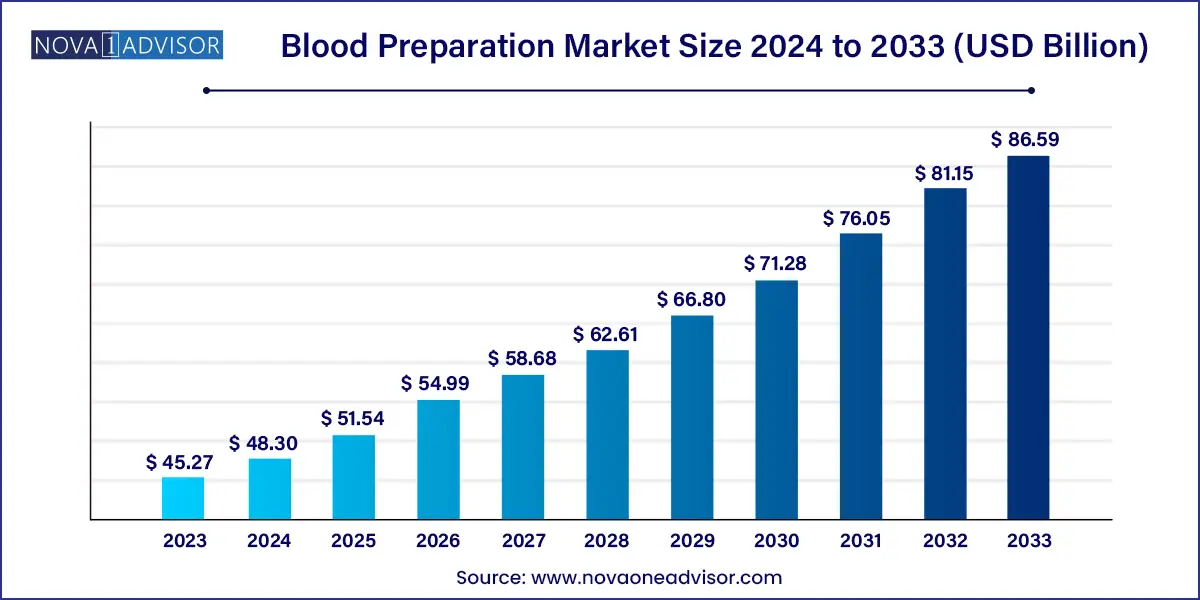

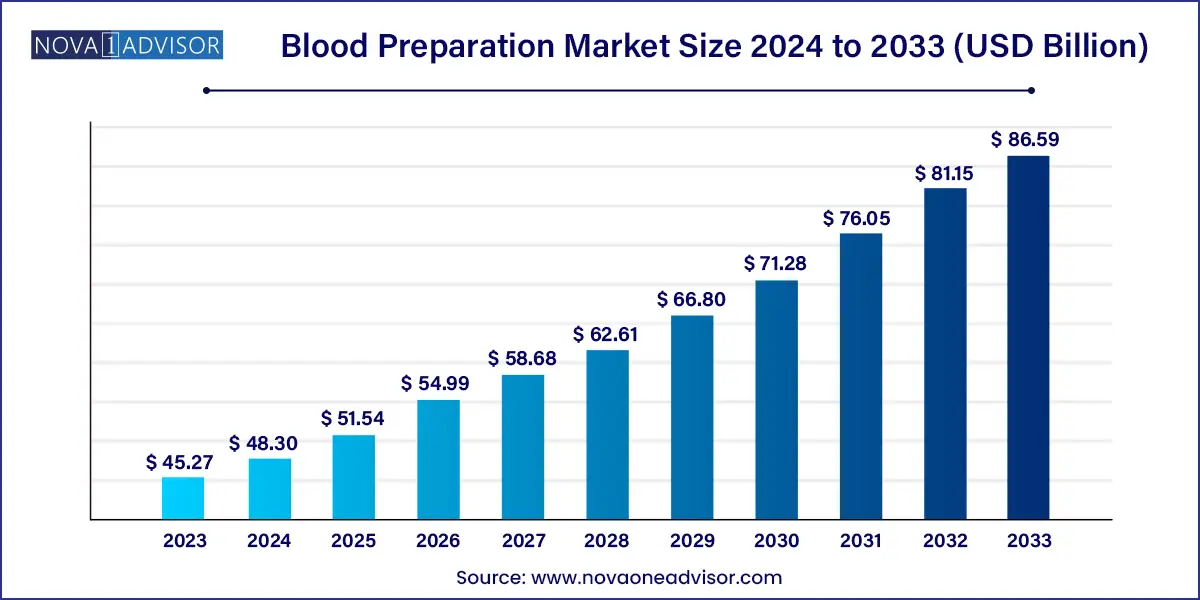

The global blood preparation market size was exhibited at USD 45.27 billion in 2023 and is projected to hit around USD 86.59 billion by 2033, growing at a CAGR of 6.7% during the forecast period of 2024 to 2033.

Key Takeaways:

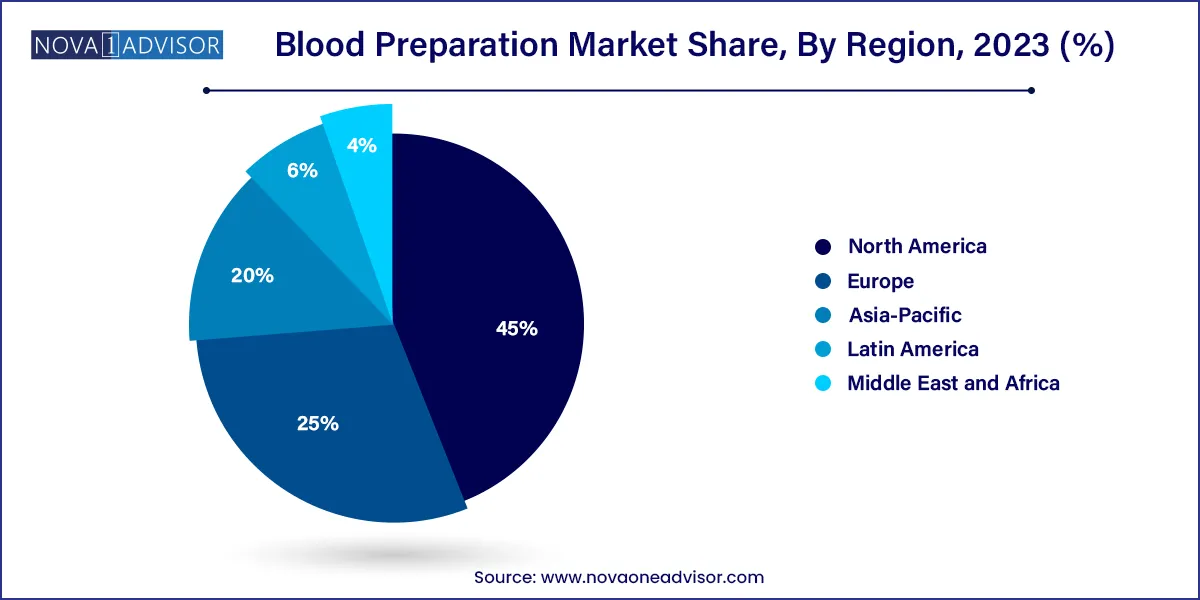

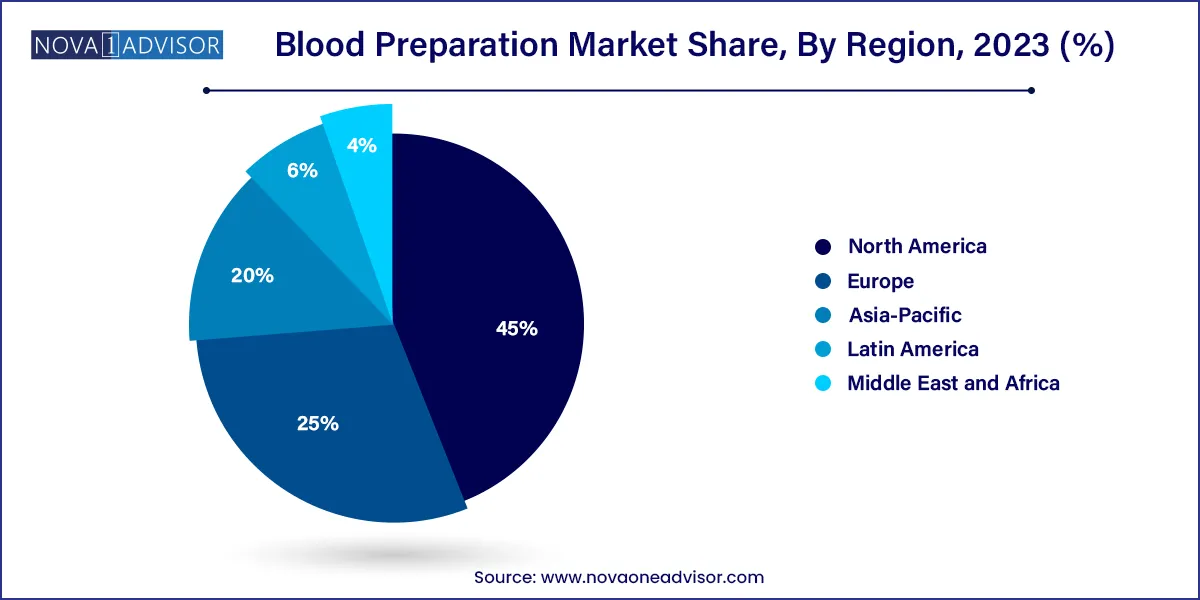

- North America led the overall blood preparation market with a share of 45.0% in 2023

- The whole blood product segment held the largest share of 47.0% of the market in 2023.

- Anticoagulants segment held a share of 64.30% of the blood preparation in 2023.

- In 2023, thrombocytosis segment held major share of 22.00% of the blood preparation market.

Market Overview

The global blood preparation market plays a foundational role in modern medicine, supporting critical functions in disease management, emergency care, surgery, and chronic disease treatment. Blood preparation refers to the collection, processing, and modification of blood and its components or derivatives to be used in therapeutic, diagnostic, or surgical applications. It includes a wide array of products such as whole blood, blood components (like plasma, red blood cells, and platelets), and blood-derived pharmaceuticals including clotting factors and immunoglobulins.

The market is witnessing steady growth due to the increasing global prevalence of hematologic disorders, cardiovascular diseases, and trauma-related injuries. Moreover, with the rise in complex surgical procedures and an aging population prone to conditions such as thrombocytopenia, anemia, and thrombosis, the demand for safe and effective blood products is climbing.

In parallel, advancements in transfusion medicine and blood processing technologies have enabled the development of highly refined products such as leukocyte-reduced red blood cells and cryoprecipitate, enhancing patient outcomes and reducing the risk of immunologic complications. The development of blood derivatives like clotting factors and anticoagulants has further extended the scope of the market, particularly in the treatment of hemophilia, pulmonary embolism, deep vein thrombosis (DVT), and stroke.

Governments, non-profit organizations, and private healthcare providers globally are investing in blood banks, donation campaigns, and research to improve availability, safety, and efficiency. Consequently, the blood preparation market has evolved into a complex, yet indispensable segment of the healthcare industry, with a growing need for innovation, infrastructure, and strategic collaboration.

Major Trends in the Market

-

Rise in automation and digitalization of blood processing and transfusion systems, leading to improved safety and operational efficiency.

-

Growth in personalized anticoagulant therapies tailored to genetic markers and specific co-morbidities.

-

Increased demand for pathogen-inactivated blood components to reduce the risk of transfusion-transmitted infections.

-

Adoption of point-of-care coagulation testing to support real-time, bedside decision-making in critical care.

-

Expansion of plasma-derived therapeutics driven by growing usage in immunodeficiencies and rare bleeding disorders.

-

Surging interest in synthetic and recombinant blood products as a solution to donor shortages.

-

Integration of artificial intelligence in blood bank management systems to optimize inventory and forecast demand.

-

Strengthened regulatory frameworks and global safety protocols, especially post-pandemic, to ensure blood product integrity.

Blood Preparation Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 45.27 Billion |

| Market Size by 2033 |

USD 86.59 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.7% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Antithrombotic And Anticoagulants Type, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Pfizer, Inc.;Bristol-Myers Squibb Company; Leo Pharma A/S; Sanofi; Xiamen Hisunny Chemical Co., LTD.; AstraZeneca plc; Baxter International Inc.; Portola Pharmaceuticals, |

Product Insights

Blood components held the dominant position in the market due to their essential role in transfusion therapy and chronic disease management. These include packed red blood cells, platelet concentrates, frozen plasma, and cryoprecipitate, each targeting specific patient needs. Packed red cells are used to treat anemia, platelet concentrates for thrombocytopenia or chemotherapy-induced bleeding, and plasma for clotting factor deficiencies.

Hospitals and trauma centers maintain high demand for blood components due to their compatibility across a variety of clinical scenarios. The ability to separate and use only the required component improves treatment efficacy while minimizing transfusion-related complications. Blood banks worldwide have optimized their logistics around component therapy, supported by cold chain infrastructure and inventory software.

Blood derivatives are emerging as the fastest-growing sub-segment, driven by their applications in oncology, autoimmune diseases, and rare bleeding disorders. Derivatives such as immunoglobulins, coagulation factors, and albumin are derived through fractionation processes and are increasingly being manufactured using recombinant technologies. Their long shelf life and standardized efficacy make them especially useful in non-emergency and long-term therapeutic scenarios, including hemophilia, primary immunodeficiency, and chronic liver conditions.

Antithrombotic and Anticoagulants Type Insights

Among antithrombotic therapies, anticoagulants held the largest market share. This category includes heparins, vitamin K antagonists, and newer direct oral anticoagulants (DOACs) such as direct thrombin inhibitors and factor Xa inhibitors. These drugs are critical in preventing and treating conditions such as deep vein thrombosis (DVT), pulmonary embolism, and atrial fibrillation-related stroke.

Heparins, especially low molecular weight heparin (LMWH), dominate clinical settings due to their safety profile and predictable pharmacokinetics. LMWHs like enoxaparin are widely used post-surgery, in cancer patients, and during dialysis. Meanwhile, ultra-low molecular weight heparins are being explored for even finer dose regulation and reduced bleeding risk.

The fibrinolytics segment—particularly tissue plasminogen activator (tPA)—is growing rapidly, especially in stroke and myocardial infarction management. The time-sensitive nature of stroke treatment has driven significant investment in emergency fibrinolysis therapies, expanding the role of agents like alteplase in pre-hospital and mobile stroke unit settings.

Application Insights

Pulmonary embolism (PE) dominated the application segment owing to its high prevalence and requirement for urgent therapeutic intervention. PE is a critical condition characterized by a blockage in the pulmonary arteries, typically by blood clots. It requires immediate anticoagulation or thrombolytic therapy to dissolve the clot and restore pulmonary circulation. The widespread use of heparins and DOACs in emergency departments and ICUs has strengthened this segment’s dominance.

Thrombocytosis, although a relatively niche application, is the fastest-growing sub-segment due to increasing recognition and diagnosis of platelet disorders. Patients undergoing chemotherapy, bone marrow disorders, or those with inflammatory conditions are susceptible to abnormal platelet production, requiring both platelet-reducing therapies and precision transfusions. The need for real-time platelet monitoring and tailored interventions is opening new avenues in clinical diagnostics and therapeutic innovations.

Regional Insights

North America held the largest market share due to its advanced healthcare infrastructure, strong presence of biopharmaceutical companies, and high prevalence of chronic diseases. The United States, in particular, has an expansive network of blood banks, donor registries, and clinical research facilities focusing on blood and coagulation disorders. The American Red Cross and other institutions ensure a steady supply of blood and its components.

Moreover, favorable reimbursement policies for blood derivatives and antithrombotic therapies, along with FDA support for innovation in recombinant products, drive market expansion. Public health initiatives encouraging voluntary blood donation and safety monitoring have positioned North America as a leader in both supply and demand dynamics.

Asia-Pacific is the fastest-growing region due to an increasing patient population, improved healthcare access, and rising awareness of blood donation. Countries like China, India, and Japan are investing in blood banking infrastructure and are seeing a rapid increase in transfusion-related services due to growing surgical procedures, trauma cases, and chronic illnesses.

India’s expansion of National Blood Transfusion Services and China’s regulatory push for voluntary donation have significantly improved component availability. In addition, the increasing incidence of genetic blood disorders such as thalassemia and hemophilia in the region has created sustained demand for blood derivatives and advanced therapies.

Private-public collaborations, mobile blood units, and telemedicine-based anticoagulation clinics are helping bridge access gaps in rural and semi-urban regions, fueling market penetration.

Some of the prominent players in the Blood preparation market include:

- Pfizer, Inc

- Bristol-Myers Squibb Company

- Leo Pharma A/S

- Sanofi

- Xiamen Hisunny Chemical Co., LTD

- AstraZeneca plc

- Baxter International Inc

- Portola Pharmaceuticals, Inc.

- GlaxoSmithKline PLC

- Shandong East Chemical Industry Co.

- Celgene Corp.

Recent Developments

-

April 2025 – Grifols S.A. launched a new hyperimmune globulin for COVID-19-related immune modulation, derived from convalescent plasma.

-

February 2025 – Baxter International Inc. announced the U.S. FDA approval of its extended shelf-life cryoprecipitate product for trauma care.

-

October 2024 – CSL Behring began phase III clinical trials of its recombinant fibrinogen concentrate aimed at rare bleeding disorders.

-

August 2024 – Octapharma AG launched OctaHeparin, a novel LMWH product in European markets targeting venous thromboembolism.

-

June 2024 – Terumo BCT unveiled its automated blood component separator at the Asia Blood Conference, focused on improving platelet and plasma yield efficiency.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global blood preparation market.

Product

-

- Red Cells

- Granulocytes

- Plasma

- Platelets

-

- Whole Blood Components

- Packed Red Cells

- Leukocyte Reduced Red Blood Cells

- Frozen Plasma

- Platelet Concentrate

- Cryoprecipitate

Antithrombotic and Anticoagulants Type

- Platelet Aggregation Inhibitors

-

- Glycoprotein Inhibitors

- COX Inhibitors

- ADP Antagonists

- Others

-

- Tissue Plasminogen Activator (tPA)

- Streptokinase

- Urokinase

-

-

- Unfractionated Heparin

- Low Molecular Weight Heparin (LMWH)

- Ultra-low Molecular Weight Heparin

-

- Vitamin K Antagonists

- Direct Thrombin Inhibitors

- Direct Factor Xa Inhibitors

Application

- Thrombocytosis

- Pulmonary Embolism

- Renal Impairment

- Angina Blood Vessel Complications

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)