Astaxanthin Market Size and Research

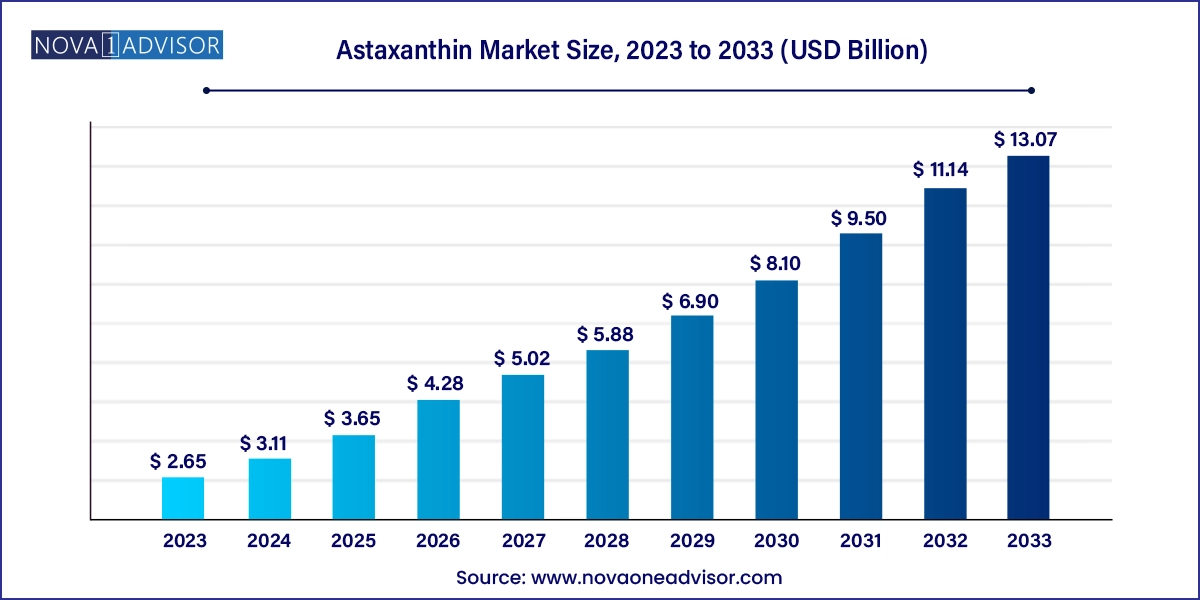

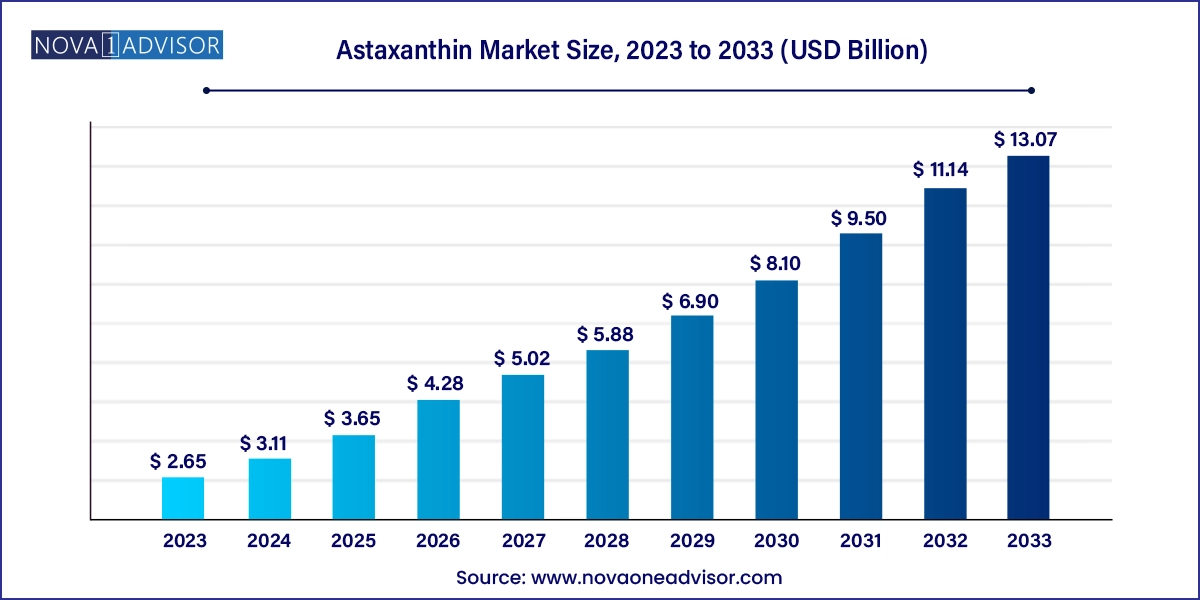

The global astaxanthin market size was exhibited at USD 2.65 billion in 2023 and is projected to hit around USD 13.07 billion by 2033, growing at a CAGR of 17.3% during the forecast period 2024 to 2033.

Astaxanthin Market Key Takeaways:

- The natural segment held largest revenue share of 56.40% of astaxanthin industry in 2023 and is anticipated to grow at a rapid rate during the forecast period.

- Dried algae meal or biomass accounted highest share of 25.26% of the market in 2023.

- Aquaculture & animal feed segment is accounted the high share of 46.39% of market in 2023.

- Nutraceuticals segment is likely to grow at fastest CAGR during the forecast period.

- North America is most developed astaxanthin market and held largest share of 36.53% in 2023.

- Asia Pacific is estimated to exhibit fastest growth rate during the forecast period.

Market Overview

The Global Astaxanthin Market is experiencing significant expansion, propelled by the compound’s growing application across nutraceuticals, cosmetics, aquaculture, and food industries. Astaxanthin is a naturally occurring carotenoid pigment primarily found in microalgae, yeast, krill, and shrimp. Often referred to as the “king of antioxidants,” it is recognized for its exceptional ability to neutralize free radicals and reduce oxidative stress, thereby offering numerous health benefits ranging from skin health and anti-aging to cardiovascular and immune support.

Initially popularized through its use in aquaculture (especially salmon farming, where it enhances color and health of the fish), astaxanthin’s adoption in the human health and wellness sector has surged in the last decade. With the increasing awareness of chronic diseases, aging populations, and rising demand for functional foods, astaxanthin has carved out a niche in both therapeutic and preventive nutrition. It is also gaining attention in the sports nutrition market due to its claimed benefits in muscle endurance, joint recovery, and eye health.

On the production side, the market encompasses both natural and synthetic astaxanthin, with microalgae-based (notably Haematococcus pluvialis) sources dominating due to their high bioactivity and consumer preference for natural ingredients. Technological advancements in algae cultivation, extraction, and purification processes are making high-quality natural astaxanthin more accessible and economically viable.

As consumer preferences continue to shift toward clean-label, natural, and health-enhancing ingredients, the astaxanthin market is positioned to benefit from expanding applications, improved production capabilities, and a supportive regulatory environment. The growth trajectory is further reinforced by robust investment in nutraceutical innovation, biotechnology, and sustainable aquaculture practices.

Major Trends in the Market

-

Increased Use in Anti-aging and Skincare Products: Astaxanthin’s antioxidant properties are widely recognized in cosmetics for skin hydration, wrinkle reduction, and UV protection.

-

Shift Toward Natural Sources: Consumer demand for clean-label, non-synthetic ingredients is fueling investments in microalgae cultivation and yeast-based production.

-

Innovation in Functional Beverages: Astaxanthin is being infused in juices, energy drinks, and fortified waters to attract health-conscious consumers.

-

Integration into Sports Nutrition: Supplements promoting muscle recovery, endurance, and eye health are incorporating astaxanthin as a key ingredient.

-

Sustainability in Aquaculture: Natural astaxanthin is being adopted in fish and shrimp feed to replace synthetic coloring agents and improve aquatic health.

-

Expansion of Clinical Research: Ongoing trials and published studies on cognitive support, inflammation, and metabolic health are strengthening scientific credibility.

-

Market Penetration in Asia-Pacific: Rising middle-class income and preventive healthcare awareness are boosting demand in countries like China, Japan, and South Korea.

-

Encapsulation and Delivery Technologies: Microencapsulation and nanocarrier systems are improving bioavailability and stability in final formulations.

Report Scope of Astaxanthin Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 3.11 Billion |

| Market Size by 2033 |

USD 13.07 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 17.3% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Source, Product, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Algatech Ltd, Cyanotech Corporation, MicroA, Beijing Gingko Group (BGG), Algalíf Iceland ehf, Fuji Chemical Industries Co., Ltd, PIVEG, Inc., Atacama Bio Natural Products S.A, ENEOS Corporation, E.I.D. – Parry (India) Limited (Alimtec S.A., Valensa International) |

Key Market Driver: Growing Consumer Demand for Natural Antioxidants

One of the most critical drivers of the astaxanthin market is the increasing global demand for natural antioxidants in both dietary supplements and functional food categories. Consumers are becoming more aware of oxidative stress as a precursor to aging, cardiovascular disease, and immune dysfunction. Unlike other carotenoids, astaxanthin is unique in that it never becomes pro-oxidant, making it one of the safest and most potent natural antioxidants on the market.

This driver is strongly supported by the booming global nutraceutical sector, where consumers are actively seeking supplements that go beyond basic nutrition and offer targeted health benefits. Astaxanthin, with its multifaceted effects—including eye health, brain function, cardiovascular protection, and even potential benefits in managing metabolic syndrome—fits this demand perfectly. Moreover, as health and wellness trends continue to dominate the post-COVID world, interest in natural, immune-boosting supplements like astaxanthin is expected to further increase.

Key Market Restraint: High Cost of Production and Limited Raw Material Supply

A key restraint to market growth is the high cost associated with the production and extraction of natural astaxanthin, especially from microalgae. The most potent natural source, Haematococcus pluvialis, requires tightly controlled conditions for optimal growth and astaxanthin synthesis. Cultivation systems—whether open pond or closed photobioreactor—are capital intensive and highly sensitive to environmental changes.

In addition to production challenges, the extraction and purification of astaxanthin require advanced technological equipment and skilled expertise, contributing to high end-product pricing. These elevated costs make it difficult for astaxanthin to compete with synthetic carotenoids in cost-sensitive sectors like aquaculture and food coloring. Although synthetic astaxanthin is more affordable, it is often less bioavailable and less accepted in health and cosmetic applications, limiting its scope. Until production becomes more scalable and efficient, high costs will remain a challenge, especially for small and mid-sized manufacturers.

Key Market Opportunity: Expansion into Functional Foods and Beverages

A significant market opportunity lies in the integration of astaxanthin into the rapidly growing functional food and beverage industry. With consumers increasingly seeking foods that offer health benefits beyond basic nutrition, astaxanthin’s potent antioxidant properties make it a valuable addition to energy drinks, fortified juices, dairy products, protein powders, and even snacks.

This application is particularly promising in markets like Japan and the U.S., where functional beverages are not just a trend but a lifestyle choice. In Asia, traditional beverages are being reformulated with astaxanthin to appeal to modern consumers looking for natural wellness solutions. In Western countries, astaxanthin-infused waters, shots, and recovery drinks are gaining traction in the fitness and wellness community.

Moreover, encapsulation technologies that protect astaxanthin from degradation during food processing are making its integration into food matrices more feasible. This not only opens doors for innovation but also creates long-term brand opportunities for companies willing to differentiate in the functional food space.

Astaxanthin Market By Source Insights

Natural sources dominate the astaxanthin market, particularly those derived from microalgae such as Haematococcus pluvialis. Natural astaxanthin is preferred in nutraceutical, cosmetic, and food applications due to its superior antioxidant potency and bioavailability. Among natural sources, microalgae offer the highest concentration of astaxanthin per biomass unit. As consumers become more label-conscious, natural astaxanthin has become a symbol of purity and efficacy, fueling the rise of algae farming and closed-loop photobioreactor installations in the U.S., India, and Israel.

Yeast-based and krill/shrimp-derived astaxanthin also contribute to the natural segment, particularly in animal feed and aquaculture applications. Yeast fermentation, especially from Phaffia rhodozyma, is gaining attention for scalability, although the pigment's bioactivity remains slightly lower than microalgae-sourced astaxanthin. On the other hand, synthetic astaxanthin, though widely used in aquaculture, is losing ground in the health and wellness sector due to concerns over synthetic additives and relatively lower antioxidant efficacy. That said, it remains dominant in price-sensitive applications where regulatory bodies permit its use.

Astaxanthin Market By Product Insights

Oil-based astaxanthin products currently dominate the market, especially in dietary supplements and cosmetics. Oil formulations protect astaxanthin from oxidation and enhance bioavailability when consumed orally. These products are often encapsulated in softgels or integrated into functional foods and serums. Due to their versatility and high absorption efficiency, oil-based formulations are the go-to option for many end-use manufacturers.

In contrast, Softgels are emerging as the fastest-growing product form, driven by convenience, dosage accuracy, and consumer familiarity. Softgels also enable the delivery of combination formulations, allowing astaxanthin to be paired with other antioxidants or nutrients like omega-3s, lutein, or coenzyme Q10. As supplement demand grows, particularly in the aging and fitness population, the softgel format is gaining popularity across global markets, especially in North America and Asia.

Astaxanthin Market By Application Insights

Nutraceuticals represent the dominant application segment of the astaxanthin market, accounting for the largest share of consumption globally. Consumers are increasingly seeking antioxidant-rich supplements to manage inflammation, eye strain, cardiovascular health, skin aging, and athletic recovery. The unique ability of astaxanthin to cross the blood-brain and blood-retina barriers enhances its appeal in neuroprotective and ophthalmic applications, further driving demand in this segment.

Cosmetics is the fastest-growing application, fueled by the rise of nutricosmetics and the inclusion of astaxanthin in anti-aging skin creams, sunscreens, and oral beauty supplements. Clinical studies have shown astaxanthin’s ability to improve skin elasticity, reduce age spots, and protect against UV-induced damage, leading to widespread adoption among premium skincare brands. With increasing demand for clean beauty and holistic skin wellness, astaxanthin’s multifunctional benefits are capturing the attention of both formulators and consumers.

Astaxanthin Market By Regional Insights

North America currently dominates the global astaxanthin market, led by the United States, which has a mature nutraceutical industry, growing health-conscious consumer base, and favorable regulatory conditions for dietary supplements. The U.S. accounts for a significant share of global microalgae-based astaxanthin production and consumption. Brands such as BioAstin (Hawaiian Astaxanthin) and companies like Algatech and Cyanotech operate large-scale cultivation facilities in the region. The presence of advanced research institutions and early adopters of wellness trends further contributes to market leadership.

Asia Pacific is the fastest-growing regional market, driven by increasing disposable incomes, expanding urbanization, and growing demand for functional foods and supplements. Countries like Japan and South Korea are leading adopters of astaxanthin in cosmetics and beverages, while India and China are emerging as production hubs due to suitable climatic conditions for algae cultivation and lower labor costs. Additionally, government support for aquaculture development in Asia is stimulating demand for astaxanthin in feed applications. The region’s cultural emphasis on preventive medicine and holistic wellness aligns well with the antioxidant positioning of astaxanthin.

Astaxanthin Market Recent Developments

-

In January 2025, BASF announced the expansion of its algae-derived astaxanthin production facility in Germany to meet the growing demand in the nutraceutical and cosmetic sectors.

-

Algatech Ltd., in October 2024, launched a new encapsulated astaxanthin ingredient optimized for beverages and dairy applications, using a patented microencapsulation technology.

-

In November 2024, Cyanotech Corporation introduced a sustainability-certified range of astaxanthin softgels, appealing to eco-conscious consumers in North America and Europe.

-

JXTG Nippon Oil & Energy, in August 2024, began commercial production of Haematococcus pluvialis at its algae plant in Japan to cater to pharmaceutical and sports nutrition markets.

-

In March 2025, AstaReal AB announced a collaboration with a leading cosmetic brand in South Korea to co-develop a new line of anti-aging skincare infused with astaxanthin.

Some of the prominent players in the global astaxanthin market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global astaxanthin market

Source

-

- Yeast

- Krill/Shrimp

- Microalgae

- Others

Product

- Dried Algae Meal or Biomass

- Oil

- Softgel

- Liquid

- Others

Application

- Nutraceuticals

- Cosmetics

- Aquaculture And Animal Feed

- Food

-

- Functional Foods And Beverages

- Other Traditional Food Manufacturing Applications

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa