Fiducial Markers Market Size and Trends

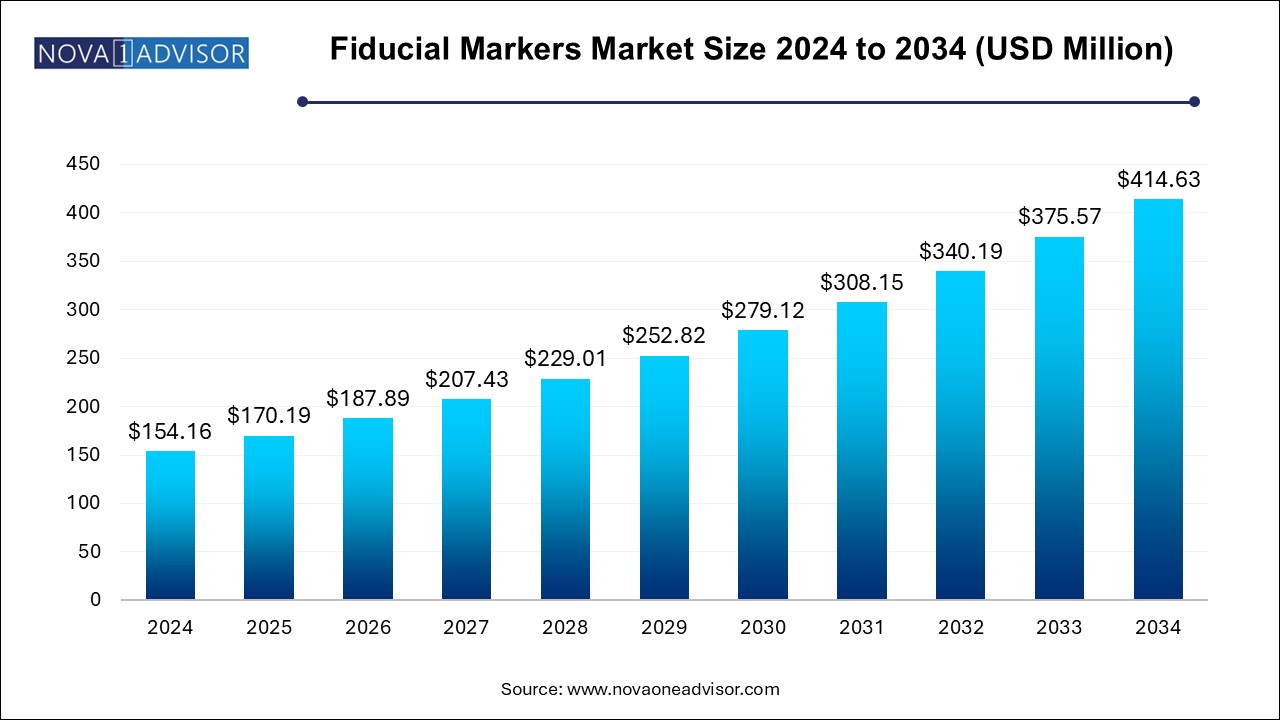

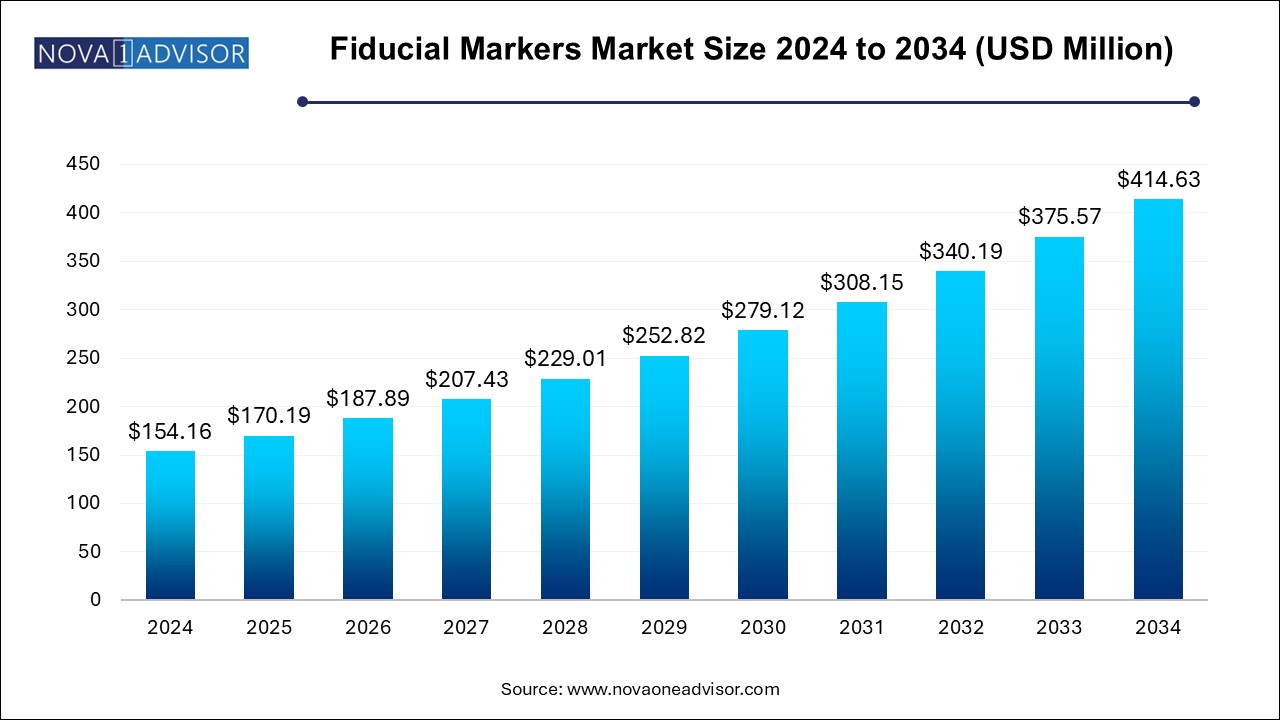

The fiducial markers market size was exhibited at USD 154.16 million in 2024 and is projected to hit around USD 414.63 million by 2034, growing at a CAGR of 10.4% during the forecast period 2024 to 2034.

Fiducial Markers Market Key Takeaways:

- The gold segment held the largest share in 2024.

- CT/CBCT segment held the largest market share in 2024.

- The ultrasound modality segment is expected to experience the fastest CAGR over the forecast period.

- The prostate cancer segment held the largest market share in 2024 and is projected to expand further at a healthy CAGR over the forecast period.

- The breast cancer segment is also expected to register a significant CAGR over the forecast period.

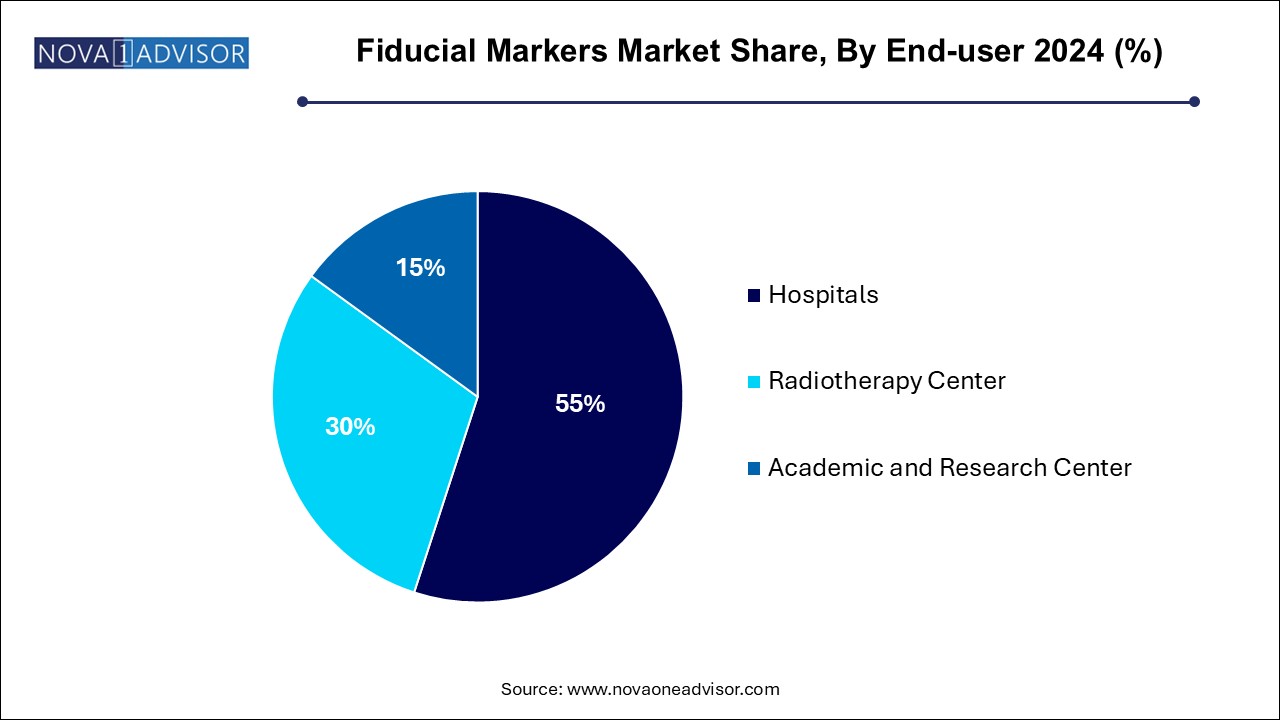

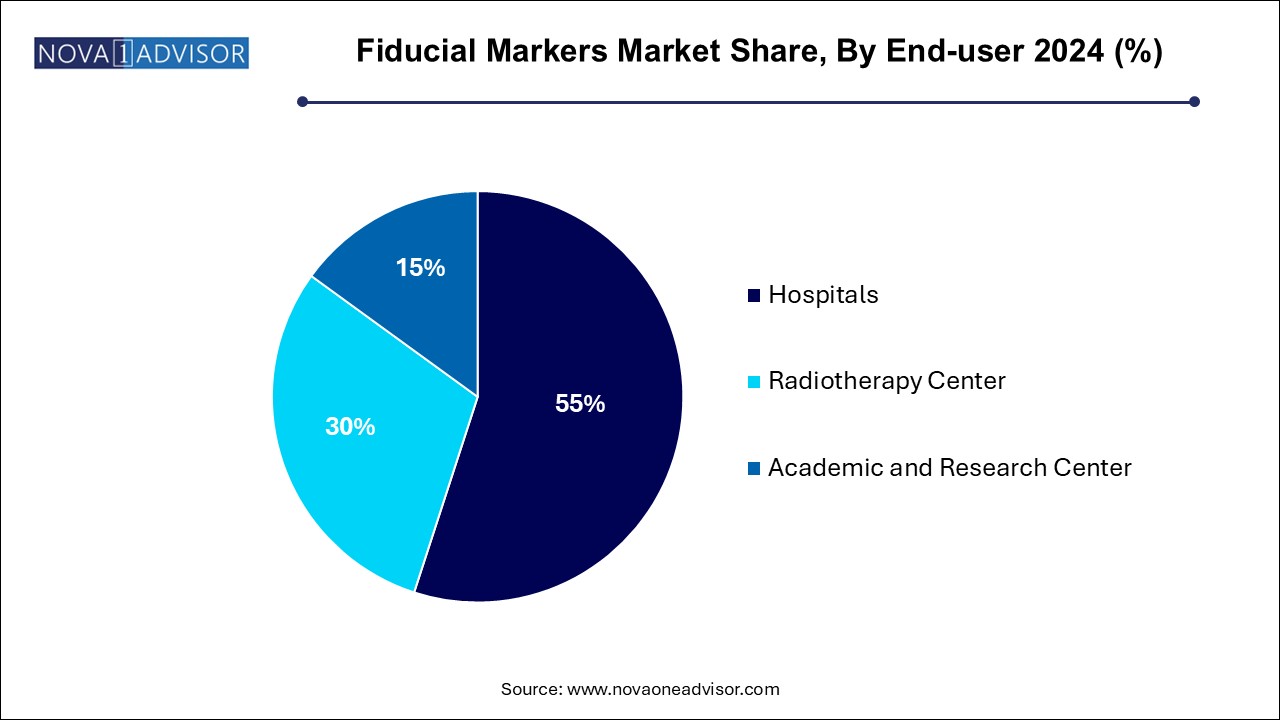

- The hospital segment held the largest market share in the past.

- Academic and research centers is anticipated to be the second fastest-growing segment during the forecast period.

- North America held the largest share of the global market in 2024.

- Europe held the second-largest market share in 2024. In Europe, over 3.2 million people are diagnosed with cancer every year.

- The Asia Pacific is expected to register the fastest growth over the forecast period.

Market Overview

The fiducial markers market plays a pivotal role in the field of image-guided therapy, offering essential tools for enhancing the precision and accuracy of diagnostic and therapeutic interventions, particularly in oncology. Fiducial markers are small objects placed in or near a tumor or anatomical structure to serve as a reference point during imaging or treatment procedures, ensuring high-precision targeting.

Primarily used in radiotherapy, stereotactic body radiotherapy (SBRT), and radiosurgery, fiducial markers assist in overcoming anatomical shifts and tissue movement, thereby minimizing damage to surrounding healthy tissues and improving therapeutic outcomes. Increasing incidences of cancer globally, coupled with advancements in radiation therapy technologies, are key factors boosting the adoption of fiducial markers.

The growing demand for minimally invasive treatments, improved imaging technologies such as MRI, CT, and CBCT, and a stronger emphasis on precision medicine are significantly contributing to market growth. Furthermore, the emergence of liquid fiducial markers and the integration of polymer-based markers to reduce imaging artifacts are expanding product options for clinicians.

With ongoing innovations, heightened awareness among healthcare professionals, and rising healthcare expenditures, the fiducial markers market is expected to grow steadily, addressing the critical need for accuracy in cancer diagnosis and treatment.

Major Trends in the Market

-

Shift Toward Non-metallic and Polymer Fiducial Markers: Reducing imaging artifacts, particularly in MRI procedures.

-

Growing Preference for Liquid Fiducial Markers: Enabling easier placement and superior integration in soft tissues.

-

Increasing Adoption in Emerging Oncology Areas: Expanding use in head and neck cancers, liver cancers, and pancreatic cancers.

-

Integration with Image-guided Radiation Therapy (IGRT) Systems: Enhancing workflow efficiency and treatment outcomes.

-

Technological Advancements in Marker Delivery Systems: Development of minimally invasive implantation devices.

-

Emphasis on Personalized Radiotherapy Planning: Use of fiducials for individualized treatment mapping.

-

Expansion of Fiducial Marker Use Beyond Oncology: Applications in orthopedic and cardiac interventions.

-

Strategic Collaborations and Acquisitions: Leading companies expanding portfolios through partnerships and mergers.

Report Scope of Fiducial Markers Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 170.19 Million |

| Market Size by 2034 |

USD 414.63 Million |

| Growth Rate From 2024 to 2034 |

CAGR of 10.4% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Product, Modality, Application, End-user, and Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

CIVCO Radiotherapy; IZI Medical Products; Naslund Medical AB; Medtronic PLC; QlRad, Inc.; QFIX; Boston Scientific Corp.; Nanovi A/S; Eckert & Ziegler; IBA Dosimetry GmbH |

Key Market Driver: Rising Global Cancer Incidence Driving Demand for Precision Therapies

The dominant driver fueling the fiducial markers market is the rising global burden of cancer, necessitating precision in radiotherapy and surgical procedures.

According to the World Health Organization (WHO), cancer is a leading cause of death globally, with millions of new cases diagnosed annually. Cancers such as prostate, lung, breast, and head and neck cancers often require localized, high-precision treatment modalities to maximize efficacy while minimizing side effects.

Fiducial markers enable accurate tumor localization, real-time tracking during therapy, and compensation for organ motion, significantly improving treatment precision. As the number of patients undergoing radiation therapy continues to rise, fiducial markers are becoming indispensable tools in modern oncology workflows.

Key Market Restraint: Risk of Migration and Complications Associated with Fiducial Placement

Despite their benefits, fiducial markers can pose risks related to migration and procedural complications, acting as a restraint to market growth.

Migration of markers from the original placement site can result in inaccurate targeting during therapy, potentially compromising treatment outcomes. Placement procedures, although minimally invasive, carry risks such as bleeding, infection, and damage to adjacent structures, particularly when performed in sensitive anatomical areas like the lungs or prostate.

Concerns over safety, especially in older or medically fragile patients, may limit fiducial marker usage. Additionally, the need for skilled professionals to perform the implantation increases the operational burden in some healthcare settings. Continuous technological advancements aimed at reducing migration risks are vital for addressing these concerns.

Key Market Opportunity: Emergence of Polymer and Liquid Fiducial Markers

A significant opportunity in the fiducial markers market lies in the emergence and commercialization of polymer-based and liquid fiducial markers.

Traditional metal markers, particularly gold-based, can cause artifacts on MRI and limit visualization during imaging. Polymer fiducials, with their MRI compatibility and reduced artifact profile, enable superior imaging quality, thus improving precision in radiotherapy planning.

Liquid fiducial markers offer the added advantages of simpler implantation procedures, the ability to conform to irregular tissue planes, and better integration with surrounding anatomy. Companies that innovate in biocompatible, artifact-free, and easy-to-use fiducial products will be well-positioned to capture emerging opportunities in the precision oncology market.

Fiducial Markers Market By Product Insights

Gold fiducial markers dominate the product segment, historically serving as the gold standard due to their high visibility under CT and X-ray imaging. Gold markers provide reliable radiographic contrast, making them essential in radiotherapy for prostate, lung, and breast cancers.

Polymer fiducial markers are growing fastest, driven by their superior compatibility with MRI and reduced imaging artifacts. As MRI-guided radiation therapy (MRgRT) platforms expand in clinical use, the demand for non-metallic fiducial markers is rising rapidly, allowing enhanced treatment planning and monitoring.

Fiducial Markers Market By Modality Insights

CT/CBCT imaging dominates the modality segment, as CT scans remain the standard imaging technique for radiotherapy planning and procedural navigation during fiducial placement.

MRI is growing fastest, fueled by the increasing adoption of MRI-guided radiotherapy systems. MRI offers superior soft-tissue contrast, critical for tumor visualization, particularly in brain, liver, and prostate cancers. Polymer and liquid fiducial innovations compatible with MRI are further boosting growth in this segment.

Fiducial Markers Market By Application Insights

Prostate cancer leads the application segment, accounting for a major share of fiducial marker use. Prostate movement during therapy sessions necessitates precise tracking to ensure radiation accuracy, making fiducials a standard component of prostate cancer radiotherapy protocols.

Lung cancer applications are growing fastest, owing to the complexity of lung tumor movement due to breathing and the high prevalence of lung cancers globally. Fiducials facilitate respiratory gating, stereotactic body radiotherapy (SBRT), and real-time tumor tracking, improving outcomes for lung cancer patients.

Fiducial Markers Market By End-user Insights

Hospitals dominate the end-user segment, serving as the primary sites for cancer diagnosis, fiducial implantation, and integrated treatment planning. Their comprehensive imaging, surgical, and radiotherapy capabilities support fiducial marker usage.

Radiotherapy centers are growing fastest, propelled by the increasing number of standalone or specialized radiotherapy units focused on precision cancer treatments. These centers are investing in advanced technologies like IGRT (Image-Guided Radiation Therapy) and MRgRT, driving strong demand for fiducial markers.

Fiducial Markers Market By Regional Insights

North America holds the largest share of the fiducial markers market, led by the United States with its robust healthcare infrastructure, high cancer incidence rates, and widespread adoption of image-guided radiotherapy technologies.

Supportive reimbursement policies for radiotherapy, growing investments in oncology research, and the presence of key industry players contribute to North America’s leadership position. Major academic medical centers and cancer treatment networks drive significant clinical adoption of fiducial marker technologies.

Asia-Pacific is the fastest-growing region, attributed to rising healthcare investments, increasing cancer prevalence, expanding radiotherapy access, and growing awareness of advanced cancer treatments in countries like China, India, Japan, and South Korea.

Government initiatives to boost cancer care infrastructure, the growing popularity of precision medicine, and international collaborations with Western oncology centers are accelerating adoption rates. As demand for sophisticated radiotherapy expands, Asia-Pacific presents a major growth frontier for fiducial marker manufacturers.

Some of the prominent players in the fiducial markers market include:

- CIVCO Radiotherapy

- IZI Medical Products

- Naslund Medical AB

- Medtronic PLC

- QlRad, Inc.

- QFIX

- Boston Scientific Corp.

- Nanovi A/S

- Eckert & Ziegler

- IBA Dosimetry GmbH.

Recent Developments

-

March 2025: CIVCO Radiotherapy launched a new polymer-based fiducial marker line compatible with MRI-guided radiation therapy systems, emphasizing reduced imaging artifacts.

-

February 2025: IZI Medical Products expanded its liquid fiducial product line with the FDA clearance of new Visicoil Soft Tissue Fiducials for breast and lung applications.

-

January 2025: Boston Scientific announced the acquisition of a start-up specializing in biodegradable fiducial markers to strengthen its radiation oncology product portfolio.

-

December 2024: Naslund Medical introduced a next-generation fiducial delivery system designed for minimal invasiveness and accurate placement in lung and liver tumors.

-

November 2024: Medtronic announced a strategic collaboration with major cancer centers to develop real-time tracking systems integrating fiducial marker technologies with robotic-assisted radiation therapies.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the fiducial markers market

By Product

- Gold

- Gold Combination

- Polymer

- Other Metal

- Liquid

By Modality

- CT/CBCT

- MRI

- Ultrasound

- X-Ray

By Application

- Breast Cancer

- Lung Cancer

- Prostate Cancer

- Head and Neck Cancer

- Other

By End-user

- Hospitals

- Radiotherapy Center

- Academic and Research Center

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)