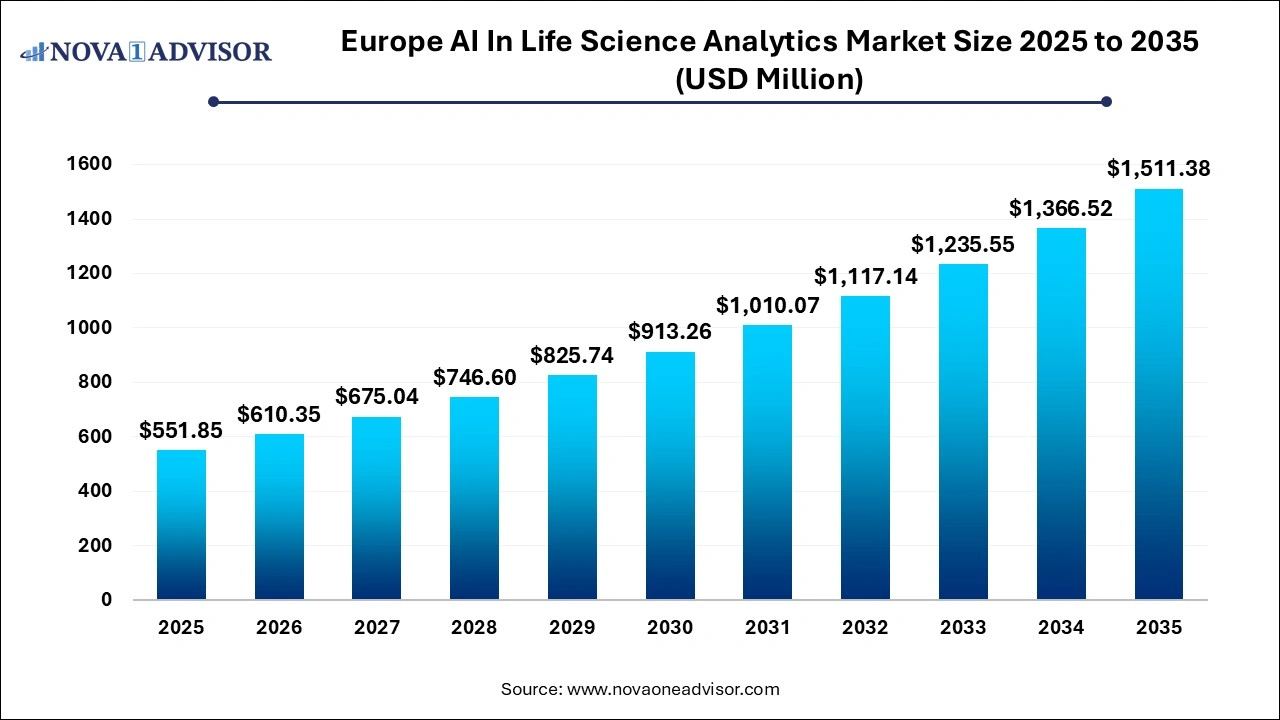

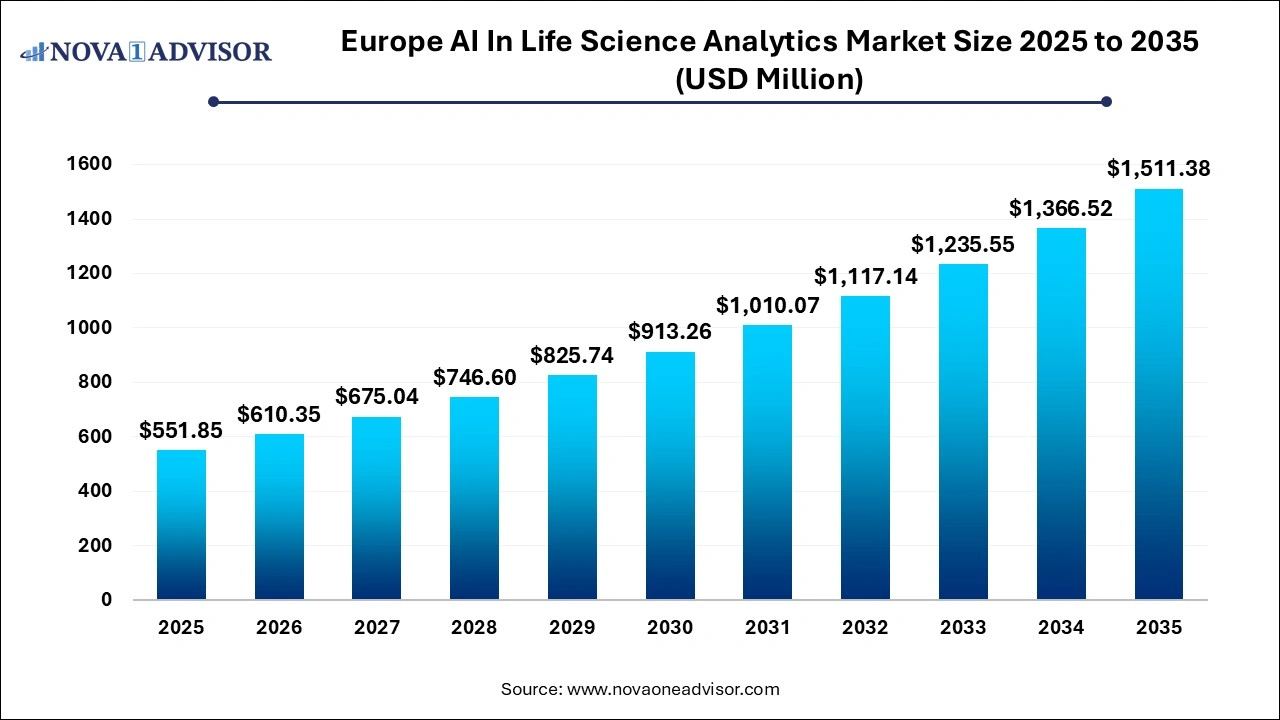

Europe AI In Life Science Analytics Market Size and Growth

The Europe AI in life science analytics market size was exhibited at USD 551.85 million in 2025 and is projected to hit around USD 1,511.38 million by 2035, growing at a CAGR of 10.4% during the forecast period 2026 to 2035.

Europe AI In Life Science Analytics Market Key Takeaways:

- Based on application type, the patient health & experience segment held the largest market share of 10.2% in 2025.

- The net-zero & sustainability segment is expected to witness the fastest CAGR of 11.3% over the forecast period.

- In 2025, Germany held the largest market share of 20.4%, owing to various initiatives undertaken for promoting the adoption are fueling the market growth.

- Ireland is expected to grow at the fastest rate of 10.6% over the forecast period.

Market Overview

Artificial Intelligence (AI) is transforming the life sciences landscape across Europe by redefining how data is collected, interpreted, and operationalized throughout the healthcare value chain. From accelerating drug discovery timelines to optimizing patient engagement strategies, AI is becoming central to clinical and commercial functions. As life science companies grapple with complex data from genomics, electronic health records, clinical trials, and real-world evidence, AI-powered analytics offers unprecedented capabilities for pattern recognition, prediction, and decision automation.

The European market, in particular, is gaining momentum due to its robust biopharma sector, regulatory support for digital health innovation, and growing digital maturity of healthcare infrastructure. The region is home to several global pharmaceutical giants, innovative startups, and academic powerhouses that are pioneering AI applications in translational research, personalized medicine, and clinical operations. Moreover, the EU’s digital and green transformation initiatives—such as the European Health Data Space and AI Act—are expected to further catalyze the integration of AI across life sciences workflows.

Countries like Germany, the U.K., France, and Switzerland are leading the charge, supported by investment from both public and private stakeholders. With healthcare systems under pressure to reduce costs and improve outcomes, AI-powered life science analytics is poised to become a cornerstone of next-generation drug development, patient care, and operational excellence.

Major Trends in the Market

-

Adoption of AI in Drug Discovery Pipelines: AI is reducing the time and cost of lead identification and optimization through predictive modeling and simulation.

-

Rise of Digital Twins for R&D and Manufacturing: Pharmaceutical firms are using AI to create digital replicas of biological systems or manufacturing plants to optimize processes.

-

Growth in Decentralized Clinical Trials (DCTs): AI-enabled data capture, remote monitoring, and analytics are powering hybrid and fully virtual trial models.

-

Increased Focus on Patient-Centric Analytics: AI is being leveraged to enhance patient engagement through omnichannel platforms and behavioral analytics.

-

Sustainability and Net Zero Initiatives: Life science companies are applying AI to monitor carbon emissions and optimize green manufacturing processes.

-

AI-Powered Compliance Automation: Regulatory and pharmacovigilance teams are using AI to streamline safety reporting, risk analysis, and audit readiness.

-

Collaborative Ecosystems and Consortiums: Public-private partnerships and cross-border collaborations are accelerating innovation and standardization in AI-based analytics.

Report Scope of Europe AI In Life Science Analytics Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 610.35 Million |

| Market Size by 2035 |

USD 1,511.38 Million |

| Growth Rate From 2026 to 2035 |

CAGR of 10.6% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Application, Country |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Lexalytics; Databricks; SAS Institute, Inc.; Sisense, Inc.; IQVIA; IBM; Sorcero; Axtria; Aktana; Mosimtec, LLC; Aon plc; Zenith Technologies; ZS Associates; Locuz; Puresoftware |

Market Driver: Accelerated Drug Discovery and Development

The single most significant driver of AI in life science analytics in Europe is its ability to significantly accelerate and de-risk the drug discovery and development process. Traditional R&D timelines span 10–15 years with high failure rates and exorbitant costs. AI platforms are now enabling researchers to identify targets, screen compounds, and predict toxicity at unprecedented speed.

For instance, AI is being applied in target identification and translational research, where machine learning models analyze multi-omics data, protein interactions, and disease pathways to pinpoint viable biological targets. Companies like BenevolentAI (U.K.) and Exscientia (U.K.) are already using deep learning to generate drug candidates, some of which are in clinical stages.

Moreover, AI supports precision recruitment for clinical trials, identifying suitable participants using EHRs, genomics, and patient-reported outcomes cutting months from trial timelines. This not only speeds up time-to-market but also enhances success rates by optimizing patient selection and trial design.

Market Restraint: Data Silos and Privacy Regulations

One of the most pressing challenges in the European AI in life science analytics market is the fragmentation of data across organizations and geographies, compounded by strict data privacy regulations such as GDPR. Unlike the U.S., where large-scale health data aggregators have emerged, Europe's data ecosystem is highly decentralized and varies by country, limiting the availability of large, harmonized datasets for model training and validation.

Furthermore, companies face regulatory complexity when handling sensitive patient information. Ensuring anonymization, data localization, and consent management across multiple jurisdictions often slows AI deployment. Even with federated learning approaches gaining traction, interoperability between different healthcare systems and standards remains an ongoing concern. This limits the scalability and generalizability of AI models across European markets.

A major opportunity lies in the integration of AI life science analytics with Europe’s growing digital health infrastructure. The expansion of electronic health records (EHRs), telemedicine platforms, wearable devices, and patient portals is generating massive volumes of structured and unstructured health data. This presents fertile ground for AI-powered analytics across both R&D and commercial functions.

For example, pharmaceutical companies can leverage AI to derive real-world evidence (RWE) from EHRs and wearable data, optimizing both regulatory submissions and marketing strategies. Hospitals and CROs can deploy AI to manage decentralized trials with remote monitoring, virtual assistants, and adherence tracking. Moreover, as countries move toward digital therapeutics and value-based care, AI-enabled omnichannel engagement tools can personalize outreach and improve treatment adherence.

The EU’s European Health Data Space (EHDS) initiative, launched in 2022, supports this trend by aiming to create a pan-European framework for secure and ethical health data use, significantly boosting opportunities for AI innovation.

Europe AI In Life Science Analytics Market By Application Insights

Based on application type, the patient health & experience segment held the largest market share of 10.2% in 2025. The treatment for patients with complex medical needs is expensive, requiring the medical sector to switch from treatment to disease prevention. AI is transforming healthcare, from chatbots that help people live more healthily to these AI systems that can diagnose illness rapidly and recommend patients the best treatment for a given individual. It can be used in various fields.

For instance, in January 2021, Wayra UK, the English division of the worldwide center for technological innovation, and GE Healthcare launched the Edison Accelerator, an acceleration program designed for AI. Several European and Italian emerging companies active in digital health have been involved in these programs. The acceleration program has welcomed six companies specializing in the use of AI for oncology, medical imaging, and patient experience enhancement.

The net-zero & sustainability segment is expected to witness the fastest CAGR of 11.3% over the forecast period. The anticipated growth is attributed to several factors, including increasing regulatory pressures, advancements in clean technologies, and the recognition of the long-term economic benefits associated with sustainability. Additionally, advancements in clean technologies made EVs more affordable and practical for consumers.

Country Insights

Germany

Germany leads the region in AI applications in life sciences, driven by its robust pharmaceutical and medtech industries. With strong federal R&D funding, the country hosts advanced AI innovation hubs and research institutions. Companies like Bayer and BioNTech are deploying AI in drug discovery, manufacturing, and clinical trials.

U.K.

The U.K. is home to a vibrant healthtech ecosystem supported by the NHS Digital Transformation Plan. Firms such as BenevolentAI and Exscientia are pioneering AI drug design, while the NHS is collaborating with AI startups to automate clinical operations and patient engagement.

France

France has committed over €1.5 billion toward its national AI strategy, including health applications. French biopharma firms and CROs are actively using AI for decentralized trials and regulatory analytics.

Switzerland

Switzerland, with its concentration of global pharma giants like Roche and Novartis, is a leader in AI deployment across smart factories and regulatory intelligence. It also benefits from cross-border AI research collaborations.

Spain, Belgium, and Ireland

These countries are rapidly scaling up their AI healthcare capabilities. Spain is integrating AI into hospital networks; Belgium’s biotech sector is seeing a rise in AI startups; and Ireland, a hub for global pharma, is applying AI across regulatory and manufacturing domains.

Some of the prominent players in the Europe AI in life science analytics market include:

Recent Developments

-

March 2025: Exscientia (U.K.) announced the successful Phase 1 trial initiation of its AI-designed oncology drug candidate, in collaboration with a European biopharma partner.

-

February 2025: Bayer (Germany) launched an AI-powered digital twin platform for its pharmaceutical R&D labs to simulate compound behavior in silico.

-

January 2025: Novartis (Switzerland) expanded its AI partnerships with Microsoft to accelerate decentralized trial analytics across European sites.

-

December 2024: Sanofi (France) deployed a next-best-action AI model for omnichannel physician engagement across five European markets.

-

November 2024: AstraZeneca (U.K.) began a pilot AI sustainability initiative using ML to optimize COâ‚‚ emissions across its European manufacturing plants.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the Europe AI in life science analytics market

By Application

- Target Identification/ Translational Research

- Hit to Candidate Identification Hardware

- Precision Recruiting for Clinical Research / Studies

- Regulatory and Safety Digitalization

- Digital Clinical Operations

- Decentralized Trials

- Smart Factory

- Net Zero & Sustainability

- Autonomous Supply Chains

- Supplier Risk Management

- Digital Twin

- Patient Health and Experience

- Content Velocity

- Omnichannel Engagement

- Next Best Engagement

- Gross to Net

- Others

By Country

- Germany

- U.K.

- France

- Spain

- Switzerland

- Belgium

- Ireland