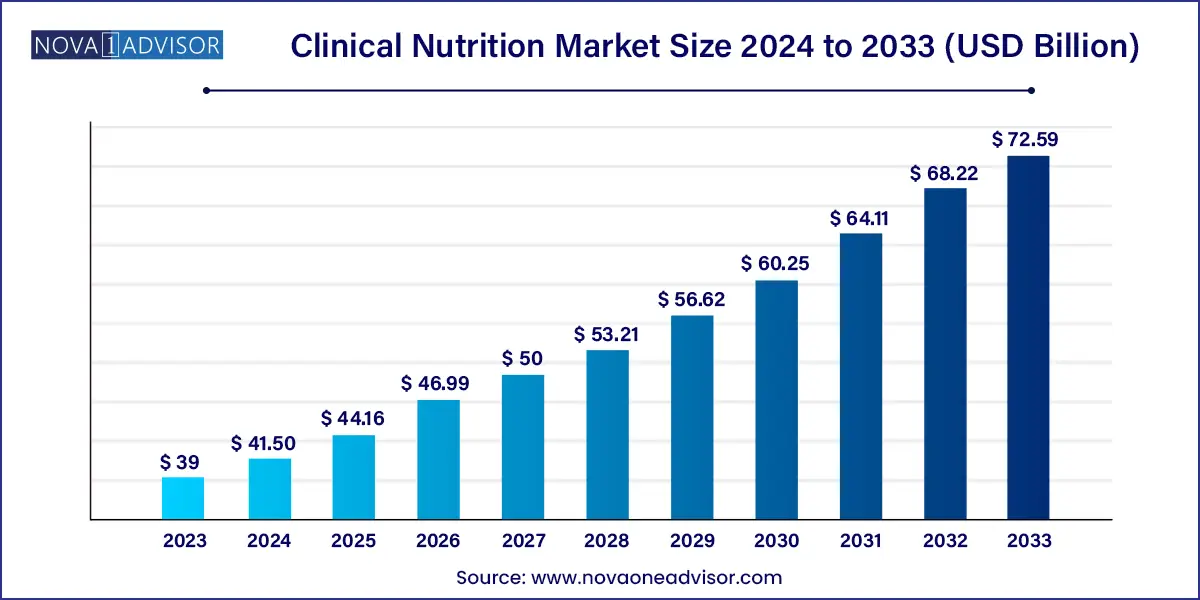

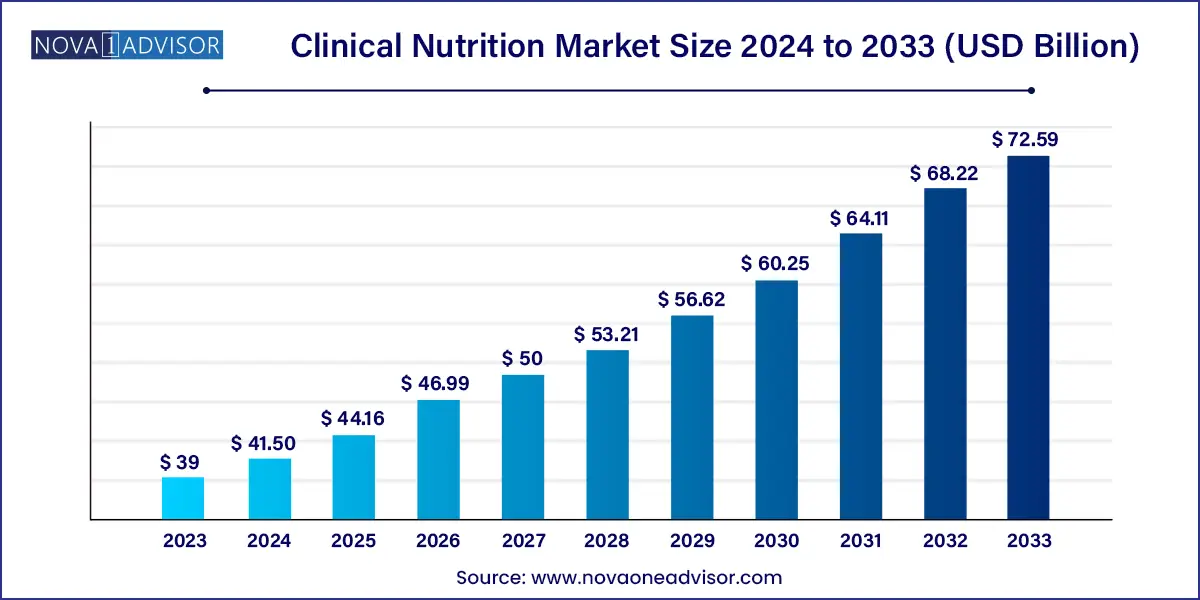

The global clinical nutrition market size was exhibited at USD 39.0 billion in 2023 and is projected to hit around USD 72.59 billion by 2033, growing at a CAGR of 6.41% during the forecast period of 2024 to 2033.

Key Takeaways:

- The North America segment dominated the global clinical nutrition market in 2023.

- The route of administration, oral, dominates the clinical nutrition market during the forecast period.

- The metabolic disorders dominate the clinical nutrition market during the forecast period.

- The pediatric dominates the clinical nutrition market during the forecast period.

Market Overview

The clinical nutrition market is experiencing robust growth globally, driven by the rising prevalence of chronic diseases, increasing geriatric population, and heightened awareness regarding malnutrition and its associated complications. Clinical nutrition involves providing nutritional support in both hospital and homecare settings to patients unable to meet their nutritional needs through a regular diet. These solutions are used to manage various medical conditions, including cancer, metabolic disorders, gastrointestinal diseases, and neurological impairments.

Unlike general wellness nutrition, clinical nutrition is evidence-based and tailored to the individual’s medical condition, metabolic needs, and recovery goals. It plays a crucial role in improving patient outcomes, reducing hospital stays, and enhancing quality of life during prolonged illness or post-surgical recovery. The sector includes a range of products such as oral nutritional supplements (ONS), enteral nutrition administered via feeding tubes, and parenteral nutrition infused directly into the bloodstream.

In recent years, clinical nutrition has transitioned from being a supplementary therapy to an integral part of comprehensive disease management protocols. Hospitals, long-term care facilities, and even homecare settings are increasingly relying on clinical nutrition to improve patient prognosis. Meanwhile, clinical trials and innovation in formula development have led to a more diversified and effective product portfolio tailored to specific diseases and age groups.

The COVID-19 pandemic also underscored the critical role of clinical nutrition, particularly in intensive care units where malnutrition was identified as a factor contributing to poor outcomes in ventilated patients. This has prompted healthcare systems to prioritize nutrition screening and interventions, further fueling market expansion.

Major Trends in the Market

-

Rising use of disease-specific nutrition formulas, such as those targeting cancer cachexia, diabetes-related malnutrition, or gastrointestinal disorders.

-

Increasing adoption of home-based clinical nutrition driven by the growing preference for outpatient recovery and cost efficiency.

-

Advancements in parenteral nutrition formulations improving nutrient bioavailability and reducing infection risks.

-

Integration of artificial intelligence and digital health tools for real-time nutrition monitoring and personalized regimen planning.

-

Expansion of pediatric clinical nutrition portfolios, especially in developing countries where child malnutrition rates remain high.

-

Sustainability efforts in packaging and ingredient sourcing, especially in Europe, where eco-labeling influences purchasing.

-

Strategic partnerships between hospitals and nutrition companies to streamline supply chains and optimize patient care pathways.

-

Heightened regulatory focus on quality and safety, especially following recalls due to contamination in enteral nutrition products.

Clinical Nutrition Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 39.0 Billion |

| Market Size by 2033 |

USD 72.59 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.41% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Route of Administration, End User, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Abbott Laboratories, B. Braun Melsungen AG., Mead Johnson Nutrition Company, Perrigo Company Plc., H.J. Heinz Company, Hospira Inc., Groupe Danone, Fresenius Kabi AG, Baxter International Inc., Nestle SA |

Key Market Driver: Growing Incidence of Chronic and Lifestyle Diseases

A primary driver of the clinical nutrition market is the surge in chronic and lifestyle-related diseases, including cancer, diabetes, obesity, and cardiovascular conditions. These illnesses often result in altered nutritional needs, impaired absorption, or increased metabolic demands that cannot be met through conventional diets. Clinical nutrition plays a vital role in managing these patients, ensuring adequate caloric intake, supporting immune function, and enhancing recovery.

For instance, cancer patients undergoing chemotherapy or radiotherapy often experience anorexia, nausea, or gastrointestinal disturbances, necessitating specialized nutritional support. Similarly, diabetic patients may benefit from formulas designed to maintain glycemic control while meeting protein and micronutrient requirements. Hospitals worldwide are now integrating clinical dietitians into oncology, endocrinology, and ICU teams to develop tailored nutrition plans. This shift has created sustained demand for disease-specific clinical nutrition products.

Moreover, an aging global population further amplifies this demand. Older adults are more prone to malnutrition due to reduced appetite, poor dentition, and chronic illnesses. Geriatric nutrition has therefore emerged as a critical component of elderly care across nursing homes, hospices, and homecare settings.

Key Market Restraint: Stringent Regulatory Framework and Product Recalls

Despite its growth, the clinical nutrition market faces a significant hurdle in the form of stringent regulations governing product development, labeling, and distribution. Clinical nutrition products are often classified as medical foods or drug-nutrition hybrids, requiring thorough documentation of clinical efficacy, safety, and compliance with national and international regulatory standards.

Manufacturers must conduct costly and time-consuming clinical trials to support their claims, especially when targeting vulnerable populations like neonates or critically ill patients. Any deviation or contamination can trigger widespread product recalls, harming brand reputation and affecting consumer trust.

For example, in 2022, a major global manufacturer faced backlash after bacterial contamination was found in a batch of infant formula. The recall disrupted supply chains and led to regulatory tightening in multiple regions. These events illustrate how even small lapses in quality control can have far-reaching implications in this sensitive market.

Key Market Opportunity: Expansion of Homecare Nutrition Services

A significant opportunity exists in the growing shift toward home-based clinical nutrition. Driven by rising healthcare costs, overcrowded hospitals, and an aging population preferring at-home care, homecare nutrition services are gaining traction. These services typically include the provision of ready-to-administer enteral or parenteral nutrition formulas, along with support equipment like feeding pumps and IV sets.

Several countries are encouraging this model through reimbursement frameworks, making homecare a viable and attractive option. For example, in Germany and the U.K., government healthcare schemes cover home enteral nutrition for eligible patients. Additionally, the COVID-19 pandemic accelerated the adoption of remote patient monitoring and tele-nutrition, enabling healthcare providers to manage nutritional therapy without requiring frequent hospital visits.

This shift opens avenues for companies to expand their delivery networks, develop user-friendly packaging, and invest in smart devices that can track patient compliance and nutrient intake remotely.

Segments Insights:

Route of Administration Insights

Oral nutrition remained the largest segment by route of administration, accounting for a substantial portion of global revenues. Oral nutritional supplements (ONS) are preferred in cases where patients can eat and digest normally but require additional nutrients to meet clinical needs. Their palatability, ease of administration, and diverse flavor options make them especially popular among geriatric and pediatric patients.

These products are often the first line of intervention in treating mild to moderate malnutrition and are widely used in outpatient settings. Leading brands offer tailored solutions for conditions like sarcopenia, cancer cachexia, and chronic renal insufficiency. In hospitals, ONS is routinely prescribed during post-operative recovery to speed healing and prevent muscle wasting. Their over-the-counter availability has also helped penetrate the non-clinical consumer base, especially among the elderly and chronically ill.

Meanwhile, parenteral nutrition is the fastest-growing sub-segment, driven by critical care applications and gastrointestinal disorders where oral or enteral routes are not feasible. Parenteral nutrition bypasses the gastrointestinal tract entirely and delivers nutrients directly into the bloodstream. It is commonly used in ICUs, surgical recovery, and neonatal care. Innovations in lipid emulsions and amino acid profiles are improving clinical outcomes, and enhanced safety protocols have reduced the risk of infections and metabolic complications, further propelling growth.

Application Insights

Cancer emerged as the dominant application area within the clinical nutrition market. Cancer-related malnutrition is a prevalent and often under-recognized condition, affecting up to 80% of patients with advanced-stage cancers. Chemotherapy, radiation, and the tumor burden itself can lead to significant nutritional deficiencies. As a result, nutrition support is a critical component of oncology care across treatment and palliative stages.

Oncology-specific nutrition formulas are designed to be energy-dense, protein-rich, and fortified with omega-3 fatty acids and antioxidants to preserve lean body mass, reduce inflammation, and improve treatment tolerance. These products have shown benefits in reducing treatment interruptions and hospital readmissions. Clinical guidelines from organizations such as ESPEN and ASPEN strongly recommend the use of clinical nutrition in cancer patients, driving consistent demand.

In contrast, metabolic disorders represent the fastest-growing application area, particularly with rising cases of diabetes and inborn errors of metabolism (IEM). Diabetic-specific formulas help manage blood glucose levels while ensuring adequate caloric intake. In pediatric patients, clinical nutrition is critical for managing rare conditions like phenylketonuria (PKU), where nutrient-specific restriction is essential for normal development. Companies are investing in low-glycemic, customized blends and amino acid formulas to cater to this growing need.

End User Insights

Adults constituted the largest end-user group in the clinical nutrition market, largely due to the burden of chronic diseases and surgical interventions that require nutritional support. Adults with conditions such as stroke, chronic obstructive pulmonary disease (COPD), heart failure, and gastrointestinal disorders benefit from tailored clinical nutrition regimens. Hospitals and rehabilitation centers are major distribution points, offering both enteral and parenteral solutions for short- and long-term care.

This segment also includes maternity and post-partum care, where nutrition plays a role in recovery and lactation. The increasing emphasis on managing obesity and metabolic syndrome through medical nutrition therapy has also strengthened demand in the adult segment. Additionally, athletes recovering from injuries and surgeries are increasingly turning to clinical nutrition to accelerate healing.

Meanwhile, the geriatric segment is the fastest-growing owing to the global aging phenomenon. Elderly patients are particularly vulnerable to malnutrition due to reduced appetite, swallowing difficulties, and multimorbidity. Malnutrition in this age group is often linked to poor prognosis, frailty, and increased mortality. As a result, nursing homes, hospice care, and homecare providers are actively adopting oral and enteral nutrition products customized for older adults, often fortified with vitamin D, calcium, and protein to maintain musculoskeletal health.

Regional Analysis

North America led the global clinical nutrition market, thanks to its advanced healthcare infrastructure, favorable reimbursement policies, and strong presence of leading nutrition brands. The U.S. remains the primary contributor, with a high incidence of chronic diseases, a growing elderly population, and established nutrition support protocols in clinical settings.

Healthcare institutions in North America employ multidisciplinary nutrition teams, including clinical dietitians, pharmacists, and physicians, to optimize nutritional interventions. Regulatory agencies like the FDA also provide clear guidelines for medical food classification, aiding market clarity and innovation. Moreover, government programs such as Medicare and Medicaid reimburse clinical nutrition products under specific conditions, supporting their uptake in both inpatient and outpatient scenarios.

Asia-Pacific is the fastest-growing region in the clinical nutrition market, propelled by a large population base, increasing healthcare expenditure, and rising awareness about malnutrition. Countries like China, India, and Indonesia are witnessing a dual burden of undernutrition and non-communicable diseases, creating significant demand for tailored nutritional solutions.

Government-led initiatives, such as India’s POSHAN Abhiyaan and China’s Healthy China 2030 policy, are encouraging nutrition screening and interventions. In parallel, private hospitals and diagnostic centers are integrating nutrition services into standard care, further accelerating market penetration. Moreover, local manufacturing and cost-effective product portfolios are enabling companies to expand in price-sensitive markets without compromising clinical efficacy.

Some of the prominent players in the clinical nutrition market include:

- Abbott Laboratories

- B. Braun Melsungen AG.

- Mead Johnson Nutrition Company

- Perrigo Company Plc.

- H.J. Heinz Company

- Hospira Inc.

- Groupe Danone

- Fresenius Kabi AG

- Baxter International Inc.

- Nestle SA

Recent Developments

-

March 2025 – Abbott Laboratories launched a new line of enteral nutrition formulas under its Ensure brand, targeting post-operative recovery and critical care patients.

-

January 2025 – Nestlé Health Science acquired a majority stake in Brazilian clinical nutrition startup Pronutrir, expanding its presence in Latin America.

-

October 2024 – Fresenius Kabi received U.S. FDA approval for its SmofKabiven central parenteral nutrition product, further strengthening its critical care portfolio.

-

August 2024 – Baxter International Inc. announced a partnership with Medtronic to integrate smart IV pump systems for safer parenteral nutrition delivery.

-

June 2024 – Danone Nutricia opened a new R&D center in Singapore focused on developing nutrition solutions for aging populations in Asia-Pacific.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global clinical nutrition market.

By Route of Administration

By Application

- Cancer

- Metabolic Disorders

- Gastrointestinal Disorders

- Neurological Disorders

- Others

By End User

- Pediatric

- Adult

- Geriatric

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)