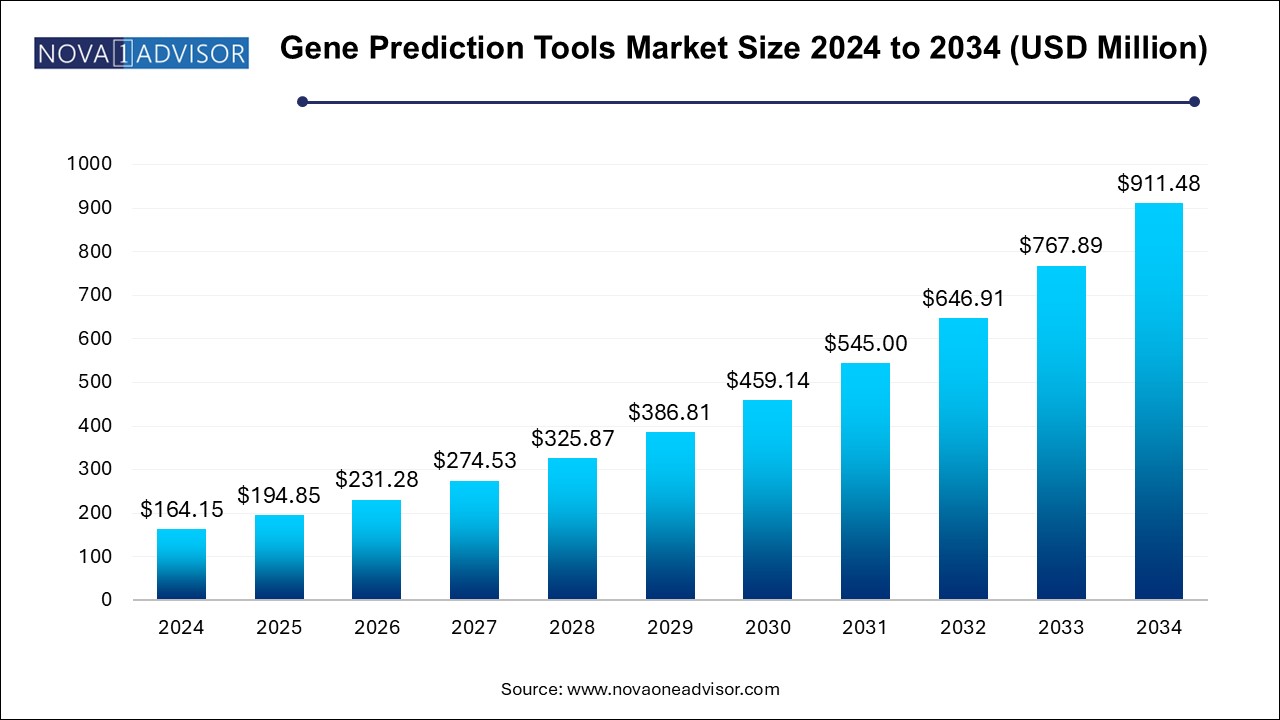

The gene prediction tools market size was exhibited at USD 164.15 million in 2024 and is projected to hit around USD 911.48 million by 2034, growing at a CAGR of 18.7% during the forecast period 2025 to 2034.

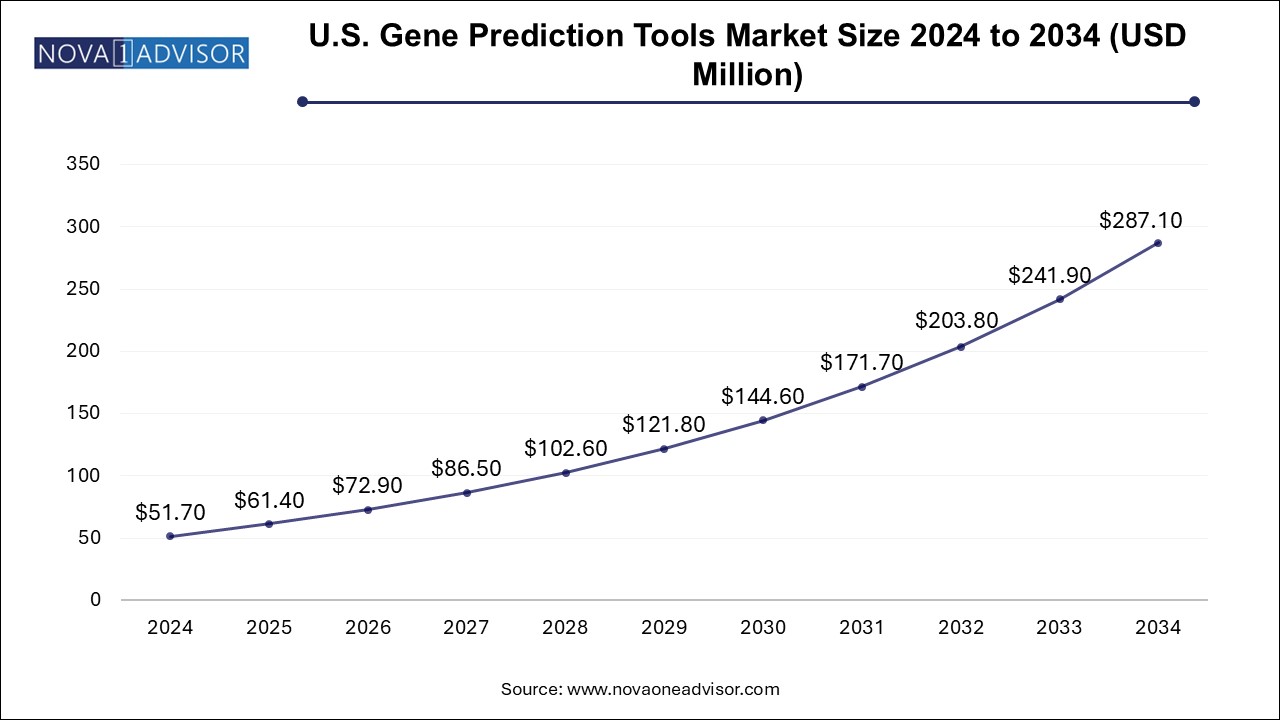

The U.S. gene prediction tools market size is evaluated at USD 51.7 million in 2024 and is projected to be worth around USD 287.1 million by 2034, growing at a CAGR of 16.86% from 2025 to 2034.

North America, led by the United States, is the largest market for gene prediction tools. The region’s dominance stems from its strong academic ecosystem, robust funding for genomic research, and the presence of leading biotechnology companies and sequencing platform developers. The U.S. is home to major genome annotation projects like the NIH’s Genomic Data Commons, the Cancer Genome Atlas (TCGA), and the All of Us Research Program, all of which utilize gene prediction pipelines extensively.

Companies such as Illumina, Thermo Fisher Scientific, and DNAnexus have also contributed to the proliferation of integrated genomics platforms that include prediction modules. The widespread adoption of NGS and AI-based bioinformatics in North American hospitals, pharma companies, and academic labs further solidifies the region’s leadership in this market.

Asia Pacific is the Fastest Growing Region

The Asia Pacific region is witnessing the fastest growth in the gene prediction tools market. Countries like China, India, and South Korea are investing heavily in genomics infrastructure, personalized medicine, and biotechnology education. China’s National Genomics Data Center and India’s GenomeIndia project are examples of government-led initiatives driving demand for gene prediction and annotation tools.

The rapid digitization of healthcare, increasing prevalence of genetic disorders, and emerging genomic startups are creating fertile ground for tool adoption. Asia Pacific also benefits from cost-effective bioinformatics talent, making it an attractive hub for outsourcing genome annotation services. As genomic literacy increases and more clinical applications emerge, this region is expected to be a major growth engine for the gene prediction tools industry.

Market Overview

The gene prediction tools market is experiencing a significant transformation as genomic research continues to expand in both scale and complexity. Gene prediction, a computational process that identifies regions of DNA that encode genes, is critical in annotating genomes and understanding gene structure and function. These tools enable scientists to decipher the blueprint of life, laying the foundation for advances in fields ranging from personalized medicine to agricultural genomics and evolutionary biology.

The increasing availability of sequenced genomes—from microbes to humans—has created an urgent need for accurate, scalable, and efficient tools that can analyze vast genomic datasets. Gene prediction tools, which include both standalone software and integrated bioinformatics services, are now pivotal in applications such as identifying protein-coding genes, discovering non-coding RNAs, and pinpointing regulatory elements. These tools operate using methods such as ab initio modeling, empirical evidence-based approaches, and hybrid systems, providing robust capabilities across a wide spectrum of biological complexity.

Market growth is further driven by the convergence of artificial intelligence (AI), big data analytics, and cloud computing with genomics. The integration of machine learning models has enhanced the predictive accuracy of gene finding algorithms, while the proliferation of genomics-as-a-service platforms allows researchers to access these tools remotely with high computational throughput. Across academia, biotech firms, pharmaceutical companies, and diagnostics developers, gene prediction has become an essential toolset that drives innovation, accelerates drug discovery, and enables precision medicine.

Major Trends in the Market

-

Increased integration of AI and machine learning into gene prediction algorithms, improving accuracy in identifying complex genomic features.

-

Cloud-based bioinformatics services offering scalable, on-demand access to gene prediction pipelines for global research teams.

-

Rising use of gene prediction tools in metagenomics, aiding in the study of microbial communities in healthcare, agriculture, and environmental sciences.

-

Expansion of open-source platforms and collaborations among academia and biotech firms to democratize access to advanced prediction tools.

-

Customization of gene prediction tools for species-specific applications, especially in non-model organisms used in agricultural and environmental research.

-

Use of gene prediction in rare disease diagnostics, where novel gene identification is essential to understanding inherited conditions.

-

Commercialization of next-generation sequencing (NGS) platforms, fueling downstream demand for annotation tools such as gene predictors.

-

Collaborations between pharma companies and genomics startups to use predictive tools in accelerating early-stage target discovery.

| Report Coverage |

Details |

| Market Size in 2025 |

USD 194.85 Million |

| Market Size by 2034 |

USD 911.48 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 18.7% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Type, Method, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Thermo Fisher Scientific; Bio-Techne; Charles River Laboratories; Eurofins; GenScript; Danaher; MedGenome; Sino Biological; Syngene; Twist Bioscience |

Market Driver: Rising Demand for Personalized Medicine and Genomic Annotation

A central driver of the gene prediction tools market is the growing global emphasis on personalized medicine, which depends heavily on the accurate interpretation of individual genomes. Personalized medicine seeks to tailor healthcare based on an individual’s genetic makeup, and this requires detailed genomic annotation—including the identification of protein-coding genes, regulatory sequences, and mutation hotspots.

Gene prediction tools serve as the foundational element in this workflow, enabling researchers to identify both known and novel genes in patient genomes. For example, when analyzing whole-genome sequencing (WGS) data from cancer patients, gene prediction software helps isolate oncogenes or tumor suppressor genes involved in tumor progression. Tools like AUGUSTUS, GENSCAN, and BRAKER are commonly used in such pipelines.

As more healthcare systems globally incorporate genetic screening and NGS into routine diagnostics, the need for rapid and accurate gene prediction becomes essential. The downstream implications of these predictions are vast—from drug target identification and pharmacogenomics to biomarker discovery and population-scale genomic initiatives.

Market Restraint: Lack of Standardization and Accuracy Challenges in Complex Genomes

Despite technological progress, a major restraint in the gene prediction tools market is the lack of standardized benchmarks and the difficulty of achieving high prediction accuracy in complex or poorly annotated genomes. While model organisms like humans and mice benefit from rich databases of empirical evidence, non-model organisms and metagenomic samples often suffer from sparse reference data.

This presents a significant challenge, especially for ab initio methods that rely on statistical modeling without experimental data. The variability in gene structure, intron-exon complexity, alternative splicing, and post-transcriptional modifications can lead to false positives or incomplete predictions. In metagenomic datasets, where short reads from multiple unknown species are analyzed simultaneously, the prediction error can be even more pronounced.

Additionally, the diversity of software tools—each with their own algorithms, user interfaces, and parameter settings—creates interoperability issues. This lack of harmonization across platforms hampers reproducibility and scalability, particularly in multi-center research projects or large pharmaceutical R&D pipelines.

Market Opportunity: Expansion of Agricultural and Environmental Genomics

An emerging opportunity in the gene prediction tools market lies in the expanding application of genomics in agriculture and environmental science. As governments and agritech companies seek to develop climate-resilient crops, reduce pesticide dependence, and understand soil and water microbiomes, gene prediction tools are being leveraged to annotate the genomes of plants, pests, and microbes involved in agricultural ecosystems.

For instance, the genome of the wheat crop—one of the most complex and repetitive among cereals—was successfully annotated with the help of advanced gene prediction algorithms. Similarly, the study of nitrogen-fixing bacteria in soil or drought-resistant genes in rice depends on predictive annotation of relevant gene clusters. Environmental genomics, including the analysis of ocean plankton and pollutants’ microbial impact, also utilizes these tools to identify new enzymes and functional genes in microbial populations.

As countries push toward sustainable agriculture and climate research, gene prediction tools will be crucial in characterizing biodiversity, discovering bioactive compounds, and engineering next-generation bioresources.

The software segment leads the gene prediction tools market, accounting for the largest revenue share due to the extensive use of standalone and integrated bioinformatics applications in genome analysis. These include popular tools like AUGUSTUS, Glimmer, GeneMark, and Prodigal, which offer both GUI and command-line versions to support diverse research workflows. Many of these tools are open-source or licensed, catering to both academic and commercial users.

Software platforms allow researchers to conduct genome annotations on local servers or through cloud-hosted environments. They support the import of sequencing data, facilitate ORF (open reading frame) identification, and provide visualization of gene structures. Some software suites also integrate downstream functionalities such as transcriptome alignment, functional annotation, and evolutionary analysis, making them indispensable in genomic research and diagnostics development.

In contrast, services represent the fastest-growing segment, especially as many research institutions and biopharma companies opt for outsourced solutions. These services, offered by specialized bioinformatics firms, provide end-to-end genome analysis pipelines that include gene prediction, annotation, and reporting. This model benefits organizations lacking in-house bioinformatics infrastructure or expertise. As genomics projects scale globally, demand for scalable, cloud-based gene prediction services will continue to rise.

Ab initio methods dominate the gene prediction tools market because of their versatility and independence from experimental evidence. These tools use computational models, including hidden Markov models (HMMs) and neural networks, to identify gene structures based solely on DNA sequence features like codon usage, GC content, and exon-intron architecture. Ab initio prediction is particularly useful in newly sequenced genomes with limited annotation history.

Tools like GENSCAN, SNAP, and GeneMark rely on training sets and mathematical modeling to identify coding regions with high speed and scalability. Their ability to function without the need for transcriptome data makes them a preferred choice in early-stage genome projects or in non-model species.

However, empirical methods are growing fastest, driven by the increasing availability of transcriptomic and proteomic data. These approaches use known gene models, RNA-Seq alignments, and expressed sequence tags (ESTs) to inform gene prediction, offering higher accuracy and context-specific insights. Hybrid methods that integrate empirical evidence with ab initio predictions are gaining traction, particularly in clinical genomics and precision medicine applications, where accuracy is paramount.

The drug discovery and development segment holds the largest market share, as pharmaceutical and biotech companies rely on gene prediction tools to identify novel therapeutic targets and validate disease-associated genes. Predictive annotation of genomes helps researchers pinpoint regulatory sequences, identify mutations, and understand gene-environment interactions that influence drug response.

In cancer drug discovery, for example, gene prediction tools are used to identify driver mutations and fusion genes that can be targeted with precision therapies. Similarly, rare disease gene discovery often involves extensive gene prediction and annotation efforts, particularly in WGS studies.

Diagnostics development is the fastest-growing application, fueled by the integration of gene prediction with liquid biopsy analysis, prenatal screening, and hereditary disease panels. As healthcare shifts toward genomics-driven diagnostics, the accurate identification of coding and non-coding genes becomes critical. Tools that can identify novel variants, splice sites, and regulatory regions are in high demand across clinical laboratories and genomics startups.

Academic and research institutions dominate the gene prediction tools market, as they are the primary drivers of genomic research and annotation projects. Universities and research centers use these tools to investigate gene function, evolution, epigenetics, and disease mechanisms. Open-access initiatives such as ENSEMBL and UCSC Genome Browser provide platforms where gene prediction results are integrated with functional genomics data.

This segment is supported by government-funded programs like NIH’s Human Genome Project, Genome Canada, and EU’s Horizon initiatives, all of which rely on large-scale genomic data interpretation.

However, the industrial segment is growing at the fastest pace, especially in sectors such as pharmaceuticals, agrigenomics, and biotech R&D. Companies involved in microbial fermentation, enzyme discovery, or gene therapy use gene prediction tools to optimize metabolic pathways, engineer synthetic genomes, and streamline bioproduction processes. This commercial application of gene prediction is opening new revenue streams for tool developers and bioinformatics service providers.

-

February 2025 – Ensembl released a new version of its genome browser integrating deep learning-based gene prediction models across vertebrate genomes.

-

January 2025 – Thermo Fisher Scientific announced the launch of a next-gen bioinformatics pipeline incorporating gene prediction for rare variant annotation.

-

November 2024 – Illumina partnered with Seer Bioinformatics to integrate predictive gene annotation tools in its personalized oncology platform.

-

September 2024 – SoftGenetics released GeneMarkerX with enhanced gene prediction capabilities tailored for forensic and clinical genetics applications.

-

July 2024 – QIAGEN Digital Insights expanded its CLC Genomics Workbench suite with AI-enhanced prediction modules for microbial genome annotation.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the gene prediction tools market

By Type

By Method

- Empirical Methods

- Ab initio Methods

- Others

By Application

- Drug Discovery & Development

- Diagnostics Development

- Others

By End-use

- Academic & Research

- Industrial

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)