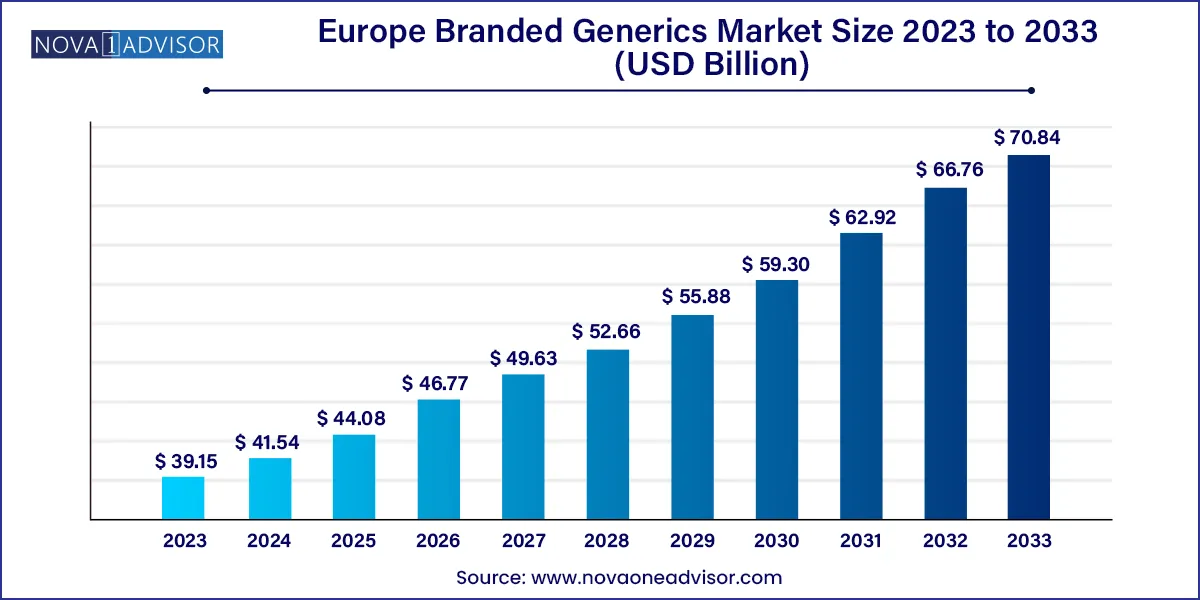

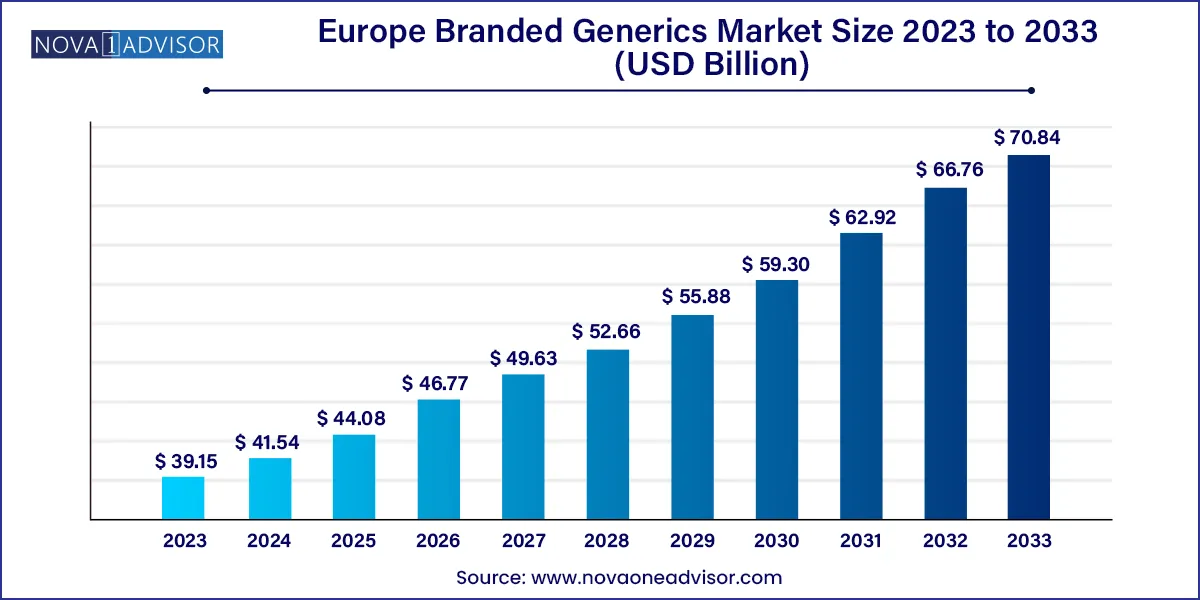

Europe Branded Generics Market Size and Growth

The Europe branded generics market size was exhibited at USD 39.15 billion in 2023 and is projected to hit around USD 70.84 billion by 2033, growing at a CAGR of 6.11% during the forecast period 2024 to 2033.

Key Takeaways:

- Other drug class segment dominated Europe branded generics market with a revenue share of 42.57% in2023.

- Hormone segment is also expected to witness lucrative growth throughout the forecast period.

- The others segment dominated Europe branded generics market with a revenue share of 26.02% in 2023.

- The oncology segment is expected to grow at a high growth rate during the forecast period.

- The oral segment dominated the Europe branded generics market with a revenue share of 59.48% in 2023.

- The parenteral segment is expected to expand at a high growth rate during the forecast period.

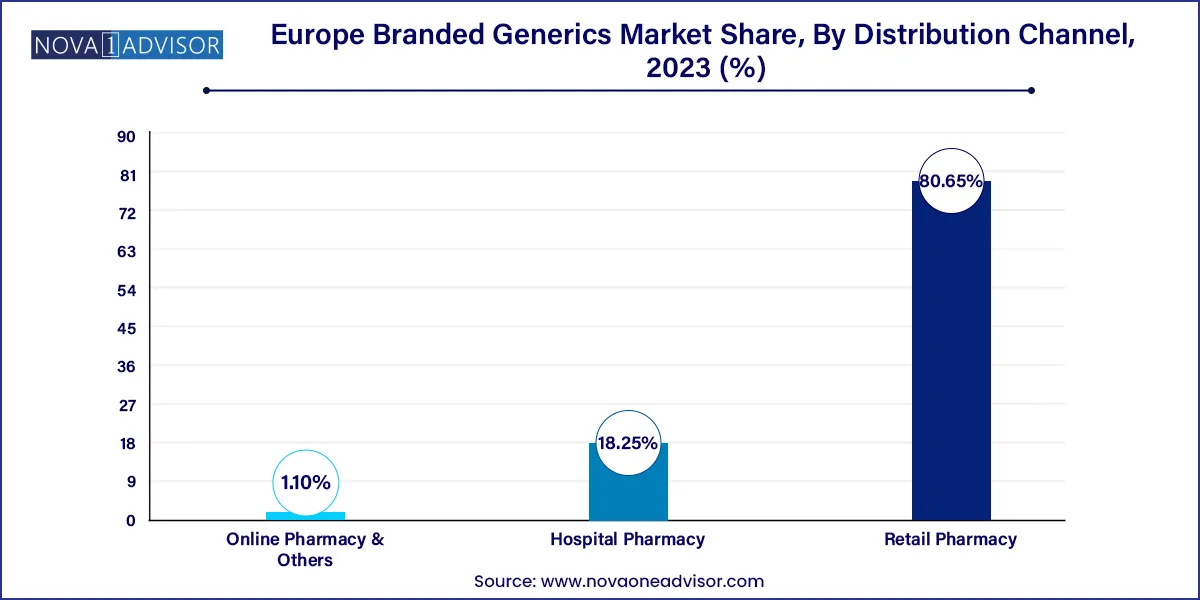

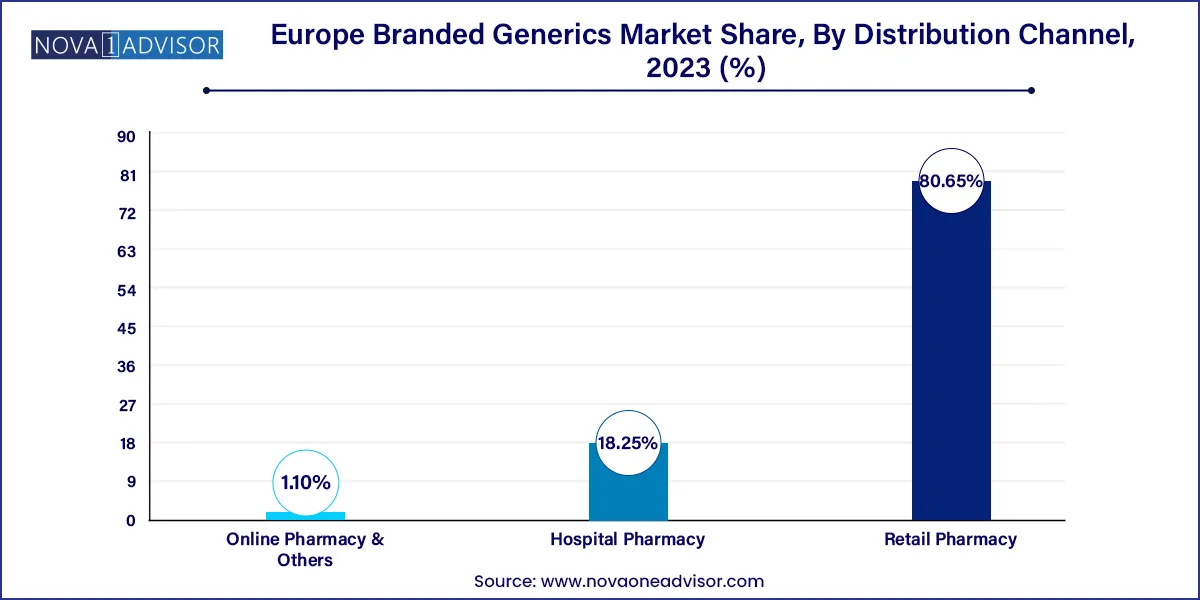

- The retail pharmacy segment dominated Europe branded generics market with a revenue share of 80.65% in 2023.

- Hospital pharmacy segment is expected to witness significant growth during the forecast period.

- Germany dominated the Europe branded generics market with a revenue share of 20.08% in 2023.

- Italy is expected to witness a growth rate of 7.4% during the forecast period.

Market Overview

The Europe branded generics market represents a strategically vital segment in the continent’s pharmaceutical industry, balancing the cost-efficiency of generics with the brand equity and trust associated with innovator drugs. Branded generics refer to off-patent drugs that are marketed under a company’s brand name, offering therapeutic equivalence to their original counterparts while maintaining market differentiation through brand recognition, pricing, or value-added features.

Europe’s healthcare landscape is defined by a growing demand for affordable medication without compromising on safety or efficacy. Branded generics meet this dual objective, offering cost-effective alternatives to high-cost branded pharmaceuticals while addressing physician and patient preferences for known, reputable products. This is especially relevant in regions where public reimbursement systems drive cost-conscious prescribing behaviors, such as in Germany, France, and the United Kingdom.

Post-COVID-19, the branded generics market has gained renewed momentum, especially in chronic disease therapy areas like cardiovascular conditions, oncology, and mental health. Aging populations, long-term care needs, and strained national health budgets have made branded generics a logical choice for formulary inclusion. Furthermore, the EU’s emphasis on self-sufficiency in drug supply, combined with initiatives to reduce drug costs, is fostering competition and innovation in this category.

Major Trends in the Market

-

Patent Expiries Driving Volume Expansion: Numerous blockbuster drugs are losing exclusivity, fueling a pipeline for branded generic versions.

-

Therapeutic Diversification: Branded generics are expanding beyond basic cardiovascular and pain drugs into oncology, neurology, and specialty segments.

-

Rise of Domestic and Regional Players: European companies are capturing market share from traditional big pharma through aggressive branded generics strategies.

-

Digital Sales Channels and e-Pharmacies: Online pharmacies and telehealth models are improving access to branded generics across Europe.

-

Focus on Brand Loyalty in Generics: Manufacturers are investing in marketing, packaging, and patient education to differentiate their generics from commodity products.

-

Supply Chain Re-shoring Post-COVID: European governments are encouraging localized manufacturing to secure pharmaceutical supply chains.

-

Reimbursement Policy Realignments: Governments are creating tiered reimbursement models that favor branded generics over originator drugs.

-

Strategic Partnerships for Market Entry: Many Asian and American generics companies are partnering with European distributors for branded entries.

Report Scope of The Europe Branded Generics Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 41.54 Billion |

| Market Size by 2033 |

USD 70.84 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.11% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Drug Class, Application, Route of Administration, Distribution Channel, Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

U.K.; Germany; France; Spain; Italy; Russia; Denmark; Sweden; Norway; Rest of Europe |

| Key Companies Profiled |

Teva Pharmaceutical Industries Ltd; Lupin; Sanofi; Sun Pharmaceutical Industries, Ltd.; Dr. Reddy’s Laboratories Ltd; Endo International plc.; GlaxoSmithKline plc.; Wockhardt; Viatris, Inc.; Apotex, Inc. |

Market Driver – Increasing Burden of Chronic Diseases and Aging Population

A leading growth driver in the European branded generics market is the escalating burden of chronic diseases, notably cardiovascular conditions, diabetes, cancer, and neurological disorders, compounded by an aging population. According to Eurostat, nearly 21% of the European Union’s population was aged 65 or older in 2023, and this figure is expected to rise to over 30% by 2050.

This demographic shift is creating persistent demand for long-term therapies that are both effective and economically sustainable. Branded generics offer a solution by delivering trusted therapies at reduced cost, enabling public and private health systems to manage large patient volumes without jeopardizing quality. For example, branded versions of atorvastatin, metformin, and amlodipine are mainstays in managing chronic heart and metabolic conditions—offering confidence to prescribers and compliance to patients due to brand familiarity.

Market Restraint – Regulatory Complexity and Price Erosion

Despite the promise of branded generics, the market faces a significant challenge in the form of regulatory heterogeneity and aggressive price control mechanisms. Europe is not a single pharmaceutical market but a patchwork of national regulatory systems, each with unique pricing, reimbursement, and substitution rules. This lack of harmonization poses entry and operational difficulties for manufacturers seeking to expand across multiple countries.

Additionally, reference pricing systems, generic substitution policies, and annual price reviews in countries like Germany and France have led to sharp price erosion, sometimes reducing branded generics’ profit margins below sustainable levels. In some cases, generics are grouped under one reimbursement ceiling regardless of branding, eroding the value proposition of maintaining brand differentiation. These dynamics demand sophisticated market access strategies and may deter smaller players from launching branded portfolios.

Market Opportunity – Expanding Pharmacist-led and Retail Access Models

A key opportunity in Europe’s branded generics market lies in the expansion of pharmacist-led prescribing and retail-based healthcare access, particularly in countries like the U.K., Germany, and Scandinavia. Pharmacies are becoming integral access points for non-critical care, and their role in chronic disease monitoring, patient education, and self-care promotion is growing.

With the rise of branded OTC generics for common conditions such as dermatological issues, minor infections, and pain management branded generics that carry patient-friendly packaging and instructions are gaining traction. Moreover, as e-prescription systems and digital pharmacy platforms proliferate, branded generics stand to benefit from direct-to-patient digital marketing and home delivery models. This shift enables companies to build brand loyalty and bypass some of the hurdles of formulary gatekeeping in traditional hospital procurement systems.

Europe Branded Generics Market By Drug Class Insights

Anti-hypertensive and lipid-lowering drugs dominate the branded generics market in Europe, driven by the massive population base affected by cardiovascular risk factors. Statins like atorvastatin and rosuvastatin, and ACE inhibitors like ramipril, have long been prescribed under branded generic labels. These drugs are cornerstones in primary and secondary cardiovascular prevention and are often the first-line choices for general practitioners. Branded versions offer a balance of affordability and familiarity, especially for elderly patients on polypharmacy regimens who are wary of frequent medication changes.

Antimetabolites and alkylating agents are among the fastest-growing drug classes, reflecting the rising use of branded generics in oncology. As biologics and advanced therapies remain expensive and sometimes inaccessible, branded generic chemotherapy agents are used extensively in public cancer programs. Agents such as methotrexate, cyclophosphamide, and fluorouracil are being marketed as branded generics with improved packaging and traceability, offering clinicians assurance of quality in high-stakes oncology treatment.

Europe Branded Generics Market By Application Segment Insights

Cardiovascular diseases dominate the application segment, in line with the high prevalence of hypertension, dyslipidemia, and heart failure across Europe. Countries like Italy and Spain have especially high rates of hypertension, with large patient bases on maintenance therapy requiring life-long medication. Branded generics allow for cost savings without switching the familiar brand names, which helps maintain treatment continuity and adherence. These drugs are typically included in public procurement and insurance lists, making them accessible to a broad demographic.

Neurological diseases represent the fastest-growing application segment, as the incidence of epilepsy, Alzheimer’s, Parkinson’s, and depression continues to rise. Branded generics such as lamotrigine, pregabalin, and duloxetine are increasingly prescribed in neurology clinics and mental health services. As prescribers seek high-quality alternatives with traceable pharmacovigilance data, branded generics are emerging as safe and trusted options. Additionally, packaging tailored for cognitive impairment patients (e.g., blister packs with colors) makes these brands particularly appealing in elderly care.

Europe Branded Generics Market By Route Of Administration Segment Insights

Oral administration remains the dominant route, accounting for the bulk of prescriptions due to convenience, cost-efficiency, and patient preference. Tablets, capsules, and dispersible forms make up the majority of branded generics, especially for chronic conditions like diabetes, hypertension, and mood disorders. Their ease of manufacturing, long shelf life, and favorable logistics make them a natural choice for retail pharmacies and wholesalers. Brands in this category compete on factors like tablet size, flavor, and packaging design.

Parenteral administration is the fastest-growing route, particularly in hospital settings. Branded injectable generics for oncology, anesthesia, and emergency medicine are widely adopted due to stringent quality requirements and traceability concerns. For instance, in intensive care units, a branded version of vancomycin or cisplatin is often preferred over a commodity generic due to better supplier credentials or documented performance. With rising hospital admissions for cancer and surgical procedures, the injectable branded generics market is poised for strong growth.

Europe Branded Generics Market By Distribution Channel Segment Insights

Hospital pharmacies lead the distribution channel segment, especially in countries where public procurement and insurance coverage dictate therapeutic access. Branded generics are often favored in tender-based procurement due to competitive pricing and known brand lineage. In oncology wards, ICU settings, and specialist clinics, physicians often opt for branded generics that offer pharmacovigilance support and consistent batch tracking.

Online pharmacy and others (e.g., telehealth platforms) is the fastest-growing distribution channel, with digital health adoption surging post-COVID-19. Platforms in the U.K., Germany, and Sweden now offer e-prescriptions, branded chronic therapy bundles, and doorstep medication delivery. Branded generics stand to benefit from consumer trust in familiar names, especially in non-prescription categories like pain relief, dermatology, and women’s health. As regulations around cross-border e-pharmacies become more defined, this channel is expected to witness exponential growth.

Country-Level Analysis

Germany

Germany is the dominant branded generics market in Europe, supported by a large and aging population, a strong generic substitution policy, and a mature health insurance system. The country’s regulatory framework allows branded generics to coexist with unbranded generics in insurance tenders, provided they meet cost benchmarks. Companies like STADA Arzneimittel and Hexal (Sandoz) have strong local presence and leverage physician relationships and brand equity to maintain high market penetration.

United Kingdom (U.K.)

The U.K. is one of the fastest-growing countries in this market, particularly due to the National Health Service (NHS) promoting branded generic prescribing where appropriate. Post-Brexit, local production and supply chains have become more important, and several companies are shifting production closer to home. Community pharmacies and general practitioners often prescribe familiar brand names for chronic drugs, enhancing the role of branded generics in long-term disease management.

Some of the prominent players in the Europe branded generics market include:

- Teva Pharmaceutical Industries Ltd

- Lupin

- Sanofi

- Sun Pharmaceutical Industries Ltd.

- Dr. Reddy’s Laboratories Ltd

- Endo International plc.

- GlaxoSmithKline plc

- Wockhardt

- Viatris, Inc.

- Apotex, Inc.

Recent Developments

-

March 2025 – Teva Pharmaceuticals Europe launched a new line of branded generics in the U.K., targeting cardiovascular and neurological segments under the “Teva Select” brand.

-

February 2025 – STADA Arzneimittel AG announced an expansion in France with three branded generic oncology products based on methotrexate and cyclophosphamide.

-

January 2025 – Sandoz (a Novartis division) filed for approval of a branded generic duloxetine in Germany under the trade name “Dulexa”, targeting major depressive disorder.

-

November 2024 – Mylan (Viatris) introduced a smart-packaging solution for branded metformin and simvastatin in Italy, featuring NFC-enabled prescription tracking.

-

October 2024 – Zentiva Group launched branded topical corticosteroids in Poland and Spain, targeting the dermatological segment with improved patient compliance packaging.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Europe branded generics market.

Drug Class

- Alkylating Agents

- Antimetabolites

- Hormones

- Anti-hypertensive & Lipid lowering drugs

- Anti-depressants

- Anti-psychotics

- Anti-epileptics

- Others

Application

- Oncology

- Cardiovascular Diseases

- Neurological Diseases

- Gastrointestinal Diseases

- Dermatological diseases

- Acute and Chronic Pain

- Others

Route of Administration

- Topical

- Oral

- Parenteral

- Others

Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy & Others

Country

- Germany

- U.K.

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Rest of Europe