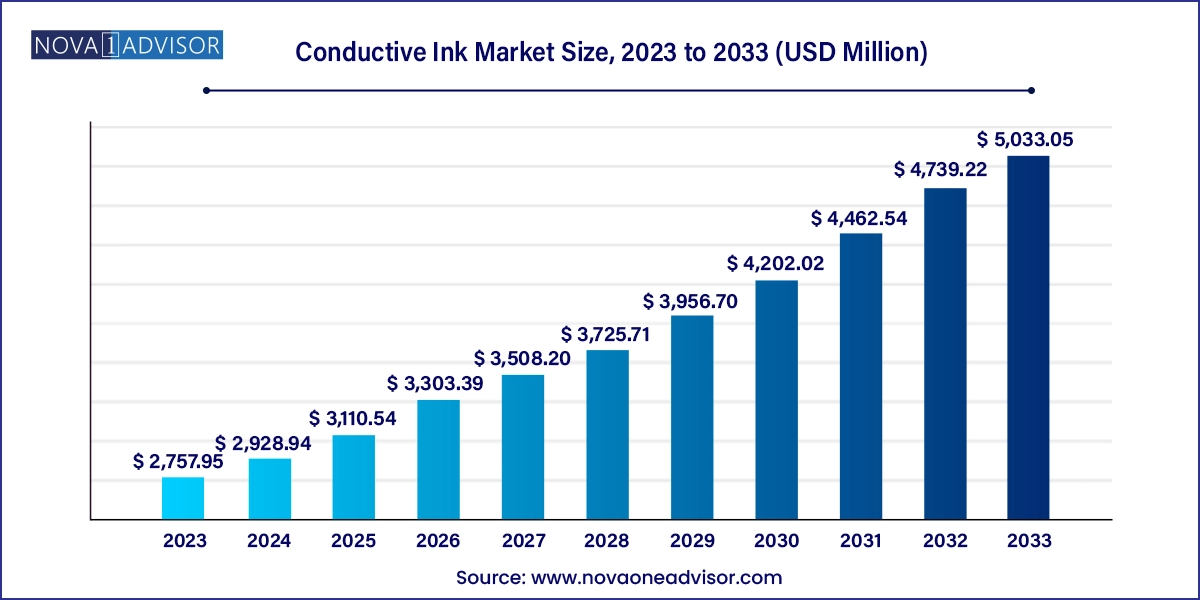

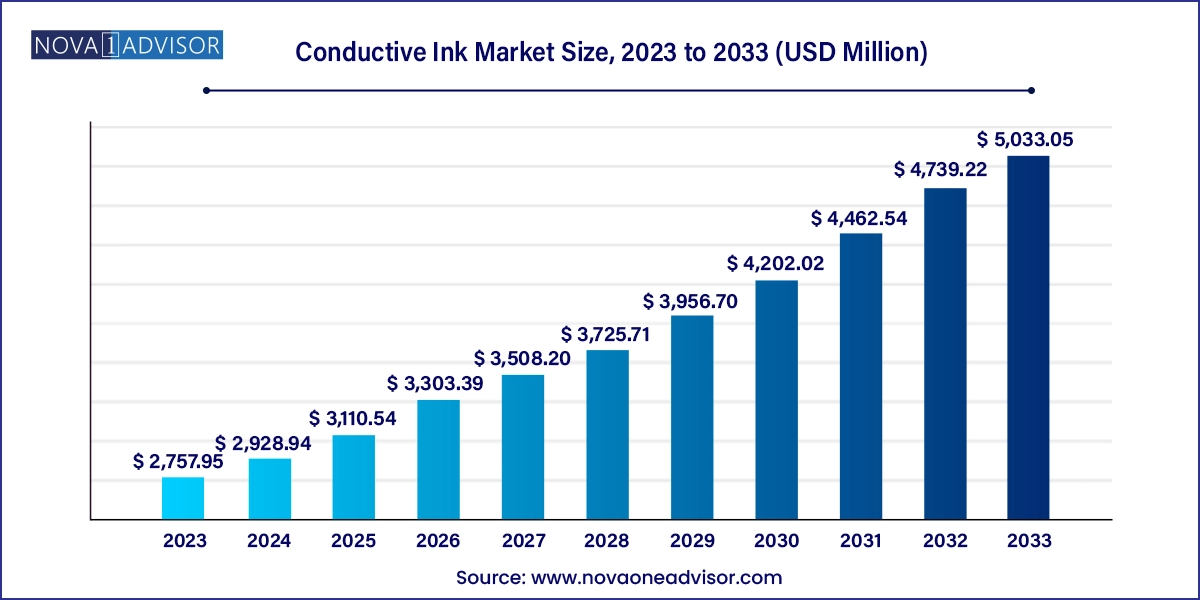

Conductive Ink Market Size and Growth

The conductive ink market size was exhibited at USD 2,757.95 million in 2023 and is projected to hit around USD 5,033.05 million by 2033, growing at a CAGR of 6.2% during the forecast period 2024 to 2033.

Conductive Ink Market Key Takeaways:

- The conductive silver ink product segment led the market and accounted for more than 21.0% revenue share in 2023.

- The segment is estimated to gain market share from more than 22.0% in 2023 to 24.0% by 2033.

- The photovoltaic application segment led the market for conductive ink and accounted for more than 23.0% revenue share in 2023.

- The rising prominence of clean energy is likely to push the growth of the photovoltaic segment over the forecast period.

- The Asia Pacific led the market for conductive ink and accounted for more than 60.0% of revenue share in 2023.

Market Overview

The conductive ink market represents a vital segment within the advanced materials and electronics sectors, enabling the development of next-generation flexible electronics and energy-efficient systems. Conductive inks are materials formulated with conductive components such as silver, copper, carbon, or graphene that, when printed or coated, allow electricity to pass through them. These inks are used in a wide range of applications including printed circuit boards (PCBs), photovoltaic cells, membrane switches, biosensors, and RFID antennas, among others.

As electronic devices become more compact, flexible, and integrated into everyday materials, the demand for conductive inks has surged. These inks facilitate additive manufacturing techniques, such as screen printing, inkjet printing, and aerosol jet printing, which reduce material waste, production time, and cost compared to traditional subtractive fabrication methods. The ability to print conductive traces on flexible substrates like PET, paper, or textiles has led to widespread adoption in wearable electronics, smart packaging, and medical diagnostics.

The market has witnessed strong traction due to increasing investments in printed electronics and emerging technologies like Internet of Things (IoT), smart sensors, and e-textiles. Moreover, global emphasis on renewable energy sources has driven the application of conductive inks in the fabrication of solar cells, especially in the creation of busbars and front-side contacts in silicon-based photovoltaic (PV) modules.

From startups to multinational chemical giants, companies are actively developing novel formulations to enhance conductivity, flexibility, and environmental compatibility. With sustainability gaining prominence, water-based, biodegradable, and low-temperature sintering inks are also being prioritized to align with green manufacturing principles.

Major Trends in the Market

-

Growing demand for flexible and wearable electronics, requiring conductive inks that work on stretchable substrates.

-

Rising adoption of conductive inks in photovoltaic cells, especially in silver-based inks used for front-side metallization.

-

Emergence of carbon and graphene-based inks as cost-effective and stable alternatives to noble metals.

-

Integration of conductive inks in biosensors and diagnostics, accelerated by pandemic-driven interest in point-of-care testing.

-

Development of stretchable, water-based, and low-temperature sintering inks for eco-friendly and energy-efficient production.

-

Increased utilization in printed RFID and smart packaging applications in retail, logistics, and healthcare.

-

Growing research into nanomaterial-based inks, such as silver nanowires and carbon nanotubes, offering enhanced conductivity and durability.

-

Miniaturization of electronics, fueling the need for high-resolution printing techniques compatible with conductive inks.

Report Scope of Conductive Ink Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 2,928.94 Million |

| Market Size by 2033 |

USD 5,033.05 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 6.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S.; U.K.; Germany; France; China; India; Japan; Brazil |

| Key Companies Profiled |

DuPont; Vorbeck Materials Corp.; Applied Nanotech Holdings, Inc.; Sun Chemical Corporation; PPG Industries, Inc.; Creative Materials, Inc.; Poly-Ink; Henkel Ag & Co. KgaA; PChem Associates, Inc.; Johnson Matthey Colour Technologies; Fujikura Ltd.; Heraeus Holding; Nagase America Corporation; Engineered Materials Systems; Epoxies; Etc; Voxel8; Methode Electronics; Novacentrix; Johnson Matthey |

Key Market Driver: Proliferation of Printed and Flexible Electronics

One of the most significant drivers of the conductive ink market is the rapid expansion of printed and flexible electronics across various industries. Traditional rigid electronics are increasingly being complemented or replaced by thin, lightweight, and bendable circuits that can be embedded into fabrics, packaging, and unconventional surfaces. This shift is driven by demand for flexible displays, electronic skin, smart labels, wearable health trackers, and foldable devices.

Conductive inks form the foundation of this transformation. Silver nanoparticle inks are particularly favored for their high conductivity and reliability, while carbon-based inks offer cost efficiency and mechanical resilience. Inkjet and screen printing technologies allow manufacturers to deposit conductive traces directly onto polymer films, paper, and textiles without the need for expensive lithographic processes.

For instance, companies like DuPont and Henkel have developed advanced formulations used in wearable biosensors that monitor vitals like glucose or ECG. Similarly, in the automotive industry, conductive inks are enabling the integration of electronic functionalities into dashboards, seats, and windows, allowing for touch-sensitive surfaces and embedded lighting.

The flexibility, customization, and scalability offered by conductive ink technologies have opened up new design possibilities, reducing manufacturing complexity and empowering innovation across industries.

Key Market Restraint: High Cost and Limited Shelf-Life of Silver-Based Inks

Despite the promising outlook, the market faces a notable restraint in the form of high material costs—particularly related to silver-based conductive inks. Silver is the most commonly used material due to its superior conductivity, but it remains expensive and subject to significant price volatility in global commodity markets. This price factor can deter adoption, especially among cost-sensitive sectors or large-volume applications such as RFID tags or packaging electronics.

Moreover, silver nanoparticle inks often require sintering (heating) post-printing to activate conductivity, which can add to energy usage and manufacturing time. While low-temperature and photonic sintering technologies are being developed, these alternatives may not be suitable for all substrates, especially flexible or temperature-sensitive materials.

Additionally, conductive inks—particularly those based on metal nanoparticles—often suffer from limited shelf life and sensitivity to environmental factors like humidity and oxidation. These challenges can compromise performance, necessitate careful storage, and complicate logistics, particularly in large-scale production or regions with limited cold-chain infrastructure.

Key Market Opportunity: Expansion in Medical Diagnostics and Biosensor Applications

An emerging opportunity in the conductive ink market lies in the expanding application of printed biosensors for real-time and point-of-care diagnostics. The COVID-19 pandemic accelerated the global demand for rapid, disposable, and wearable diagnostic tools, many of which rely on printed electrodes and conductive pathways fabricated using conductive inks.

Biosensors utilize printed conductive traces to detect biomarkers such as glucose, lactate, or pathogens through electrochemical interactions. Conductive inks especially carbon-based and silver chloride inks enable low-cost, high-volume production of such sensors. These biosensors are integrated into patches, strips, or wearables that can wirelessly transmit data to mobile applications or cloud servers for analysis.

Companies are actively investing in developing inks that are biocompatible, stretchable, and optimized for skin contact or fluid immersion. Conductive inks used in lateral flow assays, like those in pregnancy or COVID-19 rapid tests, have seen exponential demand and created pathways for adoption in wider diagnostic fields.

As healthcare moves toward personalized, real-time, and decentralized care models, the use of conductive inks in diagnostics, smart bandages, and implantable electronics offers immense growth potential over the coming decade.

Conductive Ink Market By Product Insights

Conductive silver ink dominated the product segment owing to its unparalleled electrical conductivity, stability, and compatibility with a wide range of printing methods and substrates. Silver inks are widely used in applications where high-performance and reliability are paramount, such as in photovoltaic cells, medical devices, and high-frequency RFID antennas.

In solar panels, silver ink is used to print front-side busbars and fingers that collect and transport current generated by photovoltaic cells. Silver’s low resistance ensures minimal power loss and high energy efficiency, making it the industry standard despite its cost. Similarly, in biosensors and printed circuit boards (PCBs), silver inks offer the precision and consistency needed for compact and sensitive designs. Companies like DuPont, Heraeus, and Henkel lead in silver ink formulations, often providing customizable options based on sintering temperature, curing speed, and ink rheology.

Meanwhile, carbon/graphene ink is the fastest-growing product category. Carbon-based inks offer an economical alternative with acceptable conductivity levels for a variety of non-critical and medium-performance applications. Their use in smart packaging, low-cost sensors, and touch panels is expanding due to environmental benefits, thermal stability, and compatibility with flexible substrates. Graphene inks, in particular, offer a unique combination of mechanical strength, transparency, and conductivity—ideal for next-generation wearables and transparent conductive films. Startups and research institutions are aggressively exploring scalable synthesis and printing techniques to harness graphene’s potential in commercial products.

Conductive Ink Market By Application Insights

Photovoltaic applications held the largest share of the market, owing to the extensive use of conductive inks in the solar energy sector. As the world accelerates its shift to renewable energy sources, conductive inks—particularly silver-based—have become critical in solar cell manufacturing. Screen-printed silver paste is used to create the front-side metallization in crystalline silicon solar cells, enabling efficient current collection.

Large-scale solar farms, residential installations, and building-integrated photovoltaics (BIPV) all utilize conductive ink-based solar cells. The global increase in solar panel production, supported by government subsidies and green energy targets, has significantly contributed to demand for conductive inks. Innovations in ink formulation and printing techniques continue to enhance solar cell efficiency and production throughput.

On the other hand, smart packaging is one of the fastest-growing application areas. Brands in retail, pharmaceuticals, and logistics are adopting conductive ink-based printed electronics to embed interactivity, trackability, and anti-counterfeiting features into product packaging. These innovations include printed antennas for NFC/RFID tags, temperature sensors for cold-chain monitoring, and QR-activated displays. The ability to print electronic functions directly onto packaging materials using carbon or copper inks has opened up cost-effective avenues for mass customization and consumer engagement.

Conductive Ink Market By Regional Insights

Asia Pacific leads the global conductive ink market, driven by its dominant position in electronics manufacturing, solar panel production, and expanding healthcare infrastructure. Countries like China, Japan, South Korea, and Taiwan are home to major photovoltaic manufacturers, printed electronics firms, and R&D facilities that use conductive inks extensively.

China, in particular, is the largest producer and consumer of photovoltaic cells and electronics, benefiting from government incentives, local materials availability, and low labor costs. Japan and South Korea, meanwhile, are innovation hubs for printed electronics and nanomaterials, with companies investing heavily in carbon-based and nanowire ink technologies. The widespread adoption of flexible displays, wearable tech, and automotive sensors across Asia further fuels demand.

North America is the fastest-growing region in the conductive ink market, propelled by surging investments in renewable energy, smart manufacturing, and biomedical innovation. The U.S. is witnessing robust demand for printed biosensors, RFID-enabled logistics, and smart medical patches particularly in response to a rapidly digitizing healthcare ecosystem.

Companies in the U.S. and Canada are also heavily investing in next-generation materials like graphene and carbon nanotubes, fostering academic-industry collaborations and startup accelerators. The North American automotive sector’s push toward embedded electronics in electric and autonomous vehicles is also contributing to demand for printed circuitry using conductive inks.

Moreover, supportive policies on reshoring manufacturing, green energy adoption, and digital health are positioning the region as a future innovation leader in conductive ink applications.

Some of the prominent players in the conductive ink market include:

- DuPont

- Vorbeck Materials Corp.

- Applied Nanotech Holdings, Inc.

- Sun Chemical Corporation

- PPG Industries, Inc.

- Creative Materials, Inc.

- Poly-Ink

- Henkel Ag & Co. KgaA

- PChem Associates, Inc.

- Johnson Matthey Colour Technologies

- Fujikura Ltd.

- Heraeus Holding

- Nagase America Corporation

- Engineered Materials Systems

- Epoxies, Etc

- Voxel8

- Methode Electronics

- Novacentrix

- Johnson Matthey

Recent Developments

-

March 2025 – Heraeus Electronics introduced a new hybrid silver-copper conductive ink designed for high-volume inkjet printing, targeting flexible circuit production in consumer electronics.

-

January 2025 – Henkel AG & Co. KGaA partnered with a U.S.-based graphene startup to co-develop thermally stable conductive inks for wearable electronics and smart packaging.

-

October 2024 – DuPont Interconnect Solutions launched a new low-temperature sintering silver ink for use in solar cell applications, reducing energy consumption during processing.

-

August 2024 – NovaCentrix unveiled a copper nanoparticle ink compatible with photonic curing, offering cost-effective alternatives to silver inks in printed electronics.

-

June 2024 – Poly-Ink released a biodegradable, carbon-based conductive ink aimed at reducing environmental waste in smart packaging and disposable sensors.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2033. For this study, Nova one advisor, Inc. has segmented the conductive ink market

Product

- Conductive silver ink

- Conductive copper ink

- Conductive polymers

- Carbon nanotube ink

- Dielectric inks

- Carbon/Graphene ink

- Others

Application

- Photovoltaic

- Membrane switches

- Displays

- Automotive

- Smart packaging

- Biosensors

- Printed circuit boards

- Other applications

Regional

- North America

- Europe

- Asia Pacific

- Central & South America

- Middle East & Africa