C-reactive Protein Testing Market Size and Trends

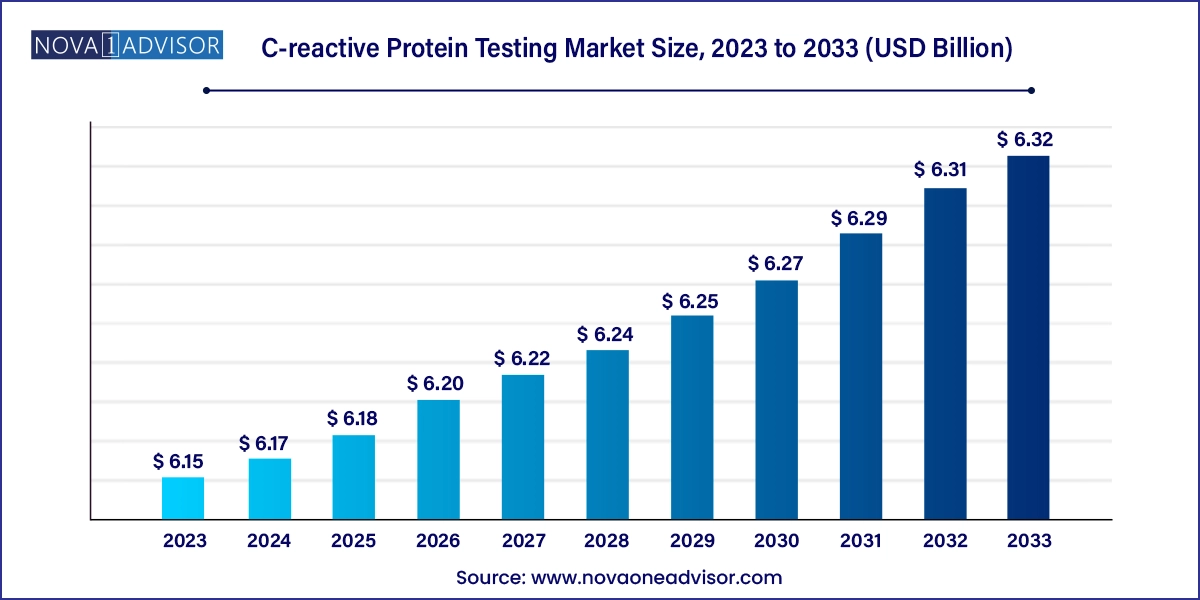

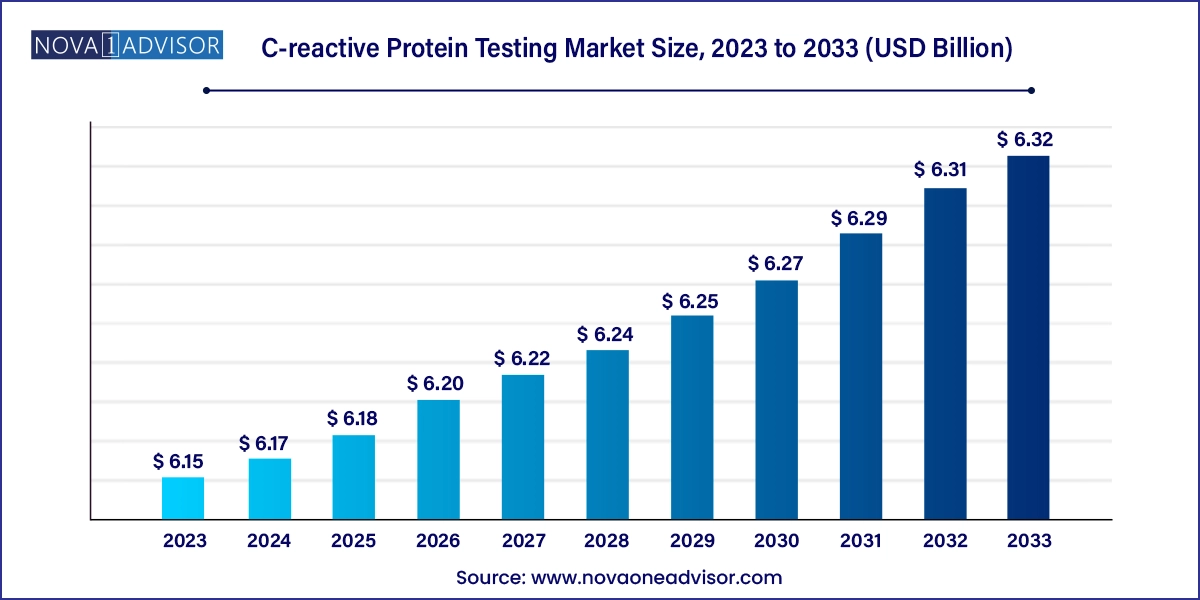

The global C-reactive protein testing market size was exhibited at USD 6.15 billion in 2023 and is projected to hit around USD 6.32 billion by 2033, growing at a CAGR of 0.28% during the forecast period 2024 to 2033.

C-reactive Protein Testing Market Key Takeaways:

- Based on assay type, immunoturbidimetric assays dominated the market with a revenue share of 48.53% in 2023.

- The hs-CRP 3 segment dominated the market in 2023 with a revenue share of approximately 42.80%.

- Based on the disease areas, the cardiovascular diseases (CVD) segment dominated the market with the largest share of 22.67% in 2023.

- The hospitals segment held the largest revenue share of 28.01% in 2023.

- North America dominated the market with a share of 39.42% in 2023

Market Overview

The C-Reactive Protein (CRP) Testing Market is a vital component of the broader in-vitro diagnostics industry, playing a pivotal role in detecting acute and chronic inflammatory conditions. CRP is a plasma protein produced by the liver in response to inflammation, and its concentration rises significantly in response to bacterial infections, autoimmune diseases, and tissue damage. As an early biomarker of inflammation, CRP testing is widely used in clinical diagnostics to detect, monitor, and assess disease severity across various medical conditions including cardiovascular diseases, rheumatoid arthritis, cancer, lupus, and infections.

With increasing awareness about early disease detection and a rising global burden of chronic inflammatory and cardiovascular conditions, CRP testing has become routine in primary care, hospital, and laboratory settings. The global push for preventive healthcare, combined with technological advancements in assay formats—ranging from traditional immunoturbidimetric assays to high-sensitivity chemiluminescence tests—has led to a diverse product portfolio and heightened demand across demographics.

Additionally, the adoption of point-of-care CRP testing and home-based kits, especially in the wake of the COVID-19 pandemic, has further diversified the market landscape. These tools are becoming essential not just for diagnosis but also for ongoing monitoring of disease activity and treatment response. Governments, healthcare providers, and diagnostic companies are increasingly integrating CRP testing into both standard diagnostic panels and personalized care strategies, expanding the market's global footprint and strategic importance.

Major Trends in the Market

-

Growing Adoption of High-Sensitivity CRP (hs-CRP) Tests: hs-CRP is being used to assess cardiovascular disease risk even at low inflammation levels.

-

Increased Utilization in Cancer Prognosis and Monitoring: CRP levels are used to monitor cancer progression and response to therapy, particularly in gastrointestinal and breast cancers.

-

Rise in Point-of-Care and Home Testing: Demand for rapid CRP tests at clinics, pharmacies, and home settings is rising, especially in rural or resource-constrained areas.

-

Integration with Multi-Parameter Diagnostic Panels: CRP testing is often bundled with complete blood count (CBC), ESR, and other inflammation markers.

-

Expansion in Personalized and Preventive Medicine: CRP testing is gaining value in personalized medicine for early disease risk prediction and therapy adjustment.

-

Technological Innovation in Immunoassays: Newer chemiluminescence and fluorescence-based platforms are improving sensitivity and throughput.

-

CRP Testing for COVID-19 and Respiratory Illnesses: CRP has been used to monitor severity in COVID-19 patients, adding a new use-case.

-

Growth of Diagnostic Services in Emerging Markets: Urbanization and healthcare investments in Asia, Africa, and Latin America are boosting demand for routine inflammatory diagnostics.

Report Scope of C-reactive Protein Testing Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 6.17 Billion |

| Market Size by 2033 |

USD 6.32 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 0.28% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Assay Type, Detection Range, Disease Area, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Thermo Fisher Scientific, Inc.; F. Hoffmann-La Roche Ltd; Danaher; Quest Diagnostics; Siemens Healthineers AG; Abbott; Merck KGaAA; Zoetis; Ortho Clinical Diagnostics; Getein Biotech, Inc; HORIBA, Ltd; Randox Laboratories Ltd; BODITECH MED, INC.; Aidian |

Key Market Driver: Rising Burden of Cardiovascular and Inflammatory Diseases

A primary driver of the global CRP testing market is the increasing prevalence of cardiovascular diseases and chronic inflammatory conditions. CRP is a validated biomarker for assessing inflammation levels, and in high-sensitivity form (hs-CRP), it provides critical prognostic information for cardiovascular events such as myocardial infarction and stroke. In fact, the Centers for Disease Control and Prevention (CDC) and the American Heart Association (AHA) recommend hs-CRP testing for assessing cardiovascular risk in asymptomatic individuals with intermediate risk scores.

Beyond heart disease, CRP is also used extensively in diagnosing and monitoring chronic inflammatory disorders like rheumatoid arthritis, lupus, inflammatory bowel disease (IBD), and certain cancers. For example, CRP levels can help clinicians differentiate between flare-ups and infections in autoimmune conditions, enabling more targeted treatments. As the global burden of these conditions rises—fueled by aging populations, sedentary lifestyles, and environmental stressors—CRP testing is increasingly seen as a first-line diagnostic tool in both hospital and outpatient settings.

Key Market Restraint: Limited Specificity of CRP as a Standalone Biomarker

Despite its clinical importance, CRP’s lack of disease specificity remains a key restraint. CRP levels can be elevated in a wide variety of conditions—from bacterial infections and autoimmune diseases to malignancies and trauma. This nonspecificity often necessitates additional tests for differential diagnosis, thereby limiting CRP’s utility as a standalone marker. For instance, an elevated CRP may signal an infection or cancer-related inflammation, but without further testing (e.g., imaging, biopsy, specific antibody tests), a definitive diagnosis is elusive.

Moreover, CRP values can be influenced by external factors like age, gender, smoking status, and obesity, which can confound test interpretations. This limits its use in certain clinical contexts, especially in population-wide screening. The need for contextual data and complementary diagnostics places a cost and infrastructure burden on healthcare systems—particularly in rural or resource-limited regions.

Key Market Opportunity: Expansion of At-Home and Point-of-Care Testing Solutions

An emerging opportunity lies in the rapid expansion of point-of-care (POC) and home-based CRP testing. The demand for quick, reliable diagnostics outside traditional hospital settings has surged, particularly in light of pandemic-induced healthcare decentralization. Portable, hand-held CRP testing devices and test strips are now available in pharmacies, primary care clinics, and even home care settings, enabling faster diagnosis and treatment decisions.

This is particularly beneficial for managing infections, inflammatory conditions, and post-surgical monitoring in rural or underserved populations. For example, in Scandinavian countries, POC CRP testing is used in general practice to reduce unnecessary antibiotic prescriptions. In developing nations, mobile clinics equipped with portable CRP analyzers are being deployed to enhance maternal and child health programs. As IoT-enabled diagnostic tools become more common, integrating CRP tests into remote health monitoring platforms can unlock new commercial and public health opportunities.

C-reactive Protein Testing Market By Assay Type Insights

Immunoturbidimetric assays dominate the CRP testing market due to their cost-effectiveness, automation compatibility, and widespread adoption in both hospital and laboratory settings. These assays work by measuring light scattering caused by antigen-antibody reactions and are particularly suited for high-throughput testing in central labs. Many routine health panels use this method because it balances accuracy with affordability. Clinical laboratories prefer immunoturbidimetric assays for standard CRP measurements in infection, cardiovascular disease, and chronic inflammatory assessments.

In contrast, chemiluminescence immunoassays (CLIA) are emerging as the fastest-growing segment, especially for high-sensitivity and research-based applications. CLIA offers superior sensitivity and specificity, which makes it ideal for cardiovascular risk profiling, oncology monitoring, and autoimmune disease detection. Hospitals and specialty diagnostics centers are increasingly adopting these assays to support precision medicine. Their ability to detect very low CRP concentrations allows earlier diagnosis and tracking of subtle inflammatory changes—a critical advantage in proactive care.

C-reactive Protein Testing Market By Detection Range Insights

Conventional CRP tests currently dominate the market, particularly in the diagnosis and monitoring of infections and acute inflammatory conditions. These tests are used extensively in emergency and inpatient settings to identify bacterial infections, monitor wound healing, or assess inflammation severity in diseases like arthritis and IBD. The tests are cost-effective and rapidly deployed in clinical laboratories, making them indispensable for acute care diagnostics.

However, hs-CRP is the fastest-growing detection range, driven by its unique application in cardiovascular risk assessment. hs-CRP testing can detect lower levels of inflammation, which helps predict heart attack or stroke in otherwise healthy individuals. The increasing shift towards preventive cardiology and wellness programs has led to a greater adoption of hs-CRP by cardiologists and primary care providers. In recent years, hs-CRP testing has also found applications in oncology and post-surgical monitoring.

C-reactive Protein Testing Market By Disease Area Insights

Cardiovascular diseases are the leading application segment for CRP testing, particularly using hs-CRP formats. Physicians use CRP readings as a part of a composite risk profile for determining likelihood of future cardiovascular events. Numerous studies have demonstrated that elevated CRP levels are associated with endothelial dysfunction and atherosclerotic plaque formation. This has positioned CRP as a key tool in both diagnosing and preventing cardiac events.

Meanwhile, cancer is emerging as one of the fastest-growing segments. CRP levels are increasingly used in tracking cancer progression and treatment response, especially in gastrointestinal, lung, and breast cancers. Elevated CRP has been correlated with poor prognosis in several malignancies, and it is being integrated into clinical decision-making pathways. CRP also plays a role in evaluating tumor-associated inflammation, which can be vital for immunotherapy outcomes.

C-reactive Protein Testing Market By End-use Insights

Hospitals represent the dominant end-use segment, largely due to the availability of sophisticated laboratory infrastructure and the need for comprehensive patient diagnostics. Urban hospital labs are particularly well-equipped for high-throughput CRP testing using ELISA, CLIA, and immunoturbidimetric platforms. Inpatient departments use CRP as a frontline marker in febrile illnesses, post-operative infections, and autoimmune flare-ups.

Home testing and assisted living facilities are the fastest-growing segments, fueled by an aging population and growing consumer preference for at-home health monitoring. Home CRP kits offer convenience and early alert for conditions like respiratory infections or flare-ups in rheumatoid arthritis. Assisted living facilities, especially in urban settings, are incorporating POC CRP analyzers to enable on-site clinical decision-making without transporting residents to external labs.

C-reactive Protein Testing Market By Regional Insights

North America leads the global CRP testing market, supported by high healthcare expenditure, robust diagnostic infrastructure, and early adoption of preventive healthcare strategies. The U.S. accounts for a significant portion of global hs-CRP tests used in cardiovascular risk stratification. Moreover, an aging population and high prevalence of obesity, diabetes, and autoimmune diseases have made inflammation testing a routine part of clinical practice. The presence of key players like Thermo Fisher Scientific, Abbott, and QuidelOrtho supports innovation and product availability across the care continuum.

In contrast, Asia Pacific is witnessing the fastest growth, driven by improving healthcare access, rising chronic disease burden, and rapid urbanization. Countries like China, India, and Japan are increasing investment in diagnostic infrastructure and community health programs. The growing middle class and government-backed health insurance schemes are expanding the reach of CRP testing beyond hospitals into rural clinics and mobile health units. Additionally, domestic manufacturers are producing affordable CRP analyzers, making the technology more accessible in low-resource settings.

Some of the prominent players in the global C-reactive protein testing market include:

Recent Developments

-

In February 2025, Abbott Laboratories received FDA clearance for its new Alinity hs-CRP test kit designed for preventive cardiac risk assessment in primary care settings.

-

Thermo Fisher Scientific, in October 2024, launched a next-gen chemiluminescent CRP assay for its Phadia™ 2500E system, enhancing precision in autoimmune diagnostics.

-

Roche Diagnostics expanded its Point-of-Care portfolio in December 2024 by introducing a portable CRP analyzer in European markets, targeting outpatient and rural clinics.

-

In August 2024, QuidelOrtho Corporation acquired a Korean startup specializing in portable CRP and ferritin testing devices to boost its diagnostic capabilities in Asia.

-

Siemens Healthineers announced in January 2025 a collaboration with AI-health platforms to integrate CRP trends with machine learning models for early disease prediction.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global C-reactive protein testing market

Assay Type

- Immunoturbidimetric Assay

- ELISA

- Chemiluminescence Immunoassay

- Others

Detection Range

- hs-CRP

- Conventional CRP

- cCRP

Disease Area

- Cardiovascular Diseases

- Cancer

- Rheumatoid Arthritis

- Inflammatory Bowel Disease

- Endometriosis

- Lupus

- Others

End-use

-

-

- Physician Offices

- Small Clinics

- Others

-

-

- Urban Setting

- Rural Setting

-

- Urban Setting

- Rural Setting

-

- Urban Setting

- Rural Setting

- Assisted Living Healthcare Facilities

-

- Urban Setting

- Rural Setting

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)