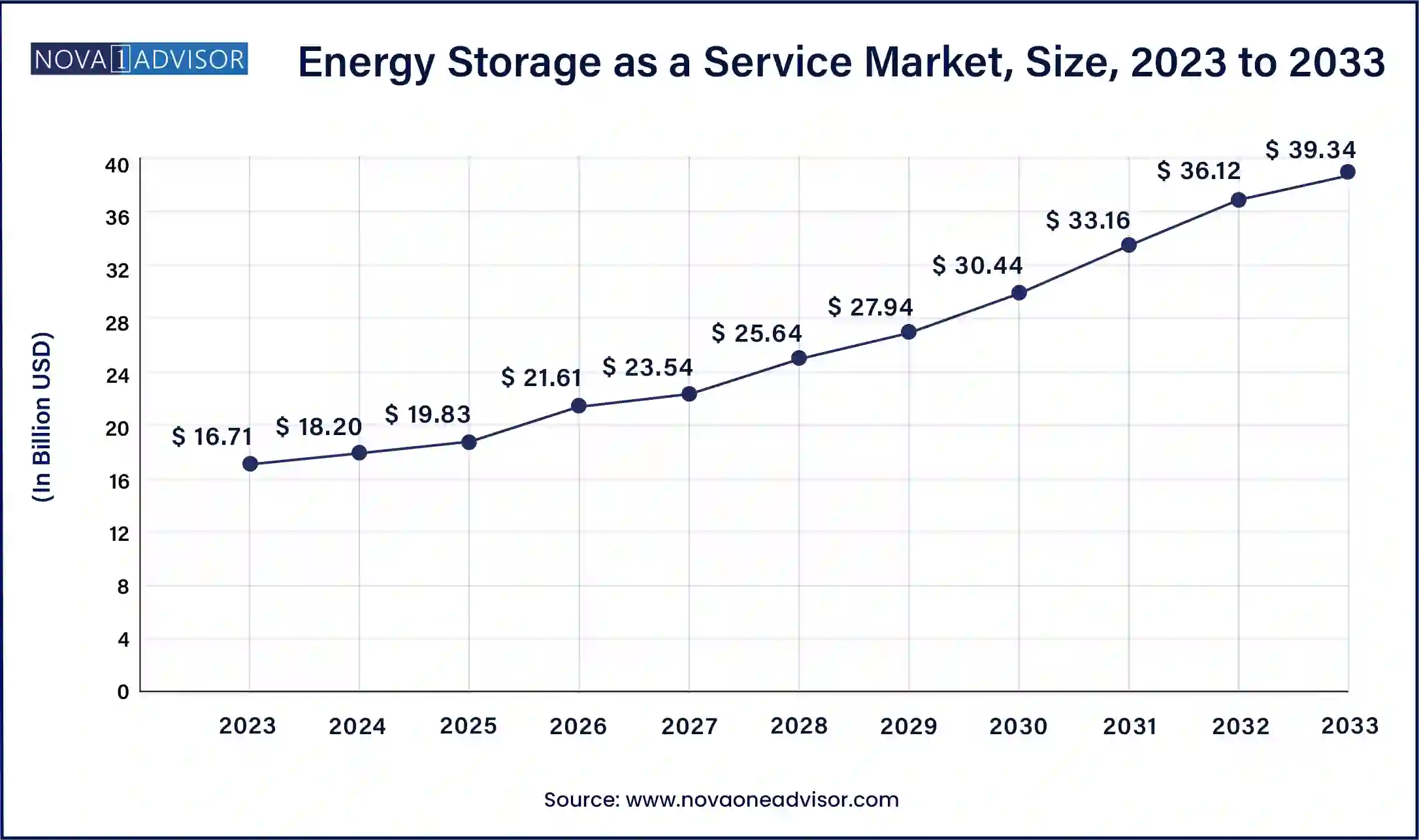

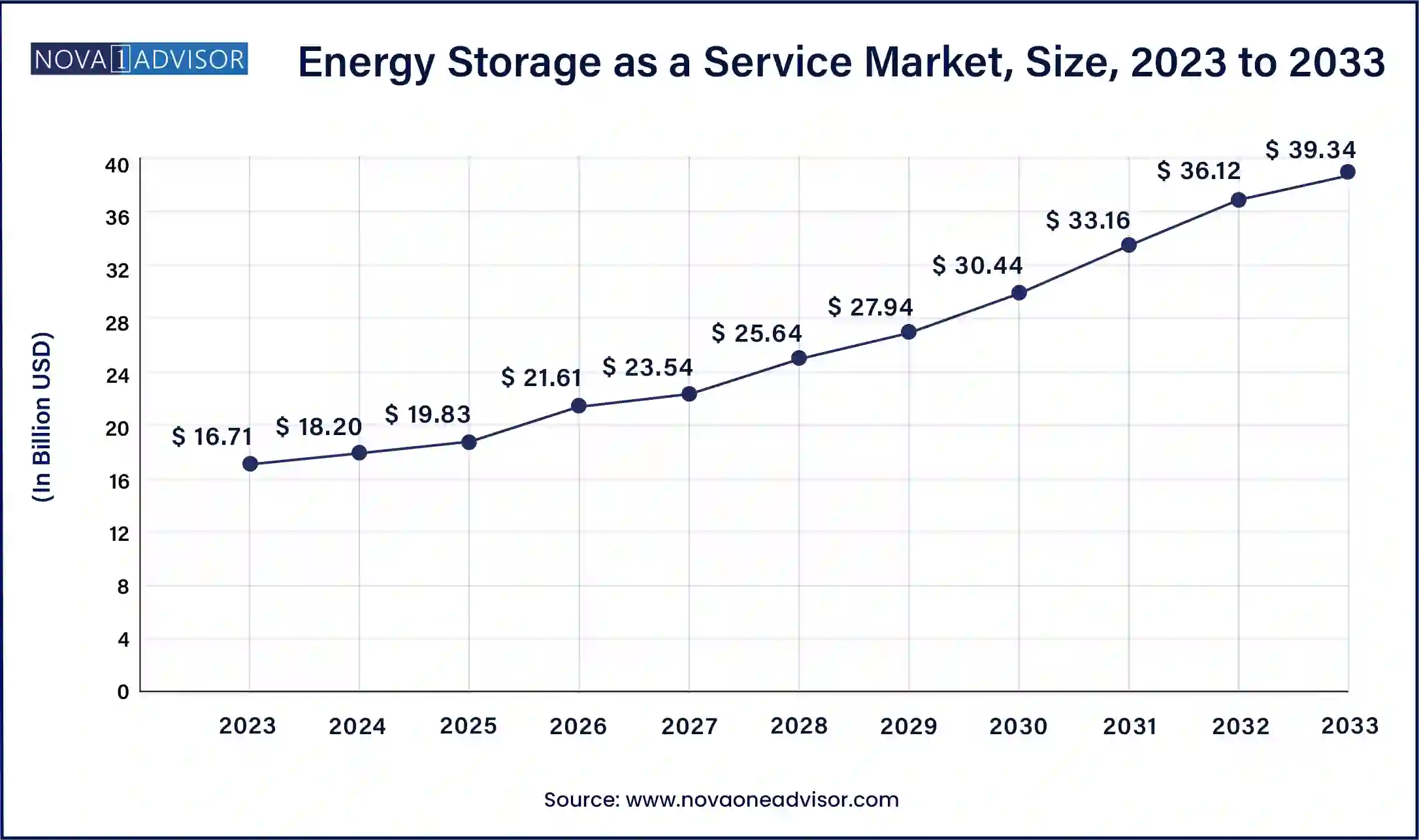

Energy Storage as a Service Market Size in the U.S. 2024 To 2033

The U.S. energy storage as a service market size reached USD 16.71 Billion in 2023 and is anticipated to reach around USD $39.34 Billion by 2033, poised to grow at a CAGR of 8.94%% from 2024 to 2033.

North America dominated the global Energy Storage as a Service market in 2024, accounting for the largest revenue share. The region's leadership is fueled by substantial investments in renewable energy, supportive regulatory frameworks, and a well-developed energy infrastructure. Initiatives like the Inflation Reduction Act in the U.S. have provided significant incentives for renewable energy projects and storage solutions. Prominent projects like New York's Reforming the Energy Vision (REV) have further encouraged utilities and private enterprises to adopt ESaaS models.

Meanwhile, the Asia-Pacific region is anticipated to witness the fastest growth during the forecast period. Countries such as China, Japan, India, and Australia are experiencing soaring energy demand coupled with aggressive renewable energy goals. In Australia, for instance, community battery projects and government support for virtual power plants are driving ESaaS deployment. Additionally, emerging economies in Southeast Asia are exploring microgrid and storage-as-a-service models to improve rural electrification, presenting abundant growth opportunities for market players.

Energy Storage As A Service Market: Overview

Energy Storage as a Service (ESaaS) is revolutionizing how industries, utilities, and residential sectors access and manage energy. This model allows users to benefit from energy storage systems (ESS) without the significant upfront capital investments traditionally associated with such installations. By offering storage capabilities through a service-based model, ESaaS providers take responsibility for installation, maintenance, and performance, ensuring optimized energy use, reduced electricity costs, and enhanced grid reliability.

Driven by the global shift towards renewable energy integration, increasing demand for reliable grid operations, and the need for peak load management, the ESaaS market is witnessing robust growth. Governments worldwide are enforcing regulations to curb carbon emissions, encouraging industries and individuals to explore cleaner energy options. This dynamic shift is creating a fertile ground for ESaaS solutions, which help manage the intermittency of renewables like solar and wind.

The market is characterized by a rising number of collaborations between technology firms, energy companies, and financial institutions to offer customized solutions. With the decline in battery costs and advancements in energy storage technologies, the affordability and attractiveness of ESaaS have expanded, attracting a diverse range of end-users from utilities to residential sectors.

Energy Storage As A Service Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 73.92 Billion |

| Market Size by 2033 |

USD 152.90 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 8.41% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Services, End User, Component, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Siemens Energy; Veolia; Honeywell International Inc.; NRStor Inc.; ENGIE Storage Services NA LLC; Customized Energy Solutions Ltd.; YSG Solar; Suntuity; Hydrostor Inc. |

Energy Storage As A Service Market Dynamics

- Technological Advancements:

Rapid advancements in energy storage technologies play a pivotal role in driving the growth of the ESaaS market. Innovations in battery chemistry, energy management systems, and grid integration solutions are enhancing the performance, efficiency, and scalability of energy storage solutions. Lithium-ion batteries, for instance, have witnessed significant improvements in energy density, cycle life, and cost-effectiveness, making them a preferred choice for ESaaS deployments. Furthermore, the emergence of new storage technologies, such as flow batteries, hydrogen storage, and thermal storage, offers diverse options for ESaaS providers to tailor solutions to specific customer needs. Additionally, developments in software platforms and predictive analytics enable real-time monitoring, optimization, and control of energy storage assets, maximizing their value and reliability.

- Regulatory Environment and Policy Support:

The regulatory environment and policy support mechanisms significantly influence the adoption and growth of the ESaaS market. Governments worldwide are implementing ambitious renewable energy targets, carbon reduction goals, and grid modernization initiatives, driving demand for energy storage solutions. Incentive programs, subsidies, and favorable regulatory frameworks incentivize investments in energy storage projects, stimulating market growth. Moreover, policies mandating renewable energy integration, grid reliability standards, and energy storage procurement targets create a conducive environment for ESaaS deployments. For example, net metering policies allow customers to monetize excess energy stored during off-peak hours, enhancing the economic viability of ESaaS solutions.

Energy Storage As A Service Market Restraint

- Initial Cost and Financing Challenges:

One of the primary restraints hindering the widespread adoption of ESaaS solutions is the initial cost and financing challenges associated with energy storage deployments. While ESaaS models offer a subscription-based approach that eliminates the need for upfront capital expenditures, the overall cost of energy storage systems remains a significant barrier for many potential customers. High upfront costs, including equipment procurement, installation, and integration expenses, can deter businesses, utilities, and homeowners from investing in energy storage solutions, particularly in markets where financial incentives and supportive regulatory frameworks are lacking. Additionally, financing constraints, such as limited access to capital or financing options, can impede the scalability of ESaaS projects, particularly for smaller organizations or those with limited financial resources.

- Interconnection and Grid Integration Issues:

Another significant restraint facing the ESaaS market is interconnection and grid integration challenges. Energy storage systems must be seamlessly integrated into existing grid infrastructure to maximize their value and effectiveness. However, grid interconnection processes can be complex and time-consuming, involving regulatory approvals, technical assessments, and coordination with utilities. Delays or uncertainties in the interconnection process can hinder the deployment of energy storage projects, leading to project delays, increased costs, and operational inefficiencies. Moreover, grid integration issues, such as voltage fluctuations, grid congestion, and system constraints, can impact the performance and reliability of energy storage systems, limiting their ability to provide grid services and deliver value to customers. To address these challenges, stakeholders must collaborate closely with utilities, regulators, and grid operators to streamline interconnection processes, develop standardized protocols, and implement grid-friendly energy storage solutions.

Energy Storage As A Service Market Opportunity

- Market Expansion in Emerging Economies:

One of the most promising opportunities for ESaaS providers lies in expanding their presence in emerging economies. Developing regions often face challenges related to energy access, grid reliability, and environmental sustainability, creating a compelling need for innovative energy storage solutions. Governments in these regions are increasingly prioritizing renewable energy deployment and grid modernization initiatives to address growing energy demand, reduce greenhouse gas emissions, and enhance energy security. ESaaS providers can leverage this favorable regulatory environment and growing market demand to penetrate emerging economies and establish a foothold in untapped markets.

- Integration with Smart Grid and Microgrid Solutions:

Another significant opportunity within the ESaaS market lies in the integration of energy storage solutions with smart grid and microgrid infrastructure. Smart grids leverage advanced technologies, such as sensors, communication networks, and data analytics, to optimize energy flows, enhance grid reliability, and empower consumers with real-time energy management capabilities. Energy storage systems play a crucial role in enabling the flexibility and resilience required for smart grid operations, serving as a buffer for intermittent renewable energy generation, mitigating peak demand, and providing grid services such as frequency regulation and voltage support. Similarly, in the context of microgrids, energy storage solutions enable islanding capabilities, allowing communities, campuses, and remote facilities to operate autonomously and enhance energy resilience. By integrating energy storage with smart grid and microgrid solutions, ESaaS providers can unlock new value streams, improve grid stability, and meet the evolving energy needs of utilities, businesses, and communities.

Energy Storage As A Service Market Challenges

- Regulatory Uncertainty and Policy Barriers:

One of the primary challenges hindering the widespread adoption of ESaaS solutions is regulatory uncertainty and policy barriers. Energy storage technologies often operate at the intersection of multiple regulatory domains, including electricity markets, utility regulations, environmental policies, and building codes. Inconsistent or outdated regulations, ambiguous policy frameworks, and regulatory hurdles can create barriers to market entry, delay project approvals, and increase compliance costs for ESaaS providers. Additionally, evolving regulatory landscapes, such as changes in net metering policies, grid interconnection standards, or energy storage incentives, can introduce uncertainty and complexity into the market, deterring investment and inhibiting market growth. To address these challenges, policymakers, regulators, and industry stakeholders must collaborate to develop clear, cohesive regulatory frameworks that support the deployment of energy storage solutions, facilitate market entry, and foster innovation.

- Technology and Market Risks:

Another significant challenge facing the ESaaS market is technology and market risks associated with energy storage deployments. While energy storage technologies offer significant benefits in terms of grid flexibility, energy management, and resilience, they also pose inherent risks related to performance, safety, and reliability. For instance, lithium-ion batteries, the most commonly deployed energy storage technology, are susceptible to degradation, thermal runaway, and safety hazards if not properly designed, operated, and maintained. Moreover, market risks, such as fluctuating energy prices, evolving customer preferences, and competitive pressures, can impact the financial viability and profitability of ESaaS projects. Uncertain revenue streams, limited access to financing, and long payback periods further compound these risks, particularly for project developers and investors. To mitigate technology and market risks, ESaaS providers must prioritize rigorous quality assurance, safety protocols, and risk management practices throughout the project lifecycle. Additionally, diversifying revenue streams, leveraging revenue stacking opportunities, and implementing robust business models can help mitigate market uncertainties and improve project economics.

Segments Insights:

Service Insights

Bulk Energy Services dominated the Energy Storage as a Service market in 2024, owing to the need for large-scale energy management and cost optimization. These services focus on storing electricity when prices are low and supplying it back to the grid or end-users when prices peak. Utilities and large industrial entities widely adopt bulk energy services to optimize their energy expenses and ensure stable energy availability. For instance, bulk services play a pivotal role in managing grid congestion during summer peaks in regions like California and Texas. The demand for flexible, large-scale storage solutions continues to propel the dominance of bulk energy services.

Meanwhile, Customer Energy Management Services are expected to be the fastest-growing segment during the forecast period. As businesses and residential users become more energy-conscious, the demand for customized energy management solutions is rising. This segment includes services like demand response, load shifting, and onsite energy optimization, helping users to lower their energy bills and carbon footprint. Companies like Enel X are actively promoting customer-centric models, offering tailored energy storage solutions combined with smart management systems, thereby making this segment highly attractive.

End-user Insights

The Utility sector accounted for the largest share in the ESaaS market in 2024, driven by the urgent need for grid modernization and stabilization. Utilities are increasingly leveraging ESaaS to balance grid loads, integrate renewables, and provide backup during peak demands. Notable utility companies in North America and Europe are forming partnerships with ESaaS providers to optimize their operational efficiency without investing heavily in infrastructure. For example, Duke Energy's collaboration with multiple storage service providers has been instrumental in strengthening its grid network across the southeastern U.S.

In contrast, the Industrial, Residential, and Commercial sector is expected to witness the fastest growth. The flexibility and scalability of ESaaS solutions make them attractive for commercial buildings, data centers, and manufacturing plants seeking to enhance energy resilience. Moreover, residential adoption is climbing due to rising interest in energy independence and home-based renewable energy systems. Tesla’s recent announcement of expanded residential energy storage offerings under service models is a testament to this sector's rapid growth trajectory.

Key Developments

-

February 2025: Fluence announced a strategic partnership with a leading Australian utility to provide ESaaS for community battery projects, aiming to enhance renewable energy integration.

-

January 2025: Enel X expanded its ESaaS offerings in North America by launching a comprehensive customer energy management platform tailored for commercial users.

-

December 2024: Stem Inc. secured a multi-year ESaaS contract with a major California-based industrial park, focusing on AI-driven energy optimization.

-

November 2024: Tesla unveiled its "Powerwall as a Service" model for residential customers across select U.S. states, allowing households to subscribe to storage services.

-

October 2024: ENGIE acquired a minority stake in an energy storage start-up focused on modular ESaaS solutions for remote industrial applications in Africa.

Some of the prominent players in the energy storage as a service market include:

- Siemens Energy

- Veolia

- Honeywell International Inc.

- NRStor Inc.

- ENGIE Storage Services NA LLC

- Customized Energy Solutions Ltd.

- YSG Solar

- Suntuity

- Hydrostor Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global energy storage as a service market.

Service

- Bulk Energy Services

- Ancillary Services

- Transmission Infrastructure Services

- Distribution Infrastructure Services

- Customer Energy Management Services

- Others

End-user

- Utility

- Industrial, Residential & Commercial

By Component

- Energy Storage System

- Control and Monitoring System

- Service Contract

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)