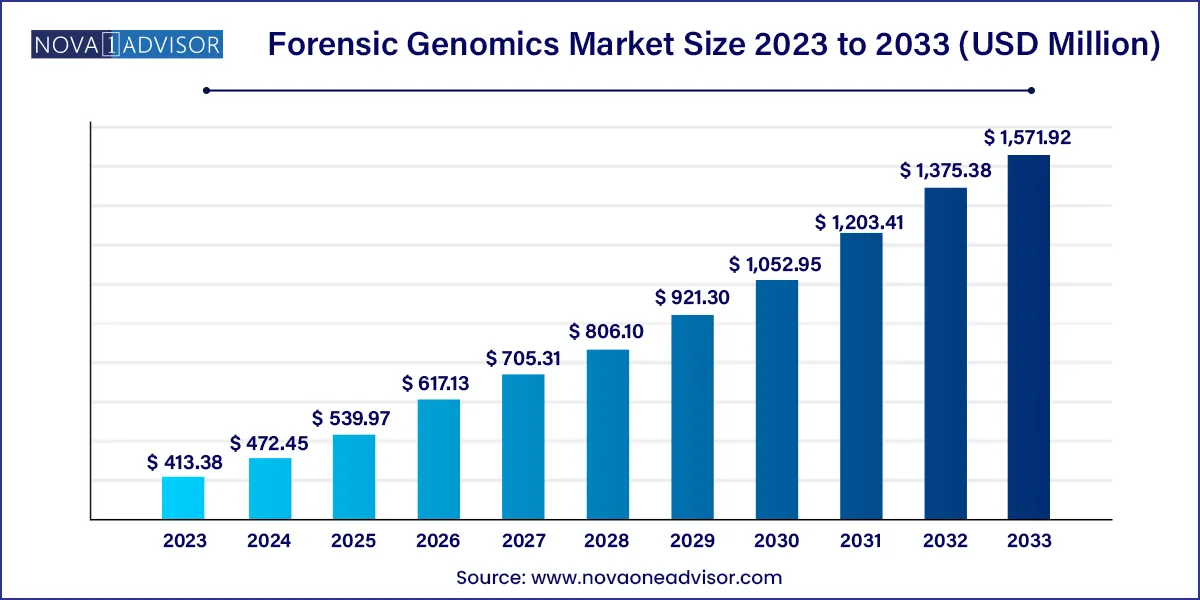

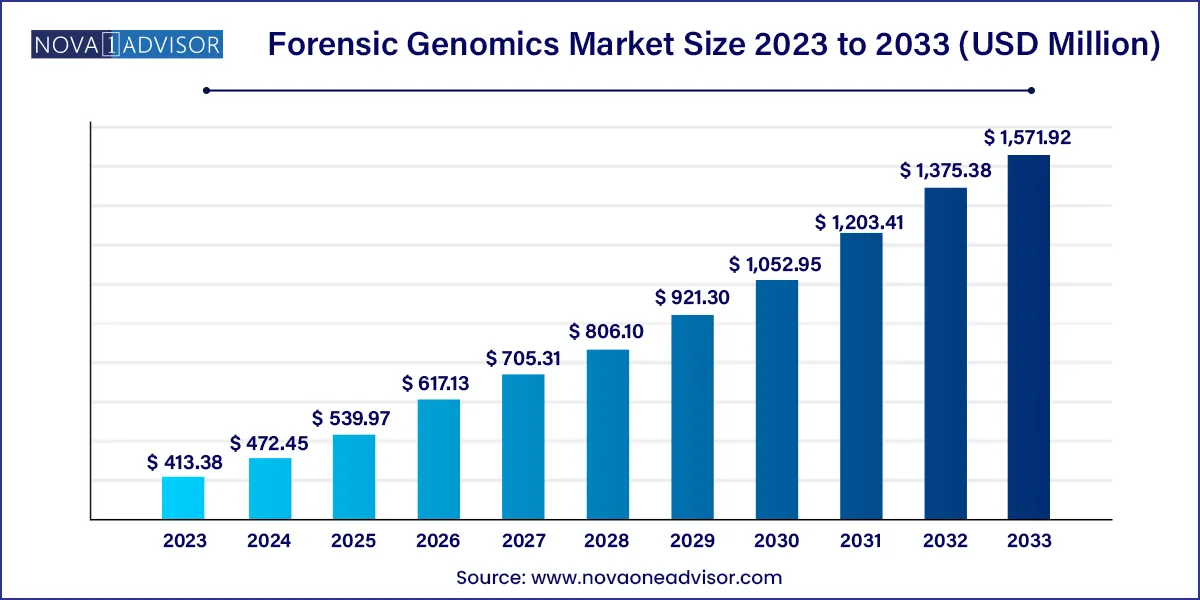

The global forensic genomics market size was exhibited at USD 413.38 million in 2023 and is projected to hit around USD 1,571.92 million by 2033, growing at a CAGR of 14.29% during the forecast period 2024 to 2033.

Key Takeaways:

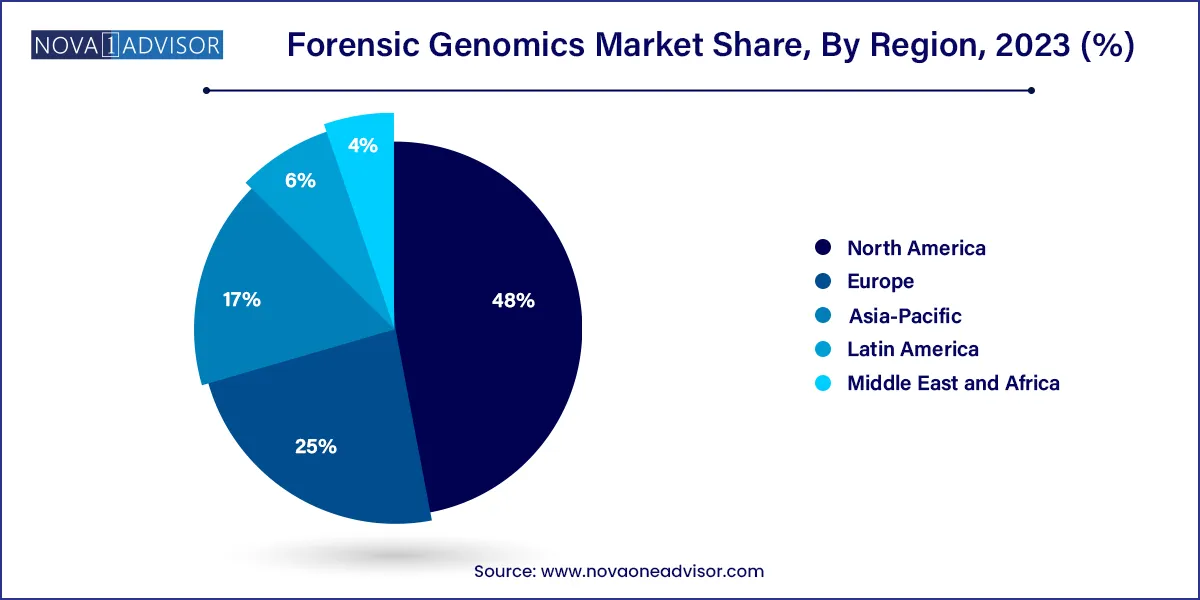

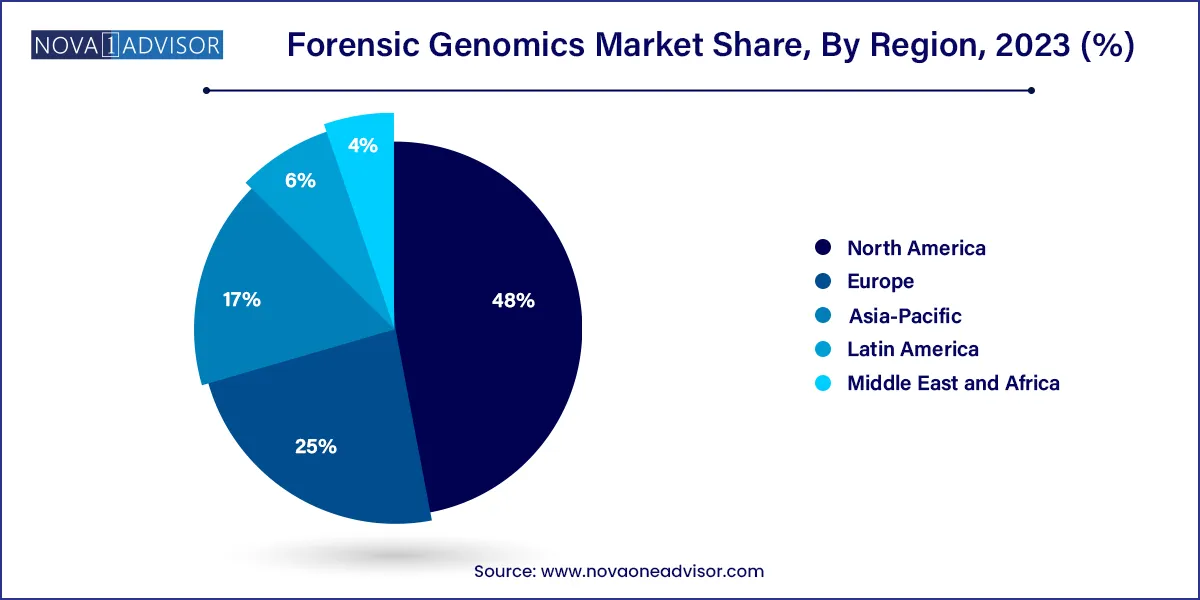

- North America dominated the global industry in 2023 and accounted for the largest share of 48.0% of the overall revenue

- The consumables & kits segment dominated the industry in 2023 and accounted for the maximum share of more than 65.30% of the overall revenue..

- The CE segment dominated the global industry in 2023 and accounted for a revenue share of more than 40.95%.

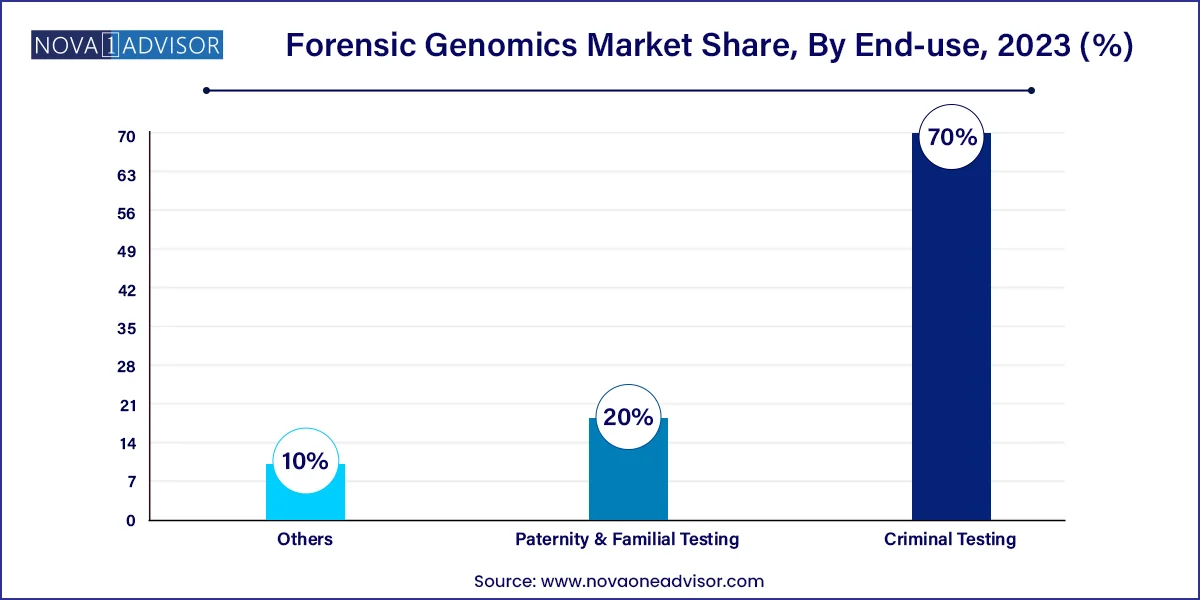

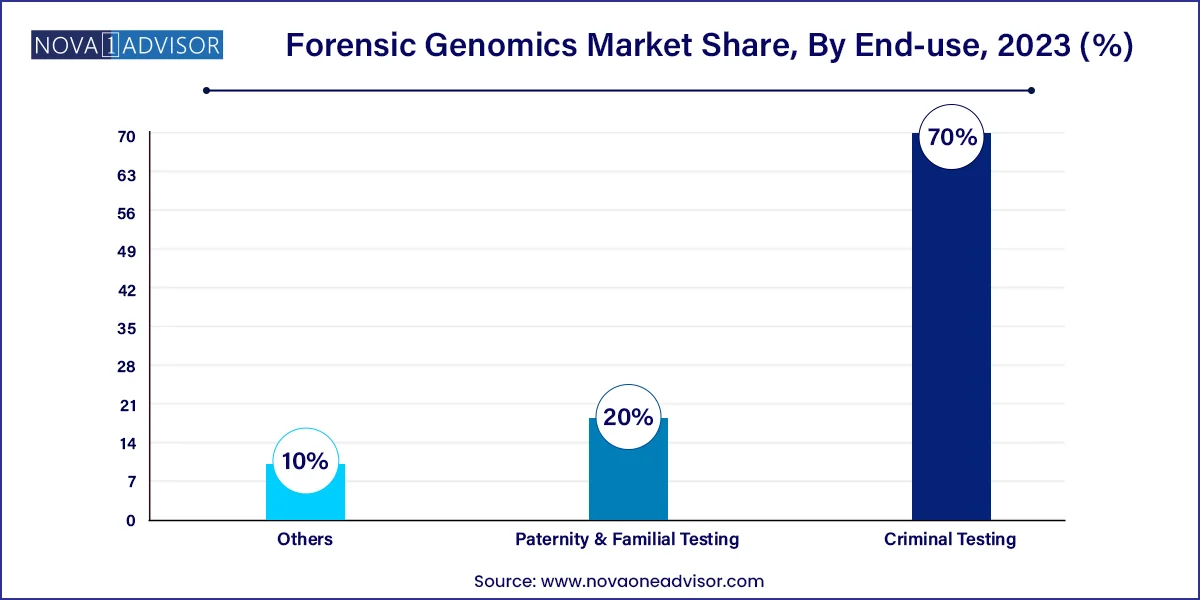

- The criminal testing application segment accounted for the highest share of more than 70.0% in 2023 owing to the increasing cases of crimes globally.

Market Overview

The forensic genomics market has evolved significantly over the past decade, driven by advances in molecular biology, genetic sequencing, and data analytics. At its core, forensic genomics involves the application of genomics technologies to identify, analyze, and interpret genetic material from crime scenes or human remains. These tools have become critical in criminal justice, disaster victim identification (DVI), paternity testing, and missing person investigations.

Unlike traditional forensic methods that rely on physical or chemical evidence, forensic genomics decodes DNA and RNA markers, offering a more definitive identification method, particularly when samples are degraded, aged, or contaminated. With growing support from legal, governmental, and security institutions, the market has gained traction not only in criminal investigations but also in immigration control, military operations, and bio-surveillance.

Key technologies propelling the market include Next-generation sequencing (NGS), Polymerase Chain Reaction (PCR), and capillary electrophoresis, alongside specialized analyzers, DNA sequencers, and bioinformatics software. These innovations enable analysts to extract actionable insights from even the smallest biological samples.

Globally, rising crime rates, increasing demand for national DNA databases, and the need for advanced tools in solving cold cases and human trafficking investigations are driving this market forward. Governments and private labs alike are investing in upgrading forensic capabilities, fostering long-term market growth.

Major Trends in the Market

-

Rapid Adoption of NGS-Based Forensic Solutions: High-throughput sequencing allows comprehensive analysis of STRs, SNPs, and mtDNA in one workflow.

-

Integration of AI and Machine Learning: Predictive models enhance DNA profiling, mixture interpretation, and kinship analysis.

-

Expansion of National DNA Databases: Countries are institutionalizing genetic registries to support criminal and civil applications.

-

Miniaturization and Portability of Sequencing Devices: Field-deployable sequencers are being developed for real-time, on-site forensic analysis.

-

Rise in Private Forensic Labs and Outsourcing: Budgetary constraints and backlog reduction are encouraging public-private partnerships.

-

Use of Epigenetics and Transcriptomics: Research is underway to determine tissue origin, age estimation, and activity timelines using non-traditional biomarkers.

-

Growth in Ethical, Legal, and Social Governance (ELSI) Frameworks: Guidelines on DNA privacy and consent are increasingly shaping product and service models.

Forensic Genomics Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 472.45 Million |

| Market Size by 2033 |

USD 1,571.92 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 14.29% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Method, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

GE Healthcare, Thermo Fisher Scientific, Inc., Agilent Technologies, Inc., Eurofins Discovery, Gene by Gene, Ltd., Verogen, Inc, Illumina, Inc., Neogen Corporation. |

Market Driver: Increasing Demand for Advanced Criminal Investigations and Cold Case Solving

One of the most compelling drivers of the forensic genomics market is the need for more effective tools in solving complex crimes, particularly cold cases, missing persons, and unidentified remains. Traditional DNA analysis methods, while effective, are often limited by sample degradation, inability to resolve mixtures, or low discriminatory power.

In contrast, forensic genomics particularly via NGS can analyze hundreds to thousands of loci simultaneously, offering higher resolution and the ability to trace ancestry, familial connections, and phenotype predictions. Law enforcement agencies are increasingly turning to these technologies to re-examine previously unsolvable cases, thereby extending justice and closure.

Cases such as the Golden State Killer’s identification through forensic genealogy exemplify the power of combining public DNA databases with advanced genomic sequencing paving the way for broader institutional adoption globally.

Despite its promise, the forensic genomics market faces significant hurdles, the most prominent being cost and operational complexity. Advanced platforms like NGS require expensive equipment, specialized training, and stringent quality assurance protocols. These factors can be a barrier for underfunded forensic laboratories, especially in developing regions.

Additionally, the interpretation of complex genetic mixtures, degraded samples, and low-template DNA poses bioinformatics challenges. Implementing new genomics workflows often demands significant capital investment in software integration, data security, and laboratory infrastructure delaying market penetration in cost-sensitive environments.

Moreover, privacy concerns and evolving regulatory landscapes around the use of genetic data in criminal and civil contexts can further complicate market expansion.

Market Opportunity: Expanding Use of Forensic Genomics in Humanitarian and Military Applications

Beyond criminal forensics, the market is witnessing new growth avenues in humanitarian, disaster recovery, and military operations. Forensic genomics is increasingly used in identifying war victims, disaster casualties, and missing persons, particularly in post-conflict or mass-fatality scenarios.

Organizations like the International Committee of the Red Cross (ICRC), Interpol, and national defense departments are collaborating with genomics labs to establish standard protocols for mass identification. The rise in geopolitical conflicts, climate-related disasters, and refugee crises is fueling the need for robust, scalable, and ethically sound identification tools.

Additionally, the development of portable, ruggedized DNA sequencers and rapid-testing kits provides an opportunity for on-site analysis in remote or crisis environments transforming how forensic genomics is applied on a global scale.

By Product Insights

Analyzers and sequencers dominate the product segment, owing to their central role in high-throughput DNA analysis. These devices, including benchtop and portable platforms, are the backbone of forensic laboratories, enabling detailed STR, SNP, and mtDNA profiling. Established brands such as Illumina, Thermo Fisher, and Verogen provide platforms widely adopted in public and private labs. Their high cost is balanced by throughput efficiency and analytical precision.

Kits and consumables are the fastest-growing subsegment, due to recurring usage in every testing cycle. These include sample prep reagents, PCR kits, extraction kits, and quality control products. The growing demand for scalable and validated forensic workflows ensures continued growth in this category.

By Method

Capillary electrophoresis currently dominates the method segment, particularly for STR-based human identification in legacy systems. Many national and local DNA labs rely on this well-established, court-admissible methodology for routine criminal profiling, especially in regions where NGS adoption remains limited.

Next-generation sequencing (NGS) is the fastest-growing method, offering simultaneous detection of multiple marker types, including STRs, SNPs, mtDNA, and Y-STRs. Its ability to provide enhanced discrimination power and mixture resolution makes it ideal for complex forensic cases, ancestry inference, and kinship analysis. The increasing affordability and user-friendly nature of newer platforms further support its growth.

By Application

Criminal testing leads the application segment, as the majority of forensic genomics work supports law enforcement in solving crimes, identifying suspects, and validating witness statements. DNA analysis is now integral to major investigations globally, with an increasing focus on high-volume backlogs and cold case reanalysis.

Paternity and familial testing is the fastest-growing application, especially in countries where cross-border immigration, inheritance claims, and child custody cases require genetic validation. The rise of direct-to-consumer ancestry testing has also driven public interest in familial relationship testing, indirectly boosting demand in regulated forensic channels.

By Regional Insights

North America dominates the global forensic genomics market, led by the U.S., which hosts some of the most advanced forensic infrastructure and technology providers. Government initiatives like the Combined DNA Index System (CODIS), increasing investments in crime lab modernization, and proactive regulatory support from agencies like the FBI and NIJ bolster market leadership. High-profile cold case resolutions and forensic genealogy advancements also keep North America at the forefront.

Asia-Pacific is the fastest-growing region, driven by rising crime rates, modernization of criminal justice systems, and expanding forensic capabilities in India, China, South Korea, and Southeast Asia. Government-backed projects to build national DNA databases, coupled with growing awareness about forensic technology, are propelling demand. Additionally, local players are emerging with cost-effective solutions suited to regional needs.

Some of the prominent players in the Forensic genomics market include:

- GE Healthcare

- Thermo Fisher Scientific, Inc.

- Agilent Technologies, Inc.

- Eurofins Discovery

- Gene by Gene, Ltd.

- Verogen, Inc.

- Illumina, Inc.

- Neogen Corp.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2033. For this study, Nova one advisor, Inc. has segmented the global forensic genomics market.

Product

- Analyzers & Sequencers

- Software

- Kits & Consumables

Method

- Capillary Electrophoresis

- Next-generation Sequencing

- PCR Amplification

Application

- Criminal Testing

- Paternity & Familial Testing

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)