Diagnostic Ultrasound Market Size and Research

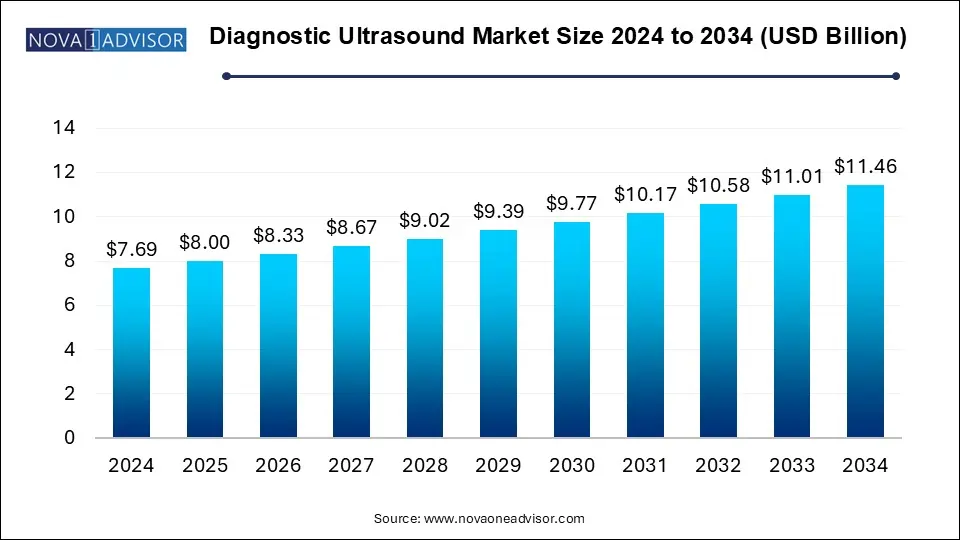

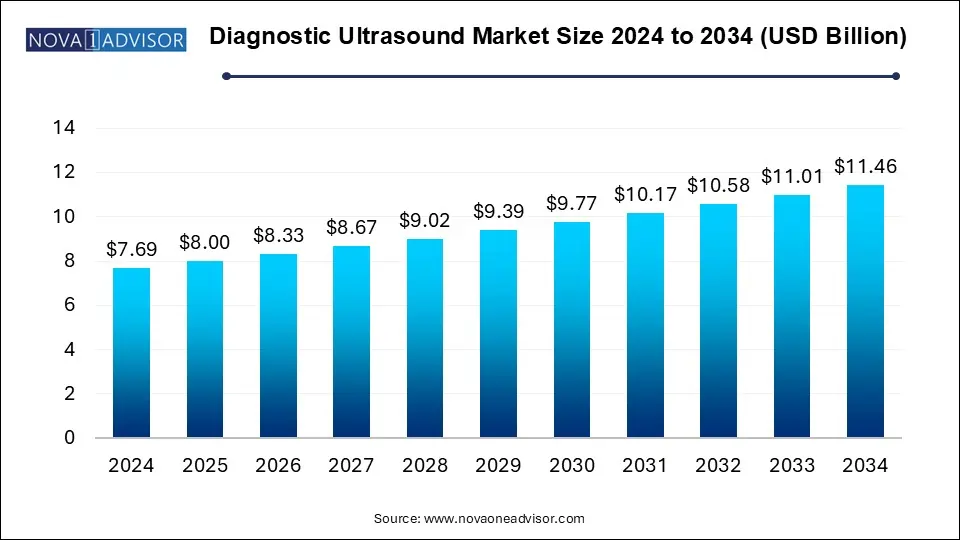

The diagnostic ultrasound market size was exhibited at USD 7.69 billion in 2024 and is projected to hit around USD 11.46 billion by 2034, growing at a CAGR of 4.07% during the forecast period 2025 to 2034.

Diagnostic Ultrasound Market Key Takeaways:

- North America has held the largest market share of 33.0% in 2024.

- By technology, the 2D segment has accounted the largest market share of 38.0% in 2024.

- By portability, in 2024, the trolley segment has captured the biggest market share of 66.0% in 2024.

- By application, the obstetrics/gynecology segment held a significant share in 2024.

- By end use, the maternity centers segment holds the largest share of the market.

U.S. Diagnostic Ultrasound Market Size and Growth 2025 to 2034

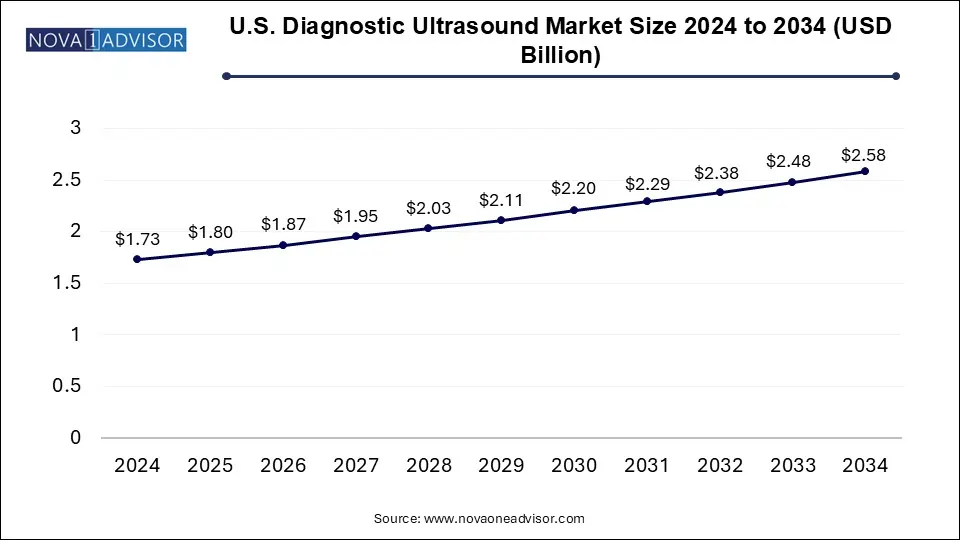

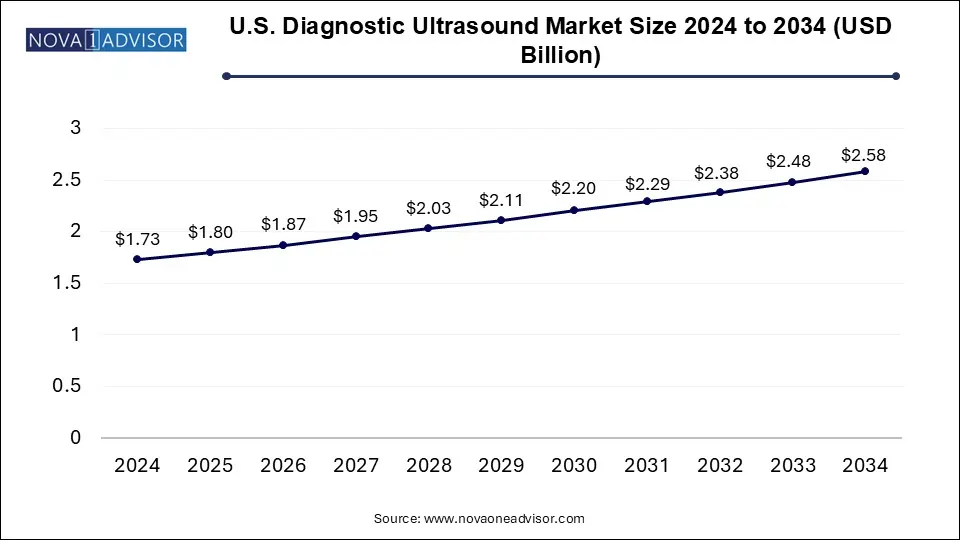

The U.S. diagnostic ultrasound market size reached USD 1.73 billion in 2024 and is anticipated to be worth around USD 2.58 billion by 2034, poised to grow at a CAGR of 4.10% from 2025 to 2034.

North America holds a dominant 33.0% share of the diagnostic ultrasound market in 2024, driven by advancements in ultrasound imaging technology. However, despite these innovations, the use of prehospital ultrasound in the region remains limited. Factors such as provider training, system size, population coverage, and transport type are believed to impact its adoption in prehospital settings.

Several barriers continue to hinder the widespread implementation of prehospital ultrasound, including high equipment costs, training expenses, and limited evidence demonstrating improved patient outcomes. These challenges have slowed its integration into North America's emergency medical services (EMS) despite the potential benefits for prehospital patient care.

The American Institute of Ultrasound in Medicine (AIUM) recognizes pioneers, innovators, and key contributors in the field of medical ultrasound through its national awards. The 2024 award recipients were honored at UltraCon in Orlando for their significant contributions to the industry.

- In August 2024, Pulsenmore won the AIUM’s Shark Tank Competition at UltraCon, showcasing an innovative patient-centered home ultrasound solution.

- UltraCon 2024 brought together esteemed experts and professionals from various skill levels in the ultrasound field to explore, discuss, and celebrate groundbreaking advancements in ultrasound technology and clinical practice.

- Additionally, in January 2024, Mindray partnered with Aegle Medical Solutions to expand its portfolio of non-invasive liver care solutions, introducing new offerings to the U.S. market.

Diagnostic Ultrasound Market Overview

Diagnostic ultrasound, also referred to as sonography or diagnostic medical sonography, is a crucial imaging technique that utilizes sound waves to create detailed images of internal body structures. These images play a vital role in diagnosing and managing various medical conditions. The versatility of ultrasound is evident in its extensive applications, including prenatal monitoring, gallbladder disease detection, blood flow assessment, and guidance during biopsies or tumor treatments. Additionally, ultrasound is instrumental in evaluating breast lumps, thyroid disorders, genital and prostate conditions, joint inflammation, and metabolic bone diseases.

Diagnostic ultrasound is broadly classified into two main types: anatomical and functional. Anatomical ultrasound provides high-resolution images of internal organs and bodily structures. On the other hand, functional ultrasound combines anatomical imaging with additional data—such as tissue stiffness, other physical attributes, and movement of blood or tissue—to generate comprehensive ‘information maps.’ These maps assist healthcare professionals in detecting functional variations in organs or tissues, enabling more precise diagnoses and tailored treatment plans.

- In March 2024, Siemens Healthineers introduced the latest advancements in the Acuson Sequoia Flagship series at the European Congress of Radiology (ECR) in Vienna.

- In November 2024, Philips unveiled a compact ultrasound system at RSNA 2022, designed to enhance first-time-right diagnoses across a wider patient population.

Diagnostic Ultrasound Market Growth Factors

- The diagnostic ultrasound market is experiencing increased demand due to its effectiveness in examining vital organs such as the kidney, bladder, prostate, liver, pancreas, uterus, and ovaries. This facilitates the early detection of abnormalities like tumors, cysts, and growths.

- The expansion of diagnostic capabilities for musculoskeletal conditions, including muscle and tendon injuries, has broadened the scope of medical applications.

- Ultrasound plays a crucial role in prenatal care, allowing for fetal monitoring without exposing the unborn child to ionizing radiation. This ensures proper growth tracking and health assessment, contributing to increased usage during pregnancy.

- It is also highly valuable in evaluating vascular conditions, providing detailed images of blood vessels and assessing blood flow to various organs. This capability aids in treatment decisions and further boosts market growth.

- The technology’s non-invasive nature, safety profile, and ability to be performed repeatedly without adverse effects have increased trust among both healthcare providers and patients, leading to greater adoption of ultrasound services.

- The diverse applications of ultrasound probes—including internal imaging via the gastrointestinal tract, vagina, and blood vessels, as well as intraoperative use—expand its utility across multiple medical fields. This adaptability drives market growth by supporting a wide range of diagnostic and procedural applications.

Report Scope of Diagnostic Ultrasound Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 8.0 Billion |

| Market Size by 2034 |

USD 11.46 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 10.06% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Technology, By Portability, By Application, and By End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Canon Medical Systems, FujiFilm, GE Healthcare, Hitachi, Kalamed, Samsung Electronics, Koninklijke Philips, TELEMED Medical Systems, Siemens Healthcare, Toshiba Medical Systems, and Others. |

Diagnostic Ultrasound Market Dynamics

Drivers

Prenatal Ultrasound Technology

The adoption of prenatal ultrasound technology plays a crucial role in driving the growth of the diagnostic ultrasound market. Expectant parents frequently opt for routine ultrasound scans during pregnancy, not only for essential fetal and maternal health assessments but also for the emotional connection it provides. These scans offer a special opportunity to observe the developing fetus, listen to the fetal heartbeat, and capture images to share with family and friends.

Advancements in ultrasound technology, particularly the emergence of three-dimensional (3D) and four-dimensional (4D) imaging, have significantly transformed the prenatal experience. These innovations allow for enhanced visualization of fetal features, such as facial expressions and limb movements, in real-time, improving both diagnostic accuracy and the bonding experience for parents.

The growing consumer demand for cutting-edge imaging technologies continues to fuel the expansion of the diagnostic ultrasound market. This underscores the necessity of ongoing technological advancements to align with evolving consumer expectations and industry trends.

- In July 2022, GE Healthcare introduced a state-of-the-art ultra-premium ultrasound system as part of its Women’s Health portfolio.

- In February 2024, Fujifilm India launched an advanced endoscopic ultrasound machine.

Utilization of High-Frequency Sound Waves

The application of high-frequency sound waves emitted by ultrasound probes is a key factor driving the expansion of the diagnostic ultrasound market. These sound waves penetrate the body and bounce off internal structures, providing critical diagnostic information for healthcare professionals. The returning echoes are captured by transducers, allowing for the generation of detailed images of internal organs and tissues.

The diagnostic ultrasound industry utilizes advanced imaging technology to provide both patients and referring physicians with a wide array of ultrasound examinations. One of the major advantages of ultrasound imaging is its non-invasive and painless nature, contributing to its widespread acceptance among patients. By harnessing high-frequency sound waves, ultrasound systems produce detailed images of internal structures, enabling early detection of tissue abnormalities in various organs. This enhanced diagnostic precision plays a crucial role in driving market growth by effectively catering to a diverse range of medical conditions.

In February 2024, Lantheus announced the acquisition of Cerveau Technologies, Inc., strengthening its imaging portfolio, particularly in the area of Alzheimer’s disease research.

Restraints

Limitations in Imaging Depth and Bone Obstruction

Although ultrasound is a highly effective diagnostic tool, its utility is restricted by certain inherent limitations. A key challenge in the diagnostic ultrasound market stems from the limited ability of sound waves to pass through air or bone, making it unsuitable for imaging areas such as the lungs or skull. Additionally, ultrasound may have difficulty capturing clear images of structures located deep within the body.

To compensate for these shortcomings, healthcare professionals often turn to alternative imaging techniques like computed tomography (CT) scans, magnetic resonance imaging (MRI), or X-rays. This dependency on supplementary diagnostic methods poses a challenge to the growth of the diagnostic ultrasound market, highlighting the need for a combination of imaging technologies to address specific anatomical complexities and ensure accurate diagnostic results.

Opportunities

Advancements in Ultrasound Technology

Ongoing advancements in ultrasound technology create significant opportunities for market expansion. Innovations such as plane wave imaging, high-resolution contrast-enhanced ultrasound, micro-elastography, 3D ultrasound, and high-frequency ultrasound have revolutionized diagnostic imaging. Additionally, the call for original research and review articles on advanced ultrasound techniques in both clinical and research settings highlights the increasing potential within this sector.

The development of cutting-edge ultrasound technologies promotes collaboration among researchers, healthcare providers, and industry leaders, fostering knowledge exchange and innovation. These advancements enhance imaging precision, allowing for more detailed and accurate diagnostic evaluations. As a result, continuous technological progress serves as a key driver for growth and innovation in the diagnostic ultrasound market.

- In July 2024, Canon Medical introduced the Aplio Flex and Aplio Go Ultrasound Systems in Europe to address evolving healthcare challenges.

- In January 2024, a private equity-backed imaging supplier continued its rapid expansion through another strategic acquisition.

3D Ultrasound Volume Imaging

The advent of three-dimensional (3D) volume imaging marks a major breakthrough in modern sonography, presenting significant opportunities for the diagnostic ultrasound market. While MRI remains a valuable imaging modality, the continued refinement of 3D ultrasound technology is positioning it as a strong competitor. With 3D ultrasound volume imaging, clinicians can acquire volumetric data that enables post-examination reconstruction in any plane, a feature that may pave the way for standardized ultrasound techniques similar to those utilized in MRI.

This technological advancement is set to reinforce ultrasound’s role in body imaging, particularly in comparison to MRI. The ability to generate multiplanar reconstructions from 3D ultrasound volumes introduces a more standardized diagnostic approach, improving consistency, reliability, and overall accuracy. Consequently, ultrasound is evolving from a subjective, skill-dependent imaging method to a structured approach with standardized planes that can be interpreted by a wider range of medical professionals.

The rise of 3D volume imaging not only promotes standardization within ultrasound diagnostics but also unlocks new avenues for growth in the diagnostic ultrasound market. By enhancing diagnostic precision and making advanced imaging more accessible to a broader spectrum of practitioners, 3D ultrasound technology is set to expand market potential, increase competitiveness, and ultimately contribute to better patient outcomes.

- In May 2024, Probo Medical finalized the acquisition of National Ultrasound.

- In February 2024, RadNet expanded into the Houston, Texas market through the strategic acquisition of Houston Medical Imaging.

- In January 2024, Abdul Latif Jameel Health partnered with iSono Health to launch the world’s first AI-powered portable 3D breast ultrasound scanner, potentially transforming healthcare access for millions of women across the Global South.

Diagnostic Ultrasound Market By Technology Insights

The 2D ultrasound segment dominated the market in 2024, accounting for 38.0% of the total market share, making it the most widely used form of ultrasound imaging. Known for its ability to generate black-and-white images that highlight skeletal structures and internal organs, 2D ultrasound plays a crucial role in fetal health assessment during pregnancy. Its effectiveness lies in its real-time, radiation-free imaging technique, which relies on high-frequency sound waves to provide live visualization of the pelvic region.

As the name suggests, 2D ultrasound produces flat images without depth, offering a widely recognized imaging method trusted by healthcare professionals and patients alike. It is typically employed until the 24th week of pregnancy, serving as a foundational tool in prenatal diagnostics.

Despite technological advancements introducing 3D and 4D ultrasound, 2D ultrasound remains the most widely used due to its accessibility, reliability, and well-established role in clinical settings. Although it lacks depth perception, its continued widespread adoption and familiarity contribute to its market dominance.

Diagnostic Ultrasound Market By Portability Insights

The trolley-based ultrasound systems led the market in 2024, particularly within the portable ultrasound segment. These specialized carts are designed to provide both mobility and stability, allowing for effortless transportation of ultrasound machines across various locations within healthcare facilities. A mobile trolley system for ultrasound imaging scanners typically includes a wheeled base with a locking mechanism to secure the machine during transit.

These mobile trolleys offer several advantages, including enhanced mobility, flexibility, and organization in clinical settings. They also feature shelves and compartments for storing probes, cables, and other necessary accessories for ultrasound procedures. The ability to easily move ultrasound machines between patient rooms, examination areas, and different healthcare facilities significantly improves workflow efficiency. Additionally, they reduce the risk of damage to ultrasound equipment by providing a stable and secure transport platform.

Trolley systems are available in various sizes and configurations, catering to different ultrasound machine models. Their durability and reliability make them an essential component in medical environments, contributing to the widespread adoption of portable ultrasound technology.

Diagnostic Ultrasound Market By Application Insights

The obstetrics and gynecology (OB/GYN) segment accounted for a significant portion of the diagnostic ultrasound market in 2024, driven by its critical role in fetal and maternal healthcare. Obstetric ultrasound provides detailed imaging of embryos and fetuses within the womb, along with comprehensive assessments of the mother’s uterus and ovaries.

A specialized technique, Doppler ultrasound, is commonly used within obstetric imaging to evaluate blood flow in arteries and veins, offering crucial insights into fetal circulation. This allows healthcare providers to assess blood flow in the umbilical cord, placenta, and fetus, ensuring optimal fetal development.

Unlike imaging methods that use ionizing radiation, obstetric ultrasound relies on sound waves, making it a safe and preferred choice for monitoring both expectant mothers and their unborn babies. Its non-invasive nature and proven safety profile underscore its importance as the primary imaging tool in prenatal care.

Given its ability to provide real-time imaging and assess blood flow dynamics, obstetric ultrasound remains one of the most dominant segments in the diagnostic ultrasound market. Its widespread use in gynecology and maternity care solidifies its status as an essential tool for ensuring maternal and fetal well-being worldwide.

Diagnostic Ultrasound Market By End-use Insights

In 2024, maternity centers held the largest share of the diagnostic ultrasound market, largely due to the well-documented safety of ultrasound in pregnancy. Research has shown that ultrasound examinations detect nearly 50% of major fetal anomalies, with multiple scans typically conducted at different stages of pregnancy.

- First-trimester scans accounted for 10.1% of total ultrasound exams.

- Second-trimester scans were the most common, comprising 57.0% of examinations.

- Third-trimester ultrasounds made up 32.9% of all scans.

Despite the dominance of ultrasound, around 15.3% of pregnancies also involved X-ray examinations, highlighting the need for a range of diagnostic tools. Additionally, electronic fetal monitoring (EFM) was used in 74.6% of pregnancies during labor. Among these cases, 54.9% relied solely on external EFM, while 19.7% combined both external and internal monitoring to ensure optimal maternal and fetal health.

Maternity centers play an essential role in utilizing diagnostic ultrasound technology to ensure safe pregnancies and successful childbirth outcomes. The integration of ultrasound with complementary diagnostic tools reinforces a comprehensive approach to maternal and fetal care, positioning maternity centers as key players in the diagnostic ultrasound market.

Some of The Prominent Players in The Diagnostic ultrasound market Include:

Diagnostic Ultrasound Market Recent Developments

- In January 2024, Canon Medical Systems and Olympus revealed a business alliance concerning Endoscopic Ultrasound Systems.

- In February 2024, IBA acquired Radcal Corporation to enhance its Medical Imaging Quality Assurance offering and bolster its presence in the U.S.

- In February 2023, GE HealthCare announced its acquisition of Caption Health, broadening its ultrasound capabilities to support new users through FDA-cleared, AI-powered image guidance.

- In June 2023, UltraSight and EchoNous partnered to facilitate more accessible cardiac ultrasound for patients.

- In February 2023, Leader Healthcare entered into a strategic partnership with Hisense Medical to redefine ultrasound imaging at Arab Health 2023.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the diagnostic ultrasound market

By Technology

By Portability

By Application

- General Imaging

- Cardiology

- Obstetrics/Gynecology

- Others

By End-use

- Hospitals

- Maternity Centers

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)