Fitness App Market Size and Research

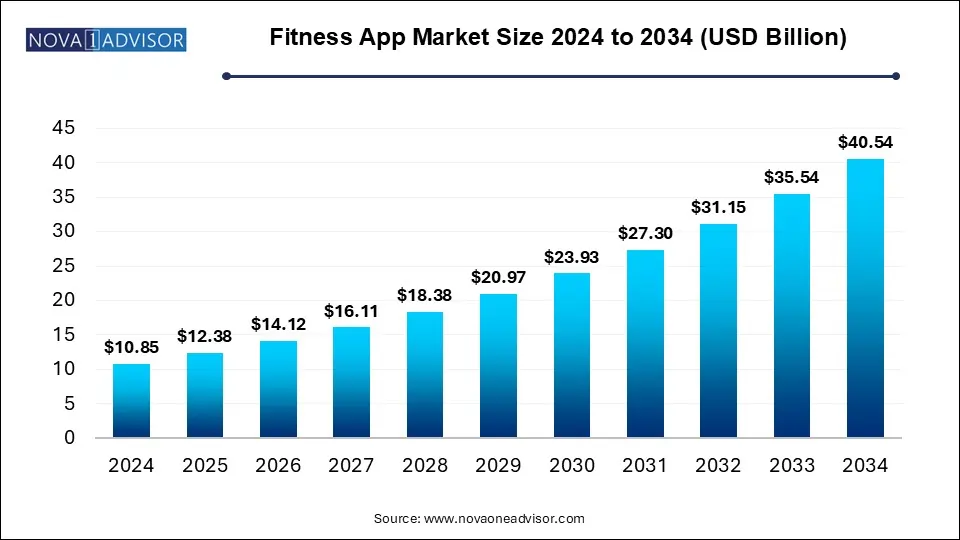

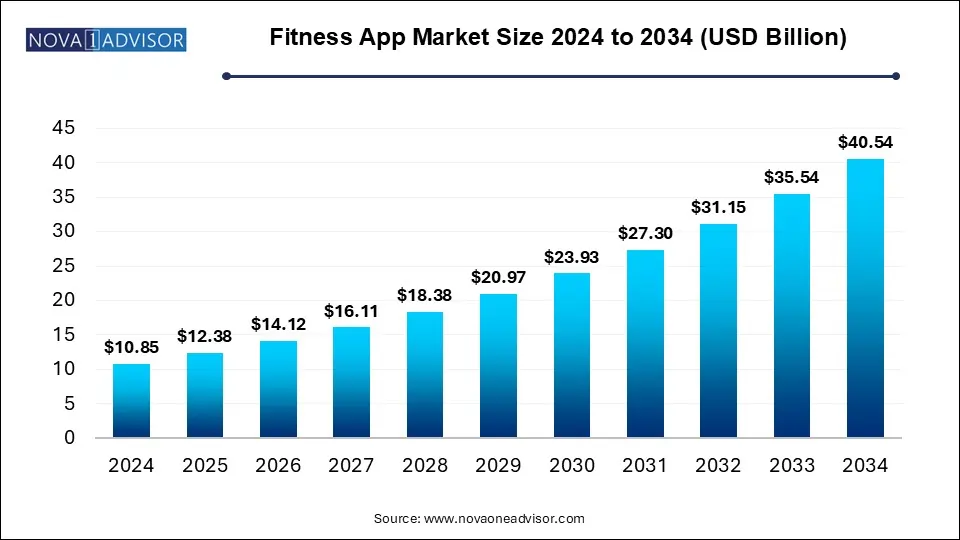

The fitness app market size was exhibited at USD 10.85 billion in 2024 and is projected to hit around USD 40.54 billion by 2034, growing at a CAGR of 14.9% during the forecast period 2025 to 2034.

Fitness App Market Key Takeaways

- Smartphones contributed the highest share of revenue in 2024.

- North America emerged as the leading region in terms of revenue in 2024.

- The exercise and weight loss category dominated the market with a 55.0% revenue share in 2024.

- The iOS platform held the largest portion of revenue in 2024.

U.S. Fitness App Market Size and Growth 2025 to 2034

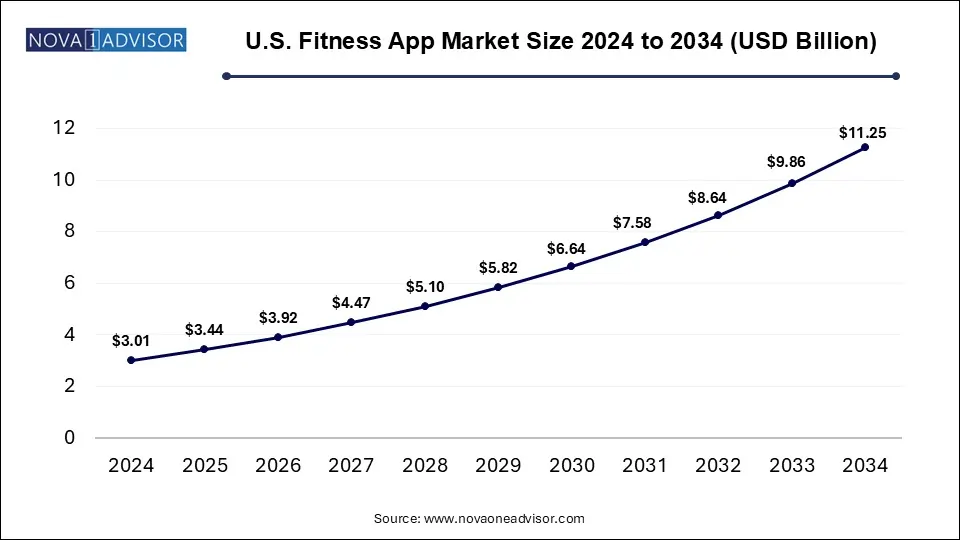

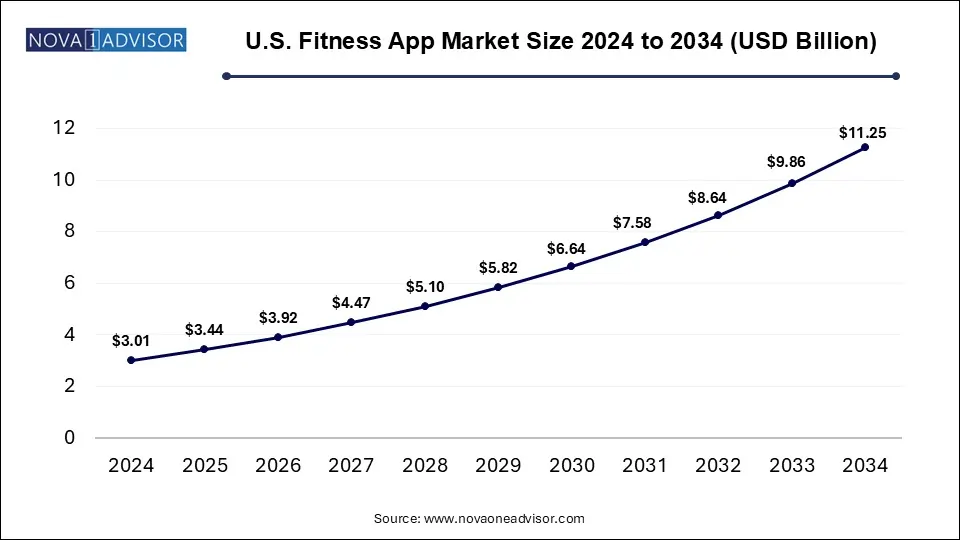

The U.S. fitness app market size was valued at USD 3.01 billion in 2024 and is expected to reach around USD 11.25 billion by 2034, growing at a CAGR of 12.73% from 2025 to 2034.

In 2024, North America held the highest share of total market revenue. Several factors—including expanded network coverage, widespread smartphone usage, a rising incidence of chronic conditions, and a growing elderly population—are fueling the adoption of fitness applications in the region. The United States leads the global market for fitness apps. A major contributor to this growth is the strong uptake of mobile health (mHealth) solutions across North America. The COVID-19 pandemic further amplified fitness app usage, with a survey by Freeletics revealing that 74.0% of Americans used at least one fitness app during lockdowns. Additionally, 60.0% of these users expressed plans to cancel their gym memberships.

The U.S. was the largest contributor to North America's fitness app market in 2024. Increased public awareness about personal health and daily fitness tracking has driven higher app adoption rates, while also attracting numerous new entrants to the industry. Furthermore, strategic partnerships between major industry players are leading to the development of more advanced applications. For example, in April 2019, Google collaborated with Apple Inc. to launch the Google Fit app for iOS, which supports fitness goals based on guidelines from the World Health Organization and the American Heart Association.

Asia Pacific is expected to represent the most promising regional market throughout the forecast period, driven by greater adoption of mobile health technologies and the rising use of smartphones and wearable devices. Increased affordability is enabling more people to access fitness apps via smartphones. Factors such as higher healthcare spending, growing obesity rates, and an expanding base of professional athletes are encouraging both government bodies and private organizations to explore new fitness models. For instance, an article from the World Economic Forum in September 2020 reported that downloads of health and fitness apps in India surged by 157%, bringing in 58 million new users.

In Japan, the market is expected to grow due to the proliferation of fitness gadgets, increased personal investment in physical activity, supportive government initiatives, rising health awareness, and a growing number of fitness centers. The significant rise in smartphone usage in Japan has also been a key enabler in the adoption of health-focused applications among consumers.

Report Scope of Fitness App Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 12.38 Billion |

| Market Size by 2034 |

USD 40.54 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 14.9% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Type, Platform, Device, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Adidas; Appster; FitnessKeeper; Fitbit, Inc.; Azumio, Inc.; MyFitnessPal Inc.; Noom; Nike; Under Armour, Inc.; WillowTree, Inc.; Polar Electro; Kayla Itsines; Google; Fooducate; ASICS America Corporation |

Fitness App Market By Device Insights

In 2024, smartphones represented the highest revenue share in the market. The growing global penetration of smartphones is a major factor boosting the expansion of this segment. In 2019, approximately 65.0% of the global population had adopted smartphones, a figure projected to reach 76.0% by 2022. As technology continues to transform the fitness landscape, many individuals are turning to their smartphones as a more convenient and cost-effective alternative to traditional gyms and fitness centers. Using fitness apps on smartphones helps users save on personal training and gym membership fees, thereby contributing to the growth of this segment.

The wearable devices segment is projected to witness the fastest growth during the forecast timeline. As per Pew Research Center's January 2020 data, about 21% of U.S. adults used wearable gadgets like fitness trackers or smartwatches in 2019. Adoption of such wearables often varies based on socioeconomic indicators such as income level, educational background, and profession. The same study revealed that 31% of individuals from households earning over USD 75,000 annually used wearables, compared to just 12% from households earning USD 30,000 or less. The increasing popularity of wearable fitness technology in the U.S. is expected to further accelerate market growth in the coming years.

Fitness App Market By Type Insights

In 2024, the exercise and weight loss segment captured the largest revenue share of 55.0%. These applications encourage regular physical activity by sending reminders and offering scheduled workouts. Most exercise apps feature video tutorials, audio prompts, and fitness tracking tools to help users stay consistent with their routines. Examples of such apps include Daily Workouts Fitness Trainer, Nike Training Club, 7 Minute Workout, Aaptiv, Sworkit, Garmin Connect, FitOn, 8fit, Adidas Training by Runtastic, and Daily Yoga. The increasing usage of these apps by a broad user base is a major factor supporting the segment’s growth. Furthermore, these platforms simplify the process of tracking calories and macronutrients like fats and carbs, offering users personalized lifestyle plans based on their inputs. Their user-friendly interface has significantly driven their popularity in recent years.

The activity tracking segment is expected to experience the quickest expansion over the forecast period. Leading the way in this space are brands like Fitbit, Jawbone, and Nike, with other tech companies such as LG, Samsung, and Pebble integrating fitness tracking into their smart devices. According to a recent IDC report, smartwatches are expected to outpace fitness bands in consumer interest. However, Fitbit has reported continued strong demand for its trackers, and this segment is projected to grow at the highest rate. Features such as progress comparisons, sharing activity updates on social media, and promoting friendly challenges encourage users to maintain an active lifestyle—driving segmental growth.

The iOS platform held the largest revenue share in 2024. The widespread use of Apple devices has been instrumental in the expansion of this segment. For example, Apple Inc. reported a rise in active devices from 1.4 billion in Q1 2019 to 1.5 billion in Q1 2020. Fitness apps built for iOS offer users functionalities such as workout coaching, activity monitoring, access to motivational video content, on-demand fitness classes, stretching routines, and meditation sessions. Popular iOS-compatible apps include 7 Minute Workout, Centr, Sworkit, MyFitnessPal, Keelo, Freeletics, Strava, PEAR, and JEFIT.

Meanwhile, the Android segment is projected to grow at the highest compound annual growth rate (CAGR) over the forecast period. In recent years, the use of Android smartphones for health and fitness tracking has surged. Users can download a wide range of fitness applications to set health goals, find workout plans, track caloric intake, and more. With the increasing number of Android users and the global rise in smartphone adoption, this segment is anticipated to expand rapidly. Notable fitness apps on Android include Google Fit, MyFitnessPal, Runtastic, Leap Fitness Workout Apps, and Sworkit.

Some of The Prominent Players in The Fitness App Market Include:

- Adidas

- Appster

- FitnessKeeper

- Fitbit, Inc.

- Azumio, Inc.

- MyFitnessPal Inc.

- Noom

- Nike

- Under Armour, Inc.

- WillowTree, Inc.

- Polar Electro

- Kayla Itsines

- Google

- Fooducate

- ASICS America Corporation

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Fitness App Market

By Type

- Exercise & Weight Loss

- Diet & Nutrition

- Activity Tracking

By Platform

By Device

- Smartphones

- Tablets

- Wearable Devices

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)