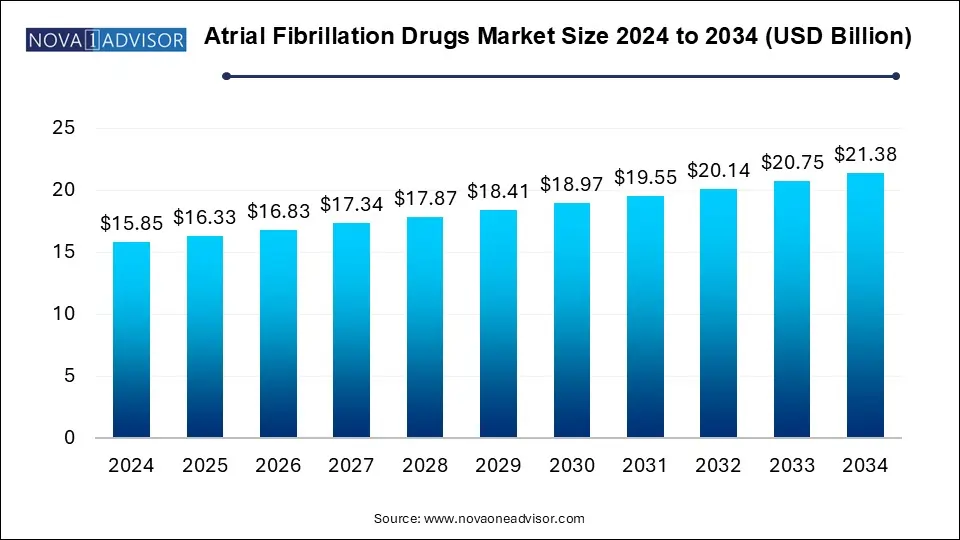

Atrial Fibrillation Drugs Market Size and Growth

The atrial fibrillation drugs market size was exhibited at USD 15.85 billion in 2024 and is projected to hit around USD 21.38 billion by 2034, growing at a CAGR of 3.03% during the forecast period 2025 to 2034.

Atrial Fibrillation Drugs Market Key Takeaways:

- North America dominated the global atrial fibrillation (AF) drugs market share of 46.0% in 2024

- In 2024, the anticoagulant drugs segment held the largest share of the atrial fibrillation drugs market.

- In 2024, the paroxysmal AF segment held the largest market share.

- The oral segment led the global atrial fibrillation drugs market in 2024.

- The heart rhythm control segment accounted for the largest share of the atrial fibrillation drugs market in 2024.

- The hospital segment was the dominant force in the global atrial fibrillation drugs market in 2024.

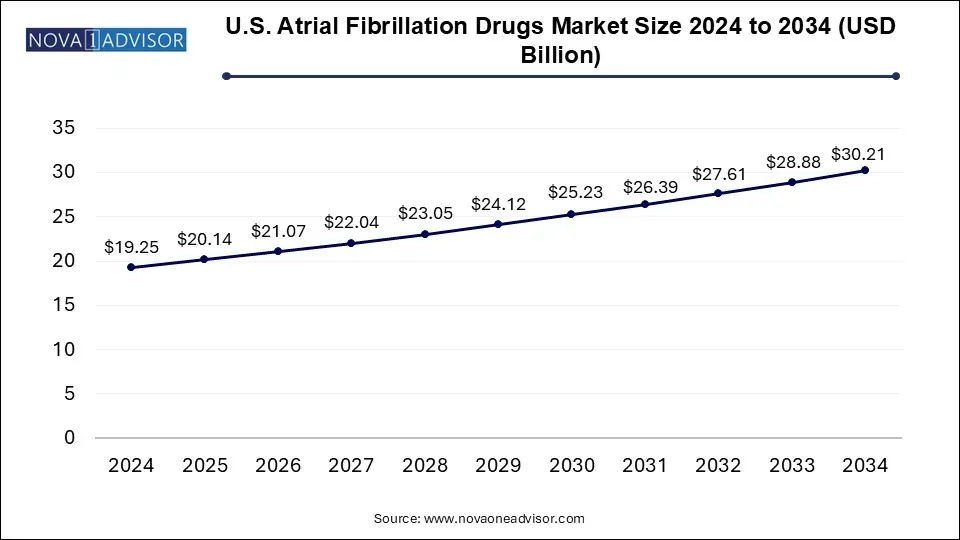

U.S. Atrial Fibrillation Drugs Market Size and Growth 2025 to 2034

The U.S. atrial fibrillation drugs market size was exhibited at USD 19.25 billion in 2024 and is projected to be worth around USD 30.21 billion by 2034, poised to grow at a CAGR of 4.61% from 2025 to 2034.

North America dominated the global atrial fibrillation (AF) drugs market share of 46.0% in 2024, driven by the region’s well-established healthcare sector, substantial healthcare expenditure, and access to advanced medical technologies, all of which contribute to its market leadership. The prevalence of atrial fibrillation is notably high, particularly among elderly individuals, further increasing the demand for pharmaceutical and therapeutic solutions.

The Asia Pacific region is projected to witness significant growth in the atrial fibrillation drugs market throughout the forecast period. This expansion is primarily attributed to the rising incidence of AF and an aging population, leading to a higher number of patients requiring treatment. Additionally, the growing prevalence of chronic illnesses such as hypertension and diabetes both known risk factors for AF is further fueling market demand.

Countries such as China, India, and Japan are expected to prioritize improvements in healthcare infrastructure, expanding access to advanced medical treatments and specialized services. This includes the establishment of dedicated cardiac centers and specialized clinics to enhance the quality of cardiovascular care.

Atrial Fibrillation Drugs Market Overview

Atrial fibrillation (AF) is the most prevalent form of cardiac arrhythmia and a leading cause of strokes. Several factors contribute to the risk of developing AF, including aging, high blood pressure, cardiovascular and pulmonary conditions, congenital heart defects, and excessive alcohol consumption. Although AF can be a long-term condition, various treatment options and preventive strategies have been developed to manage its progression and lower the risk of stroke.

As per a 2021 article published by the National Center for Biotechnology Information, the global prevalence of atrial fibrillation is estimated at approximately 37.5 million cases and is expected to rise by over 60% by 2050.

Treatment options for atrial fibrillation include medications to regulate heart rate and minimize stroke risk, as well as procedures aimed at restoring normal heart rhythm. Common interventions include rate control drugs, cardioversion, catheter ablation, rhythm management medications, anticoagulants, and other advanced cardiac procedures.

Report Scope of Atrial Fibrillation Drugs Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 16.33 Billion |

| Market Size by 2034 |

USD 21.38 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 3.03% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Products, Atrial Fibrillation Type, Route of Administration, Application, End-use Hospitals, and Regions |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Johnson & Johnson, Pfizer, Sanofi, Bayer AG, Boehringer Ingelheim, Bristol-Myers Squibb, Daiichi Sankyo, AstraZeneca, and Others. |

How is AI Transforming the Atrial Fibrillation Drugs Market?

Early detection of atrial fibrillation (AF) is essential in preventing severe cardiovascular complications, including strokes and other heart-related conditions. This plays a pivotal role in the AF drugs market. Moreover, research in artificial intelligence (AI) and AF is rapidly advancing within the healthcare sector. Notably, Eden et al. developed an AI system capable of predicting atrial fibrillation within 31 days using sinus rhythm ECGs from outpatient data. AF is a widely recognized cause of strokes, affecting millions of individuals, yet it often remains challenging to diagnose. The integration of clinical AI solutions empowers physicians by enhancing their ability to predict and manage cardiovascular diseases effectively.

In June 2024, Tempus secured 510(k) clearance from the U.S. FDA for Tempus ECG-AF, an AI-driven algorithm designed to identify patients at high risk of developing atrial fibrillation.

Factors Driving Growth in the Atrial Fibrillation Drugs Market

- The high prevalence of atrial fibrillation, especially among the elderly population, is fueling the demand for effective treatment options.

- Well-equipped healthcare facilities contribute to improved access to advanced diagnostic and treatment services for AF.

- Ongoing research and development efforts are leading to the innovation of enhanced and more effective treatment solutions.

- Increasing awareness and education among both healthcare professionals and the general public are driving higher adoption rates of AF treatments.

Market Dynamics

Driver: Rising Incidence of Cardiovascular Diseases

Atrial fibrillation (AF) is a prevalent form of cardiac arrhythmia that significantly increases the risk of developing cardiovascular conditions. Consequently, the growing number of cardiovascular cases is a key factor propelling the AF drugs market. Reports indicate a steady rise in the number of individuals diagnosed with atrial fibrillation. Notably, AF patients face a five-fold higher risk of stroke compared to the general population.

Atrial fibrillation is among the most common and concerning cardiac arrhythmias, often associated with poor outcomes due to an elevated risk of stroke and mortality. While anticoagulation therapy has traditionally been linked to AF in cardiovascular disease patients, emerging evidence suggests that AF is also highly prevalent among individuals with non-cardiovascular conditions such as cancer, sepsis, chronic obstructive pulmonary disease (COPD), obstructive sleep apnea, and chronic kidney disease.

Comorbidities Associated with Atrial Fibrillation

- Obesity

- Type 2 diabetes

- Chronic kidney disease

- Heart failure

- Coronary artery disease

- Congenital heart disease

- Lung diseases, like chronic obstructive pulmonary disease (COPD)

- Sleep apnea

- Hyperthyroidism

- Restraint

- Adverse drug side effects

Side effects are a concern in the atrial fibrillation drugs market because their consequences affect patient safety and outcomes significantly. Some of the drugs prescribed to treat AF include anticoagulants and antiarrhythmic drugs, which may cause side effects such as a high risk of bleeding, gastrointestinal disorders, renal/ hepatic problems, or other dysfunctions. These are distributed with the following by the pharmaceutical industry: regulatory scrutiny, pharmacovigilance, and constant research for safer drugs. These are important to enhance patients’ outcomes and address challenges arising from the management of AF.

Blood thinners have several possible side effects. These include

- Sick, weak, faint, or dizzy

- Red, dark brown, or black stools or urine

- Gums bleed

- Pain or swelling

- Difficulty in breathing

- Fever or illness

Opportunity

Personalized management of atrial fibrillation

The continuous changes in the management of AF are a good opportunity to improve the care of the patients by developing better treatment plans in the atrial fibrillation drugs market. Perhaps the most significant advantage is that clinicians can offer treatments that are even more accurate by validating parameters, which include the type of AF presentation, clinical factors, ECG analysis, and cardiac imaging. This marks the potential for further inclusion of these new biomarkers to improve patient-specific management strategies responsive to the specific pattern exhibited by each individual.

Atrial Fibrillation Drugs Market By Product Insights

In 2024, the anticoagulant drugs segment held the largest share of the atrial fibrillation drugs market. Anticoagulants play a crucial role in managing AF patients by preventing blood clot formation, thereby reducing stroke risk. These medications are now favored over warfarin for individuals with nonvalvular atrial fibrillation.

- In June 2023, Eagle Pharmaceuticals submitted a New Drug Application (NDA) to the U.S. FDA for landiolol, a beta-1 adrenoceptor blocker designed as a short-acting agent to manage ventricular rate in patients with atrial fibrillation, atrial flutter, and supraventricular tachycardia.

The antiarrhythmic drugs segment is expected to experience notable expansion in the coming years. Atrial fibrillation, the most prevalent type of atrial arrhythmia, becomes more common with aging, leading to increased use of antiarrhythmic drugs (AADs) for treatment. These medications not only help manage AF and atrial flutter but also have the potential to reduce hospital readmission rates for high-risk AF patients.

Atrial Fibrillation Drugs Market By Type Insights

In 2024, the paroxysmal AF segment held the largest market share. Paroxysmal AF refers to episodes of atrial fibrillation that resolve on their own within a week. Although these episodes are temporary and often do not require immediate treatment, patients with paroxysmal AF still face a higher stroke risk than those without the condition. Many individuals experience flu-like symptoms even during short AF episodes.

- In March 2024, Biosense Webster announced plans to seek U.S. FDA approval for the Varipulse System, a treatment for paroxysmal atrial fibrillation.

The persistent AF segment is projected to grow at the fastest pace during the forecast period. Persistent AF episodes last more than a week and require medical intervention, such as pharmacological or electrical conversion, to restore normal sinus rhythm. These cases often necessitate specialized treatment strategies to either regulate heart rate or restore normal rhythm.

Atrial Fibrillation Drugs Market By Route of Administration Insights

The oral segment led the global atrial fibrillation drugs market in 2024. Oral medications remain the most widely prescribed treatment for stroke prevention in AF patients due to their effectiveness in reducing blood clot formation. The convenience of tablet and capsule formulations also contributes to better patient adherence.

According to an NHS England press release from November 2024, since 2023, approximately 460,000 individuals in England have started direct oral anticoagulants (DOACs), preventing an estimated 17,000 strokes and 4,000 deaths.

The injectable segment is expected to grow substantially in the coming years. Injectable anticoagulants, such as low molecular weight heparins (LMWHs) like enoxaparin and unfractionated heparin, provide rapid anticoagulation, particularly in hospital settings or for specific patients. These treatments, administered via subcutaneous or intravenous injection, often require professional oversight and regular monitoring.

Atrial Fibrillation Drugs Market By Application Insights

The heart rhythm control segment accounted for the largest share of the atrial fibrillation drugs market in 2024. The approach to restoring normal rhythm whether through medication, electrical cardioversion, or catheter ablation is based on factors such as symptom severity, patient age, and coexisting health conditions.

The heart rate control segment is anticipated to expand significantly. Rate control is often the preferred strategy for asymptomatic AF patients, particularly when rhythm restoration is ineffective or impractical. Effective rate control can alleviate symptoms while requiring minimal monitoring and carrying fewer complications.

Atrial Fibrillation Drugs Market By End-Use Insights

The hospital segment was the dominant force in the global atrial fibrillation drugs market in 2024. This can be attributed to the high volume of AF-related procedures performed in hospitals, the presence of skilled medical professionals, and the availability of specialized surgical tools. Additionally, the rising prevalence of chronic conditions leading to increased hospital admissions further supports market growth.

Each year, approximately 454,200 AF patients are hospitalized in the United States, underscoring the critical role of hospitals in AF treatment and management.

The cardiac center segment is expected to witness significant growth in the coming years. The increasing preference for specialized treatment in dedicated cardiac clinics, along with the rising incidence of atrial fibrillation, is fueling demand for these facilities. With their focused expertise and advanced technology, cardiac centers are well-equipped to provide superior AF management and treatment.

Some of The Prominent Players in The Atrial fibrillation drugs market Include:

Atrial Fibrillation Drugs Market Recent Developments

- In June 2024, Alembic Pharmaceuticals Limited declared that they got U.S. FDA approval for their ANDA for dabigatran etexilate capsules.

- In June 2024, Kardium announced USD 104 million in new financing for innovative atrial fibrillation treatment dabigatran etexilate capsules are indicated for the reduction of the risk of stroke and systemic embolism in non-valvular atrial fibrillation in adult patients.

- In November 2024, Bayer AG broadened its phase 3 clinical trial program for the new drug candidate Asundexian. The company is exploring the possibilities of using the said drug for the treatment of affected patients who are at an increased risk of stroke or embolism.

- In March 2024, Bristol Myers Squibb initiated a pivotal phase 3 Librexia trial program with Janssen Pharmaceuticals for an oral factor Xia (FXIa) inhibitor milvexian antithrombotic. The trial is expected to compare Milvexian to Apixaban for the prevention of stroke amongst patients with AF.

- In June 2023, Apotex Inc. recreated the Eliquis brand of Apixaban through APO-Apixaban tablets in Canada. The drug is in tablets and comes in two different strengths, which are 2. 5 mg and 5 mg.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the atrial fibrillation drugs market

By Products

- Antiarrhythmic Drugs

- Anticoagulant Drugs

- Vitamin K Antagonists

- Novel Oral Anticoagulants

By Atrial Fibrillation Type

- Paroxysmal

- Persistent

- Permanent

By Route of Administration

By Application

- Heart Rhythm Control

- Heart Rate Control

By End-use Hospitals

- Cardiac Centers

- Ambulatory Surgical Centers

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)