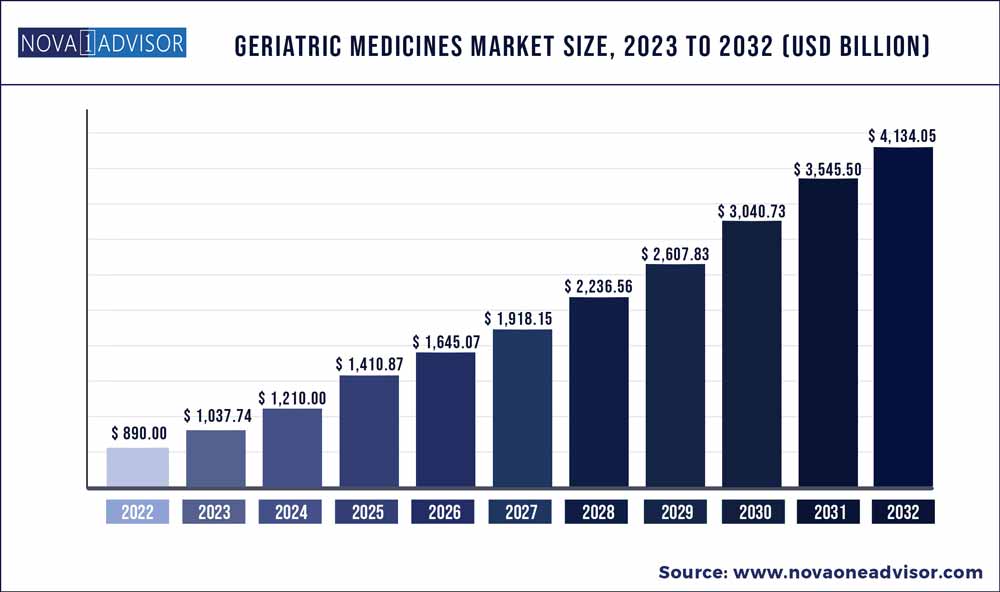

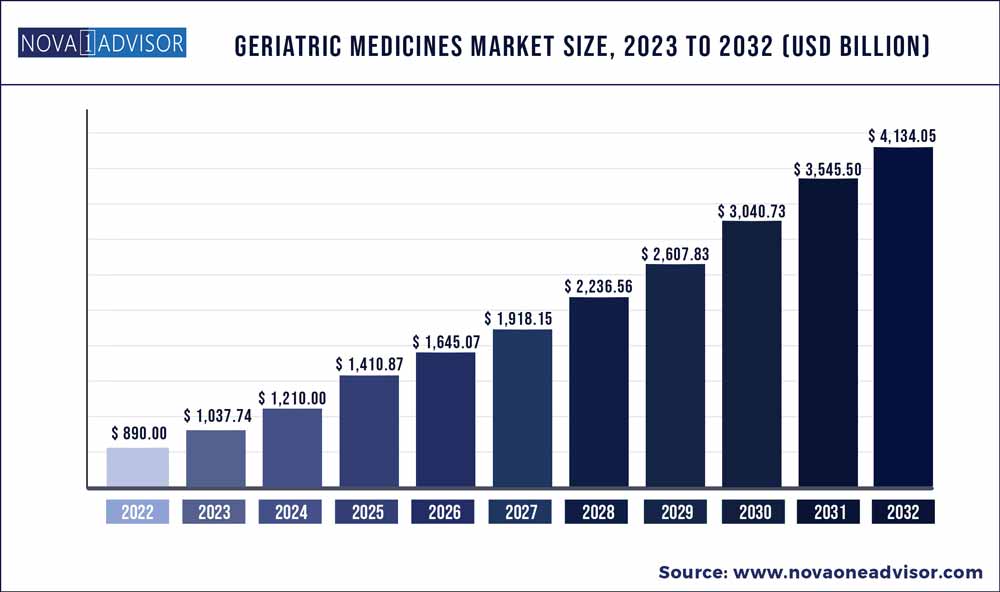

The global geriatric medicines market size was exhibited at USD 890 billion in 2022 and is projected to hit around USD 4,134.05 billion by 2032, growing at a CAGR of 16.6% during the forecast period 2023 to 2032.

Key Takeaways:

- U.S. Geriatric Medicines Market in 2023-2032

- North America dominated the geriatric medicines market in 2022 with a CAGR of 5.6% from 2023 to 2032.

- Asia-Pacific is expected to develop at the fastest rate 6.5% during the forecast period.

- The analgesics segment dominated the geriatric medicines market in 2022.

- The cardiovascular segment dominated the geriatric medicines market in 2022.

Market Overview

The global geriatric medicines market is poised for substantial growth as the global population continues to age at an unprecedented rate. Geriatric medicine, or geriatric pharmacotherapy, focuses on the diagnosis, treatment, and prevention of disease in older adults, a demographic segment that faces unique challenges such as polypharmacy, multiple chronic conditions, and age-related physiological changes. As per the United Nations, by 2050, people aged 60 years and older are projected to reach 2.1 billion globally, up from 1.1 billion in 2020. This demographic shift is influencing healthcare priorities, policies, and innovations, thereby fueling the demand for medications tailored for the elderly.

The complexity of medical care in this age group necessitates a distinct therapeutic approach. Aging leads to decreased renal and hepatic functions, altered pharmacokinetics and pharmacodynamics, and increased susceptibility to adverse drug reactions. Consequently, the development and commercialization of age-appropriate formulations such as easy-to-swallow tablets, transdermal patches, and liquid suspensions are gaining traction. Additionally, governments and healthcare systems are adopting more senior-centric policies, with some countries like Japan and Germany leading in geriatric healthcare infrastructure.

In this dynamic landscape, pharmaceutical companies are investing in R&D to produce safer and more effective drugs for elderly patients. Moreover, collaboration between public health institutions and private sector players is fostering innovation in geriatric care solutions, including personalized medicine, digital health tools, and integrated treatment plans.

Major Trends in the Market

-

Rising Polypharmacy Among the Elderly: The growing incidence of multiple comorbidities in seniors, such as diabetes, hypertension, and arthritis, leads to polypharmacy, thus driving the demand for comprehensive geriatric pharmacological solutions.

-

Innovation in Drug Delivery Systems: Development of age-friendly formulations such as orodispersible tablets, patches, and syrups enhances patient compliance and minimizes risks of incorrect dosing.

-

Increased Focus on Preventive Care: There is a notable shift towards preventive healthcare strategies like statin therapy and antihypertensives, which aim to manage chronic conditions before complications arise.

-

Rise of Telehealth and Online Pharmacies: The integration of digital health services with medication delivery has transformed access to geriatric medicines, particularly during and post the COVID-19 pandemic.

-

Regulatory Support for Elderly Care: Several countries are streamlining approval processes for geriatric drugs and offering incentives to manufacturers targeting this demographic.

-

Pharmacogenomics Integration: Personalized medicine approaches based on genetic profiling are increasingly being used to optimize treatment outcomes for older patients.

Geriatric Medicines Market Report Scope

| Report Coverage |

Details |

| Market Size in 2023 |

USD 890 Billion |

| Market Size by 2032 |

USD 4,134.05 Billion |

| Growth Rate From 2023 to 2032 |

CAGR of 16.6% |

| Base Year |

2022 |

| Forecast Period |

2023-2032 |

| Segments Covered |

Therapeutics, Condition, Distribution Channels, Route of Administration, Geography |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

GlaxoSmithKline PLC, Novartis AG, Pfizer Inc., Sanofi S.A., Bristol-Myers Squibb Company, Boehringer Ingelheim GmbH, Merck & Company Inc., Abbott Laboratories Inc., Eli Lilly & Company, AstraZeneca PLC |

Key Market Driver: Aging Global Population

One of the most significant drivers of the geriatric medicines market is the rapidly aging global population. As longevity increases due to improved living conditions and medical advancements, the proportion of the elderly in the global demographic structure has surged. Countries like Japan, where over 28% of the population is above 65 years, exemplify the pressing need for dedicated geriatric care. This demographic not only has a higher prevalence of chronic diseases but also experiences physiological changes that require specialized medication regimens. The increasing demand for customized drugs, along with healthcare reforms aimed at elder care, is directly propelling the expansion of this market.

Key Market Restraint: Drug Safety and Adverse Reactions

Despite market growth, the safety profile of drugs used in the elderly population remains a major challenge. Older adults often experience altered metabolism and excretion of drugs, which heightens the risk of adverse drug reactions (ADRs). Polypharmacy further complicates medication management, often resulting in drug-drug interactions or medication non-adherence. These complications can lead to hospitalizations, reduced quality of life, and increased mortality. Regulatory agencies are increasingly cautious about approving drugs for older populations, and pharmaceutical companies must invest significantly in geriatric-specific clinical trials to ensure safety.

Key Market Opportunity: Expansion of Home-Based and Digital Care

The growing adoption of home healthcare services and digital platforms presents a notable opportunity in the geriatric medicines market. Home-based care models have gained popularity due to their cost-effectiveness, reduced hospital visits, and improved patient comfort. In parallel, telemedicine and e-pharmacy platforms have enabled older adults to consult healthcare professionals and receive medications without leaving their homes. For instance, companies like PillPack (Amazon) are revolutionizing medication adherence with pre-sorted dose packaging and delivery. This model is not only beneficial for patients but also for caregivers and healthcare providers striving to manage large elderly populations efficiently.

By Therapeutics Insights

Antihypertensives dominate the therapeutics segment, accounting for a major share due to the high prevalence of hypertension among the elderly. According to the American Heart Association, nearly 70% of adults aged 65 or older have hypertension, necessitating continuous pharmacological management. Antihypertensives such as ACE inhibitors, beta-blockers, and diuretics are staples in geriatric care. Their widespread use is attributed to both preventive and curative roles in managing cardiovascular risk, making them indispensable. Moreover, elderly patients often require lifelong therapy, reinforcing consistent demand for these drugs.

Conversely, antidiabetic medications are the fastest-growing segment, fueled by the rising incidence of type 2 diabetes in seniors. Insulin sensitivity diminishes with age, and the prevalence of obesity among the elderly contributes to diabetes progression. Oral hypoglycemics and insulin analogs tailored for the elderly, with reduced risk of hypoglycemia, are gaining momentum. Emerging therapies, including GLP-1 receptor agonists with cardiovascular benefits, are also finding greater use in aged populations, particularly among those with comorbid conditions.

By Condition Insights

Cardiovascular conditions represent the dominant condition segment, owing to the sheer burden of heart diseases among older adults. Coronary artery disease, arrhythmias, and congestive heart failure are common diagnoses in the elderly, necessitating regular use of medications like statins, anticoagulants, and antiplatelets. Preventive strategies, supported by clinical guidelines, advocate early initiation of treatment, especially in high-risk groups. This has led to a surge in prescriptions and routine cardiovascular drug usage.

Neurological conditions such as dementia and Parkinson’s disease are the fastest-growing within this segment. As life expectancy rises, so does the incidence of neurodegenerative disorders. Alzheimer’s disease alone affects nearly 6 million Americans aged 65 and older. Advances in neurotherapeutics and supportive drugs, such as cholinesterase inhibitors and antipsychotics, are fostering demand. With ongoing research into disease-modifying treatments, this segment is projected to expand significantly.

By Distribution Channels

Hospital pharmacies currently dominate the distribution channel, primarily due to institutional prescribing and inpatient care needs. Many geriatric patients require hospitalization for acute and chronic conditions, where medications are administered under supervision. Additionally, hospital pharmacies ensure better compliance with formulary drugs and insurance reimbursement, making them a preferred channel for high-value prescriptions.

However, online pharmacies are rapidly emerging as the fastest-growing channel. Their convenience, particularly for immobile or isolated seniors, and integration with telehealth platforms have revolutionized access to medication. Companies like Netmeds, 1mg (India), and Capsule (USA) are expanding geriatric product portfolios and offering value-added services like automated refills, virtual consultations, and adherence tracking.

By Route of Administration

Oral medications remain the dominant route, as they are non-invasive, easy to administer, and widely accepted. Tablets, capsules, and liquid formulations tailored for elderly needs such as coated or chewable pills are common. Their ease of use, combined with efficient systemic absorption, makes oral routes highly suitable for chronic conditions requiring long-term therapy.

Parenteral administration is witnessing faster growth, especially in hospital and home care settings where rapid drug action is critical. This includes injectable anticoagulants, biologics for arthritis, and intravenous chemotherapy. The rise in complex conditions requiring immediate interventions and the growth of home nursing services are driving demand for parenteral formulations.

Regional Analysis

North America leads the global geriatric medicines market, with the United States as the dominant contributor. The region’s leadership is underpinned by a high geriatric population, strong healthcare infrastructure, robust insurance coverage, and proactive regulatory policies. According to the U.S. Census Bureau, more than 54 million Americans were aged 65 or older in 2021. Furthermore, Medicare and Medicaid have facilitated widespread access to healthcare services, ensuring medication availability. The presence of major pharmaceutical companies and a high level of R&D investment further consolidate North America's market dominance.

Asia-Pacific is the fastest-growing regional market, driven by rapid aging in countries like China, Japan, and South Korea. Japan has one of the oldest populations globally, while China’s elderly population is expected to surpass 400 million by 2040. These demographic changes are placing immense pressure on healthcare systems, prompting reforms and investments in elder care infrastructure. Additionally, rising healthcare expenditure, improving access to medication, and increased government initiatives such as China’s Healthy Aging Plan are boosting regional growth.

Recent Developments

-

Pfizer Inc. (January 2025): Announced its expansion of age-specific clinical trials for novel cardiovascular and neurodegenerative therapies aimed at elderly populations.

-

Boehringer Ingelheim (February 2025): Collaborated with a European digital health startup to develop an AI-powered medication adherence solution for older adults with multiple comorbidities.

-

GSK (March 2025): Launched a new statin formulation with reduced gastrointestinal side effects, specifically targeting geriatric patients.

-

Sun Pharma (December 2024): Increased production capacity in India to meet rising demand for generic antihypertensives and statins across Asia-Pacific.

Some of the prominent players in the global geriatric medicines market include:

- GlaxoSmithKline PLC

- Novartis AG

- Pfizer Inc.

- Sanofi S.A.

- Bristol-Myers Squibb Company

- Boehringer Ingelheim GmbH

- Merck & Company Inc.

- Abbott Laboratories Inc.

- Eli Lilly & Company

- AstraZeneca PLC

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2032. For this study, Nova one advisor, Inc. has segmented the global Geriatric medicines market.

By Therapeutics

- Analgesic

- Antihypertensive

- Statins

- Antidiabetic

- PPI

- Anticoagulant

- Antipsychotic

- Others

By Condition

- Cardiovascular

- Arthritis

- Neurological

- Cancer

- Osteoporosis

- Respiratory

- Others

By Distribution Channels

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

By Route of Administration

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)