Cash Management System Market Size and Research

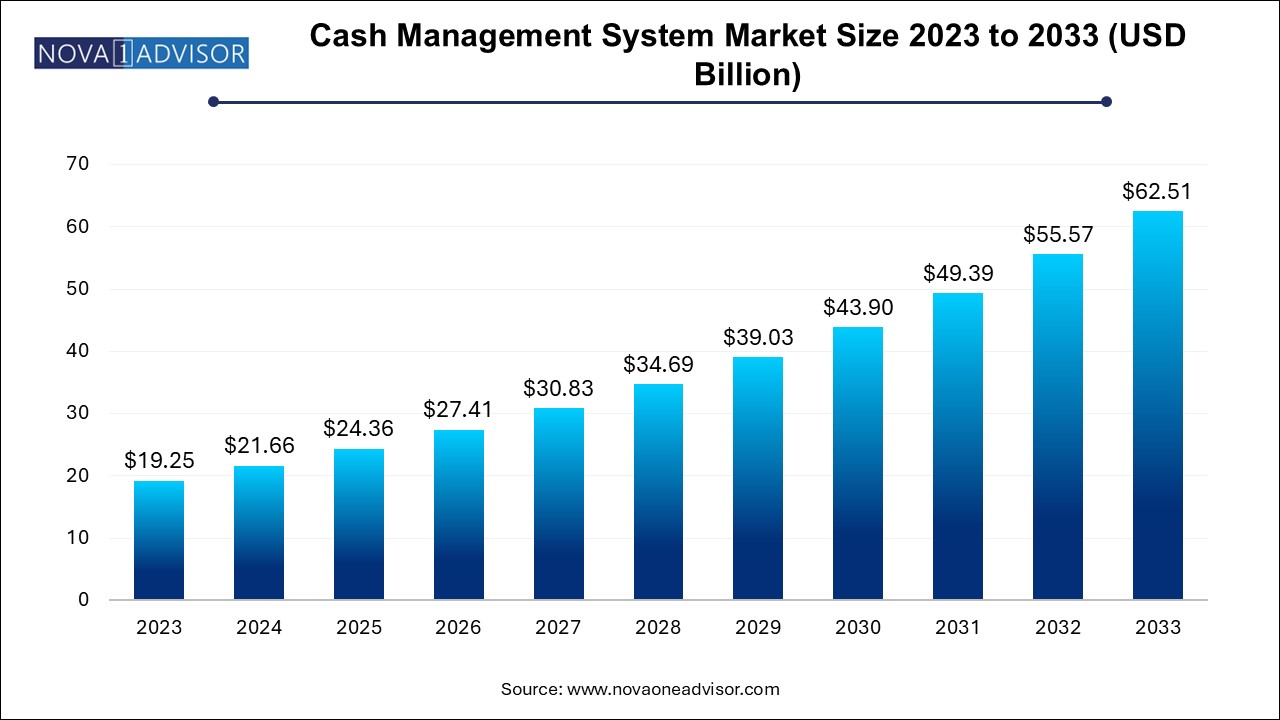

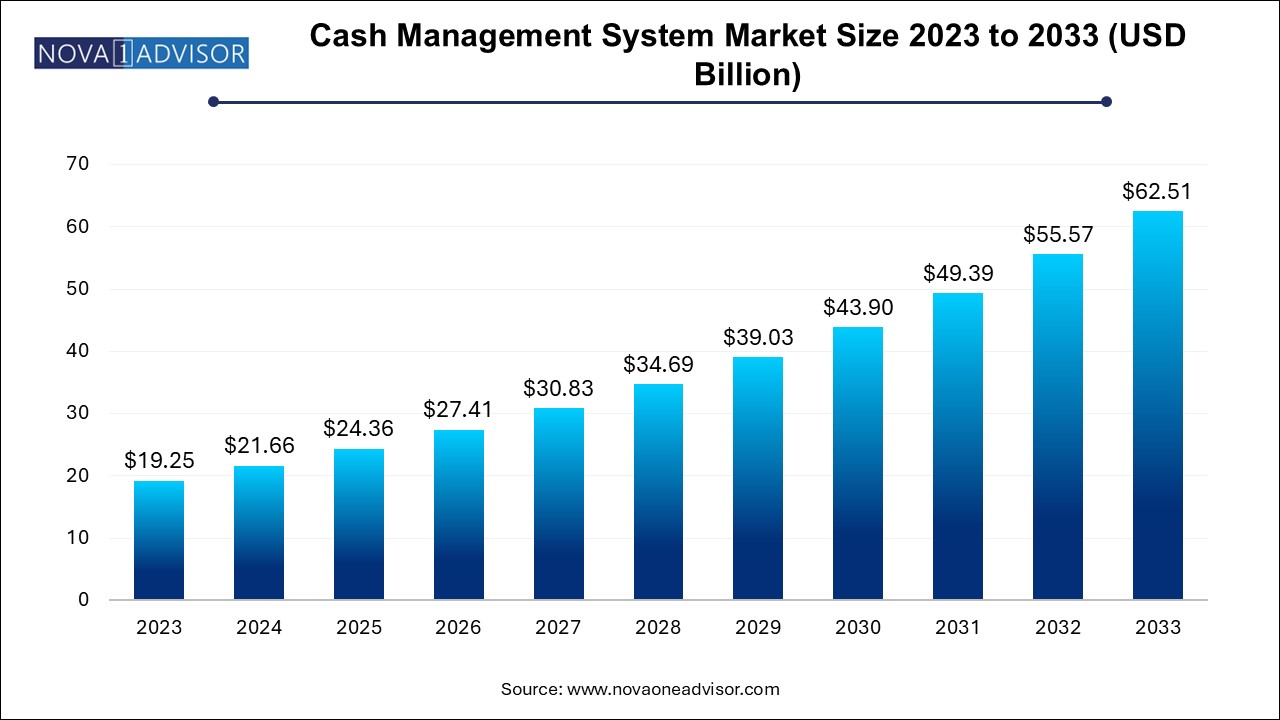

The global cash management system market size was exhibited at USD 19.25 billion in 2023 and is projected to hit around USD 62.51 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2024 to 2033.

Market Overview

The global Cash Management System (CMS) market plays a critical role in streamlining and automating financial operations for businesses and institutions worldwide. These systems empower organizations to manage their liquidity, monitor cash flows, optimize the deployment of cash assets, and ensure regulatory compliance. The increasing complexity of financial environments, driven by globalization, multi-currency operations, and the rise of digital payment platforms, has made CMS solutions indispensable for both financial institutions and enterprises.

Rapid digital transformation across industries, particularly in banking and retail, has accelerated the adoption of automated cash handling and forecasting tools. These solutions not only reduce manual errors but also enhance real-time visibility into financial operations. With features like receivables and payables management, transaction reporting, and corporate liquidity management, CMS platforms are becoming a cornerstone of modern financial infrastructure.

According to industry estimations, the CMS market has been witnessing robust growth, attributed to heightened demand for real-time data, rising cyber threats requiring enhanced financial security, and growing awareness among SMEs regarding cash optimization. With businesses increasingly turning toward cloud-based deployment models and leveraging AI and data analytics, the market is poised for continued expansion through 2034.

Major Trends in the Market

-

Cloud-Based Deployment is Becoming the Norm: Businesses are increasingly adopting cloud-hosted cash management solutions to gain scalability, reduce operational costs, and improve accessibility across geographies.

-

Integration with AI and Predictive Analytics: CMS platforms are being integrated with AI-driven forecasting tools to enhance accuracy in cash flow predictions and optimize financial planning.

-

Rise in Demand from SMEs: Previously dominated by large enterprises, the CMS market is seeing increased penetration in small and medium enterprises (SMEs) owing to user-friendly and affordable SaaS models.

-

Growing Importance of Cybersecurity Features: With rising incidents of cyber threats, CMS providers are incorporating multi-factor authentication, encryption, and fraud detection systems.

-

Expansion into Emerging Markets: Vendors are targeting emerging economies in Asia Pacific and Latin America due to the rapid digitization of banking infrastructure.

-

Customization and Modular Offerings: Companies are offering modular systems that allow end-users to select only those features that align with their operational needs, boosting adoption.

-

Sustainability and ESG Integration: Financial technology providers are beginning to integrate ESG (Environmental, Social, and Governance) metrics into CMS platforms to support sustainable financial planning.

Report Scope of Cash Management System Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 21.66 Billion |

| Market Size by 2033 |

USD 62.51 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 12.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Component, Operation Type, Deployment, Enterprise Size, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Sopra Banking Software SA; Intacct Corporation; NTT Data Corporation; National Cash Management Systems (NCMS); Giesecke & Devrient GmbH; Oracle Corporation. |

One of the key driving forces propelling the growth of the CMS market is the ongoing digital transformation within the financial services sector. As banks and financial institutions modernize their infrastructure, they are prioritizing automation and real-time data accessibility. CMS solutions fulfill this need by automating payment processing, consolidating account information, and offering real-time dashboards for monitoring liquidity. With APIs enabling seamless integration into broader enterprise resource planning (ERP) systems, CMS platforms have become central to building agile and responsive financial systems.

For example, multinational banks such as HSBC and JPMorgan have implemented AI-powered cash management modules that allow them to forecast liquidity positions globally across different time zones. This digital shift ensures better decision-making, enhances customer experience, and boosts financial resilience in volatile markets.

Restraint: High Implementation and Integration Costs

Despite the benefits, high initial implementation and integration costs remain a major challenge to the adoption of CMS platforms, especially for small and medium enterprises. Customizing solutions to align with legacy IT infrastructure often demands significant investment in hardware, software, staff training, and consulting services. Additionally, the complexity involved in aligning CMS software with existing ERP and accounting systems poses integration hurdles.

Many SMEs find the total cost of ownership prohibitive, particularly when deploying on-premise solutions. Even cloud models, while more cost-effective in the long term, require upfront resources and IT change management, slowing down the pace of adoption in budget-sensitive markets.

Opportunity: Rise of FinTech Collaborations

The emergence of fintech partnerships presents a substantial opportunity in the CMS market. Traditional banks and financial institutions are increasingly partnering with fintech startups to co-develop agile and innovative CMS solutions. These collaborations focus on developing feature-rich platforms equipped with AI, blockchain, and predictive analytics, tailored to niche financial needs.

For instance, partnerships between tech firms like Tink (a part of Visa) and European banks have enabled faster rollout of real-time cash visibility solutions. In another example, Intellect Design Arena partnered with leading banks in Southeast Asia to offer cloud-native treasury and cash management systems that reduce deployment time significantly.

These strategic alliances not only accelerate digital innovation but also facilitate market entry into underserved regions by leveraging local fintech expertise.

Cash Management System Market By Component Insights

Solution segment dominated the market owing to the increased demand for end-to-end automation and analytics tools. Cash management solutions are extensively used by organizations for functions such as cash flow forecasting, liquidity management, and transaction processing. These platforms are being constantly updated with capabilities like AI-driven forecasting and fraud detection, making them a necessity for large financial organizations and multinational corporations.

As organizations continue to embrace digital-first strategies, these solutions help reduce manual intervention and improve compliance with financial regulations. The demand is especially notable in sectors like banking and retail, where real-time cash tracking and optimization are mission-critical.

The service segment is projected to witness the fastest growth over the forecast period. Services include consultation, implementation, training, and maintenance. As companies struggle with legacy system integration and digital transformation, they increasingly rely on managed services and IT consulting to deploy CMS platforms. Vendors offering 24/7 support and remote onboarding through cloud platforms have particularly seen rising demand from SMEs, especially in regions like Asia Pacific.

Cash Management System Market By Operation Type Insights

Balance & Transaction Reporting is the leading operational type due to its critical importance in offering real-time visibility into account balances and transactional activity. This function allows financial controllers to monitor discrepancies, anticipate liquidity gaps, and streamline reconciliation processes. The rise of multi-currency, multi-entity operations has made real-time reporting a priority, particularly among global enterprises and financial institutions.

Conversely, cash flow forecasting is emerging as the fastest-growing segment. The volatility of global markets and increased emphasis on proactive cash planning are driving adoption. Companies are moving beyond static spreadsheets to dynamic forecasting tools integrated with real-time data sources. These systems allow CFOs to model various financial scenarios, ensuring better liquidity management and contingency planning.

Cash Management System Market By Deployment Insights

On-premise deployment remains dominant especially among large institutions that require high data security and full control over internal infrastructure. Banks and large commercial enterprises with strict data governance policies prefer on-premise CMS solutions to ensure compliance with regulatory frameworks.

Cloud deployment, however, is growing at the fastest rate, fueled by the need for scalable, flexible, and cost-effective solutions. Cloud-based CMS platforms enable organizations to centralize treasury operations, gain instant updates, and reduce IT maintenance costs. Cloud adoption is particularly strong in Asia Pacific and North America, driven by fintech innovation and favorable regulatory shifts toward open banking.

Cash Management System Market By Enterprise Size Insights

Large enterprises dominate the market due to their complex cash flow structures and the necessity of centralized treasury operations across global subsidiaries. Their investment capability allows for sophisticated customization, integration with ERP systems, and dedicated support services. These enterprises view CMS platforms as strategic assets for improving working capital efficiency.

SMEs are the fastest-growing adopters, particularly through subscription-based cloud CMS models. As awareness grows around the benefits of cash flow visibility, smaller firms are embracing modular and low-cost solutions that require minimal IT overhead. This shift is supported by government-led digitalization initiatives and the rise of fintechs offering tailored packages for SMEs.

Cash Management System Market By End-use Insights

Banks remain the dominant end-users of CMS platforms, using them to enhance liquidity monitoring, streamline payment processing, and meet regulatory mandates. The rise of cross-border digital banking and real-time settlements has necessitated robust cash management systems. Leading global and regional banks are investing heavily in AI-driven platforms to stay competitive.

Retail is witnessing the fastest adoption, driven by the surge in digital payments and the complexity of multi-channel financial flows. Retailers are increasingly implementing CMS to reconcile cash across physical stores, online platforms, and third-party payment gateways. Automated reconciliation and real-time dashboard views enable better financial forecasting and decision-making.

Cash Management System Market By Regional Insights

North America dominates the cash management system market, accounting for the highest revenue share. This leadership is primarily driven by the advanced banking infrastructure, widespread adoption of cloud technologies, and a strong presence of leading CMS vendors such as Oracle Corporation, FIS Global, and Intuit Inc. Furthermore, the region has seen aggressive investments in fintech, with banks collaborating closely with technology providers to enhance liquidity and cash visibility through automation.

The United States, in particular, has been a frontrunner in adopting AI-enabled financial management systems. Government and private sector initiatives promoting real-time payments and open banking further boost CMS market growth. Financial institutions in North America also tend to have high cybersecurity standards, prompting a preference for robust and compliant CMS platforms.

Asia Pacific is the fastest-growing region in the global CMS market. Countries like China, India, and Southeast Asian nations are undergoing rapid digital transformation in banking and enterprise finance. The proliferation of cloud-based platforms and the rising number of SMEs are key drivers in this region. Governments are also promoting digital financial literacy and automation through initiatives like “Digital India,” further accelerating the adoption of CMS.

Multinational CMS providers are expanding into Asia Pacific through strategic partnerships and localized offerings. For example, SAP and TCS have tailored CMS solutions to fit the regulatory and operational requirements of Asian financial institutions, contributing to widespread market penetration.

Cash Management System Market Recent Development

-

March 2025 – FIS Global launched a next-generation real-time treasury management solution integrated into its CMS suite, aimed at enhancing decision-making for corporate treasurers using AI-based predictive analytics.

-

February 2025 – Oracle Corporation announced a partnership with HSBC to modernize the bank’s global liquidity and cash management infrastructure using Oracle Fusion Cloud Treasury Management.

-

January 2025 – SAP SE introduced enhanced features in its SAP Cash Management application, focusing on real-time visibility, predictive forecasting, and integration with sustainability KPIs.

-

November 2024 – Intellect Design Arena collaborated with multiple Southeast Asian banks to deploy its cloud-native cash management solution “CashPower,” targeting digitization of regional cash operations.

Some of the prominent players in the global cash management system market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global cash management system market

Component

Operation Type

- Balance & Transaction Reporting

- Cash Flow Forecasting

- Corporate Liquidity Management

- Payables

- Receivables

- Others

Deployment

Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

End-use

- Banks

- Retail

- Non-Banking Financial Corporations

- Commercial Enterprises

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa