Flow Cytometry Market Size and Growth

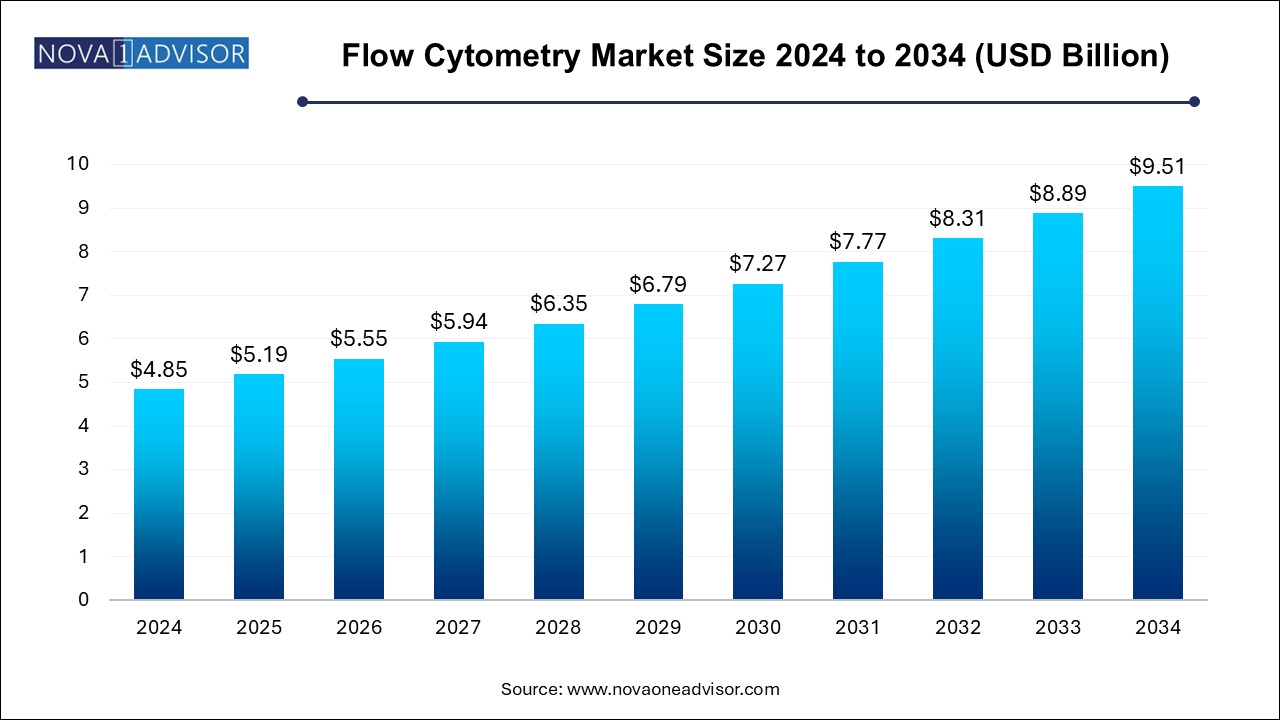

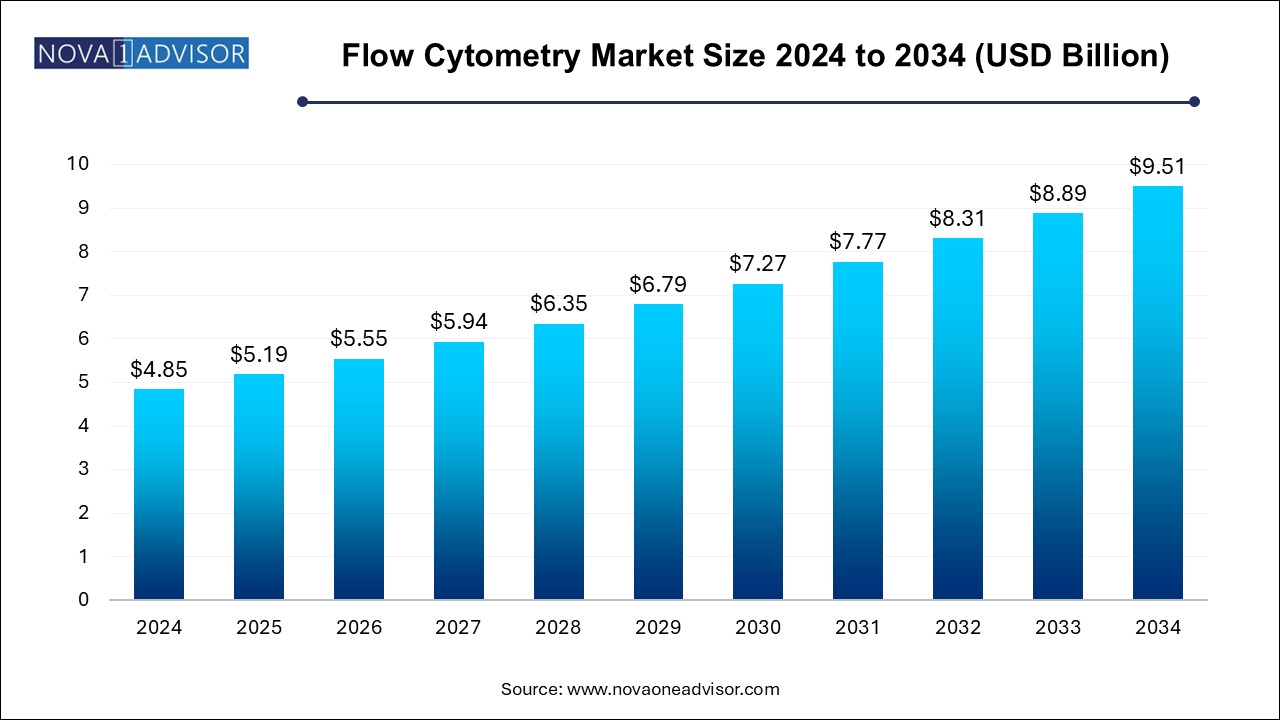

The flow cytometry market size was exhibited at USD 4.85 billion in 2024 and is projected to hit around USD 9.51 billion by 2034, growing at a CAGR of 6.97% during the forecast period 2024 to 2034.

Flow Cytometry Market Key Takeaways:

- The instrument segment dominated the market with a revenue share of 35.40% in 2024.

- The software segment is expected to witness significant CAGR from 2024 to 2034.

- Cell-based flow cytometry held the largest revenue share in 2024 and is expected to grow at a CAGR of 6.41% from 2024 to 2034.

- The bead-based assays segment is predicted to grow at an exponential CAGR from 2024 to 2034.

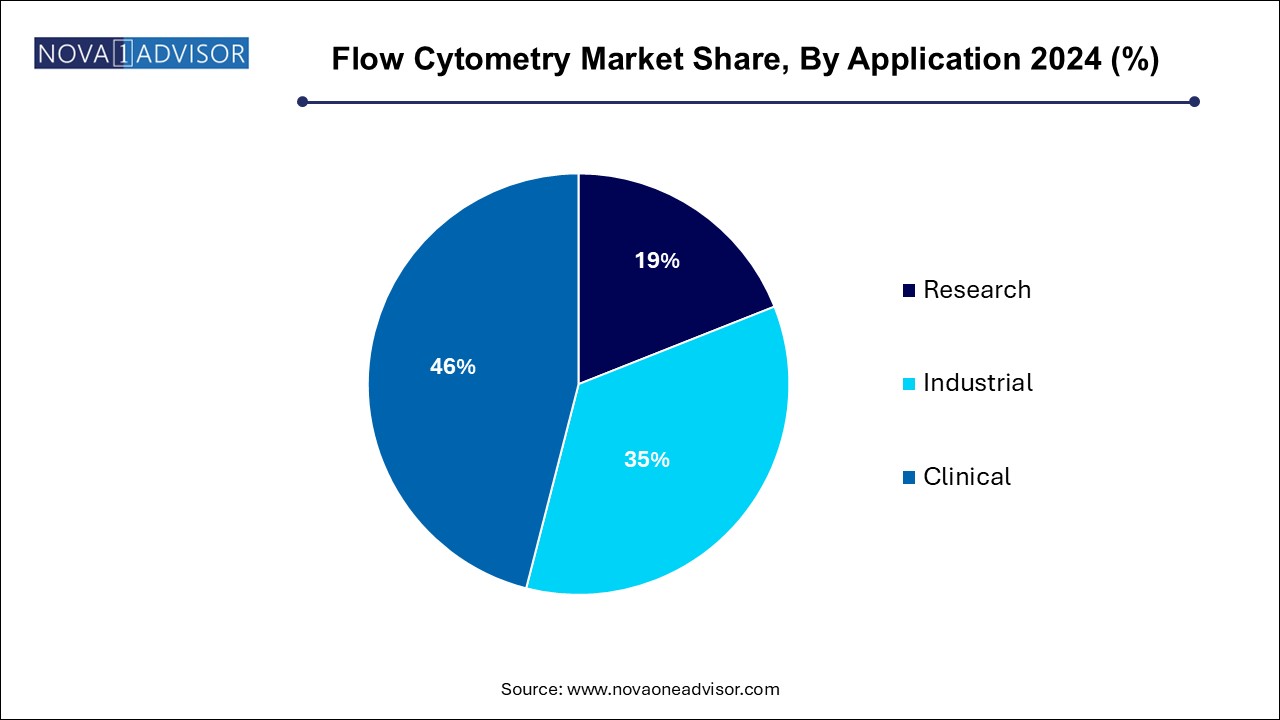

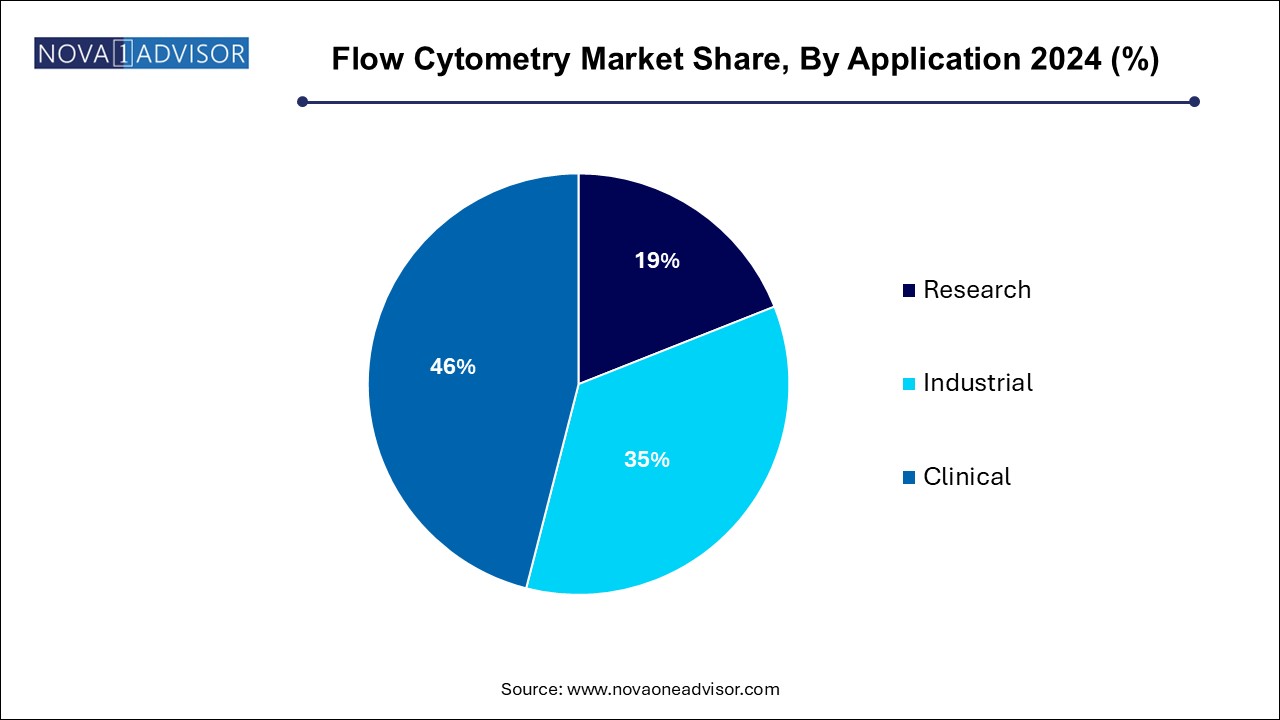

- The clinical segment accounted for a major revenue share of 46.0% in 2024.

- The academic institutes segment captured the highest revenue share in 2024.

- The clinical testing labs segment is anticipated to be the fastest-growing segment from 2024 to 2034

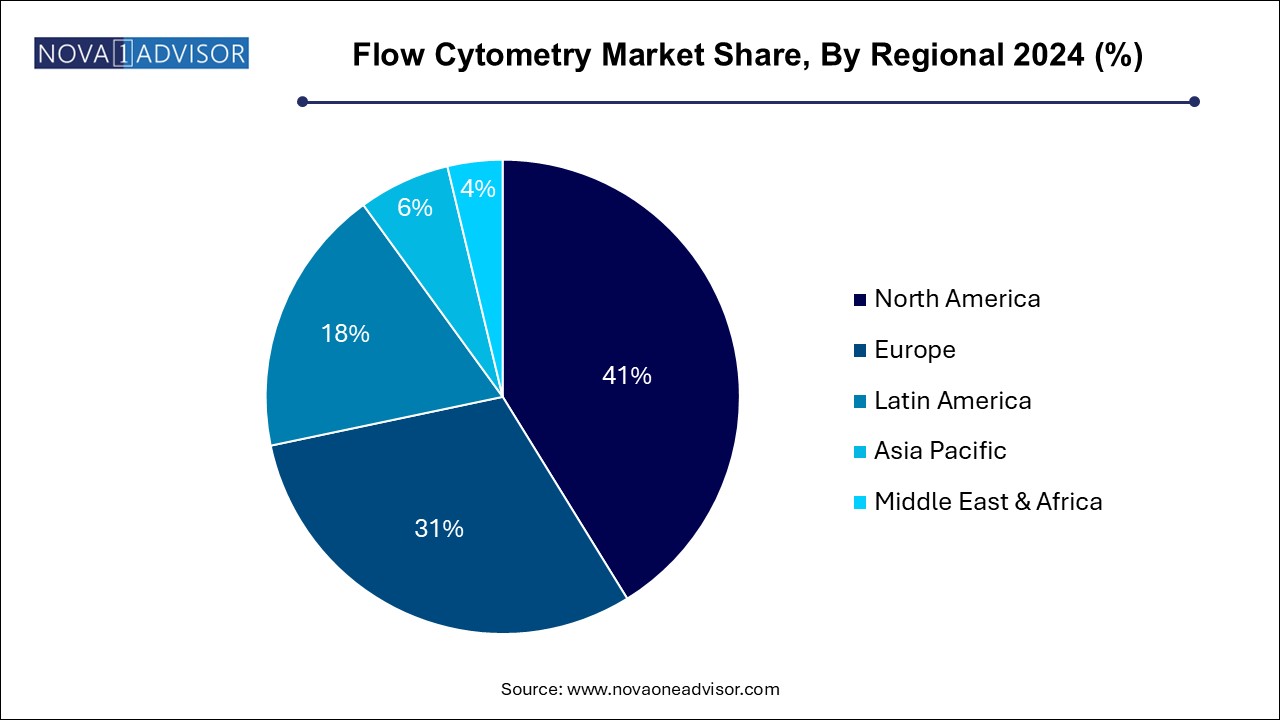

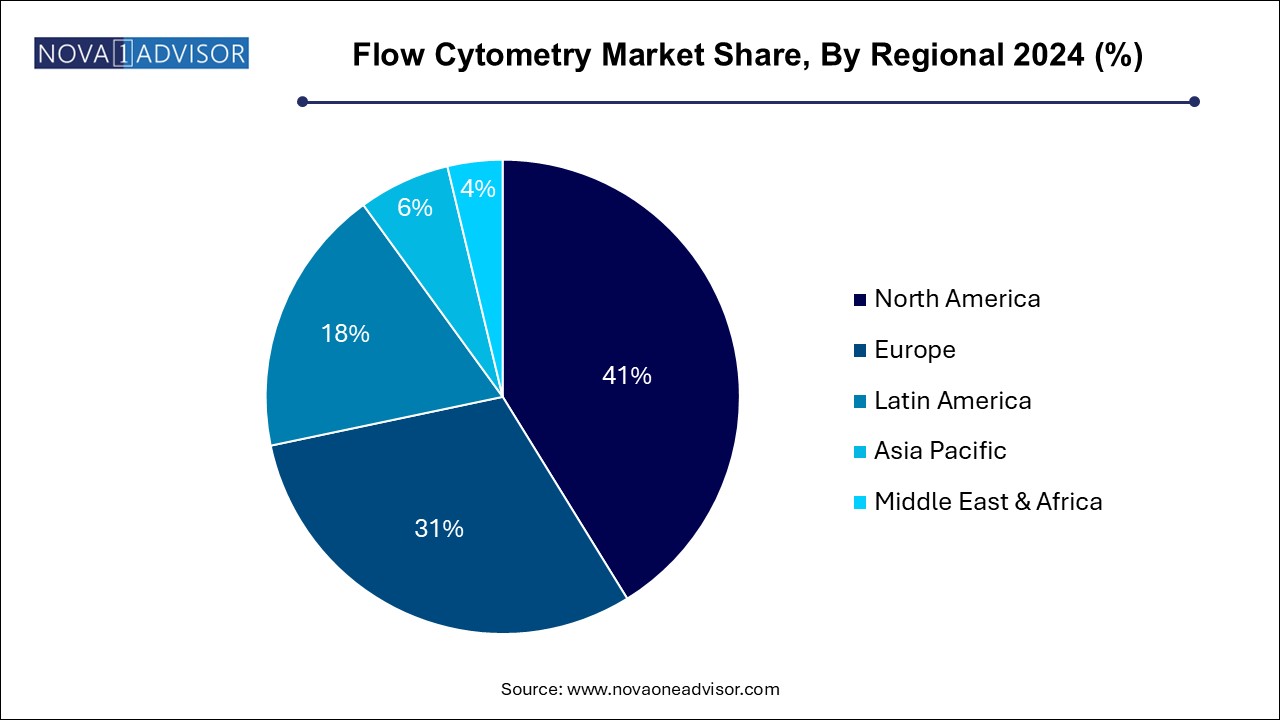

- North America dominated the overall market with a revenue share of 41.20% in 2024.

Market Overview

The flow cytometry market represents one of the most critical intersections of life sciences, diagnostics, and analytical technologies. Flow cytometry is a laser-based biophysical technology used for cell counting, sorting, biomarker detection, and protein engineering by suspending cells in a stream of fluid and passing them through an electronic detection apparatus. Widely utilized across biomedical research, clinical diagnostics, and pharmaceutical development, flow cytometry is foundational in immunology, oncology, stem cell biology, and vaccine development.

The rapid growth of personalized medicine, rising prevalence of chronic and infectious diseases, and expanded immuno-oncology research have significantly increased the demand for flow cytometric analysis. With its ability to analyze multiple parameters simultaneously at a single-cell level, the technique offers unparalleled depth in understanding disease pathology and immune response. This precision makes it indispensable for researchers and clinicians alike.

From basic research in academic laboratories to complex phenotyping in commercial biotech and high-throughput drug screening in pharmaceutical giants, flow cytometry systems are widely embedded across workflows. Recent innovations have enhanced throughput, automation, and data analytics capabilities, enabling real-time decision-making and expanded clinical applications. As new-generation flow cytometers are integrated with machine learning and AI-driven software for predictive diagnostics and cell-based therapy monitoring, the market is poised for transformational growth over the coming decade.

Major Trends in the Market

-

Miniaturization and Automation of Flow Cytometers: Compact and fully automated systems are improving accessibility and usability in non-specialized laboratories and clinical settings.

-

Integration with Artificial Intelligence and Machine Learning: AI-enhanced cytometry platforms are supporting faster, more accurate cell population classification and diagnostic decision-making.

-

Rising Demand for Single-Cell Analysis: Advances in genomics and personalized medicine are boosting interest in high-resolution, single-cell-level analytics.

-

Shift Toward Multiparametric and High-Throughput Cytometry: Instruments are now capable of analyzing over 20 parameters simultaneously, increasing research capabilities.

-

Expansion of Flow Cytometry in Immunotherapy and CAR-T Cell Therapy: It plays a crucial role in immune profiling, monitoring efficacy, and safety of cell-based therapies.

-

Growth of Bead-Based Cytometry in Multiplex Diagnostics: Bead-based assays are gaining traction in serological and infectious disease testing.

-

Cloud-Based Data Management and Remote Access: Integration of cloud technologies is facilitating global data sharing and multi-site collaboration in large research programs.

Report Scope of Flow Cytometry Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 5.19 Billion |

| Market Size by 2034 |

USD 9.51 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 6.97% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Product, Technology, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Danaher; BD; Sysmex Corp.; Agilent Technologies, Inc.; Apogee Flow Systems Ltd.; Bio-Rad Laboratories, Inc.; Thermo Fisher Scientific, Inc.; Stratedigm, Inc.; Miltenyi Biotec; Cytek Biosciences; Sony Group Corporation (Sony Biotechnology Inc.) |

Market Driver: Expanding Use in Immuno-Oncology and Precision Medicine

A key driver in the flow cytometry market is its indispensable role in immuno-oncology and the expansion of precision medicine. As immune checkpoint inhibitors, adoptive cell therapies (like CAR-T), and cancer vaccines reshape oncology treatment paradigms, flow cytometry remains central to immune monitoring and biomarker discovery. It enables precise quantification of immune cell subsets (e.g., T-cells, NK cells), detection of cytokines, and evaluation of tumor-infiltrating lymphocytes (TILs).

For example, in CAR-T therapy, flow cytometry is used to assess transduction efficiency, monitor T-cell expansion, and detect memory phenotype markers, ensuring patient safety and therapeutic effectiveness. The ability to perform detailed immunophenotyping makes flow cytometry vital in evaluating patient responses and adjusting treatment protocols. With oncology clinical trials increasingly relying on immunological endpoints, demand for high-performance cytometry systems and reagents is rising sharply.

Market Restraint: High Cost of Instruments and Complex Operation

Despite strong demand, a major restraint in the market is the high cost of acquisition, operation, and maintenance of flow cytometers, particularly advanced multicolor and high-speed models. Instruments from leading manufacturers often require significant upfront investment, as well as recurring costs for calibration, reagents, and trained personnel.

Moreover, the complexity of operating flow cytometry systems especially multicolor panels necessitates skilled technicians who are proficient in panel design, gating strategy, and data interpretation. In many developing countries and small-scale laboratories, limited budget and expertise present barriers to adoption. Although newer user-friendly and compact systems are emerging, achieving wide accessibility remains a challenge.

Market Opportunity: Expansion of Clinical Applications and Point-of-Care Integration

A significant opportunity lies in the expansion of flow cytometry into clinical diagnostics, particularly in hematological malignancies, autoimmune conditions, and infectious disease monitoring. Flow cytometry has long been a cornerstone of HIV progression assessment, but newer panels are now enabling diagnosis of leukemia subtypes, minimal residual disease (MRD) detection, and even tuberculosis immunodiagnostics.

As companies innovate compact, automated flow cytometers with pre-validated panels for specific clinical applications, the potential to integrate cytometry into decentralized testing environments grows. For instance, portable flow cytometers are being explored for field use in epidemiological surveys or remote clinics. Companies that successfully develop cost-effective, CLIA-waived flow cytometry systems could unlock massive growth in global diagnostics markets.

Flow Cytometry Market By Product Insights

Reagents and consumables dominate the product segment, representing the largest share due to their recurring nature and essential role in every cytometry assay. These include fluorochrome-conjugated antibodies, viability dyes, buffer solutions, and calibration kits. With the growing complexity of multicolor panels and need for precise gating, demand for high-quality, customizable reagents continues to rise. Vendors offering broad, validated antibody panels optimized for various platforms are particularly competitive in the research and clinical sectors.

Instruments are the fastest-growing segment, fueled by innovation in compact, high-throughput, and multiparametric analyzers and sorters. Cell sorters with enhanced safety features and high-speed sorting capabilities are gaining attention in gene therapy and stem cell applications. Additionally, newer analyzers integrated with touchscreen interfaces, automation, and AI-assisted software are lowering the operational barrier and attracting new labs. The push for lab automation and demand for point-of-care cytometry tools further propel this segment.

Flow Cytometry Market By Technology Insights

Cell-based flow cytometry is the dominant technology, due to its versatility and precision in single-cell analysis. It is widely applied in immune profiling, cancer research, drug development, and clinical diagnostics. The ability to simultaneously measure physical and chemical characteristics of cells using fluorescence-labeled antibodies provides unparalleled insights into disease mechanisms and therapeutic responses. Cell-based cytometry remains the foundation for nearly all immunophenotyping applications in hospitals, research institutions, and pharma labs.

Bead-based cytometry is the fastest-growing technology, particularly for high-throughput multiplex assays. This technique uses microspheres coated with specific ligands to detect analytes such as cytokines, antibodies, or small molecules. Bead-based systems like Luminex are extensively used in serology, vaccine development, and allergy testing. Their ability to process thousands of samples quickly with limited volume requirements makes them ideal for centralized labs and diagnostics companies.

Flow Cytometry Market By Application Insights

Research applications dominate, accounting for the largest market share. Pharmaceutical and biotech companies, academic labs, and CROs use flow cytometry for applications such as drug discovery, stem cell analysis, in vitro toxicity testing, and immunology research. For instance, in stem cell biology, flow cytometry is used to identify pluripotent cells and track differentiation markers. Immunological assays for cytokine detection, apoptosis analysis, and T-cell exhaustion markers are increasingly used in vaccine and cancer therapy research.

Clinical applications are the fastest-growing, supported by rising incidence of cancer, organ transplant cases, and autoimmune diseases. Flow cytometry plays a central role in diagnosing hematological malignancies, evaluating immune competency, and managing conditions like lupus or rheumatoid arthritis. For example, CD4/CD8 T-cell enumeration remains a standard test in HIV management. More recently, flow cytometry is used to assess vaccine responses, such as antibody titers and B-cell populations in COVID-19 vaccine trials.

Flow Cytometry Market By End-use Insights

Commercial organizations dominate the end-use segment, particularly pharmaceutical companies, biotechnology firms, and contract research organizations (CROs). These entities rely heavily on flow cytometry in early-stage drug screening, target validation, and mechanism of action studies. As the biotech startup ecosystem flourishes globally, more firms are investing in advanced cytometers and customized antibody panels to support proprietary research pipelines.

Clinical testing laboratories are the fastest-growing end-users, driven by an increase in molecular diagnostics and personalized medicine. Labs offering cytometry-based diagnostic services for cancers, immunodeficiencies, or transplant monitoring are expanding rapidly. Consolidation of diagnostics services and the emergence of specialty labs focused on immuno-oncology and CAR-T monitoring further fuel this segment. These labs benefit from advances in workflow automation, digital cytometry, and reimbursement support.

Flow Cytometry Market By Regional Insights

North America leads the global flow cytometry market, with the United States accounting for the lion’s share due to its advanced healthcare system, strong research infrastructure, and dominant presence of major market players such as BD Biosciences, Thermo Fisher Scientific, and Beckman Coulter. NIH and private foundation funding for immunology, oncology, and genomics research continuously support cytometry adoption. Furthermore, the region’s active biopharmaceutical pipeline, coupled with a robust network of CROs and academic centers, ensures high usage across research and clinical domains.

Asia-Pacific is the fastest-growing region, driven by expanding biomedical research, increasing cancer prevalence, and greater investment in healthcare infrastructure. China, Japan, India, and South Korea are witnessing rapid adoption of flow cytometry in clinical laboratories, medical universities, and pharmaceutical R&D hubs. Governments in the region are funding genomics and personalized medicine initiatives, while local manufacturers and distributors are increasingly partnering with global players to offer cytometry solutions at competitive prices. The growth of private diagnostics labs and rising awareness about advanced testing are also contributing to market expansion.

Some of the prominent players in the flow cytometry market include:

- Danaher

- BD

- Sysmex Corporation

- Agilent Technologies, Inc.

- Apogee Flow Systems Ltd.

- Bio-Rad Laboratories, Inc.

- Thermo Fisher Scientific, Inc.

- Stratedigm, Inc.

- Miltenyi Biotec

- Cytek Biosciences

- Sony Group Corporation (Sony Biotechnology Inc.)

Flow Cytometry Market Recent Developments

-

BD Biosciences (April 2025): Launched a next-gen flow cytometry platform—BD FACSymphony™ A10—that enables simultaneous analysis of up to 50 parameters, aimed at translational immunology and complex biomarker discovery.

-

Beckman Coulter Life Sciences (March 2025): Released a high-throughput sorter with integrated AI for oncology applications and rare cell analysis in clinical trials.

-

Thermo Fisher Scientific (February 2025): Expanded its Invitrogen™ antibody panel line with over 1,200 new validated flow cytometry antibodies targeting immune checkpoint and stem cell markers.

-

Cytek Biosciences (January 2025): Introduced cloud-enabled data sharing capabilities across its Aurora and Northern Lights platforms for multi-site collaboration and meta-analysis in large-scale studies.

-

Luminex Corporation (December 2024): Announced CE-IVD approval for its bead-based cytometry COVID-19 serology panel in Europe, expanding its reach into decentralized labs.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the flow cytometry market

By Product

-

- Cell Analyzers

- Cell Sorters

- Reagents & Consumables

- Software

- Accessories

- Services

By Technology

By Application

-

-

- Drug Discovery

- Stem Cell

- In Vitro Toxicity

-

- Apoptosis

- Cell Sorting

- Cell Cycle Analysis

- Immunology

- Cell Viability

- Others

-

- Cancer

- Organ Transplantation

- Immunodeficiency

- Hematology

- Autoimmune Disorders

By End-use

-

- Biotechnology Companies

- Pharmaceutical Companies

- CROs

- Hospitals

- Academic Institutes

- Clinical Testing Labs

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)