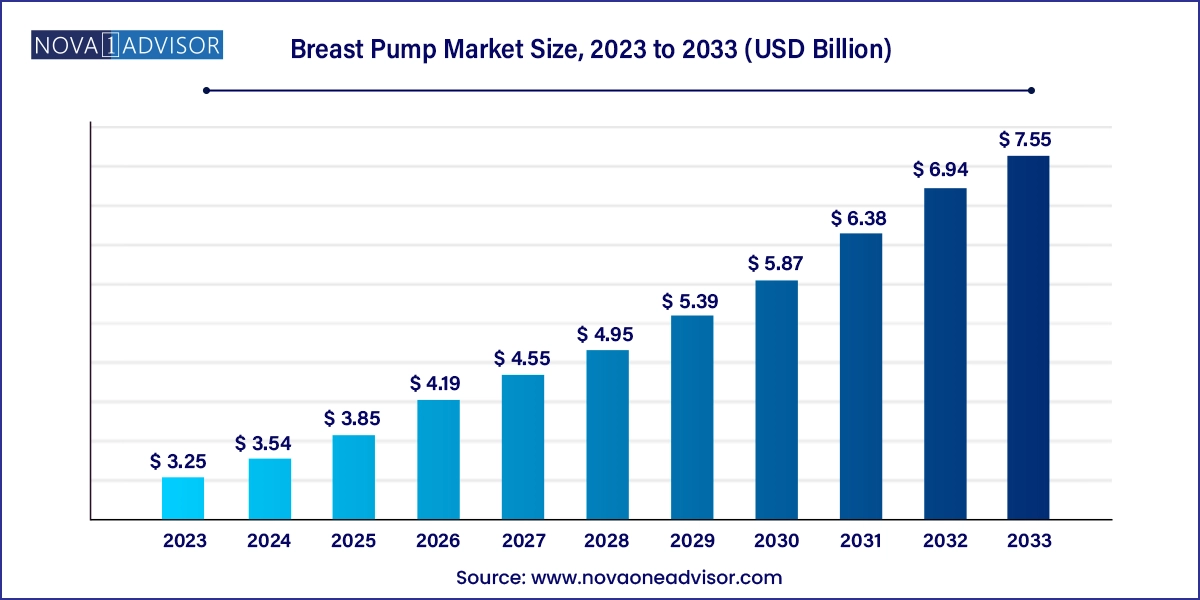

The global breast pump market size was exhibited at USD 3.25 billion in 2023 and is projected to hit around USD 7.55 billion by 2033, growing at a CAGR of 8.8% during the forecast period 2024 to 2033.

The global breast pump market has emerged as a critical segment of the maternal and infant care ecosystem, reflecting changing lifestyle patterns, increased awareness of breastfeeding benefits, and growing demand for convenience among working mothers. Breast pumps are devices designed to extract milk from the breast of lactating women, facilitating storage and later feeding of infants. They are widely used by mothers who return to work shortly after childbirth, experience breastfeeding challenges, or want to share feeding duties with partners or caregivers.

Globally, the breast pump market has been positively influenced by supportive government policies promoting breastfeeding, expanding female workforce participation, and the rising prevalence of nuclear families. Additionally, increased medicalization of childbirth and heightened awareness of breast milk’s immunological and developmental benefits have led to greater acceptance and utilization of breast pumps, especially in urban and semi-urban populations.

Market growth is also being fueled by the diversification of product portfolios, ranging from basic manual pumps to technologically advanced double electric models with digital displays, memory settings, and app connectivity. Furthermore, the COVID-19 pandemic underscored the importance of hygienic feeding alternatives, elevating demand for closed-system breast pumps, which minimize contamination risk. As parental health consciousness grows, and as innovation in pump design and accessories accelerates, the breast pump market is poised for sustained expansion in both developed and emerging markets.

Technological Innovation in Pump Designs: Introduction of smart pumps with app connectivity, memory functions, and hands-free usage is reshaping user expectations.

Rising Popularity of Closed-System Pumps: Due to enhanced hygiene and reduced risk of contamination, closed systems are increasingly favored by hospitals and mothers.

Government Support for Breastfeeding: Health programs encouraging breastfeeding, such as the WHO and UNICEF’s “Baby-Friendly Hospital Initiative,” are increasing pump usage globally.

Increasing Demand from Working Mothers: Greater female workforce participation in both developing and developed regions is significantly boosting breast pump adoption.

Home-Based and E-Commerce Sales Surging: Online retail platforms are becoming preferred channels due to convenience, privacy, and access to product variety and reviews.

Growing Preference for Electric and Battery-Operated Pumps: These offer higher efficiency and comfort, particularly for frequent or long-term users.

Rental Models for Hospital-Grade Pumps: Hospitals and medical supply companies are offering hospital-grade pump rentals to reduce upfront costs and improve accessibility.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.54 Billion |

| Market Size by 2033 | USD 7.55 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 8.8% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Technology, Application, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Ameda (Magento, Inc.); Hygeia Health; Medela AG; Koninklijke Philips N.V.; Lansinoh Laboratories, Inc.; Pigeon Corporation; Motif Medical; Chiaro Technology Limited (Elvie); Willow Innovations, Inc.; Spectra Baby USA |

One of the primary drivers of the breast pump market is the growing number of women in the global workforce, which has significantly changed the dynamics of infant care and maternal responsibilities. In many urban economies, both parents contribute to household income, requiring mothers to resume work soon after childbirth. In such scenarios, breast pumps provide an essential solution by allowing continued breastfeeding without interrupting work schedules or compromising infant nutrition.

For instance, in countries like the United States, Canada, and South Korea, corporate maternity leave policies often extend only a few months, creating a pressing need for tools that support lactation beyond the postpartum period. Additionally, corporate wellness initiatives are increasingly including lactation rooms and pump-friendly work environments, encouraging more women to sustain breastfeeding even after returning to work. As global labor patterns continue to evolve, the breast pump market stands to benefit from growing maternal empowerment and institutional support.

Despite their benefits, high initial costs associated with electric and hospital-grade breast pumps act as a restraint, especially in price-sensitive markets and low-income households. While manual pumps are more affordable, they may not be ideal for frequent use or for mothers with medical challenges, such as low milk supply or premature births.

Advanced electric pumps often come with digital controls, adjustable suction settings, memory functions, and dual-expressing capabilities, which push their prices beyond reach for many. Hospital-grade pumps, known for their durability and hygiene, are even more expensive, further limiting their accessibility. In regions without strong insurance coverage, subsidies, or rental programs, these costs may discourage adoption, especially among underserved communities. Bridging this affordability gap remains crucial for unlocking the full market potential.

An emerging opportunity in the breast pump market lies in the development and adoption of digitally connected, app-enabled breast pumps. These smart pumps offer features like pumping history tracking, real-time milk volume monitoring, adjustable rhythm settings, and personalized usage analytics. Connected via Bluetooth or Wi-Fi, these devices can sync with mobile apps to enhance user convenience and provide data-driven insights for both users and healthcare providers.

For example, brands like Willow and Elvie have launched wearable, silent breast pumps with sleek designs that allow mothers to pump discreetly while on the go or at work. The inclusion of mobile app integration not only improves the user experience but also introduces a community-based approach by connecting mothers with resources, guidance, and support networks. As consumer preference shifts toward smarter, time-efficient solutions, this digital transformation represents a high-growth frontier in the industry.

Closed-system breast pumps dominated the market, primarily due to their hygienic advantage and suitability for multiple users. These pumps are designed with a barrier between the milk collection components and the pumping mechanism, minimizing the risk of milk contamination and mold formation. Hospitals, NICUs, and breastfeeding centers often prefer closed systems for shared use, reinforcing their demand. They are also gaining popularity in home settings, as parents become more informed about the importance of sterility and ease of cleaning. Several leading brands have adopted closed-system designs as standard, elevating this product category’s share in both sales and brand trust.

Conversely, open-system pumps are still used in price-sensitive segments, but are gradually losing ground to their closed-system counterparts. These pumps lack a barrier, making them harder to sterilize and riskier in terms of cross-contamination, especially when reused. However, due to their lower cost, they remain relevant in developing regions or among occasional users. Future trends suggest that unless further cost reductions are achieved in closed-system designs, open systems may persist as an entry-level solution for short-term or emergency use, though their market share is expected to decline over time.

Electric pumps led the technology segment, particularly among working mothers and long-term users who require high-efficiency, comfortable, and hands-free pumping. These devices often offer dual-pumping capabilities, multiple speed and suction settings, and programmable memory features. Electric pumps reduce the physical strain associated with manual pumping and can significantly cut down expression time. Brands like Medela and Spectra have developed high-end models with hospital-grade power for home use, meeting the needs of frequent users and mothers with twins or premature babies.

Battery-powered pumps are the fastest-growing segment, especially as consumers demand portability and mobility. These pumps offer a middle ground between manual and electric models, delivering moderate suction power without dependency on direct electrical outlets. Recent innovations have enhanced battery life, included USB recharging options, and added sleek designs, making them ideal for mothers on the move. As more women resume work soon after childbirth or seek to maintain active lifestyles, battery-powered pumps are emerging as a go-to solution for convenience without sacrificing performance.

Personal-use breast pumps are the most dominant application segment, thanks to the increasing number of mothers seeking to establish flexible feeding routines at home. With rising awareness about the benefits of exclusive breastfeeding and the availability of home-use pump models at various price points, personal usage is becoming standard in both developed and developing nations. Many manufacturers now offer bundles including pumps, storage bags, sterilizers, and accessories, enhancing the value proposition for home users.

Hospital-grade pumps are growing rapidly, driven by increased adoption in maternity wards, neonatal units, and lactation consultation centers. These pumps are built for durability, high suction capacity, and safety in shared environments. Hospitals typically offer these for in-hospital use or rental programs, especially for mothers of premature or hospitalized infants. The post-discharge rental market is expanding, supported by insurance reimbursements and public health campaigns promoting prolonged breastfeeding in high-risk or medically complex births.

North America dominates the global breast pump market, supported by a well-developed healthcare system, high awareness levels, and strong insurance frameworks that often cover breast pump costs. The U.S. Affordable Care Act mandates health insurers to provide breast pumps at no additional cost, significantly boosting accessibility and adoption. Furthermore, North America is home to several key market players, including Medela, Spectra Baby USA, and Lansinoh, who drive innovation and expand product accessibility across retail and online channels. Urban working mothers in cities like New York, Toronto, and Los Angeles are increasingly embracing premium, smart, and wearable pump solutions, reflecting high market maturity.

Asia Pacific is the fastest-growing regional market, driven by rising birth rates, increased healthcare spending, and greater urbanization. Countries like China, India, and Indonesia are witnessing a demographic transition, with more women entering the workforce and adopting modern parenting practices. In China, for example, the relaxation of the one-child policy and growing middle-class incomes have led to an increase in maternal and infant product consumption. Local and international brands are entering these markets with region-specific strategies, including budget-friendly pump models and educational campaigns. Government initiatives promoting breastfeeding also support this trend, making Asia Pacific a critical growth engine.

Medela (March 2025) announced the launch of its redesigned Freestyle Hands-Free Breast Pump with quieter motor and enhanced battery life, targeting working mothers and frequent users.

Elvie (February 2025) revealed plans to expand into Southeast Asia with localized versions of its wearable smart pumps, tapping into rising demand in urban Asian markets.

Willow Innovations Inc. (January 2025) raised $55 million in funding to enhance its R&D and scale production of its Gen 3 wearable breast pump with app-based support.

Spectra Baby USA (November 2024) launched a new hospital-grade pump rental program in partnership with leading U.S. hospitals to provide short-term support for high-risk newborns.

Lansinoh (October 2024) introduced its new Compact Single Electric Pump with a focus on affordability and ease of use for first-time mothers.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global breast pump market

Product

Technology

Application

Regional