Atrial Fibrillation Devices Market Size and Research

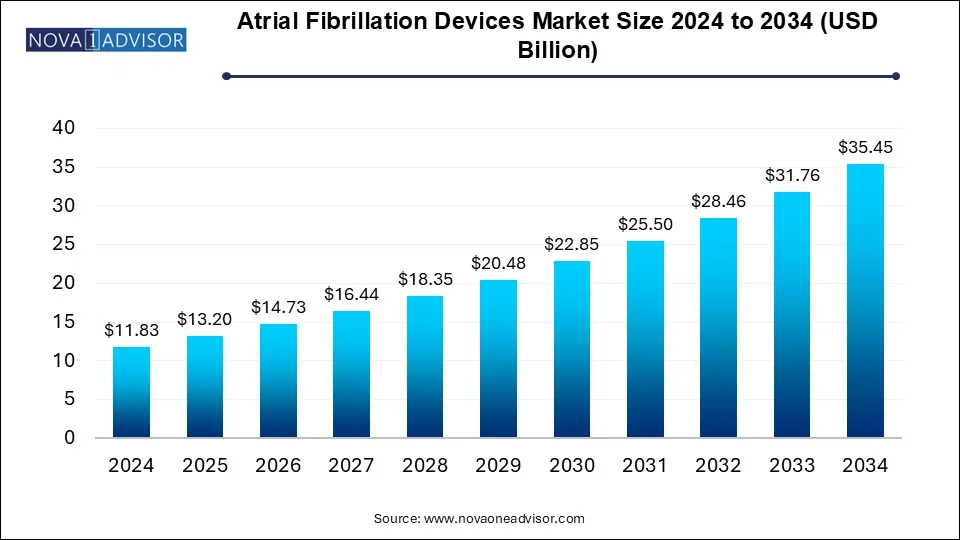

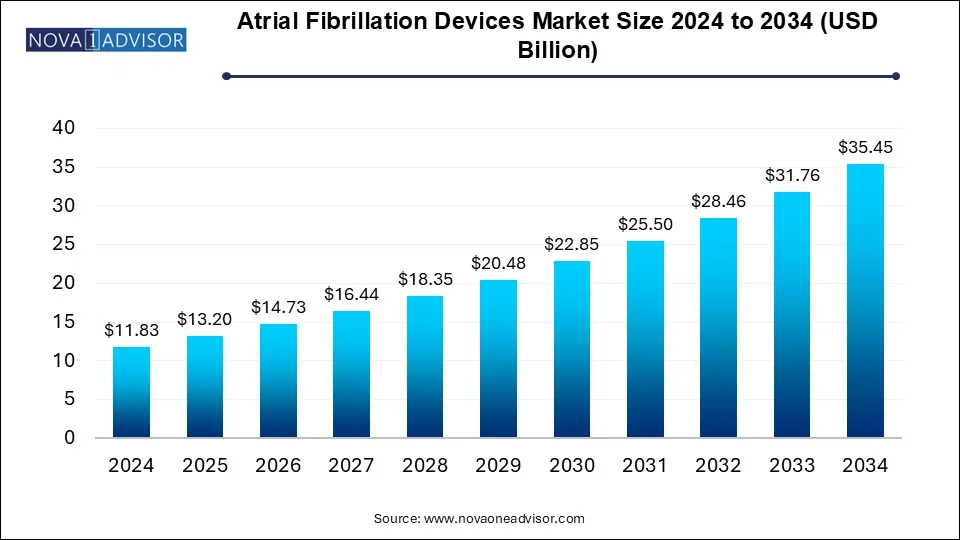

The atrial fibrillation devices market size was exhibited at USD 11.83 billion in 2024 and is projected to hit around USD 35.45 billion by 2034, growing at a CAGR of 11.6% during the forecast period 2025 to 2034.The significant market growth is driven by continuous advancements in atrial fibrillation (AF) devices, the rising incidence of atrial fibrillation, the increasing adoption of cardiac ablation procedures, and enhanced awareness leading to early diagnosis, among other contributing factors.

Report Scope of Atrial Fibrillation Devices Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 13.20 Billion |

| Market Size by 2034 |

USD 35.45 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 11.6% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, End-use, and Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Abbott Laboratories, Acutus Medical, Inc., AtriCure, Inc., Biotronik, Boston Scientific Corporation, CardioFocus, CathRx Ltd., Hansen Medical, Inc., Imricor, Johnson and Johnson (Biosense Webster), and Medtronic plc |

The rising global incidence of atrial fibrillation (AF) is significantly contributing to market growth. AF is the most prevalent type of cardiac arrhythmia, with its occurrence increasing due to factors such as aging populations, rising obesity rates, hypertension, and other cardiovascular conditions. For example, the Centers for Disease Control and Prevention (CDC) reported that in 2024, approximately 40 million people worldwide were affected by AFib, including 6 million in the U.S. alone. Furthermore, projections indicate that around 12.1 million individuals in the U.S. could be living with AFib by 2030. Consequently, the growing number of AF cases is fueling the demand for diagnostic and treatment devices.

Additionally, heightened awareness of atrial fibrillation among both patients and healthcare profess sionalhas led to earlier diagnosis and treatment. Public health initiatives and educational campaigns stress the importance of monitoring and managing AF, which in turn increases demand for AF devices. Early detection and intervention are vital in preventing complications such as stroke, driving greater utilization of diagnostic and monitoring devices.

Atrial fibrillation devices are specialized medical tools designed to diagnose, monitor, and treat AFib, a common heart rhythm disorder. These devices include ablation catheters, implantable cardiac monitors, pacemakers, and defibrillators that help regulate heart rhythm. Their primary objective is to restore normal heart function, prevent strokes, and alleviate AFib-related symptoms. These devices play an essential role in both acute and long-term management of AFib patients.

Trends in the Atrial Fibrillation Devices Market

The market is witnessing several key trends that are shaping its expansion and evolution. Continuous technological advancements, the increasing preference for minimally invasive procedures, the growing adoption of wearable and remote monitoring devices, and the rising use of hybrid procedures are among the major drivers of industry growth.

One of the most notable trends in the atrial fibrillation devices market is the increasing preference for minimally invasive procedures. Catheter ablation, which involves using thermal energy to destroy abnormal heart tissue responsible for irregular heartbeats, is gaining popularity due to its effectiveness and shorter recovery periods. This trend is propelling the development and adoption of advanced ablation catheters and other minimally invasive technologies, making AF treatments more accessible and patient-friendly.

Moreover, with the rapid advancement of digital health, there is a growing shift toward the use of wearable devices and remote monitoring systems for managing atrial fibrillation. These devices enable continuous heart rhythm tracking, facilitating early detection of AF episodes and timely medical intervention. The integration of artificial intelligence (AI) and machine learning into these devices is further enhancing their diagnostic accuracy, improving patient outcomes, and enabling more proactive AF management.

Atrial Fibrillation Devices Market By Product Type

The atrial fibrillation devices market into EP ablation catheters, cardiac monitors or implantable loop recorders, EP diagnostic catheters, mapping and recording systems, access devices, intracardiac echocardiography (ICE), left atrial appendage (LAA) closure devices, and other related products. Among these, the EP ablation catheters segment recorded the highest revenue of USD 3.2 billion in 2023.

Innovations in EP ablation catheters, including contact force-sensing technology, irrigated tip catheters, and enhanced energy delivery systems, are improving the safety and effectiveness of ablation procedures. These advancements are expanding the scope of ablation treatments, making them a more feasible option for a broader patient base, thereby fueling market growth. Additionally, improved catheter designs contribute to reduced procedure durations and higher success rates in atrial fibrillation (AF) treatments.

The increasing preference for minimally invasive procedures in healthcare further drives the demand for ablation catheters. Compared to traditional surgical methods, ablation procedures are less invasive, offering benefits such as faster recovery, reduced complication risks, and shorter hospital stays. This trend toward minimally invasive treatments continues to propel the EP ablation catheters market forward.

Atrial Fibrillation Devices Market By End-use

The atrial fibrillation devices market is classified into hospitals, ambulatory surgical centers, cardiac centers, and other healthcare providers. Hospitals led the market in 2024 and are projected to reach USD 12.6 billion by the end of the forecast period.

The rising demand for specialized atrial fibrillation treatment centers within hospitals is driving increased investment in AF devices. These centers require a comprehensive range of diagnostic, treatment, and monitoring devices, leading to higher procurement rates.

Moreover, hospitals are increasingly pursuing accreditation for excellence in cardiac care, which often necessitates the adoption of the latest AF treatment technologies. Such accreditation efforts and quality enhancement initiatives encourage hospitals to invest in cutting-edge atrial fibrillation devices, further boosting market growth.

In 2024, North America's atrial fibrillation devices market generated USD 4.15 billion in revenue and is expected to expand at a CAGR of 11.5% from 2025 to 2034.

The high prevalence of atrial fibrillation in North America, particularly in the U.S., is largely attributed to an aging population and the increasing incidence of lifestyle-related conditions such as obesity, hypertension, and diabetes. The growing number of AF patients drives the demand for diagnostic and treatment devices, including ablation catheters, pacemakers, and other electrophysiology tools.

Additionally, North America's substantial healthcare expenditure facilitates significant investment in advanced medical technologies, including atrial fibrillation devices. The willingness of healthcare institutions to adopt innovative treatments and the region's high per capita healthcare spending further accelerate market growth.

Germany’s atrial fibrillation devices market is expected to witness substantial growth in the coming years.

Germany's advanced healthcare infrastructure supports the adoption of state-of-the-art medical technologies, including AF treatment devices. Hospitals and medical centers are equipped with cutting-edge electrophysiology labs, enabling the use of sophisticated ablation catheters, pacemakers, and other AF-related devices. This well-established infrastructure ensures widespread access to high-quality treatments, contributing to market expansion.

Furthermore, Germany is at the forefront of medical research and development, with significant investments in healthcare innovation. The country’s strong emphasis on R&D fosters the continuous introduction of next-generation atrial fibrillation devices, such as advanced ablation technologies and diagnostic systems, further driving market growth.

Japan holds a leading position in the Asia-Pacific atrial fibrillation devices market.

Japan has one of the highest proportions of elderly individuals globally, with aging being a major risk factor for atrial fibrillation. As the elderly population grows, so does the incidence of AF, leading to a rising demand for diagnostic and treatment devices in the country.

Additionally, Japan is experiencing an increase in lifestyle-related conditions such as hypertension and diabetes, both of which are linked to a higher likelihood of developing atrial fibrillation. The growing prevalence of these diseases is driving demand for AF management solutions, reinforcing Japan’s dominance in the regional market.

Some of the prominent players in the Atrial Fibrillation Devices Market include:

Atrial Fibrillation Devices Industry News:

- In August 2024, GE Healthcare announced introduction of an advanced clinical decision support system called CardioVision for atrial fibrillation. This newly launched system enables precision care and patient-centric approach for improved treatment.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Atrial Fibrillation Devices Market

By Product

-

- Radiofrequency (RF)

- Laser

- Cryoablation

- Ultrasound

- Microwave

- Other EP ablation catheters

- Cardiac monitors or implantable loop recorder

- EP diagnostic catheters

-

- Advanced mapping catheters

- Steerable catheters

- Fixed curve catheters

- Mapping and recording systems

- Access devices

- Intracardiac echocardiography (ICE)

- Left atrial appendage (LAA) closure devices

- Other products

By End-use

- Hospitals

- Cardiac centers

- Ambulatory surgical centers

- Other end-users

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)