C-RAN Market Size and Trends

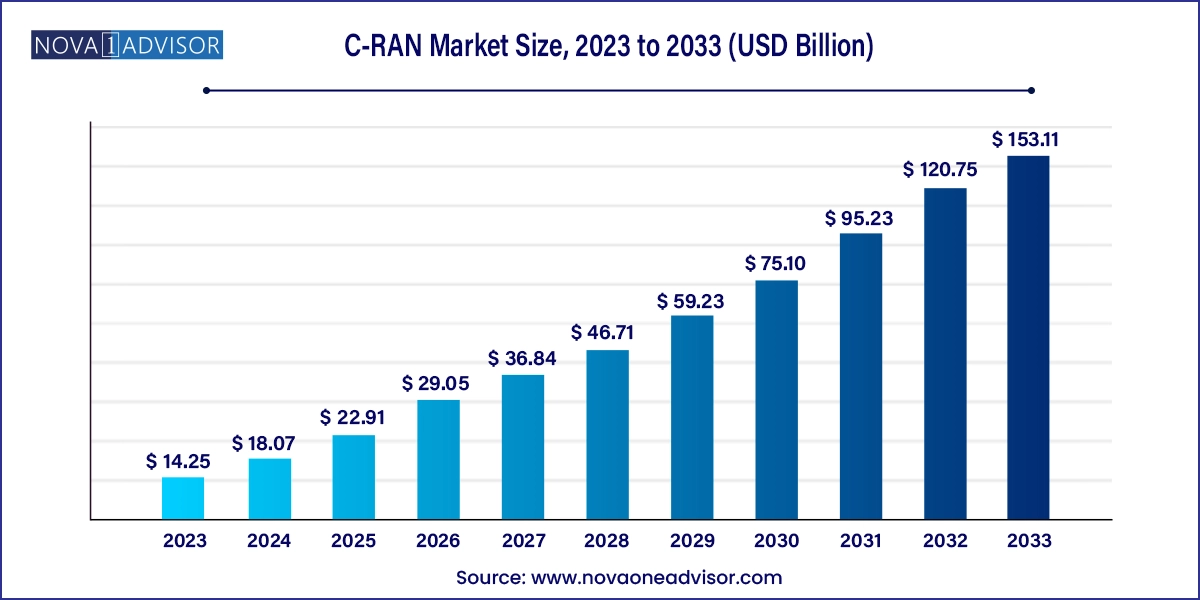

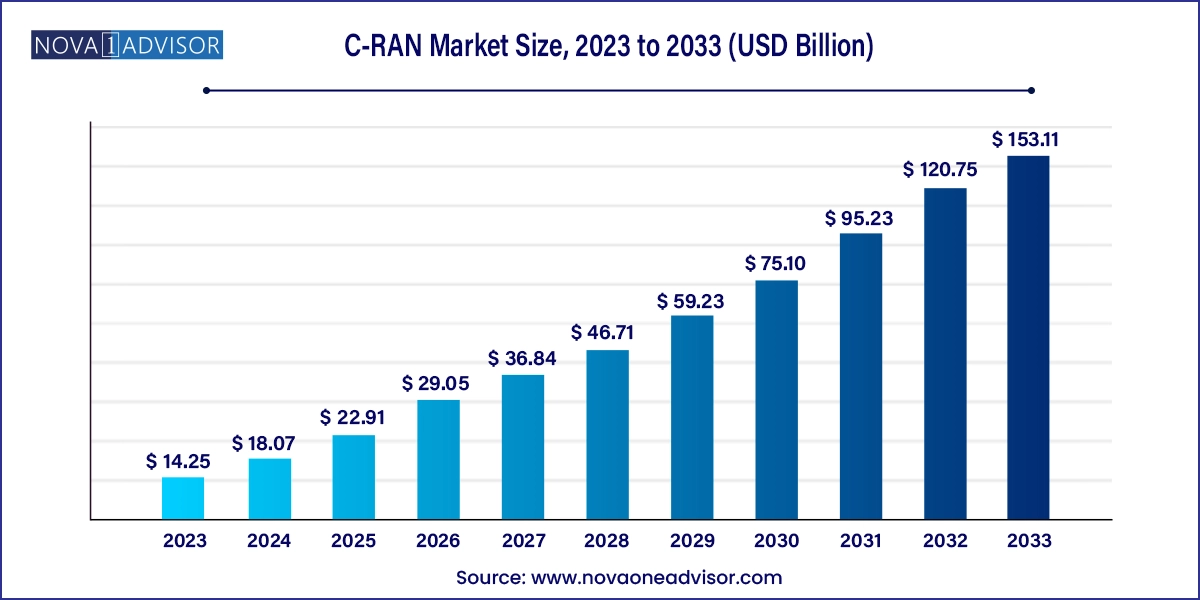

The global C-RAN market size was exhibited at USD 14.25 billion in 2023 and is projected to hit around USD 153.11 billion by 2033, growing at a CAGR of 26.8% during the forecast period 2024 to 2033.

C-RAN Market Key Takeaways:

- The centralized RAN segment accounted for the largest market share of around 60% in 2023.

- The virtualized/cloud RAN segment is expected to record the highest CAGR of around 28% over the forecast period.

- The infrastructure segment accounted for the largest market share of over 49% in 2023.

- The software segment is projected to expand at a significant CAGR of around 27% during the forecast period.

- The LTE and 5G segment accounted for the largest market share of around 88% in 2023.

- The 3G network type segment is expected to face challenges over the forecast period.

- The outdoor segment accounted for the largest market share of around 81% in 2023.

- The indoor segment is expected to grow at a notable CAGR of around 31% over the forecast period.

- Asia Pacific accounted for the largest market share of around 32% in 2023.

- North America is expected to hold the second largest market share of around 29.5% in 2023.

Market Overview

The global Cloud Radio Access Network (C-RAN) market is undergoing a rapid evolution, driven by the increasing demand for high-speed data, scalable network architecture, and efficient mobile communication infrastructure. As the telecommunications industry transitions toward 5G, C-RAN has emerged as a transformative technology redefining the radio access network (RAN) framework. Unlike traditional RAN architectures that use distributed base stations, C-RAN consolidates baseband processing units (BBUs) into centralized locations while keeping remote radio units (RRUs) near antennas. This architectural innovation leads to significant reductions in capital and operational expenditures, power consumption, and network latency.

Globally, operators are adopting C-RAN to optimize their network capabilities while meeting the growing subscriber expectations for high-quality, low-latency services. Urban areas with high user density particularly benefit from the centralized architecture, enabling better resource pooling, coordinated multipoint transmission (CoMP), and dynamic allocation of resources. The growth of data-intensive applications such as HD video streaming, IoT connectivity, and augmented reality (AR) further fuels the market’s expansion.

With telecom operators investing heavily in upgrading legacy networks to 5G-compatible infrastructure, C-RAN plays a vital role in supporting the evolution toward ultra-reliable and low-latency communications (URLLC). The ecosystem includes component manufacturers, software vendors, and service providers collaborating to develop innovative, scalable, and future-ready solutions. As such, the global C-RAN market is poised for sustained growth in the coming decade.

Major Trends in the Market

-

Adoption of 5G technology: C-RAN is a foundational architecture for 5G rollouts, enabling scalable deployment and low-latency communication.

-

Virtualization of network components: Increasing integration of NFV (Network Function Virtualization) and SDN (Software-Defined Networking) to enhance flexibility and reduce hardware dependence.

-

Edge computing integration: Shift toward deploying computing capabilities closer to users, leveraging C-RAN's centralized design to support edge data processing.

-

Energy efficiency and green networking: Telecom operators adopting C-RAN for its reduced power consumption and smaller carbon footprint.

-

Open RAN (O-RAN) compatibility: Growing interest in open and interoperable network architectures facilitating multi-vendor ecosystems within C-RAN.

-

Increase in private network deployments: Enterprises across manufacturing, healthcare, and logistics adopting C-RAN-based private 5G networks.

-

Surge in rural connectivity initiatives: Government and public sector investments in extending mobile broadband to underserved areas with cost-efficient C-RAN deployments.

-

AI and automation in network optimization: C-RAN platforms increasingly integrating AI for dynamic resource allocation and predictive maintenance.

Report Scope of C-RAN Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 18.07 Billion |

| Market Size by 2033 |

USD 153.11 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 26.8% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Architecture Type, Component, Network Type, Deployment Model, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; South America; Middle East & Africa |

| Key Companies Profiled |

Altiostar Networks; ASOCS Ltd; Cisco Systems, Inc.; Telefonaktiebolaget LM Ericsson; Fujitsu Limited; Huawei Technologies Co., Ltd; Intel Corporation; HRMavenir Systems, Inc.; NEC Corporation; Samsung Electronics Co., Ltd.; Nokia Corporation; ZTE Corporation |

Market Driver: Acceleration of 5G Deployment

One of the most compelling drivers for the C-RAN market is the accelerated deployment of 5G networks across both developed and developing economies. The transition to 5G demands a shift from traditional network designs to architectures that can support massive data throughput, ultra-low latency, and dense user environments. C-RAN facilitates this by decoupling the radio and baseband functions, enabling centralized processing, and allowing more effective coordination between cells—essential for advanced 5G use cases like massive MIMO, beamforming, and network slicing.

Furthermore, with the growing rollout of small cells in urban areas to support dense network traffic, C-RAN enables more efficient signal processing and spectrum usage. Governments, especially in countries like China, the U.S., and South Korea, are pushing aggressive 5G timelines, resulting in heightened investments in compatible infrastructure. This trend is expected to continue as 5G coverage expands to suburban and rural areas.

Market Restraint: High Initial Capital Expenditure

Despite its long-term operational savings, the high initial capital investment required for C-RAN infrastructure deployment poses a significant restraint. The transition from traditional RAN to C-RAN demands extensive fiber connectivity for fronthaul links, powerful centralized processing units, and advanced synchronization systems. Small and mid-sized telecom operators often lack the financial resources to undertake such investments, especially in regions with limited existing infrastructure.

Additionally, interoperability challenges between legacy equipment and new C-RAN components can increase costs. The requirement for trained technical personnel to manage and integrate these complex systems further adds to the financial burden. Thus, while the benefits of C-RAN are compelling, the upfront costs can slow down adoption, particularly in emerging markets.

Market Opportunity: Rising Demand for Edge and Cloud-native Architectures

The growing demand for edge computing and cloud-native architectures presents a significant opportunity for the C-RAN market. As telecom networks evolve toward distributed cloud environments, C-RAN’s centralized yet virtualizable design aligns perfectly with edge-centric service delivery models. This synergy supports the development of low-latency applications such as autonomous vehicles, real-time gaming, and industrial automation.

Companies are leveraging the flexibility of cloud-RAN (vRAN) to deploy network functions on commercial off-the-shelf (COTS) hardware, enabling cost-effective scaling and orchestration. This is particularly beneficial for enterprises implementing private 5G networks where rapid configuration and dynamic resource allocation are crucial. As edge data centers proliferate, they will serve as natural hubs for C-RAN deployments, enhancing both coverage and performance.

C-RAN Market By Architecture Type Insights

Virtualized/Cloud-RAN (vRAN) currently dominates the architecture segment due to its flexibility, scalability, and compatibility with next-generation networks. Unlike traditional centralized-RAN, vRAN decouples hardware and software components, allowing network functions to run on standard servers. This enables telecom operators to reduce hardware dependencies and improve efficiency through dynamic orchestration. As software-based deployments increase in tandem with AI and analytics integration, vRAN adoption is outpacing centralized-RAN, especially in regions with high 5G rollout intensity.

In parallel, vRAN is also the fastest-growing segment, driven by its ability to enable network slicing, automate resource management, and support edge deployments. For instance, in 2024, Rakuten Mobile continued expanding its fully virtualized network in Japan, becoming a reference model for global telecom operators. The trend toward software-defined networking across industries will further boost the vRAN market in coming years.

C-RAN Market By Component Insights

The infrastructure segment dominates the component category, encompassing Remote Radio Units (RRUs), Baseband Units (BBUs), and fronthaul connectivity systems. These components form the physical backbone of any C-RAN setup. The demand for high-capacity and energy-efficient RRUs, particularly in dense urban environments, has surged with 5G proliferation. Similarly, advanced BBUs that support multi-technology and multi-band networks are being rapidly adopted to manage increasing mobile traffic.

Conversely, services are the fastest-growing component, including consulting, design and deployment, maintenance, and support. As network complexity increases, operators are outsourcing end-to-end C-RAN implementation and management to specialized service providers. The need for tailored deployment strategies, optimization services, and lifecycle support is growing, especially among enterprises and in government-backed rural connectivity projects.

C-RAN Market By Network Type Insights

LTE & 5G networks dominate the network type segment due to their alignment with C-RAN’s advanced features. C-RAN architecture enhances LTE and 5G performance by enabling coordinated multipoint transmission and centralized control, leading to improved spectral efficiency and reduced latency. The widespread rollout of 4G LTE across emerging markets and the rapid adoption of 5G in developed economies ensure the dominance of this segment.

Simultaneously, the LTE & 5G segment is also growing at the fastest pace, with countries like China, South Korea, and the United States making substantial infrastructure investments. The need to support higher bandwidth, IoT devices, and mission-critical applications makes C-RAN indispensable for modern LTE and 5G networks.

C-RAN Market By Deployment Insights

The outdoor deployment model dominates the C-RAN market due to large-scale installations by telecom operators in urban and suburban regions. Macro cell sites, which require robust outdoor infrastructure, benefit from C-RAN’s centralized resource pooling. Such deployments support broader geographic coverage and are often backed by public investments in national broadband expansion.

In contrast, the indoor deployment model is experiencing faster growth, driven by the rise in enterprise-level private networks and smart building initiatives. High-density environments like stadiums, airports, and corporate campuses demand reliable indoor connectivity. Indoor C-RAN deployments are addressing these requirements with compact, energy-efficient solutions tailored to confined spaces.

C-RAN Market By Regional Insights

Asia Pacific holds the dominant position in the global C-RAN market, primarily due to aggressive 5G deployment strategies in countries such as China, Japan, and South Korea. These nations lead in telecom innovation, supported by government initiatives, public-private partnerships, and massive subscriber bases. China Mobile, for instance, operates one of the largest centralized-RAN networks globally, with thousands of BBUs and RRUs connected via high-speed fronthaul.

Furthermore, telecom OEMs like Huawei and ZTE, headquartered in the region, are actively advancing C-RAN technologies, thereby catalyzing domestic adoption. The presence of a robust manufacturing ecosystem, combined with rapid urbanization and smart city projects, reinforces Asia Pacific’s leadership in the market.

The Middle East & Africa (MEA) region is the fastest-growing in the C-RAN landscape. Nations such as the UAE and Saudi Arabia are investing heavily in next-generation telecom infrastructure as part of their digital transformation agendas. The 2024 launch of 5G standalone services in Saudi Arabia by STC Group, supported by C-RAN, exemplifies this trend.

In Africa, increasing demand for mobile broadband in underserved areas is prompting governments and international donors to explore cost-efficient C-RAN deployments. These initiatives aim to bridge the digital divide, with C-RAN offering an optimal solution for cost-effective and scalable network expansion.

Some of the prominent players in the global C-RAN market include:

Recent Developments

-

January 2025: Nokia announced a collaboration with Etisalat to deploy cloud-based RAN infrastructure across the UAE. The project aims to enhance network performance and enable future 5G applications using C-RAN and edge technologies.

-

December 2024: Ericsson and Ooredoo Qatar launched a fully virtualized RAN trial, showcasing low-latency applications using C-RAN and AI for dynamic spectrum management.

-

November 2024: Samsung Networks and Verizon extended their partnership to deploy vRAN in the U.S., emphasizing software-defined network transformation and cloud-native architecture.

-

September 2024: Fujitsu introduced its open vRAN platform in Europe, highlighting the company’s commitment to supporting O-RAN standards in C-RAN deployments.

-

August 2024: NEC Corporation partnered with Rakuten Symphony to co-develop scalable vRAN systems, enabling rapid global deployments.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global C-RAN market

Architecture Type

- Centralized-RAN

- Virtualized/Cloud-RAN

Component

-

- Remote Radio Units

- Baseband Units

- Fronthaul

-

- Consulting

- Design and Deployment

- Maintenance and Support

- Others

Network Type

Deployment Model

Regional

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa