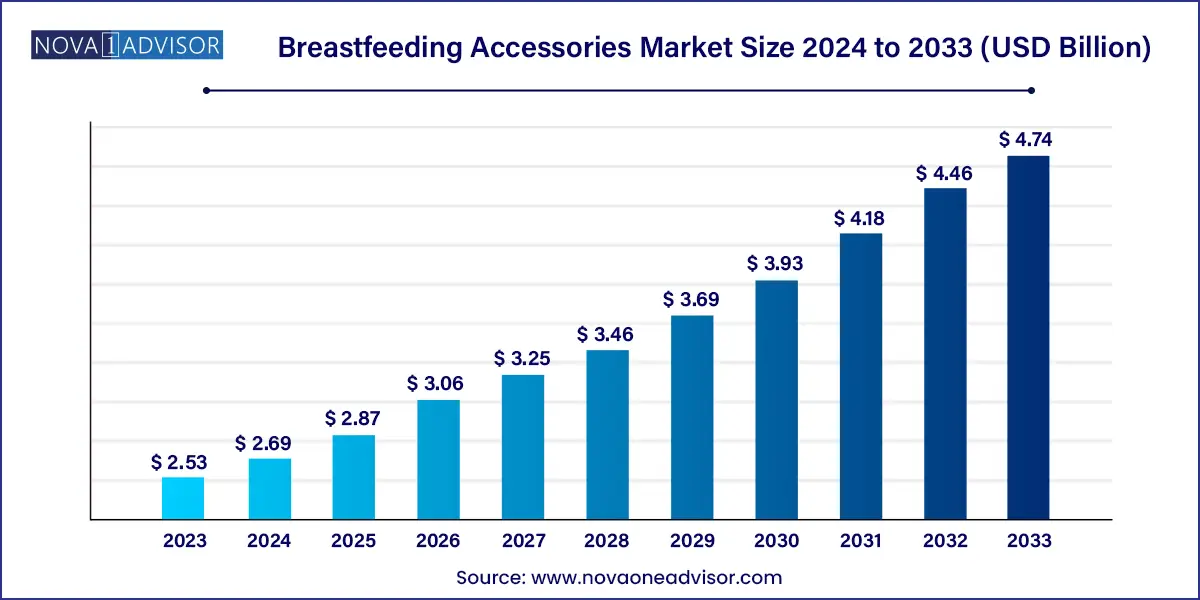

The global breastfeeding accessories market size was exhibited at USD 2.53 billion in 2023 and is projected to hit around USD 4.74 billion by 2033, growing at a CAGR of 6.49% during the forecast period of 2024 to 2033.

The breastfeeding accessories market has become a vital subset of the broader maternal and infant care industry, driven by rising breastfeeding awareness, healthcare advocacy, and changing lifestyles of modern mothers. Breastfeeding is widely promoted for its numerous health benefits for both infants and mothers including improved immunity, bonding, and postnatal recovery. However, challenges such as time constraints, workplace responsibilities, physical discomfort, and medical complications have necessitated the adoption of supportive tools and accessories to facilitate successful breastfeeding experiences.

Breastfeeding accessories encompass a wide range of products designed to aid lactation, provide comfort to nursing mothers, ensure milk storage and hygiene, and offer postpartum recovery support. Items such as breast pads, nursing bras, milk storage bags, nipple creams, lactation massagers, breast pump tote bags, and maternity garments are increasingly adopted by mothers, both during and after pregnancy.

The surge in global urbanization, dual-income households, and participation of women in the workforce has particularly amplified demand for products that make breastfeeding more flexible and convenient. Concurrently, e-commerce growth and social media marketing have transformed the way new mothers discover and purchase these accessories. As governments, NGOs, and healthcare providers advocate for increased breastfeeding rates, the market for supportive accessories continues to expand—offering comfort, privacy, and empowerment to breastfeeding women globally.

Rising Demand for Organic and Hypoallergenic Products: Mothers are increasingly opting for accessories made from natural, skin-safe materials to minimize allergic reactions and skin irritation.

Integration of Smart Technology: The rise of connected baby scales, temperature-controlled milk storage bags, and app-synced lactation massagers is transforming product usability.

Boom in E-commerce and Subscription Services: Online platforms and personalized product kits are enabling easier access and higher customer retention.

Focus on Workplace-Friendly Solutions: Portable breast milk storage, wearable nursing garments, and discreet carry bags are becoming essential for working mothers.

Increased Product Personalization and Inclusivity: Brands are offering diverse product lines to cater to different body types, breastfeeding challenges, and cultural preferences.

Eco-Conscious and Reusable Alternatives: Reusable breast pads, washable nursing bras, and eco-friendly cleaning kits are appealing to sustainability-focused consumers.

Postpartum Recovery Kits and Bundles: Brands are bundling postpartum care and breastfeeding products into comprehensive kits, increasing average transaction value and convenience.

| Report Coverage | Details |

| Market Size in 2024 | USD 2.53 Billion |

| Market Size by 2033 | USD 4.74 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.49% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | Medela AG; Ameda Inc.; Willow Innovations, Inc.; Koninklijke Philips N.V.; Chiaro Technology Limited; Pigeon Corporation; Spectra Baby; Lavie Mom; Motif Medical; Mayborn Group Limited |

One of the foremost drivers of the breastfeeding accessories market is the rising global emphasis on breastfeeding through health advocacy, policy support, and awareness campaigns. Organizations such as the World Health Organization (WHO), UNICEF, and the American Academy of Pediatrics strongly recommend exclusive breastfeeding for the first six months of life. Numerous national campaigns—such as India’s “MAA” program or the U.S. “It’s Only Natural” initiative—aim to educate mothers on breastfeeding benefits and techniques.

This heightened awareness has led to a substantial increase in breastfeeding initiation rates across several countries. As a result, demand has grown for products that assist mothers in managing breastfeeding challenges like nipple pain, milk leakage, and scheduling conflicts. Accessories such as breast pads, nipple shields, and cooling/heating pads are gaining traction for their role in improving comfort and prolonging breastfeeding duration. The healthcare sector’s endorsement of breastfeeding as a critical component of maternal and child health continues to catalyze consumer demand and government-backed support for breastfeeding accessories.

Despite growing awareness, deep-rooted cultural taboos and unequal access in underdeveloped and rural regions continue to hamper the market's potential. In many conservative societies, public breastfeeding remains stigmatized, discouraging mothers from seeking external help or using accessories that might draw attention. In addition, breastfeeding issues such as mastitis or low milk supply are often dismissed or hidden due to shame, reducing adoption of therapeutic products like lactation massagers or nipple care solutions.

Accessibility is also a major concern in low-income and remote areas, where retail distribution is limited and e-commerce penetration remains low. Here, women often rely on traditional methods or homemade alternatives, limiting the reach of commercial products. Affordability becomes another critical factor; premium brands and technologically advanced accessories are often priced beyond the means of rural consumers. These socio-economic disparities present a persistent challenge for market penetration, particularly in parts of Africa, South Asia, and Latin America.

An emerging opportunity in the market lies in the development of smart and discreet breastfeeding accessories tailored for tech-savvy and working mothers. Modern mothers increasingly value convenience, efficiency, and discreetness when managing breastfeeding in public or work settings. Products like smart nursing bras with leak detectors, app-connected baby scales, and rechargeable breast milk warming bottles are appealing to younger demographics.

Startups and established brands are focusing on wearable tech innovations that offer real-time feedback, such as temperature-controlled breast pads or massage-equipped nursing pillows. In addition, fashion-focused nursing garments are gaining popularity for their blend of style, functionality, and comfort. As digital tools continue to reshape parenting behavior, brands that integrate IoT, mobile apps, and ergonomic designs into their offerings are poised to gain a significant competitive advantage.

Breastmilk storage and feeding accessories dominate the global market owing to their indispensable role for mothers who pump milk for later use. This category includes coolers, bottles, freezer-safe storage bags, and feeding accessories such as temperature-indicating bottles. Their importance is amplified in urban populations, where mothers often return to work soon after childbirth and need reliable milk storage solutions to ensure continuity in breastfeeding. Leading brands like Medela and Lansinoh offer complete systems that integrate storage and feeding products with pumps, creating seamless user experiences and boosting segment loyalty.

Breastmilk storage products are also widely promoted in hospitals and prenatal programs, further solidifying their dominance. Many healthcare providers recommend specific systems for hygiene and safety, driving adoption among first-time parents.

In contrast, lactation massagers represent the fastest-growing segment as awareness grows around breast health during lactation. These handheld, often rechargeable devices help alleviate engorgement, clogged ducts, and improve milk flow. Traditionally, mothers used manual techniques or hot compresses, but modern massagers offer more targeted and effective relief.

Lactation massagers are increasingly recommended by lactation consultants and endorsed on parenting platforms and social media. As postpartum care shifts towards proactive and self-managed solutions, these devices are gaining popularity among mothers seeking comfort and efficiency, particularly in Western and urban Asian markets.

North America dominates the global breastfeeding accessories market, primarily due to high consumer awareness, a strong culture of breastfeeding support, and widespread retail and digital availability. The U.S. and Canada boast numerous government and healthcare-led initiatives encouraging breastfeeding, which has led to increased adoption of both basic and premium accessories.

Mothers in this region typically return to work within 6–12 weeks postpartum, creating demand for advanced accessories like breast milk storage, wearable nursing gear, and electric pump bags. North America also has a mature e-commerce ecosystem that supports personalized product recommendations, subscription services, and tele-lactation consultations. Brands such as Lansinoh, Boppy, and Medela have strong customer loyalty and retail partnerships across major drugstores and online platforms.

Asia-Pacific is the fastest-growing region, driven by increasing urbanization, government-backed breastfeeding campaigns, and a rising middle class. Countries such as China, India, South Korea, and Japan are witnessing a shift in parenting norms, with working mothers actively seeking tools to balance breastfeeding with professional obligations.

In India, national programs like POSHAN Abhiyaan and Janani Suraksha Yojana are increasing institutional deliveries and awareness about breastfeeding, supporting market growth. Meanwhile, Chinese brands are innovating in design and pricing to target tier 2 and 3 cities. E-commerce platforms such as Alibaba and Flipkart have also made accessories more accessible across the region, breaking geographic and affordability barriers.

February 2025 – Medela launched the "Comfort Collection", including temperature-sensitive breast pads and a redesigned nursing bra aimed at enhancing comfort and style.

December 2024 – Haakaa introduced an upgraded version of its manual breast pump and milk collector combo, improving ergonomic design and leak-proof functionality.

October 2024 – Frida Mom debuted a new postpartum recovery and breastfeeding care kit featuring cooling pads, gowns, and reusable heat packs, marketed as a hospital-grade take-home bundle.

September 2024 – Lansinoh partnered with major online retailers in Southeast Asia to expand its reach through curated baby care kits, targeting new mothers in urban centers.

July 2024 – Boppy Company released its new 2-in-1 Nursing and Pumping Bra, allowing hands-free pumping with enhanced support, designed in collaboration with lactation consultants.

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global breastfeeding accessories market.

Product

By Region