Enteric Disease Testing Market Size and Growth

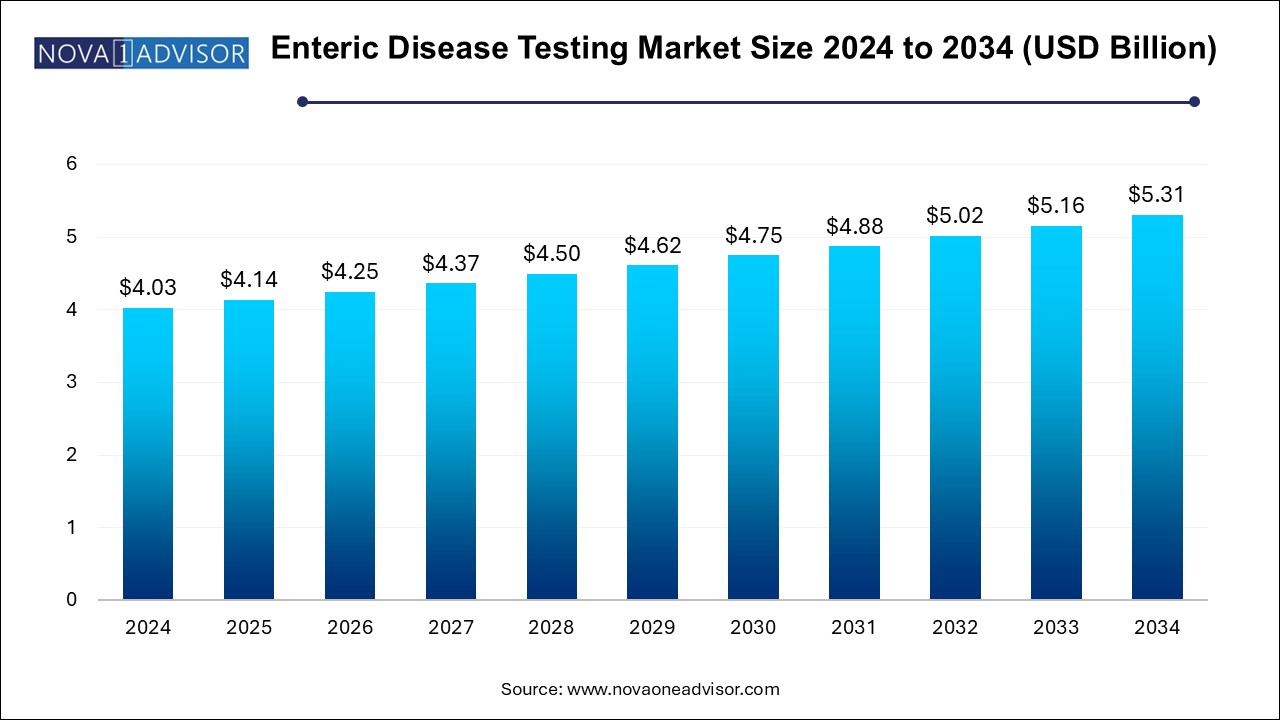

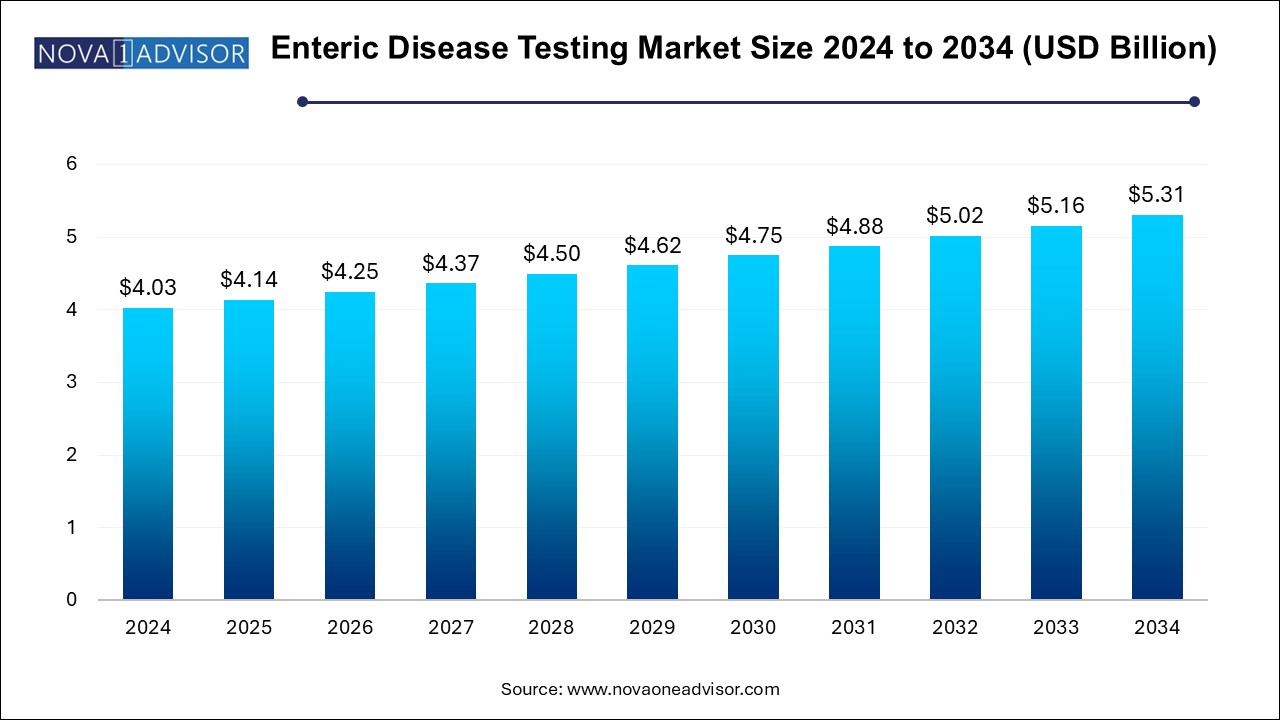

The enteric disease testing market size was exhibited at USD 4.03 billion in 2024 and is projected to hit around USD 5.31 billion by 2034, growing at a CAGR of 2.8% during the forecast period 2025 to 2034.

Market Overview

The enteric disease testing market plays a critical role in modern healthcare infrastructure as it helps in the timely diagnosis and treatment of gastrointestinal infections caused by bacteria, viruses, and parasites. These infections are prevalent globally, especially in developing regions where water sanitation and hygiene remain inadequate. The rising global burden of enteric diseases, especially among children and elderly populations, necessitates effective diagnostic solutions that are both rapid and accurate.

Advancements in diagnostic technologies, including molecular diagnostics, rapid antigen tests, and polymerase chain reaction (PCR) assays, have significantly enhanced the sensitivity and specificity of enteric disease detection. The healthcare industry is increasingly shifting toward point-of-care (PoC) diagnostics, especially in remote and resource-limited settings. This trend is catalyzing the demand for more efficient, cost-effective, and user-friendly testing kits.

The market's growth is further propelled by heightened awareness, governmental initiatives to control disease outbreaks, and the growing need for early detection to prevent complications. The World Health Organization (WHO) and Centers for Disease Control and Prevention (CDC) have emphasized the importance of surveillance and control programs, which positively impact the demand for enteric disease testing services.

Major Trends in the Market

-

Shift Toward Point-of-Care Testing: Rapid diagnostics are becoming more popular due to their ability to deliver results within minutes, crucial during outbreaks and in remote areas.

-

Adoption of Molecular Diagnostics: Techniques like PCR and nucleic acid amplification tests (NAATs) are becoming the gold standard due to their high accuracy.

-

Rise of At-Home Testing Kits: With increasing digital health adoption, many companies are launching consumer-friendly kits for enteric disease testing at home.

-

Increased Surveillance and Screening Programs: National and international health agencies are pushing for wider surveillance, especially in high-burden countries.

-

Technological Integration with AI and Data Analytics: AI is being integrated into diagnostic tools to enhance predictive analytics and decision-making.

-

Emphasis on Multiplex Testing Platforms: Diagnostic platforms that can detect multiple pathogens simultaneously are gaining traction.

-

Sustainable and Eco-Friendly Testing Kits: Companies are focusing on environmentally friendly testing solutions as sustainability becomes a priority.

Report Scope of Enteric Disease Testing Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 4.14 Billion |

| Market Size by 2034 |

USD 5.31 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 2.8% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Disease Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Abbott; BD; Biomerica; BIOMÉRIEUX; Bio-Rad Laboratories, Inc.; Cepheid; Coris BioConcept; DiaSorin S.p.A.; Meridian Bioscience; Quest Diagnostics Incorporated |

Driver: Growing Incidence of Waterborne Diseases

A major driving force behind the enteric disease testing market is the escalating incidence of waterborne diseases, especially in underdeveloped and developing nations. According to the WHO, over 2 billion people globally consume water that is contaminated with feces, making them susceptible to infections like cholera, typhoid, and dysentery. These conditions are caused by enteric pathogens, which are primarily transmitted through the fecal-oral route due to poor sanitation.

For instance, the widespread outbreak of cholera in Mozambique (2019) and Bangladesh’s recurring diarrheal disease spikes highlight the dire need for robust diagnostic tools. This demand has led to increased government and NGO interventions for clean water and early diagnosis. Accurate testing ensures timely intervention, thereby reducing disease spread and healthcare burden. Consequently, healthcare systems are investing in diagnostic capabilities to mitigate the risks of future outbreaks.

While the enteric disease testing market is growing, the high cost of advanced diagnostic tools remains a significant restraint. Technologies like PCR, although accurate and efficient, are expensive to implement and require skilled professionals to operate. This poses a considerable challenge in low-resource settings where financial and technical resources are limited.

In rural clinics and hospitals, especially in Sub-Saharan Africa and parts of Southeast Asia, traditional testing methods are still in use due to cost barriers. This limits access to high-end diagnostics and delays early detection. Without adequate funding and infrastructure, the adoption of modern technologies becomes stagnant, hampering market penetration in potential high-burden regions.

Opportunity: Emerging Markets in Asia Pacific and Africa

One of the most promising opportunities in the enteric disease testing market lies in emerging economies across Asia Pacific and Africa. These regions exhibit a high burden of enteric diseases due to inadequate sanitation and water infrastructure, creating a substantial need for reliable diagnostics.

For example, India's Swachh Bharat Abhiyan (Clean India Mission) is not only improving sanitation but also fostering a conducive environment for the implementation of preventive healthcare measures, including diagnostic testing. In Africa, collaborations between governments and global health organizations such as UNICEF and the Bill & Melinda Gates Foundation are facilitating improved access to diagnostics. These regions represent untapped potential where affordable and scalable solutions can make a significant impact, especially in rural and underserved populations.

Enteric Disease Testing Market By Disease Type Insights

Bacterial Enteric Disease dominated the market segment due to the high prevalence of bacterial infections like Salmonella, Shigella, and Escherichia coli. These pathogens are commonly found in contaminated water and food, making them a frequent cause of gastrointestinal illnesses, especially in areas with inadequate hygiene practices. The demand for bacterial testing kits is high, given their critical role in outbreak detection and management. The growing use of multiplex PCR tests to detect bacterial pathogens has also supported the dominance of this segment.

In parallel, viral enteric diseases are expected to be the fastest-growing segment. Viruses such as rotavirus and norovirus are increasingly recognized as major contributors to pediatric and geriatric gastrointestinal infections. For instance, rotavirus alone causes around 215,000 deaths annually among children under five, predominantly in developing countries. The introduction of rotavirus vaccines and global immunization programs has also led to increased testing and surveillance to measure efficacy, thereby accelerating market growth in this segment.

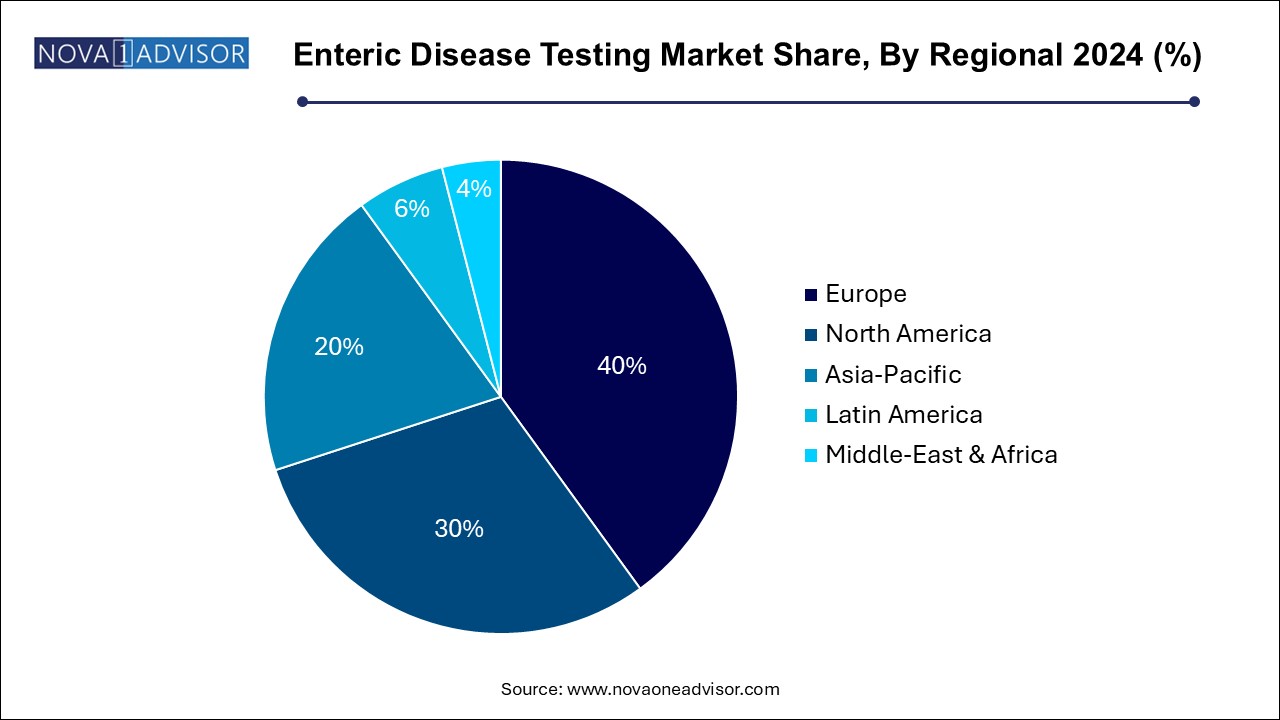

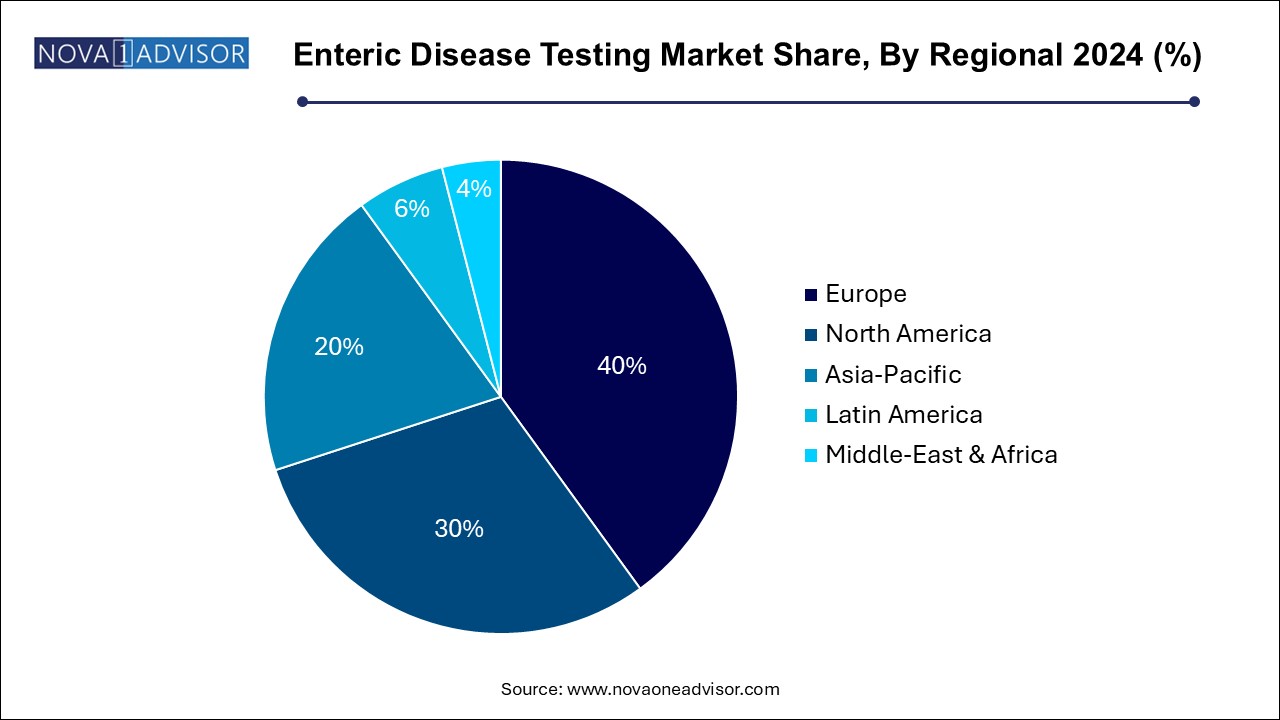

Enteric Disease Testing Market By Regional Insights

North America dominated the enteric disease testing market, primarily due to its well-developed healthcare infrastructure, high awareness levels, and advanced diagnostic technology adoption. The United States and Canada have rigorous food and water safety standards, driving demand for frequent testing. Public health institutions such as the CDC conduct nationwide surveillance, which necessitates constant diagnostic innovation and procurement.

Moreover, North America benefits from a robust insurance framework that covers most diagnostic procedures, making them accessible to a large population. Major players headquartered in this region, including Thermo Fisher Scientific and Bio-Rad Laboratories, contribute to its dominance through continuous product innovation and partnerships with healthcare providers.

Asia Pacific is the fastest-growing region in the enteric disease testing market. Countries like India, China, and Indonesia are experiencing rapid urbanization, but sanitation infrastructure often lags behind, leading to high disease incidence. Public-private partnerships and international health collaborations are increasingly targeting these regions for enteric disease prevention and control.

In addition, growing government investments in healthcare infrastructure, expanding medical tourism, and increased awareness are driving demand for diagnostic services. The rise of local diagnostic startups and mobile testing labs has also made testing more accessible, contributing to the region’s exceptional growth.

Some of the prominent players in the enteric disease testing market include:

- Abbott

- BD

- Biomerica

- BIOMÉRIEUX

- Bio-Rad Laboratories, Inc.

- Cepheid

- Coris BioConcept

- DiaSorin S.p.A.

- Meridian Bioscience

- Quest Diagnostics Incorporated

Recent Developments

-

In January 2024, Thermo Fisher Scientific launched a new multiplex PCR panel designed for simultaneous detection of 20 gastrointestinal pathogens, reducing diagnostic time significantly.

-

In October 2023, bioMérieux announced a strategic partnership with the Indian Council of Medical Research (ICMR) to provide enteric disease testing kits across rural India.

-

In August 2023, QuidelOrtho introduced a compact, point-of-care molecular testing device targeting low-resource clinics, receiving regulatory approval in several Asia Pacific countries.

-

In March 2024, Abbott Laboratories unveiled a sustainable diagnostic platform made with recyclable materials, aimed at eco-conscious healthcare facilities.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the enteric disease testing market

By Disease Type

- Bacterial Enteric Disease

- Viral Enteric Disease

- Parasitic Enteric Disease

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)