Europe Disposable Face Masks Market Size and Trends

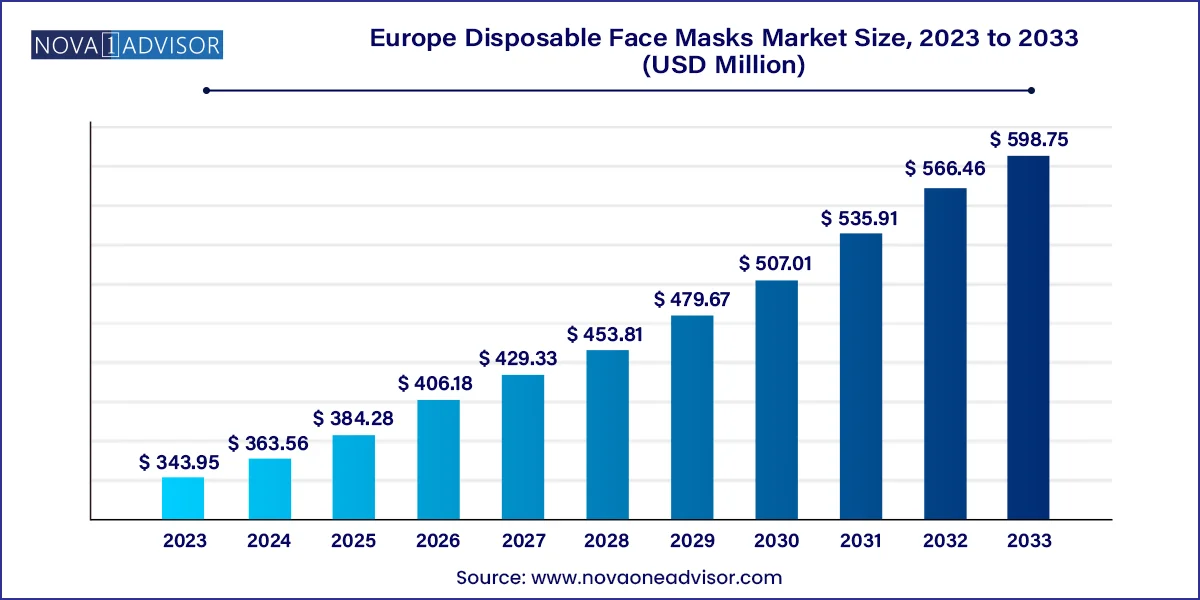

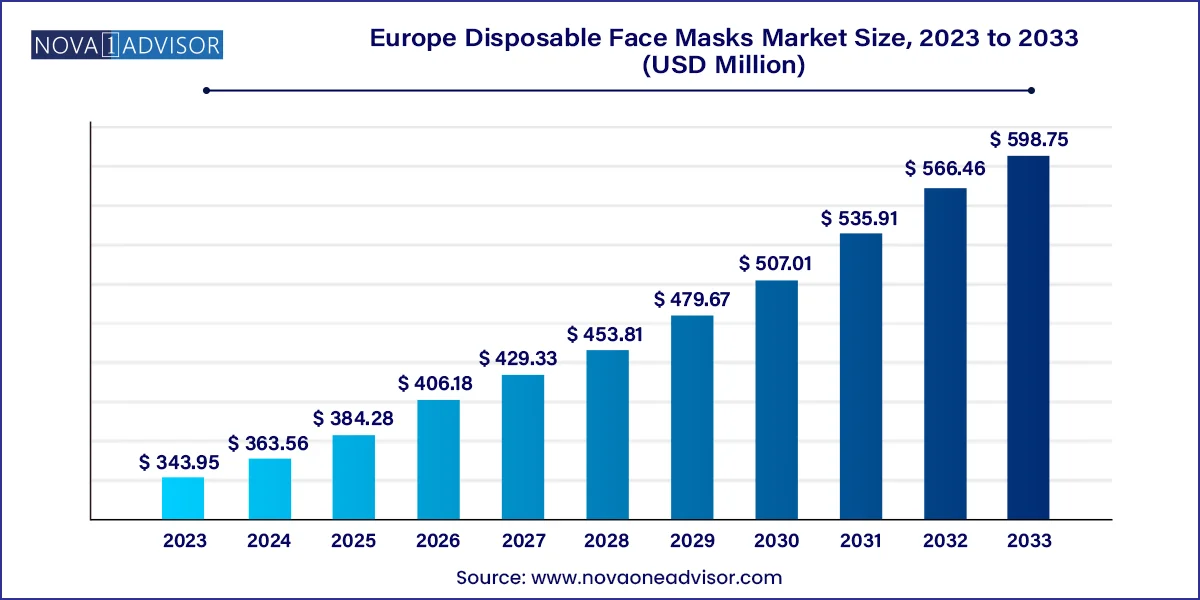

The Europe disposable face masks market size was exhibited at USD 343.95 million in 2023 and is projected to hit around USD 598.75 million by 2033, growing at a CAGR of 5.7% during the forecast period 2024 to 2033.

Europe Disposable Face Masks Market Key Takeaways:

- The protective mask segment accounted for a revenue share of 35.7% in 2023.

- The non-woven mask segment is expected to grow at a CAGR of 7.0% from 2024 to 2033.

- The offline segment accounted for a revenue share of 73.8% in 2023.

- The online segment is expected to grow at a CAGR of 6.0% from 2024 to 2033.

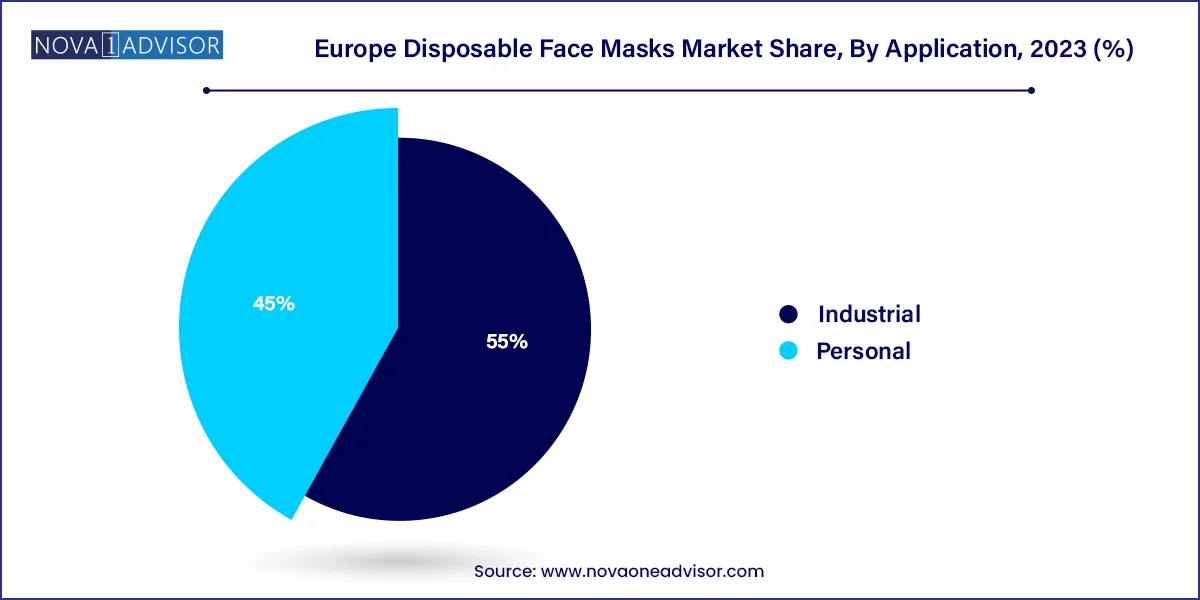

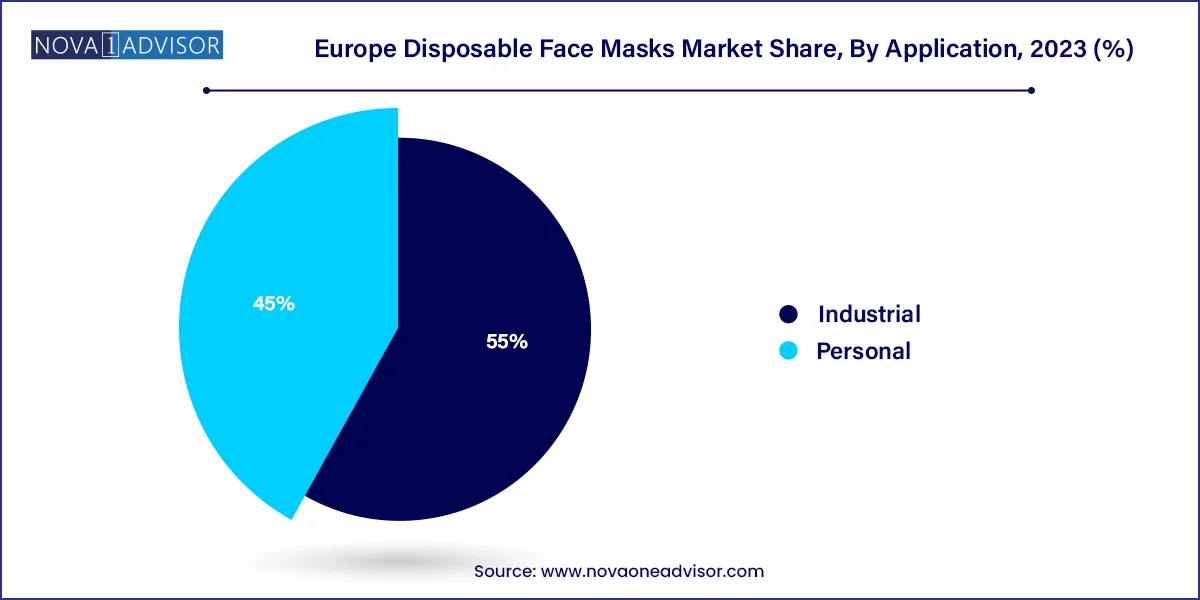

- The industrial application segment accounted for a revenue share of 55.0% in 2023.

Market Overview

The Europe disposable face masks market has evolved significantly over the last few years, transitioning from a niche industrial safety segment to a mainstream health and personal protection category. Once largely associated with occupational settings—particularly in construction, manufacturing, and healthcare—the market saw a dramatic surge during the COVID-19 pandemic. This event not only transformed public attitudes toward masks but also created a sustained culture of personal hygiene, respiratory safety, and infection control that continues to shape consumption patterns across the continent.

As of 2025, while pandemic-induced emergency demand has normalized, disposable face masks remain an integral part of daily life in several public-facing professions and health-sensitive environments. Europe’s focus on environmental sustainability and regulatory compliance has pushed manufacturers to invest in biodegradable materials, advanced filtration technology, and ergonomic mask designs. Face masks are now also seen as seasonal protection accessories against pollution, allergens, and flu, particularly in urban regions with high population density and air quality concerns.

In addition to healthcare, new consumer groups are emerging from educational institutions, public service organizations, and travel segments. The widespread adoption of disposable masks across both personal and professional domains signifies a stable, if not growing, demand—anchored by shifting health perceptions and regulatory preparedness for future public health crises. Moreover, European Union (EU) directives on workplace safety, coupled with country-specific hygiene standards, are supporting consistent procurement of high-quality disposable face masks in bulk, particularly in healthcare and industrial sectors.

Major Trends in the Market

-

Shift Toward Eco-Friendly Disposable Masks: Demand is rising for biodegradable and recyclable mask materials to address environmental concerns caused by synthetic polymer-based disposables.

-

Design Innovation and Comfort Focus: Ergonomically contoured, breathable, and skin-friendly mask variants are gaining favor, especially among long-duration users.

-

Continued Use in Public Transport and Events: Public transport authorities, airlines, and entertainment venues continue to maintain mask usage guidelines seasonally or by policy.

-

Rise of CE Certified and Medical Grade Masks: Consumers and institutions are increasingly opting for EU-compliant products to ensure safety and filtration efficiency.

-

Private Label and Local Manufacturing Growth: European SMEs and retailers are entering the market with private-label disposable mask brands to counter import dependency.

-

Customized and Printed Face Masks: Growing use of branded and aesthetically designed masks in retail, hospitality, and promotional events.

-

Hybrid Distribution Models: Brands are optimizing between online and offline channels to reach both bulk institutional buyers and end-consumers.

-

Post-COVID Medical Readiness Investments: Governments and healthcare providers are stockpiling disposable face masks as part of national emergency health reserves.

Report Scope of Europe Disposable Face Masks Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 363.56 Million |

| Market Size by 2033 |

USD 598.75 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 5.7% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Application, Distribution Channel, Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

Germany; UK |

| Key Companies Profiled |

DACH Schutzbekleidung GmbH & Co. KG.; JIANGSU TEYIN IMP. & EXP. CO., LTD; SAS Safety Corp.; Kowa Company Ltd; Kimberly Clark Worldwide; Honeywell International Inc.; 3M; uvex group; Ambu A/S; Parburch Medical Developments Ltd. |

Market Driver: Continued Institutional Demand in Healthcare and Industry

The strong institutional demand from healthcare and industrial sectors remains the cornerstone of the European disposable face masks market. Hospitals, clinics, eldercare homes, and diagnostic laboratories require a consistent supply of medical-grade disposable face masks to comply with hygiene protocols and prevent cross-contamination. Even in post-pandemic Europe, face masks continue to be mandatory in surgical procedures, ICU environments, and in certain public-facing health service roles.

In parallel, industries such as pharmaceuticals, electronics manufacturing, food processing, and construction continue to rely on dust masks and protective face coverings to safeguard workers from airborne particles, chemical exposure, and particulate pollution. For instance, in Germany, where manufacturing and export of fine chemicals is a major economic driver, the demand for occupational safety masks remains high. Moreover, EU-level occupational health and safety regulations under the European Agency for Safety and Health at Work (EU-OSHA) require strict PPE compliance—further reinforcing long-term institutional purchasing.

Market Restraint: Environmental Impact of Non-Biodegradable Waste

One of the most pressing challenges in the disposable face masks market is the environmental burden caused by single-use synthetic materials. The mass adoption of disposable face masks during and after the COVID-19 outbreak led to a surge in plastic waste, most of which is composed of polypropylene and other non-biodegradable polymers. According to various environmental studies, disposable masks have been identified as a contributor to urban and marine pollution across Europe, prompting regulatory pushback and consumer criticism.

As a result, there is growing pressure on manufacturers to innovate sustainable alternatives that balance safety, filtration, and environmental friendliness. However, these green materials often carry higher production costs, which are passed on to end-users. For low-margin sectors like public education or budget healthcare, this creates a pricing barrier. Until scalable, cost-effective biodegradable solutions become widespread, environmental sustainability will continue to challenge the sector's perception and policy alignment.

Market Opportunity: Integration of Biodegradable and Compostable Face Masks

An exciting opportunity for manufacturers lies in the production of biodegradable and compostable disposable face masks. As consumers and governments alike embrace circular economy models, face mask producers can gain a competitive edge by introducing eco-friendly solutions that align with European sustainability goals. Some companies have already introduced masks made from bamboo fiber, plant-based cellulose, and PLA (polylactic acid) materials—garnering strong interest among eco-conscious buyers.

In countries such as Germany and the UK, where environmental legislation and public awareness are particularly high, such innovations are likely to receive both regulatory approval and consumer support. Moreover, businesses operating in ESG-sensitive sectors (such as green tourism, organic retail, and sustainable hospitality) are actively sourcing biodegradable PPE as part of their branding and compliance strategy. There is substantial potential for partnerships between material science firms, PPE manufacturers, and EU green funding programs to scale such initiatives profitably.

Europe Disposable Face Masks Market By Product Insights

The protective mask segment accounted for a revenue share of 35.7% in 2023. primarily due to their medical-grade filtration, regulated manufacturing standards, and wide usage in hospitals and industrial environments. These include FFP1, FFP2, and FFP3-certified respirators which meet European EN standards and provide particulate and bacterial filtration up to 99%. Hospitals, nursing homes, and outpatient clinics procure these masks in large volumes, and procurement cycles are often tied to annual budgeting and emergency preparedness protocols.

Non-woven masks are emerging as the fastest-growing product type, owing to their light weight, breathability, and compatibility with both surgical and general public use. Typically consisting of three or more layers, these masks are inexpensive, widely available, and customizable, making them ideal for mass distribution. Non-woven variants are increasingly used in public-facing roles, schools, transport sectors, and commercial offices, offering a balance of comfort and basic protection. Local manufacturers in the UK and Eastern Europe are ramping up non-woven production to meet demand for both white-label and branded options.

Europe Disposable Face Masks Market By Distribution Channel Insights

The offline segment accounted for a revenue share of 73.8% in 2023. As institutions and bulk buyers continue to prefer traditional procurement routes through medical supply stores, PPE wholesalers, and in-store retail chains. Hospitals and industrial buyers rely on verified vendor networks and physical evaluation of product specifications before large-scale procurement. Pharmacies, supermarkets, and department stores also maintain a substantial offline presence for personal use masks.

The online segment is expected to grow at a CAGR of 6.0% from 2024 to 2033. E-commerce platforms such as Amazon EU, Boots.com, and Medisupplies UK offer a wide range of certified disposable masks with user reviews and doorstep delivery. Online vendors are increasingly leveraging subscription models, filter refills, and seasonal discounts to drive retention. The convenience of online reordering is particularly attractive to small clinics, schools, and retail businesses managing limited inventory storage.

Europe Disposable Face Masks Market By Application Insights

The industrial application segment accounted for a revenue share of 55.0% in 2023. supported by mandatory PPE policies across construction, manufacturing, and chemical sectors. Dust masks and protective respirators are essential in shielding workers from micro-particles, gases, and allergens. Compliance with workplace safety standards under the EU’s PPE Regulation (EU 2016/425) ensures continuous institutional procurement. Industrial players often enter into long-term supply contracts with mask vendors to maintain occupational health standards and avoid fines or legal complications.

The personal use segment is the fastest growing, as disposable masks become part of routine hygiene for the general public—especially during flu season, air pollution spikes, or international travel. Tourists, students, and commuters increasingly prefer disposable options for convenience and portability. In countries with high public transport density such as the UK and Germany, personal-use masks are often bundled in retail health kits or sold via vending machines at train stations and airports. Retailers are diversifying product lines to include fashion-forward, breathable, and hypoallergenic disposable mask options for individual consumers.

Country Insights

United Kingdom (UK)

The UK plays a vital role in the Europe disposable face masks market, owing to its robust healthcare infrastructure, strong e-commerce penetration, and high public health awareness. The National Health Service (NHS) remains a major institutional buyer of protective and non-woven masks, particularly in eldercare and outpatient settings. The government has also invested in domestic mask production facilities post-Brexit to reduce dependency on Asian imports.

Consumer behavior in the UK favors convenience and quality assurance, leading to high demand for CE-certified, skin-safe, and hypoallergenic disposable masks. Seasonal flu outbreaks and poor urban air quality in cities like London and Manchester also contribute to steady consumer purchases. Retail chains such as Boots, Tesco, and Superdrug stock a wide range of disposable masks in various sizes and styles, often bundled with sanitizers and gloves in hygiene kits.

Germany

Germany remains one of the largest markets for disposable face masks in Europe, backed by a highly industrialized economy and strong emphasis on workplace safety. Protective masks used in manufacturing, chemicals, and automotive sectors form a major part of the country’s PPE ecosystem. Furthermore, stringent enforcement of health and safety norms under Germany’s Federal Institute for Occupational Safety and Health (BAuA) ensures continual demand for certified disposable masks.

Germany’s healthcare system also maintains strategic mask reserves for hospitals, care homes, and emergency services. Local firms and multinationals operating in the region continue to explore biodegradable mask innovations to align with Germany’s ambitious environmental goals. In retail, pharmacies and organic stores often carry eco-labeled mask options targeting eco-conscious buyers, while online sales through platforms like dm.de and apotheke.de continue to grow.

Some of the prominent players in the Europe disposable face masks market include:

- DACH Schutzbekleidung GmbH & Co. KG.

- JIANGSU TEYIN IMP. & EXP. CO., LTD

- SAS Safety Corp.

- Kowa Company Ltd

- Kimberly Clark Worldwide

- Honeywell International Inc.

- 3M

- uvex group

- Ambu A/S

- Parburch Medical Developments Ltd.

Recent Developments

-

February 2024 – UK-based Cambridgeshire Medical launched a new line of biodegradable disposable face masks made from plant-based fibers, aimed at NHS procurement and environmentally conscious consumers.

-

November 2023 – Germany’s UVEX Group expanded its disposable PPE product line by adding high-filtration FFP3 masks certified under new EU medical device guidelines.

-

September 2023 – French manufacturer Kolmi-Hopen received CE certification for its new surgical masks with enhanced breathability and skin compatibility, targeting EU-wide hospital contracts.

-

July 2023 – German start-up GreenMask Solutions raised €5 million in funding to scale its fully compostable mask production using bamboo-based materials.

-

April 2023 – The UK Department of Health and Social Care awarded a contract to a consortium of local manufacturers to supply disposable face masks to public schools and care homes through 2025.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Europe disposable face masks market

Product

- Protective Masks

- Dust Masks

- Non-woven Masks

Application

Distribution Channel

Country