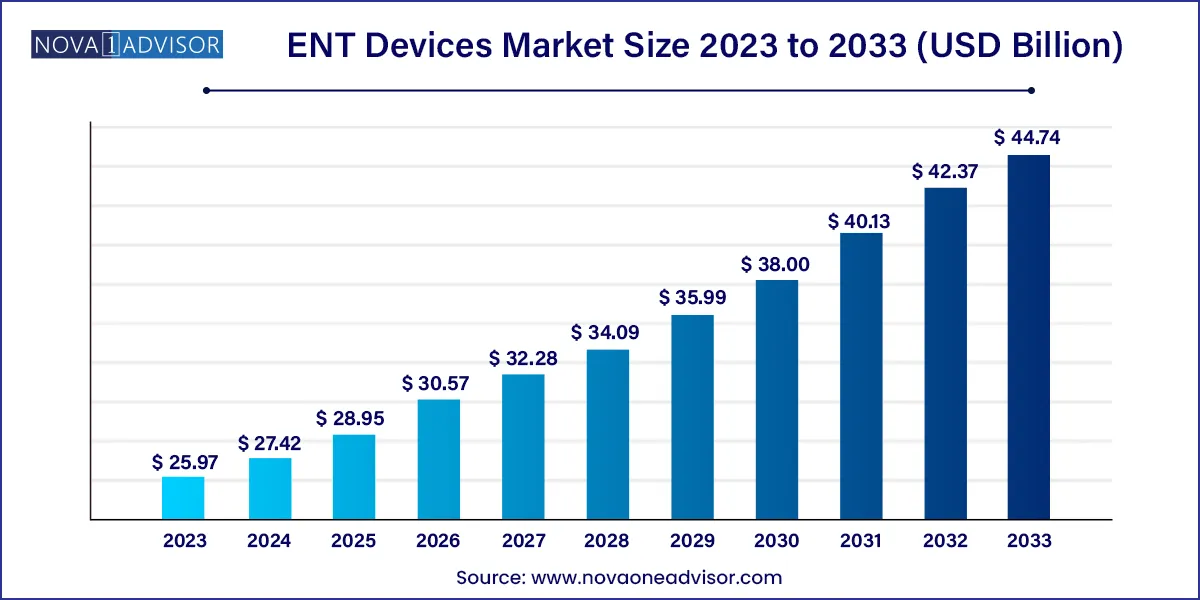

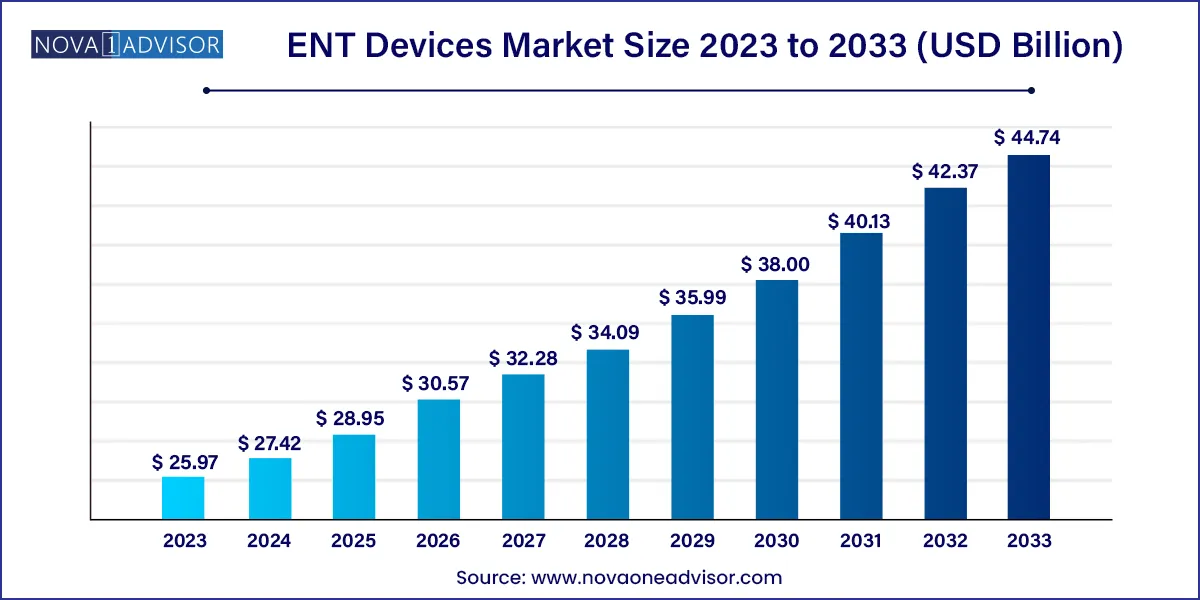

The global ENT devices market size was exhibited at USD 25.97 billion in 2023 and is projected to hit around USD 44.74 billion by 2033, growing at a CAGR of 5.59% during the forecast period 2024 to 2033.

Key Takeaways:

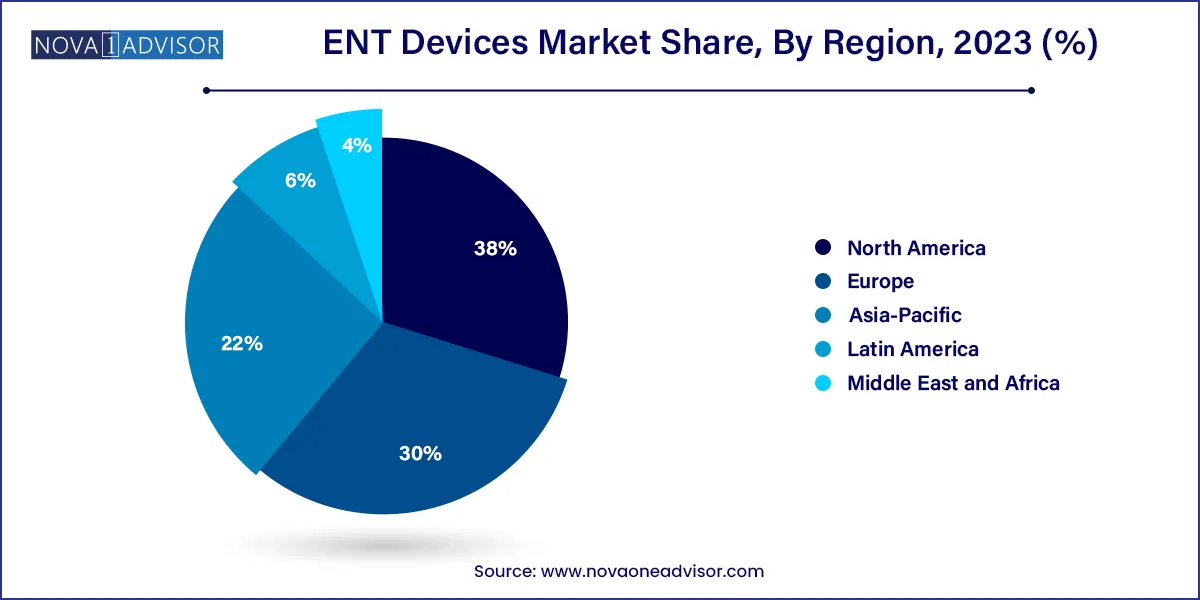

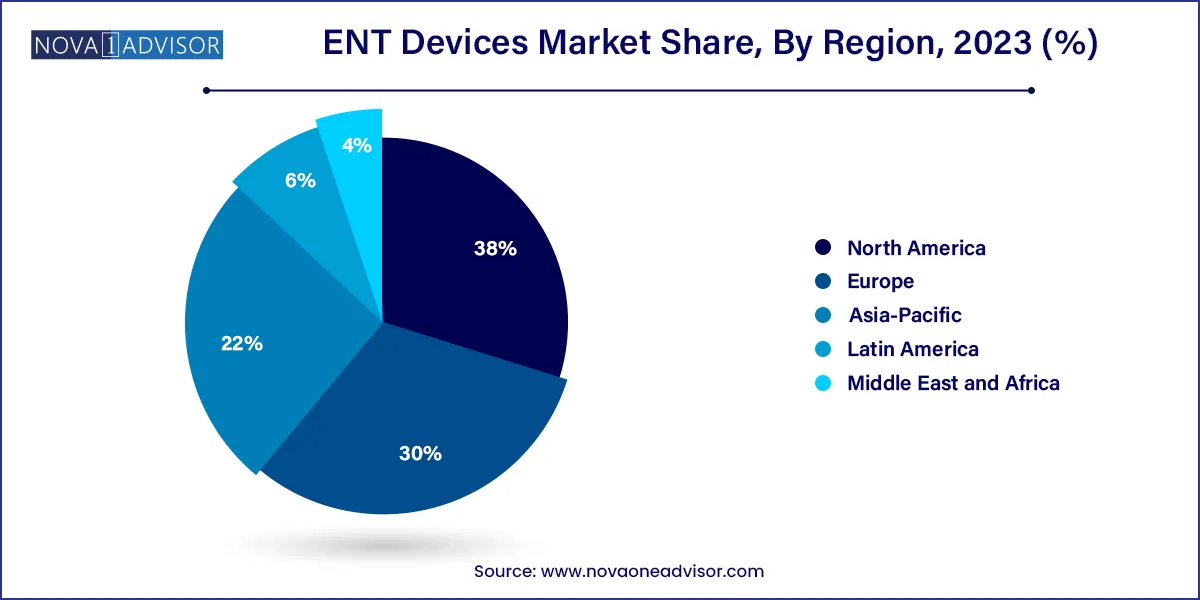

- North America dominated the market with 38% share in 2023.

- The hearing aids segment held the largest revenue share of over 32% in 2023.

Market Overview

The ENT (Ear, Nose, and Throat) devices market represents a critical segment of the broader medical devices industry, catering to the diagnosis, treatment, and management of conditions affecting the ear, nose, throat, head, and neck. ENT disorders are among the most common health issues globally, impacting people across all age groups. With growing awareness, technological advancements, and the aging global population, the demand for specialized ENT equipment has been surging.

ENT devices include a diverse range of tools such as diagnostic endoscopes, surgical instruments, hearing aids, and implants. They play a pivotal role in addressing diseases such as chronic sinusitis, sleep apnea, otitis media, tonsillitis, hearing loss, and cancers of the head and neck. Additionally, the market is witnessing a paradigm shift from traditional, invasive surgeries to minimally invasive procedures facilitated by advanced diagnostic and surgical ENT devices.

The rise of robot-assisted ENT surgeries, increasing noise-induced hearing loss cases due to urban lifestyles, and the expansion of outpatient ENT clinics are collectively fueling the growth of this market. Moreover, with technological innovations such as wireless hearing aids, 3D-printed nasal splints, and AI-assisted diagnostic tools, the ENT devices market is poised for significant evolution over the next decade.

Major Trends in the Market

-

Growth of Minimally Invasive ENT Surgeries: High demand for sinus dilation devices and flexible endoscopy systems.

-

Integration of Robotics in ENT Procedures: Robot-assisted endoscopes are enhancing surgical precision and recovery outcomes.

-

Technological Advancements in Hearing Devices: Bluetooth connectivity, rechargeable batteries, and AI sound processing in hearing aids.

-

Expansion of Home Healthcare Solutions: Increase in hearing screening devices suitable for home use.

-

Rising Adoption of Nasal Packing Devices: Particularly in trauma and postoperative care to control bleeding and support healing.

-

Customization and Personalization of Hearing Aids: Patient-specific fitting based on 3D ear imaging.

-

Increased Focus on Pediatric ENT Disorders: Innovations targeting congenital hearing loss, sinus conditions, and adenoid issues.

-

Proliferation of Portable and Wearable ENT Diagnostic Devices: Surge in compact otoscopes and mobile-connected diagnostic tools.

ENT Devices Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 27.42 Billion |

| Market Size by 2033 |

USD 44.74 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.59% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Demant A/S; Sonova; GN Store Nord A/S; Ambu A/S; Pentax Medical (HOYA Corporation); Karl Storz; Olympus Corporation; Richard Wolf GmbH; Cochlear Ltd.; Starkey Laboratories, Inc.; Rion Co., Ltd.; Stryker; and Smith & Nephew plc; Nico Corporation, Nemera |

Key Market Driver: Aging Population and Rise in ENT Disorders

One of the primary drivers propelling the ENT devices market is the growing elderly population, which is more susceptible to ENT disorders, particularly hearing loss, voice disorders, and chronic sinus issues. According to WHO estimates, nearly one-third of the global population aged over 65 suffers from disabling hearing loss, making hearing aids and implants increasingly vital.

Furthermore, conditions like obstructive sleep apnea, presbycusis (age-related hearing loss), and vocal cord dysfunction are more common among the elderly, necessitating timely diagnosis and treatment. As life expectancy continues to rise globally, healthcare systems are placing greater emphasis on ENT healthcare services, driving consistent demand for both diagnostic and surgical devices.

Key Market Restraint: High Cost of Advanced ENT Devices and Procedures

Despite the strong growth potential, the market faces a significant restraint in the form of high cost associated with ENT devices and procedures. Advanced devices, such as robot-assisted endoscopes and cochlear implants, come with substantial price tags that are often beyond the reach of patients without comprehensive insurance coverage.

Moreover, maintenance costs, the need for specialized training for operating robotic systems, and limited reimbursement policies in some countries add to the burden. These economic barriers limit adoption, particularly in emerging economies, where budget constraints often dictate medical equipment purchases.

Key Market Opportunity: Expansion in Emerging Markets

A significant growth opportunity lies in expanding access to ENT care in emerging markets such as India, China, Brazil, and parts of Africa. In many of these regions, ENT disorders are prevalent due to factors such as untreated infections, poor access to early healthcare, environmental pollution, and high tobacco use.

Government initiatives to improve healthcare infrastructure, combined with growing middle-class incomes and insurance penetration, are opening the door for ENT device manufacturers to tap into previously underserved markets. Moreover, lower-cost and portable diagnostic tools tailored for rural and semi-urban areas are increasingly in demand, providing substantial opportunity for strategic market expansion.

Segments Insights:

Product Insights

Diagnostic ENT devices dominate the market, given their critical role in identifying conditions early and accurately. Devices such as rigid endoscopes (sinuscopes, otoscopes, and laryngoscopes) and flexible endoscopes (nasopharyngoscopes, bronchoscopes) are routinely used in outpatient clinics and hospitals. These devices allow for visual inspection of complex anatomical structures, aiding in the diagnosis of sinus infections, vocal cord lesions, and ear pathologies.

Among diagnostic devices, flexible endoscopes are rapidly gaining popularity due to their patient comfort, superior maneuverability, and wider field of view. Robot-assisted endoscopes are also gaining traction for their precision and minimally invasive approach, particularly in head and neck cancer surgeries.

Hearing aids are the fastest-growing product segment, fueled by technological advancements and increasing prevalence of hearing impairments. Innovations such as wireless connectivity, rechargeable batteries, AI-driven sound adjustments, and near-invisible designs have made hearing aids more attractive and user-friendly. Additionally, rising social acceptance and government support programs for hearing assistance are encouraging greater adoption, particularly among younger demographics affected by early-onset hearing loss.

Regional Insights

North America is the leading region in the ENT devices market, driven by high healthcare spending, advanced healthcare infrastructure, and a large patient pool suffering from ENT disorders. The United States, in particular, has a high prevalence of hearing loss and sleep apnea, necessitating significant use of diagnostic and surgical ENT devices.

Moreover, the presence of leading manufacturers like Medtronic, Stryker, and Cochlear Ltd., coupled with rapid adoption of technologically advanced devices, contributes to North America's dominant share. Government healthcare programs, insurance coverage for ENT surgeries and devices, and strong awareness campaigns around early diagnosis further reinforce the region’s leadership.

Asia-Pacific is the fastest-growing region, with countries like China, India, Japan, and South Korea at the forefront of healthcare modernization. Factors such as a large aging population, rising disposable incomes, increasing prevalence of ENT disorders, and government initiatives to improve rural healthcare access are driving demand.

Particularly, hearing impairment screening programs in newborns, rapid urbanization leading to pollution-induced ENT disorders, and growing awareness around minimally invasive surgeries are spurring market expansion. Additionally, many global companies are establishing local manufacturing units or partnerships to cater to price-sensitive markets, further fueling growth in the region.

Recent Developments

-

March 2025: Medtronic unveiled its next-generation flexible robotic-assisted endoscope designed for ENT and neurosurgery procedures, enhancing maneuverability and precision.

-

February 2025: Cochlear Limited launched a new Bluetooth-enabled cochlear implant sound processor that offers direct streaming and AI-based sound adjustments.

-

January 2025: Stryker Corporation acquired a mid-sized ENT surgical instrument manufacturer to expand its portfolio of otological and rhinological devices.

-

December 2024: Smith & Nephew launched a new line of minimally invasive sinus dilation balloons with drug-eluting properties to prevent post-surgical infections.

-

November 2024: Demant A/S announced the launch of an ultra-light, rechargeable hearing aid with 48-hour battery life and adaptive sound environment detection.

Some of the prominent players in the ENT devices market include:

- Ambu A/S

- Cochlear Ltd.

- Demant A/S

- GN Store Nord A/S

- Karl Storz SE & Co.

- Olympus Corporation

- Pentax of America, Inc.

- Richard Wolf GmbH

- Rion Co., Ltd.

- Smith & Nephew plc

- Sonova

- Starkey Laboratories, Inc.

- Stryker

- Nico Corporation

- Nemera

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global ENT devices market.

Product

-

-

- Sinuscopes

- Otoscopes

- Laryngoscopes

-

-

- Bronchoscopes

- Laryngoscopes

- Nasopharyngoscopes

-

- Robot Assisted Endoscope

- Hearing Screening Device

-

- Radiofrequency handpieces

- Otological Drill Burrs

- ENT Hand Instruments

- Sinus Dilation Devices

- Nasal Packing Devices

- Hearing Aids

- Hearing Implants

- Nasal Splints

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)