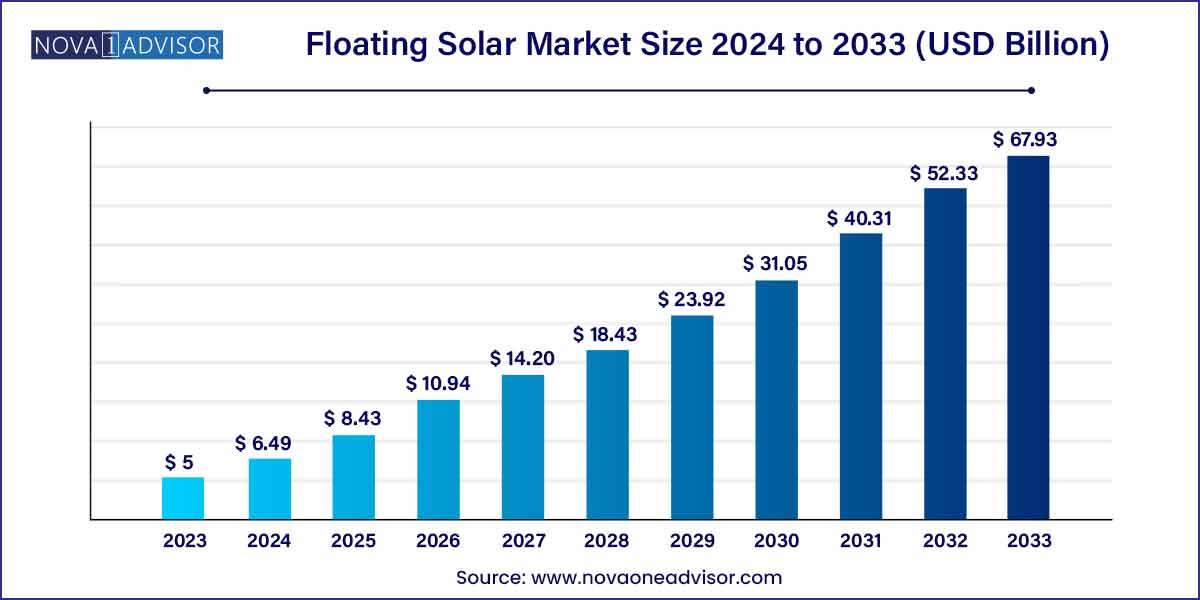

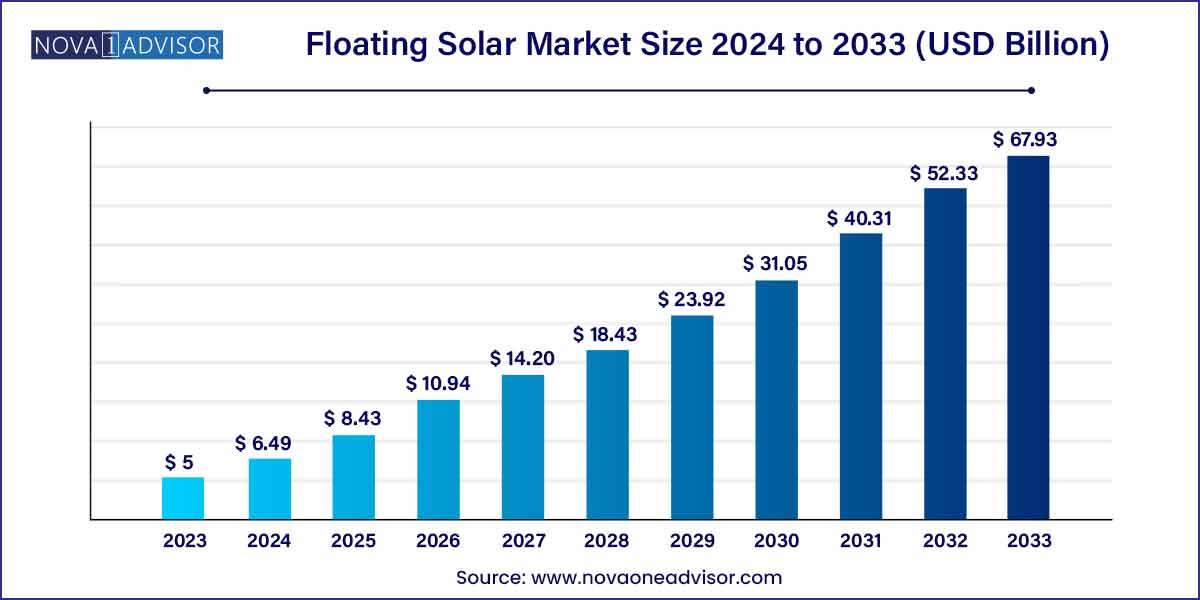

The global floating solar market size was exhibited at USD 5.0 billion in 2023 and is projected to hit around USD 67.93 billion by 2033, growing at a CAGR of 29.81% during the forecast period of 2024 to 2033.

Key Takeaways:

- Asia Pacific led the global market with the highest market share in 2023.

- North America region is estimated to expand the fastest CAGR between 2023 and 2032.

- By Type, the stationary floating panels segment has held the largest market share in 2023.

- By capacity, the 5 MW-50 MW segment captured the biggest revenue share in 2023.

- By connectivity, the on-grid segment is estimated to hold the highest market share in 2023.

Market Overview

The solar panels attached to a structure that floats on a body of water, usually a reservoir or lake, are known as floating solar or floating photovoltaics. The fundamental benefit of floating photovoltaic plants is that they do not require any land, with the exception of the small areas required for the electric cabinet and grid connections. Their cost is equivalent to that of land-based plants, but they offer a smart option to avoid using up the land.

The use of floating solar panels has been highlighted as a viable and cost-effective alternative to land-based photovoltaic systems. It's a novel way to generate solar energy by utilizing the available water surface on dams, reservoirs, and other bodies of water. Solar panels that float on water, such as irrigation ponds, reservoirs, lakes, canals, and the ocean, are known as floating solar panels.

The companies in the floating solar industry are optimistic about the expansion of large-scale projects all around the world. They're putting more emphasis on utility-scale floating solar plants, which will help to reduce fossil fuel imports in various parts of the world while saving countries money in foreign currencies.

Major Trends in the Market

-

Expansion of Mega Floating Solar Farms: Construction of projects above 100 MW, particularly in Asia-Pacific.

-

Hybrid Renewable Energy Systems: Integration of floating solar with hydroelectric plants and wind farms.

-

Technological Innovation in Floating Platforms: Development of durable, low-cost, and environmentally sustainable floating structures.

-

Adoption of Solar Tracking Systems on Water: Use of floating tracking technologies to maximize solar capture.

-

Public-Private Partnerships (PPPs): Governments collaborating with private companies to fast-track floating solar deployment.

-

Deployment in Coastal and Offshore Environments: Pilot projects exploring marine-based floating solar farms.

-

Smart Monitoring and Automation: Integration of IoT, AI, and drones for maintenance, performance optimization, and inspection.

-

Focus on Environmental Impact Mitigation: Research and guidelines ensuring minimal aquatic ecosystem disruption.

Floating Solar Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 5.00 Billion |

| Market Size by 2033 |

USD 67.93 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 29.81% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Capacity, Type, Geography |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

KYOCERA Corporation, JA SOLAR Technology Co. Ltd, Yellow Tropus Pvt. Ltd, Ciel & Terre International, Trina Solar, Vikram Solar Limited, Sharp Corporation, Yingli Solar, Sulzer Ltd., Hanwha Group. |

Driver: Rising Land Scarcity and Cost Pressures for Solar Installations

A major driver propelling the floating solar market is rising land scarcity and the high cost of land acquisition for traditional ground-mounted solar projects. Urbanization, agricultural expansion, and industrialization have intensified competition for land, especially in densely populated countries.

Floating solar presents an ideal solution by utilizing idle water bodies like reservoirs, irrigation ponds, quarry lakes, and wastewater treatment plants. It helps countries achieve renewable energy targets without compromising valuable agricultural or urban land. For example, Singapore, facing acute land constraints, has invested heavily in floating solar, including the 60 MWp Tengeh Reservoir project. The dual benefit of energy production and water conservation further strengthens the value proposition of floating solar installations.

Restraint: Technical Challenges and High Initial Costs

A key restraint facing the floating solar market is the technical challenges and high initial costs associated with system design, anchoring, and maintenance. Unlike land-based systems, floating solar projects must withstand complex environmental conditions, including fluctuating water levels, strong winds, currents, and corrosion risks.

Designing robust floating structures, reliable mooring systems, and waterproof cabling solutions adds to upfront capital expenditures. Additionally, maintenance activities are logistically more complex and often costlier due to limited access compared to land-based solar farms. Although technology improvements and economies of scale are helping to reduce costs, initial investment hurdles continue to slow adoption, particularly in emerging markets.

Opportunity: Integration with Hydropower Infrastructure

A significant opportunity lies in the integration of floating solar with existing hydropower infrastructure. Co-locating floating solar systems on hydropower reservoirs can optimize land and water use, leverage existing grid connections, and enhance energy output stability.

Hydropower reservoirs already have transmission infrastructure in place, enabling faster project deployment and reducing additional investment needs. Moreover, during periods of low water flow, floating solar can supplement power generation, ensuring more consistent energy supply. Projects like the hybrid floating solar-hydro plant at Thailand’s Sirindhorn Dam showcase the potential of this synergistic approach. Such integrated models can accelerate renewable energy expansion while maximizing resource efficiency.

Segmental Analysis

By Capacity

5MW – 50MW capacity segment dominated the floating solar market, accounting for the largest share in 2024. Medium-scale projects of this capacity range strike an ideal balance between investment size, technical complexity, and return on investment. They are particularly popular for installations on municipal reservoirs, agricultural ponds, and industrial water bodies. Countries like China, Japan, and South Korea have led the development of floating solar plants in this capacity band, driven by strong policy support and availability of suitable water surfaces. These installations not only serve local energy needs but also contribute significantly to regional renewable energy goals.

Above 50MW is the fastest-growing capacity segment, propelled by the growing ambition to develop large utility-scale floating solar farms. Mega projects, such as the 320 MW FPV plant planned in Indonesia and the 150 MW Cirata floating solar plant by Masdar and PLN, reflect the shift towards massive installations. These projects benefit from economies of scale, technological advancements in platform stability, and optimized power evacuation infrastructure. As governments and developers seek to maximize renewable energy contributions to national grids, large-scale floating solar farms are gaining momentum across Asia-Pacific, Middle East, and Europe.

By Type

Stationary floating solar panels dominated the type segment, largely because of their lower cost, simpler installation process, and proven operational performance. Stationary systems are anchored in place and remain fixed, offering stability and reliability under various environmental conditions. The relative ease of maintenance and maturity of technology make stationary floating panels the preferred choice for most water-based solar deployments globally.

Tracking floating solar panels are the fastest-growing segment, driven by their potential to increase energy generation efficiency. Tracking systems follow the sun's path across the sky, enhancing power output by 15-25% compared to fixed panels. Although more expensive and mechanically complex, tracking floating systems are gaining interest in high-solar-irradiance regions where maximizing energy harvest justifies the additional investment. Recent technological advances in lightweight, durable floating tracking systems are making this segment increasingly viable for utility-scale projects.

By Connectivity

On-grid floating solar systems dominated the connectivity segment, primarily because they are easier to integrate into existing energy infrastructure and offer stable revenue streams through power purchase agreements (PPAs). Utility companies and independent power producers (IPPs) are investing heavily in on-grid floating solar projects to supply clean energy to national or regional grids, contributing directly to renewable energy targets. Grid-tied floating solar installations in countries like China, India, and South Korea exemplify this dominance.

Off-grid floating solar systems are the fastest-growing segment, particularly in remote or underserved regions. Off-grid FPV systems provide energy access to isolated communities, industrial facilities, and agricultural operations where grid extension is economically or logistically impractical. Solar mini-grids on remote islands, floating systems for fish farms, and off-grid installations for mining operations are emerging applications. As technology costs decline and demand for decentralized energy solutions rises, the off-grid floating solar market is poised for rapid expansion.

Regional Analysis

Asia-Pacific dominated the floating solar market, leading in both installed capacity and number of projects. Countries like China, Japan, South Korea, India, and Thailand have aggressively pursued floating solar deployments, supported by government incentives, ambitious renewable energy targets, and land scarcity challenges. China's early adoption of FPV technology and large-scale projects, such as the 150 MW Huainan project built over a former coal mining site, highlight the region's leadership. Asia-Pacific benefits from a combination of strong policy frameworks, abundant water surfaces, and significant technical expertise.

Europe is the fastest-growing regional market, driven by the European Union's green transition policies, carbon neutrality commitments, and innovative renewable energy projects. Countries such as the Netherlands, France, and the United Kingdom are exploring floating solar to optimize land use and enhance energy resilience. The Netherlands, in particular, is investing in floating solar farms on lakes and nearshore marine environments. Europe’s emphasis on sustainable infrastructure, research initiatives, and public-private collaboration is fueling robust growth in FPV deployments across the continent.

Recent Developments

-

April 2025: Trina Solar Limited announced the launch of its new floating solar platform "TrinaFloat," targeting utility-scale projects globally.

-

March 2025: Masdar and PLN completed financial closure on the 145 MW Cirata Floating Solar Plant in Indonesia, Southeast Asia's largest FPV project.

-

February 2025: Ocean Sun AS secured a contract to deliver offshore floating solar installations in the Philippines, showcasing marine FPV potential.

-

January 2025: Ciel & Terre International introduced its "Hydrelio Aero" lightweight floating platform, designed for harsher offshore conditions.

-

December 2024: BayWa r.e. commissioned a 12 MW floating solar park in the Netherlands, integrated with an adjacent land-based solar farm for hybrid operations.

Some of the prominent players in the floating solar market include:

- KYOCERA Corporation

- JA SOLAR Technology Co. Ltd

- Yellow Tropus Pvt. Ltd

- Ciel & Terre International

- Trina Solar

- Vikram Solar Limited

- Sharp Corporation

- Yingli Solar

- Sulzer Ltd.

- Hanwha Group

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global floating solar market.

By Capacity

- Below 5MW

- 5MW – 50MW

- Above 50MW

By Type

- Stationary Floating Solar Panels

- Tracking Floating Solar Panels

By Connectivity

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)