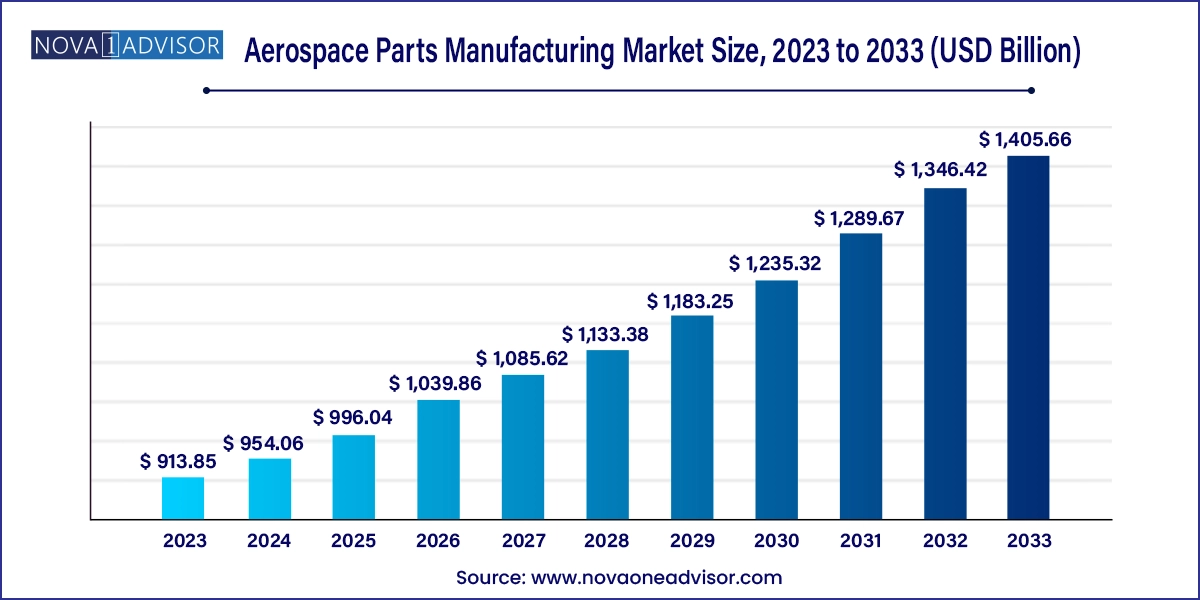

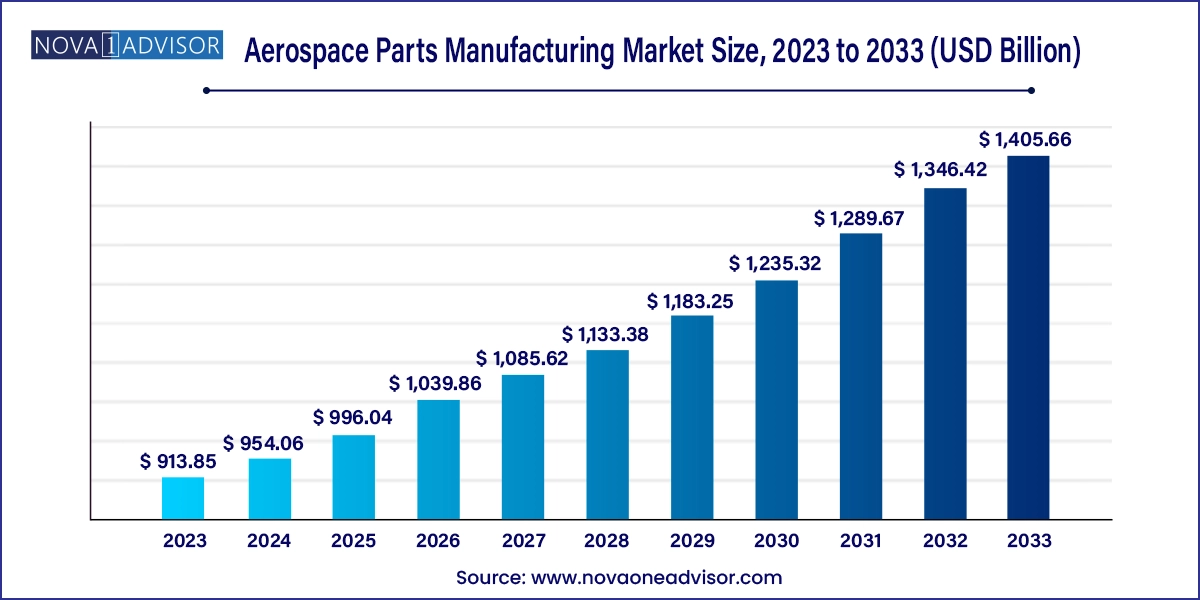

Aerospace Parts Manufacturing Market Size and Growth

The global aerospace parts manufacturing market size was exhibited at USD 913.85 billion in 2023 and is projected to hit around USD 1,405.66 billion by 2033, growing at a CAGR of 4.4% during the forecast period 2024 to 2033.

Aerospace Parts Manufacturing Market Key Takeaways:

- Based on product, aircraft manufacturing accounted for the largest revenue share of over 51% in 2023.

- Based on end-use, commercial segment dominated the market with highest revenue share in 2023 in manufacturing of aerospace parts.

- North America industry for aerospace parts manufacturing dominated the regional market with largest revenue share of 51.7% in 2023.

Market Overview

The global aerospace parts manufacturing market has become a cornerstone of the aviation industry, underpinned by growing air travel demand, defense modernization initiatives, and advancements in aerospace technology. Aerospace parts manufacturing encompasses the production of crucial components such as engines, aerostructures, avionics, cabin interiors, and support equipment, all of which are integral to the performance, safety, and operational efficiency of aircraft.

As both commercial and military aviation fleets expand, the demand for sophisticated, lightweight, and fuel-efficient parts has surged. Stringent regulatory standards and the industry's increasing focus on sustainability have further pushed manufacturers to innovate with advanced materials such as composites, titanium alloys, and additive manufacturing techniques. With the resurgence of air traffic post-pandemic and emerging markets investing heavily in aviation infrastructure, aerospace part manufacturers are experiencing a renaissance period marked by both opportunity and transformation.

The industry also serves as a critical strategic asset for national security, with governments investing in domestic manufacturing capabilities to reduce dependence on foreign suppliers. This dual role—commercial and military—adds resilience to the market, enabling it to withstand cyclical disruptions better than many other manufacturing sectors.

Major Trends in the Market

-

Shift Toward Lightweight and Composite Materials

The use of carbon fiber-reinforced polymers and other composites is gaining traction to reduce aircraft weight and improve fuel efficiency.

-

Rise of Additive Manufacturing (3D Printing)

Aerospace companies are increasingly adopting 3D printing to produce complex parts faster, with reduced waste and cost.

-

Digitization and Smart Manufacturing

Integration of IoT, AI, and robotics in production lines is enhancing precision, reducing errors, and enabling predictive maintenance of equipment.

-

Increased Investment in Electric Propulsion Systems

As the industry aims for carbon neutrality, electric propulsion and hybrid systems are pushing the demand for specialized electrical components and lightweight systems.

-

Globalization of Supply Chains with Localized Production

While global collaboration remains strong, countries are encouraging local part production to ensure supply chain resilience and national security.

-

Sustainable Aircraft Initiatives

OEMs and suppliers are investing in designing recyclable parts, bio-composite materials, and modular components to support circular manufacturing.

-

Aftermarket Services and MRO Expansion

The aerospace maintenance, repair, and overhaul (MRO) segment is booming, especially for commercial fleets requiring extended lifecycle services.

Report Scope of Aerospace Parts Manufacturing Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 954.06 Billion |

| Market Size by 2033 |

USD 1,405.66 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.4% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America, Europe, Asia Pacific, Middle East & Africa, Central & South America |

| Key Companies Profiled |

JAMCO Corporation, Intrex Aerospace, Rolls Royce plc, CAMAR Aircraft Parts Company, Safran Group, Woodward, Inc., Engineered Propulsion System, Eaton Corporation plc, Aequs, Aero Engineering & Manufacturing Co., GE Aviation, Lycoming Engines, Pratt & Whitney, Superior Air Parts Inc., MTU Aero Engines AG, Honeywell International, Inc., Collins Aerospace, Composite Technology Research Malaysia Sdn. Bhd., Mitsubishi Heavy Industries Ltd., Kawasaki Heavy Industries Ltd., Subaru Corporation, IHI Corporation, Lufthansa Technik AG, Diel Aviation Holding GmbH, Elektro-Metall Export GmbH, Liebherr International AG, Hexcel Corporation, DuCommun Incorporated, Rockwell Collins, Spirit Aerosystems, Inc., Panasonic Avionics Corporation, Zodiac Aerospace, Thales S.A., Dassault Systems SE, Parker-Hannifin Corporation, Chemetall GmbH, Premium AEROTECH GmbH, Daher Group, FACC AG, Triumph Group, Curtiss-Wright Corporation, Stelia Aerospace, Magellan Aerospace, Bridgestone Corporation |

Market Driver: Surge in Commercial Aviation Demand

A primary driver of the aerospace parts manufacturing market is the accelerating growth of commercial aviation worldwide, particularly in emerging economies. The proliferation of low-cost carriers (LCCs), rising disposable incomes, and increasing business and leisure travel are contributing to a surge in air passenger traffic. The International Air Transport Association (IATA) projects that the global number of air travelers could double by 2040, from around 4.5 billion to nearly 9 billion.

This growth directly impacts demand for new commercial aircraft, which in turn drives the need for thousands of high-performance aerospace components—from engines and avionics to structural elements and cabin interiors. For instance, Airbus and Boeing, the two aerospace giants, have projected a combined demand for over 40,000 new aircraft by 2040. This massive pipeline requires a sustained and robust supply chain of aerospace parts, providing long-term business certainty for manufacturers across the globe.

Market Restraint: Supply Chain Disruptions and Material Shortages

Despite promising growth, the aerospace parts manufacturing industry faces a significant restraint in the form of supply chain vulnerabilities and raw material shortages. The COVID-19 pandemic exposed critical weaknesses in the global supply chain, with delays in raw material delivery, semiconductor shortages, and a lack of labor hampering production timelines. Many aerospace parts rely on rare and high-performance materials like titanium, composites, and advanced ceramics, which have limited suppliers and long lead times.

Geopolitical tensions, such as trade disputes and sanctions, have further complicated international sourcing. For example, sanctions on Russian titanium—a key supplier to global aerospace firms—have caused major sourcing challenges. These disruptions affect cost predictability, delivery schedules, and production scalability, particularly for Tier 2 and Tier 3 suppliers, many of whom operate with thin margins.

Market Opportunity: Electrification and Urban Air Mobility (UAM)

The emergence of electric aviation and Urban Air Mobility (UAM) presents a transformative opportunity for aerospace parts manufacturers. Electric vertical takeoff and landing (eVTOL) aircraft, designed for short-distance urban travel, are gaining momentum with companies like Joby Aviation, Lilium, and Archer leading the race. These new-age aircraft demand a unique set of components, including lightweight battery housings, electric propulsion systems, flight control electronics, and advanced cooling mechanisms.

As aviation giants and startups invest in UAM infrastructure, aerospace part suppliers can tap into a burgeoning sub-sector with minimal legacy constraints. The demand for compact, modular, and highly reliable parts tailored for electric aviation could open up lucrative avenues for specialized manufacturers, particularly those investing in R&D and advanced manufacturing techniques.

Aerospace Parts Manufacturing Market By Product Insights

The aerostructure segment dominates the product category, comprising essential airframe components such as fuselage, wings, empennage, and flight control surfaces. These parts are foundational to the aircraft’s structural integrity and aerodynamics. The dominance of this segment stems from the sheer scale of aerostructural content in an aircraft and the high precision required in their manufacturing. Leading players such as Spirit AeroSystems and Triumph Group specialize in these large, load-bearing components, often using lightweight materials like carbon composites and aluminum alloys to enhance fuel efficiency. Aerostructures also see strong demand in both commercial and defense applications, making it a versatile and resilient segment.

Avionics is the fastest-growing product segment, driven by technological advancements and the increasing complexity of modern flight systems. With the aviation sector pushing toward automated, safer, and more efficient operations, demand for digital flight control systems, advanced radar, satellite navigation, and cockpit displays has grown exponentially. Avionics also play a critical role in military aircraft, supporting electronic warfare, surveillance, and command & control functions. The rise of autonomous drones and integration of AI in navigation and decision-making further fuels the growth of this high-margin segment.

Aerospace Parts Manufacturing Market By End-use Insights

The commercial aircraft segment holds the largest market share in aerospace parts manufacturing. The global recovery of airline fleets after the pandemic, along with growing travel demand, is spurring orders for narrow-body and wide-body jets. With fuel economy and passenger comfort becoming top priorities, airlines are investing in newer, more efficient aircraft equipped with next-gen parts. Components such as lightweight interiors, energy-efficient engines, and advanced environmental control systems are in high demand. Manufacturers catering to Airbus A320neo and Boeing 737 MAX programs are witnessing a steady resurgence in production volumes.

Military aircraft is the fastest-growing end-use segment, driven by increasing defense budgets and geopolitical tensions. Countries like the U.S., India, and China are investing heavily in modernizing their air forces with next-generation fighter jets, surveillance aircraft, and drones. Military-grade parts require specialized manufacturing techniques to meet stringent durability, stealth, and performance criteria. Suppliers who are able to deliver mission-critical components such as radar-absorbent aerostructures, high-thrust jet engines, and electronic countermeasure systems are seeing substantial growth in this niche yet lucrative market.

Aerospace Parts Manufacturing Market By Regional Insights

North America is the largest and most established region in the aerospace parts manufacturing market, led by the presence of major aerospace OEMs such as Boeing, Lockheed Martin, Raytheon Technologies, and General Electric. The U.S. government’s substantial investment in both commercial aviation and defense ensures consistent demand for high-quality parts. Additionally, North America hosts a dense network of Tier 1 and Tier 2 suppliers, advanced manufacturing hubs, and innovation centers that contribute to the region’s dominance.

Boeing’s Commercial Airplanes division, headquartered in Seattle, continues to be a key demand generator, supported by defense contracts from the Pentagon. Furthermore, Canada’s Bombardier and the robust MRO ecosystem across the continent enhance its strategic importance. The region's mature infrastructure, skilled workforce, and proactive regulatory support give it a competitive edge.

Asia Pacific is the fastest-growing region, fueled by rapid urbanization, expanding middle class, and aggressive investments in aviation infrastructure. Countries like China and India are developing indigenous aircraft manufacturing capabilities while increasing aircraft imports to meet rising passenger traffic. For example, China's COMAC C919 program aims to challenge the duopoly of Boeing and Airbus, thereby spurring domestic demand for aerospace parts.

Additionally, governments in Asia are fostering aerospace manufacturing through policy incentives, special economic zones, and international collaborations. Japan and South Korea, with their strong electronics and precision engineering sectors, are emerging as key suppliers for avionics and control systems. The region’s growing participation in global aerospace supply chains is expected to continue, especially as OEMs seek to diversify sourcing away from traditional hubs.

Some of the prominent players in the global aerospace parts manufacturing market include:

- JAMCO Corporation

- Intrex Aerospace

- Rolls Royce plc

- CAMAR Aircraft Parts Company

- Safran Group

- Woodward, Inc.

- Engineered Propulsion System

- Eaton Corporation plc

- Aequs

- Aero Engineering & Manufacturing Co.

- GE Aviation

- Lycoming Engines

- Pratt & Whitney

- Superior Air Parts Inc.

- MTU Aero Engines AG

- Honeywell International, Inc.

- Collins Aerospace

- Composite Technology Research Malaysia Sdn. Bhd.

- Mitsubishi Heavy Industries Ltd.

- Kawasaki Heavy Industries Ltd.

- Subaru Corporation

- IHI Corporation

- Lufthansa Technik AG

- Diel Aviation Holding GmbH

- Elektro-Metall Export GmbH

- Liebherr International AG

- Hexcel Corporation

- DuCommun Incorporated

- Rockwell Collins

- Spirit Aerosystems, Inc.

- Panasonic Avionics Corporation

- Zodiac Aerospace

- Thales S.A.

- Dassault Systems SE

- Parker-Hannifin Corporation

- Chemetall GmbH

- Premium AEROTECH GmbH

- Daher Group

- FACC AG

- Triumph Group

- Curtiss-Wright Corporation

- Stelia Aerospace

- Magellan Aerospace

- Bridgestone Corporation

Recent Developments

-

In April 2025, Airbus announced the expansion of its manufacturing facility in Tianjin, China, to increase the local production of structural parts for its A320neo family, indicating a strategic shift to meet demand in Asia.

-

In March 2025, Spirit AeroSystems secured a multi-year agreement with Rolls-Royce to supply complex aerostructures for its next-generation engine programs, reinforcing collaboration on sustainable aviation.

-

In February 2025, Lockheed Martin awarded a contract to L3Harris Technologies for the delivery of electronic warfare components to support the F-35 Lightning II program, highlighting growth in the military avionics space.

-

In January 2025, GE Aerospace opened a new research lab in Ohio dedicated to developing ceramic matrix composite (CMC) materials for next-gen jet engines, aiming to improve thermal resistance and reduce weight.

-

In December 2024, Safran Group entered into a joint venture with an Indian aerospace supplier to produce landing gear components locally, supporting the Make in India defense initiative.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global aerospace parts manufacturing market

Product

- Engines

- Aerostructure

- Cabin Interiors

- Equipment, System, and Support

- Avionics

- Insulation Components

End-use

- Commercial Aircraft

- Business Aircraft

- Military Aircraft

- Other Aircraft

Regional

- North America

- Europe

- Asia Pacific

- Central & South America

- Middle East & Africa