Europe Digital Health Market Size and Research

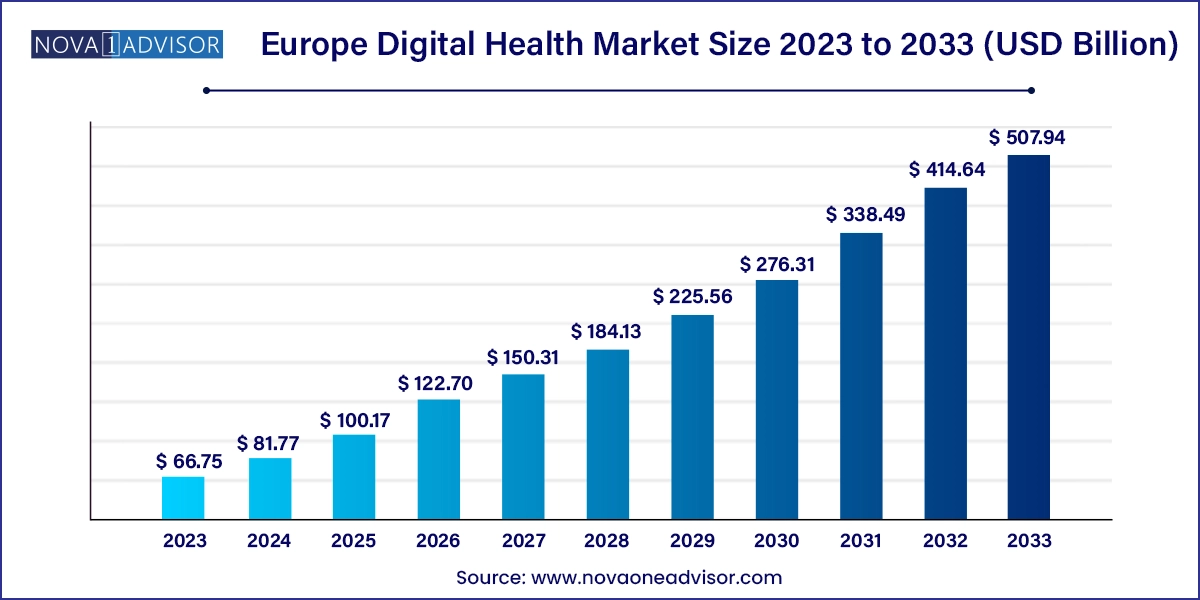

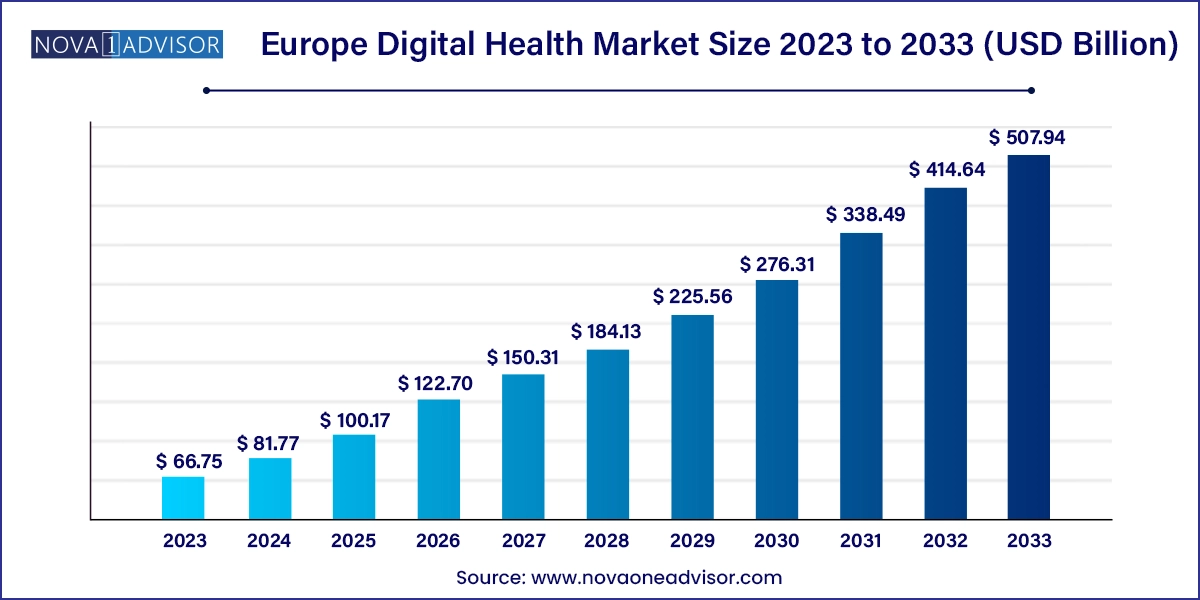

The Europe digital health market size was exhibited at USD 66.75 billion in 2023 and is projected to hit around USD 507.94 billion by 2033, growing at a CAGR of 22.5% during the forecast period 2024 to 2033.

Europe Digital Health Market Key Takeaways:

- The telehealthcare segment dominated the market with the highest revenue share of 43.21% in 2023.

- The mHealth segment held the second-highest revenue share in 2023.

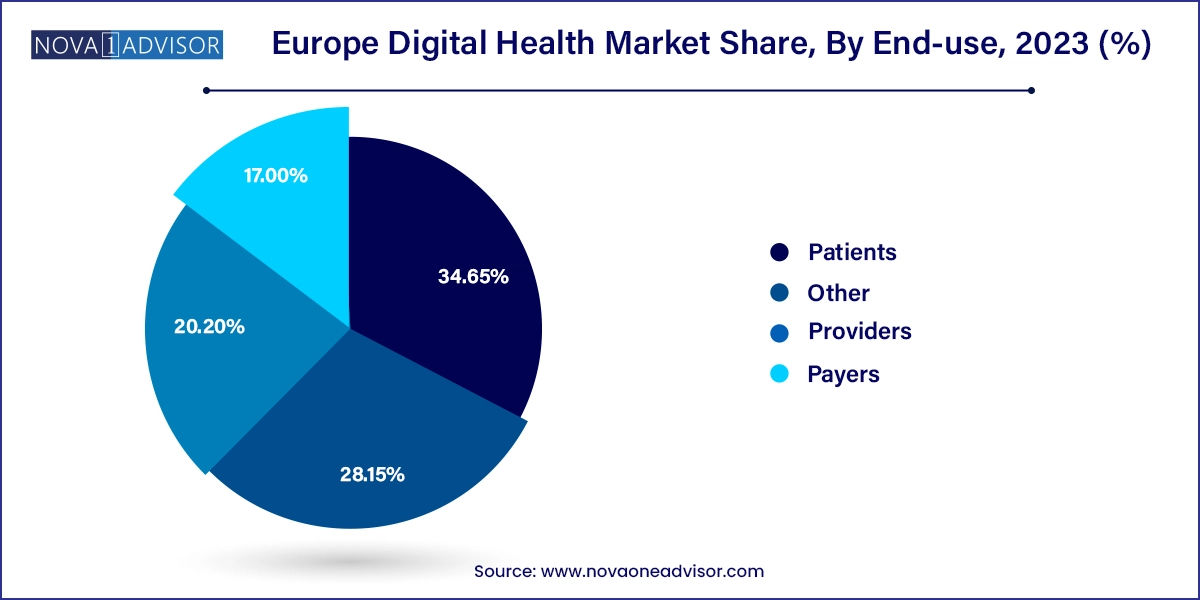

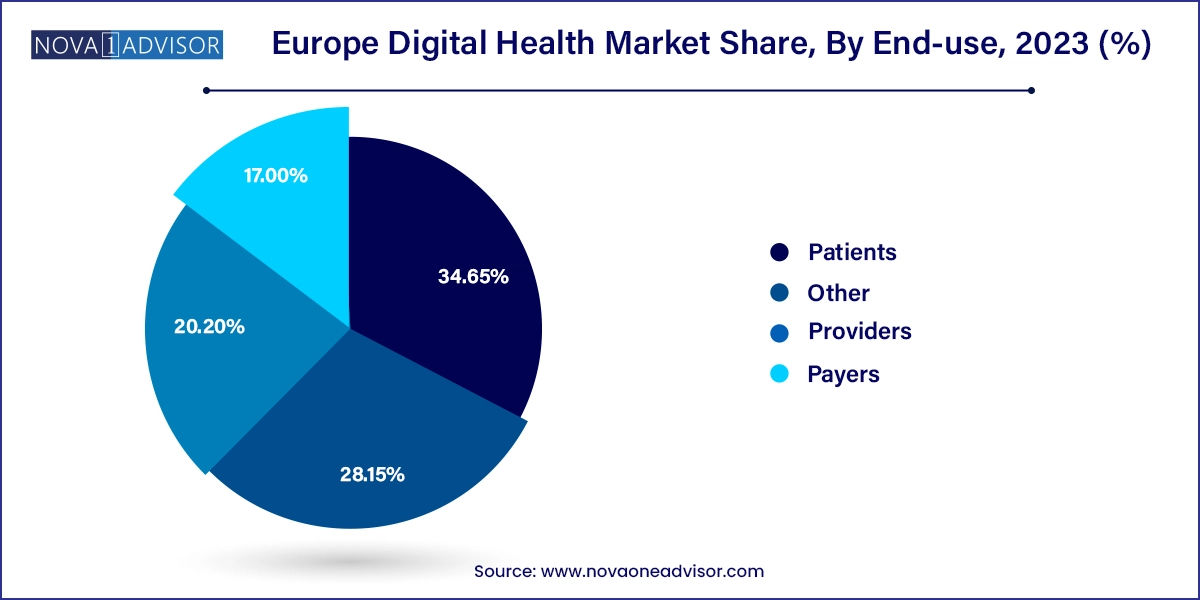

- The patients segment dominated the market with a revenue share of 34.65% in 2023.

- The services component segment accounted for the largest revenue share of 37.18% in 2023.

- The software segment is expected to register the fastest CAGR throughout the forecast period.

- The diabetes segment dominated the market with the largest revenue share of 24.31% in 2023.

- The obesity segment is expected to register the second-fastest CAGR from 2024 to 2033.

Market Overview

The Europe digital health market is undergoing a technological transformation, reshaping how healthcare is delivered, accessed, and managed across the continent. Digital health encompasses a wide array of technologies, including telehealth, mobile health (mHealth), wearable devices, electronic health records (EHRs), and advanced data analytics. These solutions aim to improve patient outcomes, reduce healthcare costs, and enable real-time care delivery. The COVID-19 pandemic acted as a catalyst, rapidly accelerating the adoption of digital tools in healthcare systems overwhelmed by demand and constrained by physical distancing norms.

Europe’s mature healthcare infrastructure, supported by proactive government policies, a high internet penetration rate, and increasing smartphone adoption, has enabled a thriving digital health ecosystem. Countries such as Germany, the UK, France, and the Nordic region have integrated digital technologies into national healthcare strategies. For instance, Germany's Digital Healthcare Act (DVG) and France's "MaSanté2022" strategy are prominent examples of public policy support aimed at enabling innovation in health IT.

The European digital health market is also benefiting from a growing elderly population, increasing chronic disease burden, and consumer demand for personalized care. Digital tools are empowering patients with self-monitoring capabilities and access to medical advice without visiting hospitals or clinics. The convergence of technology, policy, and healthcare challenges positions digital health not only as a necessity but as a long-term strategic asset for healthcare sustainability in Europe.

Major Trends in the Market

-

Rapid integration of telehealth in primary care settings and remote consultations

-

Surge in mHealth applications focused on chronic disease management and wellness tracking

-

Proliferation of wearable health devices offering real-time physiological monitoring

-

Government incentives for digital prescription and EHR interoperability

-

Increased investment in healthcare data analytics for population health management

-

AI-powered diagnostics and virtual assistants gaining traction among providers

-

Cross-border digital health initiatives supported by the EU Digital Single Market

-

Rise of personalized healthcare through connected apps and genomic data integration

Report Scope of Europe Digital Health Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 81.77 Billion |

| Market Size by 2033 |

USD 507.94 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 22.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Technology, Component, Application, End-use, and Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

Europe |

| Key Companies Profiled |

Oracle; Veradigm LLC; Apple Inc; Telefonica S.A.; McKesson Corporation; Epic Systems Corporation; QSI Management, LLC; AT&T; Vodafone Group; Airstrip Technologies; Google, Inc; Samsung Electronics Co. Ltd; HiMS; Orange; Qualcomm Technologies, Inc; Softserve; Computer Programs and Systems, Inc; IBM Corporation; CISCO Systems, Inc |

Key Market Driver: Aging Population and Chronic Disease Prevalence

Europe’s aging demographics are a key driver of the digital health market. The region is home to some of the oldest populations globally, with more than 20% of its citizens aged 65 or older. This aging trend is accompanied by a growing prevalence of chronic diseases such as diabetes, cardiovascular disorders, and respiratory illnesses. Traditional healthcare systems face growing pressure due to increased hospitalization, long-term care requirements, and resource constraints.

Digital health technologies offer scalable and efficient solutions for elderly care and chronic disease management. Remote monitoring devices help track vital parameters such as blood pressure, glucose levels, and heart rate. mHealth apps assist in medication adherence, appointment scheduling, and self-care education. Telehealth services bridge geographical gaps, allowing seniors and chronic patients to consult physicians without travel. By enabling continuous monitoring and early intervention, digital health significantly reduces hospital readmissions and enhances quality of life for the elderly population.

Key Market Restraint: Data Privacy and Regulatory Challenges

Despite its growth, the digital health market in Europe faces significant regulatory and data privacy challenges. The General Data Protection Regulation (GDPR) imposes strict guidelines on the collection, storage, and sharing of personal health information. Digital health providers must ensure transparency, data minimization, consent mechanisms, and cybersecurity compliance. These requirements often pose technical and financial hurdles, especially for startups and SMEs entering the market.

Additionally, the fragmented nature of Europe’s healthcare systems with different policies, infrastructure, and reimbursement models across countries creates barriers to seamless digital health adoption. Interoperability among various EHR systems and platforms remains a technical challenge, hindering the creation of unified health records. Regulatory uncertainty and slow approval processes for novel digital tools can delay time-to-market, limiting the speed of innovation.

Key Market Opportunity: AI and Predictive Analytics in Healthcare Delivery

The application of artificial intelligence (AI) and predictive analytics in digital health represents a transformative opportunity. AI tools can enhance diagnostics, optimize treatment pathways, and predict disease progression based on real-time patient data. Predictive models assist healthcare providers in identifying at-risk populations, enabling early intervention and resource optimization.

AI-driven analytics platforms are being integrated with EHRs, wearable devices, and diagnostic imaging systems to generate actionable insights. For example, machine learning algorithms can detect early signs of diabetic retinopathy from retinal scans or forecast cardiac events based on ECG patterns. These technologies not only improve clinical accuracy but also help personalize treatment plans, reducing costs and improving outcomes. Europe’s strong research ecosystem and tech-savvy population make it well-positioned to lead the adoption of AI in digital health.

Europe Digital Health Market By Technology Insights

Tele-healthcare dominated the Europe digital health market, especially during the COVID-19 pandemic. Within tele-healthcare, video consultations and remote monitoring gained significant traction as they allowed continued care without exposing patients and providers to infection risks. LTC (long-term care) monitoring solutions have gained popularity for elderly care, enabling families and providers to remotely monitor daily activities, medication intake, and emergency needs.

On the other hand, mHealth is the fastest-growing segment, driven by the ubiquity of smartphones and consumer health awareness. mHealth apps and connected devices empower users to monitor and manage their health independently. Wearable devices such as smartwatches, fitness bands, and medical-grade monitors are increasingly used for chronic disease management, fitness tracking, and even mental health support. Women’s health apps and chronic disease management platforms have experienced a surge in adoption, reflecting shifting consumer behaviors toward digital wellness.

Europe Digital Health Market By Component Insights

Software held the largest share in the component segment, as it powers EHR systems, diagnostic platforms, mobile applications, and AI algorithms. Software solutions are the backbone of digital health infrastructure, ensuring functionality, interoperability, and user engagement. Hospitals and clinics invest heavily in custom software platforms to enhance workflow efficiency, teleconsultation, and patient engagement.

Services are emerging as the fastest-growing component, driven by demand for monitoring, integration, analytics, and support. Managed service providers are helping healthcare systems implement and maintain digital solutions, offering training, technical support, and data management. This trend is especially notable in smaller practices and rural regions where in-house digital expertise may be lacking.

Europe Digital Health Market By Application Insights

Cardiovascular applications dominated the Europe digital health market, largely due to the high prevalence of heart-related disorders and the suitability of digital tools for monitoring vital signs. Blood pressure monitors, ECG apps, and wearable devices capable of detecting arrhythmias are widely used across cardiac care pathways. Healthcare providers also use remote telemetry for patients post-surgery or with chronic heart failure.

In contrast, diabetes management is emerging as the fastest-growing application, fueled by a rising diabetic population and the availability of connected glucose monitors and mobile apps. Patients can now monitor blood glucose levels in real-time, share data with physicians, and receive AI-powered alerts for lifestyle changes. These tools empower self-care and improve adherence to treatment, reducing complications and hospital visits.

Europe Digital Health Market By End-use Insights

Providers, such as hospitals and clinics, represent the dominant end-user segment. The shift to value-based care, combined with the need to enhance patient experience, has led healthcare providers to adopt digital health solutions ranging from teleconsultations to predictive analytics. Providers benefit from reduced administrative burden, improved diagnosis accuracy, and better resource management.

Patients are the fastest-growing end-user group, as digital health democratizes access to healthcare. Patients are increasingly using apps for fitness, symptom checking, mental health, and chronic disease management. The rise in direct-to-consumer platforms reflects this empowerment, with individuals proactively managing their health data, medication schedules, and consultations.

Country Insights

United Kingdom: The UK has been a pioneer in telehealth adoption, supported by the National Health Service (NHS) and initiatives like NHSX. The use of apps such as the NHS App and platforms like LIVI has increased digital interactions in primary care. The UK's regulatory openness and patient engagement strategies fuel a dynamic digital health ecosystem.

Germany: Germany’s Digital Healthcare Act (DVG) allows physicians to prescribe digital health apps reimbursed by statutory health insurance. The nation leads in EHR implementation and AI in diagnostics. Germany also boasts strong domestic digital health startups like Ada Health and Compugroup Medical.

France: France has rolled out its MaSanté2022 strategy to support digital health services. The country emphasizes EHR interoperability and telemedicine reimbursement. Public and private sectors are investing heavily in platforms for chronic disease management and elderly care.

Italy: Italy is witnessing increased adoption of digital health post-COVID-19. Investments are directed at remote monitoring tools for chronic disease and telehealth for rural regions. Government partnerships with health tech companies are being fostered to scale solutions.

Spain: Spain's decentralized healthcare system has adopted region-specific digital tools. Catalonia and Madrid lead in EHR implementation and teleconsultation services. Public-private collaborations and EU funding are accelerating innovation.

Nordic Countries (Sweden, Denmark, Norway): The Nordics are known for high digital maturity in healthcare. Denmark’s national EHR system and Sweden’s mobile-first approach position them as digital health leaders. Telehealth services, wearable integration, and health analytics are widely adopted.

Europe Digital Health Market Recent Developments

-

March 2025: Ada Health (Germany) announced a strategic partnership with UK-based Babylon Health to integrate AI symptom checkers into teleconsultation platforms.

-

January 2025: Sweden’s KRY (LIVI in UK and France) launched a new remote mental health monitoring service tailored for chronic stress and burnout.

-

November 2024: Germany’s government allocated €300 million to accelerate digital transformation in hospitals, focusing on EHR upgrades and cybersecurity.

-

September 2024: Doctolib (France) expanded its e-prescribing capabilities across France and Germany, enabling seamless teleconsultations and medication delivery.

-

August 2024: mySugr (Austria/Germany) launched an AI-powered diabetes coach integrated with Roche’s glucose monitors for enhanced real-time guidance.

Some of the prominent players in the Europe digital health market include:

- Oracle

- Veradigm LLC

- Apple Inc

- Telefonica S.A.

- McKesson Corporation

- Epic Systems Corporation

- QSI Management, LLC

- AT&T

- Vodafone Group

- Airstrip Technologies

- Google, Inc

- Samsung Electronics Co. Ltd

- HiMS

- Orange

- Qualcomm Technologies, Inc

- Softserve

- Computer Programs and Systems, Inc

- IBM Corporation

- CISCO Systems, Inc

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Europe digital health market

Technology

-

-

- Activity Monitoring

- Remote Medication Management

-

-

- LTC Monitoring

- Video Consultation

-

- Wearables & Connected Medical Devices

-

-

- Vital Sign Monitoring Devices

-

-

-

- Heart Rate Monitors

- Activity Monitors

- Electrocardiographs

- Pulse Oximeters

- Spirometers

- Blood Pressure Monitors

- Others

-

-

-

- Sleep trackers

- Wrist Actigraphs

- Polysomnographs

- Others

-

-

- Electrocardiographs Fetal & Obstetric Devices

- Neuromonitoring Devices

-

-

-

- Electroencephalographs

- Electromyographs

- Others

-

-

-

-

- Fitness & Nutrition

- Menstrual Health

- Pregnancy Tracking & Postpartum Care

- Menopause

- Disease Management

- Others

-

-

-

- Chronic Disease Management Apps

-

-

-

-

- Diabetes Management Apps

- Blood Pressure & ECG Monitoring Apps

- Mental Health Management Apps

- Cancer Management Apps

- Obesity Management Apps

- Other Chronic Disease Management Apps

-

-

-

- Personal Health Record Apps

- Medication Management Apps

- Diagnostic Apps

- Remote Monitoring Apps

- Others (Pill Reminder, Medical Reference, Professional Networking, Healthcare Education)

-

-

-

- Independent Aging Solutions

- Chronic Disease Management & Post-Acute Care Services

-

-

- Diagnosis Services

- Healthcare Systems Strengthening Services

- Others

-

- EHR

- E-prescribing Systems

Component

- Software

- Hardware

- Services

Application

- Obesity

- Diabetes

- Cardiovascular

- Respiratory Diseases

- Others

End-use

- Patients

- Providers

- Payers

- Others

Country

- UK

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway