FemTech Market Size and Trends

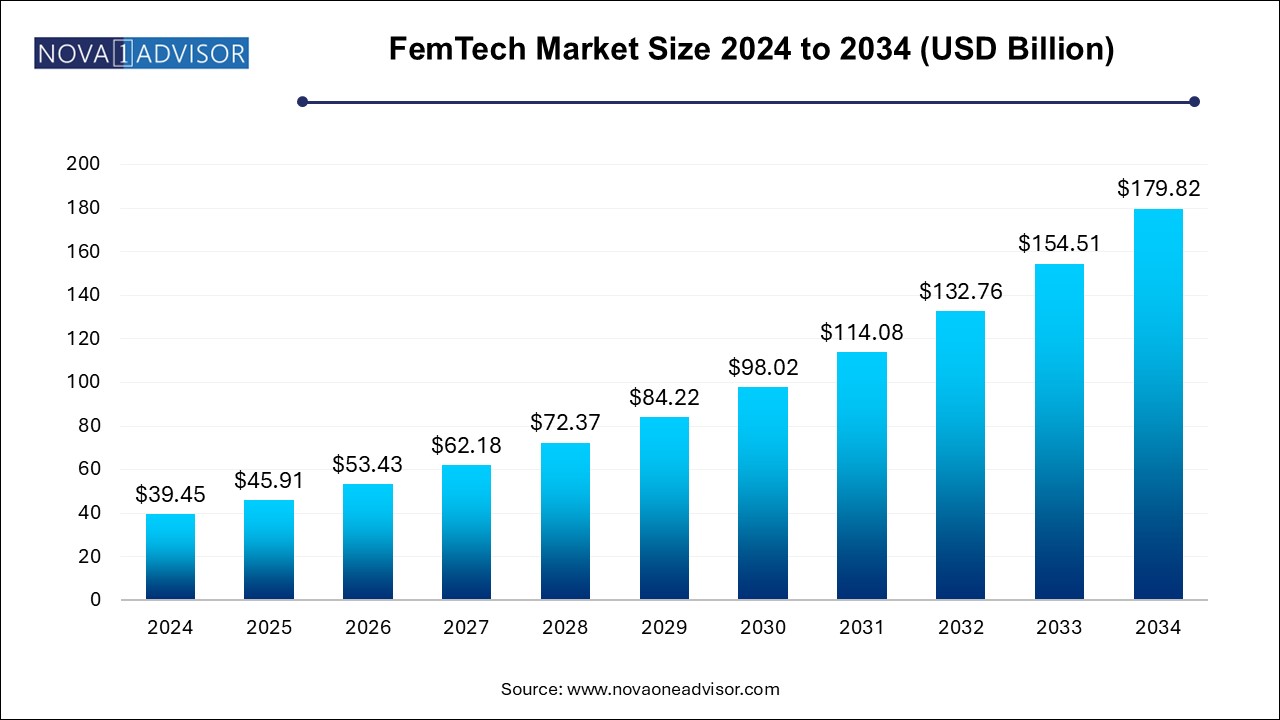

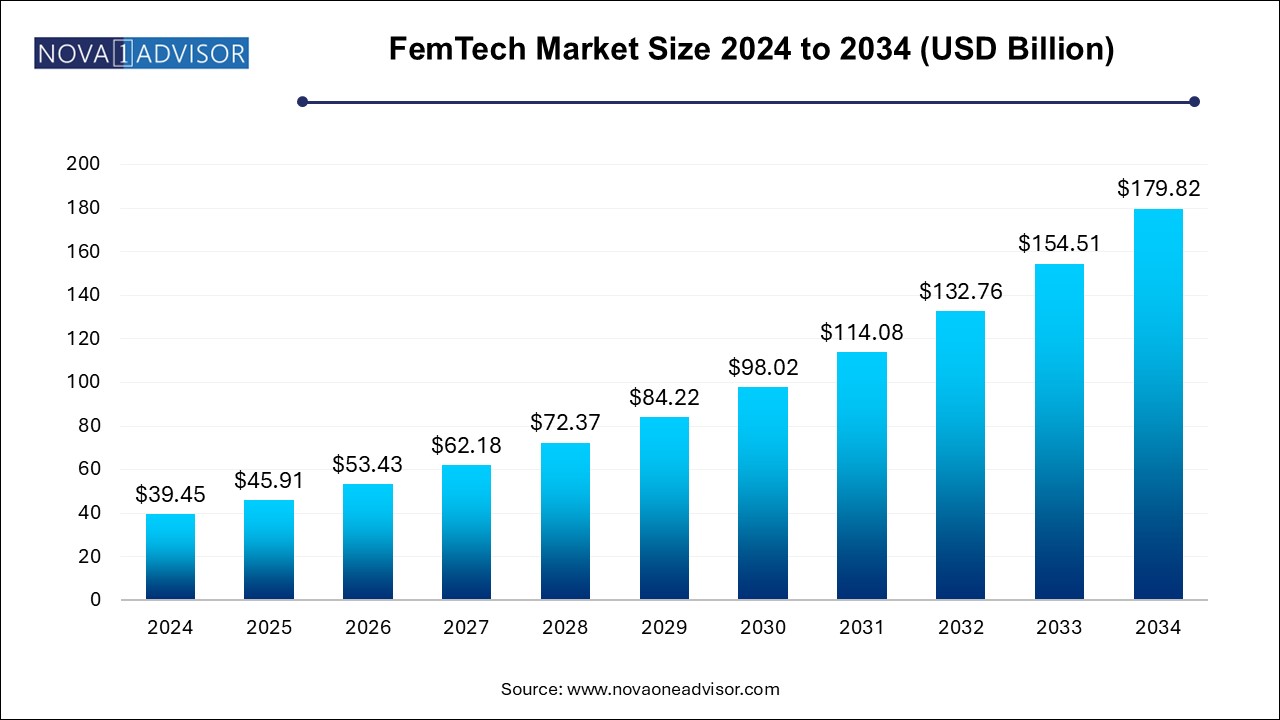

The FemTech market size was exhibited at USD 39.45 billion in 2024 and is projected to hit around USD 179.82 billion by 2034, growing at a CAGR of 16.38% during the forecast period 2024 to 2034.

FemTech Market Key Takeaways:

- Based on type, the devices segment dominated the market with a revenue share of 33.33% in 2024.

- Based on application, the pregnancy and nursing care segment dominated the market in 2024 with a revenue share of 17.72%.

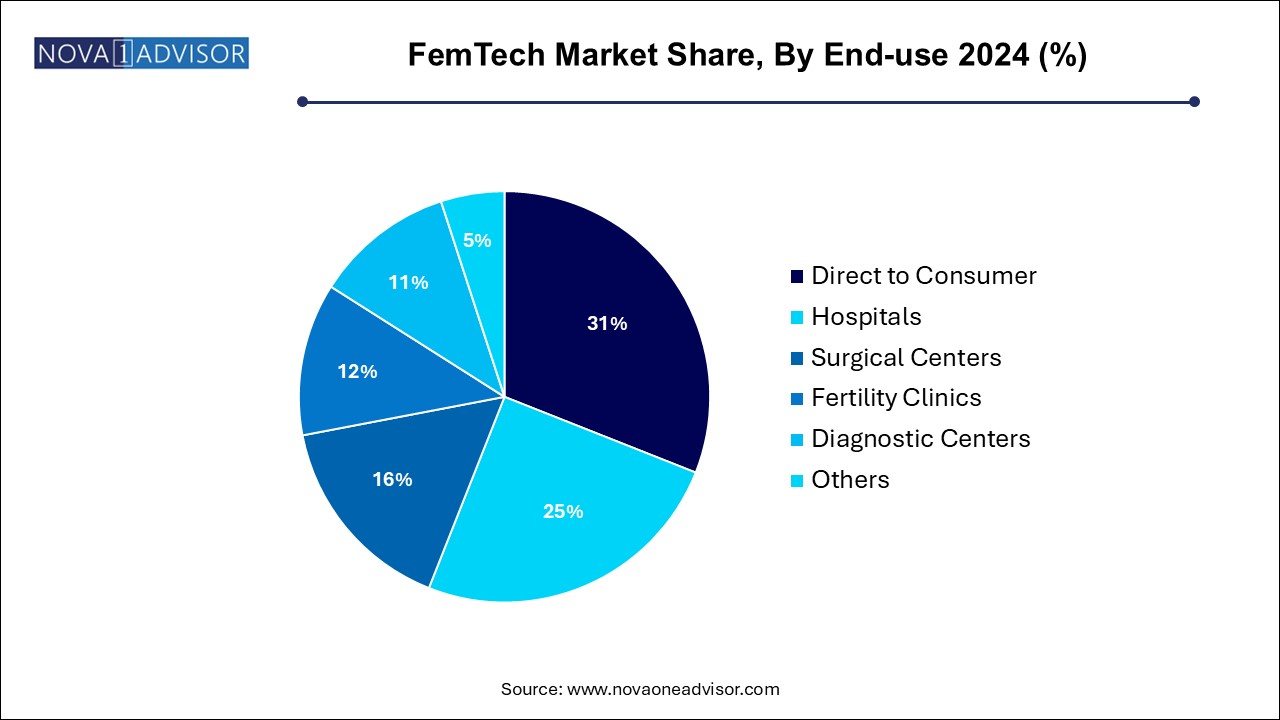

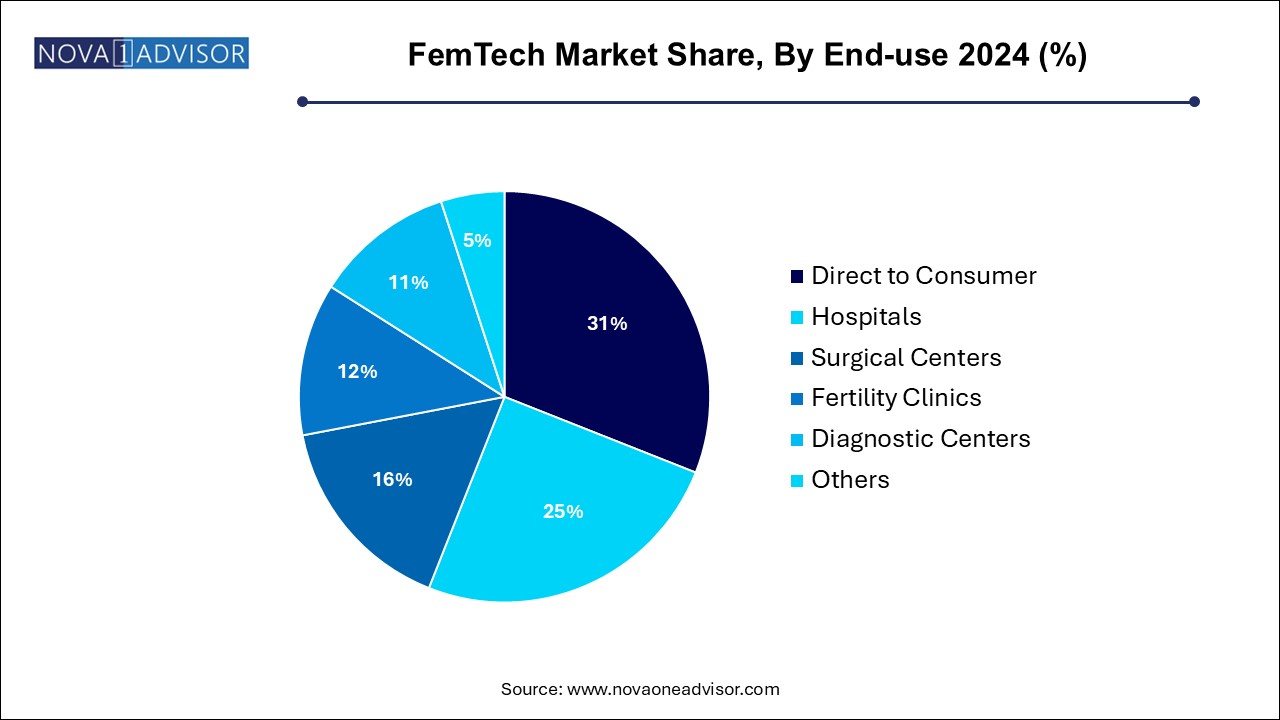

- Based on end use, the direct-to-consumer segment dominated the market with a revenue share of 31.0% in 2024.

- North America FemTech market region dominated the market with largest revenue share of 45.90% in 2024.

Market Overview

The Femtech (female technology) market represents a transformative evolution in healthcare and wellness, focused exclusively on the needs of women. It encompasses a broad range of technologies, products, and services that cater to various aspects of women's health, including reproductive health, menstrual care, fertility, pregnancy, menopause, mental health, and general well-being. The emergence of Femtech has challenged traditional approaches to women’s health, introducing smart wearable devices, mobile applications, telehealth services, and personalized solutions that empower women to take charge of their health.

Driven by technological advancement, increased awareness about women-specific health conditions, and the breaking of societal taboos, the Femtech industry has witnessed exponential growth over the last decade. The global market is becoming increasingly competitive, with startups, health-tech giants, and pharmaceutical companies investing in innovative products that aim to close the gender health gap. Growing recognition from healthcare policymakers and investors is adding further momentum to this movement, making Femtech a vital pillar of the future digital healthcare ecosystem.

The COVID-19 pandemic further accelerated the adoption of digital healthcare, highlighting the importance of accessible and user-friendly health tech solutions. Femtech apps, telemedicine consultations, and home-based diagnostics gained prominence during this period, laying a strong foundation for future expansion. As personalized medicine gains popularity, Femtech solutions that provide tailored insights based on biomarkers, hormonal cycles, or fertility patterns are becoming more mainstream.

Report Scope of FemTech Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 45.91 Billion |

| Market Size by 2034 |

USD 179.82 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 16.38% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Type, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Chiaro Technology Limited; HeraMED; Flo Health, Inc.; Natural Cycles USA Corp; Glow, Inc; Allara Health; NUVO Inc.; Bloomlife; Syrona Health; Sirona Hygiene Private Limited; Samplytics Technologies Private Limited; iSono Health, Inc.;Athena Feminine Technologies |

Market Driver – Growing Awareness and De-stigmatization of Women's Health

A significant driver fueling the growth of the Femtech market is the increasing societal openness and awareness surrounding women’s health issues. Historically, topics such as menstruation, sexual wellness, and menopause were considered taboo, often resulting in underdiagnosed and undertreated conditions. Today, there is a growing cultural shift, backed by media campaigns, public health initiatives, and advocacy from influencers and celebrities, pushing women to speak more openly about their health experiences. This awareness is translating into greater demand for customized, data-driven Femtech products. For instance, the surge in downloads of period tracking apps such as Flo and Clue demonstrates the rising comfort level with digital solutions.

Market Restraint – Data Privacy and Regulatory Challenges

Despite the promise of Femtech, data privacy and regulatory compliance remain significant hurdles. Femtech products often collect sensitive data, including hormonal levels, sexual activity, and mental health status. The misuse or breach of such data can have severe consequences for users. Regulatory oversight in many regions remains inconsistent, with varying standards for data security, informed consent, and medical claims. Moreover, some Femtech startups may prioritize rapid development over comprehensive clinical validation, leading to questions about efficacy and reliability. These issues can deter user trust and hinder widespread adoption, especially in regions with strict data governance policies like the EU (GDPR compliance).

Market Opportunity – Untapped Potential in Menopause and Aging Wellness

One of the most promising opportunities in the Femtech market lies in the underserved segment of menopause and aging wellness. Millions of women globally experience menopause-related symptoms, yet this phase of life has long been neglected by the healthcare system. With increasing life expectancy and a rising middle-aged female population, there is a growing demand for solutions that address hormonal imbalances, bone density, sleep disorders, and mental health challenges associated with menopause. Companies like Gennev and Lisa Health are leading the charge with digital platforms, supplements, and lifestyle coaching specifically tailored to menopausal women. This segment represents a multi-billion-dollar opportunity that remains largely untapped.

FemTech Market By Type Insights

Devices form the backbone of the Femtech market and dominate the landscape due to their tangible benefits and measurable outcomes. Products such as wearable ovulation trackers, smart pelvic trainers, and diagnostic kits provide real-time health monitoring and management. For instance, wearable fertility monitors like Ava and Mira have gained popularity for their ease of use and accuracy. These devices offer immediate value to consumers, bridging the gap between clinical care and self-management. Hospitals and diagnostic centers also prefer hardware solutions for in-clinic use, further reinforcing device dominance.

On the other hand, software solutions, particularly mobile apps, are the fastest-growing segment. They are accessible, affordable, and offer personalized insights that empower users daily. From period tracking to AI-powered fertility coaching, the software ecosystem is expanding rapidly. These apps are often integrated with wearables, creating an interconnected Femtech experience. The rise in smartphone usage and internet penetration, especially in developing countries, is further propelling this growth. Moreover, software is scalable, allowing companies to reach millions of users without the complexities of hardware distribution.

FemTech Market By Application Insights

Reproductive health and contraception remain the largest application segment in the Femtech market. This is due to the foundational need for reliable birth control methods and fertility management solutions across age groups. Products like NuvaRing, wearable fertility monitors, and contraceptive tracking apps have transformed how women engage with their reproductive health. The demand for non-invasive and hormone-free options has led to innovations in this space. Additionally, socio-political developments, such as debates around reproductive rights in the U.S., have driven increased attention and funding to this category.

While reproductive health dominates, menopause care is emerging as the fastest-growing application. With an aging global population and rising awareness, women are actively seeking tools to manage their menopausal transition. Companies are launching personalized hormone monitoring apps, teleconsultation services with menopause specialists, and community-driven wellness platforms. The narrative is shifting from symptom control to holistic aging wellness, and this redefinition is attracting investors and innovators alike. The segment’s growth trajectory suggests it will play a central role in the next wave of Femtech innovation.

FemTech Market By End-use Insights

Direct-to-consumer (DTC) platforms are the dominant end-use segment due to their convenience and ability to bypass traditional healthcare gatekeepers. Brands like Elvie, Natural Cycles, and Bloomlife have built loyal customer bases by offering products directly through e-commerce and app stores. DTC models allow for rapid feedback loops, user engagement, and brand loyalty. The COVID-19 pandemic further entrenched the DTC trend, with women increasingly seeking remote, personalized solutions for healthcare.

Fertility clinics, however, are emerging as a rapidly growing segment. As infertility rates climb and IVF becomes more mainstream, clinics are adopting Femtech solutions for patient management and success optimization. Tools that track ovulation, hormonal fluctuations, and embryo viability are being integrated into clinic workflows. Additionally, collaborations between Femtech startups and fertility clinics are improving data collection and treatment personalization. As clinics modernize, Femtech is becoming an indispensable partner in reproductive medicine.

FemTech Market By Regional Insights

North America, particularly the United States, stands as the undisputed leader in the Femtech market. It boasts a mature digital health ecosystem, high levels of health awareness, and a progressive approach to women's wellness. The region is home to leading Femtech innovators such as Clue, Modern Fertility, and Maven Clinic. Robust funding from venture capital firms, favorable reimbursement policies, and a strong focus on research and development have driven market penetration. In June 2024, Maven Clinic raised an additional $50 million in funding to expand its virtual clinic services for women's health across rural America, emphasizing the region's commitment to expanding access.

Asia Pacific is emerging as the fastest-growing Femtech market, driven by rising healthcare digitization, increased mobile penetration, and changing cultural attitudes. Countries like China, India, and South Korea are witnessing a boom in mobile health apps tailored for women. The region's demographic dividend, with a large young population, creates a fertile ground for Femtech innovation. Moreover, government initiatives promoting maternal and reproductive health are aligning well with Femtech offerings. In February 2025, India launched a public-private partnership to integrate digital reproductive health tools into rural healthcare services, showcasing the region’s commitment to Femtech scalability.

Some of the prominent players in the FemTech market include:

- Chiaro Technology Limited

- HeraMED

- Flo Health, Inc.

- Natural Cycles USA Corp

- Glow, Inc

- Allara Health

- NUVO Inc.

- Bloomlife

- Syrona Health

- Sirona Hygiene Private Limited

- Samplytics Technologies Private Limited

- iSono Health, Inc.

- Athena Feminine Technologies

FemTech Market Recent Developments

-

February 2025 – Natural Cycles announced its FDA clearance to integrate wearable temperature sensors into its digital birth control app.

-

January 2025 – Elvie launched its second-generation smart breast pump, Elvie Stride Plus, with improved noise control and app tracking.

-

December 2024 – Maven Clinic expanded its global reach by launching services in the UK, Canada, and Australia.

-

November 2024 – Clue introduced an AI-powered menstrual forecasting feature using anonymized user data to improve prediction accuracy.

-

October 2024 – Gennev secured $10 million in Series B funding to scale its menopause-specific digital health services.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the FemTech market

By Type

- Devices

- Software

- Services

- Consumer Products

By Application

- Pregnancy and Nursing Care

- Reproductive Health & Contraception

- Menstrual Health

- General Health

- Pelvic & Uterine Health

- Sexual Health

- Womens Wellness

- Menopause Care

- Longevity & Mental Health

By End-use

- Direct to Consumer

- Hospitals

- Surgical Centers

- Fertility Clinics

- Diagnostic Centers

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)