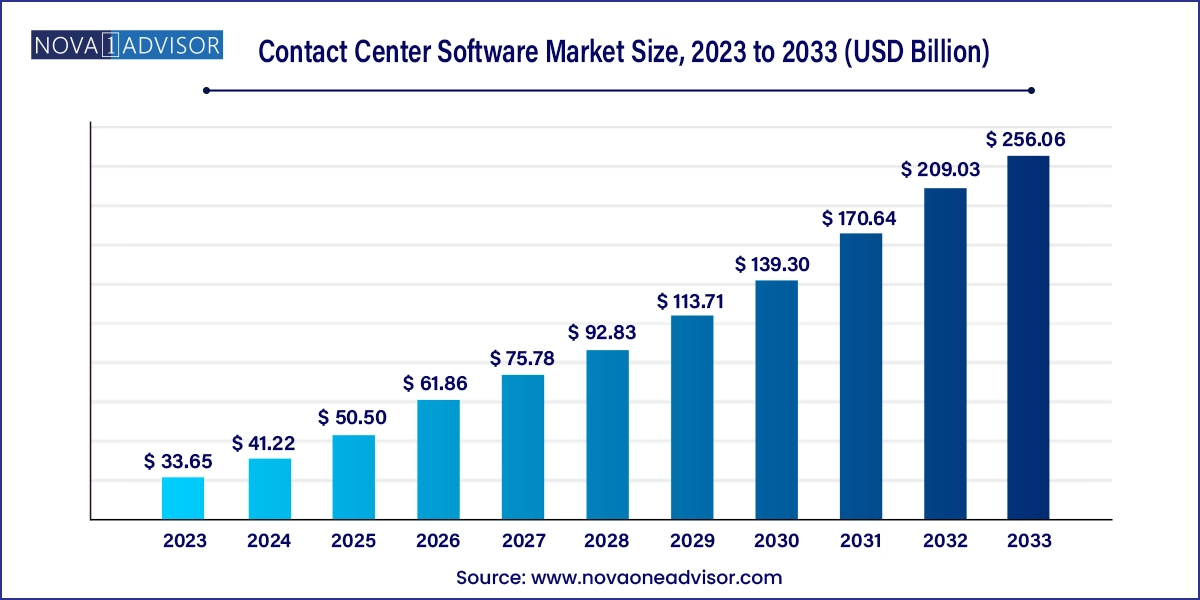

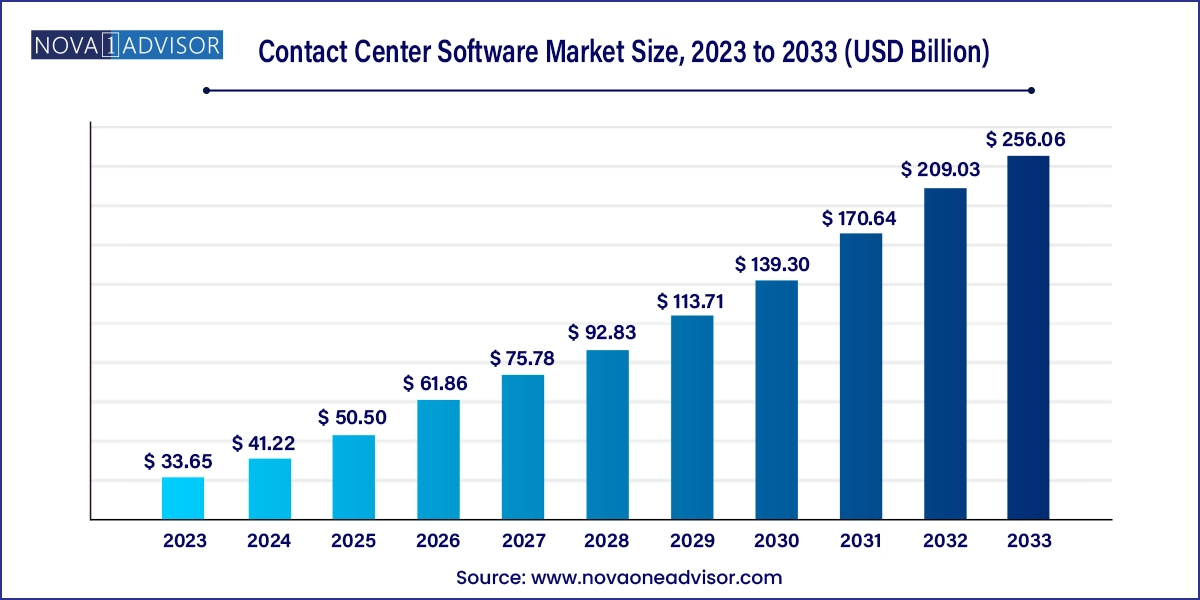

The global contact center software market size was exhibited at USD 33.65 billion in 2023 and is projected to hit around USD 256.06 billion by 2033, growing at a CAGR of 22.5% during the forecast period 2024 to 2033.

- The interactive voice responses (IVR) segment dominated the market in 2023 and accounted for a revenue share of more than 21.0%.

- The customer collaboration segment is expected to register the fastest growth over the forecast period.

- The integration and deployment segment dominated the market in 2023 and accounted for a revenue share of more than 41.0%.

- The on-premise segment dominated the contact center software market in 2023 and accounted for a global revenue share of over 57.0%.

- The hosted segment is anticipated to register the fastest growth over the forecast period.

- The large enterprise segment dominated the contact center software market in 2023 and reported for a global revenue share of over 57.0%.

- The small & medium enterprise segment is anticipated to register the fastest growth over the forecast period.

- The IT & telecom segment dominated the market in 2023 and reported a revenue share of more than 24.0%.

- North America dominated the contact center software market in 2023 and accounted for a revenue share of over 35.0%.

- Asia Pacific is projected to emerge as the fastest-growing regional market over the forecast period.

Market Overview

The global contact center software market is a dynamic and rapidly evolving sector that plays a central role in modern customer service infrastructure. In the digital-first age, organizations across industries rely on contact center solutions not merely as a communication platform, but as a core component of their customer experience strategy. Contact center software facilitates seamless interaction across multiple channels—phone, email, chat, SMS, and social media—providing a unified view of customer engagements and enabling intelligent, automated, and human-assisted customer support.

The surge in omnichannel communication preferences, demand for personalized customer interactions, and the rising need for operational efficiency have driven the wide-scale adoption of contact center solutions. Enterprises of all sizes are investing in advanced cloud-based systems equipped with artificial intelligence (AI), machine learning (ML), natural language processing (NLP), and real-time analytics to enhance service delivery and customer satisfaction. Additionally, the COVID-19 pandemic significantly accelerated the shift to remote contact center operations, creating long-term implications for cloud deployment and digital transformation in this space.

Major Trends in the Market

-

Increased Adoption of Cloud-based Contact Center Solutions for scalability, cost-efficiency, and remote work support.

-

Rise of AI and Chatbots to enable automation, reduce agent workload, and provide 24/7 customer service.

-

Integration of Omnichannel Communication Platforms that unify voice, email, social media, and live chat.

-

Data-driven Customer Insights through Advanced Analytics to enhance personalization and decision-making.

-

Workforce Optimization Tools to manage agent performance and improve productivity.

-

Expansion of Contact Centers Beyond Traditional Use Cases, such as in telehealth and government e-services.

-

Growing Interest in Emotion AI and Sentiment Analysis for real-time customer emotion detection and engagement.

-

Migration from On-premise to Hybrid and Cloud-first Models, especially in emerging markets.

| Report Coverage |

Details |

| Market Size in 2024 |

USD 41.22 Billion |

| Market Size by 2033 |

USD 256.06 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 22.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Solution, Service, Deployment, Enterprise Size, End use, and Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

8X8, Inc.; ALE International; Altivon; Amazon Web Services, Inc.; Ameyo; Amtelco; Aspect Software; Avaya Inc.; Avoxi; Cisco Systems, Inc.; Enghouse Interactive Inc.; Exotel Techcom Pvt. Ltd.; Five9, Inc.; Genesys; Microsoft Corporation; NEC Corporation; SAP SE; Spok, Inc.; Talkdesk, Inc.; Twilio Inc.; UiPath; Unify Inc.; VCC Live |

Market Driver: Growing Demand for Omnichannel Customer Engagement

One of the most compelling drivers of the contact center software market is the surging demand for omnichannel customer engagement. Customers today expect to interact with businesses on their preferred communication channels, whether it's via voice call, instant messaging, social media, or video chat. A fragmented approach to managing these interactions often leads to inefficiencies and customer dissatisfaction.

Contact center software provides a unified interface that enables agents to track and manage conversations across channels while maintaining full context. For instance, if a customer first connects via chat and later switches to a phone call, the agent can access the entire history of the interaction, ensuring a seamless and personalized experience. This capability is especially crucial in sectors like retail, banking, and healthcare where customer satisfaction directly impacts brand loyalty and revenue. Companies leveraging true omnichannel solutions have reported up to 20% higher customer retention rates.

Market Restraint: Data Security and Privacy Concerns

Despite the rapid growth of contact center software, data security and privacy concerns remain a significant restraint. Contact centers handle vast volumes of sensitive information personal identification details, financial records, health information, and confidential business data. The risk of data breaches, insider threats, and non-compliance with regional data protection laws such as GDPR, HIPAA, and CCPA can deter businesses from full-scale deployment of cloud-based contact center solutions.

Moreover, the increasing use of AI and analytics tools requires the collection and processing of vast datasets, amplifying concerns around data ownership and misuse. Many organizations face challenges in implementing end-to-end encryption, secure APIs, identity management, and access control protocols. For instance, a data breach in a healthcare call center not only threatens the organization's credibility but can also result in substantial legal and regulatory penalties.

Market Opportunity: AI-driven Predictive Customer Service

An emerging opportunity lies in the realm of AI-driven predictive customer service. With advanced analytics, machine learning algorithms, and customer behavior models, contact center software can predict customer needs before they even arise. This proactive approach significantly enhances customer experience, improves first contact resolution (FCR), and reduces operational costs.

For example, telecom companies are now using predictive models to anticipate service disruptions and proactively inform customers, reducing inbound complaint volumes. Similarly, e-commerce firms analyze browsing and purchasing patterns to tailor support offerings and cross-sell opportunities. The integration of predictive insights with CRM systems allows businesses to forecast churn, identify upselling prospects, and allocate resources optimally. This evolution from reactive to predictive customer service marks a transformative shift in how enterprises engage with clients.

Interactive Voice Response (IVR) dominated the solution segment in 2024, widely adopted across industries to route calls efficiently and reduce agent handling time. IVR systems help automate routine queries such as balance checks, appointment scheduling, or order status updates, allowing human agents to focus on more complex issues. IVR enhances self-service capabilities and is cost-effective, particularly for high-volume contact centers. The combination of IVR with speech recognition and NLP technologies is further boosting its utility, particularly in healthcare and banking sectors.

Reporting & Analytics is the fastest growing segment, driven by organizations' increasing focus on data-driven decision-making and performance monitoring. These solutions provide real-time dashboards, customer journey maps, agent performance metrics, and call quality assessments, enabling managers to fine-tune operations. Analytics tools are also critical in compliance monitoring and customer sentiment analysis. The growing demand for AI-powered insights into call trends and customer behavior is driving investments in this segment, especially among large enterprises.

Integration & Deployment services lead this segment, as companies seek end-to-end deployment assistance for their contact center platforms. This includes setting up telephony infrastructure, CRM integration, API configuration, and data migration. Enterprises with legacy systems especially require robust integration support to transition to modern cloud-based platforms without disrupting operations. Vendors offering tailored deployment strategies have seen high demand, particularly in regulated industries like BFSI and government.

Managed Services are the fastest growing, as organizations increasingly outsource the maintenance and management of contact center operations to focus on core business activities. Managed services provide round-the-clock system monitoring, updates, security patches, and performance optimization, ensuring operational continuity. With the rise of remote work and global service delivery models, managed services are becoming indispensable for business continuity planning and IT resource optimization.

Hosted deployment models dominate, fueled by the flexibility, scalability, and cost-efficiency they offer. Cloud-based solutions eliminate the need for significant upfront infrastructure investment and facilitate rapid deployment. Hosted contact centers are also easier to update and customize, ensuring faster time-to-value. Businesses in retail and e-commerce, which experience seasonal spikes, particularly benefit from the scalability of hosted solutions.

On-premise deployment is gradually declining, but still relevant for organizations with stringent security requirements or custom compliance needs. Certain segments of the BFSI and government sectors prefer on-premise solutions to retain full control over their data environments.

Large Enterprises accounted for the dominant market share, driven by their extensive customer base, global operations, and complex support infrastructure. These enterprises require advanced functionalities such as workforce management, real-time analytics, CRM integration, and multi-language support. Moreover, large enterprises often maintain hybrid deployments across regions, necessitating robust, scalable software platforms.

Small & Medium Enterprises (SMEs) are the fastest growing, thanks to the proliferation of SaaS-based contact center platforms offering affordable, pay-as-you-go models. Cloud solutions have significantly lowered the entry barrier for SMEs, enabling them to provide professional-grade customer service without investing in costly hardware or IT staff. This democratization of technology is especially evident in Asia Pacific and Latin America, where digital-first SMEs are driving innovation.

The IT & Telecom sector dominated the end-use segment, as companies in this vertical require continuous, high-volume, and technically nuanced customer interaction. Telecom providers manage a vast customer base and service portfolios, making robust contact center operations indispensable. These companies are also early adopters of AI, chatbots, and analytics, driving innovation in the sector.

Healthcare is emerging as the fastest growing end-use, fueled by the rising demand for telehealth services and patient support during and post-COVID. Contact center software is being leveraged to manage patient inquiries, appointment bookings, insurance claims, and health monitoring. The integration of IVR, CRM, and secure messaging is enabling healthcare providers to enhance service delivery and comply with data privacy regulations.

North America led the global contact center software market in 2024, owing to the region's strong digital infrastructure, early adoption of advanced technologies, and a highly competitive business environment. The United States, in particular, hosts a large number of contact center software providers and is home to global leaders in AI, cloud computing, and customer experience. Enterprises across BFSI, retail, and healthcare in North America invest heavily in customer engagement technologies. Moreover, regulatory frameworks such as CCPA and HIPAA have driven the adoption of secure, compliant contact center solutions.

Asia Pacific is the fastest growing region, propelled by economic growth, digital transformation initiatives, and the expanding IT and BPO sectors. Countries like India and the Philippines are global hubs for outsourced contact center operations, while China, Japan, and South Korea are investing in AI-enabled customer engagement platforms. The region's large, mobile-first population also presents significant opportunities for businesses to adopt omnichannel communication strategies. Government programs promoting cloud adoption and startup ecosystems in Southeast Asia further contribute to the regional momentum.

-

In March 2024, Genesys launched "Experience Orchestration AI" to enhance real-time customer journey management across voice and digital channels.

-

In February 2024, NICE announced the acquisition of LiveVox, aiming to expand its CXone cloud platform and enhance its AI capabilities.

-

In January 2024, Five9 introduced its new agent-assist solution powered by generative AI to improve agent productivity and customer experience.

-

In December 2023, Talkdesk expanded its global partner program, focusing on regional cloud deployments in Asia Pacific and Europe.

-

In November 2023, Cisco released a revamped version of its Webex Contact Center with enhanced omnichannel routing and real-time transcription.

- 8X8, Inc.

- ALE International

- Altivon

- Amazon Web Services, Inc.

- Ameyo

- Amtelco

- Aspect Software

- Avaya Inc.

- Avoxi

- Cisco Systems, Inc.

- Enghouse Interactive Inc.

- Exotel Techcom Pvt. Ltd.

- Five9, Inc.

- Genesys

- Microsoft Corporation

- NEC Corporation

- SAP SE

- Spok, Inc.

- Talkdesk, Inc.

- Twilio Inc.

- UiPath

- Unify Inc

- VCC Live

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global contact center software market

Solution

- Automatic Call Distribution (ACD)

- Call Recording

- Computer Telephony Integration (CTI)

- Customer Collaboration

- Dialer

- Interactive Voice Responses (IVR)

- Reporting & Analytics

- Workforce Optimization

- Others

Service

- Integration & Deployment

- Support & Maintenance

- Training & Consulting

- Managed Services

Deployment

Enterprise Size

- Large Enterprise

- Small & Medium Enterprise

End Use

- BFSI

- Consumer Goods & Retail

- Government

- Healthcare

- IT & Telecom

- Travel & Hospitality

- Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa