Europe Thermal Spray Coatings Market Size and Research

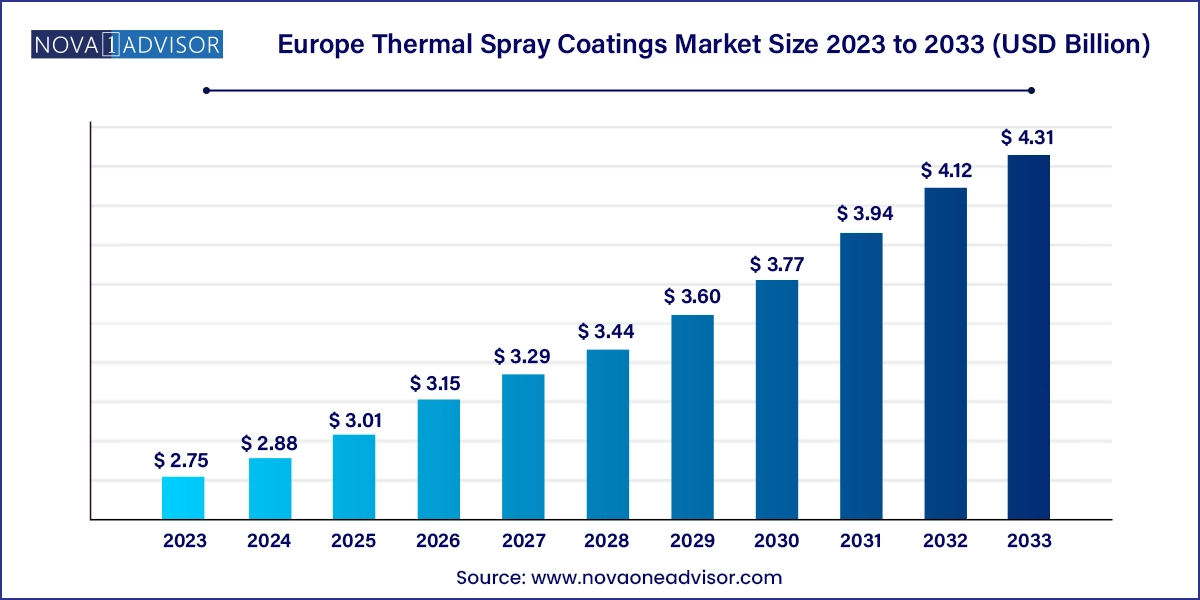

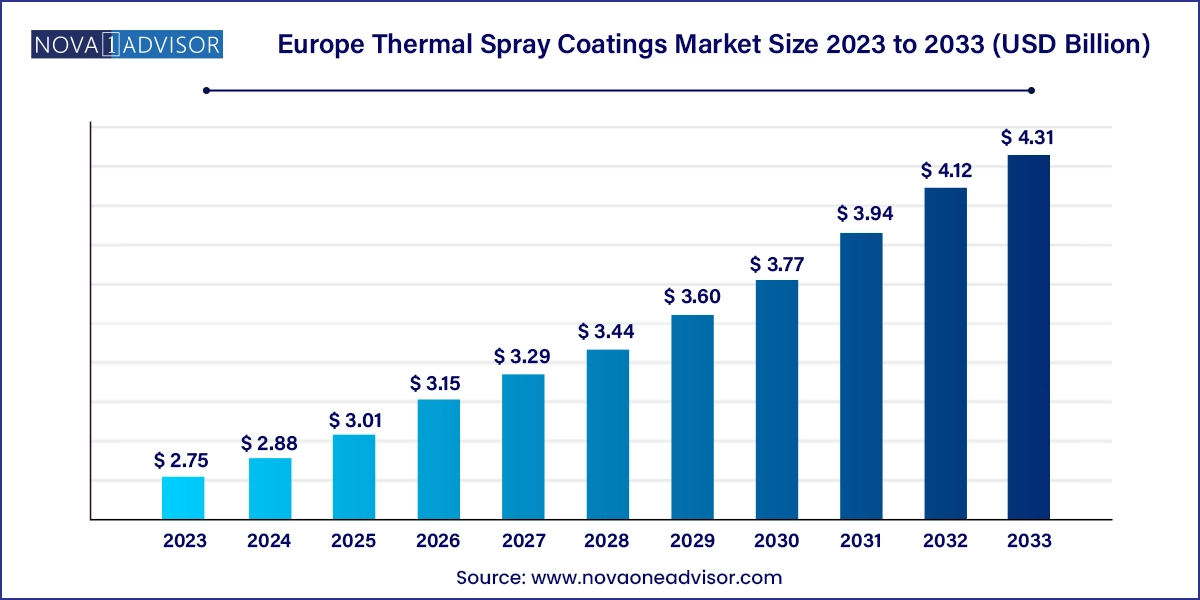

The Europe thermal spray coatings market size was exhibited at USD 2.75 billion in 2023 and is projected to hit around USD 4.31 billion by 2033, growing at a CAGR of 4.6% during the forecast period 2024 to 2033.

Europe Thermal Spray Coatings Market Key Takeaways:

- The ceramic coatings segment dominated the market and accounted for a revenue share of 34.3% in 2023.

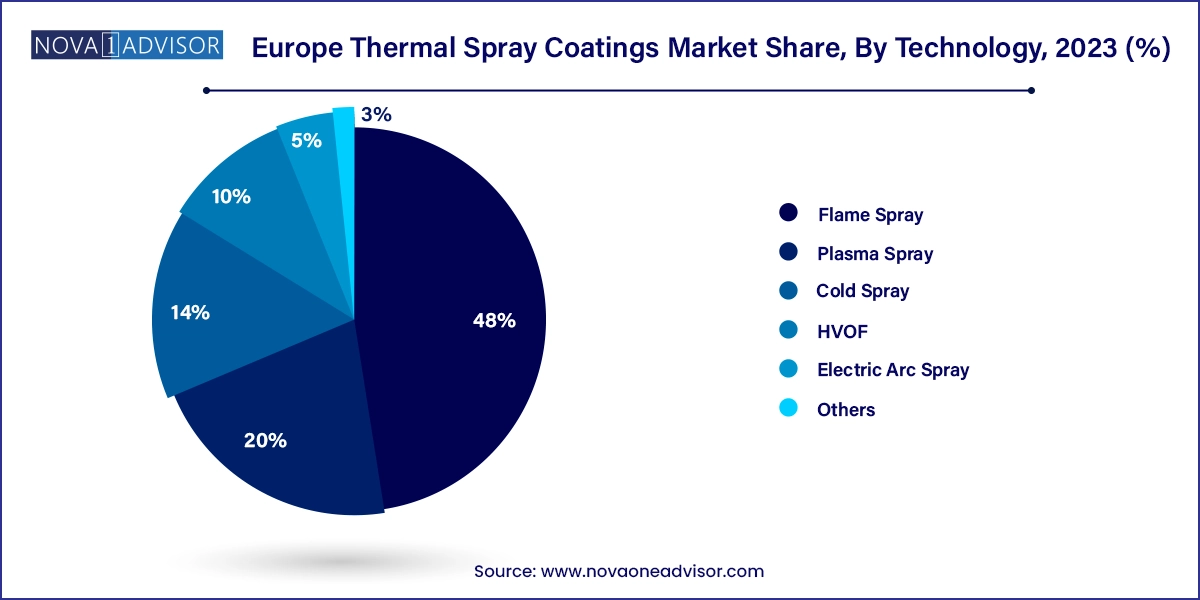

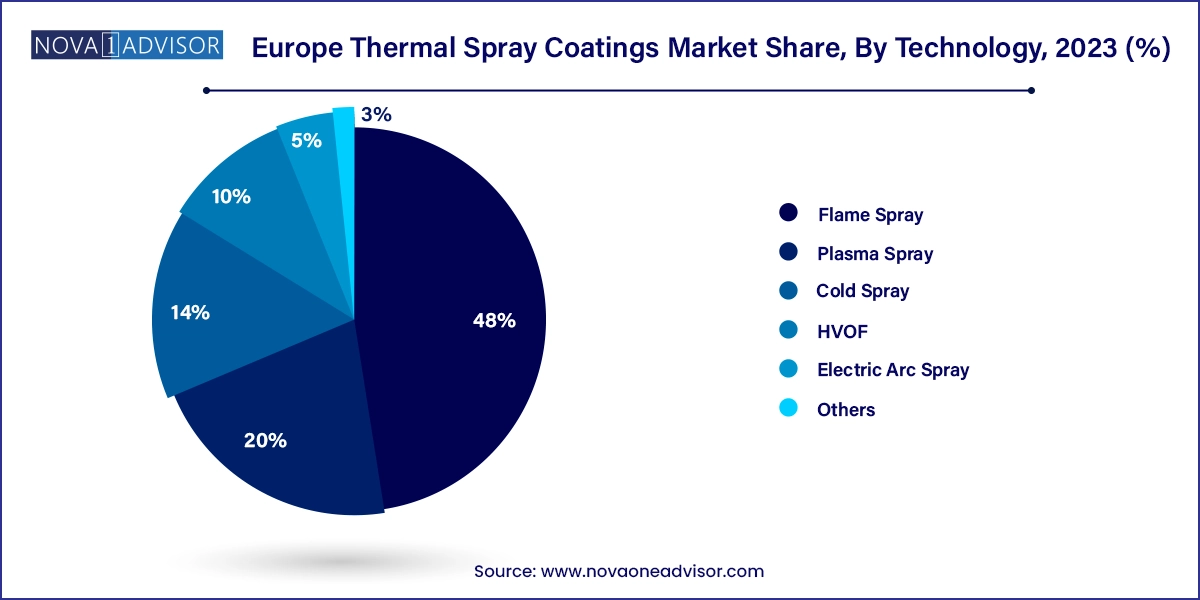

- The flamespray segment captured the largest revenue share of 48.0% in 2023.

- The plasma spray segment is projected to witness the fastest CAGR of 6.0% from 2024 to 2033

- The aerospace industry dominated the market and accounted for a revenue share of 35.2% in 2023.

- The medical device sector is expected to experience a CAGR of 4.9% from 2024 to 2033.

Market Overview

The Europe Thermal Spray Coatings Market is a dynamic and rapidly advancing sector, driven by the region's technological sophistication, industrial diversification, and regulatory emphasis on performance and sustainability. Thermal spray coatings involve a range of technologies used to deposit molten or semi-molten materials onto surfaces, enhancing wear resistance, thermal protection, electrical conductivity, or corrosion resistance.

Europe has historically led in precision engineering, aerospace development, automotive innovation, and industrial gas turbine production, which naturally translates into strong demand for surface enhancement technologies like thermal spray. These coatings serve critical roles in ensuring component longevity, energy efficiency, and high-temperature tolerance across applications ranging from jet engines to biomedical implants.

Rising investments in clean energy, electric vehicles, advanced manufacturing, and circular economy initiatives are further pushing industries toward remanufacturing and component life-extension strategies, where thermal spray technologies play a vital role. Additionally, with Europe's firm stance on reducing industrial emissions and replacing hazardous surface treatments (e.g., hexavalent chromium), thermal spray coatings are being adopted as an eco-friendlier and RoHS-compliant alternative.

The presence of global players, R&D-driven SMEs, and specialized job shops across the region ensures a competitive ecosystem where innovation and quality standards are prioritized. This market continues to evolve with innovations in materials science, robotics integration, and nano-coating technologies, ensuring long-term viability and cross-sector relevance.

Major Trends in the Market

-

Rising Shift from Hard Chrome to HVOF and Plasma Spray Coatings: In response to REACH regulations and chromium bans, industries are migrating toward safer alternatives like HVOF.

-

Adoption of Cold Spray for Additive Repairs: Particularly in aerospace and defense, cold spray is enabling structural repairs without heat-induced stress.

-

Growth of Ceramic and Carbide-Based Coatings: These materials are increasingly used for high-wear, thermal barrier, and insulating applications.

-

Integration of Robotics and AI in Spray Processes: Automated coating lines are improving consistency, precision, and throughput across factories.

-

Expansion in Wind Turbines and Renewable Sectors: Thermal spray is being applied to protect turbine blades and offshore components from erosion and saltwater corrosion.

-

Biomedical Innovations with Bioceramic Coatings: Hydroxyapatite and titanium oxide coatings are used on orthopedic implants and dental fixtures to improve osseointegration.

-

Digital Pre-Spray Simulation and Monitoring Tools: European firms are investing in IoT-driven process monitoring for quality assurance and predictive maintenance.

Report Scope of Europe Thermal Spray Coatings Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 2.88 Billion |

| Market Size by 2033 |

USD 4.31 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.6% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Material, Technology, Application, Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

Japan; China; India; Australia; South Korea |

| Key Companies Profiled |

APS Materials, Inc.; ARC International; Bodycote; Kennametal Stellite; CASTOLIN EUTECTIC; Chromalloy Gas Turbine LLC; Fujimi Corp.; Kennametl Stellite; Linde Plc; Metallisation Ltd.; OC Oerlikon Management AG |

Key Market Driver: Strong Aerospace and Energy Equipment Base

One of the most influential growth drivers in the European thermal spray coatings market is the region’s robust base in aerospace, defense, and industrial gas turbine manufacturing. Europe hosts global OEMs such as Airbus, Rolls-Royce, Safran, and Siemens, all of which rely on thermal spray for critical components exposed to high temperatures, wear, and corrosion.

For example, thermal barrier coatings (TBCs) are essential for jet engine turbine blades, reducing heat absorption and extending operational lifespan. Similarly, gas turbines used in power plants, ships, and offshore platforms require plasma and HVOF-applied coatings to handle aggressive combustion environments. With European governments investing heavily in energy transition strategies, thermal spray is becoming a crucial enabler for extending the life of aging energy infrastructure.

In the post-pandemic recovery, the surge in aerospace orders, coupled with an ongoing push for fuel efficiency and lightweighting, is fueling demand for ceramic-based coatings and bond coats to optimize engine performance and reduce emissions.

Key Market Restraint: High Cost of Equipment and Technical Complexity

Despite its advantages, thermal spray coatings face a notable barrier in the form of high capital investment and specialized skill requirements. Establishing a thermal spray facility involves significant upfront costs, including plasma guns, powder feeders, robot arms, vacuum chambers, gas handling systems, and safety enclosures.

Moreover, the process requires rigorous surface preparation, precise control of spray parameters (particle velocity, temperature, stand-off distance), and post-treatment such as grinding or sealing. Small and mid-sized enterprises often struggle to absorb these costs, especially in regions where demand volumes are not consistent.

Additionally, certification and compliance requirements particularly in aerospace and medical applications further raise the barrier to entry. Coating quality must often meet strict standards such as EN ISO 14923, AS9100, or ASTM C633, necessitating continual testing and documentation.

Key Market Opportunity: Growth in Biomedical and Eco-Friendly Coating Applications

An exciting growth area for Europe lies in the biomedical and sustainability-focused coating applications, particularly in orthopedics, dental implants, and environmentally responsible surface treatments.

As Europe’s population ages and healthcare systems prioritize advanced surgical procedures, demand for joint replacements, spinal implants, and load-bearing prosthetics is rising. Thermal spray coatings especially hydroxyapatite, titanium, and zirconium-based ceramics are essential for ensuring biocompatibility, osseointegration, and infection resistance.

Simultaneously, environmental regulations are creating opportunities for thermal spray to replace galvanic coatings, especially hard chrome and cadmium, across industrial and automotive sectors. Electric vehicles, for instance, require coated motor housings, battery components, and braking systems that can be protected with eco-friendly ceramic and metal matrix coatings.

The convergence of green manufacturing mandates and the medical device boom gives European coating providers a unique opportunity to specialize and expand into these technically demanding and high-margin sectors.

Europe Thermal Spray Coatings Market By Material Insights

Metals dominated the material segment, widely used for applications requiring corrosion resistance, thermal conductivity, and structural integrity. Coatings made of nickel, aluminum, and molybdenum alloys are applied across aerospace, automotive, and oil & gas components. Nickel-based alloys are commonly used in turbine engines and heat exchangers, while aluminum-bronze is used in marine propeller shafts and hydraulic cylinders. The cost-effectiveness and adaptability of metals make them the go-to option in general industrial applications.

Carbides are the fastest-growing segment, particularly tungsten carbide (WC) and chromium carbide (CrC). These materials are highly valued for their abrasion resistance, hardness, and ability to withstand harsh wear conditions. Carbide coatings applied via HVOF technology are increasingly being used in steel processing rolls, mining tools, pump shafts, and cutting equipment. The rise in manufacturing efficiency and longer component life is making carbides indispensable in Europe’s high-precision industries.

Europe Thermal Spray Coatings Market By Technology Insights

Plasma Spray technology holds the largest market share, attributed to its versatility and ability to process ceramics, metals, polymers, and composites. The high-temperature plasma arc allows for dense, uniform coatings, making it ideal for aerospace turbine components, orthopedic implants, and thermal barrier systems. The technology’s adoption is further supported by its compatibility with robotic automation, a trend particularly strong in European advanced manufacturing hubs.

Cold Spray is the fastest-growing technology, driven by its solid-state deposition mechanism, which eliminates heat-affected zones and thermal stress. This makes it ideal for repairing aluminum airframes, titanium alloy components, and sensitive electronic parts. Cold spray is increasingly favored by European defense contractors and MRO operators, particularly in the UK and France, for non-invasive component restoration and corrosion prevention.

Europe Thermal Spray Coatings Market By Application Insights

Aerospace dominated the application segment, given the high demand for thermal barrier, erosion-resistant, and oxidation-stable coatings on critical engine and structural components. Europe's prominence in jet engine manufacturing (e.g., Rolls-Royce, Safran) and satellite and defense programs ensures strong recurring demand for thermal spray across the lifecycle of aircraft and spacecraft.

Medical is the fastest-growing application, with coatings used on hip implants, dental fixtures, and spinal rods to promote biocompatibility and minimize post-operative infection. Hydroxyapatite coatings, in particular, are gaining traction due to their bone-mimicking properties, and European orthopedic device manufacturers are rapidly adopting robot-assisted thermal spray lines to increase throughput while maintaining coating uniformity.

Country Insights

Germany

Germany leads the European thermal spray coatings market, driven by its dominant automotive, aerospace, and industrial machinery sectors. German manufacturers such as MTU Aero Engines and Siemens Energy heavily rely on HVOF and plasma spray technologies for turbine blade protection. Additionally, automotive remanufacturing plants in Bavaria and Baden-Württemberg use thermal spray to restore engine and transmission parts, aligning with Germany’s focus on circular economy practices.

France

France is a hub for aerospace and defense coatings, with firms like Safran, Airbus, and Thales investing in advanced plasma spray facilities. Cold spray is also being explored for military vehicle refurbishment and nuclear reactor component cladding. Paris-based research institutes are at the forefront of bioceramic coatings for orthopedic use, and several French SMEs supply hospitals across Europe with coated implant components.

Italy

Italy's market is driven by its automotive and energy sectors, especially in northern industrial zones such as Lombardy and Emilia-Romagna. Italian companies are integrating electric arc and flame spray into gear manufacturing, marine engines, and agricultural machinery. Italy also has growing interest in eco-friendly coating solutions, with several start-ups focusing on recyclable powder feeds and bioresorbable coatings.

Spain

Spain is developing into a regional center for wind turbine and energy infrastructure coatings. Offshore turbine components, such as rotor blades and nacelles, are increasingly being coated with ceramic and abradable materials to withstand salt fog, sand erosion, and thermal cycling. Spanish universities, including Universidad Politécnica de Madrid, are collaborating with global players on AI-driven spray process optimization.

United Kingdom

The UK is a strong player in both defense and medical coatings, with companies like Bodycote and Rolls-Royce investing in automated thermal spray systems. Cold spray adoption is high in military aviation for structural restoration, and the NHS is increasingly sourcing bio-ceramic coated implants from domestic manufacturers. With growing R&D funding post-Brexit, UK startups are also exploring nanostructured spray coatings and graphene-infused barrier layers.

Some of the prominent players in the Europe thermal spray coatings market include:

- APS Materials, Inc.

- ARC International

- Bodycote

- Kennametal Stellite

- CASTOLIN EUTECTIC

- Chromalloy Gas Turbine LLC

- Fujimi Corporation

- Kennametl Stellite

- Linde Plc

- Metallisation Ltd.

- OC Oerlikon Management AG

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Europe thermal spray coatings market

Material

- Metals

- Ceramics

- Intermetallics

- Polymers

- Carbides

- Abradables

- Others

Technology

- Cold Spray

- Flame Spray

- Plasma Spray

- HVOF

- Electric Arc Spray

- Others

Application

- Aerospace

- Industrial Gas Turbine

- Automotive

- Medical

- Printing

- Oil & Gas

- Steel

- Pulp & Paper

- Others

Country

- Germany

- France

- Italy

- Spain

- UK