Generic Drugs Market Size Trends Analysis and Forecast till 2034

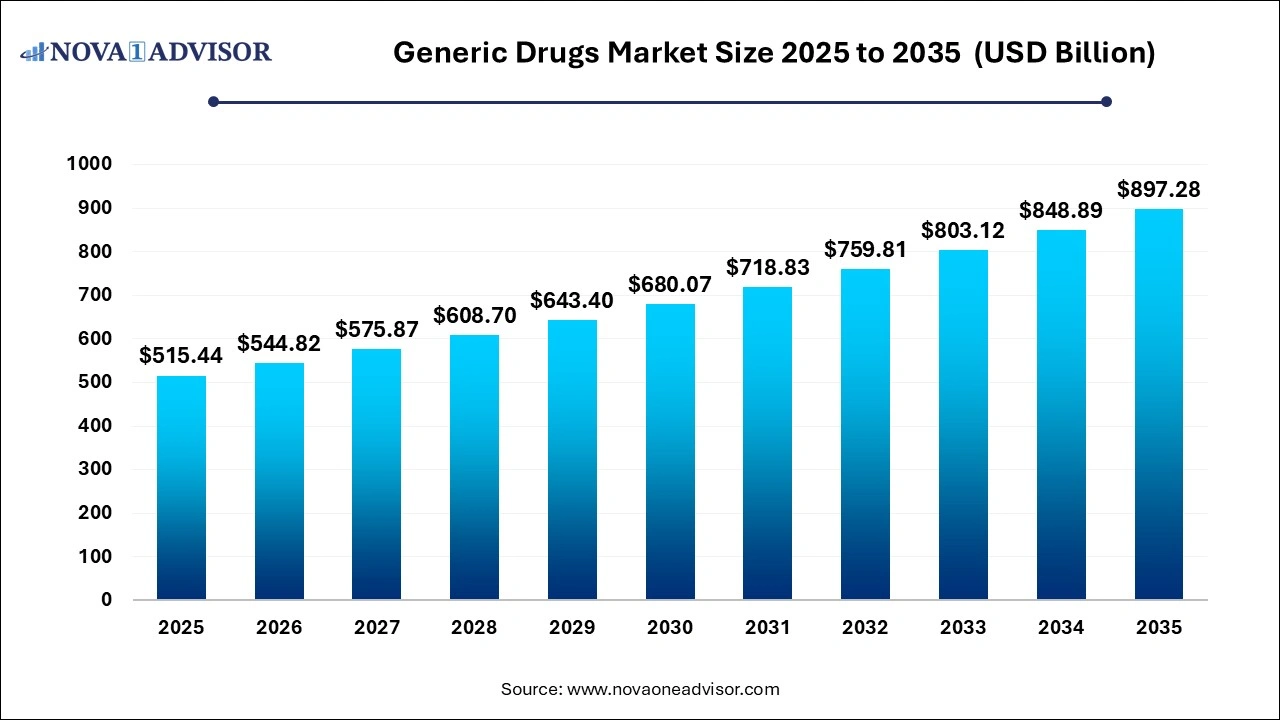

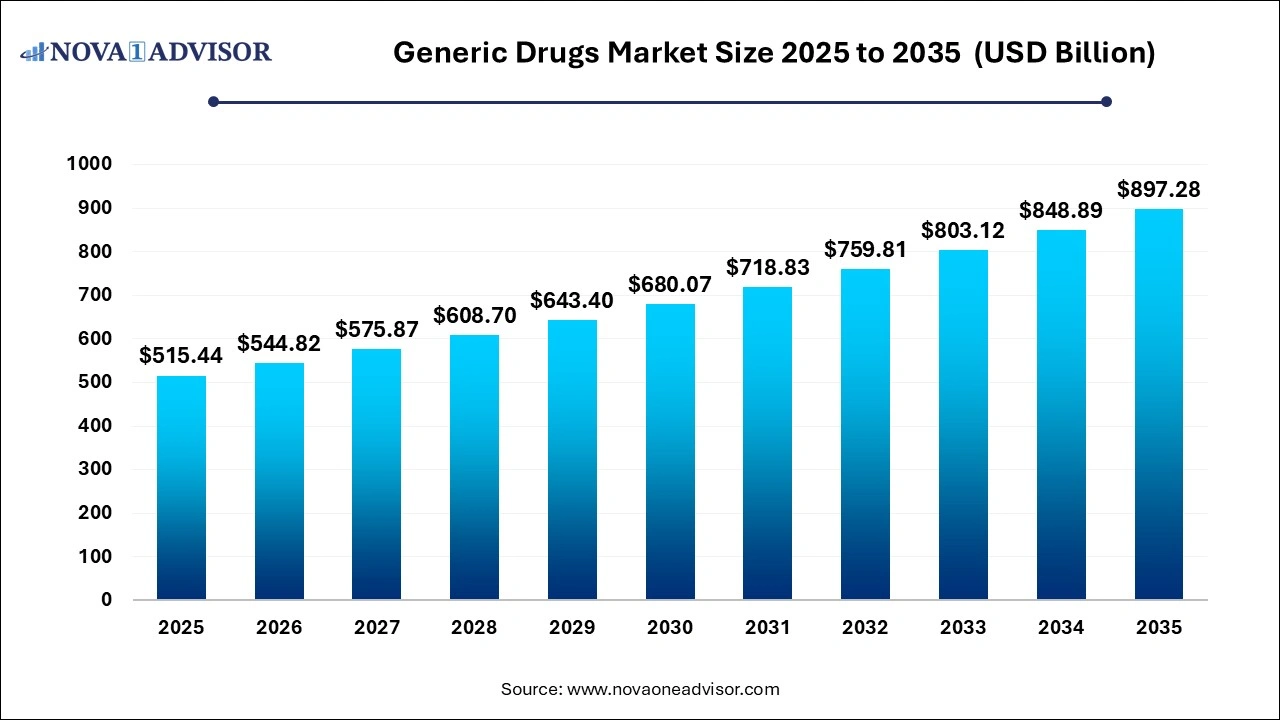

The global Xxxmarket size was calculated at USD 515.44 billion in 2025 and is expected to reach USD 897.28

billion by 2035, growing at a CAGR of 5.7% from 2026 to 2035. The market is growing due to rising demand for affordable medication and increasing patent expiration of branded drugs. Government initiatives promoting cost-effective healthcare also boost the market growth.

Key Takeaways

- North America dominated the generic drugs market with a revenue share in 2025.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By therapeutic application, the diabetes segment led the market with the largest revenue share in 2025.

- By therapeutic application, the cardiovascular diseases segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By route of administration, the oral segment held the largest market share in 2025.

- By route of administration, the injection segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By distribution channel, the retail pharmacies segment held the highest market share in 2025.

- By distribution channel, the hospital pharmacies segment is expected to grow at the fastest CAGR in the market during the forecast period.

What is Generic Drugs?

Generic drugs are low-cost versions of branded medicines that contain the same active ingredients, strength, and effectiveness as the original approved drugs. The growth of the generic drugs market is driven by expanding healthcare access in emerging burden of non-communicable diseases. Pharmaceutical companies are also focusing on strategic collaborations and biosimilars development to enhance product portfolios. Moreover, regulatory agencies are streamlining approval processes, reducing barriers for generic entries. These factors collectively contribute to the rapid global adoption and competitiveness of generic medicines in both developed and developing markets.

What are the Key trends in the Generic Drugs Market in 2024?

- In December 2024, India’s Health Minister stated that over 14,000 Pradhan Mantri Bharatiya Janaushadhi Kendras would supply affordable, high-quality generic medicines to enhance access to essential healthcare.

- In October 2024, the U.S. Centers for Medicare & Medicaid Services announced that by January 2027, 101 generic medicines, including penicillin, metformin, lithium, and albuterol inhalers, would be offered to Medicare beneficiaries at just $2 per month.

How Can AI Affect the Generic Drugs Market?

AI is reshaping the market by enhancing patent analysis, identifying potential molecules for formulation, and predicting market trends. It aids in automating clinical trial data assessment, ensuring faster approvals, and improving pharmacovigilance through real-time monitoring of adverse effects. Additionally, AI supports cost-efficient manufacturing and personalized drug recommendations, helping companies maintain competitiveness while ensuring the timely availability of safe, effective, and affordable generic medicines across diverse healthcare systems.

Generic Drugs Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 544.82 Billion |

| Market Size by 2035 |

USD 897.28 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 5.7% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

By Therapeutic Application, By Route of Administration, By Distribution Channel, By Region |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Generic Drugs Market Dynamics

Driver

Patent Expiration of Branded Drugs

The expiration of branded drug patents fuels the generic drugs market by opening doors for multiple manufacturers to produce and sell the same medication. This boosts market competition, lowers treatment costs, and accelerates patient access to essential therapies. It also encourages pharmaceutical companies to invest in efficient production and marketing strategies for generics, expanding their market presence. Overall, patent expiration created a favorable environment for rapid growth and increased adoption of cost-effective generic medicine worldwide.

- For Instance, In June 2024, Teva launched an authorized generic of Novo Nordisk’s diabetes drug Victoza, marking the first generic GLP-1 medication in the U.S. Hikma Pharmaceuticals also received FDA approval for its generic version in December 2024.

Restraint

High Quality and Safety Expectations

High quality and safety expectations pose a significant restraint in the generic drugs market due to the stringent regulatory standards and rigorous testing required to ensure bioequivalence and patient safety. Manufacturers must heavily in advanced technologies and quality control measures to meet these standards, leading to increased production costs and extended development timelines. Smaller companies may struggle with these financial and technical demands, limiting their ability to enter the market and hindering the overall growth of the generic drug sector.

Opportunity

Expanding Healthcare Access in Emerging Markets

Expanding healthcare access in emerging markets presents a significant opportunity for the generic drugs market. Governments in countries like India. Brazil and Mexico are implementing policies to enhance access to essential medicines, creating new market potential for generics. Additionally, the increasing prevalence of chronic diseases in these regions drives demand for affordable treatment options. This trend allows manufacturers to expand their reach, increase sales, and strengthen their presence in high-growth regions.

Segmental Insights

By Therapeutic Application Insights

What made the Diabetes Segment Dominant in the Generic Drugs Market in 2025?

In 2025, the diabetes segment led the market with the largest revenue shares due to the rising global prevalence of diabetes and increasing demand for long-term, affordable treatments. The high cost of branded antidiabetic medications drives patients and healthcare providers towards cost-effective generic alternatives. Additionally, the introduction of multiple generic versions of widely used drugs like metformin and empagliflozin has expanded accessibility, strengthened market penetration, and significantly contributed to the revenue growth in this therapeutic segment.

The cardiovascular disease segment is expected to grow at a faster CAGR in the generic drugs market due to the rising prevalence of heart-related conditions worldwide, including hypertension, coronary artery disease, and heart failure. Increasing awareness about affordable treatment options and the availability of multiple generic versions of key cardiovascular drugs, such as statins and beta-blockers, is driving adoption. Additionally, aging populations and lifestyle-related risk factors further boost demand, making cardiovascular generics a high-growth therapeutic segment during the forecast period.

By Route of Administration Insights

How did Oral Dominate the Generic Drugs Market in 2025?

The oral segment held the largest market share in 2025 because oral medications are convenient, easy to administer, and widely accepted by patients. They are suitable for a broad range of chronic and acute conditions, including diabetes, cardiovascular diseases, and infections. Additionally, the availability of numerous oral generic formulations, cost-effectiveness, and well-established manufacturing processes contribute to their high adoption. These factors collectively make oral administration the dominant segment in the market.

The injection segment is expected to register the fastest CAGR in the generic drugs market during the forecast period due to the increasing demand for biologics and specialty medications that require parenteral administration. Injectable generics, including insulin, vaccines, and oncology drugs, are gaining popularity because they provide rapid and targeted therapeutic effects. Additionally, advancements in manufacturing technologies, improved stability of injectable formulations, and growing adoption in hospitals and clinics are driving market growth, making injections a high-growth route of administration.

By Distribution Channel Insights

Why the Retail Pharmacies Segment Dominated the Generic Drugs Market in 2025?

The retail pharmacies segment held the highest market share in 2025 because they provides convenient access to a wide range of generic medications for patients. They are widely available in urban and rural areas, making it easier for consumers to obtain essential drugs quickly. Additionally, retail pharmacies often offer competitive pricing, discounts, and counseling services, encouraging patient trust and repeat purchases. Their established distribution networks and high consumer footfall contribute to their dominant position in the market.

The hospital pharmacies segment is expected to grow at the fastest CAGR in the generic drugs market during the forecast period due to increasing hospital admissions and the rising demand for inpatient care. Hospitals require a steady supply of high-quality generics for critical treatments, surgeries, and chronic disease management. Additionally, the expansion of healthcare infrastructure, adoption of specialty generics, and government initiatives to improve hospital-based drug accessibility are driving growth, making hospital pharmacies a rapidly expanding distribution channel.

Regional Insights

How is North America contributing to the Expansion of the Generic Drugs Market?

North America dominated the market in 2025 due to a well-established healthcare infrastructure, high adoption of cost-effective medications, and a strong presence of major generic drug manufacturers. The region benefits from extensive government support, including Medicare and Medicaid programs that promote generic utilization. Additionally, numerous patent expirations of high-revenue branded drugs in the U.S. have enabled rapid entry of generics. Growing patient awareness, advanced regulatory frameworks, and robust distribution networks further reinforced North America’s leading revenue share.

- For Instance, In June 2025, Hikma Pharmaceuticals USA announced plans to invest USD 1 billion by 2030 to strengthen its U.S. manufacturing and R&D capabilities. The initiative, titled “America Relies on Hikma: Quality Pharmaceuticals Made in the USA,” aims to expand the company’s capacity to produce and supply a broad range of generic drugs, supporting the U.S. healthcare system and ensuring consistent access to essential medications nationwide.

How is Asia-Pacific Accelerating the Generic Drugs Market?

The Asia-Pacific region is expected to grow at the fastest CAGR in the market during the forecast period due to increasing healthcare access, rising population, and growing prevalence of chronic diseases. Expanding healthcare infrastructure, government initiatives promoting affordable medicines, and a strong base of local generic manufacturers further fuel growth. Additionally, rising awareness about cost-effective treatment options and increasing medical insurance coverage are driving higher adoption of generics, making Asia-Pacific a high-growth market in the coming years.

Top Companies in the Generic Drugs Market

Recent Developments in the Generic Drugs Market

- In March 2025, Mallinckrodt plc and Endo, Inc. announced a definitive agreement to merge through a stock and cash deal, forming a globally diversified and scaled pharmaceutical company.

- In February 2025, Cosette Pharmaceuticals, Inc. announced an agreement to acquire all outstanding shares of Mayne Pharma Group Limited at AUD 7.40 per share, valuing the deal at around USD 430 million. The boards of both companies approved the transaction, with Mayne Pharma’s board unanimously recommending shareholders support the acquisition.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the generic drugs market.

By Therapeutic Application

- Diabetes

- Cardiovascular Diseases

- Cancer

- Infectious Diseases

By Route of Administration

By Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

List of Tables

- Table 1: Global Generic Drugs Market Size (USD Billion) by Therapeutic Application, 2024–2034

- Table 2: Global Generic Drugs Market Size (USD Billion) by Route of Administration, 2024–2034

- Table 3: Global Generic Drugs Market Size (USD Billion) by Distribution Channel, 2024–2034

- Table 4: North America Market Size (USD Billion) by Therapeutic Application, 2024–2034

- Table 5: North America Market Size (USD Billion) by Route of Administration, 2024–2034

- Table 6: North America Market Size (USD Billion) by Distribution Channel, 2024–2034

- Table 7: U.S. Market Size (USD Billion) by Therapeutic Application & Route of Administration, 2024–2034

- Table 8: Canada Market Size (USD Billion) by Therapeutic Application & Route of Administration, 2024–2034

- Table 9: Mexico Market Size (USD Billion) by Therapeutic Application & Route of Administration, 2024–2034

- Table 10: Europe Market Size (USD Billion) by Therapeutic Application, 2024–2034

- Table 11: Europe Market Size (USD Billion) by Route of Administration, 2024–2034

- Table 12: Germany Market Size (USD Billion) by Therapeutic Application & Route of Administration, 2024–2034

- Table 13: France Market Size (USD Billion) by Therapeutic Application & Route of Administration, 2024–2034

- Table 14: UK Market Size (USD Billion) by Therapeutic Application & Route of Administration, 2024–2034

- Table 15: Italy Market Size (USD Billion) by Therapeutic Application & Route of Administration, 2024–2034

- Table 16: Asia Pacific Market Size (USD Billion) by Therapeutic Application, 2024–2034

- Table 17: Asia Pacific Market Size (USD Billion) by Route of Administration, 2024–2034

- Table 18: China Market Size (USD Billion) by Therapeutic Application & Route of Administration, 2024–2034

- Table 19: Japan Market Size (USD Billion) by Therapeutic Application & Route of Administration, 2024–2034

- Table 20: India Market Size (USD Billion) by Therapeutic Application & Route of Administration, 2024–2034

- Table 21: South Korea Market Size (USD Billion) by Therapeutic Application & Route of Administration, 2024–2034

- Table 22: Southeast Asia Market Size (USD Billion) by Therapeutic Application & Route of Administration, 2024–2034

- Table 23: Latin America Market Size (USD Billion) by Therapeutic Application & Route of Administration, 2024–2034

- Table 24: Brazil Market Size (USD Billion) by Therapeutic Application & Route of Administration, 2024–2034

- Table 25: Middle East & Africa Market Size (USD Billion) by Therapeutic Application & Route of Administration, 2024–2034

- Table 26: GCC Countries Market Size (USD Billion) by Therapeutic Application & Route of Administration, 2024–2034

- Table 27: Turkey Market Size (USD Billion) by Therapeutic Application & Route of Administration, 2024–2034

- Table 28: Africa Market Size (USD Billion) by Therapeutic Application & Route of Administration, 2024–2034

List of Figures

- Figure 1: Global Market Share by Therapeutic Application, 2024

- Figure 2: Global Market Share by Route of Administration, 2024

- Figure 3: Global Market Share by Distribution Channel, 2024

- Figure 4: North America Market Share by Therapeutic Application, 2024

- Figure 5: North America Market Share by Route of Administration, 2024

- Figure 6: North America Market Share by Distribution Channel, 2024

- Figure 7: U.S. Market Share by Therapeutic Application, 2024

- Figure 8: U.S. Market Share by Route of Administration, 2024

- Figure 9: Canada Market Share by Therapeutic Application, 2024

- Figure 10: Canada Market Share by Route of Administration, 2024

- Figure 11: Mexico Market Share by Therapeutic Application, 2024

- Figure 12: Mexico Market Share by Route of Administration, 2024

- Figure 13: Europe Market Share by Therapeutic Application, 2024

- Figure 14: Europe Market Share by Route of Administration, 2024

- Figure 15: Germany Market Share by Therapeutic Application, 2024

- Figure 16: Germany Market Share by Route of Administration, 2024

- Figure 17: France Market Share by Therapeutic Application, 2024

- Figure 18: France Market Share by Route of Administration, 2024

- Figure 19: UK Market Share by Therapeutic Application, 2024

- Figure 20: UK Market Share by Route of Administration, 2024

- Figure 21: Italy Market Share by Therapeutic Application, 2024

- Figure 22: Italy Market Share by Route of Administration, 2024

- Figure 23: Asia Pacific Market Share by Therapeutic Application, 2024

- Figure 24: Asia Pacific Market Share by Route of Administration, 2024

- Figure 25: China Market Share by Therapeutic Application, 2024

- Figure 26: China Market Share by Route of Administration, 2024

- Figure 27: Japan Market Share by Therapeutic Application, 2024

- Figure 28: Japan Market Share by Route of Administration, 2024

- Figure 29: India Market Share by Therapeutic Application, 2024

- Figure 30: India Market Share by Route of Administration, 2024

- Figure 31: South Korea Market Share by Therapeutic Application, 2024

- Figure 32: South Korea Market Share by Route of Administration, 2024

- Figure 33: Southeast Asia Market Share by Therapeutic Application, 2024

- Figure 34: Southeast Asia Market Share by Route of Administration, 2024

- Figure 35: Latin America Market Share by Therapeutic Application, 2024

- Figure 36: Latin America Market Share by Route of Administration, 2024

- Figure 37: Brazil Market Share by Therapeutic Application, 2024

- Figure 38: Brazil Market Share by Route of Administration, 2024

- Figure 39: Middle East & Africa Market Share by Therapeutic Application, 2024

- Figure 40: Middle East & Africa Market Share by Route of Administration, 2024

- Figure 41: GCC Countries Market Share by Therapeutic Application, 2024

- Figure 42: GCC Countries Market Share by Route of Administration, 2024

- Figure 43: Turkey Market Share by Therapeutic Application, 2024

- Figure 44: Turkey Market Share by Route of Administration, 2024

- Figure 45: Africa Market Share by Therapeutic Application, 2024

- Figure 46: Africa Market Share by Route of Administration, 2024