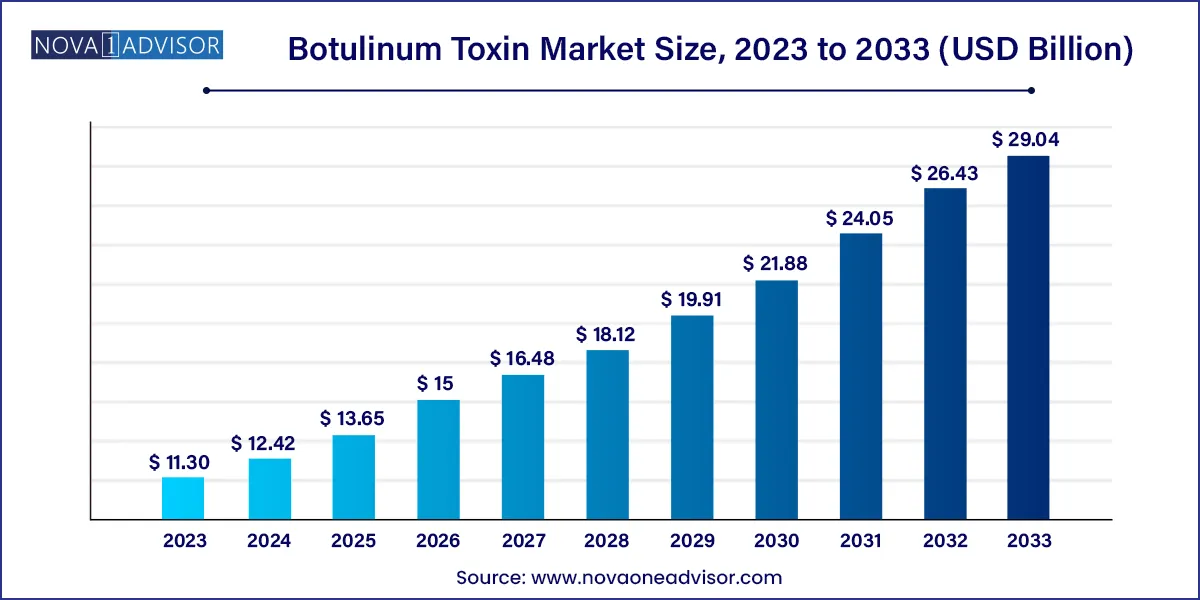

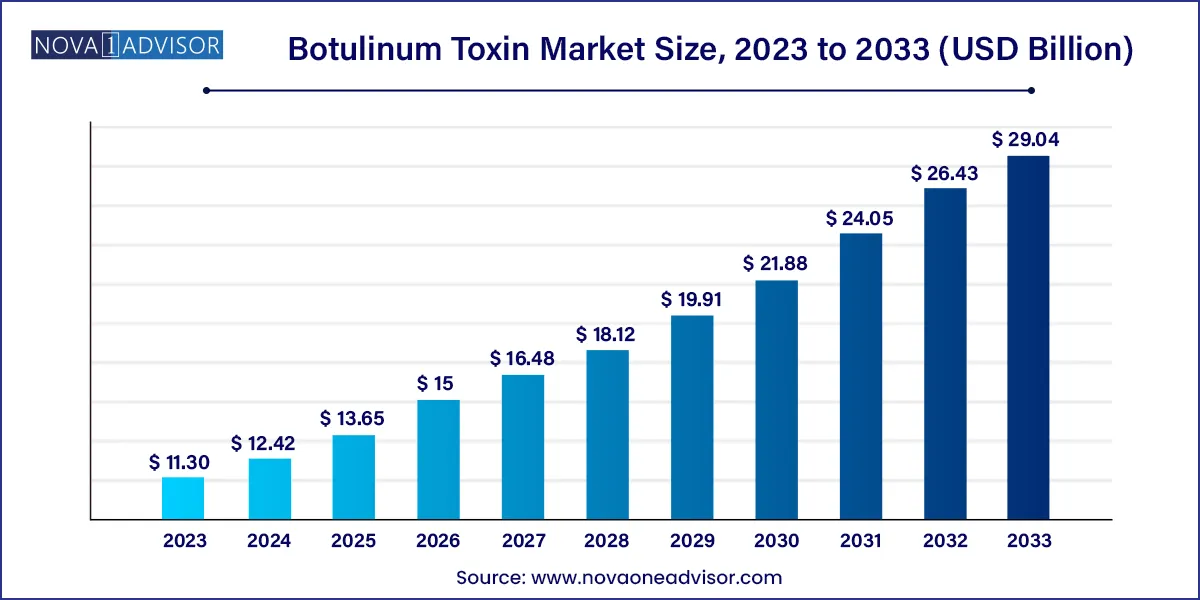

The global botulinum toxin market size was exhibited at USD 11.30 billion in 2023 and is projected to hit around USD 29.04 billion by 2033, growing at a CAGR of 9.9% during the forecast period of 2024 to 2033.

Key Takeaways:

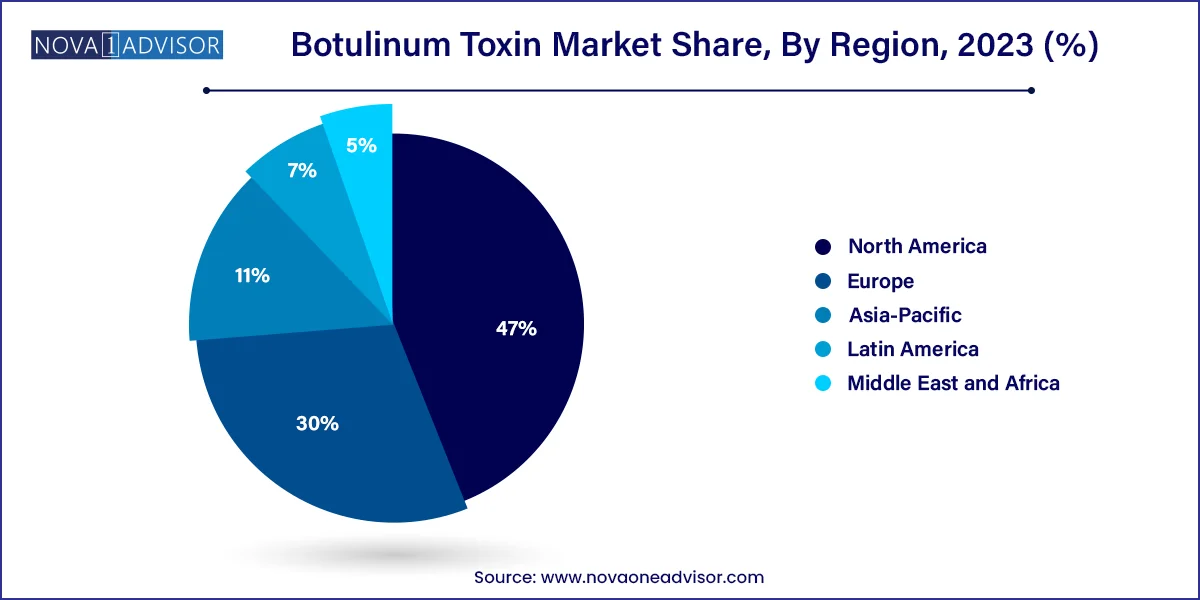

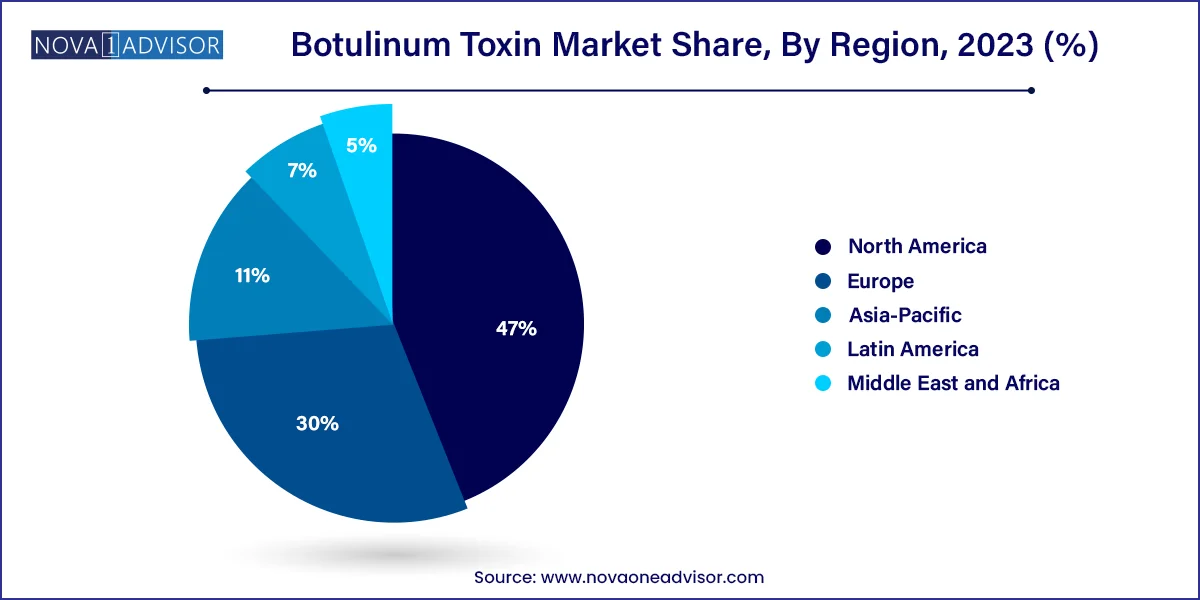

- North America accounted for a significant revenue share of 47.0% in 2023

- The Cosmetic centers and medspas accounted for the largest market share of 44.5% in 2023.

- The botulinum toxin-type- A segment exhibited the largest revenue share of 98.8% in 2023.

- The aesthetic segment is expected to witness a significant CAGR of 10.2% during the forecast period.

Market Overview

The Global Botulinum Toxin Market has evolved from a niche pharmaceutical application into a multi-billion-dollar industry with wide-ranging implications in both the therapeutic and aesthetic domains. Botulinum toxin, a neurotoxic protein produced by the bacterium Clostridium botulinum, is used in controlled medical doses to temporarily paralyze muscle activity. Though commonly associated with cosmetic wrinkle reduction, the compound has several medical applications, including the treatment of chronic migraines, spasticity, overactive bladder, and cervical dystonia.

The increasing acceptance of non-invasive aesthetic procedures, growing aging population, and rising awareness regarding appearance enhancement have significantly contributed to the market’s expansion. Moreover, as regulatory approvals widen the scope for therapeutic uses, demand is also surging in neurology, urology, and pain management specialties. In 2024, the market continued to benefit from a post-pandemic revival in cosmetic procedures and an increase in global medical tourism.

With further innovations underway and new indications under clinical trials, the botulinum toxin market is poised for robust long-term growth. As competition intensifies with biosimilar and next-generation products entering the scene, manufacturers are expanding their geographic reach and investing in strategic collaborations to secure market share.

Major Trends in the Market

-

Rise of Preventive Aesthetics: Younger demographics are increasingly using botulinum toxin as a preventive treatment to delay the onset of wrinkles.

-

Expansion into Therapeutics: New indications such as depression, bruxism (teeth grinding), and scar prevention are being explored for botulinum toxin use.

-

Increased Male Participation: A growing number of male patients are opting for botulinum toxin treatments for both aesthetic and therapeutic purposes.

-

Minimally Invasive Procedure Popularity: The broader shift towards outpatient, low-downtime procedures is boosting the appeal of botulinum toxin injections.

-

Regulatory Approvals for New Indications: More FDA and EMA approvals are allowing botulinum toxins to treat diverse medical conditions, enhancing their credibility.

-

Emergence of Biosimilars: Generic versions and biosimilar products are entering the market, creating pricing pressure on existing brands.

-

Medspa and Cosmetic Center Expansion: The rise in specialized aesthetic facilities is increasing patient access to botulinum toxin treatments outside traditional hospital settings.

Botulinum Toxin Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 11.30 Billion |

| Market Size by 2033 |

USD 29.04 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 9.9% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Ipsen Group; Allergen Inc.; Medy-Tox, Inc.; Merz Pharma; US Worldmeds; Evolus; Galderma; Metabiologics Inc.; Lanzhou Institute of Biological Products. |

Key Market Driver: Increasing Demand for Non-Invasive Aesthetic Enhancements

A prominent driver for the botulinum toxin market is the rising demand for non-invasive cosmetic procedures. With changing beauty standards and increased social media exposure, individuals are more focused than ever on maintaining a youthful appearance. Botulinum toxin has emerged as a gold standard for treating facial lines, offering noticeable results without surgery.

According to the American Society of Plastic Surgeons, over 7.4 million botulinum toxin procedures were performed in the United States alone in 2023, making it the most common non-surgical aesthetic procedure. Its rapid action, minimal recovery time, and affordability compared to surgical facelifts have made it a preferred choice for wrinkle reduction. Additionally, cultural shifts have normalized cosmetic interventions, reducing stigma and expanding the customer base across genders and age groups.

Key Market Restraint: High Cost and Temporary Effects

Despite its growing popularity, the high cost and temporary nature of botulinum toxin treatments act as a restraint for market expansion. On average, aesthetic treatments must be repeated every 3 to 6 months to maintain visible results, leading to substantial cumulative costs for patients. This periodic expense makes the treatment unaffordable for large portions of the population, especially in developing nations.

In therapeutic applications, repeated injections over a patient’s lifetime—such as for chronic migraine or spasticity—can impose long-term financial burdens, particularly in healthcare systems where insurance coverage is limited. Moreover, the temporary muscle paralysis induced by botulinum toxin necessitates frequent physician visits, which can be a logistical barrier in regions with poor healthcare access.

Key Market Opportunity: Expansion of Therapeutic Applications

An important opportunity lies in the expansion of botulinum toxin applications in therapeutics. Beyond its established uses in spasticity and dystonia, ongoing clinical trials are exploring its efficacy in conditions such as major depressive disorder, chronic pain, bruxism, scar management, and even atrial fibrillation.

For instance, studies have shown that botulinum toxin injections in the glabellar region can alleviate symptoms of depression by interrupting negative emotional feedback loops. Similarly, its use in dental practice to manage bruxism is gaining traction. These new indications not only increase patient populations but also help reposition botulinum toxin as a medical necessity rather than a luxury.

This therapeutic diversification can generate recurring revenue streams for manufacturers and reduce their reliance on the competitive cosmetic segment. As awareness grows among healthcare providers and payers, botulinum toxin could become a standard treatment across multiple specialties.

Segments Insights:

End-use Insights

Dermatology clinics currently lead the market, benefiting from physician-led services and a strong trust factor among patients. These settings offer medically supervised treatments, which are often perceived as safer and more effective. Clinics often combine botulinum toxin treatments with other dermatologic services like chemical peels or laser therapy, providing a comprehensive skin rejuvenation solution.

Cosmetic centers and medspas are the fastest-growing end-use segment, fueled by the consumer trend toward convenience and wellness-focused environments. These centers are often more affordable and less clinical in appearance, attracting a broader customer base, including younger and first-time users. Medspas also benefit from marketing strategies focused on beauty, lifestyle, and luxury, which make botulinum toxin treatments more approachable.

Product Type Insights

Type A botulinum toxin products dominate the global market, accounting for the majority of therapeutic and aesthetic applications. Within Type A, Botox, manufactured by AbbVie, remains the most recognized and widely used brand. It is approved for multiple indications in over 90 countries and is often the first-line product for both cosmetic and medical professionals.

Botox's market dominance is rooted in its brand equity, clinical safety profile, and extensive physician familiarity. Its strong distribution network and strategic marketing initiatives have enabled it to maintain a leading position despite rising competition. Furthermore, Botox’s utility in treating overactive bladder, migraines, and forehead lines exemplifies its broad appeal.

The fastest-growing product segment is Xeomin, a Type A formulation by Merz Pharmaceuticals, known for being free of complexing proteins, which reduces the risk of antibody formation in long-term use. Xeomin is gaining popularity among physicians who treat patients requiring repeated injections over extended periods, especially for conditions like cervical dystonia or blepharospasm. Its ‘naked’ formulation also appeals to consumers looking for more natural or minimalist options.

Application Insights

Aesthetic applications continue to dominate the botulinum toxin market, particularly treatments for glabellar lines, crow’s feet, and forehead lines. The pursuit of youthful facial aesthetics among aging populations in developed countries and the surge in preventive Botox among younger adults are key factors supporting this dominance. Clinics and medspas worldwide are seeing a consistent increase in first-time patients seeking these minimally invasive solutions.

However, therapeutic applications represent the fastest-growing segment, driven by the approval of new indications and an increase in off-label usage. For example, chronic migraine management with botulinum toxin has gained considerable traction since the FDA approval of Botox for this purpose. Additionally, its role in treating neurological conditions such as spasticity and dystonia has grown with expanding geriatric populations. Spasticity in post-stroke patients and cerebral palsy in children are key areas where botulinum toxin provides relief and enhances quality of life.

Regional Insights

North America dominates the global botulinum toxin market, thanks to high aesthetic awareness, favorable reimbursement frameworks for therapeutic uses, and the strong presence of leading players such as AbbVie (Botox) and Revance Therapeutics. The U.S. is the largest individual market, accounting for over 35% of global revenue, fueled by widespread cultural acceptance of aesthetic procedures and advanced healthcare infrastructure.

The U.S. FDA has approved botulinum toxin for more than 10 medical indications, and private insurance often covers therapeutic use. Additionally, aggressive marketing, medical training, and consumer education by manufacturers have helped increase adoption across both therapeutic and cosmetic sectors.

Asia-Pacific is the fastest-growing region due to its large population base, increasing disposable incomes, and growing interest in beauty and aesthetic treatments. South Korea, known for its thriving cosmetic surgery industry, leads the region in aesthetic botulinum toxin procedures. China, Japan, and India are also seeing rapid uptake, driven by urbanization and the rising influence of Western beauty standards.

In many Asian countries, social acceptance of cosmetic enhancements among younger individuals is higher than in the West, making botulinum toxin treatments a normalized part of skincare routines. Moreover, government investments in healthcare infrastructure and supportive regulatory environments are enhancing access to therapeutic applications.

Some of the prominent players in the botulinum toxin market include:

- Ipsen Group

- Allergen, Inc.

- Metabiologics

- Merz Pharma

- US Worldmeds

- Evolus

- Galderma

- Lanzhou Institute of Biological Products

Recent Developments

-

March 2025 – Revance Therapeutics announced the U.S. commercial expansion of Daxxify, a long-acting botulinum toxin for glabellar lines, with plans to enter the therapeutic segment by early 2026.

-

January 2025 – Medytox and Hugel, South Korean pharmaceutical firms, received conditional approval for new biosimilar botulinum toxin products in the ASEAN region.

-

November 2024 – Ipsen launched a global awareness campaign for Dysport Therapeutic, targeting spasticity and cervical dystonia awareness in collaboration with patient advocacy groups.

-

September 2024 – AbbVie introduced a new consumer mobile platform to educate users about Botox Cosmetic, featuring booking options and virtual consultations.

-

June 2024 – Evolus secured European approval for Jeuveau (marketed as Nuceiva), expanding its aesthetic-focused botulinum toxin to several EU countries.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global botulinum toxin market.

Product Type

-

- Botox

- Dysport

- Xeomin

- Others

Application

-

- Chronic Migraine

- Overactive Bladder

- Cervical Dystonia

- Spasticity

- Others

-

- Glabellar Lines

- Crow’s Feet

- Forehead Lines

- Others

End-use

- Hospitals

- Dermatology Clinics

- Cosmetic Centers and Medspas

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)