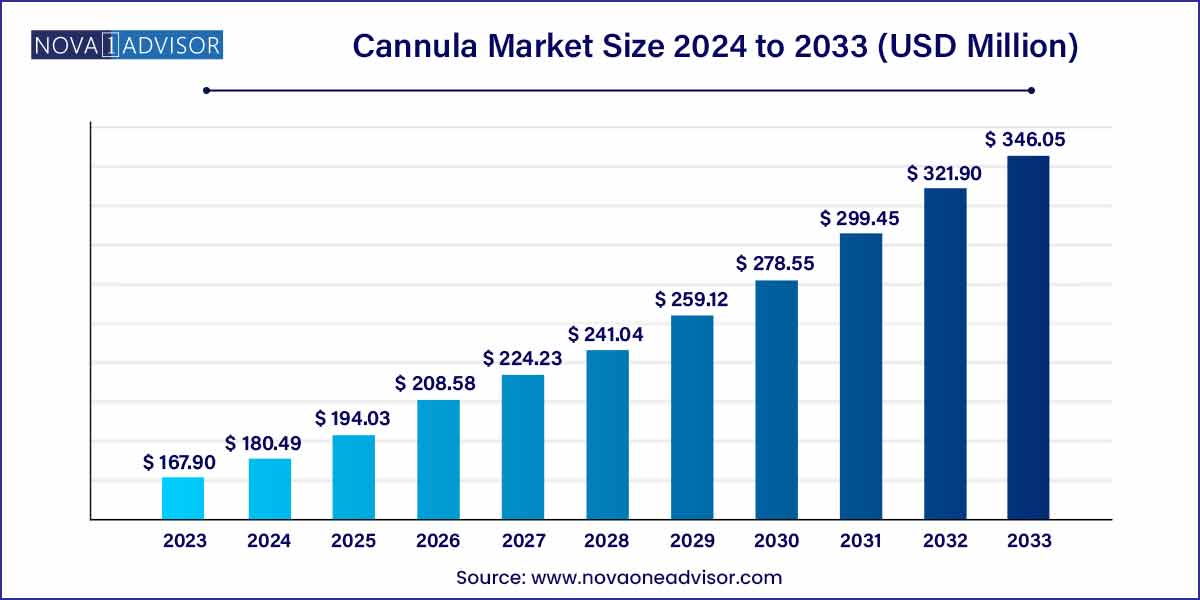

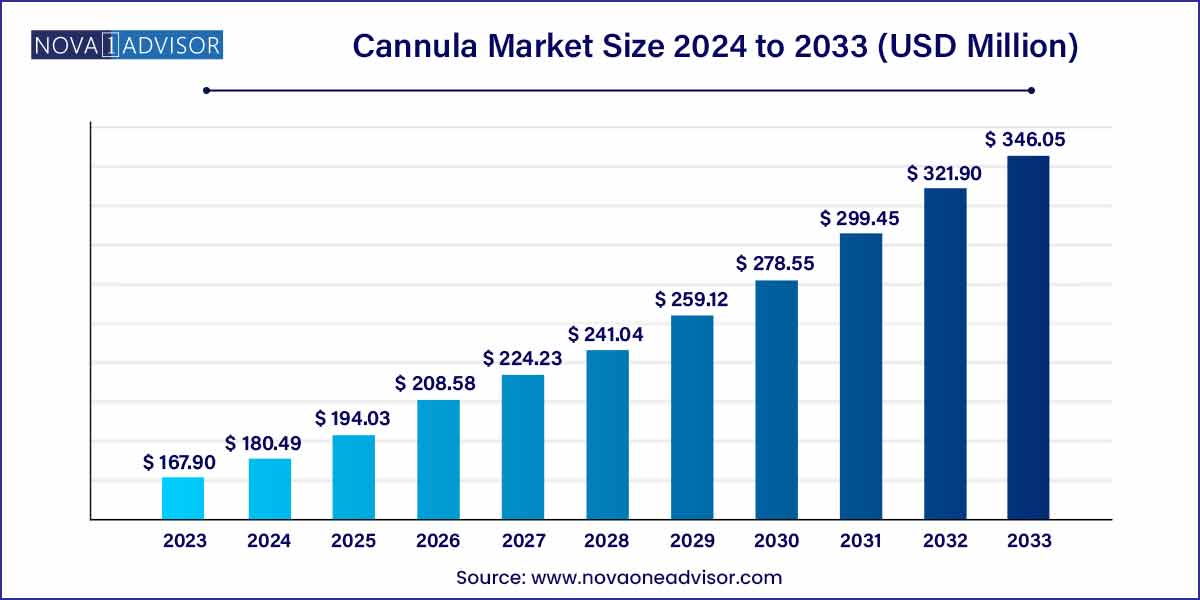

The global cannula market size was exhibited at USD 167.90 million in 2023 and is projected to hit around USD 346.05 million by 2033, growing at a CAGR of 7.5% during the forecast period of 2024 to 2033.

Key Takeaways:

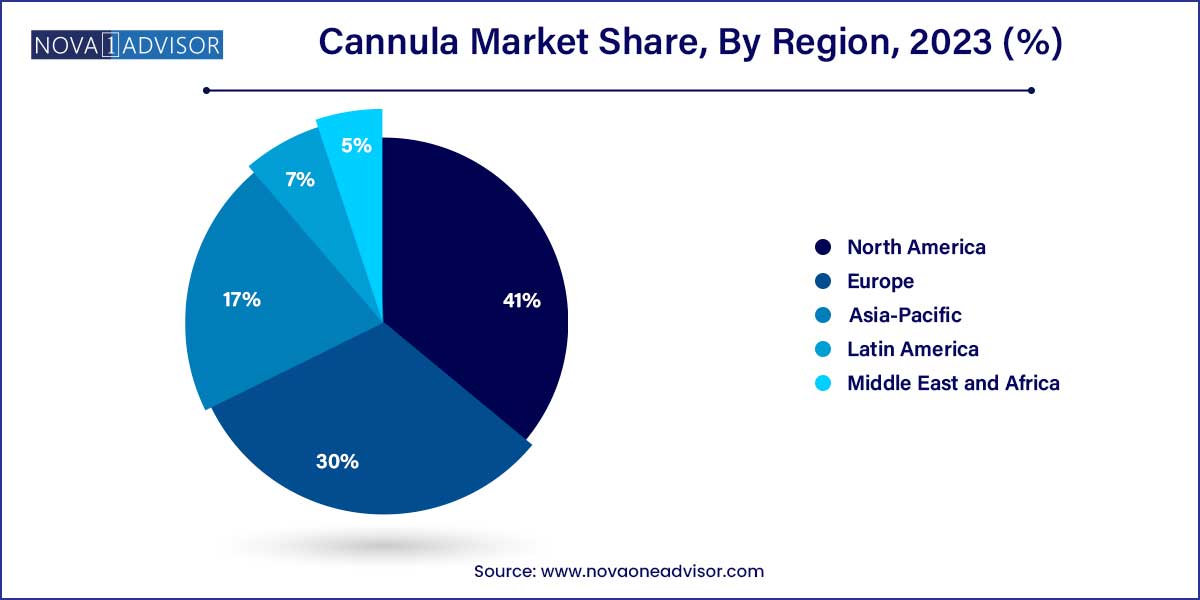

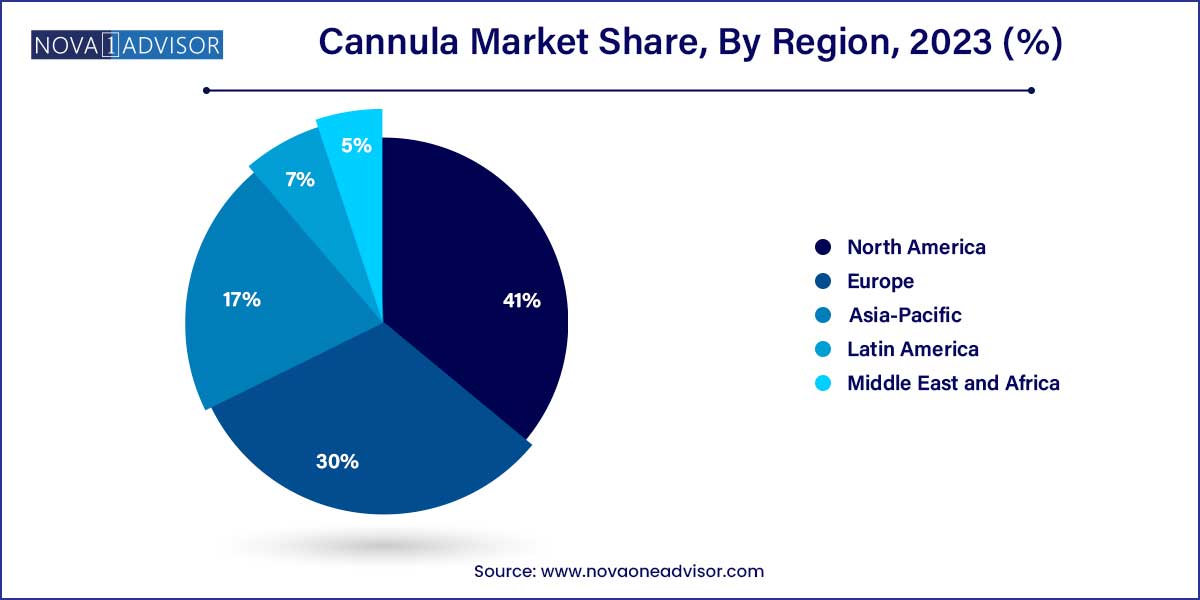

- North America dominated the market with the highest revenue share of 41.0% in 2023

- The cardiac segment held the largest market with 46.3% share in 2023.

- The straight cannulae segment dominated the market with the highest market share in 2023 and is anticipated to grow at a CAGR of 7.5% over the forecast period.

- The plastic segment held the highest market share with 60.0% in 2023

- Based on size, the market is segmented into 14G,16G,18G, 20G, 22G, 24G, and 26G.

- The hospitals segment held the maximum market share in 2023 with 53.2%.

Market Overview

The Global Cannula Market represents a crucial segment in the broader medical devices industry. A cannula is a thin tube inserted into the body, commonly for the delivery or removal of fluid or for surgical intervention. With broad applications across cardiac surgery, dermatological procedures, respiratory management, and aesthetic medicine, cannulas serve as indispensable tools in both routine and complex medical care.

In recent years, the market has experienced considerable growth, fueled by rising surgical volumes, increasing demand for minimally invasive procedures, and advancements in cannula design. Cardiovascular diseases, one of the leading causes of death globally, necessitate various cardiac cannulation procedures. Simultaneously, the global rise in cosmetic procedures and dermatological treatments, particularly among younger and aging populations alike, has significantly driven the use of microcannulas in aesthetic practices.

Cannula designs have evolved from simple straight tubes to multifunctional, precision-engineered tools with specialized ports and ergonomic grips. Materials have also diversified—ranging from plastic and metal to biocompatible silicone—to enhance patient safety and procedure outcomes. With hospitals and ambulatory surgical centers increasingly investing in specialized surgical infrastructure, cannula use is expected to expand even further. Emerging economies, rising healthcare investments, and growing awareness of elective surgical options are all contributing to the robust outlook for the global cannula market.

Major Trends in the Market

-

Surging adoption of minimally invasive procedures: Cannulas enable small incisions, reducing recovery time and risk of infection, particularly in laparoscopic and cosmetic surgeries.

-

Increased focus on pediatric and neonatal care: Demand for smaller gauge neonatal cannulas is increasing in NICUs and pediatric intensive care units worldwide.

-

Rising aesthetic and cosmetic procedures: Microcannulas are widely used in dermal filler applications for facial rejuvenation, body contouring, and liposuction.

-

Material innovation and biocompatibility: Manufacturers are developing cannulas with advanced polymers and silicone to reduce tissue trauma and allergic reactions.

-

Ergonomic design improvements: The incorporation of winged cannulas with ports and stopcocks enhances procedural ease and fluid control for clinicians.

-

Growth of ambulatory surgical centers (ASCs): Outpatient surgeries, increasingly conducted in ASCs, are fueling demand for single-use and specialized cannulas.

-

Advances in cardiopulmonary bypass and ECMO: Arterial and venous cannulas are vital in extracorporeal membrane oxygenation, with rising use during cardiac and respiratory failures.

-

Expansion in respiratory care applications: Nasal cannulas continue to be used extensively for oxygen therapy in chronic respiratory conditions and post-COVID-19 care settings.

Cannula Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 167.90 Million |

| Market Size by 2033 |

USD 346.05 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 7.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Type, Material, Size, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Medtronic; Becton Dickinson (BD); Edward Lifesciences; LivaNova; Smiths Medical; Boston Scientific Corporation |

Key Market Driver: Increasing Prevalence of Chronic Diseases and Surgical Interventions

A key growth driver of the cannula market is the rising global burden of chronic illnesses such as cardiovascular disease, diabetes, and chronic respiratory conditions, which often necessitate hospitalization and surgical intervention. According to the WHO, cardiovascular diseases claim approximately 18 million lives each year, and many such cases require invasive procedures such as angioplasty, bypass surgery, or extracorporeal support—each of which requires arterial or venous cannulas.

Moreover, advances in surgical technology and improved access to care have expanded the range of patients eligible for procedures previously considered high-risk. Cannulas play an essential role in these interventions by facilitating precise fluid management, oxygen delivery, and medication administration. With healthcare systems prioritizing early diagnosis, surgical innovation, and minimally invasive care pathways, cannula usage continues to expand globally.

Key Market Restraint: Risk of Infection and Complications from Invasive Procedures

Despite technological advances, the risk of infection, thrombophlebitis, or vascular injury associated with cannula use remains a key restraint for the market. Invasive cannulation, particularly in neonates or immunocompromised patients, can introduce pathogens and lead to bloodstream infections (BSIs), a major concern in critical care environments. According to the CDC, catheter-related bloodstream infections (CRBSIs) account for a significant portion of hospital-acquired infections in the U.S.

Furthermore, improper insertion, prolonged use, or suboptimal cannula material can lead to patient discomfort, inflammation, or vessel rupture. These complications increase healthcare costs, extend hospital stays, and negatively affect patient outcomes. As such, hospitals and clinicians are highly selective in cannula choice, and demand high-quality, sterile, and easy-to-handle products. For manufacturers, meeting stringent safety regulations and maintaining consistency in product quality remains an ongoing challenge.

Key Market Opportunity: Expansion of Elective and Cosmetic Procedures in Emerging Economies

A rapidly growing opportunity lies in the increased demand for elective aesthetic procedures in emerging economies such as Brazil, India, China, and the UAE. As disposable incomes rise and societal acceptance of cosmetic enhancement grows, minimally invasive dermatological treatments—such as liposuction, fat grafting, and dermal filler injections—are witnessing exponential growth. These procedures heavily depend on fine-gauge, blunt-tip microcannulas, which offer reduced bruising and precision for injectable treatments.

Local clinics and medispas in these regions are investing in advanced cannula systems and partnering with global brands to offer high-quality outcomes. Simultaneously, patients are increasingly seeking these services outside traditional hospitals, making dermatological and aesthetic cannulas a high-margin, high-growth segment. With urbanization, medical tourism, and influencer culture shaping patient behavior, the cannula market stands to gain substantially from this aesthetic boom in developing markets.

Segments Insights:

Product Insights

Cardiac cannulas dominated the global cannula market in 2024. Within this segment, arterial and venous cannulas are extensively used in cardiopulmonary bypass (CPB), extracorporeal membrane oxygenation (ECMO), and open-heart surgeries. The rising number of cardiovascular surgeries worldwide—driven by aging populations and lifestyle-related heart conditions—has kept demand strong. Cardioplegia and femoral cannulas are also critical in heart valve replacements and complex surgeries. Leading medical centers and tertiary hospitals maintain an inventory of cardiac cannulas as part of emergency cardiac care preparedness.

Dermatology cannulas are the fastest-growing product segment. With growing interest in facial aesthetics and non-surgical rejuvenation, microcannulas are being used for filler injections, PRP (platelet-rich plasma) therapy, and fat transfer procedures. Their blunt-tip design reduces bruising and swelling, making them preferred over hypodermic needles. Innovations in flexible materials and ultra-thin diameters are enhancing performance and safety. Markets like South Korea, the U.S., and parts of Europe are witnessing a surge in dermatological cannula usage across both men and women seeking cosmetic enhancements.

Type Insights

Straight cannulas led the market share by type. These cannulas, used in standard infusion, suction, or oxygenation procedures, are widely adopted across hospital settings. Their design supports a broad range of clinical applications including fluid administration, blood draws, and ECMO. Due to their versatility and availability in multiple gauges and materials, straight cannulas remain the default choice in many surgical and critical care environments.

Winged with port cannulas are projected to grow at the fastest rate. These are commonly used for patients requiring long-term venous access, such as those undergoing chemotherapy, dialysis, or frequent blood sampling. The integrated port allows for repeated access without multiple insertions, reducing trauma and infection risks. Their ergonomic grip and stability also aid nurses during insertion. As long-term disease management grows, these cannulas will see increasing adoption in both hospital and home care settings.

Material Insights

Plastic cannulas dominated the material segment. They are cost-effective, disposable, and widely used for intravenous access and oxygen therapy. Plastic cannulas, particularly made of polyurethane and Teflon, offer flexibility and compatibility with a wide range of sizes. In mass healthcare settings—like public hospitals or emergency rooms—plastic cannulas are the preferred choice due to safety and affordability.

Silicone cannulas are the fastest-growing material segment. Known for superior biocompatibility, flexibility, and lower risk of tissue irritation, silicone cannulas are increasingly used in neonatal and critical care environments. They are ideal for long-term use, particularly in respiratory and enteral applications. With innovation in soft-touch silicone blends and antimicrobial coatings, their popularity is rising in high-risk patient populations.

Size Insights

18G cannulas held the largest market share in 2024. These are standard-size cannulas commonly used for general infusion and blood transfusion. They offer a balance between flow rate and patient comfort, making them suitable for a variety of medical scenarios, from fluid therapy to pre-surgical preparation.

24G and 26G cannulas are the fastest-growing segments. These smaller gauges are used in pediatric and neonatal care, where vein size and patient sensitivity require extremely gentle insertion. As neonatal ICUs expand in developing countries and preterm births increase globally, the need for micro-gauge cannulas is climbing sharply.

End-use Insights

Hospitals remain the dominant end-user segment. Hospitals are the primary buyers of cannulas across all types, from surgical to general use. The diversity of procedures, large patient volumes, and availability of specialized departments ensure consistent demand. In emergency rooms, surgical suites, ICUs, and post-operative care units, cannulas are essential daily-use items.

Ambulatory surgical centers (ASCs) are the fastest-growing end-users. These outpatient facilities are becoming increasingly popular for elective procedures, cosmetic surgeries, and minor operations. Their cost-efficiency and shorter patient stay times make them ideal for high-throughput procedures requiring cannulation. As the number of ASCs grows globally, especially in North America and Asia, demand for specialized and portable cannula systems is expected to surge.

Regional Insights

North America led the global cannula market in 2023. The region benefits from a robust healthcare infrastructure, high per capita surgical rates, and strong adoption of advanced medical technologies. In the U.S., where elective cosmetic procedures like liposuction and filler treatments are among the highest globally, demand for dermatological cannulas is particularly strong. Cardiac care in the region also drives the use of arterial and venous cannulas, especially with the rising incidence of heart diseases and obesity.

Furthermore, key players such as Medtronic, Smiths Medical, and Teleflex operate extensively in this region, ensuring consistent innovation and product availability. Reimbursement support and growing outpatient surgery volumes further cement North America’s leadership in cannula adoption across clinical and cosmetic domains.

Asia-Pacific is the fastest-growing region in the cannula market. The region’s growth is driven by expanding healthcare infrastructure, rising disposable incomes, and increasing health awareness. Countries like China, India, South Korea, and Japan are witnessing rising surgical volumes, both in cardiac and cosmetic segments. For instance, South Korea is known as a global hub for cosmetic surgery, with widespread use of microcannulas in facial aesthetic procedures.

Government healthcare reforms, medical tourism, and rapid urbanization in Southeast Asia also contribute to growth. Moreover, regional manufacturers are developing cost-effective cannulas tailored to local needs, increasing market penetration. With improving access to quality healthcare and increased funding for public health programs, APAC is expected to play a central role in the future expansion of the cannula market.

Some of the prominent players in the cannula market include:

- Medtronic

- Becton Dickinson (BD)

- Edward Lifesciences

- LivaNovaca

- Smiths Medical

- Boston Scientific Corporation

Recent Developments

-

Medtronic (February 2025): Launched a new line of low-profile venous cannulas designed for minimally invasive cardiac surgery, enabling smaller incisions and quicker recovery times.

-

Smiths Medical (January 2025): Expanded its soft cannula product line for pediatric respiratory care, emphasizing improved patient comfort and safety.

-

Teleflex Inc. (December 2024): Introduced a silicone-coated arterial cannula for ECMO procedures with enhanced biocompatibility and anti-thrombotic features.

-

Surgimed Medical (March 2025): Announced a collaboration with a South Korean aesthetic clinic chain to co-develop ergonomic dermatology cannulas for Asian facial anatomy.

-

B. Braun (April 2024): Rolled out color-coded winged cannulas with integrated safety valves to reduce needlestick injuries in emergency and inpatient settings.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global cannula market.

Product

-

- Arterial

- Venous

- Cardioplegia

- Femmoral

Type

- Neonatal Cannulae

- Straight Cannulae

- Winged Cannulae

- Wing With Port

- Winged With Stop Cork

Material

Size

- 14G

- 16G

- 18G

- 20G

- 22G

- 24G

- 26G

End-use

- Hospital

- Ambulatory Surgical Centers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)