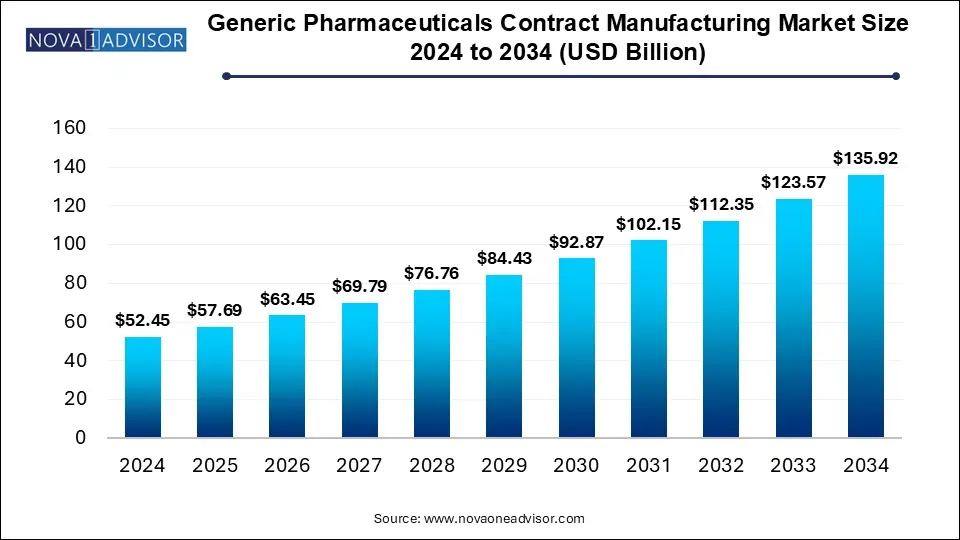

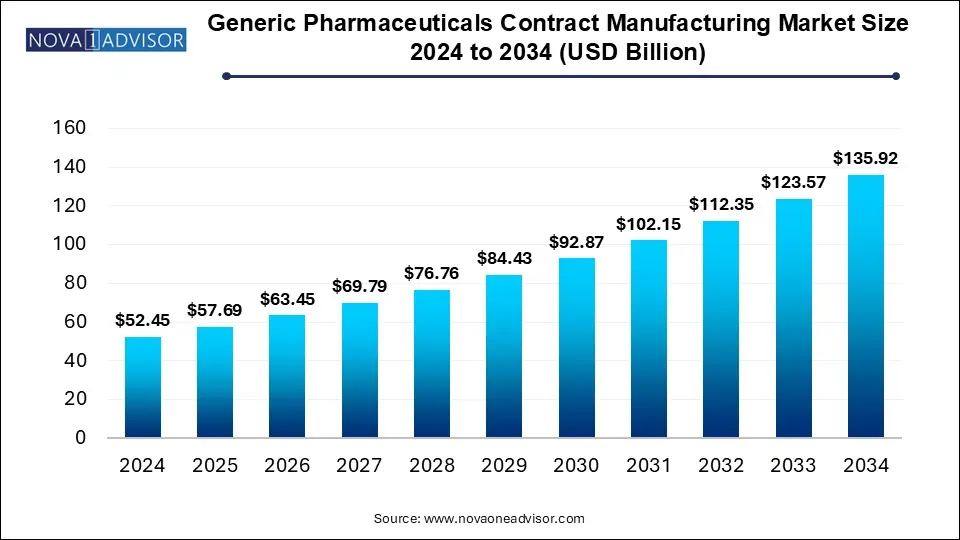

The global generic pharmaceuticals contract manufacturing market was valued at USD 52.45 billion in 2024 and is projected to reach USD 135.92 billion by 2034, registering a CAGR of 9.99% from 2025 to 2034. The global generic pharmaceuticals contract manufacturing market growth is attributed to the increasing availability of generic injectable drugs.

Key Takeaways:

- By region, North America dominated the generic pharmaceuticals contract manufacturing market in 2024.

- By region, Asia Pacific is expected to grow fastest during the forecast period.

- By drug type insights, the branded generics segment dominated the market share in 2024.

- By drug type insights, the unbranded generics segment is expected to grow fastest during the forecast period.

- By product type insights, the API segment dominated the market share in 2024.

- By product type insights, the drug product segment is expected to grow fastest during the forecast period.

- By application insights, the oncology segment dominated the generic pharmaceuticals contract manufacturing market in 2024.

- By application insights, the immunology segment is expected to grow fastest during the forecast period.

- By route of administration insights, the oral segment dominated the market share in 2024.

- By route of administration insights, the parenteral segment is expected to grow fastest during the forecast period.

Generic Pharmaceuticals Contract Manufacturing Market Overview

The generic pharmaceuticals contract manufacturing market includes partnerships between brand-name pharmaceutical companies and contract manufacturing providers to expand the production of generic equivalents. The market plays an important role in the biotechnology and pharmaceutical industries including the manufacturing and production of generic pharmaceutical products. This helps pharmaceutical companies to support the infrastructure and expertise of contract manufacturing organizations to produce generic drugs at lower cost. This helps companies to focus on marketing, research, and development, which may drive market growth.

The generic pharmaceuticals contract manufacturing market is witnessing significant growth due to factors such as the expiration of patents for branded drugs and the increasing prevalence of chronic diseases. In addition, the increasing demand for complex generic products, the adoption of biosimilars, the expansion of emerging markets, and government initiatives to promote access to affordable medications.

Innovative Trends Contributing to Market Growth

- Rising R&D activities: The rising research and development activities to help the market growth. R&D enables businesses to acquire consumer needs in an ever-changing market.

- Expansion of complex generic drugs: The expansion of complex generic drugs in the biotechnology and pharmaceutical industries, which are more demanding to manufacture, administer, and test than traditional generics, may drive the growth of the generic pharmaceuticals contract manufacturing market.

- Telemedicine and tele-pharmacy: Tele pharmacy and telemedicine are changing and enabling remote patient management and consultations of medication prescriptions, which further propels the market growth.

Generic Pharmaceuticals Contract Manufacturing Market Report Scope

| Report Coverage |

Details |

| Market Size in 2025 |

USD 57.69 Billion |

| Market Size by 2034 |

USD 135.92 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 9.9% |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Segments Covered |

Drug Type, Product, Route Of Administration, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Jubilant Generics Ltd.; Recipharm AB; Siegfried Holding AG; Aurobindo Pharma; Cambrex Corp.; Alcami Corp., Inc.; Catalent, Inc; Acme Generics Pvt. Ltd.; Syngene International Limited; Pfizer CentreOne; Curia Global, Inc.; Metric Contract Services |

Rising Technological Advancements Creates Market Opportunities

The rising technological advancements such as advanced manufacturing processes, artificial intelligence (AI), and automation are enhancing the growth of the generic pharmaceuticals contract manufacturing market. These technological advancements are reducing operational costs, improving quality control, and streamlining manufacturing efficiency. In addition, increased requirements for continuous manufacturing improve production capabilities by reducing material waste, supporting consistency, and minimizing batch processing time. Furthermore, AI-drive ensures the early detection of quality deviations in real-time monitoring and predictive analytics improve operations, maximizing efficiency and ensuring early detection. In addition, by improving overall transparency, preventing counterfeit drugs, and enhancing traceability, blockchain technology is strengthening supply chain security are further creating growth opportunities in the generic pharmaceuticals contract manufacturing market.

Risks of generic pharmaceutical contract manufacturing hamper market growth

Depending on a single manufacturing organization, the risks of generic pharmaceutical contract manufacturing involve ensuring compliance with regulatory standards may be challenging, and may lead to supply chain risks. The risk of formulation processes and proprietary production with contract manufacturing organizations raises communication hurdles and problems related to intellectual property protection, which may restrain the growth of the generic pharmaceuticals contract manufacturing market.

Segment Insights

Generic Pharmaceuticals Contract Manufacturing Market By Drug Type Insights

The branded generics segment dominated the generic pharmaceuticals contract manufacturing market in 2024. The segment growth in the market is attributed to the increasing patent expiration for innovator drugs, the growing disease burden, and the high penetration of branded generic drugs. Whereas the unbranded generics segment is expected to grow fastest during the forecast period. As compared to branded generics, the unbranded generic drugs are equally effective, safe, and cheaper, which may drive the segment growth.

Generic Pharmaceuticals Contract Manufacturing Market By Product Insights

The API segment dominated the generic pharmaceuticals contract manufacturing market in 2024. The segment growth in the market is driven by the increasing interest of public organizations in improving the production of API and increasing the requirement for patent expiry of exclusive small-molecule drugs. In addition, the drug product segment is expected to grow fastest during the forecast period. The adoption of the expansion agreements by the CMO for drug product manufacturing and increasing demand for a CMO for manufacturing drug products are expected to drive the segment growth in the market.

Generic Pharmaceuticals Contract Manufacturing Market By Application Insights

The oncology segment dominated the generic pharmaceuticals contract manufacturing market in 2024. The segment growth in the market is attributed to the growing number of CMOs focusing on the development of generic drugs, growing generic product launches, increasing demand for potency generic injectable products, and increasing prevalence of cancer. In addition, the immunology segment is expected to grow fastest during the forecast period. The segment growth in the market is driven by increasing demand for generic medications for treating immunological disorders, increased cost of medications, and growing geriatric population.

Generic Pharmaceuticals Contract Manufacturing Market By Route of Administration Insights

The oral segment dominated the generic pharmaceuticals contract manufacturing market in 2024. The segment growth in the market is propelled by the high acceptance of oral formulations. Oral formulations are used in treating common diseases, such as diabetes, migraines, infectious diseases, and fever, and are considered more flexible in design. Furthermore, the parenteral segment growth is attributed to the immediate onset of action and the increasing bioavailability of injectable formulations.

Generic Pharmaceuticals Contract Manufacturing Market By Regional Insights

North America dominated the generic pharmaceuticals contract manufacturing market in 2024. The market growth in the region is attributed to the increasing focus on pharmaceutical industries and contract manufacturers, the increasing presence of a large number of major players, and favorable government regulations. The U.S. and Canada are dominating countries driving the market growth.

Asia Pacific Market Trends

The generic pharmaceuticals contract manufacturing market growth in the region is driven by increasing demand for affordable generic drugs in emerging countries and increasing healthcare expenditure. China, India, Japan, and South Korea are the fastest growing countries in the market. The increasing trend towards the use of cutting-edge technologies, rising investments in pharmaceuticals R&D, and increasing demand for biologics and generic drugs are expected to drive market growth in India.

Some of the prominent players in the Generic pharmaceuticals contract manufacturing market include:

- Jubilant Generics Ltd.

- Recipharm AB

- Siegfried Holding AG

- Aurobindo Pharma

- Cambrex Corp.

- Alcami Corp., Inc.

- Catalent, Inc.

- Acme Generics Pvt Ltd.

- Syngene International Ltd.

- Pfizer CentreOne

- Curia Global, Inc.

- Metric Contract Services

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the global generic pharmaceuticals contract manufacturing market.

Drug Type

- Branded Generics

- Unbranded Generics

Product

Route of Administration

- Oral

- Parenteral

- Topical

- Others

Application

- Oncology

- Immunology

- Antidiabetic

- Neurology

- Anticoagulants

- Cardiovascular

- Respiratory

- Pain

- HIV antivirals

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)