Europe Mobility Aids Market Size and Growth

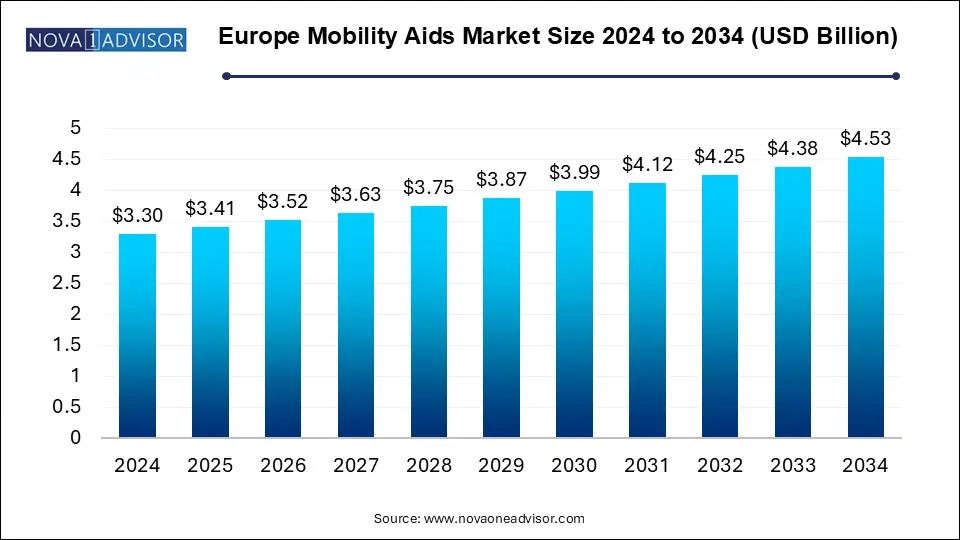

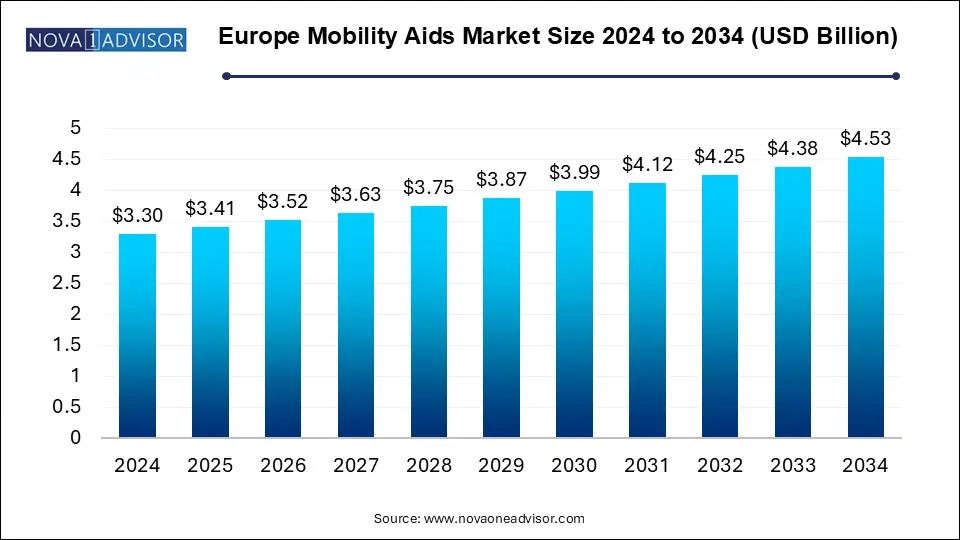

The Europe mobility aids market size was exhibited at USD 3.30 billion in 2024 and is projected to hit around USD 4.53 billion by 2034, growing at a CAGR of 3.2% during the forecast period 2025 to 2034.

Europe Mobility Aids Market Key Takeaways:

- The private segment accounted for the largest revenue share of around 50.0% in 2024 and is expected to grow at the fastest CAGR of 3.3% over the forecast period.

- The public sector segment held a revenue share of 49.5% in 2024.

- The offline segment held the largest revenue share of 66.3% in 2024.

- The online segment is expected to grow at the fastest CAGR of 3.4% over the forecast period.

- The rehabilitation segment held the largest revenue share of 52.0% in 2024 owing to the increasing demand for rehabilitation activities.

- The aged care segment is expected to grow at the fastest CAGR of 3.2% over the forecast period.

- The wheelchair segment accounted for the largest revenue share of 32.8% in 2024.

- The rollators segment is expected to grow at the fastest CAGR of 4.1% during the forecast period.

Market Overview

The Europe Mobility Aids Market is evolving rapidly in response to demographic changes, technological advancements, and growing public awareness around accessibility and independent living. Mobility aids ranging from wheelchairs and rollators to walkers and home care beds are essential tools that enhance the quality of life for individuals with temporary or permanent mobility impairments. In the European context, the aging population, combined with rising incidences of chronic illnesses, post-operative recovery needs, and disability management, has made mobility assistance a healthcare priority.

As per Eurostat, nearly 21% of the European Union’s population was aged 65 or older in 2024, a figure projected to increase significantly over the coming decades. This demographic shift has led to a surge in demand for mobility aids that can cater to both homecare and rehabilitation needs. Governments across Europe are implementing aging-in-place policies that emphasize helping elderly citizens maintain autonomy in their daily activities. Consequently, the need for user-friendly, technologically enhanced, and ergonomically designed mobility devices is growing across both the private and public healthcare sectors.

European healthcare systems particularly in Germany, France, and the UK are providing subsidies and reimbursement models to increase access to high-quality mobility equipment. At the same time, private players are innovating with smart, foldable, and app-integrated products that provide greater customization and convenience. These developments, supported by a robust distribution network and rising e-commerce adoption, are reinforcing the Europe mobility aids market as one of the most dynamic healthcare segments.

Major Trends in the Market

-

Rising Demand for Smart and Connected Mobility Devices: Integration of IoT and telehealth capabilities in powered wheelchairs and LTC beds for remote monitoring and fall detection.

-

Expansion of Home Healthcare Services: Increased use of mobility aids in home-based care settings due to cost savings and patient comfort.

-

Growth in Online Sales Channels: E-commerce platforms are becoming key distribution points for mobility aids, especially in rural and remote regions.

-

Focus on Lightweight and Foldable Designs: Consumers are increasingly seeking portability and convenience in rollators, walkers, and manual wheelchairs.

-

Increased Customization and Ergonomic Design: Manufacturers are prioritizing patient comfort through adjustable, user-specific mobility solutions.

-

Public Sector Support and Reimbursement Policies: Government funding, insurance coverage, and national health service procurement are promoting accessibility and affordability.

-

Shift Toward Preventive and Rehabilitation Care: Growing importance of mobility aids in post-surgical recovery, stroke rehabilitation, and chronic musculoskeletal condition management.

Report Scope of Europe Mobility Aids Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 3.41 Billion |

| Market Size by 2034 |

USD 4.53 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 3.2% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Sector, Type of Split, Distribution Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

Europe |

| Key Companies Profiled |

Human Care HC AB; Drive DeVilbiss Healthcare; Roma Medical; Day’s Mobility Ltd.; Van Os Medical; Invacare Corp.; Z-Tec Mobility; Sunrise Medical; Karma Mobility; TOPRO Ltd. |

Key Market Driver: Growing Aging Population and Disability Prevalence

A primary driver propelling the Europe Mobility Aids Market is the rapidly aging population and the associated rise in physical impairments and chronic health conditions. Europe is home to one of the world’s oldest populations. Age-related conditions such as osteoarthritis, Parkinson’s disease, and hip fractures often result in impaired mobility, necessitating the use of assistive devices.

For example, in Germany Europe’s most populous nation more than 17 million people are aged 65 or older. Similar trends are evident in Italy, where nearly one in four residents is a senior citizen. These individuals often require walking aids or wheelchairs to maintain independence and prevent falls, which are a leading cause of injury in the elderly. The demand is further amplified by improved life expectancy, higher recovery rates from surgeries, and growing awareness around aging-in-place solutions. Collectively, these factors are fostering consistent growth in the need for reliable, comfortable, and clinically approved mobility aids across Europe.

Key Market Restraint: Reimbursement and Accessibility Gaps Across Countries

Despite strong demand and policy support, the market faces notable barriers related to fragmented reimbursement systems and accessibility disparities across Europe. While countries such as Germany, France, and the UK have well-established frameworks that subsidize or fully cover mobility aids for patients, others—especially in Eastern and Southern Europe—often lack comprehensive funding mechanisms. This leads to uneven access to critical devices, particularly for low-income and rural populations.

Moreover, inconsistent pricing standards, complex paperwork, and delayed approvals in public procurement processes can deter patients from acquiring needed devices. In some cases, public health insurance programs may only cover basic models, pushing patients to bear out-of-pocket expenses for customized or powered variants. These systemic limitations, if not addressed, could slow the market’s growth and reinforce inequities in access to mobility solutions across Europe.

Key Opportunity: Technological Integration in Mobility Devices

The integration of technology into mobility aids presents a transformative opportunity in the European market. Innovations in smart mobility devices—such as powered wheelchairs with joystick controls, GPS navigation, obstacle detection sensors, and remote monitoring—are opening new horizons for people with mobility impairments. These devices are particularly useful for patients with complex conditions such as multiple sclerosis or ALS, where traditional aids may be insufficient.

Moreover, the application of telematics and mobile apps allows caregivers and healthcare providers to track usage patterns, battery levels, and patient safety remotely. The trend is also expanding into LTC beds, with adjustable height settings, automated repositioning features, and emergency alert systems gaining popularity in both home and clinical settings. Companies that can integrate user-friendly technology while ensuring safety, regulatory compliance, and affordability are well-positioned to capture the next wave of market growth in Europe.

Europe Mobility Aids Market By Sector Insights

The public sector dominated the European mobility aids market, underpinned by state-sponsored healthcare programs, hospital networks, and community rehabilitation centers. Public procurement accounts for a significant volume of mobility aid distribution, particularly in countries with universal healthcare coverage like France, the UK, and Sweden. Public hospitals and insurance systems often cover part or full costs of wheelchairs, walkers, and LTC beds for qualifying individuals. This makes government tenders a major channel for manufacturers and suppliers seeking to scale in the European market.

The private sector is emerging as the fastest-growing segment, fueled by rising out-of-pocket expenditure, private insurance plans, and growing preferences for personalized or premium-quality aids. Private rehabilitation clinics, specialty orthopedic centers, and private home care providers are increasingly offering high-end and technologically advanced mobility solutions. Moreover, as consumer expectations rise, many patients opt to purchase aids directly from private vendors, especially for short-term recovery or aesthetic preferences not covered by public systems.

Europe Mobility Aids Market By Distribution Channels Insights

Offline distribution channels led the market, especially through medical supply stores, hospital procurement systems, and rehabilitation centers. Patients and caregivers often prefer in-person evaluation and fitting services when selecting mobility aids, especially for items like LTC beds or wheelchairs that require customization and training. Moreover, offline sales remain dominant in rural and older populations who may not be comfortable with digital platforms.

Online channels are witnessing the fastest growth, driven by the expansion of e-commerce platforms and the digital transformation of healthcare retail. Companies such as Amazon, MedMart, and specialized medical retailers are now offering home delivery, virtual consultations, and installment-based payment systems. Younger caregivers, urban buyers, and patients seeking convenience are increasingly turning to digital channels for both standard and premium mobility devices. The COVID-19 pandemic has also normalized online medical purchases, further propelling this trend.

Europe Mobility Aids Market By Type of Split Insights

Aged care emerged as the dominant segment, given the rapidly aging European demographic and the prevalence of degenerative joint and neurological conditions. Mobility aids in aged care are commonly used in residential care homes, assisted living facilities, and home environments. Rollators, walkers, and manual wheelchairs are particularly common among elderly users for day-to-day mobility and fall prevention. LTC beds also play a vital role in long-term elderly care by reducing caregiver burden and enhancing comfort.

Rehabilitation is the fastest-growing segment, bolstered by the increasing number of orthopedic surgeries, road accidents, and stroke-related recoveries. Hospitals and specialized rehab centers across Germany, Italy, and the Netherlands are investing in mobility aids such as rehabilitation wheelchairs, adjustable walkers, and patient transfer systems. As post-operative recovery protocols become more structured and focused on early mobilization, the demand for targeted rehabilitation devices is accelerating rapidly.

Europe Mobility Aids Market By Product Insights

Wheelchairs emerged as the dominant product segment in Europe, owing to their widespread application among the elderly, disabled, and rehabilitation patients. Manual wheelchairs, especially active and rehabilitation types, account for a substantial share due to their affordability and lightweight designs. Bariatric wheelchairs, which cater to heavier patients, are also gaining prominence as obesity rates rise in several European countries. In contrast, powered wheelchairs are seeing accelerated adoption in urban settings and long-term care facilities where patients demand ease of movement and technological features such as power elevation, reclining backrests, and joystick navigation. The versatility and range of options within the wheelchair segment ensure its continued leadership in the mobility aids market.

LTC (Long-Term Care) beds are the fastest-growing segment, propelled by the shift toward home-based care and increased emphasis on aging in place. Designed for both home and institutional use, these beds provide comfort, mobility, and safety for patients requiring extended recovery or end-of-life care. Features like height adjustment, side rail integration, pressure-relieving mattresses, and remote-controlled bed positions make them indispensable in long-term caregiving. Germany and the UK, in particular, are seeing rapid adoption of LTC beds in community and home settings, supported by national home healthcare initiatives. Technological enhancements such as automated repositioning and fall detection systems are expected to further fuel growth in this segment.

Europe Mobility Aids Market By Regional Insights

Germany stands out as the largest and most mature market for mobility aids in Europe. With over 22% of the population aged 65 and above, and a well-funded public health system, the country has a deeply embedded infrastructure for aged care and rehabilitation. German public health insurance covers a wide array of mobility devices, with standardized reimbursement pathways and strong institutional support. Cities like Berlin, Munich, and Hamburg have comprehensive networks of rehabilitation centers, orthopedic clinics, and home healthcare providers that rely heavily on modern mobility aids.

Germany is also a manufacturing hub, with several domestic companies producing high-quality mobility devices that are exported across Europe. Moreover, German consumers and care institutions often demand cutting-edge technology, driving growth in powered mobility aids, smart LTC beds, and IoT-enabled rehabilitation equipment. Regulatory rigor, combined with high consumer expectations, has made Germany a benchmark for quality and innovation in the European mobility aids sector.

Some of the prominent players in the Europe mobility aids market include:

Recent Developments

-

Invacare Corporation launched a new lightweight, foldable powered wheelchair model in April 2025 designed specifically for the European market, focusing on users with mild to moderate mobility impairments.

-

Sunrise Medical, a global mobility solutions provider headquartered in Germany, announced in March 2025 its acquisition of a French orthopedic support firm to expand its product portfolio in walkers and rollators.

-

In February 2025, Rehasense Europe partnered with online health platform DocMorris to distribute its rollators and walking aids through a dedicated digital portal across Germany and the Netherlands.

-

Arjo AB, a Swedish medical device company, rolled out a new series of home-use LTC beds with integrated smart sensors in January 2025, targeting the rising demand in residential aged care.

-

Meyra GmbH expanded its production facility in North Rhine-Westphalia in May 2025 to meet growing European demand for bariatric wheelchairs and customized rehabilitation aids.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Europe mobility aids market

By Product

- Rollators

- Walkers

- Wheelchairs

-

-

- Active

- Bariatric

- Rehabilitation

- Others

By Sector

By Type of Split

By Distribution Channel

By Regional

-

- UK

- Germany

- France

- Italy

- Spain

- Switzerland

- Poland