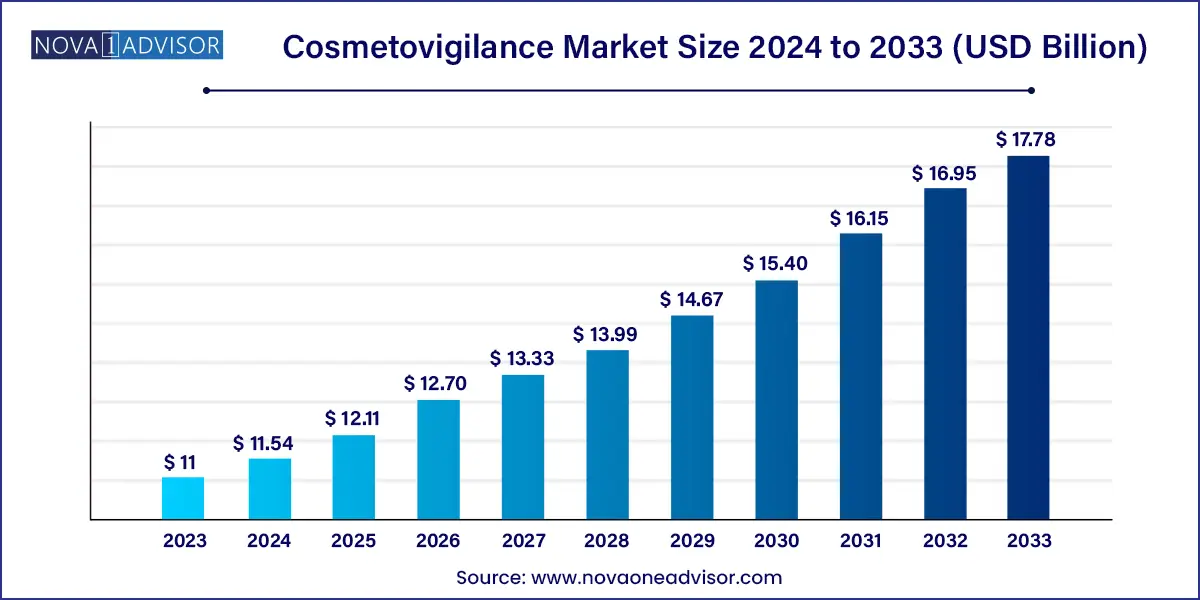

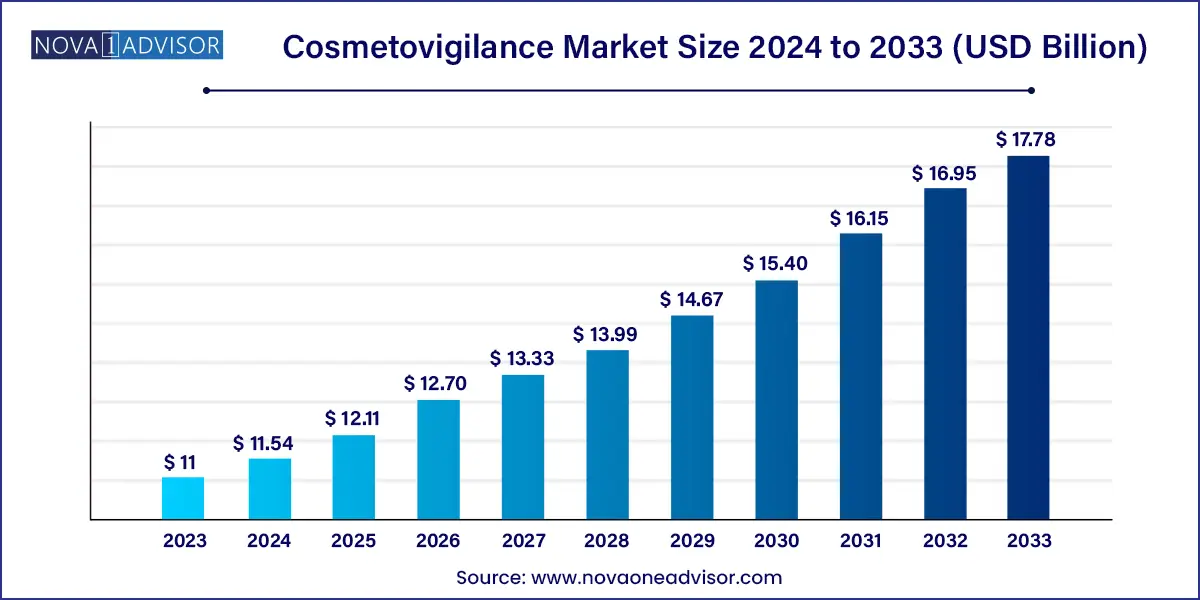

The global cosmetovigilance market size was exhibited at USD 11.0 billion in 2023 and is projected to hit around USD 17.78 billion by 2033, growing at a CAGR of 4.92% during the forecast period of 2024 to 2033.

Key Takeaways:

- The North America region is expected to growth at a significant CAGR during the forecast period.

- Based on service type, the post-marketing service segment held the market with the largest revenue share of 23.7% in 2023

- Based on phase type, the Phase IV segment led the market with the largest revenue share of 75.76% in 2023.

- Based on category, the skincare segment led the market with the largest revenue share of 32.95% in 2023,

- Based on service provider, the contract outsourcing segment led the market with the largest revenue share of 60.0% in 2023.

Market Overview

The cosmetovigilance market is emerging as a crucial component of regulatory compliance and consumer safety in the cosmetics and personal care industry. As the global cosmetics market experiences rapid growth—driven by evolving beauty standards, social media influence, and innovation in skincare and makeup—there is an equally rising need to ensure that these products are safe for consumer use. Cosmetovigilance, defined as the systematic monitoring, collection, assessment, and prevention of adverse effects related to cosmetic products, functions as a post-market safety surveillance mechanism similar to pharmacovigilance in pharmaceuticals.

Unlike pharmaceutical drugs, cosmetic products do not undergo rigorous pre-market clinical trials in many countries, particularly where cosmetics are classified as low-risk. This makes post-marketing safety surveillance even more important, as issues such as skin allergies, dermatitis, photosensitivity, and chronic irritation may not surface until large-scale consumer use begins. Regulatory authorities like the European Medicines Agency (EMA), U.S. FDA, and emerging bodies in Asia-Pacific have implemented or strengthened guidelines that require companies to report and investigate adverse reactions.

As cosmetics become more complex with bioactive ingredients, nanotechnology, and hybrid formulations (cosmeceuticals), the boundary between medicine and beauty is increasingly blurred. Consequently, manufacturers are now investing in structured cosmetovigilance systems to avoid product recalls, litigation, and reputational damage. Whether conducted in-house or via specialized contract organizations, cosmetovigilance is poised to become a cornerstone of responsible product lifecycle management in the cosmetics sector.

Major Trends in the Market

-

Growing Regulatory Pressure for Post-Market Surveillance: Regulatory bodies are tightening safety reporting guidelines for cosmetics, making surveillance mandatory in several markets.

-

Shift Toward Hybrid Products (Cosmeceuticals): Products blending cosmetics and pharmaceutical properties are increasing safety risk, thus requiring more robust vigilance mechanisms.

-

Increased Use of Artificial Intelligence in Adverse Event Detection: AI tools are being used to detect safety signals from social media, product reviews, and consumer complaints.

-

Outsourcing to Specialized CROs and BPOs: Many cosmetic companies are shifting cosmetovigilance responsibilities to contract research organizations and BPOs for scalability and cost-efficiency.

-

Consumer Awareness and Advocacy: The rise of conscious consumerism and influencer-driven scrutiny is encouraging more transparent safety communication.

-

Expansion of Cosmetovigilance into Emerging Markets: Countries in Asia-Pacific and Latin America are adopting European-style vigilance frameworks to align with international trade partners.

-

Use of Real-World Evidence (RWE): Companies are leveraging consumer experience data, dermatological studies, and online reviews as supplementary evidence in safety reporting.

Cosmetovigilance Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 11.0 Billion |

| Market Size by 2033 |

USD 17.78 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.92% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Phase Type, Service Type, Category, Service Provider, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Poseidon CRO: AxeRegel; PharSafer; AB Cube; Aixial Group; Di Renzo; Accenture; OC Vigilance ; SKILLPHARMA S.R.L.; Proclinical. |

Key Market Driver: Increasing Consumer Awareness and Demand for Product Safety

A critical driver propelling the cosmetovigilance market is heightened consumer awareness about product safety. In the age of digital connectivity, consumers are more informed and vigilant than ever. Online platforms, ingredient-tracking apps (like Think Dirty or EWG’s Skin Deep), and social media influencers have empowered users to question product safety, report adverse events, and demand accountability from brands. Incidents of contact dermatitis, chemical burns, allergic reactions, and even pigmentation disorders due to cosmetics are widely reported, sometimes going viral, compelling companies to act swiftly.

This environment of consumer scrutiny has encouraged manufacturers to implement proactive cosmetovigilance frameworks that go beyond minimum regulatory requirements. In many cases, brands are voluntarily collecting adverse event data, even in regions where it is not mandated. For example, after a customer backlash over certain facial masks causing skin burns in the U.S. and Canada in 2023, the manufacturer had to recall the batch, initiate an investigation, and rebuild consumer trust. Companies that prioritize consumer safety through active surveillance are increasingly seen as ethical, trustworthy, and quality-focused, translating to stronger brand equity.

Key Market Restraint: Lack of Standardized Global Regulations

A major restraint in the cosmetovigilance market is the absence of harmonized global regulations, leading to inconsistencies in reporting requirements and compliance standards. While the European Union has enforced strict guidelines under Regulation (EC) No 1223/2009, mandating serious undesirable effects (SUEs) to be reported within 20 days, other regions like the United States, India, and many parts of the Middle East still lack unified mandates.

In the U.S., the FDA does not pre-approve cosmetics and only monitors adverse effects through the Voluntary Cosmetic Registration Program (VCRP), leaving many products untracked post-launch. Meanwhile, companies operating in multiple countries face logistical and legal hurdles in establishing consistent cosmetovigilance procedures across markets. These disparities create confusion, increase compliance costs, and pose risks of missed safety signals. In regions with lax regulations, many consumers do not report adverse reactions, and companies are not incentivized to investigate non-serious events, which may ultimately damage public trust and delay policy harmonization.

Key Market Opportunity: Integration of AI and Big Data for Adverse Event Monitoring

One of the most promising opportunities in the cosmetovigilance market is the integration of artificial intelligence (AI), big data analytics, and natural language processing (NLP) to improve adverse event detection, pattern recognition, and decision-making. Traditional methods of cosmetovigilance, such as consumer hotlines or physician reports, are slow, reactive, and labor-intensive. AI-powered platforms now allow companies to mine data from social media comments, customer service chat logs, e-commerce reviews, and dermatological forums to identify early safety signals.

For instance, if a particular sunscreen receives multiple complaints on Amazon and Reddit about causing rashes in a specific demographic group, AI tools can flag this trend in real time, even before formal complaints reach regulatory authorities. Such proactive surveillance enhances consumer protection, accelerates root-cause analysis, and enables faster interventions like reformulation or withdrawal. Additionally, sentiment analysis and geographic heatmaps help companies predict region-specific sensitivities and tailor formulations accordingly. As AI becomes more embedded in cosmetic safety systems, companies that invest in predictive cosmetovigilance will gain a strategic edge in product quality and market responsiveness.

Segments Insights:

Service Type Insights

Post-marketing services dominate the global cosmetovigilance landscape, reflecting the importance of real-world surveillance in consumer safety assurance. Activities such as case intake, triage, data acquisition, and regulatory reporting are conducted regularly to identify, assess, and mitigate risks. These services are typically supported by IT platforms and standardized protocols that ensure adverse event reporting is timely, compliant, and comprehensive.

Multinational cosmetic firms often outsource post-marketing services to CROs and BPOs to manage data flow from multiple geographies and ensure compliance with region-specific regulations. These services are also becoming more digitalized, with automated case intake portals and AI-driven report generation systems.

However, pre-marketing services are growing rapidly, especially among startups and mid-sized cosmetic brands that prioritize safety from the earliest development stages. Clinical safety testing, document writing for regulatory submissions, and risk management planning are being embedded into product development pipelines. This proactive approach reduces the likelihood of post-launch issues, builds investor confidence, and ensures smoother market approvals.

Given the global rise of cosmeceuticals—products that blur the line between cosmetics and drugs—pre-market services are becoming vital for legal defensibility and brand positioning.

Phase Type Insights

Phase IV dominates the cosmetovigilance market, as it encompasses the critical post-marketing surveillance stage, where real-world adverse events are tracked and analyzed. Once a product is launched, it enters mass consumer use—exposing it to a wide range of skin types, environments, and usage patterns that may not have been captured in pre-clinical or clinical testing. This phase is especially important for long-term safety validation.

Companies invest heavily in post-launch vigilance through adverse event collection systems, dermatological studies, and consumer feedback monitoring. Given the sheer scale of cosmetic product launches globally—especially in skincare and makeup—Phase IV activities have become foundational to a brand’s safety and compliance strategy.

On the other hand, Phase I is the fastest-growing phase, driven by rising demand for ethical and safety-compliant products. Phase I involves initial clinical trials on small groups to assess dermal reactions, irritation potential, and tolerance. With increasing scrutiny over ingredient safety and ethical testing protocols, cosmetic brands are conducting robust early-stage safety trials to prevent long-term liability.

The growth of cruelty-free and vegan cosmetic brands, particularly in Europe and North America, is accelerating investment in Phase I. Dermatological testing using reconstructed human skin models and in vitro assessments is also expanding the scope of Phase I, enabling brands to refine product design before larger trials.

Category Insights

Skincare holds the dominant position in the cosmetovigilance market due to its high share in the overall cosmetic industry and the increased risk of adverse events like rashes, photosensitivity, and acne breakouts. With more consumers using active ingredients such as retinoids, AHAs, and peptides, the margin for skin irritation or hypersensitivity is higher. Skincare products like serums, moisturizers, and sunscreens often require safety tracking systems to address these risks.

The segment is also affected by changing consumer skin profiles, due to urban pollution, stress, and hormonal changes. Companies are leveraging dermatological data and feedback loops from dermatologists and online reviews to monitor their products' safety profiles continuously.

Haircare is the fastest-growing category, propelled by increased experimentation with dyes, straightening treatments, scalp serums, and hair growth enhancers. Many haircare products include strong chemical agents such as parabens, formaldehyde, and sulfates that can trigger allergic reactions or scalp dermatitis.

High-profile cases of hair loss associated with certain shampoo brands in the U.S. and Asia have raised consumer sensitivity, prompting more robust surveillance in this category. Haircare companies are also tracking long-term effects of hair cosmetics on diverse ethnic groups, making cosmetovigilance a strategic necessity.

Service Provider Insights

Contract outsourcing leads the market, as many companies choose to outsource their cosmetovigilance functions to third-party service providers, including Contract Research Organizations (CROs) and Business Process Outsourcing Organizations (BPOs). These firms bring specialized expertise, regulatory knowledge, scalable infrastructure, and cost savings. They handle everything from case intake to adverse event tracking, ensuring global compliance and freeing up internal resources.

Large global brands like L’Oréal and Unilever frequently engage CROs for multi-region post-marketing safety monitoring. CROs with dermatological expertise and data analytics capabilities are especially in demand, given the growing complexity of hybrid cosmetic products.

In-house vigilance is growing strategically, particularly among mid- to large-scale companies seeking more control over safety data. In-house teams are better positioned to respond quickly to consumer complaints, integrate safety insights into R&D, and ensure seamless communication with regulatory bodies.

Companies prioritizing data privacy or those launching personalized skincare lines are building internal teams to own the entire cosmetovigilance lifecycle, from formulation to post-market feedback loops. As the role of safety reporting shifts from compliance to brand differentiation, in-house vigilance is regaining importance.

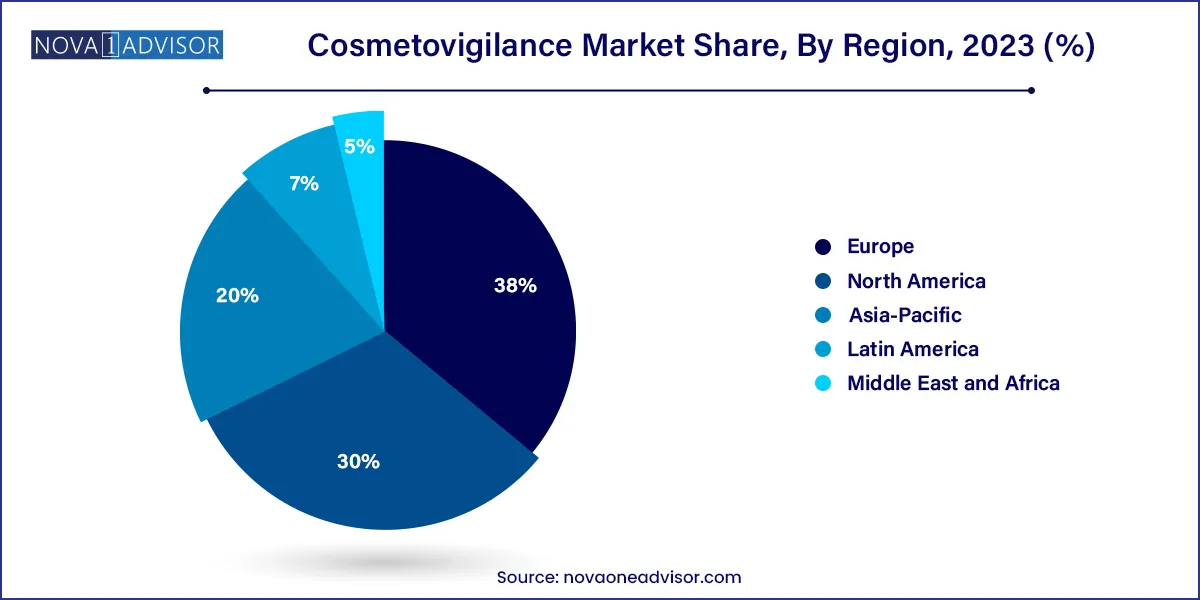

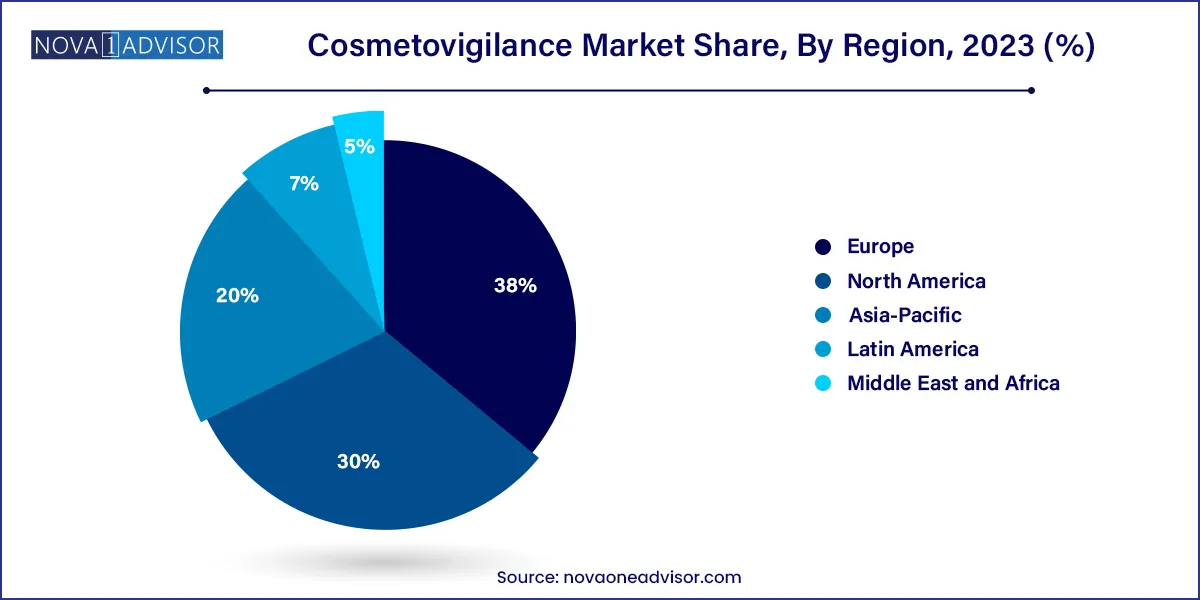

Regional Insights

Europe dominates the global cosmetovigilance market, owing to its stringent regulatory framework and high consumer demand for safe, ethical products. Regulation (EC) No 1223/2009 mandates cosmetic companies to implement post-market surveillance systems, report serious undesirable effects (SUEs), and maintain a Product Information File (PIF) containing safety data.

European consumers are particularly conscious of product safety, favoring brands that are dermatologically tested, cruelty-free, and transparent about ingredients. Multinational brands operating in the EU must comply with the regulation or face market bans, driving substantial investment in vigilance systems. CROs and dermatological research centers based in France, Germany, and Italy play a significant role in supporting EU-based compliance.

Asia-Pacific is the fastest-growing market for cosmetovigilance, propelled by explosive growth in cosmetics consumption, especially in countries like China, India, Japan, and South Korea. Governments in this region are progressively strengthening cosmetic safety regulations in alignment with international best practices.

China's National Medical Products Administration (NMPA) introduced post-market surveillance requirements for imported cosmetics, while India’s CDSCO has proposed new rules for adverse event monitoring. Local consumers are also becoming more vocal on social media about safety issues, prompting domestic and international brands to adopt robust vigilance frameworks. As beauty-tech startups proliferate across the region, demand for third-party safety monitoring and pre-market testing services is accelerating.

Recent Developments

-

February 2025 – IQVIA launched a dedicated cosmetovigilance analytics platform using NLP and AI to track adverse reactions across digital channels globally.

-

December 2024 – Symrise AG partnered with an Asian regulatory technology startup to implement a real-time cosmetovigilance solution across India and Southeast Asia.

-

October 2024 – Eurofins Scientific expanded its dermatology CRO network in France to offer advanced clinical safety and tolerance testing services.

-

August 2024 – SGS Group released a whitepaper outlining post-market vigilance best practices for cosmeceutical brands operating in both the EU and China.

Some of the prominent players in the cosmetovigilance market include:

- Poseidon CRO

- AxeRegel

- PharSafer

- AB Cube

- Aixial Group

- Di Renzo

- Accenture

- OC Vigilance

- SKILLPHARMA S.R.L.

- Proclinical

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global cosmetovigilance market.

Phase Type

- Pre-clinical

- Phase I

- Phase II

- Phase III

- Phase IV

Services Type

-

- Clinical Safety Testing

- Document Writing

- Risk Management

-

- Case Intake

- Case Triage

- Data Entry & Acquisition

- Tracking & Reporting

Category

- Skincare

- Makeup

- Haircare

- Perfume & Deodorants

Service Provider

- In-house

- Contract Outsourcing

-

- Contract Research Organizations (CROs)

- Business Process Outsourcing Organizations (BPOs)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)