Europe Recycled Plastics Market Size and Trends

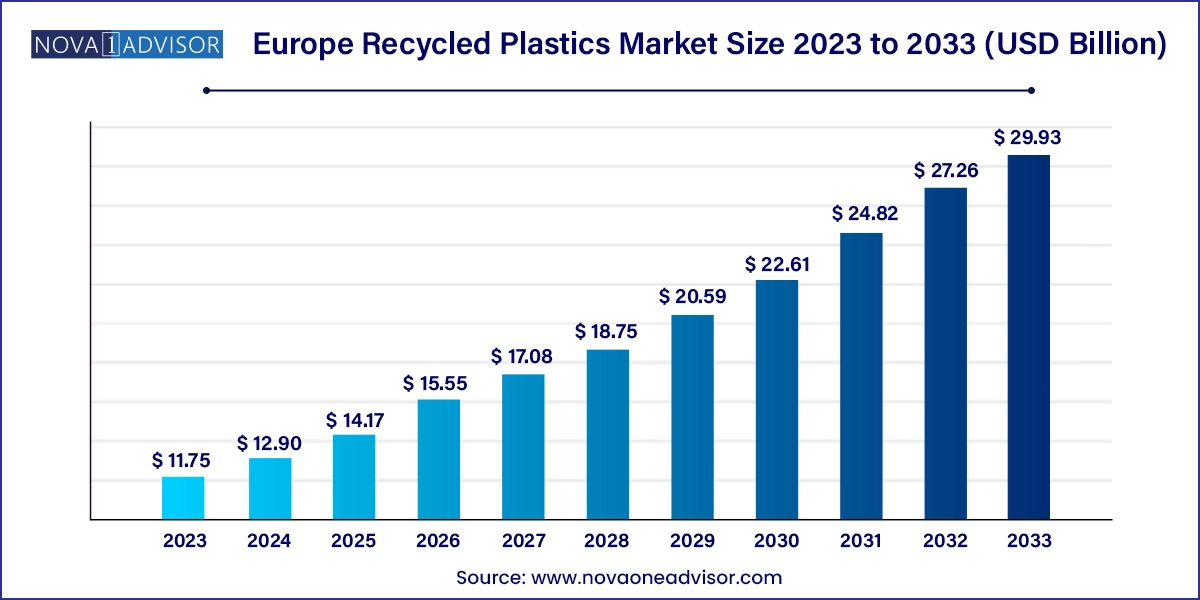

The Europe recycled plastics market size was exhibited at USD 11.75 billion in 2023 and is projected to hit around USD 29.93 billion by 2033, growing at a CAGR of 9.8% during the forecast period 2024 to 2033.

Europe Recycled Plastics Market Key Takeaways:

- Polyethylene dominated the market in 2023 with the largest revenue share of 33.1%.

- Polypropylene is anticipated to grow at the fastest CAGR over the forecast period.

- The plastic bottles segment dominated the market in 2023.

- In terms of end-use, the packaging segment held the largest share 35.0% in 2023.

Market Overview

The Europe Recycled Plastics Market stands at the forefront of the global circular economy movement, characterized by a growing emphasis on environmental sustainability, resource efficiency, and the minimization of plastic waste. Driven by stringent environmental regulations, consumer awareness, and corporate sustainability pledges, the demand for recycled plastics across industries is surging in key European economies including Germany, the UK, France, and Italy.

Europe has long been a leader in plastic recycling, supported by policy instruments such as the European Green Deal, Single-Use Plastics Directive, and Plastics Strategy for a Circular Economy. These frameworks, reinforced by national-level bans on single-use plastics and ambitious waste diversion targets, have created a robust policy environment that encourages investments in mechanical recycling, chemical depolymerization, and upcycling technologies.

The market primarily focuses on reprocessing polymers such as polyethylene terephthalate (PET), polyethylene (PE), polypropylene (PP), polyvinyl chloride (PVC), and polystyrene (PS) sourced from post-consumer and post-industrial streams like bottles, films, and polymer foams. These materials are finding increasing applications in packaging, construction, automotive, textiles, and electronics, where sustainable sourcing is becoming a commercial imperative.

Major Trends in the Market

-

Increased Corporate Commitments to Circular Packaging: Leading FMCG and retail brands in Europe are committing to use 50–100% recycled plastic in packaging by 2025–2030.

-

Expansion of Chemical Recycling Facilities: Chemical recycling methods are emerging alongside mechanical recycling to process hard-to-recycle and multilayer plastics.

-

Integration of Blockchain in Recycling Supply Chains: Blockchain and digital traceability tools are being piloted to verify the origin and authenticity of recycled plastic materials.

-

Shift Toward Food-Grade Recycled Plastics: Regulatory developments and technological advancements are pushing the market for EFSA-approved food-contact recycled PET (rPET).

-

Rise of Bottle-to-Bottle Recycling Initiatives: Beverage companies are investing in closed-loop systems that turn used PET bottles into new ones, particularly in Germany and the UK.

-

Increased Investment in Advanced Sorting Technology: Use of AI-powered robotics and infrared sorting is enhancing the purity and value of sorted plastic waste.

-

Textile Industry Adoption of Recycled PET Fibers: Fast fashion brands in Europe are incorporating recycled plastics in performance wear and mainstream apparel lines.

Report Scope of Europe Recycled Plastics Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 12.90 Billion |

| Market Size by 2033 |

USD 29.93 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 9.8% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Source, End-use, Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

Germany; UK; France; Italy; ROE |

| Key Companies Profiled |

Veolia, Müller-Guttenbrunn Group; MBA Polymers, Inc; Paprec Group; Morssinkhod Rymoplast; Suez SA; Borealis AG; Rialti S.p.A.; Iber Resinas SL; Total Energies; Berry Global Inc; LyondellBasell Industries Holdings B.V.; KW Plastics; Jayplas |

One of the most powerful drivers in the European recycled plastics market is the comprehensive regulatory framework implemented by the European Union (EU) to achieve circular economy goals. The EU Plastics Strategy, launched in 2018, targets the reuse and recycling of over 50% of plastic waste by 2030. Complementing this, the EU Waste Framework Directive mandates member states to prioritize recycling over landfilling, with strong penalties for non-compliance.

The 2021 implementation of the EU plastic packaging levy—a tax of €800 per tonne of non-recycled plastic packaging waste—has spurred both public and private sectors to adopt recycled content in packaging. Moreover, the Directive on Single-Use Plastics (SUPD) bans specific single-use plastic items and requires producers to finance waste collection and awareness campaigns.

These legislative tools, combined with increasing producer responsibility and green public procurement policies, are stimulating demand for recycled plastics across sectors and making them a mainstream material in European manufacturing and packaging.

Key Market Restraint: Quality Variability and Food-Grade Certification Challenges

Despite the rapid expansion of recycled plastics in Europe, a key restraint is the inconsistent quality and performance of recycled polymers, particularly when compared to virgin resins. Mechanical recycling often leads to degradation in material properties, color variability, and odor retention, limiting their use in high-performance and aesthetic-sensitive applications.

One of the most pressing challenges is in the food-contact packaging sector, where compliance with European Food Safety Authority (EFSA) standards is mandatory. Contamination risks, inadequate sorting, and the presence of non-food-grade materials make it difficult for recyclers to produce certified rPET, PP, or PE for direct food-contact use.

This creates a supply-demand imbalance, especially as beverage and food companies race to meet their recycled content targets. While chemical recycling offers potential, it remains costly and technically complex, with limited commercial-scale operations in place.

Key Market Opportunity: Rapid Growth in Sustainable Packaging Demand

A compelling opportunity in the Europe recycled plastics market lies in the explosive growth of sustainable packaging solutions, particularly in retail, e-commerce, and consumer goods. Consumers are increasingly making purchase decisions based on environmental impact, pressuring companies to adopt packaging made from recycled and recyclable plastics.

Retailers and brands are responding by integrating rPET and rPE into bottle caps, films, shrink wraps, thermoformed trays, and flexible pouches. Supermarket chains in the UK and France have launched “plastic-free” aisles and private label packaging lines made from 100% recycled content. Germany’s reverse vending machine (RVM) network is also enhancing bottle-to-bottle recycling under a deposit return scheme (DRS).

As regulatory frameworks like the EU Packaging and Packaging Waste Directive evolve to mandate minimum recycled content in new packaging, the demand for high-quality recycled polymers will soar. This opens the door for investments in advanced recycling infrastructure, food-grade processing, and circular supply chain innovation.

Europe Recycled Plastics Market By Product Insights

Polyethylene Terephthalate (PET) dominated the recycled plastics market, primarily due to its widespread use in beverage bottles, food containers, and packaging films. PET is highly recyclable and retains much of its material integrity post-processing. Recycled PET (rPET) is especially critical in the food and beverage sector, where leading brands like Coca-Cola, Nestlé, and Danone are incorporating rPET into their packaging lines. In Germany and the UK, bottle-to-bottle recycling is increasingly closing the loop, supported by reverse logistics infrastructure.

Polypropylene (PP) is the fastest-growing recycled plastic segment, fueled by rising demand from automotive components, rigid packaging, caps and closures, and appliances. Although traditionally harder to recycle due to contamination and polymer identification issues, new sorting technologies like near-infrared (NIR) scanners and digital watermarking are making PP recycling more viable. Additionally, brands are exploring post-industrial waste (PIW) recovery to obtain cleaner PP streams.

Europe Recycled Plastics Market By Source Insights

Plastic bottles were the dominant source for recycled plastics, reflecting the maturity of PET collection and processing systems. Bottle recycling is supported by DRS systems in countries like Germany, where return rates exceed 90%. PET bottles are easier to sort, clean, and convert into high-value rPET, which finds use in packaging and textiles.

Plastic films are the fastest-growing source segment, driven by increased packaging waste from e-commerce, agricultural applications, and flexible food packaging. These films, primarily made of LDPE and HDPE, are being recycled into garbage bags, construction films, and composite wood products. Film-to-film recycling is also emerging, though it faces challenges with contamination and multilayer lamination.

Europe Recycled Plastics Market By End-use Insights.

Packaging held the leading share in the recycled plastics market, owing to its sheer volume and rapid product turnover. With regulatory and consumer pressure to reduce virgin plastic use, packaging manufacturers are increasingly using rPET, rPE, and rPP in both rigid and flexible formats. In France and Italy, food-safe rPET is making inroads into supermarket shelves through pre-formed trays and clamshells.

.webp)

Textiles are the fastest-growing end-use segment, fueled by the shift toward sustainable fashion and recycled performance fabrics. Major apparel brands like H&M, Adidas, and Zara are integrating rPET fibers into sportswear and everyday clothing lines. Italy, with its heritage in textile manufacturing, is emerging as a hub for rPET fiber spinning, offering opportunities for innovation in dyeing, blending, and mechanical enhancement.

Country Insights

Germany

Germany is the largest and most advanced market for recycled plastics in Europe, backed by a comprehensive waste segregation system, high collection rates, and progressive recycling mandates. The Green Dot system (Der Grüne Punkt) and a well-established DRS for PET bottles contribute to efficient recycling infrastructure. German manufacturers are leaders in both mechanical and chemical recycling technologies, including innovations in enzymatic depolymerization of PET. Companies like ALBA Group, Veolia Germany, and Reclay Systems are major players.

United Kingdom

The UK is undergoing a major transition post-Brexit with plans to implement Extended Producer Responsibility (EPR) and Plastic Packaging Tax regulations. These measures mandate a minimum 30% recycled content in plastic packaging, creating massive demand for food-grade rPET and recycled flexible packaging. The UK’s fashion and consumer goods industries are also integrating rPET and recycled polyamide (rPA) in product lines, with initiatives supported by the WRAP Plastics Pact.

France

France has positioned itself as a key innovator in circular plastics, with government mandates to phase out single-use plastics by 2040 and increase recycled content in consumer goods. French recycler Carbios is developing enzymatic PET recycling on an industrial scale, offering a potential breakthrough in food-grade plastic recovery. Additionally, French supermarkets are piloting reusable and refillable packaging schemes using high-quality recycled polymers.

Italy

Italy’s recycled plastics market is growing, especially in textiles, agriculture, and automotive applications. The country’s textile hubs, including Prato and Lombardy, are using rPET fibers in clothing and home furnishings. Italy’s film and packaging manufacturers are also increasingly using recycled LDPE and HDPE, spurred by EU subsidies and recovery incentives under NextGenerationEU funds. Companies like Montello S.p.A. are leading recyclers with vertical integration into film production.

Some of the prominent players in the Europe recycled plastics market include:

- Veolia

- Müller-Guttenbrunn Group

- MBA Polymers, Inc

- Paprec Group

- Morssinkhod Rymoplast

- Suez SA

- Berry Global Inc

- LyondellBasell Industries Holdings B.V.

- KW Plastics

- Jayplas

- Total Energies

- Borealis AG

- Rialti S.p.A.

- Iber Resinas SL

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Europe recycled plastics market

Product

- Polyethylene

- Polyethylene Terephthalate

- Polypropylene

- Polyvinyl Chloride

- Polystyrene

- Others

Source

- Plastic Bottles

- Plastic Films

- Polymer Foam

End-use

- Building & Construction

- Packaging

- Electrical & Electronics

- Textiles

- Automotive

- Others

Country

.webp)