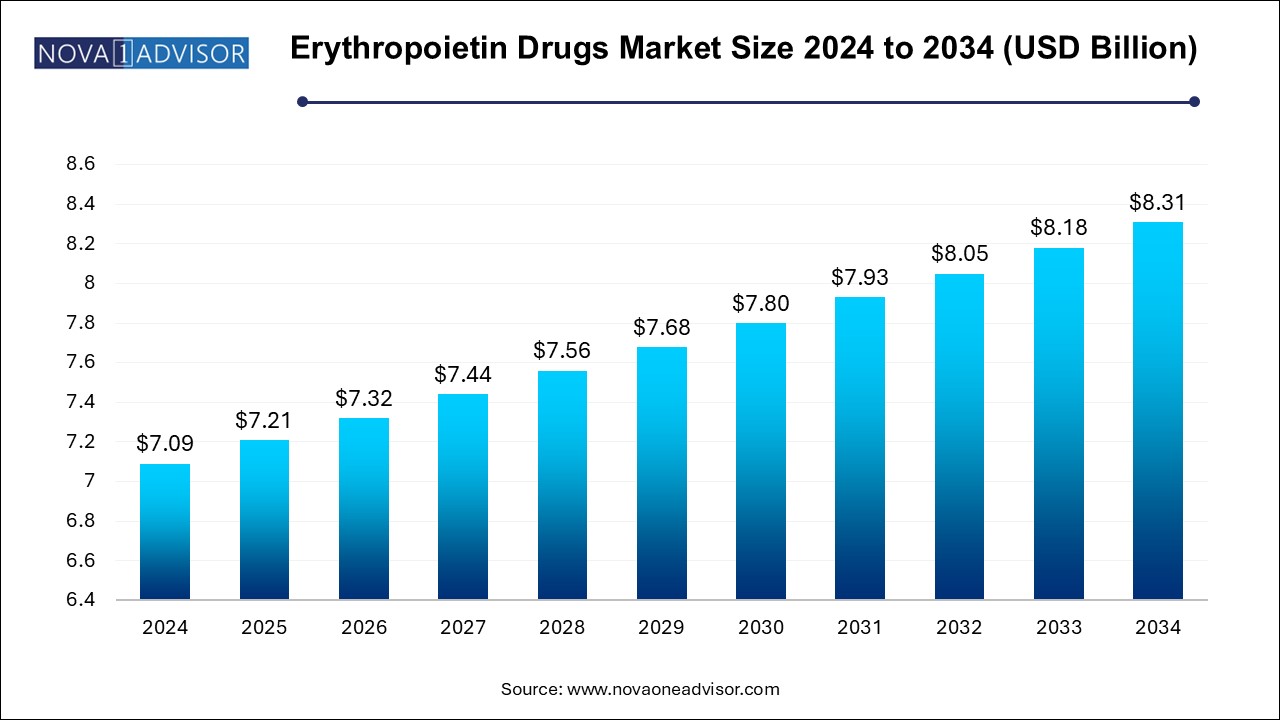

Erythropoietin Drugs Market Size and Growth

The erythropoietin drugs market size was exhibited at USD 7.09 billion in 2024 and is projected to hit around USD 8.31 billion by 2034, growing at a CAGR of 1.6% during the forecast period 2025 to 2034. Increased burden of chronic diseases, need for effective therapies and rising healthcare expenditure are the factors driving the growth of the erythropoietin drugs market.

Erythropoietin Drugs Market Key Takeaways:

- North America dominated the erythropoietin drugs market in 2024.

- Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period.

- By product type, the epoetin-alfa segment held the major market share in 2024.

- By product type, the darbepoetin-alfa segment is anticipated to witness lucrative growth in the market over the forecast period.

- By application, the kidney disorders segment contributed the biggest market share in 2024.

- By application, the cancer segment is expected to register the fastest growth during the forecast period.

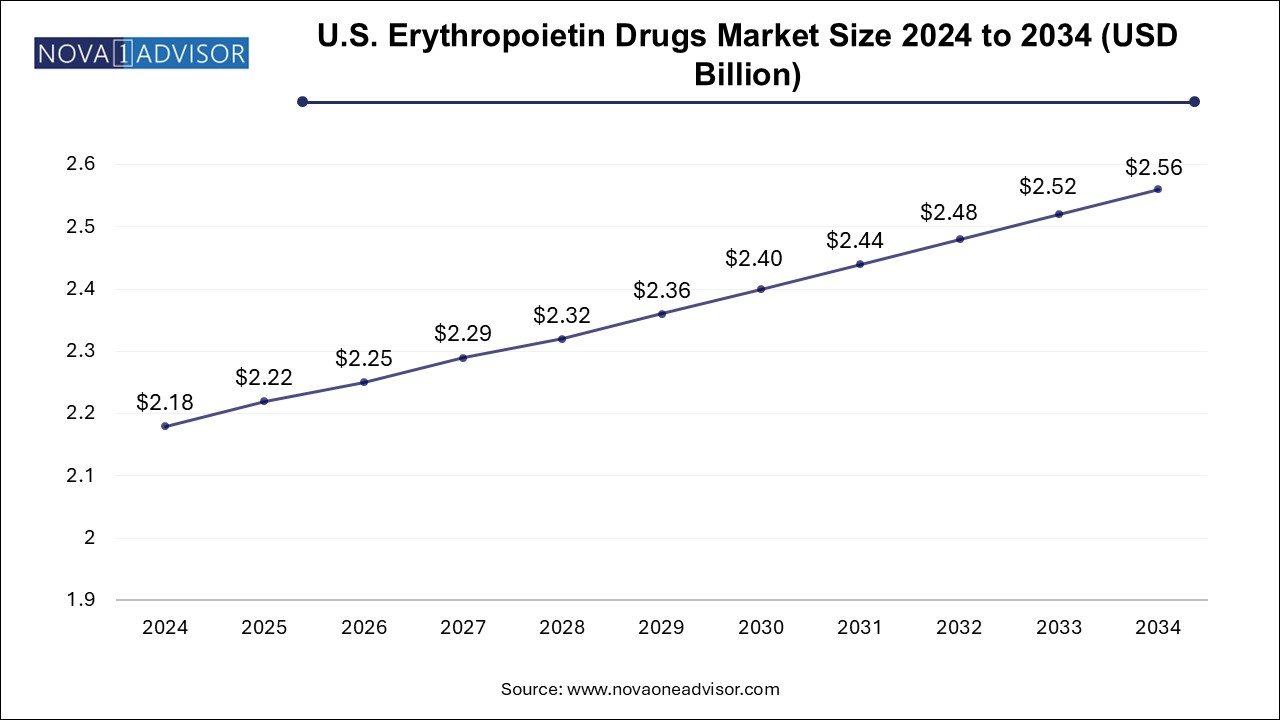

U.S. Erythropoietin Drugs Market Size and Growth 2025 to 2034

The U.S. erythropoietin drugs market size is evaluated at USD 2.18 billion in 2024 and is projected to be worth around USD 2.56 billion by 2034, growing at a CAGR of 1.47% from 2025 to 2034.

What is Driving North America’s Dominance in the Erythropoietin Drugs Market?

North America dominated the global erythropoietin drugs market with the largest share in 2024. The region’s market dominance is driven by increasing incidences of cancer and chronic kidney diseases, presence of robust healthcare infrastructure with advanced diagnostic capabilities, increased awareness, major market players investing heavily in R&D and adoption of biosimilar EPO drugs.

U.S. Government Influence Boosting the Erythropoietin Drugs Market Growth

U.S. is a major contributor to the market in North America, owing to the factors such as access to state-of-the-art medical facilities, presence of key market players with advanced manufacturing capabilities, strong research infrastructure and rising disposable incomes. Regulation of development, approval and manufacturing of erythropoietin drugs for ensuing their safety and efficacy is done by the U.S. Food and Drug Administration. Government agencies such as the Centers for Disease Control and Prevention (CDC) provides data for research and development of public health policy by tracking and monitoring chronic diseases requiring EPO treatment. Favorable reimbursement policies like Medicare and Medicaid are enabling access to EPO drugs for a wide range population suffering from cancer and end-stage renal disease.

How is the Asia Pacific Market for Erythropoietin Drugs Expanding?

Asia Pacific is anticipated to show the fastest growth in the global erythropoietin drugs market over the forecast period. Rising healthcare expenditure, increasing investments for building advanced medical and diagnostic facilities, surging demand for affordable therapies, presence of well-established manufacturing infrastructure for biosimilar development and production, availability of skilled labour, medical tourism and supportive government initiatives are driving the market growth of this region. Furthermore, large population base with aging population and suffering from chronic diseases like cancer and CKD in India and China is contributing to the market expansion.

How is the Erythropoietin Drug Market Evolving?

Erythropoietin is a biological drug that stimulates red blood cell production, mainly used to treat anemia caused by chronic kidney diseases or chemotherapy. The erythropoietin drug market is driven by the increasing prevalence of chronic kidney diseases and cancer-related anemia. The emergence of biosimilars, offering cost-effective alternatives, is enhancing accessibility and fostering competition. Advancements in drug formulations, such as extended-release versions, are improving patient compliance by reducing dosing frequency. Additionally, innovations in drug delivery systems and supportive regulatory frameworks are contributing to the market growth and transformation.

What is Fuelling the Expansion of Erythropoietin Drugs Market?

Erythropoietin drugs also known as erythropoiesis-stimulating agents (ESAs) refer to medications used for treating anemia arising from conditions such as chronic kidney disease, chemotherapy or certain HIV treatments by stimulating the production of red blood cells in the body. These drugs are synthetic versions of erythropoietin (EPO). Some of the commonly used erythropoietin drugs include daprodustat, darbepoetin-alfa (Aranesp), epoetin-alfa (Epogen, Procrit) and methoxy polyethylene glycol-epoetin beta (Mircera).

The expansion of the erythropoietin drugs market is driven by factors such as globally rising prevalence of long-term illnesses like cancer and chronic kidney disease (CKD), increasing geriatric population, surging demand for cost-effective therapies like biosimilar erythropoietin drugs, ongoing advancements in recombinant DNA technology, emerging markets in developing regions and rising investment in R&D activities.

Where is AI Finding Applications in the Erythropoietin Drugs Market?

Artificial intelligence is increasingly being employed in erythropoietin drugs market for transforming drug discovery and manufacturing processes as well as for personalizing patient care. AI algorithms can be applied for analyzing large datasets to accelerate research workflows like prediction of drug interactions, improving stability and efficacy by optimizing protein modifications as well as for identification and validation of novel targets for developing potential and targeted erythropoietin (EPO) therapies. Optimization of production processes and real-time quality control in manufacturing can be achieved with integration of AI, leading to high quality and safer EPO drugs.

Furthermore, AI-based algorithms can assist in personalizing treatment plans and management of anemia in chronic conditions like kidney disease. The AI-powered Anemia Control Model developed by Fresenius Medical Care optimizes management of anemia in patients with chronic kidney disease (CKD) by offering personalized dosing recommendations for ESAs and iron therapy by analyzing individual patient characteristics, leading to improved patient outcomes.

How Can AI Affect the Erythropoietin Drug Market?

AI can significantly impact the erythropoietin drug market by accelerating drug discovery and development through advanced data analysis and predictive modeling. It helps optimize drug formulations and personalized treatment plans, improving patient outcomes. Additionally, AI-driven automation enhances manufacturing efficiency and quality control, reducing costs. Overall, AI supports faster innovation, better-targeted therapies, and increased accessibility in the erythropoietin drug market.

Major Trends in the Erythropoietin Drugs Market

- Adoption of biosimilars: Biosimilar EPO drugs are gaining traction in the market with the expiry of patents for original EPO biologics, further offering a cost-effective, affordable convenient approach for effective treatment to patients.

- Improved Patient Monitoring: Digital health tools are actively being deployed for real-time monitoring of patient response to EPO drugs to anticipate adverse events and proactive adjustment of treatment.

- Personalized medicine: For improving patient outcomes, healthcare professionals are applying personalized treatment strategies based on individual patient data, comorbidities and treatment response for developing optimized dosing regimens with maximum efficacy while mitigating the side effects.

Report Scope of Erythropoietin Drugs Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 7.21 Billion |

| Market Size by 2034 |

USD 8.31 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 1.6% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Type, Product, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Johnson & Johnson Services, Inc.; Novartis AG; Teva Pharmaceutical Industries Ltd.; Amgen, Inc.; F. Hoffmann-La Roche Ltd.; LG Chem; Biocon; Intas Pharmaceuticals Ltd.; Sun Pharmaceutical Industries Ltd; Dr. Reddy’s Laboratories Ltd |

Market Dynamics

Drivers

Rising Prevalence of Chronic Diseases

The globally increasing burden of chronic diseases like chronic kidney disease (CKD) and cancer as well as the rising geriatric population are susceptible to severe conditions leading to anemia which drives the demand for erythropoietin drugs for treatment. Furthermore, increased access to better diagnostic capabilities enabling early detection of anemia-related conditions, rising public awareness and adoption of biosimilar options is fuelling the market expansion of erythropoietin drugs.

Restraints

Side Effects and High Costs of Erythropoietin Drugs

Erythropoietin drugs have several side effects associated with their use such as arterial hypertension, influenza-like syndrome, iron deficiency and also risk of thromboembolic events (blood clots) and stroke which can result in reduced patient compliance. Additionally, high costs of erythropoietin drugs are a major issue in developing countries with middle class populations having limited or no reimbursement policies or insurance coverage, further restricting the market growth.

Opportunities

Continuous Scientific Advancements

Rising investments by various governments, research organizations and pharmaceutical and biotechnology industries in research and development activities for improving and developing novel erythropoietin formulations such as long-acting drugs which reduce dosing frequency and enhance patient adherence. Furthermore, increased number of ongoing clinical trials, progress in genetic engineering and biotechnology as well as increased expenditure on advancing healthcare and research infrastructure in emerging economies is creating lucrative opportunities for market growth.

Erythropoietin Drugs Market By Product Insights

The Epoetin-Alfa Segment Dominant Share

By product type, the epoetin-alfa segment dominated with the largest market share in 2024. The well-established efficacy and safety profile of epoetin-alfa in patients for anemia management drives its sustained adoption by healthcare professionals. Epoetin-alfa is widely being used in hospitals and dialysis centers for treating anemia associated with chronic kidney disease and chemotherapy-induced anemia in cancer patients. Additionally, the growing demand for better anemia management solutions in the geriatric population, availability of advanced diagnostic procedures, increased patient access to biosimilars and supportive government policies are the factors driving the market growth.

The Darbepoetin-Alfa Segment Fastest Growing

By product type, the darbepoetin-alfa segment is anticipated to witness lucrative growth in the market during the predicted timeframe. Darbapoeitin-alfa is known for its extended half-life in comparison to other erythropoietin-stimulating agents (ESAa), further enabling reducing dosing frequency leading to enhanced convenience, adherence and quality of life for patients requiring long-term treatment. Rising global demand for darbepoetin-alfa, continuously evolving clinical guidelines for optimizing anemia management, growing emphasis on personalized medicine and improving healthcare infrastructure in emerging markets are the factors expected to boost the growth of this segment in the upcoming years.

Erythropoietin Drugs Market By Application Segment Insights

The Kidney Disorders Segment Biggest Share

By application, the kidney disorders segment held the biggest market share in 2024. Rising prevalence of chronic kidney disease (CKD) resulting in insufficient amounts of erythropoietin produced in the body due to damaged kidneys is driving the demand for erythropoietin (EPO) drugs for effective management of anemia. Increasing number of patients with end-stage renal disease (ESRD), especially those undergoing dialysis including hemodialysis or peritoneal dialysis continuously require EPO drugs for stimulating red blood cell production for managing severe anemia and improving their quality of life. Furthermore, continuous advancements in developing long-acting EPO formulations and establishment of clinical guidelines for improving standard of care for EPO therapy are contributing to the market dominance of this segment.

The Cancer Segment Expanding Rapidly

By application, the cancer segment is expected to show the fastest growth over the forecast period. Chemotherapy is the most common treatment for cancer and can cause bone marrow suppression leading to decreased production of red blood cells and ultimately anemia. With the globally rising burden of cancer, erythropoietin-stimulating agents are actively being used for management of chemotherapy-induced anemia (CIA) for reducing need of red blood cell transfusions, further improving patient life quality. Moreover, continuous advancements in cancer treatments, emphasis on biosimilar development and increased awareness among healthcare professionals about cancer-related anemia are the factors bolstering the market growth.

Some of the prominent players in the Erythropoietin Drugs Market include:

Recent Developments

- In May 2025, the Rotary Club of Kuala Lumpur DiRaja launched the Erythropoietin Injection Project, an initiative for patients suffering from End-Stage Kidney Disease (ESKD). The project focuses on delivering life-sustaining erythropoietin treatments to over 300 underprivileged dialysis patients throughout Malaysia.

- In March 2025, after the U.S. market launch of Vafseo in January, Akebia Therapeutics’ announced plans for expanding a phase 3 clinical trial, called Valor, for assessing Vafseo’s potential in treating anemia of late-stage CKD patients who are not on dialysis.

- In January 2025, Kwality Pharmaceuticals Ltd., received the Review Committee on Genetic Manipulation (RCGM) approval for commencing pre-clinical toxicity studies of its recombinant Erythropoietin product.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Erythropoietin Drugs Market

By Type

By Product

- Erythropoietin

- Darbepoetin-alfa

By Application

- Cancer

- Renal Diseases

- Neurology

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)